This is where users flocked to BNB-Chain (rebrand from BSC) and Solana, leading to rising TVLs and astronomical price increases for BNB & SOL (LUNA in there too).

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make is your full responsibility and only you are accountable for the results.

Ethereum has reached certain capacity limits as the number of individuals using the network has grown. The cost of using the network has increased as a result, creating the need for "scaling solutions”. Which solution is the “correct” one though? This is what we’ll be delving into in this research report.TLDR

- 2021 was the year of “Ethereum killers”.

- Ethereum still lacks scalability suffering from high gas fees and low throughput due to high network demand.

- Scaling solutions (Layer 2s) will make Ethereum usable but which solution will emerge victorious?

- Layer 2 (L2) transactions happen instantly with nearly-free gas fees.

- Layer 2s' TVL has increased by 1664% in a year, and we expect it to continue to rise once development reaches full potential.

- Will 2022 be the year of Layer 2s? will L222 happen?

Scaling Problem on Ethereum

“Nobody goes to that restaurant anymore because it’s too crowded”— Yogi Berra.This quote reminds us of Ethereum. The year 2021 was the year of “Ethereum killers” where a significant proportion of Ethereum developers and users had switched to these alternative chains dragging capital along with them. Primarily because the Ethereum network was still dealing with high gas fees and congestion.

Today, Ethereum processes roughly 1,000,000 transactions per day, and at full capacity can process 15 transactions per second. When the network becomes congested due to high demand and low throughput, transactions begin to back in the memory pool which is where pending transactions reside. “Gas” paid in Ether is a reward for miners for adding new transactions to the blockchain. Miners prioritize higher returns from gas fees, so a transaction with a higher gas fee will be accepted faster, whereas a transaction with a lower gas fee will be accepted slowly - think of it like a higher payment for VIP access. As a result, the network's gas fees rise to ridiculously high amounts.

The “Scaling Contenders”

