During the 2017 bull run, ERC-20 tokens and ICOs led the discussions.

In 2021, NFTs and the Metaverse were major hits.

In 2024, there is increasing interest in the L2 protocols to enhance speed and reduce transactional costs. Layer-2 networks are not entirely new, but the competition will become dynamic.

One of the projects that recently re-established its presence in the sector is Metis. The token witnessed a 300% hike during the last two weeks of December.

In this report, we will evaluate the protocol and analyse its investment potential over the long term.

What is Metis?

Metis is a permissionless Layer 2 scaling solution for the Ethereum network.The network aims to provide efficiency, affordability and a scalable outlook for decentralised applications and DeFi protocols. The $METIS token serves multiple purposes on the network. These include transaction fees, locking or staking for a sequencer, and more.

The network is also completely EVM-equivalent, allowing compatibility with Ethereum-based applications and tools.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Why is Metis gaining market interest?

Metis is the 7th largest L2 project in the sector but the only project with a Hybrid Rollup configuration.Between December 18 and December 31, 2023, the asset rallied over 300%. This surge came after its official blog announced the Metis Ecosystem Development Fund (Metis EDF) worth close to $375 million.

One of the main reasons Metis is becoming a big deal is its introduction of a decentralised sequencer in Q1 2024. Metis will be the first L2 project to launch a decentralised sequencing pool, allowing the protocol to break away from centralised risk and a single point of failure.

But all these refer to the tech; let’s talk about the finance component.

