This Stock Could Be the Smartest Hedge With Decent Growth

If your portfolio is heavy crypto, you need something that doesn’t break the same way crypto breaks. This stock is one of the few plays that can grow when risk goes risk-off… and still win long-term. Here’s why we are bullish…

In this report:

- Intro to the stock

- TradFi partnerships

- Looking into company’s performance

- Our thesis and what market is missing

- Cryptonary’s take

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results

What is Circle?

Circle (officially Circle Internet Group, Inc.) is a global fintech and blockchain company best known as the issuer of USDC, one of the world’s largest regulated stablecoins, pegged 1:1 to the US dollar.Founded in 2013 by Jeremy Allaire (current CEO) and Sean Neville, Circle started with a vision to make money move as easily as information on the internet. It initially focused on Bitcoin payments before pivoting into stablecoins and digital dollar infrastructure.

Today, Circle operates as a platform, network, and market infrastructure provider for stablecoin and blockchain applications. It issues USDC (USD-denominated) and EURC (euro-denominated), collectively referred to as Circle stablecoins.

Beyond issuance, Circle provides a stablecoin network and a suite of blockchain-native software infrastructure, designed to abstract away the complexity of blockchain rails and improve the usability and reach of its stablecoins.

Following its June 5, 2025, IPO and the July 2025 passage of the GENIUS Act, Circle’s narrative has increasingly shifted from a speculative crypto issuer to a more regulated, large-cap fintech/tech hybrid (market cap roughly $20b as of early 2026)

Core Business & Products

Circle's flagship product is USDC, a fully reserved digital dollar backed 100% by cash and highly liquid cash-equivalent assets (like short-term US Treasuries). It's redeemable 1:1 for USD and widely used for:- Global payments & remittances

- DeFi (decentralised finance)

- Trading on crypto exchanges

- Cross-border settlements

- Integration with traditional finance (e.g., Visa, Mastercard partners)

