ThorChain Ecosystem: Enabling $755M in Liquidity with 67% Faster Cross-Chain Swaps

Decentralised Finance is “Wall Street on-chain” without corruption; the efficiency is superbly high. Most of DeFi is fragmented and there are so many blockchains out there with unique ecosystems and liquidity. However, for composable and harmonic development of these markets there needs to be a way to connect the value flow across these blockchains in an efficient and decentralised way.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is ThorChain?

ThorChain is a decentralized cross-chain liquidity protocol that enables the swapping of native assets between different blockchain networks, such as Bitcoin, Ethereum, and others, without the need for wrapped or pegged tokens. Built using the Cosmos SDK, it operates as an independent layer-1 network, functioning essentially as a trust-minimised decentralized exchange (DEX).ThorChain uses a unique system where users can exchange assets directly from one blockchain to another in a permissionless environment. That means you can directly swap native BTC to ETH, AVAX, BNB, USDT and others without any centralised entities involved. This is a game-changer because ThorChain is 1st protocol to natively connect BTC to all other different blockchains such as Ethereum, Avalanche, Binance Smart Chain and others.

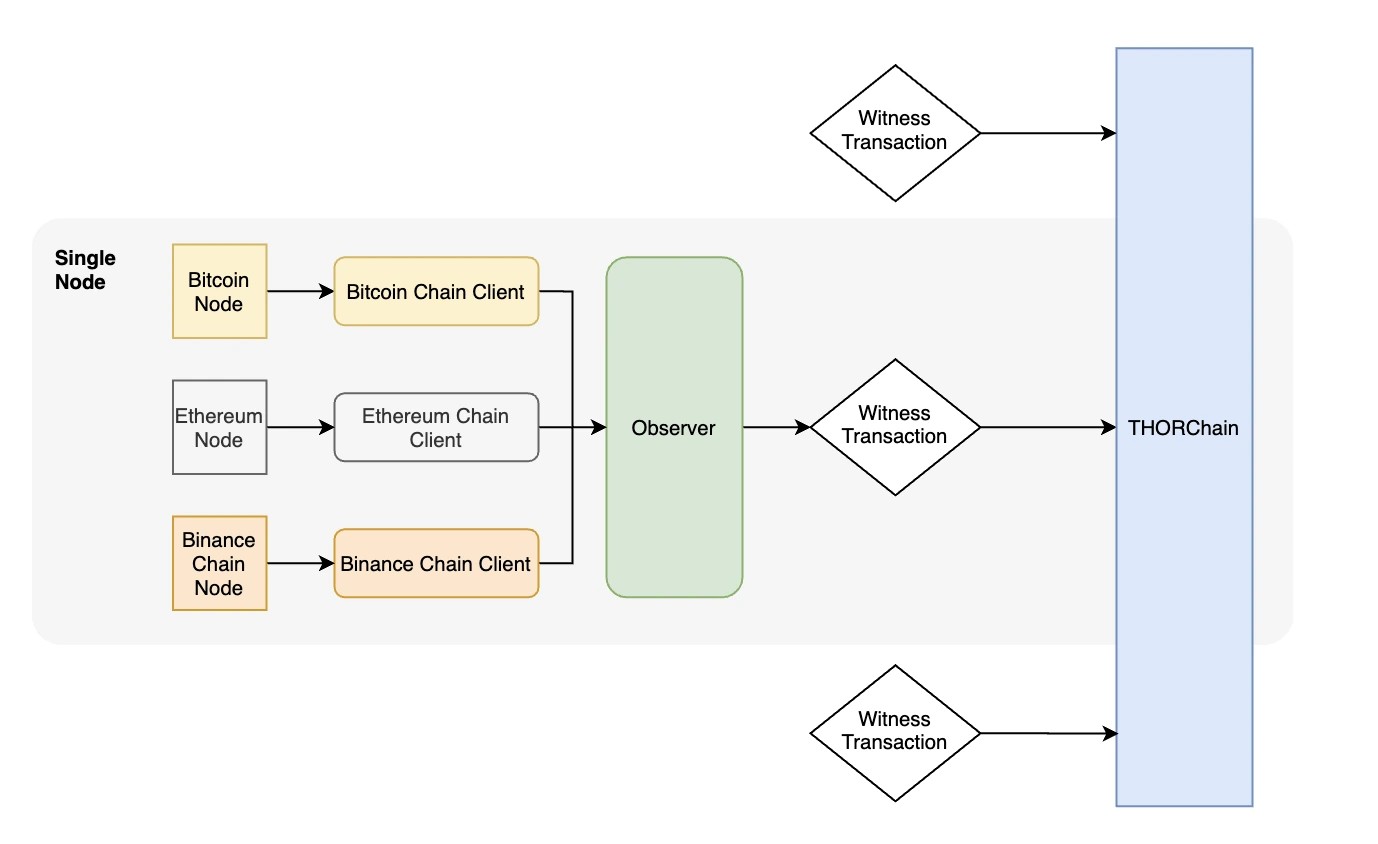

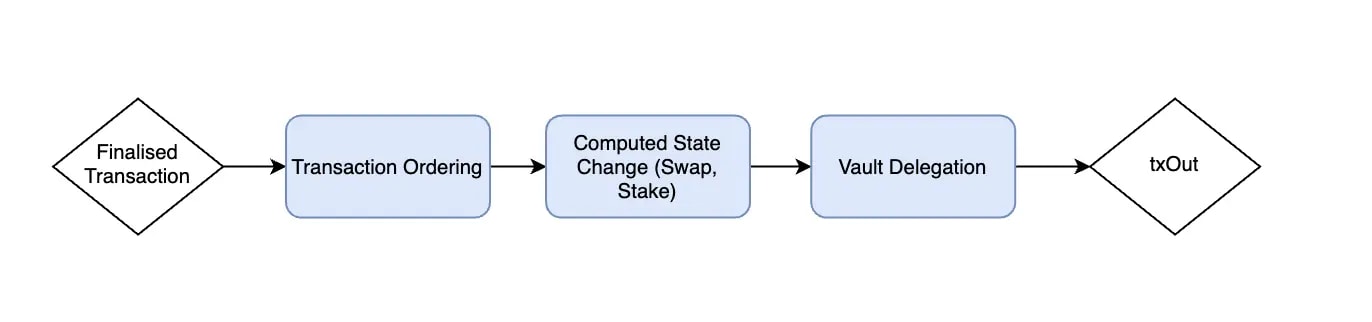

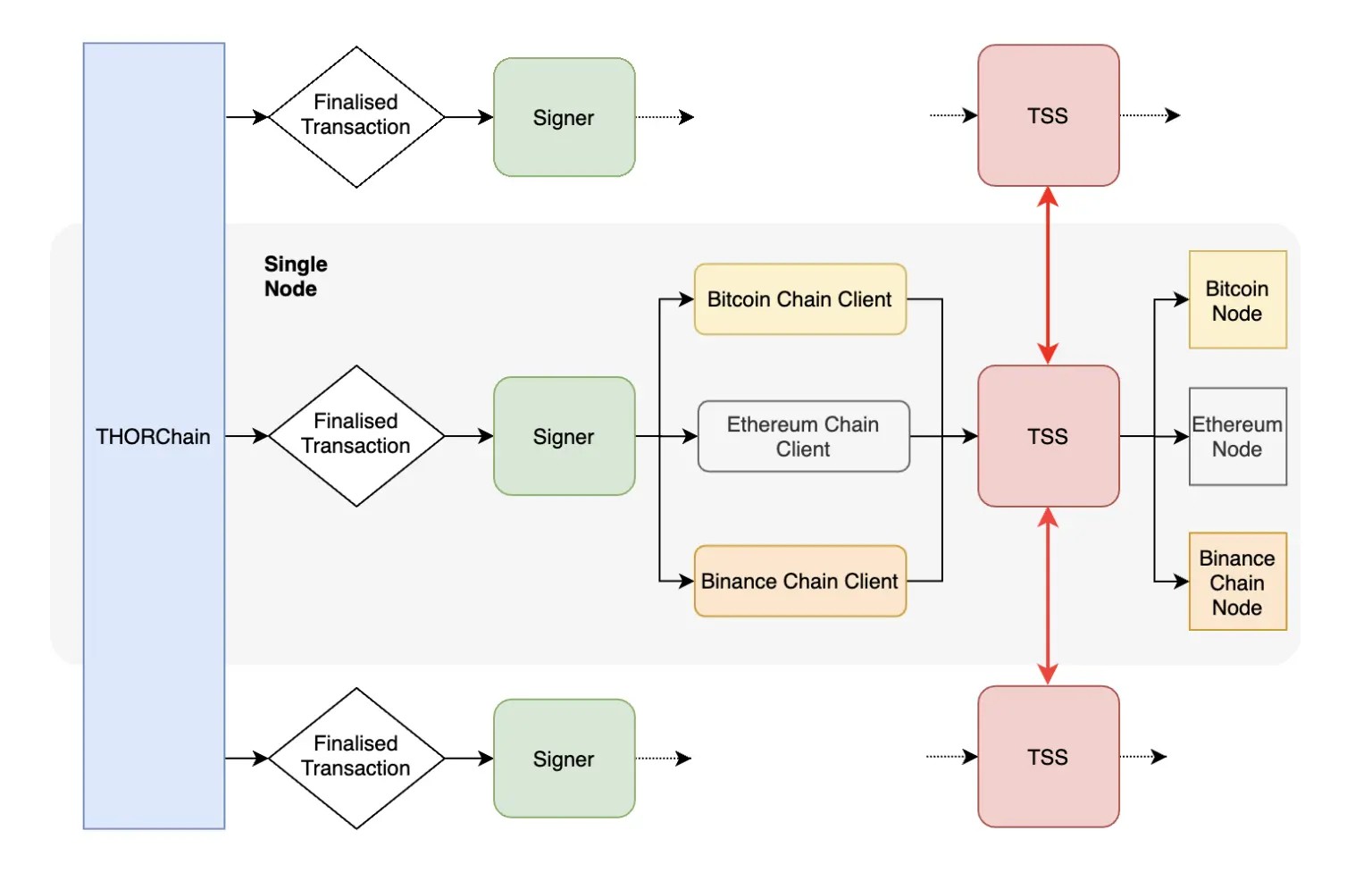

From a developer perspective, maintaining transaction security with no errors when dealing with cross-chain swaps is no simple task, which is why the devs have decided to combine multiple proven technologies to create the desired outcome rather than innovating from the ground up which may result in a longer trial/error process.