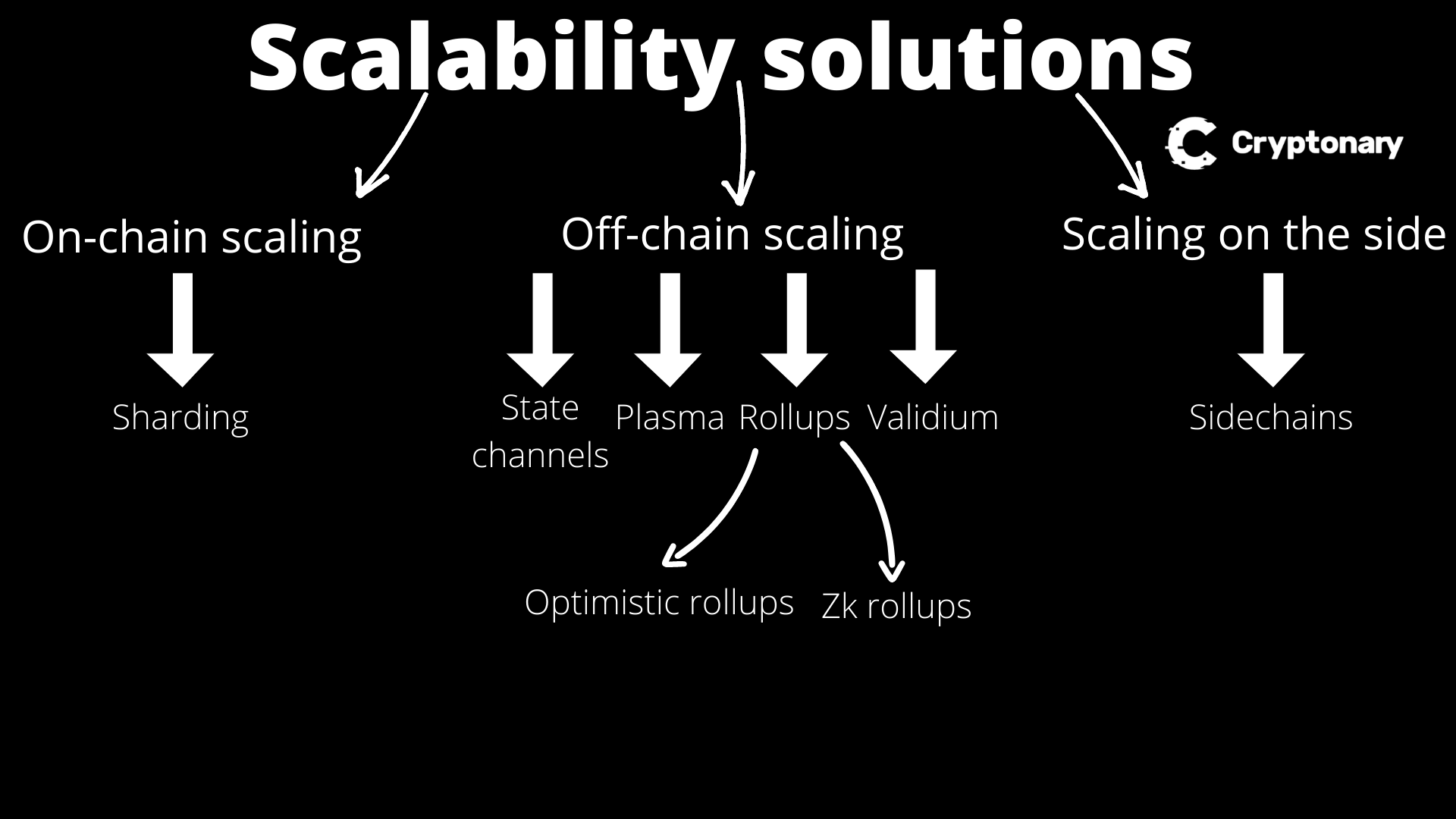

Ethereum is referred to as a Layer 1 because it is the base for it's Ecosystem since dApps are built on top of it.The primary goal of scalability is to increase transaction speed (finality) and transaction throughput (number of transactions per second) while maintaining decentralization and security. There are 3 ways to scale Ethereum. On-chain (Layer 1) scaling, refers to scaling the Blockchain itself. Off-chain (Layer 2) scaling, refers to scaling on top of Layer 1. And finally, scaling on the side of Layer 1 which is done through a Sidechain.

Sharding

Sharding refers to splitting the entire Ethereum network into multiple chains called “shards”, which will reduce network congestion and increase transaction throughput. Each shard would have its own state, which would include a distinct set of account balances and smart contracts. This will also reduce the workload of each validator, since they will no longer be required to process the entire network's transactions. Sharding upgrade expected in 2023 so at the minute this solution is not yet available.State Channels

The State Channel is a mechanism that allows users to do several Blockchain transactions, such as state changes or money transfers, without committing all of the transactions to the Blockchain. Participants must lock a portion of Ethereum's state, like an ETH deposit, into a multisig contract.A multisig contract is a smart contract on the blockchain that allows many signers to review and agree on an action.

The initial transaction is to lock the state in this manner, which opens the channel, participants can then transact off-chain swiftly and freely, When the transaction is complete, the state is unlocked with a final on-chain transaction. Only two transactions are uploaded to the Blockchain, but the participants can conduct an infinite (or almost infinite) number of transactions off-chain.

Plasma

A framework for building scalable dApps on Ethereum. Plasma Chains enables the establishment of “Child Chains” that rely on the “Parent Chain”(Ethereum) for trust and resolution. Child Chains are smaller copies of the Ethereum main chain that have their own rules and consensuses , offloading transactions off the parent chain to the child chains offers cheaper and faster transactions.Rollups

These are the tastiest Rollups without a doubt but we're not referring to these ones, we're talking about these Rollups!Rollups are smart contracts that rollup hundreds of transactions into a single batch outside Layer 1 (Ethereum) but still post transaction data on Layer 1. Executing transactions off-chain means less gas is required therefore reducing gas fees.

