Understandably, the network offers cheap transactions, a great UX, and astonishing speed. Many projects in the Solana ecosystem—from DEXs to meme coins—have shown strength and rewarded investors with gains.

AI is another winning narrative. AI projects became interesting after ChatGPT launched, and AI coins became popular after OpenAI introduced Sora.

The potential of AI to significantly impact our daily lives has captured the interest of investors.

Today, we will dive deep into a project trying to solve one of the main blockers in the development of AI.

Unsurprisingly, this project is also on Solana. So, can this project combine Solana's winning narrative with the AI narrative to deliver impressive gains in this bull run?

Let's find out.

TLDR

- The development of AI will require cheap and accessible computing power.

- This project is a decentralised crowd-computing platform powered by the Solana network.

- A surge in demand for compute has led to a rise in positive price for this token.

- There's a potential 20x upside as the demand for compute continues to increase and AI applications go mainstream.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

A quick primer on AI x Crypto

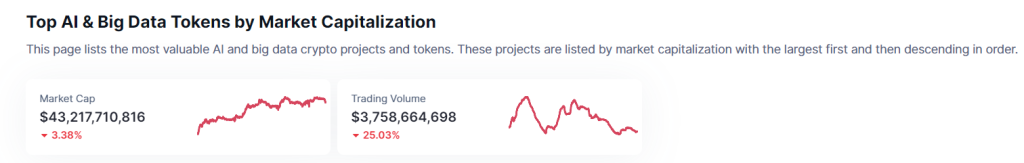

We have already seen massive gains in a board of AI tokens, but is there any more potential?To be frank, crypto AI is still small. The total market capitalisation of AI-related tokens is just over $40b. It is nothing compared to the projected $10+ trillion capitalisation

What that means is that there is still a massive upside in crypto.

If you are bullish on AI, you likely have a similar stance on GPUs, as AI applications demand substantial computational power. Nevertheless, the current scarcity of GPUs impedes the advancement of AI applications. Researchers, institutions, and individuals don't have access to a cheap way of training their AI models.

In 2-3 years, if the demand for AI continues to surge, the need for GPUs will grow even more significantly. This disproportionate increase in GPU demand could be attributed to the expanding complexity and sophistication of AI models, which necessitate higher computational resources.

As AI becomes more deeply integrated into our daily lives, the need for GPUs will only continue to grow.

Currently, several centralised players are trying to tackle the problem (E.g. Nvidia, Microsoft)

However, decentralised DePin platforms can offer better alternatives that are cheaper and more innovative.

Therefore, we remain extra bullish on decentralised compute providers, especially on assets showing incredible strength.

We present you with a deep dive into the asset that has been making rounds on our trading floor.

Introducing…

Nosana

Nosana is a decentralised crowd-computing platform powered by the Solana Network. It aims to revolutionise how software automation pipelines are executed using community-contributed compute resources to run tasks for open-source projects and other users.We have already discussed the shortage of GPUs and projects that are trying to solve them.

Nosana also addresses the global GPU shortage problem by creating a decentralised GPU compute grid. This grid allows anyone with an idle GPU to contribute resources to the network and earn rewards.

By leveraging the power of idle GPUs, Nosana aims to provide affordable and efficient GPU resources for running AI workloads without the overhead of traditional cloud solutions. This approach helps alleviate the strain on the GPU supply chain and offers a more sustainable and cost-effective solution for users needing GPU resources.

As we can see, the approach taken by Nosana is slightly different from that of IO.net.

Nosana received a grant from the Solana Foundation and has a decent list of backers.

Adoption

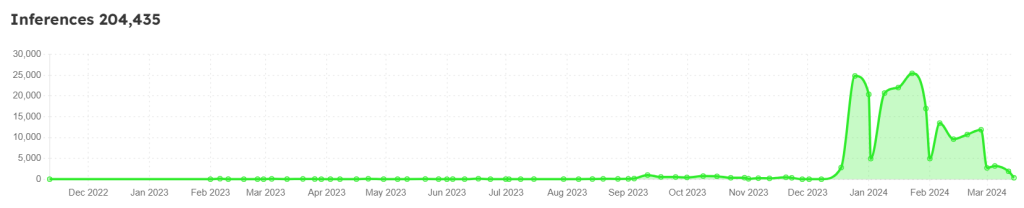

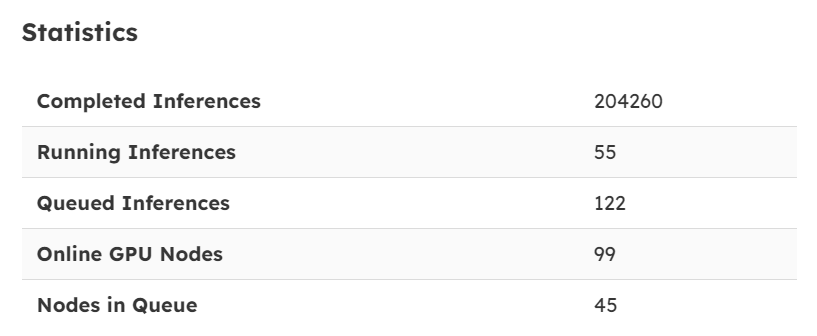

Looking at the number of inferences (output of the AI models), we can see that the number of inferences made by Nosana surged dramatically after December 2023 and has been trending down since.

However, Nosana is still at the "Genesis" stage, where the protocol is subject to rigorous testing and refining.