Here are the technologies they combined together (it’s technical):

- 1-way state pegs (Bifröst protocol)

- State machine (dubbed ThorChain state machine)

- Signer module & TSS protocol

Market participant roles

For the whole mechanism to work, four categories of participants are required:- Liquidity providers: Providing assets to the pools to be traded against, they are paid a reward in exchange for that service.

- Node operators: Process transactions and secure the vaults/assets.

- Traders: Use the protocol to swap one asset to another.

- Arbitrageurs: Capitalise on any price discrepancies to maintain an overall efficient pricing system.

The token: RUNE

This is where things go up a notch. RUNE, by far, has one of the strongest economic models we have seen to date. As you know, one of the most appealing aspects of DeFi protocols is revenue, which is palpable by token holders/stakers. This gives intrinsic value to the assets. RUNE benefits from this revenue, but RUNE must also be kept in 1:1 proportion in pools with other assets, and its supply is limited (500,000,000 RUNE). Let's break it down further.

- Revenue

Inflation begins at 30% APR and drops to a smaller 2% by the end of the decade. Two-thirds of the emissions are sent to node operators who process the blocks, and the remaining third is shared between liquidity providers.

Fees are a more sustainable source of income which has a very high ceiling with protocol adoption and use. The team also innovated a lot in this area.

