Time to Rebalance Among Majors?

Every cycle reaches a turning point. Bitcoin led the way, Ethereum confirmed the move, and now capital is rotating further down the curve. We have done a comprehensive analysis and are quite confident on what happens next. Let's dive in...

Now, the focus is shifting. This report argues that while Bitcoin and Ethereum remain the anchors of the cycle, the outsized gains from here will come from Solana, Hyperliquid, and the broader alt market.

Solana has reclaimed key levels against Bitcoin and Ethereum, showing clear signs of preparing for its next breakout. Hyperliquid has already smashed through fresh all-time highs against Bitcoin, consolidating against Ethereum and Solana in a way that suggests it's setting up for another explosive run.

This is the moment where rebalancing matters most. In this edition, we'll be covering the full spectrum of market signals:

- Bitcoin Dominance chart

- ETH vs BTC chart

- SOL vs BTC and SOL vs ETH charts

- HYPE vs BTC, HYPE vs ETH and HYPE vs SOL charts

So let's dive in!

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Bitcoin Dominance (BTC.D)

Weekly View: The Bigger PictureLet's start from the bigger picture: Bitcoin Dominance marked its local top around 66% earlier this year, just shy of the multi-year supply zone we had been tracking. Since then, dominance has rolled over and now sits just below 58%, a clear sign that the rotation phase into altcoins has already begun. On the weekly timeframe, the most important level to watch is the 200 EMA at 55.85%, which hasn't been tapped since January 2024. This makes it a magnet for price, and a clean retest would align perfectly with the broader rotation thesis.

If BTC.D loses this 55.85% support, the floodgates open. The next logical level is 54.5%, a key pivot point. A breakdown here would put dominance into what we call the "banana zone", an aggressive downtrend environment where dominance can quickly slide to 48.9%, and eventually into the 48–40% range. Historically, this is where altcoins go parabolic and cycle tops approach. That zone, for us, is also the moonbag/DCA out region, where profits should be actively managed.

Daily View: Short-Term Scenario

On the daily timeframe, however, Bitcoin Dominance is showing a different picture. The structure here has already turned bearish, with lower highs forming and the 200 EMA flipped above price. Currently, BTC.D trades around 58%, while the 200 EMA sits higher at 61.9%. This leaves room for a short-term relief bounce where dominance could climb back toward the 200 EMA before resuming its broader downtrend.

This scenario would mean a temporary pullback for altcoins as dominance grinds higher, before the broader trend of altcoin outperformance resumes. Importantly, the 200 EMA on the daily is sloping down, which suggests any bounce would be corrective rather than trend-changing.

Key Levels to Watch

- Resistance: 61.9% (200 EMA daily), 66% (recent top/supply rejection).

- Support: 55.85% (weekly 200 EMA), 54.5% (key breakdown level).

- Targets: Breakdown → 48.9%, then 48–40% = DCA out / cycle-end range.

BTC.D's weekly chart suggests that the downside trend is intact, with 55.85% and 54.5% as the key levels before dominance truly unravels. The daily chart, however, warns of a possible short-term bounce to 61.9%, which could trigger temporary pressure on alts. Our base case remains that dominance has topped, and the next major move is a rotation into Solana, Hyperliquid, and broader alts, but we cannot rule out a brief dominance relief rally before that unfolds.

Ethereum/Bitcoin (ETH/BTC)

Monthly Context: The Bottom is InEthereum/Bitcoin has already staged one of the cleanest reversals of this cycle. Price bottomed inside our monthly demand zone between 0.0169 and 0.02, tapping the midpoint at 0.0177 before reversing. This demand zone has acted as a generational level, and the reaction since confirms it. From that bottom, ETH/BTC rallied +150%, setting the stage for Ethereum's recent strength against Bitcoin.

Daily & Weekly View: Cooling Off

After this explosive move, ETH/BTC is now cooling. On the daily timeframe, price has run into resistance from the 0.043–0.046 region, which aligns with the breakdown wedge that had defined the pair from 2021 through 2024. This zone is critical: reclaiming it would put ETH back inside its multi-year wedge structure, opening the door to sustained outperformance against Bitcoin.

