It is no longer just about getting from point A to point B. It is about optimising the route, avoiding traffic and congestion, and considering real-time delays such as accidents or road maintenance.

Popular applications such as Google and Apple Maps take care of most of these requirements, but Altas Navi is bringing a different approach, which also incentivises the users.

This Web3 protocol uses AI and blockchain technology to pay users rewards per mile driven. However, is this solution sustainable enough to compete in a competitive market? Is adoption taking place, or is it just a smokescreen?

The project is undervalued, with a market cap under $50 million.

But is it investment-worthy?

Let's find out!

TDLR

- Introducing a revolutionary drive-to-earn app that leverages AI and blockchain, allowing users to earn crypto for every mile driven—backed by major auto brands and EU grants.

- The token utility is robust: It can be used for NFTs, staking, premium features, and even real-world services like refuelling, encouraging holding over selling.

- Adoption is surging: 700k downloads, 112M miles logged, and $678k paid out. As the only crypto app on major auto platforms, it eyes a slice of the 1B+ navigation app users.

- Investment thesis: Targeting 1-3% of a $30B market by 2025. Conservative targets suggest 4.5x (bear) to 16x (bull) potential, riding AI and DePIN trends.

- Verdict: Strong product-market fit, auto giant backing, and clear token utility make this sub-$100M project a compelling play despite average tokenomics.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

A brief introduction

Atlas Navi is a drive-to-earn platform that uses artificial intelligence (AI) and the user’s smartphone camera to detect and estimate the best route possible. Machine learning algorithms allow the app to analyse any road 25 times per second, producing better data than other navigation apps.The project was launched in Q3 2022, and it has progressively been improved over the past 18 months.

From a security perspective, Atlas Navi only uploads relevant information to the server for traffic optimisation. No images or videos are uploaded unless specifically enabled by the user. If enabled, it can store the videos recorded from your road trips in the cloud, but the default option is to keep them on your device.

The protocol is currently backed by renowned brands in the automotive industry such as Alfa Romeo, Fiat, and Abarth. It also received an innovation grant from the European Union worth $1.6 million, and the commission conducts quarterly financial and technical / code audits throughout the product development.

Drive-to-earn model

Atlas Navi’s drive-to-earn reward system is one of the main selling points of this project. Since the introduction of its drive-to-earn model, it has recorded over 12,900 daily trips, with an average of 500,000 miles driven every day by its users.So how does that work?

Well, to receive rewards in the form of $NAVI tokens for each km/mile driven, users need to purchase licensed 3D vehicle NFTs on the application.

Here’s the catch.

The prices of NFTs vary, and the rewards that users earn depend on the price range of the NFTs that they own.

After buying an NFT, users need to stake it. Afterwards, they’ll be eligible to earn $MILE tokens for every km/mile driven. These $MILE tokens can be converted to $NAVI, which can later be cashed out to the user's wallet or used in the application.

It is important to note that the $MILE to $NAVI exchange rate changes weekly depending on the token and user demand.