Rollups are secured by Ethereum because transaction data is posted on Ethereum, this is a very important characteristic of Rollups.

Rollups come in two distinct flavors:

- Optimistic Rollups: Assumes transactions are valid by default and only runs computation, via a fraud proof in the event of a challenge.

- ZK Rollups: Runs computation off-chain and submits a validity proof to the chain.

Validium

Validium is a ZK Rollup that uses validity proofs but stores data off-chain as opposed to ZK Rollups which stores data on-chain. This can result in higher throughput than Rollups.Sidechains

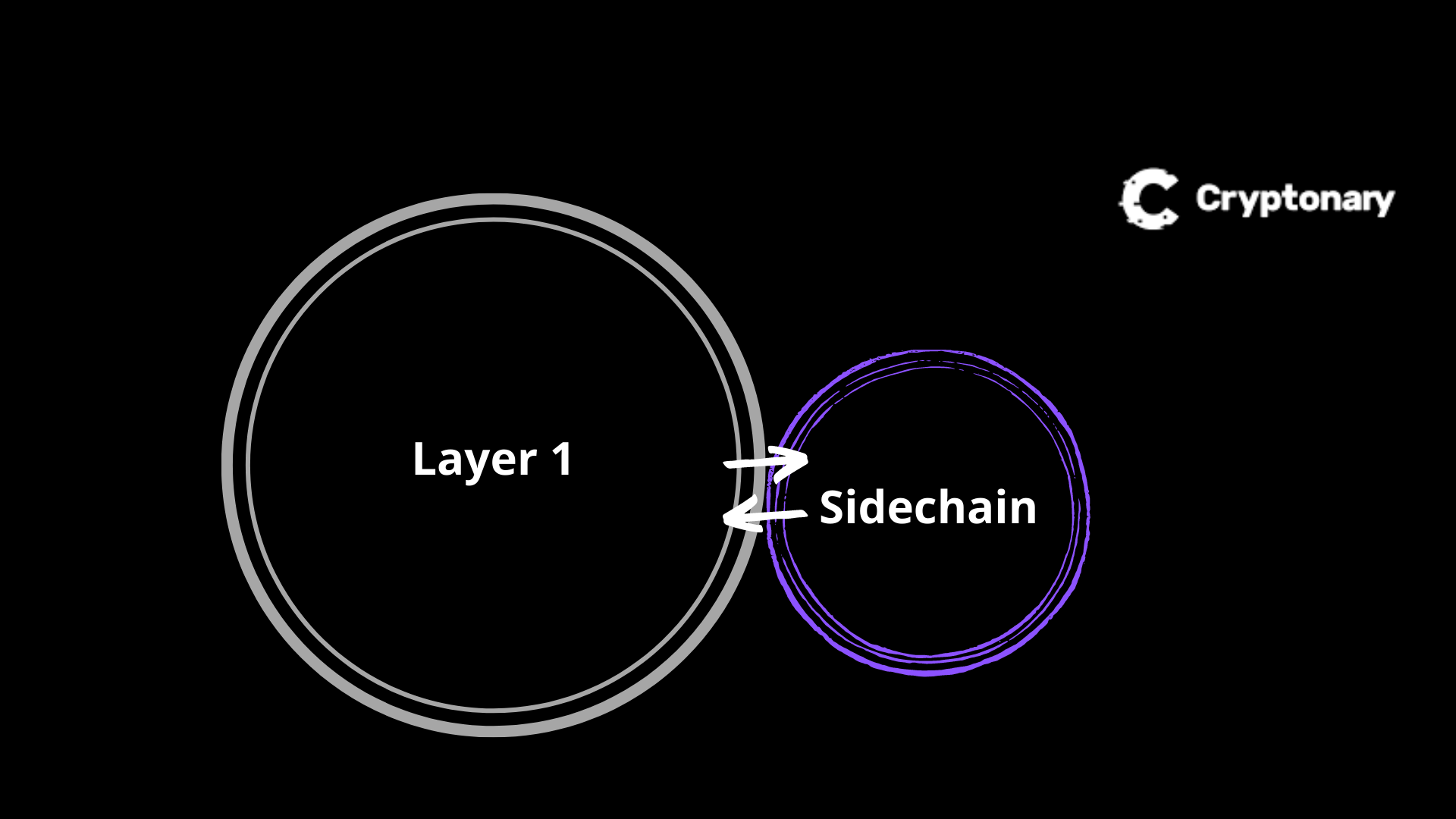

Sidechains will not be discussed in our thesis; they are presented in the report for educational purposes.A Sidechain is a separate EVM-compatible blockchain that runs alongside the main chain (Ethereum), thus the name. Due to the fact that Sidechains can communicate with Ethereum via two-way bridges, assets can be transferred from Ethereum to the Sidechain and vice versa. Because a Sidechain has its own set of parameters and consensus such as proof-of-stake or proof-of-work, it relies on its own security rather than Ethereum's. Polygon is a well-known example of a Sidechain.

Polygon is not a Layer 2 because it has its own separate Blockchain and rules. It is important to distinguish between a Sidechain and a Layer 2. You might even find this mistake when searching on Google.