For now, however, the pair has been rejected from this resistance. On the downside, strong supports exist at 0.04 and 0.035, both of which could act as consolidation zones before the next leg higher. Importantly, even with this cooldown, ETH remains structurally bullish above 0.035.

Our Take: What Comes Next

The main takeaway is that Ethereum's easy upside against Bitcoin has already played out. The +150% rally from demand was the aggressive leg, and now the pair is consolidating. Ethereum can still stretch higher in USD terms, potentially toward $5.5K, setting a new ATH, but relative to Bitcoin, it is likely to move sideways for now. This opens the door for other majors like Solana and Hyperliquid to take over leadership during this phase, especially since their respective charts are supporting our thesis.

We have been consistent in tracking ETH/BTC's bottoming process. This reversal was first highlighted in detail in our On-chain Research Analysis published on May 31st, and later reaffirmed in a Market Update on July 29th. Both reports pointed to ETH/BTC entering a generational demand zone, which has since played out exactly as anticipated.

Key Levels to Watch

- Support: 0.04 (local support), 0.035 (major cycle support).

- Resistance: 0.043–0.046 (wedge re-entry zone).

Solana/Bitcoin (SOL/BTC)

Weekly Context: Structure ReclaimedAmong all the charts we will be covering today, Solana/Bitcoin stands out as one of the most bullish. For over a year, SOL/BTC consolidated in a wide range between 0.0018 and 0.0028, only to break down into a lower band supported by 0.00135. This breakdown, however, turned out to be an extended accumulation. Price formed a visible double bottom around 0.00135, then squeezed beneath the weekly 200 EMA before finally reclaiming it. Today, Solana not only trades back above the weekly 200 EMA, but it has also reclaimed the 0.0018 range, a massive structural win.

Current Setup: Space to Run

This reclaim gives Solana significant upside potential. The first resistance lies at 0.0022, followed by 0.0026 and 0.0028, the top of its prior range. If these levels are cleared, the next big target is 0.0038, a major weekly supply zone. Momentum indicators support this view: RSI sits around 60, leaving plenty of room for the pair to run higher without being overextended.

Solana as a Leader

The reclaim of structure signals that Solana is ready to outperform even if Bitcoin stalls. This makes it a leader for the rotation phase we are entering. If Solana continues to strengthen, it will not only drive SOL higher but also ignite Solana betas and memecoins (e.g. $AURA), as liquidity and speculation spread across its ecosystem.

Key Levels to Watch

- Support: 0.0018 (reclaimed range), 0.00135 (cycle accumulation low).

- Resistance: 0.0022, 0.0026, 0.0028.

- Target: 0.0038 (weekly supply).

SOL/BTC has done the hard work, it broke down, accumulated, reclaimed the 200 EMA, and regained its lost range. This sets the stage for Solana to outperform Bitcoin in the weeks and months ahead. With ample RSI room and multiple resistance levels lining up toward 0.0038, Solana is positioned to be one of the clearest beneficiaries of the upcoming capital rotation.

Solana/Ethereum (SOL/ETH)

Weekly Context: Holding the LineSolana/Ethereum has shown resilience after a sharp drawdown. The pair recently bottomed at the 0.04 level, which acted as a critical support and triggered a +20% bounce. Just below sits the weekly 200 EMA at 0.037, creating strong layered support in this zone. Together, these levels provide a solid foundation that reduces downside risk and sets up Solana for continued relative strength against Ethereum.

Price Action: Range in Play

SOL/ETH topped out in January 2025 at 0.093, well above our earlier target of 0.075. Since then, it has pulled back into a wide range, currently trading between 0.04 and 0.055. Breaking above 0.055 would open clean upside toward 0.064 and then 0.072, while reclaiming the cycle high of 0.093 would put the pair into fresh price discovery. On the downside, the 0.04–0.037 support cluster is the critical line in the sand.