Reasons to be bullish on Metis in 2024

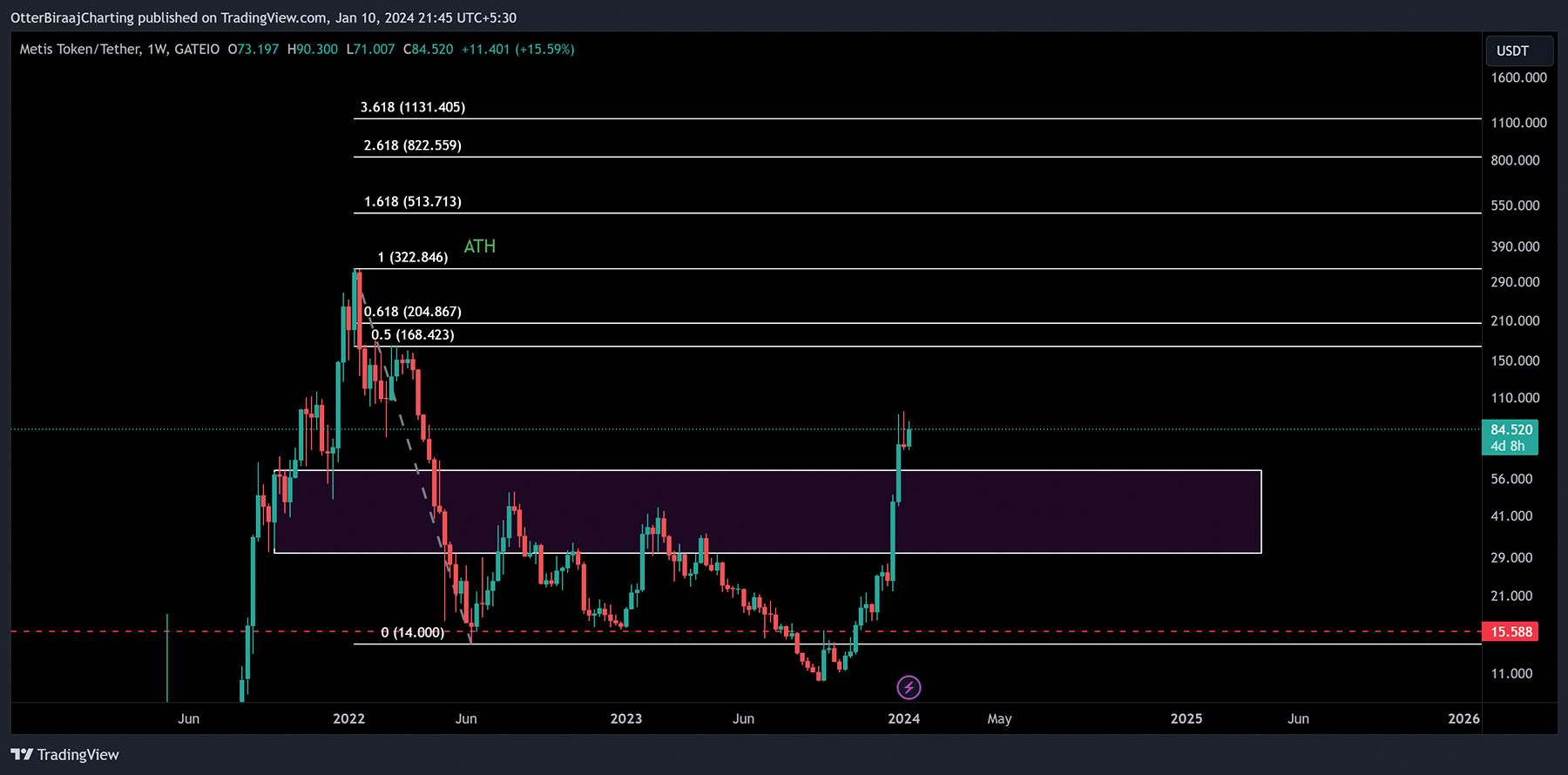

Metis is not a new kid on the block. The project first launched in 2021; its token has seen a bull and bear market – it set an all-time high of $323 in January 2022 and bottomed around $10 in September 2023.So, why bet on $METIS at the start of a new bull run when you could be betting on a newer project?

The answer is simple. Metis is playing at the forefront of innovation.

-

Hybrid rollups

-

Competitive edge after EIP4844

Most L2s face these common issues:

- Centralization Risk

- Security

- User Adoption

Before, Layer 2 would have limited data storage on which they could submit their transaction volume to the ETH mainnet. After EIP4844, the data storage or limit that Layer 2 can access will increase, improving data efficiency and decreasing storage costs.

The result?

Transactions per second, or TPS, improve, while gas prices decrease due to the higher availability of storage. The landscape will completely change for ETH Layer 2s, and this is where Metis might have the biggest advantage going forward.

On January 3, the Metis decentralized sequencer went live on the Metis Sepolia Testnet, getting closer to initiating community testing. A sequencer aggregates multiple transactions off-chain from the main network and then submits a summary to the decentralized mainnet, i.e., Ethereum. The main issue with Sequencer is centralisation risk, which Metis is tackling with its decentralization approach, as sequencer rewards will be distributed to METIS holders and stakers, avoiding a single point of failure.

