In fact, it has continued to develop during the bear market of 2022-2023.

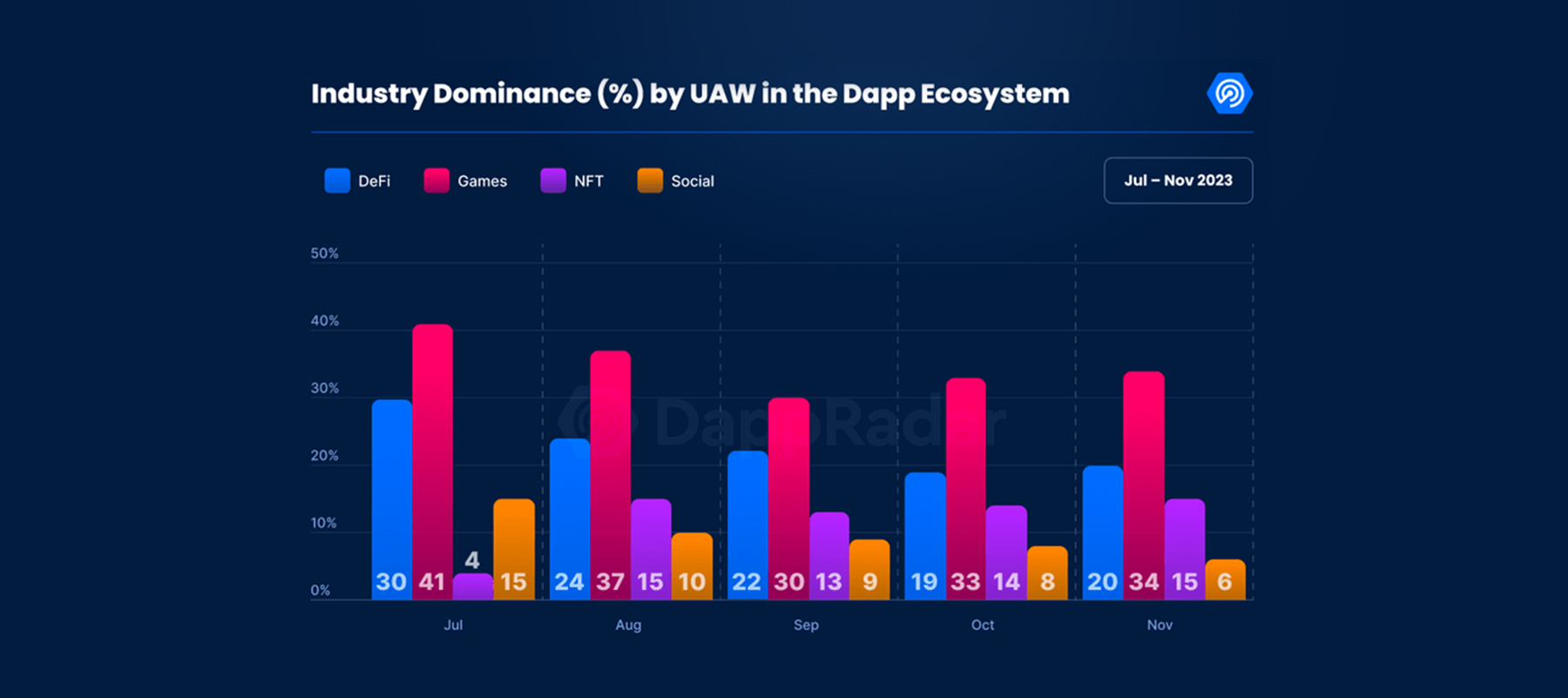

For context, blockchain gaming activity grew by 2000% during the beginning of the bearish cycle. And in 2023, investments have continued to pour in. Between May and Nov 2023, a combined $1.5 billion was invested in dApp development. Blockchain gaming also commanded 34% of the dApp industry, with over 1.2 million daily unique active wallets (dUAW) towards the end of 2023.