SOL Leading ETH

Ethereum has already delivered its +150% move off the lows, and is now consolidating. Solana, on the other hand, is building strength against ETH and showing signs of leadership. As long as 0.04 holds, Solana is positioned to continue outperforming, reinforcing its role as one of the cycle's key majors alongside Hyperliquid.

Key Levels to Watch

- Support: 0.04 (key horizontal), 0.037 (weekly 200 EMA).

- Resistance: 0.055, 0.064, 0.072.

- High: 0.093 (January 2025 top).

SOL/ETH remains in a strong structural position. With layered support below and clear upside targets, Solana is set to continue outperforming Ethereum during this consolidation phase. If Ethereum stabilizes against Bitcoin, Solana could accelerate even faster, making this pair a critical chart to watch in the weeks ahead.

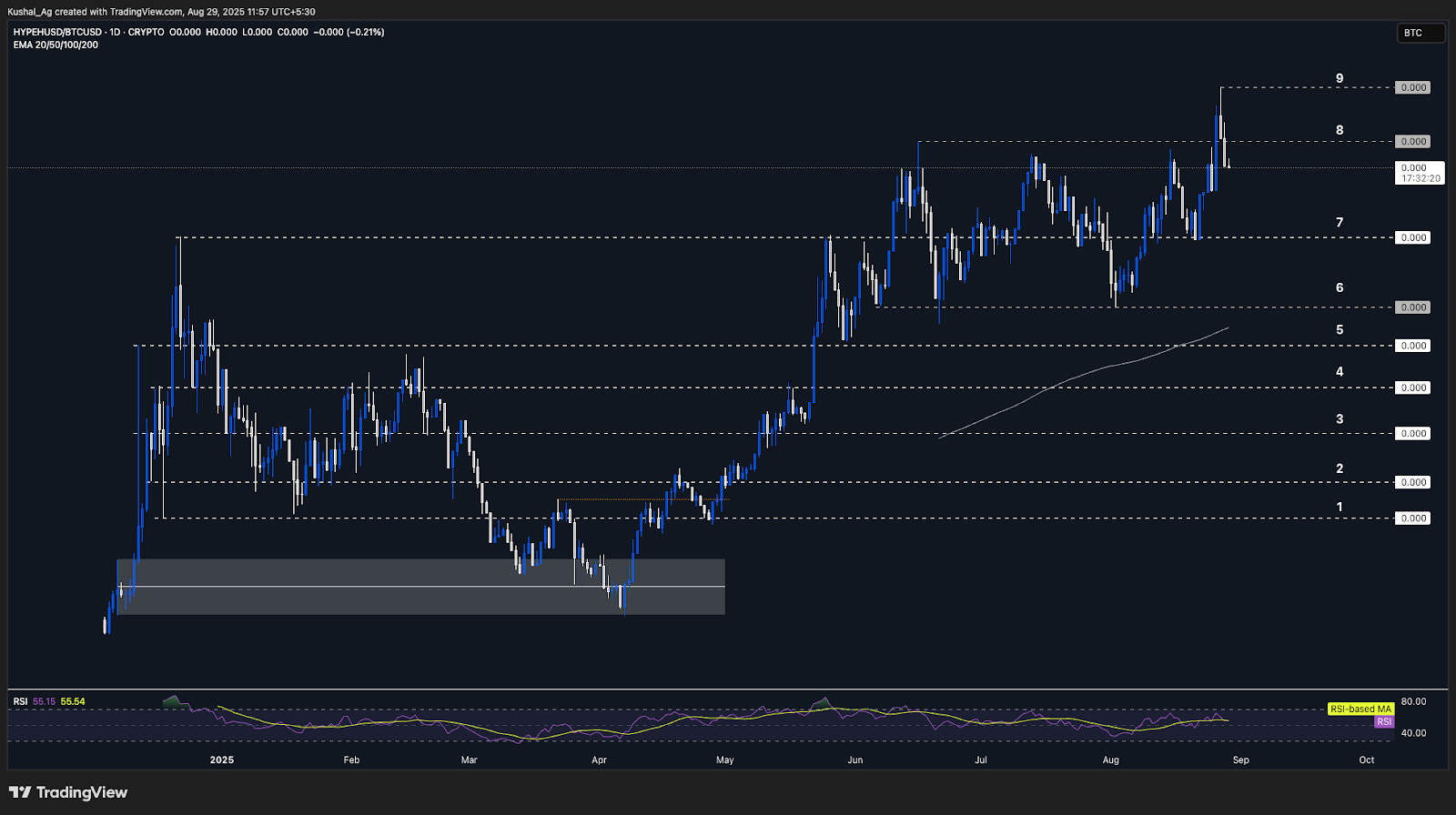

Hyperliquid/Bitcoin (HYPE/BTC)

Daily Context: Relentless StrengthAmong the new majors, Hyperliquid has been the standout. Even with limited history, the HYPE/BTC chart is one of the cleanest in the market. After ranging between line 6 and line 8 from June through August 2025, with line 7 marking the prior ATH from December 2024, Hyperliquid broke out decisively and has already set a new all-time high (line 9) just two days ago.

Price Action: Unstoppable Momentum

This breakout shows how HYPE continues to slash through resistance levels while Bitcoin consolidates. Unlike many alts that struggle against BTC's strength, Hyperliquid is outperforming in real time. The breakout to fresh highs signals that buyers remain in control and the market is rewarding Hyperliquid's unique fundamentals.

Fundamentals: A New Kind of Leader

What makes Hyperliquid exceptional is its fundamental model. As a decentralized exchange, it has already surpassed trading volumes of major US exchanges, and unlike competitors, its revenues directly flow into buybacks of the token. This feedback loop creates organic demand for HYPE, strengthening its price structure. It's rare for fundamentals and technicals to align this strongly in a newer asset.

Price Discovery Ahead