- EURC — a regulated digital euro stablecoin

- USYC — an institutional-grade tokenised money market fund

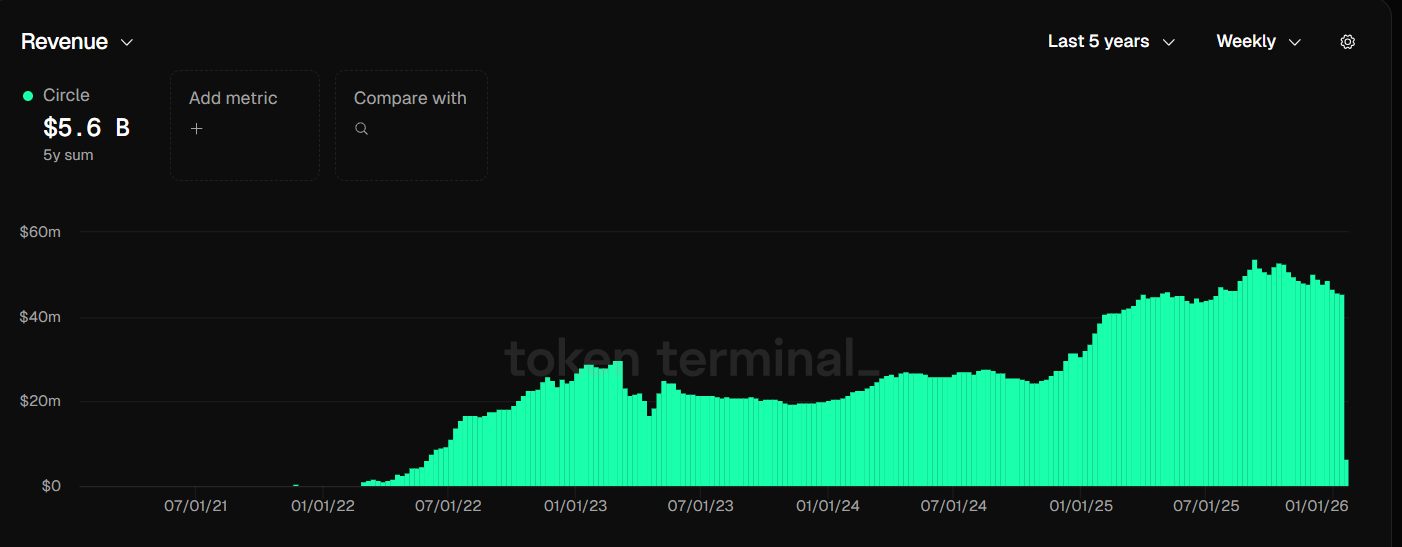

The dominant driver today is Reserve Income: users deposit dollars to mint USDC; Circle invests the reserves primarily in short-dated U.S. T-bills and repos via cash accounts and the BlackRock-managed Circle Reserve Fund.

The critical structural advantage is a near-zero cost of capital because Circle generally pays no interest to USDC holders, capturing the risk-free yield spread.

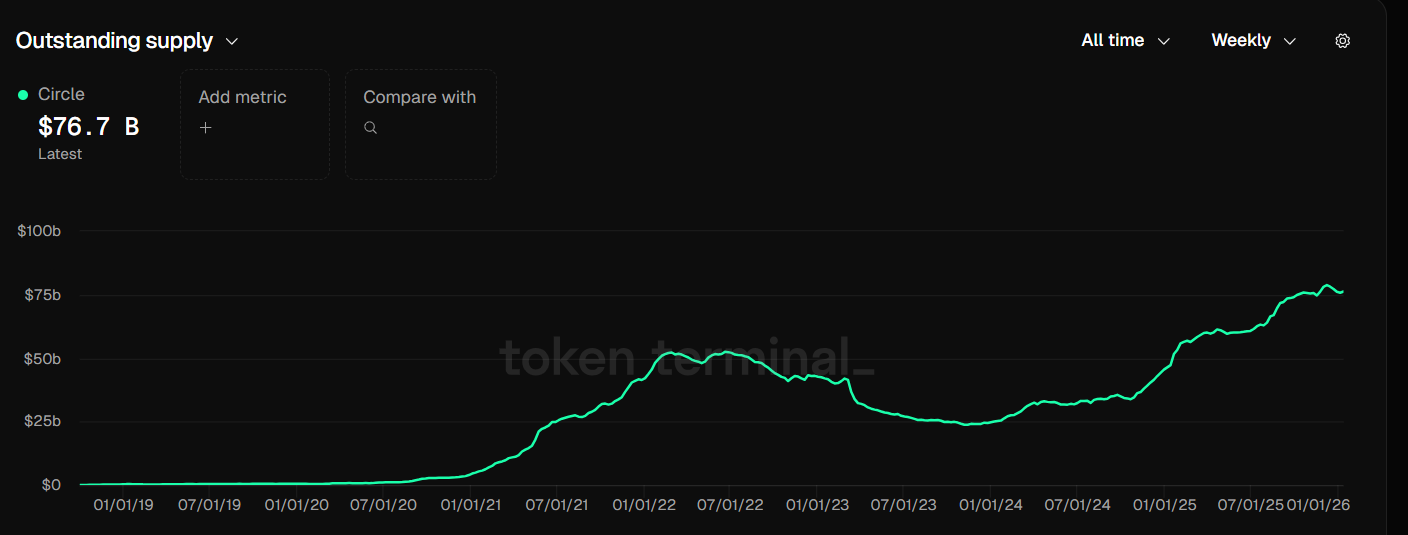

USDC’s circulating supply is roughly $77B. Circle takes those reserves, deploys them into risk-free instruments, and earns a yield of around ~3% (rate-dependent).

This model has proven very successful for Tether (a competing stablecoin issuer) and for Circle, even though it’s highly sensitive to the Fed’s interest rate policy. It’s a genuinely interesting arbitrage that has grown into a multi-billion-dollar business.

That model works best when you have scale and distribution, and Circle’s scale has largely come from strong partnerships across the crypto industry, especially with Coinbase.