Yet, amidst the ongoing reawakening in Web3 gaming, one player is quietly being positioned as a gamechanger that may revolutionise blockchain gaming as we know it today.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Introducing Beam

Beam (BEAM) is a gaming-centric blockchain introduced by Merit Circle. Merit Circle DAO is one of the largest gaming decentralised autonomous organisations (DAO) in the Web3 gaming ecosystem. Merit Circle supports the development of ‘all things gaming’. It also has a transparent, decentralised governance model in which the community votes to invest its treasury funds in various gaming projects.Beam utilises LayerZero, an interoperability omnichain protocol, to seamlessly transfer game assets across different blockchains.

After announcing Beam, Merit Circle delivered proposals MIP-28 and MIP-29 to migrate its original Merit Circle (MC) token to the BEAM token. The migration started on October 26, 2023, and it will last 12 months. The migration from MC tokens to BEAM tokens began a new era for Merit Circle DAO.

Now, Beam aims to revolutionise game development, player experience, and gaming asset trading within the blockchain ecosystem.

How does Beam plan to do that?

Well, it uniquely presents itself as an ecosystem that will house gamers, game developers, and an in-house NFT marketplace for gaming assets. It also has a dedicated mobile app to link any game account across multiple games. All these are backed by Merit Circle’s treasury and development team.Additionally, Beam operates on Avalanche (AVAX) as a subnet. Avalanches’ subnets have been a key fertile ecosystem for web3 gaming because each Subnet is customizable. It can have its currency, security system, and set of validators. Rise Online World, a popular game with over $1.82 million in total value of assets, is built on one of such subnets.

The Beam ecosystem stands out from projects like Axie Infinity, The Sandbox, and Decentraland because it is not focused on one environment. While the competitors are building in one direction, Beam is building an ecosystem that will be a hub for engagement, asset distribution, development and everything related to blockchain gaming under one domain.

Why investors should take an interest in Beam

The BEAM token is only three months old, but Beam is not just another GameFi project trying to ride on a popular narrative. For Beam, the development process started during the bear market.Merit Circle’s ‘silent hustle’ in 2023, building for 2024

The Merit Circle DAO laid the groundwork for the investment, infrastructure and network perspective in 2023, and it is now executing with incredible precision as 2024 gets underway.Some of the key developments include:

1. Industry-wide partnerships

Last month, Merit Circle DAO partnered with Immutable, another gaming platform. Sphere, Merit Circle’s NFT marketplace, is the centre of this partnership. The objective is to expand BEAM’s reach and improve its trading experience through wider marketplaces. This is a positive approach to improving BEAM’s availability to different user bases.2. Active investments in other Web3 games

Merit Circle has a strong network of 60 partnered games, either already launched on BEAM or awaiting future deployment. A cumulative of $40 million has been invested across various projects, and the success of any of these projects will improve BEAM’s economy.3. Transparent and evolving treasury balance