With no overhead resistance, HYPE/BTC is about to go fully into price discovery. Our cycle target for Hyperliquid remains $80–$100, which looks increasingly realistic given the current momentum and on-chain dynamics. The key risk to monitor is whether Bitcoin itself resumes strong dominance, but even then, HYPE's ability to outperform suggests it will remain one of the top leaders.

Our Take

Hyperliquid is the emerging powerhouse of this cycle. It has already broken fresh highs against Bitcoin while most assets consolidate, proving that it is ready to lead alongside Solana.

Hyperliquid/Ethereum (HYPE/ETH)

Daily Context: Building the BaseAfter a strong first half of 2025, Hyperliquid/ETH has entered a healthy consolidation phase. The pair topped in June 2025 at 0.017 before retracing to a local bottom around 0.009. Since then, price has been stabilizing inside the 0.009–0.01 support zone, with the 200 EMA on the daily timeframe at 0.011 acting as a key pivot level. This area has effectively become the foundation for HYPE/ETH's next move.

Despite the pullback, the uptrend trendline from December 2024 remains intact, with higher lows continuing to print. This suggests that the correction has been more of a base-building process than a breakdown. The longer price spends coiling here, the stronger the eventual breakout is likely to be.

Upside Potential

The first resistance to clear is at 0.012. A decisive break above this level would open clean space for a swift rally toward 0.015, representing a 30% upside move from the breakout. Given how well Hyperliquid has performed against Bitcoin, once it resumes strength here, it could easily begin to outperform Ethereum again.

Consolidation Before Outperformance

This chart suggests that while Hyperliquid has taken a pause against Ethereum, it is preparing for its next leg up.

Key Levels to Watch

- Support: 0.009–0.01 (local base), 0.011 (200 EMA daily).

- Resistance: 0.012 (breakout trigger), 0.015 (measured move target).

HYPE/ETH is coiling at a strong support base, with layered confluence at the 200 EMA and trendline. A breakout above 0.012 would likely set off the next rally phase, targeting 0.015 and beyond. While Ethereum consolidates, Hyperliquid is quietly preparing to outperform once again against ETH, a setup that strengthens the case for its leadership in the next phase of this cycle.