Coinbase + Circle

Circle and Coinbase share one of the deepest and most enduring partnerships in the crypto industry, dating back to the very creation of USDC. Circle and Coinbase were the original co-founders of the CENTRE Consortium, which governed USDC. In late 2023, they dissolved CENTRE and moved governance in-house to Circle, but signed a long-term commercial agreement.At the core of that agreement is a defined split of the interest income generated from USDC reserves, depending on where the USDC is held:

- On-Platform: Coinbase retains 100% of the interest income generated by USDC held in customer accounts on the Coinbase exchange. In other words, Coinbase captures the full reserve yield on USDC, which it directly distributes and custodies within its own ecosystem.

- Off-Platform: Interest income from USDC held outside Coinbase, such as in DeFi protocols, self-custody wallets, or third-party exchanges, is split 50/50 between Circle and Coinbase. This effectively aligns incentives for both firms to support broader USDC adoption beyond Coinbase itself, while still sharing in the upside from USDC’s global circulation.

TradFi Partnerships: USDC goes mainstream

In the last couple of years, Circle has expanded into a growing list of well-known TradFi and payments companies. The pattern is consistent: USDC is increasingly being used as a settlement rail and not only for crypto trading. The more these institutions integrate USDC into their plumbing, the more it becomes a de facto settlement and payments stablecoin.For example…

- Visa: Visa has moved USDC into real settlement. In December 2025, Visa launched USDC settlement in the U.S., allowing select issuer and acquirer partners to settle with Visa in Circle’s USDC.

- Mastercard: Mastercard expanded its partnership with Circle to support settlement in USDC and EURC for acquirers across Eastern Europe, the Middle East, and Africa (EEMEA). This brings stablecoin settlement closer to everyday merchant flows.

- Interactive Brokers: Interactive Brokers now supports USDC funding through a wallet flow powered by ZeroHash. Clients can send USDC, and it gets automatically converted into USD and credited to their brokerage account.

- MoneyGram: MoneyGram helps bring USDC into the real world through cash-in and cash-out rails, especially in markets where cash is still dominant. This matters for remittances and cross-border corridors where speed and cost savings are a big deal.