The second fee is the Slip-Based Fee. A protocol like Uniswap, charges 0.3% per transaction, regardless of the size of the pool being traded against. This poses a problem, if the BTC/USDT pool is attracting the most volume then naturally liquidity providers will gravitate towards it to capture the fees. This decreases the depth of other pools. By charging a slip-based fee, meaning a fee proportional to the order size/liquidity available, pool depths converge to the size of transactions passed through them.

- Base currency

Collective assets/funds are locked in a smart contract against which other traders can trade. A liquidity provider provides both BTC and ETH to the BTC/ETH pool, and a trader who owns ETH sells it to the pool in exchange for getting BTC. This liquidity that the trader requires, unlike order books in CEX, is available for use at any time, thanks to the pool.

Why would anyone provide assets as a liquidity provider? In exchange for earning trading fees.

ThorChain operates similarly, with pools to be traded against. However, if they are to offer BTC, ETH, BNB, XMR and XRP as assets and create every single combination possible, this would require 9 different pools for 5 assets, and this number only grows (499,500 pools for 1,000 assets), which makes having deep liquidity on every one of these pools an impossible task. Instead, ThorChain uses a simpler approach: RUNE as the base currency.

In the example above, there would only be 5 pools needed: RUNE-BTC, RUNE-ETH, RUNE-BNB, RUNE-XMR, RUNE-XRP. Pools also must be 1:1 balanced. If there’s $1,000,000 worth of BTC in the RUNE-BTC pool, it must be balanced with $1,000,000 worth of RUNE. The more assets that make it onto the pools, the more RUNE captures in value.