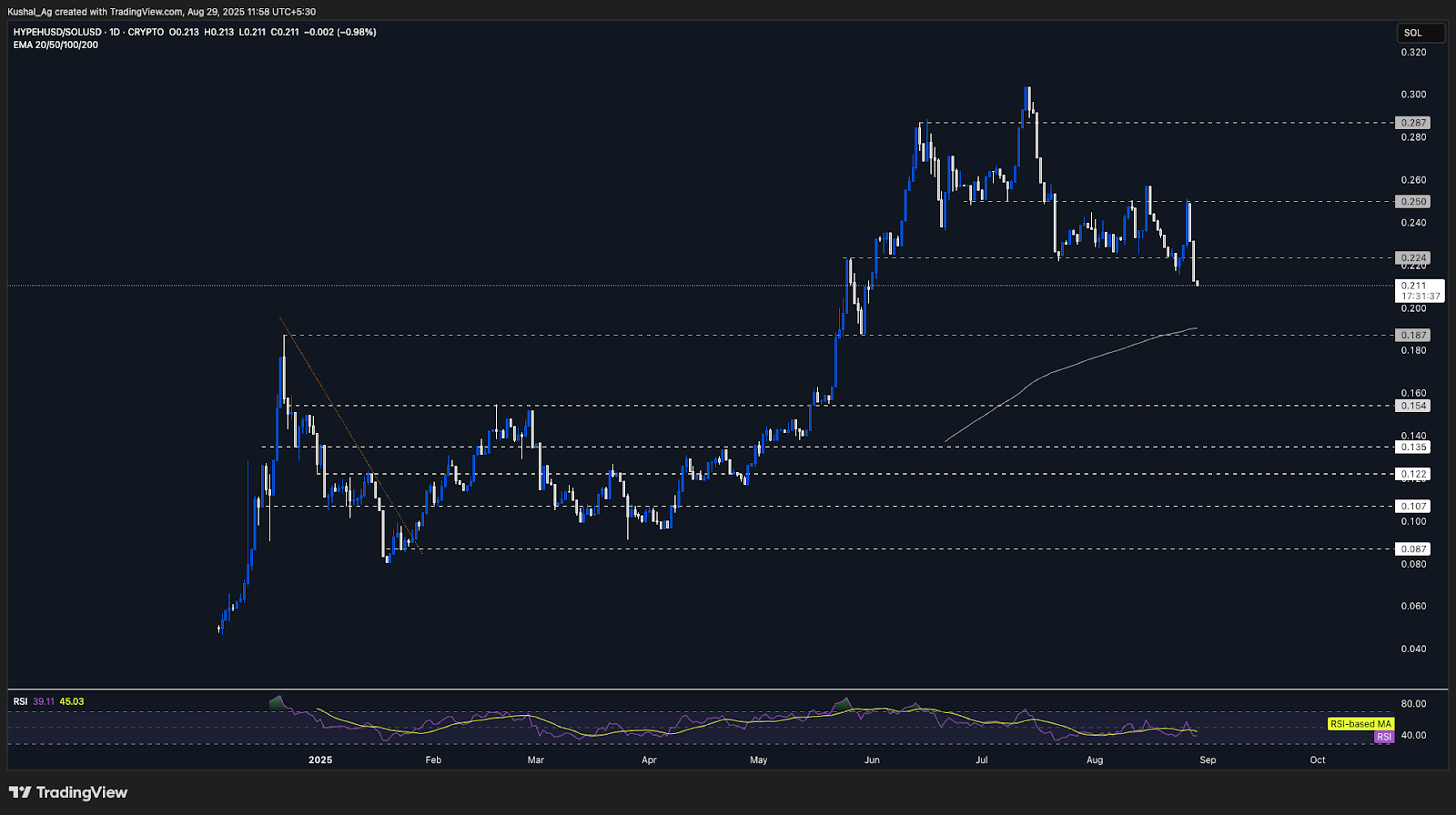

Hyperliquid/Solana (HYPE/SOL)

Cycle Context: A Battle of LeadersThe HYPE vs SOL chart is one of the most important pairs to watch in this cycle because it reflects the competition between two of the strongest majors. For most of 2025, Hyperliquid was the clear winner: after bottoming at 0.08 in late January 2025, HYPE/SOL surged +270% in just 5–6 months, topping out at 0.3 in mid-July.