-

An incentive program

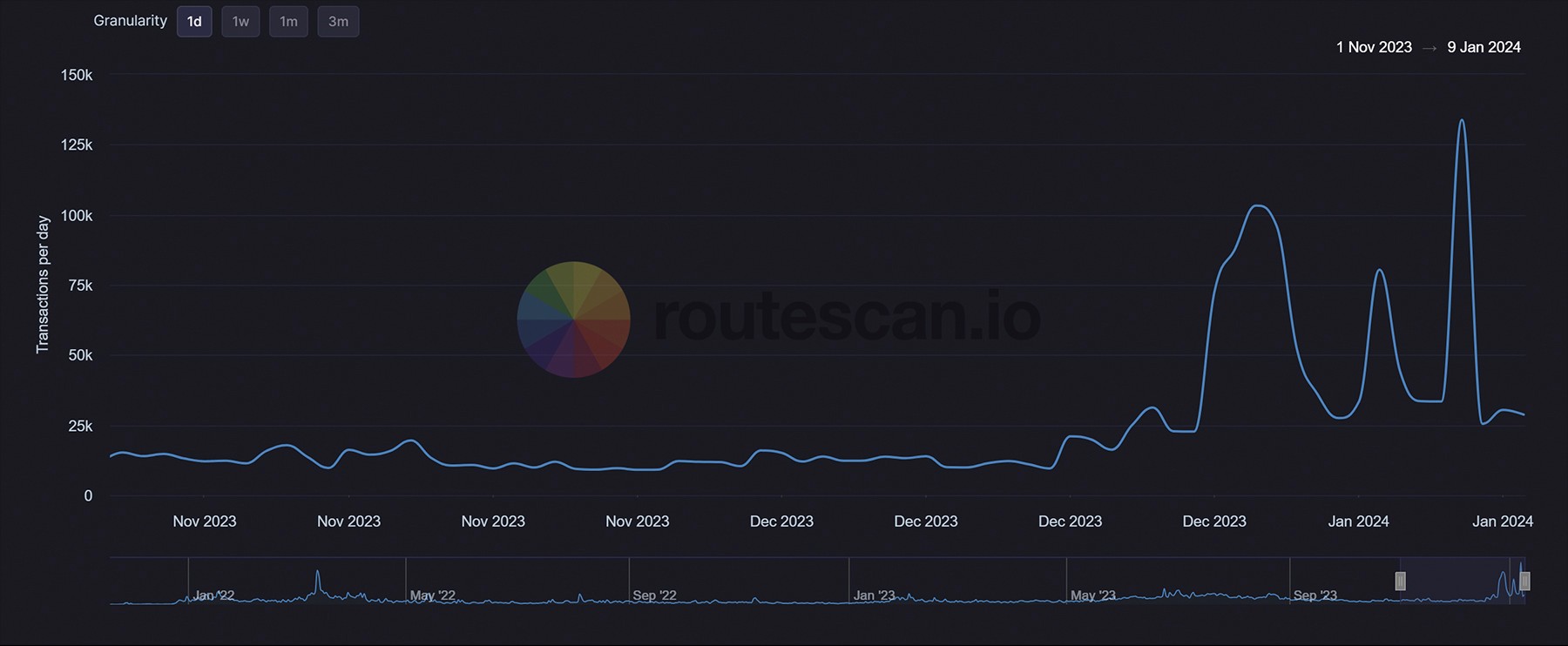

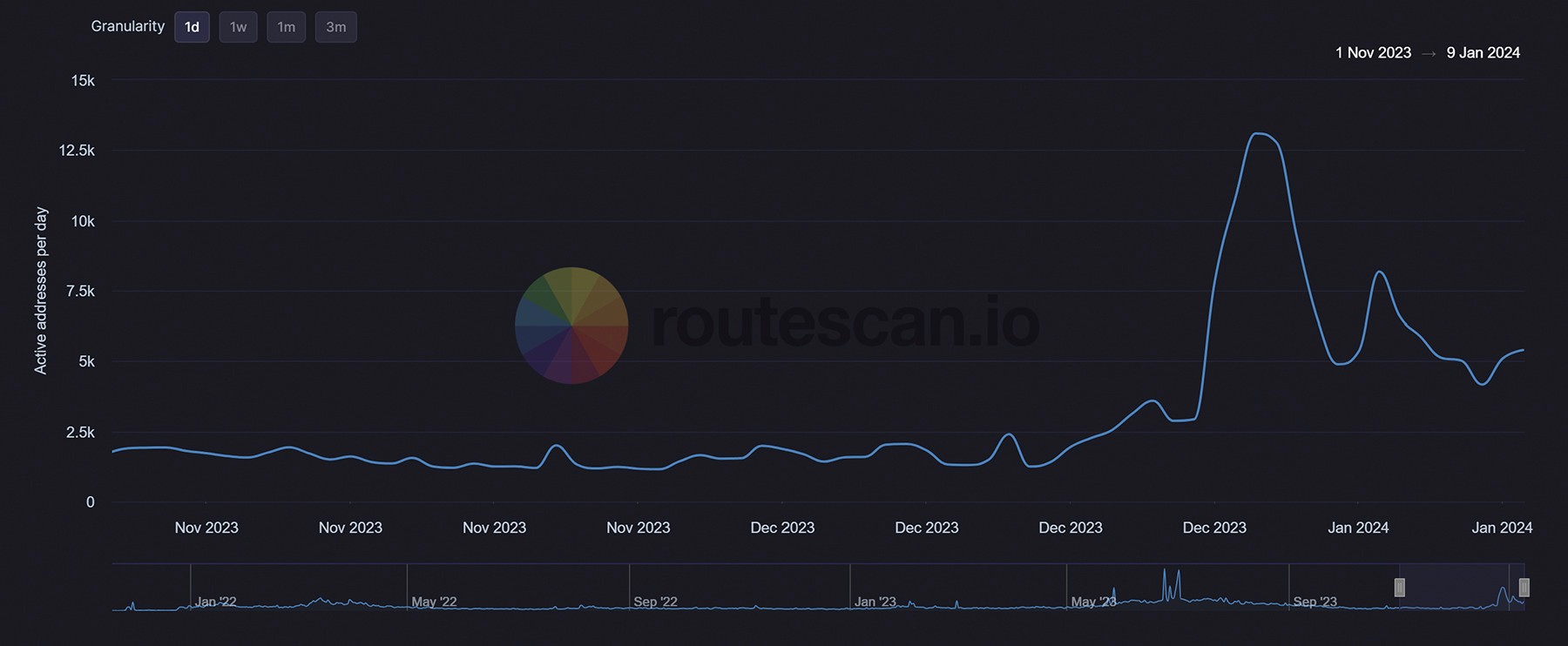

The number of transactions and daily active addresses had risen, reflecting market activity in response to the EDF news. However, this interest has sharply dissipated by the end of last week.

The ecosystem welcomed its first DeFi product suite post-EDF announcement with WAGMI. Daniele Sesta’s WAGMI is set to receive a $2 million grant, the 1st disbursement from the fund. After launch, the protocol will offer its users DEX(Swaps), arbitrage bots, and concentrated liquidity management strategies.

Now, the consensus is that the EDF will be bullish for Metis because previous incentive programs by other L1 and L2 chains led to positive price movements.

Let's look at some examples.

Skale

An L2 competitor with a market cap of $457 million (just ahead of Metis), SKALE announced an incentive program during the beginning of the 2022 bear market. Despite Bitcoin undergoing corrections at the time, SKL appreciated 147% in 40 days from the program's launch. The asset eventually faced a drop due to the overall bearish market, but the next example highlights the positive effect that can take place during a bull market.