Given that there can only be 500M RUNE, this means the only way for any of this to be possible if ThorChain is to be used and have deep liquidity would be a ridiculously high price per RUNE.

The other aspect to factor in is, in a bull-market, the value of the pooled assets increases which means the value of pooled RUNE must also increase. Additionally, due to the mechanism called the “Incentive Pendulum”, for each 1 RUNE pooled 2 RUNE are incentivised to be bonded by node operators.

Simply speaking, $1M in pooled assets (such as BTC, ETH etc) will cause the total value of RUNE to be $3M to reach equilibrium.

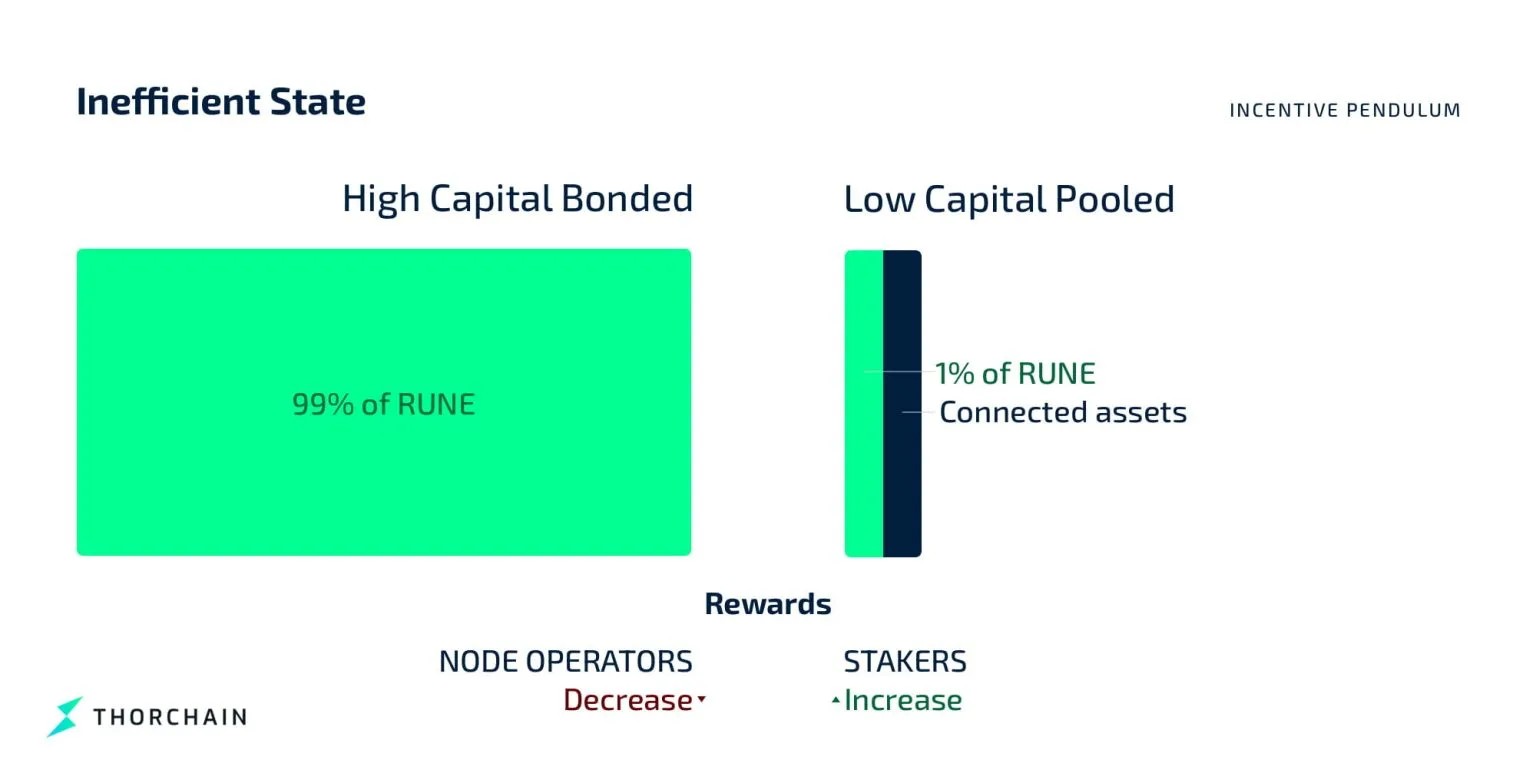

To maintain the 67/33 (~2:1) equilibrium in the network for optimal functionality between bonded RUNE and pooled RUNE, incentives are dynamically changed.