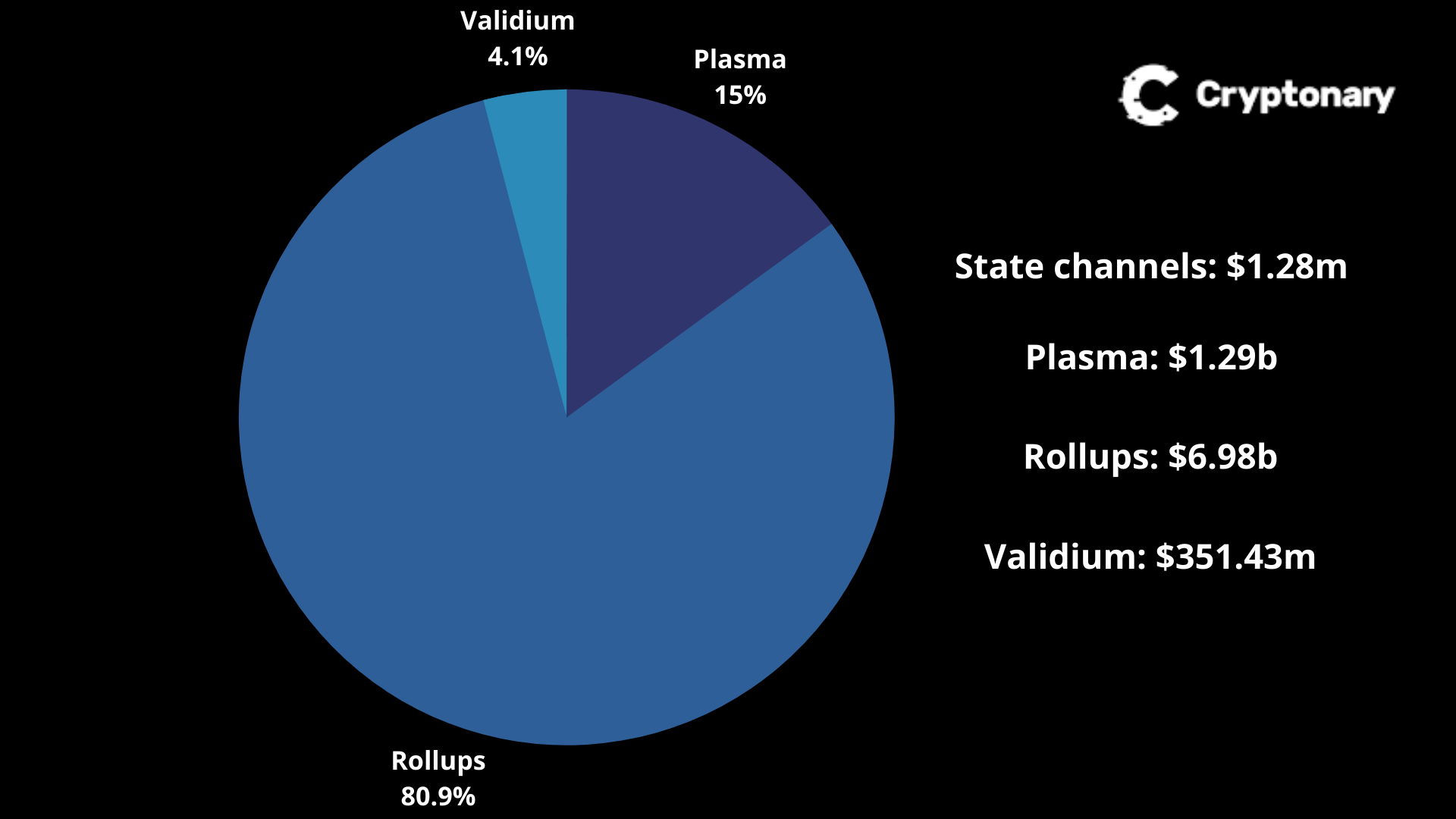

As of February 2021, Layer 2s had a TVL of $518.58 million, and as of February 2022, the TVL of Layer 2s had increased significantly all the way to $8.63 BILLION. Because these alternatives offer reduced fees, higher transaction throughput, and finality, many individuals are resorting to them as an alternative to Ethereum mainnet. When Layer 2s are further developed and utilized more, we predict the TVL to rise dramatically.

Some Layer 2s are still being developed and are not fully functioning. This sector has a very promising upside for DeFi once it reaches it's full potential.

The Winner is... drumroll 🥁

Rollups, without a doubt, dominate the other scaling solutions when it comes to TVL. Rollups account for $6.98 billion out of $8.63 billion in TVL for all L2s. That's a 80.9% dominance.

Let’s take a look at the fundamental structure differences:

Rollups are unquestionably the winners. Providing scalability, decentralization, and security. State Channels, Plasma, and Validium provide higher throughput and cheaper gas fees, but they are centralized and lack security. Scalability, as defined earlier, is the ability to increase throughput and finality while maintaining decentralization and security.

Why would 2022 be the year for Layer 2s? In other words, will L222 happen?

The vision of Ethereum is to be more scalable, secure and also remain decentralized. Achieving all 3 is known as solving the scalability trilemma.Ethereum has had incredible success since its launch, but in order for Ethereum to reach its full potential, the scalability issue needs to be fixed. Ethereum would still be unable to scale even with the “merge”. The Ethereum mainnet will eventually “merge” with the beacon chain proof-of-stake system. This will be the final step in Ethereum’s shift from proof-of-work to proof-of-stake. Rollups exist to assist Ethereum in completing its purpose and achieving worldwide adoption for all users. Rollups should have a significant influence on DeFi. Users who previously were unable to transact on Ethereum due to excessive transaction fees will be allowed to remain in the Ecosystem the next time network activity is high. Rollups will also open the door to a new generation of dApps that demand lower transaction fees and faster confirmation times. All of this is done while being completely secure thanks to the Ethereum consensus. Rollups appear to be setting the stage for another phase of growth expansion for DeFi, therefore bringing the capital back “home” to Ethereum.

In the next report, we'll discuss Rollups in greater detail, including which type of Rollup will reign triumphant and then pushing it to certain Assets. Keep an eye out for the next report! 👀