Tokenomics

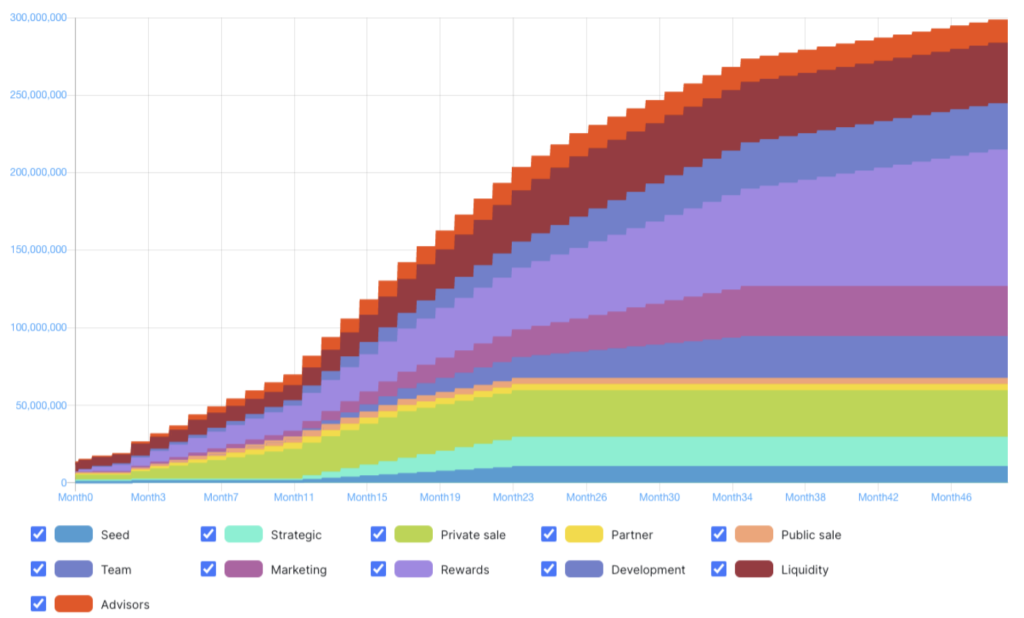

The maximum circulating supply for $NAVI is capped at 300 million tokens. At the moment, close to 88 million are in circulation, i.e. 29%. The distribution of the token is listed below:

- Rewards: 30%

- Liquidity: 13%

- Marketing: 10.7%

- Development: 10%

- Private sale: 10%

- Team: 9%

- Strategic round: 6.33%

- Advisors: 5%

- Seed round: 3.33%

- Partner round: 1.33%

- Public sale: 1.33%

The vesting schedule is somewhat aggressive over the next few months as by the end of 2024, the circulating supply could increase to almost 50%, i.e. 150 million tokens.

Overall, tokenomics is not very investment-friendly right now.

This is where the $NAVI token utility comes in to possibly save the plot.

As mentioned earlier, its entire drive-to-earn model is based around its $NAVI token. This token is essential for minting NFTs and staking, which allows users to receive rewards. There is also a staking option, which is separated from the D2E setup.

Users can stake their tokens for 12 months and earn a flat 50% APY. However, if the staked amount is withdrawn before the staking period, a 25% principal amount penalty will apply.

A premium feature also includes fleet management solutions that offer advanced navigation, route optimisation, and multi-stop options for couriers, delivery vans, and truckers. This feature, essential for corporate users, is paid for with $NAVI. This module supports fleet dispatching, driver monitoring, and tracking, demonstrating the token's practical value in the market.

Additionally, NAVI holders can purchase real-world services around their vehicle with $NAVI, which includes insurance, vehicle maintenance, car washes, refuelling, etc.

Holders also possess voting rights and can decide on things like which vehicles to be released or what features to develop next. They can also organise themselves in virtual and real-world auto clubs with paid/free events (paid in $NAVI) for participation.

Hence, despite average tokenomics, the token utility does provide enough stimulus to its user base to hold and use Navi.

Investment thesis

When building an investment thesis around a Web3 service or product, it is often great if the product is understandable and with data-driven statistics.With Atlas Navi, we are in a similar position, where two major crypto narratives in AI and DePin come together. The best part is that the product is already live, being utilised, and delivering returns.

However, it is important to look into the reasons we are bullish on Atlas Navi so you can build the conviction that will carry you through the inevitable drawdowns.

Adoption

The Atlas Navi team built through the 2022-2023 bear market, and since the application was launched in October 2022, it has done pretty well from an adoption perspective. For instance, the application has been downloaded 698,037 times since it launched.Over 112 million miles have been driven by cars registered on the application, and currently, the application has over 200,000 daily active users. Other important statistics include:

- Over 500,000 miles driven daily

- 2,988,981 $NAVI tokens staked

- 4,302,008 $NAVI tokens awarded from referrals

- 3,200,000 $NAVI spent on NFTs

- 1,400 NFTs sold

- $678,158 total payout

In terms of targeted audience, Atlas Navi has barely scratched the surface, considering it only has 200,000+ active users.

Over a billion users use a navigation app of some kind, but none of the incumbent navigation apps offer user rewards. So, the potential for NAVI to gain market share because of its unique USP is pretty relevant.

Team and partnerships

When evaluating a crypto project with a customer base that consists mainly of retail users rather than enterprise clients, a doxxed team is always a positive sign. The team behind Atlas Navi included 16+ core members with backgrounds in software development, business management, and investments.The project is also vetted and funded by the European Union and CCAM, i.e., Connected Cooperative & Automated Mobility.

We mentioned its partnerships with Fiat, Alfa Romeo, and Abarth earlier, but other significant entities include NVIDIA and OMV Petrom. OMV Petrom is the largest fuel station chain in Romania, with 555 gas stations and one of the biggest oil and gas companies in Europe.