At any point in time, ThorChain can be in one of five states:

- Unsafe

- Under-bonded

- Optimal

- Over-bonded

- Inefficient

This maintains the reward distribution as is since the network is at an optimal ratio.

Unsafe state

To incentivise an increase in bonded RUNE, the rewards are skewed towards node operators until the Optimal State is again reached.

Inefficient state

The polar opposite of the Unsafe State, where pooled RUNE need to be increased and hence LP rewards are boosted to return the Optimal State.

The bullish case for RUNE

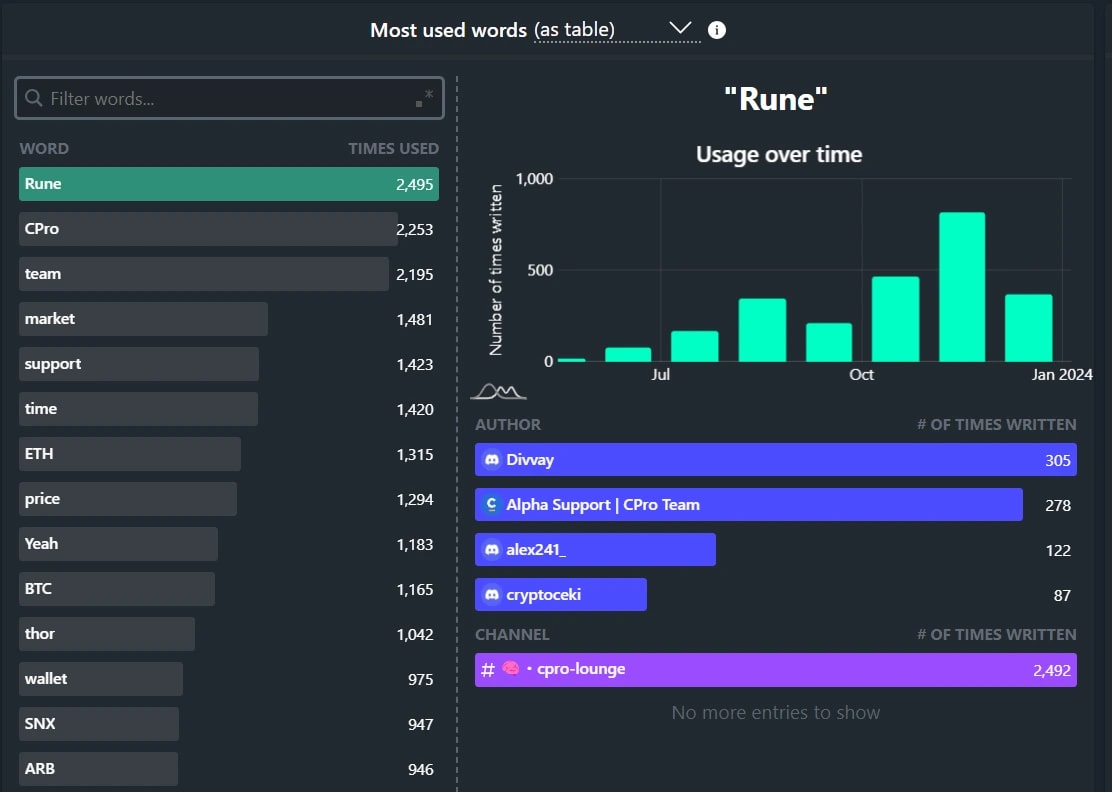

If you’ve been around for a while on our Discord, you probably have heard of RUNE. Before the memecoin supercycle kicked in, it was one of the most discussed assets among our members.

And that’s with very good reason.

As one of the market’s leading cross-chain solutions, the ThorChain ecosystem has quietly fleshed out one of the most comprehensive, fundamentally sound economic models we’ve ever seen with its token RUNE at the core of it.

For every $1 of liquidity added in external assets to ThorChain, there is a resulting $3 in buying pressure on RUNE. This breaks down as follows:

- $1 is used to pair with the external asset in the liquidity pool.

- $2 generates buying pressure as Node Operators secure the network's liquidity.

ThorChain's ultimate goal is to beat centralised exchanges by offering superior price execution, greater liquidity, enhanced security, permisionless and KYC-free cross-chain swaps. To achieve this, it is innovating on multiple fronts.

Streaming swaps

The first ground-breaking update on ThorChain is the launch of Streaming Swaps (SS). Streaming Swaps enables breaking large trades into many small ones, reducing slippage and resulting in competitive prices.Thus, ThorChain currently provides the cheapest quotes for native swaps between BTC and ETH, not only among DEXs but also among some CEXs.