Optimism

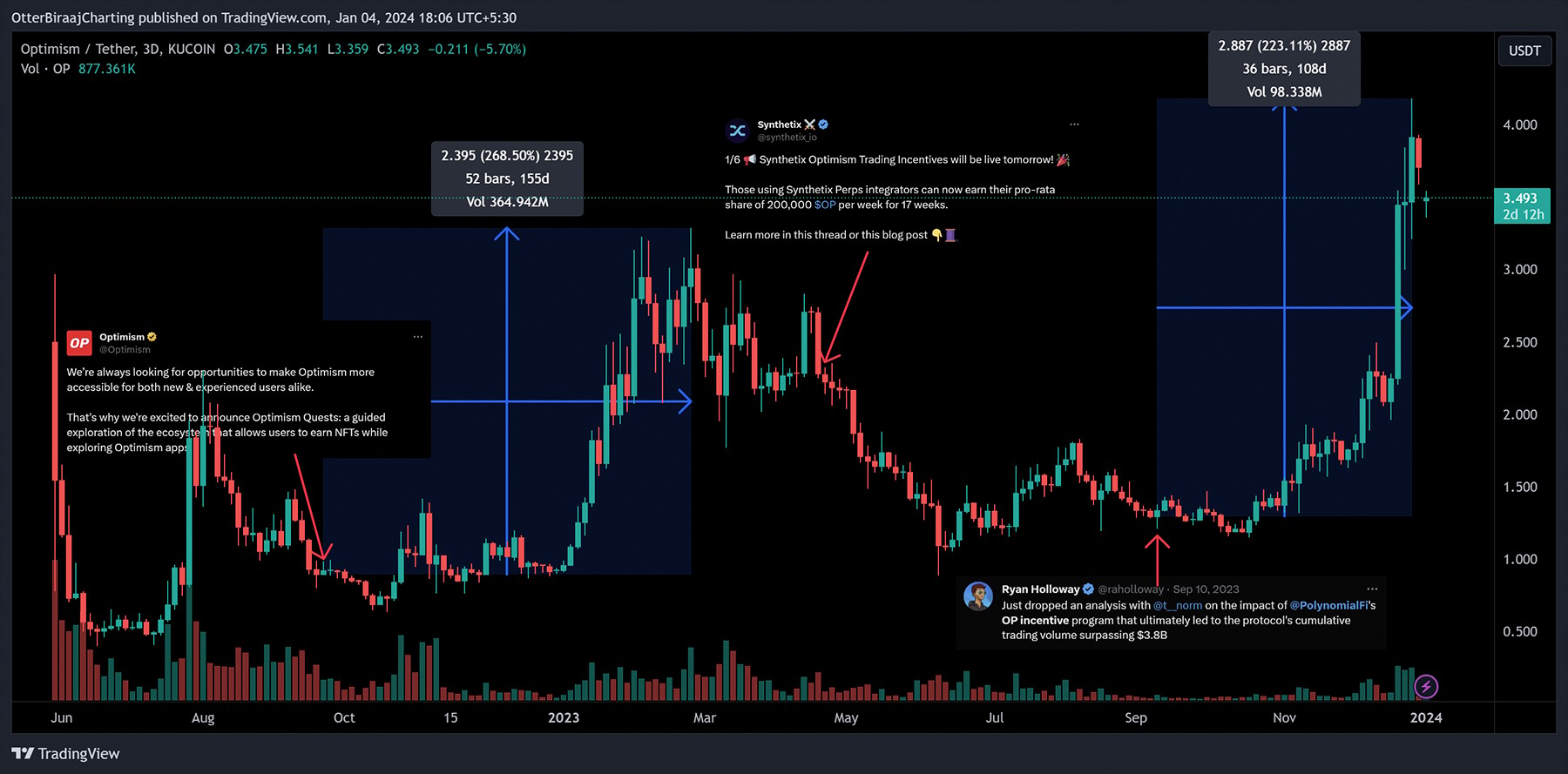

This project does not require any introduction after it reached an all-time high on December 27, 2023.However, the protocol has mustered interest in its ecosystem through multiple incentive programs over the past two years and has paid a massive dividend.

The chart shows that the first NFT incentive program was launched in September 2022, during a peak bearish structure (BTC dropped to yearly lows the next month). However, OP managed to consolidate, and the token reached a new ATH (at that time) in 155 days.

In 2023, it partnered with Synthetix Protocol to launch another incentive program. Right after the launch on April 19, OP did face a massive drawdown, but the long-term turnaround was extremely positive.

As the market became bullish in H2 2023, an impact analysis report was released indicating the incentive program's positive effect, which led to the protocol’s cumulative trading volume exceeding $3.8 billion. By the end of December, the token had reached an all-time high yet again.