Current Setup: Healthy Pullback

Since topping, the pair has entered a healthy retracement phase and is now trading around 0.2. Strong support exists at 0.187–0.191, which aligns with the 200 EMA on the daily timeframe. Below that, the next major support sits at 0.154, though we do not expect price to revisit that level unless Solana significantly accelerates.

Solana Temporarily in Control

The pullback shows that Solana is currently outperforming Hyperliquid on a short-term basis. This lines up with what we're seeing on SOL/BTC and SOL/ETH, both of which suggest Solana is entering a breakout phase. In contrast, Hyperliquid is consolidating its gains after a massive rally. This divergence highlights how capital is rotating within leaders, with Solana catching up while HYPE regroups.

Rotation Within the Strongest

While Solana may continue to outperform in the short term, Hyperliquid remains structurally strong. Once HYPE/SOL stabilizes around its support base at 0.187–0.191, the trend could reverse, and HYPE may resume outperformance. In essence, this chart confirms that the battle for leadership is between Solana and Hyperliquid, two assets that together are driving the next leg of the market cycle.

Key Levels to Watch

- Support: 0.187–0.191 (daily 200 EMA), 0.154 (deeper support).

- Resistance: 0.25, 0.3 (cycle high).

HYPE/SOL is showing us a healthy internal rotation between two of the strongest majors. Solana is currently outperforming, but Hyperliquid remains in a position to reclaim leadership once it finishes consolidating. The bigger picture is clear: the future of this cycle is being led by Solana and Hyperliquid, and this pair will decide which one dominates the narrative in the months ahead.

Correlation Across the Majors

When we connect the dots across all these charts, a clear story emerges: the market is entering the rebalancing/rotation phase of the cycle. Here is a summary:- Bitcoin Dominance (BTC.D) has already topped out at 66% and rolled over, confirming that Bitcoin's phase of leadership is fading. Even if there's a short-term bounce toward the 200 EMA on the daily, the weekly structure points to lower dominance ahead, which means capital rotation is firmly in play.

- Ethereum/Bitcoin (ETH/BTC) already completed its +150% rally from demand and is cooling off, stuck below resistance at 0.046. This signals that Ethereum's relative strength phase is mostly done, and leadership is shifting elsewhere.

- That "elsewhere" is clear: Solana has reclaimed its 200 EMA and prior range against BTC, and is holding support against ETH. With clean upside to 0.0038 vs BTC and higher levels vs ETH, Solana is emerging as the next major leader.

- Hyperliquid has gone a step further, breaking fresh ATHs against BTC while building a strong base against ETH and SOL. This dual performance shows that HYPE is not only holding ground but creating new ground, making it one of the strongest high-beta leaders this cycle.

- The HYPE/SOL pair confirms this internal rotation dynamic: Solana is temporarily outperforming while Hyperliquid consolidates, but structurally both assets remain at the forefront of the market.

- Summarizing everything into 1 sentence: SOL and HYPE are ready to lead and likely outperform both ETH and BTC in the coming weeks/months, with SOL likely to pump first...

Cryptonary's Take

The easy money in Bitcoin and Ethereum is gone. Solana has reclaimed structure and is ready to outperform. Hyperliquid is already breaking new ground, proving it's the high-beta leader of this cycle. These are the majors worth leaning into now.This is the time to rebalance: heavier allocation to SOL and HYPE is likely to outperform ETH and BTC allocation in the mid-term. Rotation has already started and it is time for these 2 assets to take the lead.

Let's GOO!