As demand for computing power will only increase over time and Nosana moves from testing to actual implementation, we expect the number of inferences to be trending up again.

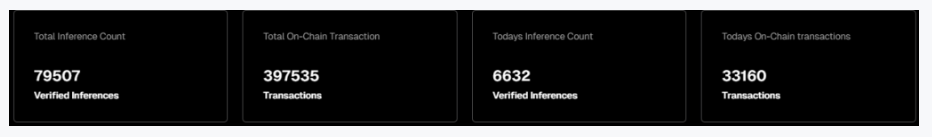

Despite being in the testing stage, the total inferences by Nosana sit at over 200k.

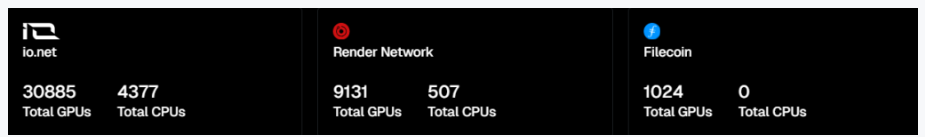

For comparison, IO.net's total number of inferences is around 80k. The latest valuation of io.net was $1b. More than 2x of mcap of Nosana with 2x less number of inferences

However, Nosana still has to work on its "supply" side. Currently, Nosana has only 99 GPU nodes.

This is very low compared to other providers such as IO.net and Render.

Nevertheless, the "demand" side (inferences) looks impressive, especially with a lower number of GPUs

Overall, as a player in the Depin x AI sector, Nosana looks very solid.

Now, let's look at tokenomics

Tokenomics

The native token of the Nosana platform is the NOS token. It serves several purposes within the ecosystem, including:- Incentivising contributors: Users who contribute their idle GPU resources to the network are rewarded with NOS tokens.

- Payment for services: Developers and organisations utilising the Nosana network for their computing needs can pay for these services using NOS tokens.

- Governance: NOS token holders can participate in the platform's governance, allowing them to vote on proposals and help shape Nosana's future.

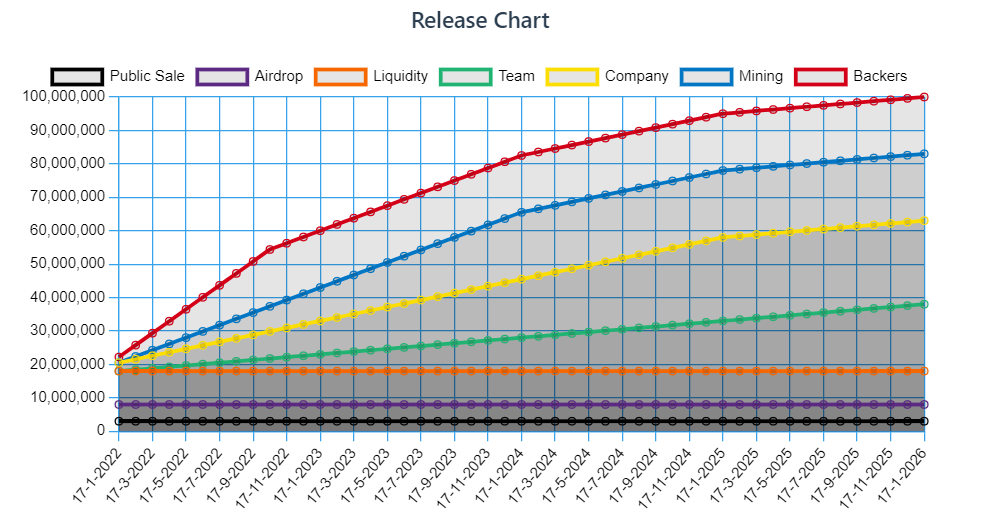

- Market cap(circulating): $434m

- Market cap (fully diluted): $519m

Valuation exercise

We believe that the valuation of DePin platforms that offer GPU solutions will continue to grow as demand for GPUs rises.Regarding Nosana, since the demand side of Nosana has been twice as high as that of IO.net, we believe that the latest valuation of IO.net should be the floor.

In other words:

- Conservative case: $1b mcap (roughly 2x)

- Base case: $5b mcap (approximately 10x)

- Bullish case: $10b mcap (roughly 20x)

Release schedule

We can see that the release schedule looks good, with the majority of tokens already circulating.

You can stake NOS on Nosana Staking to receive rewards.

A user can stake Nosana Tokens for a minimum period of two weeks and a maximum of one year. The longer the duration of the stake, the higher the multiplier applied to the number of tokens staked.

The maximum multiplier is 4.

Technical analysis

Nosana has been performing and driving really strong to the upside. This shows the demand and the want for this asset.

Price topped out at 7.90 dollars and has begun to retrace down into a key area of demand and price point of 5.00, where we previously saw a dramatic push to the upside and again another 40% + bounce to the upside with a pretty dramatic move again. We could see exhaustion and price move back to this level. As there is clearly significant buying pressure here, it could provide another opportunity.

This aligns with a key Fibonacci retracement of 61.8%, as well, when taken from the scene of the crime of around 3 dollars.

Price could retrace deeper into 4 dollars, which would only give a better ROI.

Cryptonary's take

Nosana has a significant upside potential as the demand for GPU-based computing continues to grow.With the rise of AI, machine learning, and other data-intensive applications, the need for cost-effective and scalable computing solutions is more pressing than ever.

By offering a decentralised alternative to traditional cloud computing, Nosana has the potential to be one of the key outperformers among AI-related coins.

Cryptonary, OUT!