Token utility

We have already discussed this in length in the previous section, but this is also one of the reasons that improves the investment case for $NAVI. The entire application is built around $NAVI’s utility, which is a positive considering that many transactions are involved in the app itself.According to the roadmap, the team is targeting an immersive play-to-earn drag race game experience in 2024. This race will include a more creative economy to further amplify $NAVI’s use case. There hasn’t been any announcement yet, so we will keep a lookout for more developments.

Now, one possible concern we want to address about $NAVI is the possibility of selling pressure from the user rewards.

If you are only looking to hold $NAVI purely as an investment, you may be concerned that many app users will be selling their $NAVI rewards, thereby causing constant selling pressure.

However, from what we have observed, that is not the case yet. From tracking the community chats and analysing the user base queries, many users are using their token rewards in the app for refuelling, NFT sales, registration, premium features, etc.

From our observations, $NAVI utility is preserved in the product, and we don’t think selling pressure from rewards is currently a concern.

Valuation exercise

The automobile manufacturing industry was valued at over $2.5 trillion in 2022 and was expected to reach around $3 trillion by the end of 2023. That is an enormous total addressable market (TAM), but is $NAVI targeting this entire market?The answer is "No".

For a fair market valuation, we need to be more specific with Navi’s target in the automobile industry; this is where the automotive navigation systems industry comes into play.

Multiple studies have shown that the value of the automotive navigation systems industry was between $30 billion and $35 billion at the end of 2023. By the end of 2030, it is estimated to reach above $50 billion. We believe this sector of the automobile industry represents the actual addressable market for Atlas Navi.

Now, let us evaluate the revenue streams for Atlas Navi. The protocol is currently generation money from:

- Sales of 3D licensed NFTs for user rewards

- NFT vehicle upgrades and repairs

- Premium features, which include fleet management accounts, etc.

- In-app advertising revenue

- Tax and Royalty from secondary NFT markets

- Service charge for real-world products, i.e. car insurance, car wash, refuelling, etc

- DAO auto club event memberships

Now, before we get into the valuation, we need also to outline the circulating supply that could be reached in a year from now. There are a few conditions to keep in mind:

- NAVI’s current market cap is $22 million, with a full diluted market cap of $75 million.

- The current circulating supply is 88M, but the unlocked supply is about 150M

- Based on the linear release, the unlocked supply in May 2025 will be 246M, and the circulating supply is expected to be 144 million.

The total addressable market cap for Atlas Navi is $30 billion to$35 billion.

Considering we do not have strict revenue data, estimating how much of the total addressable market or TAM $NAVI can capture is still difficult. However, taking into account $NAVI’s multiple revenue streams, token utility, and adoption, we expect it to capture at least 1-3% of the TAM.Since the total addressable market cap is $30-$35 billion, so let us take the lower limit for a conservative approach, i.e. $30 billion. Therefore,

- 1-3% of $30 billion would be around $300 million to $900 million.

Keep the above in mind and the circulating supply of 144 million, so we will reduce the captured market cap for $NAVI even further. Therefore, based on the above conditions,

- Base target (0.5% of TAM): $150M or $1.2 per token, i.e. a 4.5X upside

- Bull target (1% of TAM): $300M or $2 per token, i.e. an 8.1x upside

- Best target (2% of TAM): $600M or 4.166 per token, i.e. a 16x upside

(It is important to note that these targets are pretty conservative but are mostly based on assumptions.)

Technical analysis

After reaching an all-time high of $0.55 on March 21, 2024, $NAVI registered a 66% market decline. However, unlike certain other altcoins, its long-term bullish structure remains intact. The token re-tested the upper limit of a support range between $0.13 and $0.20.

Following the bounce, the asset was able to momentarily recover a bullish position above the 50 and 100-exponential moving averages, but over the past four days, it has been again below both indicators. It is currently oscillating below both 50 and 100 EMAs.

To initiate a bullish trend shift, $NAVI needs to close a daily candle above $0.33 and break the short-term bearish structure.

Cryptonary’s take

The value proposition and investment opportunity in Atlas Navi are very solid. We have a protocol under the $100 million market that is potentially targeting over a billion users who utilise navigation apps.There is clear token utility, a solid team building the product, and reputable brands are backing it.

On the downside, the tokenomics are average, and there have been a few issues with withdrawing $ NAVI tokens from the app to user wallets. There is also the case of centralisation since users need to include their phone numbers during registration, but it is not a complete deal-breaker.

Overall, Atlas Navi has a product-market fit at the intersection of DePIN, AI, and crypto.

With the market inclining towards AI, DePin projects in 2024, Atlas Navi has its fundamental bases clear to take advantage of capital inflows in these trending narratives.

Until then,

Cryptonary Out!