As a result, volumes directed through ThorChain have been hitting all-time highs after all-time highs. Streaming Swaps is undoubtedly a game changer for the volume.

App layer

One of the remarkably bullish developments within the ThorChain ecosystem has been the strategic deleveraging of its base layer and the introduction of an application layer built on top of its L1 protocol. Innovative features such as Lending and Earn have proven to be massive successes, significantly enhancing user engagement and liquidity. However, there was a growing concern regarding the accumulation of leverage upon leverage within the system. This compounding leverage posed a potential risk for a catastrophic 'death-spiral', reminiscent of the infamous collapse of Terra's Luna. This vulnerability made many whales and institutional investors wary of entering ThorChain due to the inherent risk in such a leveraged environment. To mitigate these risks and attract more substantial, sustainable investments and liquidity, ThorChain's shift towards an app layer design aims to distribute risk more effectively while providing a robust platform for further DeFi innovations. This evolution not only addresses the risks but also opens up avenues for safer, more diverse financial products, thereby reassuring large-scale investors of the platform's stability and potential for growth.The app layer will introduce a range of products such as lending, saving, perps markets, options and more, making ThorChain a DeFi hub powered with deep liquidity it attractive by offering the best cross-chain swap experience on the base layer.

Aggressive expansion

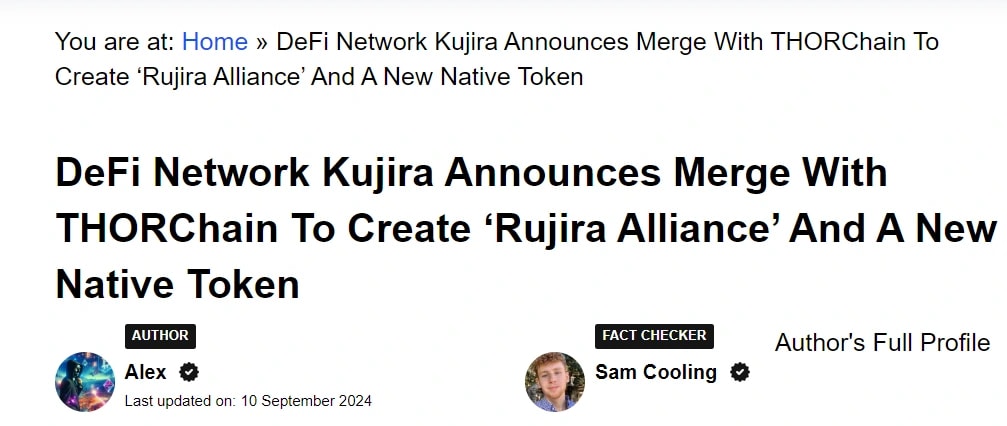

To achieve all of this, ThorChain has figured out that it is cheaper and less developmentally intensive to simply acquire the infrastructure that other protocols have already built. This is achieved by purchasing a controlling share of the DAO. The latest example is the Kujira meltdown.

For minimal cost, ThorChain has picked up not only a development team but also a “working” product. The reason for the quotation marks is that Kujira was working, but management was awful, which led to their downfall.

By implementing a pseudo-hostile, but actually still friendly, takeover of Kujira, ThorChain has essentially let them do all the hard work. Kujira has already done the heavy lifting for the users, volume, and marketing. By attaching their name to and supporting the project, ThorChain has fixed the reputational issues and can capitalise on the previous relationship that Kujira had with its investors and supporter base.

ThorChain community want further expansion by acquiring and merging wallets and interfaces, creating a robust and aligned ecosystem on its journey to overtake CEXes

New chains and integrations

Further, ThorChain has been actively integrating with various wallets and DeFi platforms to enhance its ecosystem. For instance, wallets like Trust Wallet, OKX, Ctrl, and aggregators like ShapeShift, LiFi and Jumper provide users with native RUNE support and cross-chain swap capabilities powered by ThorChain. Furthermore, DEXes like OpenOcean, Rubic, and PLEXUS have integrated ThorChain to offer users optimised cross-chain swaps by aggregating liquidity from multiple sources. Eventually, ThorChain aims to be the backbone of DeFi by bringing its liquidity and cross-chain capabilities to every wallet, interface and aggregator. Users won’t even notice they are using Thorchain on the backend.Rune’s valuation exercise + price targets