Financials

- Market cap: around $18b - $20b

- Cash: $1.3b

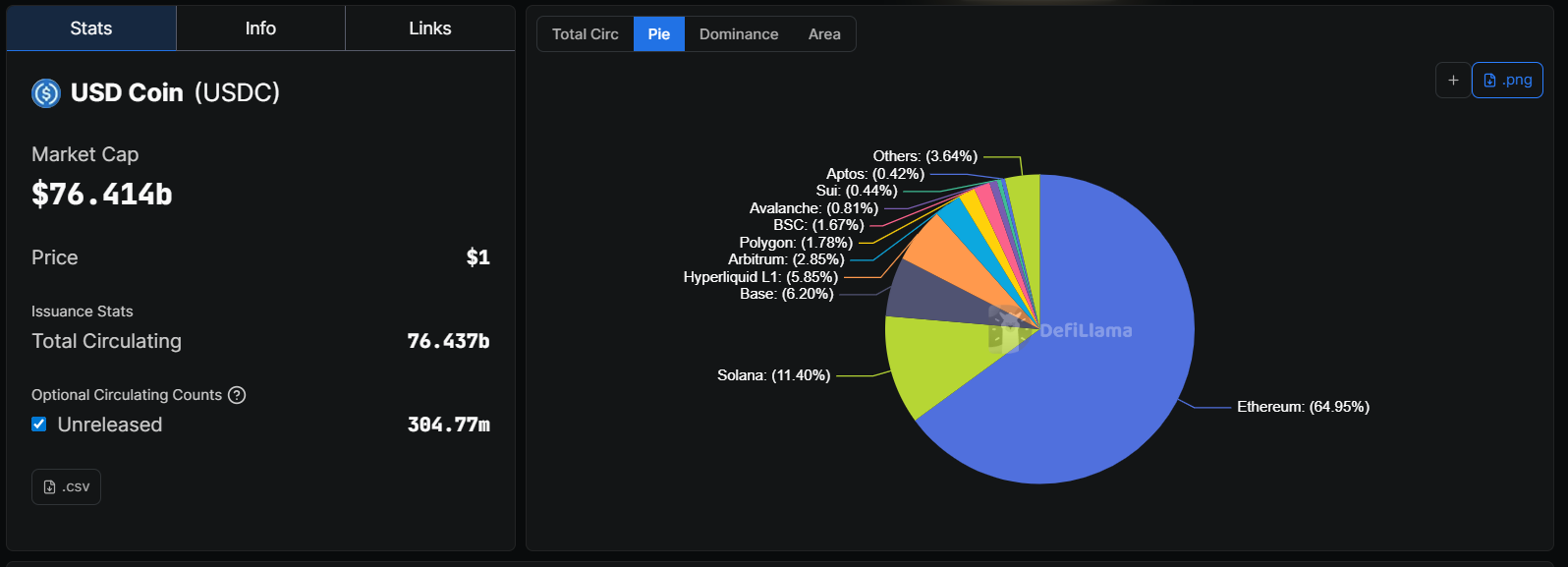

- USDC supply: $77b

- Annual growth of USDC: over 70%

- Supply distribution: Over half on Ethereum, followed by Solana, Base and Hyperliquid

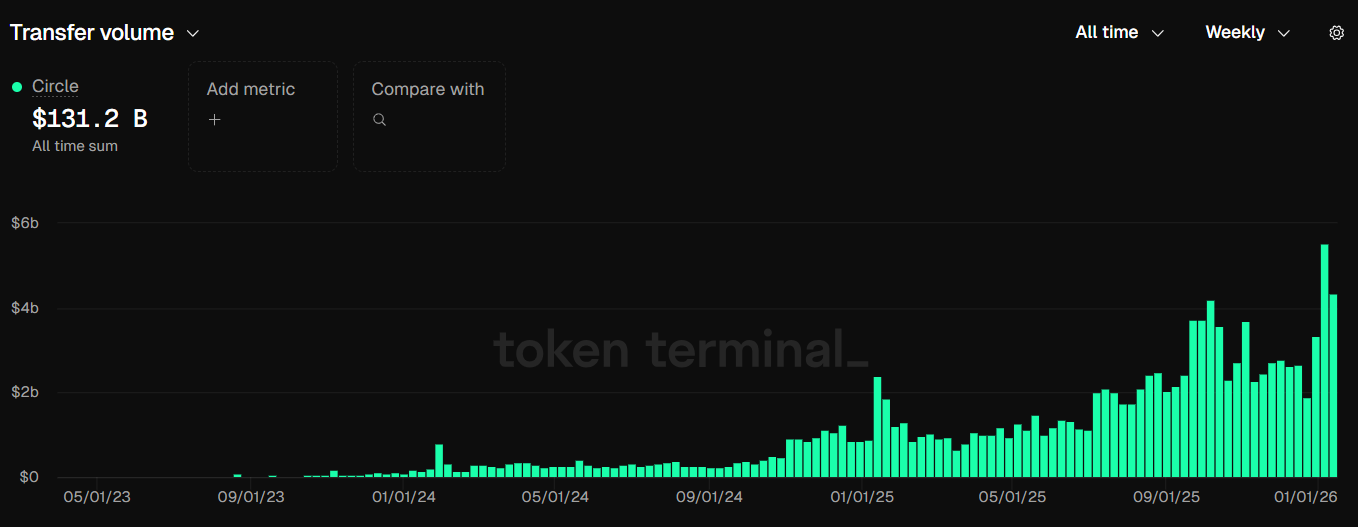

In the last five years, Circle has generated around $5.6B in revenue. As the circulating supply of USDC has grown over time, so has the underlying revenue base.

With several positive catalysts ahead, and a broader push toward tokenising dollars and effectively exporting U.S. debt via stablecoins, we think both USDC supply and Circle’s revenue can continue to scale from here.