Avalanche

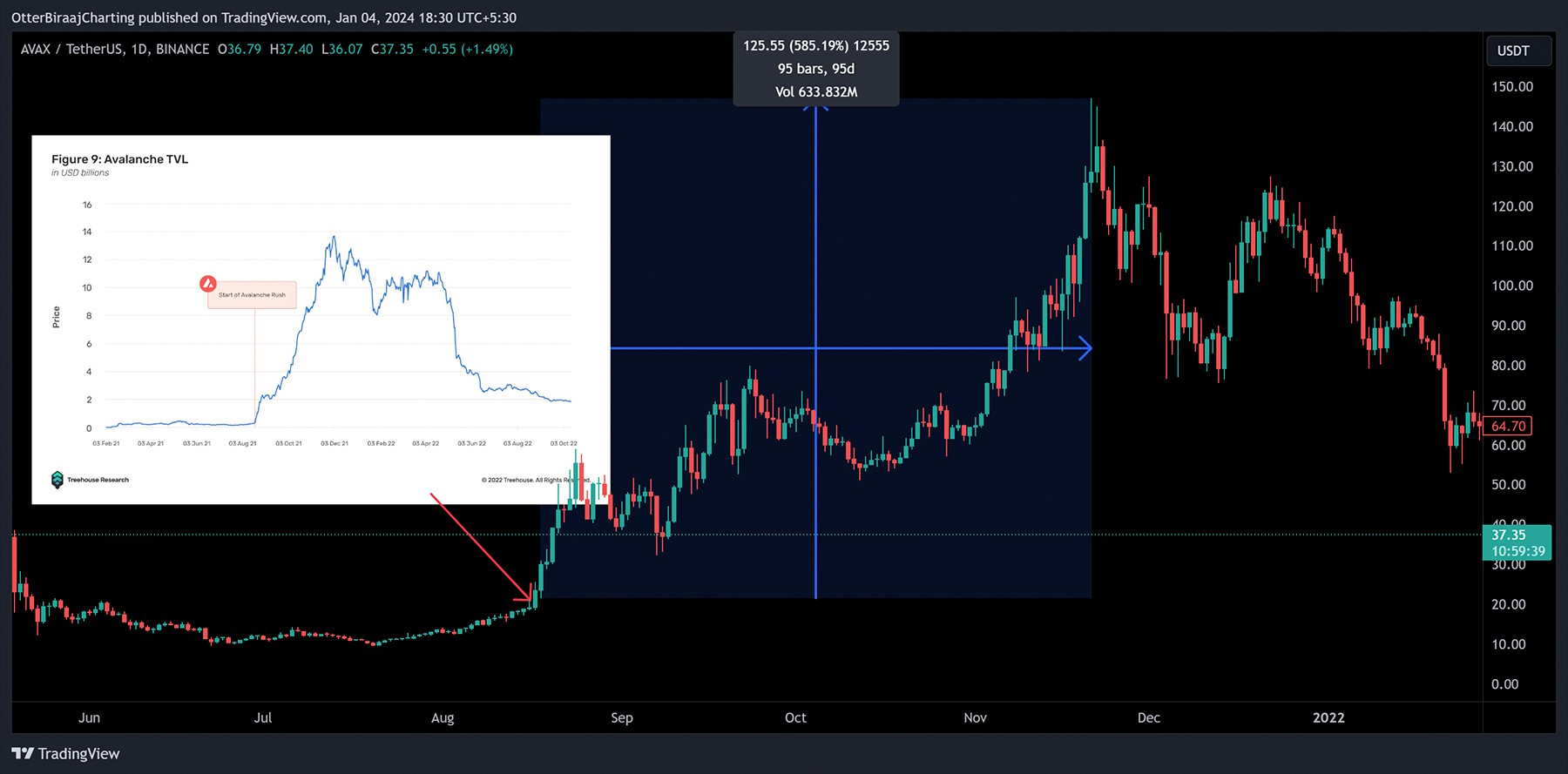

After announcing its ‘Avalanche Rush’ incentive program in August 2021, AVAX's ROI can only be termed as a peak-bull market hopium rally.With TVL crossing over $12 billion, AVAX recorded a massive 600% rally in 95 days, a significant rise to $145 from around $20.