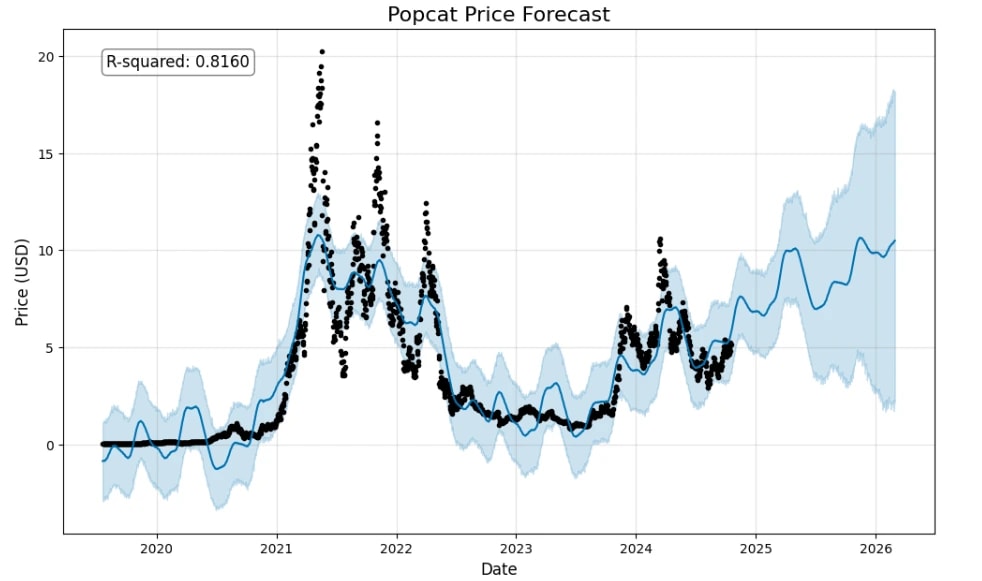

If you have been reading our thesis on assets, you might have noticed that we like using quantitative methods for our valuations. Similar to our previous valuation frameworks, we employed a mix of quantitative and qualitative methods for Rune’s valuation.We downloaded the historical market cap of Rune and utilised a machine-learning model based on the Prophet library to forecast future market cap, resulting in the following projections:

For 24/25 cycle

The graph shows a time series forecast with actual values (black line) and predicted values (blue line) along with a confidence interval (shaded area).

Bearish scenario: This scenario suggests that Rune might struggle this cycle, suggesting a potential price of roughly $7.

Base scenario: In this scenario, we can expect the price of Rune to be around $20 as per our model.

Bullish scenario: In a bullish scenario, we can expect the price of Rune to break the previous ATH and reach roughly $30 per Rune by the end of 2025.

For 2032

Our crypto-market theory states the Total Market Cap reach $10 Trillion in the coming years. ThorChain operates as a metaphorical “liquidity black hole.”As liquidity deeps, volume ramps up as the protocol can facilitate larger swaps with reasonable liquidity. This in turn generates more fees and encourages further liquidity to be provided, increasing the value of the RUNE pooled. (Positive feedback loop).

The incentive pendulum means that at a base level, the ratio of assets in the liquidity pools must be backed 3:1 in the pools.

Remember, this is simply a baseline requirement for ThorChain liquidity pools. It does not take into account further developments like the App Layer and the acquisition of other protocols as outlined above.

With $10 trillion in Total MCap, and based on the absolute minimal value accrual for RUNE, it is reasonable to project that ThorChain gains access to 0.15% of those assets. This is the equivalent of $15 billion in liquidity provided by the protocol. Due to protocol design, this means RUNE should have an MCap of $45 Billion, translating to roughly $90 per token as a base case.

Summary

We believe ThorChains is one of the coolest pieces of infrastructure and one of the strongest DeFi plays currently in the market. It has a place in the industry, and we are optimistic about its future. Here is the summary of our price targets:

Risks to consider

While the report thus far has consistently supported our bullish stance on ThorChain, we must address potential risks and considerations crucial for making informed investment decisions.Competition

The original thesis for ThorChain was that of an OG cross-chain protocol. As with all new sectors, the tides constantly shift, and innovation happens. LayerZero has specifically changed the game regarding cross-chain comms and continues to do so.Although ThorChain is tied to the Cosmos IBC, comparable to LayerZero as a cross-chain messaging service, it is largely limited to Cosmos-based protocols. The intermediary function of the RUNE token and its economic value remains strong, but ThorChain simply hasn't captured the expected value.

One of the key selling points for ThorChain is the liquidity black hole that locks up assets and demands RUNE to back those assets in liquidity pools - which gives RUNE an intrinsic value.