Here’s why we think CRCL can be a great addition to your portfolio

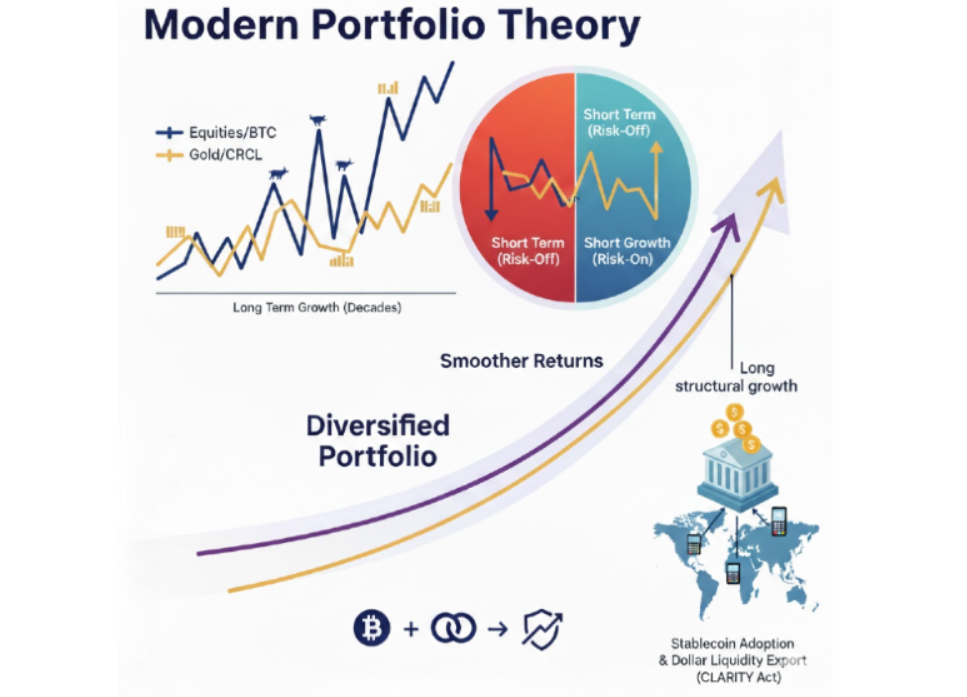

Modern Portfolio Theory

Modern Portfolio Theory (MPT) is one of the most influential concepts in finance and investment management, developed by Harry Markowitz in 1952 (his famous paper was published in The Journal of Finance in March 1952).It basically gave birth to modern investment thinking and is still the foundation of how most institutional investors, robo-advisors, and financial planners approach portfolio construction today.

This framework is frequently referenced by Ray Dalio, who simplifies it as owning assets that:

- Tend to go up together over the long run

- But behave differently during short-term stress

Why does CRCL make sense?

In rising interest-rate environments, risk assets like equities and crypto usually struggle. Higher bond yields attract capital, liquidity tightens, and markets shift into risk-off mode.However, Circle operates differently.

Circle earns revenue by holding reserves backing stablecoins (USDC, EURC) in short-duration U.S. Treasuries. When interest rates rise:

- Treasury yields increase

- Circle earns more on the same reserves

- Revenue expands structurally

This creates a useful dynamic:

- Bitcoin tends to react negatively to tighter monetary policy

- CRCL will likely react positively to higher rates and risk-off behaviour

However, over the long term, the U.S. policy increasingly points toward exporting dollar liquidity through stablecoins. Regulatory initiatives such as the CLARITY Act signal institutional and government support for stablecoin infrastructure.

As adoption grows:

- Stablecoin usage expands across payments, trading, and settlement

- Reserve balances grow structurally

- Circle benefits regardless of short-term rate direction

Taken together, this creates a setup where both assets can trend higher over the long term. But when the path of interest rates is uncertain, combining crypto exposure with CRCL becomes especially powerful.

Crypto captures upside in risk-on environments, while CRCL helps offset rate and risk-off shocks, reducing overall portfolio volatility without sacrificing the upside of a stock-plus-crypto allocation.