One red flag to watch in Metis

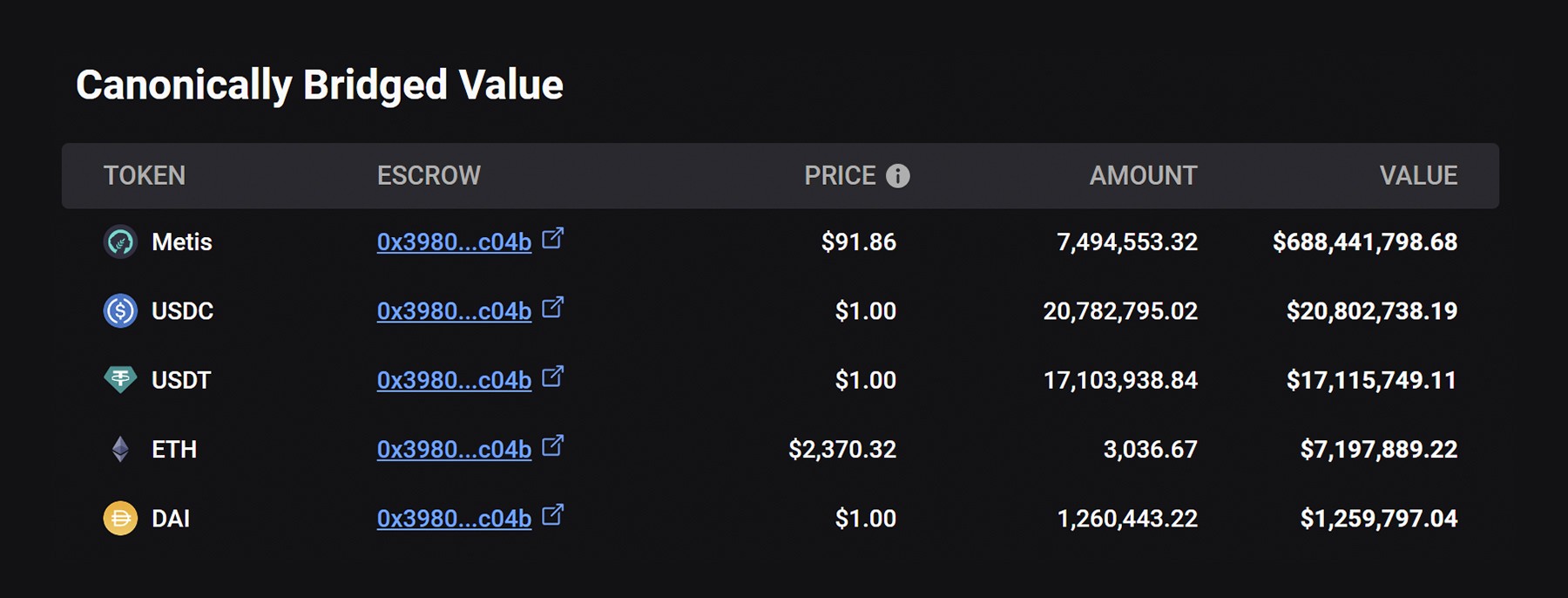

While we are impressed with Metis, we found a red flag worth mentioning.Data from L2beat suggested that Metis’ Canonically Bridged Value, i.e. all TVL on Ethereum, was concentrated on the Metis token for a whopping 93.6%, which means the asset was promoting its own value as a utility without any legitimate asset integration.

In comparison, other L2 competitors, such as Arbitrum, Optimism, and Base, comprised less than 40% of their tokens as part of TVL. For Arbitrum, it was as low as 25%.

If the Metis token is incorporated in various DeFi protocols on other chains over the next few months, this concentrated value will decrease, and that would eliminate the concern. So, it is currently not a major issue just yet.

(Important Note: The TVL mentioned above is retrieved from L2beats, which calculates all value locked on Ethereum, while the TVL value used to compare projects is derived from Defi llama, which only calculates the value locked on various dApps across chains)

What is our valuation expectation from Metis?

To draw a fair valuation for Metis, we will compare its current market cap to other L2 competitors and identify a few talking points.

Starting with the Fully Diluted Valuation (FDV) to Market Cap (MC) ratio.

An FDV:MC ratio below 1 is regarded as undervalued, between 1 and 2 is fairly valued, and anything over 4 reads as overvalued.

Optimism and Arbitrum are strongly established projects in the ecosystem. They both have respective FDV: Market Cap ratios of 4.76 and 7.92, which indicate overvaluation. An inference can also be drawn that these assets could be subjected to inflation because they have a huge total or max supply compared to their current circulating supply.

Now, Metis has an FDV of $920M and a Market Cap of $440M, giving us an FDV:MC ratio of 2.09, which means it is close to being fairly valued right now.