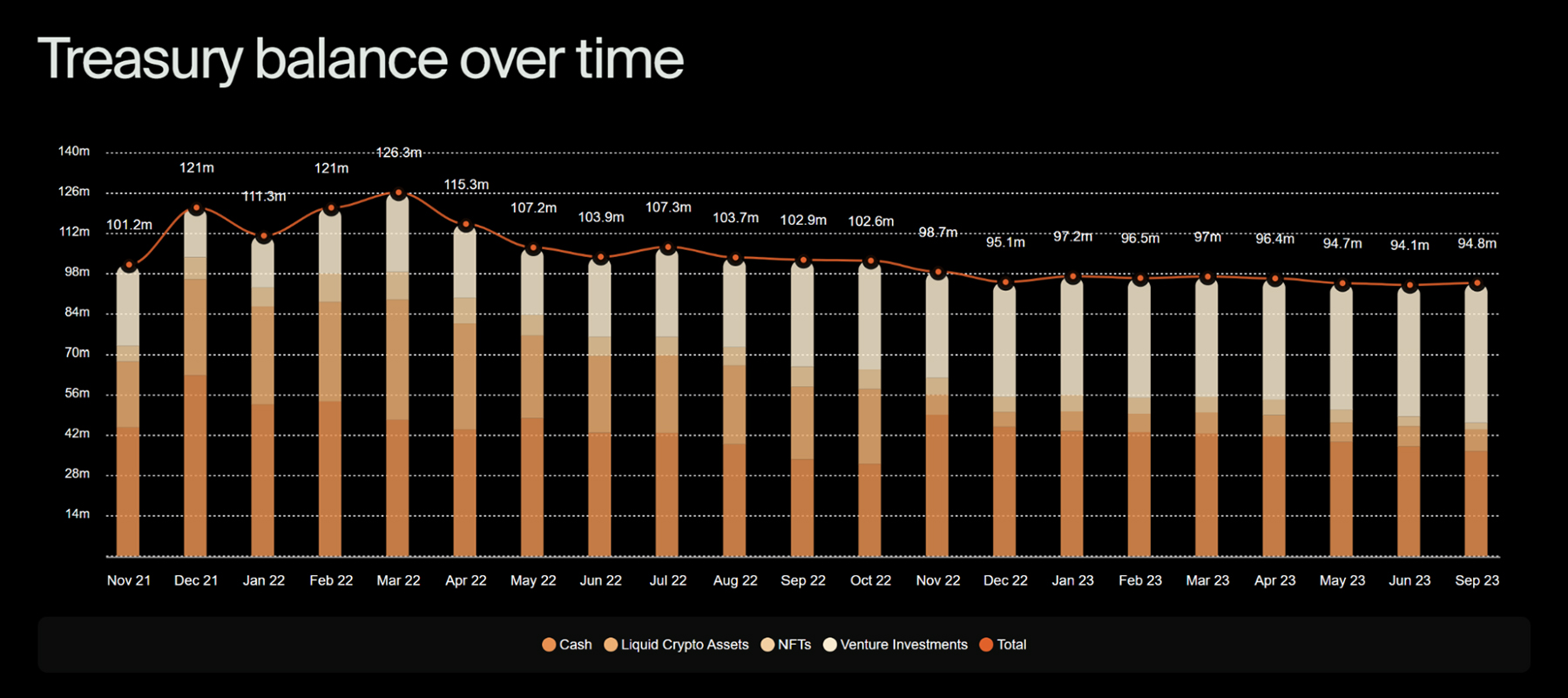

One unique aspect of the Merit Circle DAO is its treasury. The organization holds close to $100M (The last reported value is $94M, still Sept. 2023).

The fund is diversified between cash, liquid crypto assets, NFTs, and venture investments. When comparing Merit Circle’s Treasury against CCi30, a crypto-based index, you’ll see that MC’s fund outperformed during the bear market. The treasury marks a massive financial strength for Merit Circle DAO, in liquid value rather than unrealised capital.

What does Beam’s fundamentals look like?

Beyond Merit Circle and how its foundational work supports Beam, let’s dive into the core fundamental positives of the project.1. Deflationary tokenomics

Beam’s tokenomics favours investors due to its buyback and burn process. Merit Circles’ MIP-7 proposal dictates that part of the profit generated by the DAO should be deployed in a structured manner across four divisions. The breakdown consists:- 20% in USDC, increasing non-native token balance treasury.

- 60% is used for a buyback 10-35% below market price, to be burned or sold to investors with a defined lock-up period.

- 5% for purchasing BTC, ETH for crypto asset treasury.

- 15% to purchase BEAM from the market, with the sole act of burning supply.