Price Targets

Currently, Circle trades at around $18b - $20b market capitalisation with annual revenue of $2.4b last year.That results in an implied P/S ratio of 7.5x-8.3x. So right now, the market values Circle at roughly ~8x revenue.

- Target 1: $50b mcap (that’s about a 2.5x move from $20B.)

- Target 2: $100b mcap (about 5x from here)

In this scenario, Circle is likely to grow by more than 70% due to:

- Higher revenue from interest

- Higher supply of USDC

- Also, let’s not forget the growth of EURC, Tokenised treasury and other non-interest related revenue sources

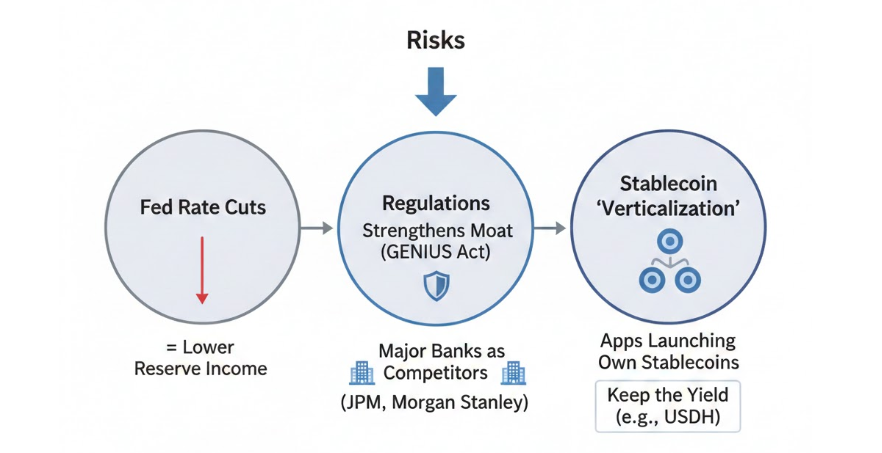

Risks

Circle’s business is powerful, but the risk profile is clear because earnings are still dominated by rates, regulation, and distributionFed rate cuts = lower Reserve Income

Circle’s earnings are heavily tied to Fed policy, and expected rate cuts in 2026–2027 threaten margin compression. In simple terms: lower rates = less revenue per USDC in circulation.This can be mitigated via:

- scale USDC circulation fast enough to offset yield declines and

- diversify into platform/transaction revenues (“Other Revenue”) via products like CCTP, programmable wallets, Circle Mint, and others.

Regulations

Regulatory risk is paradoxical: the GENIUS Act strengthens Circle’s moat vs offshore issuers (e.g., Tether) but opens the door for the most formidable competitors: major global banks like JPMorgan, Morgan Stanley, etc who have distribution, trust, and potential capital-structure advantages.However, USDC has major network effects and is often considered to be the safest stablecoin issuer among crypto-native users and developers.

This is a very strong moat. We believe many crypto users would be hesitant to use any other stablecoin even if it's issued by a major bank, though non-crypto users would likely be less picky.

There are hundreds of different stablecoins now in the market, but the most widely used are still USDC and USDT.

Stablecoin “verticalization” inside crypto

A growing risk is crypto-native apps launching their own stablecoins to capture the same reserve yield and control distribution.If an app issues the stablecoin, it keeps the yield. Examples include platforms moving toward internal settlement units, like Hyperliquid’s USDH. This trend can slowly pull usage and liquidity away from USDC in key on-chain venues.