Unfortunately, that liquidity just hasn't flown into ThorChain as we anticipated. Why? The critical issue is the increasing popularity of cross-chain messaging infrastructure, like LayerZero and Chainlink's CCIP.

Rather than becoming the top dog in the cross-chain world, ThorChain has been relegated to niche swaps between integrated chains; the impact of protocols like LayerZero cannot be ignored.

Relegation to a niche has undoubtedly limited ThorChain's potential, but it still has a place. It is still up there with the most trusted and used method of moving wealth between chains, using native assets. Bridging remains the most popular method.

DeFi inactivity

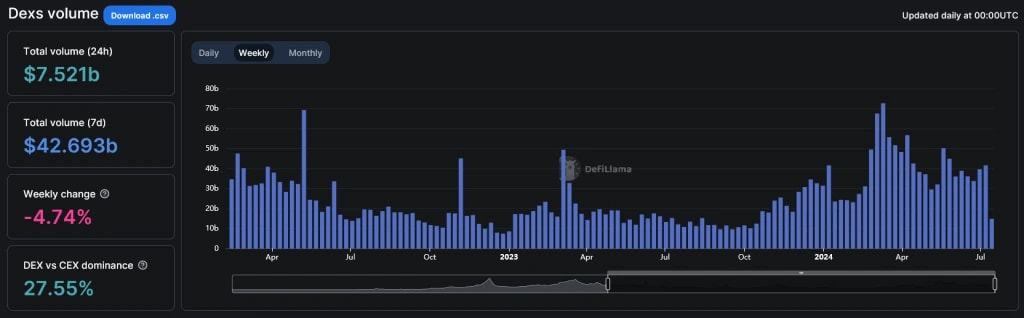

This is partly a function of DeFi protocols, which are generally underperforming as the attention isn't there. However, the development of competition with more flexible functionality is also a massive factor in the underperformance.Regarding the ThorChain ecosystem and the many tokens launched over the last few years, shifting the focus to RUNE is the key takeaway. We keep using the term "niche" to describe ThorChain within the cross-comms sector. But first and foremost, ThorChain fulfils the role of a DEX.

The key issues are not so much a lack of innovation as new protocols expand the cross-comms sector's scope.

Three years ago, we would never have imagined the functionality that the cross-chain sector now provides. ThorChain is becoming the UNISwap of the industry—but you wouldn't compare UNISwap to Lido; it's an utterly different ballgame.

We've always divided the cross-comms sector into three categories: DEXs, communications (e.g. Polkadot, Cosmos IBC, LayerZero, etc.), and bridges. ThorChain remains the leader in cross-chain DEXs, but not everything can be achieved with a simple swap.

As a DEX, volume is still up compared to last year. However, the decline in the charts is largely in line with the overall decrease in total DEX volumes marketwide.

If we're being honest, the market for DeFi is lagging. Bitcoin has been teetering around previous all-time highs, and DeFi reflects this. The key issue is that many protocols are launching, but fresh capital is not flowing into the market yet.

In essence, the existing capital in the market is only being passed around among the projects; there are many hands in the pie, but the pie is not getting bigger.

Downtrending market

Unfortunately, what makes RUNE so valuable also causes it to face significantly more downside price volatility than other tokens. Namely, the amount of liquidity in the system. Several factors are at play here:- Bear market leads to reduced users for ThorChain and THORSwap.

- Decreased usage results in lower revenue for both protocols.

- Reduced yield from liquidity pools due to fewer participants.

- The diminished incentive to provide liquidity leads to fewer RUNE locked up.

- Bear market causes a significant USD value drop in assets backed by RUNE.

- The decline in the value of assets in USD contributes to RUNE's USD value decline.

Cryptonary’s take

Cross-chain swaps have become a foundational element in decentralised finance, with ThorChain leading the charge. What began as a simple solution for moving assets between chains has evolved into a multifaceted platform catering to a variety of sectors. ThorChain’s innovative features, such as its Streaming Swaps and Application Layer, are reshaping the way users interact across chains, providing cheaper, faster, and more secure solutions.However, as with any emerging technology, patience is key. The market sentiment around DeFi is in a downtrend, and while development continues to push the boundaries of what’s possible, the full potential of these innovations has yet to be realized. Timing, as always, is critical. Rune’s future success will largely depend on how well it can appeal to retail and institutional players and the liquidity it can attract

In the long run, ThorChain’s ability to fill crucial niches within DeFi and its growing ecosystem of integrations will ensure its place at the backend of this evolving industry. Thus, we remain bullish on Rune. Peace!

Cryptonary, OUT!