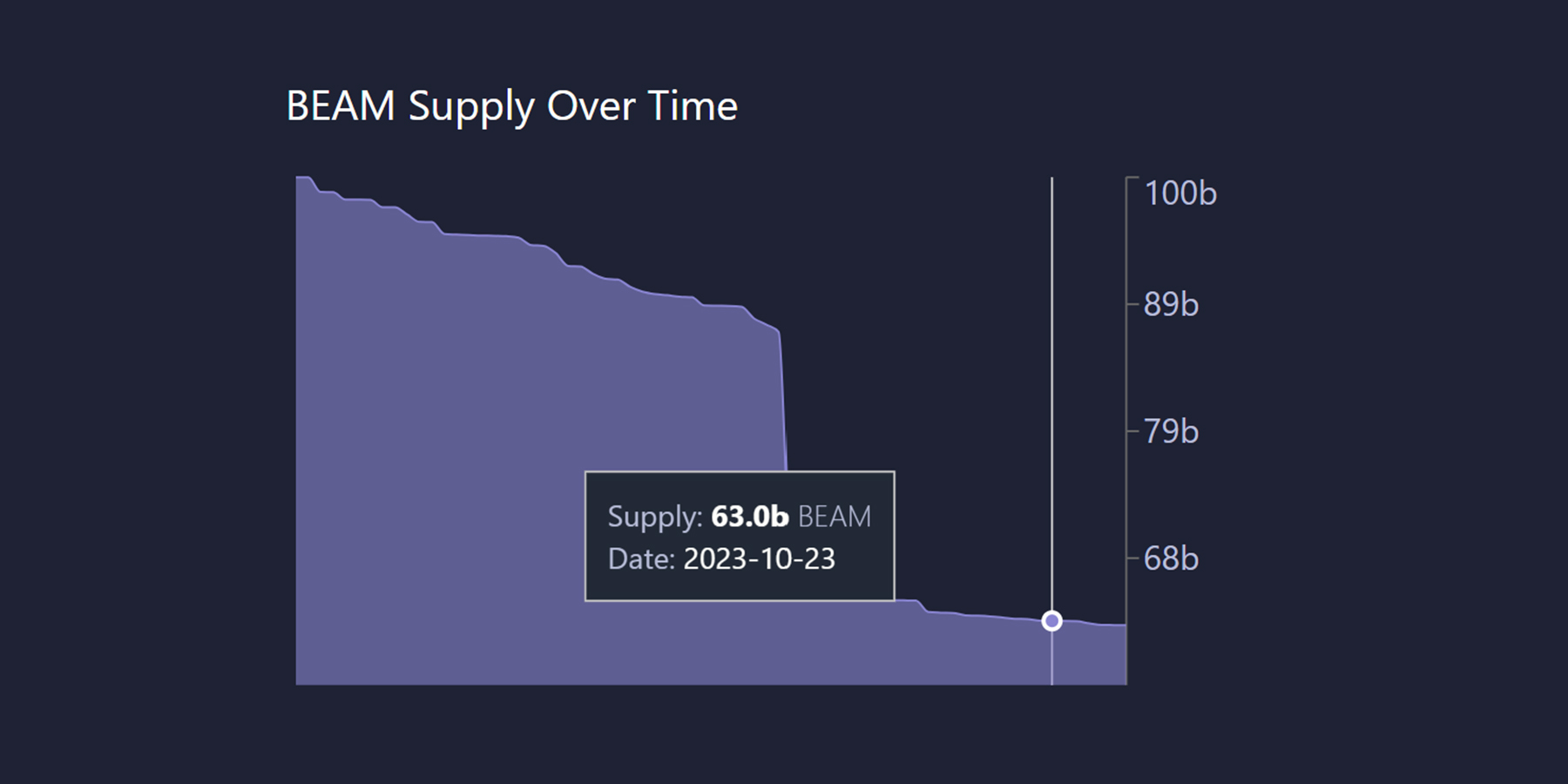

Based on the impact of this proposal over the past two years, the total circulating supply of BEAM (previously MC token) has been reduced by 37.4%. Making BEAM deflationary in the process, the value-accrual mechanism is also evident. We believe the potential for a supply shock event based on BEAM’s burning is highly probable.

The decreasing circulating supply over time may push token prices higher, incentivising token holders to actively engage in governance and the Beam ecosystem’s development.

2. Multiple revenue streams

We must evaluate and explain Merit Circle’s four verticals to identify these revenue paths. They include,- Merit Circle Investments

- Merit Circle Infrastructure

- Merit Circle Gaming

- Merit Circle Studios

For Merit Circle Investments

For Merit Circle Investments, the goal is to maximise treasury value, as mentioned in the previous section. The main focus areas are tokens, NFT investments, and yield returns. The value created is the investment profits, which are then distributed based on the stipulations of MIP-7.Merit Circle Gaming

Merit Circle Gaming connects the gamers and the community. The strategy is to offer games, industry education, a game library and tools to drive user retention. Revenue generated here will be from the gamers.Merit Circle Studios

Lastly, Merit Circle Studios will lead the development and incubation of new projects, whether they are gaming or NFT-based. One successful example is Merit Circles’ Edenhorde, a media franchise with 8,800 NFTs. The value created here is through ownership and success per game or project.Merit Circle Infrastructure

Merit Circle Infrastructure is the development vertical which houses the core Beam solutions and services. For trading in-game assets, Beam’s NFT marketplace, Sphere, will offer better tools for buyers, sellers and creators at competitive trading fees. The fees will be paid in BEAM to the chain, which forms a revenue path for the protocol. Other BEAM services include:- Beam Bridge: for easy asset transfer to the Beam network. Users need BEAM tokens for necessary transaction fees.