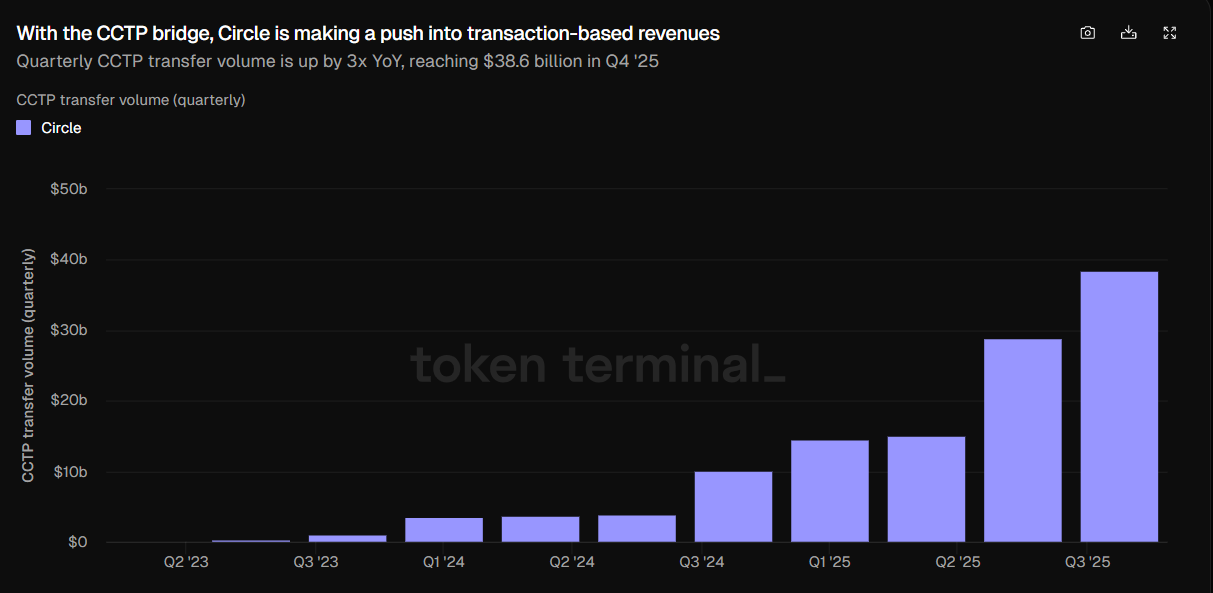

The Path to Diversification: Beyond Reserve Yields

What the market still isn’t fully pricing in is Circle’s ability to diversify beyond interest income.Circle is actively building non-interest, non-reserve income streams (categorised as "Other Revenue"), which are made up of platform services, subscriptions, transaction fees, and infrastructure products. It’s still smaller than reserve income today, but the growth curve is starting to look meaningful.

The company released its flagship 2026 report, "Beyond Stablecoins: The Rise of the Internet Financial System", highlighting the shift to programmable, compliant blockchain infrastructure.

Two data points show where this is heading:

1) CCTP (Cross-Chain Transfer Protocol) is turning Circle into a transaction layer. Quarterly CCTP transfer volume is now up ~3x YoY, reaching $38.6B in Q4 ’25

2) USYC is Circle pushing into yield-bearing assets. USYC’s market cap is now around $1.5B, making it the #2 largest tokenised money market fund, proving Circle isn’t only a stablecoin issuer, but also a player in the fast-growing “tokenised cash/T-bills” category.

This aligns with Circle’s broader strategy shift, outlined in its 2026 flagship report “Beyond Stablecoins: The Rise of the Internet Financial System”, positioning Circle as a programmable, compliant financial infrastructure, not just a USDC business.

Technical analysis (Areas of Interest)

On the daily timeframe (log scale), $CRCL had a strong IPO debut, launching near $69 and rallying sharply to just under $300 between early and late June 2025. That initial expansion phase was aggressive, but since the June 2025 highs, price has been in a clear bearish structure, forming lower highs and lower lows. This can be clearly seen by the descending red dotted trendline that has capped prices consistently since June.

The first major demand zone formed during the IPO rally between roughly $104-$118. Price initially respected this zone when price came for a retest but decisively broke below it in November 2025, triggering a sharp continuation move to the downside. From there, CRCL sold off toward its launch region, forming a local low around $64-65 in mid to late November. A short term base then developed between $75 and $91, but that structure has since broken down, keeping the broader trend weak.