However, one thing to note is that Metis has a fixed 10 million circulating supply, and its EDF will have 4.6 million metis tokens dedicated to bootstrap development, liquidity, activity, and adoption in the Metis ecosystem.Starting in Q1 2024, Metis will distribute this 4.6 million in the ecosystem, over the next ten years, That is close to 1260 tokens/daily. This will not be a linear unlock, but the token emission is not expected to cause inflation. Metis Validators in the Sequencer Mining program will also have to stake 20,000 Metis tokens to receive mining yield, creating a supply crunch.

And then, another bullish assumption we have to draw out here is that the Metis EDF fund will bring more DeFi protocols, dApps, and liquidity to the ecosystem. This is because there it serves as an incentive to build on Metis. Three million tokens are allocated for Sequencer Mining, and 1.6 million are allocated for ecosystem funding. Combined with the fact that EIP4844 is putting Metis in an advantageous position above its competitors, there will be a substantial market share to absorb.

Best case

Now, if Metis attracts at least 200 defi protocols, which will put it in the same range as Optimism and Arbitrum, then we could potentially look at a best-case scenario of $1 billion in TVL.If this scenario plays out, Metis should be able to rise 8.4x from current prices to about $700.

The Fibonacci lines drawn from the high and low ranges indicate a similar target range, which confluences with the estimate mentioned above.

Base case

According to DefiLlama, Metis and Mantle are home to about the same number of protocols - 47 and 50, respectively. However, Mantle’s TVL is 2x higher than Metis’, and Mantle’s market cap is almost 4x higher than Metis’.Over the next few months, if DeFi protocols continue to flock in the Metis ecosystem, the Metis should be able to, at least, recoup its previous TVL high of $480 million. For context, Metis’s ATH value of TVL of $480 million matches up with a market cap high of $600 million and its previous ATH of $322.

Therefore, a surge in TVL from $65M to $480M should trigger a positive performance for Metis's price as well.

So, in the base case, Metis can grow 3.8x from its current price to its previous ATH of $322.

Worst case

Now, if Metis cannot attract a significant number of Web3 projects and developers through its EDF, the number of active addresses will not improve beyond its current range of 15000-20000 per day.Without strong fundamentals driving its price performance, Metis would rally meagerly with the market, where capital flows through major to mid to low-cap assets during bull market cycles.

Such a scenario might see the token register around a 2x rally, consolidating around $160-$180.

- In the best case scenario, METIS can do an 8.4x from current prices.

- In the base case scenario, METIS can do a 3.8x from current prices.

- A bearish case would see the asset consolidate under 2x.

Invalidation criteria

Past market performance does not always indicate future performance, and lack of development will affect TVL's growth.The two main factors that will invalidate the bullish thesis on Metis include:

- The scalability challenge is not solved even after the Sequencer Pool or EIP4844 becomes operational.

- Token-centric TVL remains concentrated on Metis itself, lacking utility and diverse asset integration.

How to position into Metis

- Currently, Metis has broken above a price range of $95 - $73. This is bullish in the short term.

- This might push the price to $165 - $170, i.e. the next resistance range in the short term - note that this is a risky short-term bet.

- For a longer-term investment, it might be best to wait for a 50% flush and then buy in the $65 - $50 range.

- A drop below $20 should invalidate this bullish thesis.

Cryptonary’s take

The Ethereum ecosystem largely underperformed during the 2023 bull run. Yet, ETH is not dead, and the ecosystem will have its day in the limelight. Once the 2024 bull ruck kicks off and Bitcoin rallies, there’ll be capital rotation into alts. While Solana is a strong contender, ETH remains the king of DeFi.And once ETH is back to winning ways, that’s where Metis is uniquely positioned for success. The announcement of its $375M fund, alongside the imminent EIP4844 upgrade, should allow the token to attract market liquidity.

Fundamentally, Metis is ticking all the right boxes at the moment on paper, and we expect implementation and better on-chain data and activity as we move forward in 2024.