- Beam Swap: AMM of the Beam Network. To swap assets or provide liquidity on the Beam network.

- Beam Companion: a mobile app that allows gamers to link in-game accounts of any game together. For gamers, this will allow them to take ownership of their game assets whenever they want to.

- BeamOS: In-house UX featuring each tool, app and feature from the Beam ecosystem.

- BeamSDK: For game developers – it gives programmatic control over design and game development.

How would we value Beam?

While we were able to define multiple revenue streams for BEAM through the above verticals and products, the current situation is that most of these are theoretical assumptions.BEAM tokens have been in active circulation for only three months, and only one vertical out of four is currently active. Therefore, the real revenue generated over the past three months is negligible, and conducting a comprehensive valuation exercise is difficult.

Nonetheless, we observed the potential of Beam’s staking revenue based on Merit Circle’s V2 reward deployed between November 2022 and July 2023.

During that period,

- V2 staking rewards from Nov. 7 2022, to July 14, 2023, = 19,716,957 MC tokens.

- Total reward in USD value based around an average price of $0.3= approx. $6M.

- With a 5% staking fee, the revenue was around $300,000 over six months.

While a $600k to $900k revenue is still small, it is important to note that this is just one part of the revenue potential. It is a part of the whole and not the entirety of the potential long-term market value of the ecosystem.

Another point to note with the Beam ecosystem is that it is trying to represent the eventual success of the blockchain gaming ecosystem. Housing over 60 projects on the chain, there will be credible value flowing into BEAM if other projects are successful over the next few years.

That is, again, a speculative expectation, but if GameFi has a profitable future, it is difficult to imagine that Beam will get left behind.

Another way to evaluate how big Beam could get is to see its market cap relative to the Total Market Cap of GameFi projects at the peak of the 2021 bull run.At the moment, these are the key numbers for BEAM:

- Market Cap: $1.12b

- Fully Diluted Valuation: $1.40b

- FDV/Market Cap Ratio: 1.25

Therefore, Beam currently accounts for 5.4% of the total GameFi market cap. At the peak of November 2021, the total market cap of GameFi tokens was $74b. Hence, calculating 5.4% of $74b would have given Beam a market share of $4b.

This means that if the total market cap of GameFi rises back to its previous high, Beam may record a 4x growth.

Again, BEAM is still early in its development roadmap; there’s no way to predict if it will deliver its over verticals, and there’s no guarantee that the GameFi sector will grow back to 2021 highs.

If we wanted to buy BEAM now, the token is currently available on multiple centralised exchanges, such as Binance, Gate.io, Bybit and MEXC. Binance is responsible for 57% of the current trading volume.

However, it would be, at best, a moonshot bet on Beam’s ability to deliver its roadmap and the GameFi sector’s continued growth throughout the current bull market. We will review Beam again by the end of Q2 2024 to see if there’s enough data to deliver a comprehensive valuation with worse, base, and bull-case scenarios.

Technical analysis

From a technical perspective, BEAM currently looks strong, adhering to a rising trendline.

The asset recorded a 484% rise between November 6 and December 14, following which the price dropped close to 51% by January 3.

The retest zone also fell between 0.5-0.618 Fibonacci. A bullish trend is currently still intact.

Currently, the price is consolidating near resistant at $0.023, and a strong position above this range may lead to another re-test of the previous high of $0.027, a potential 20% hike.

Cryptonary’s take

The hype and sentiment surrounding Beam are real at the moment.While the project is relatively new, its market cap is already on par with major GameFi projects such as Axie Infinity, The Sandbox, and GALA.

Of course, its on-chain activity is minimal, and the ecosystem is yet to launch other key verticals in 2024, but there is true intrinsic value in a blockchain gaming narrative. The project has a self-sustaining DAO with a progressively reducing circulating supply.

The lack of concrete data on user retention and aggregate revenue collected makes it hard to estimate a fair projection.

Hence, we would need to return to the project in a few months to re-evaluate our position and opinion on the ecosystem.