Price is now trading into a lower demand zone between $68-$73, just above the IPO launch area. This zone is critical from a structure perspective. Any improvement requires, at minimum, a reclaim of the $75-$91 range. A break above $91, along with a break of the red dotted downtrend line, would mark an intermediate improvement in structure. A full daily structural shift would come above $150. That is when the higher timeframe trend flips, unless we get a new ATL and new structure is formed.

RSI bottomed near 20 during the November sell off but has repeatedly failed to sustain above 50 on rebounds. Currently, RSI is hovering in the high 30s with an average in the mid 40s, indicating muted momentum.

How to Buy

- Step 1: Install Phantom wallet

- Download and install the Phantom wallet extension for your browser from the official Phantom website.

- Create a new wallet or import an existing one using your recovery phrase.

- Step 2: Secure your wallet

- Write down and securely store your recovery phrase. This phrase is crucial for recovering your wallet in case of loss or device failure.

- Step 3: Fund your Phantom wallet

- Deposit Solana-supported tokens, stablecoins like USDC or USDT

- Step 4: Use the built-in swap feature

- Open the Phantom wallet and navigate to the "Swap" tab.

- Choose the token you wish to swap (e.g., USDC) and insert the following contract address: XsueG8BtpquVJX9LVLLEGuViXUungE6WmK5YZ3p3bd1

- Enter the amount you want to swap and review the transaction details, including the estimated network fees.

- Confirm the transaction and approve it within the Phantom wallet.

- Or go to Jupiter exchange and insert the following contract address: XsueG8BtpquVJX9LVLLEGuViXUungE6WmK5YZ3p3bd1

- Enter the amount you want to swap and review the transaction details, including the estimated network fees.

- Step 5: Verify the transaction

- Once the transaction is complete, you'll see the updated CRCL balance in your Phantom wallet.

Also, it is important that the liquidity of onchain stocks isn’t as deep as native tokens like SOL or ETH. Therefore, size properly and if you have a large order, break it down and enter the position over time. Additionally, avoid buying tokenised stocks during weekends, as market makers might need additional spread to offset the risk of not being able to sell the asset till market opens on Monday

Cryptonary’s Take

CRCL is a defensive growth bet on one simple idea: the dollar is becoming programmable.We’re moving into a world where money increasingly lives on rails that look more like the internet than legacy banking. And in an era where BRICS and other blocs are actively pushing de-dollarisation, the US has a strategic incentive to export the dollar digitally. That’s exactly what Circle enables.

USDC spreads USD hegemony instantly and globally without needing local bank accounts, correspondent banking, or permissioned infrastructure. It’s a frictionless “dollar export,” usable by anyone with an internet connection.

The network effect is already there. There are hundreds of stablecoins now: PayPal USD, FDUSD, USD1, USDe, and plenty more. So it is a relatively safe bet on stablecoin growths

However, it is a very smart bet if you correctly construct a portfolio with it and hedge interest rate decisions. If rates continue to go down and the economy runs hot, BTC and other risk assets are likely to continue to grow

If, however, we see a right hike down the future, risk assets will sell off while the stock is likely to grow because of the expanded supply of USDC and revenue..

Investors looking at Circle today are essentially underwriting a binary outcome: either USDC becomes the de facto “HTTP for Money”, a global settlement layer that captures trillions in volume and makes interest rate cycles irrelevant, or it gets commoditised as money-centre banks (JPMorgan, Citi) use regulation like the GENIUS Act to launch insured stablecoins and crush margins.

We think both camps are wrong.

“HTTP for Money” is a massive ask, and in finance, the winner rarely takes all. Smart institutions and large holders will always diversify. The most likely endgame is a world with 3–4 dominant stablecoins, not one.

But the commoditisation argument misses the reality on the ground: Circle is already deeply embedded. USDC has real network effects, real integrations across DeFi and TradFi, and is widely viewed as the safest stablecoin among crypto-natives. That kind of positioning isn’t easy to replicate overnight, even for banks.

That’s why we think CRCL is a solid bet, especially as a defensive growth position inside a crypto-dominated portfolio.

Peace!

Cryptonary, OUT!

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms