TON defies the bear: Keeping up with our low-risk 8x opportunity

In March, we presented TON as a low-risk 8x opportunity and were right on the money. Despite the market's bearish trend over the last two months, the TON ecosystem has delivered impressive gains to set a new ATH.

While most altcoins have depreciated over the past few weeks, TON has maintained a higher range and is currently up 53% since our initial report in March.

The native token recorded a new all-time high of $8.25 on June 12 - this was not a fluke. The TON blockchain has undergone significant developments over the past few weeks. For example, you may have already heard about Notcoin and its rising popularity within the TON ecosystem – but that's just one of the many exciting things as TON continues its mission to onboard non-native crypto users.

So, is TON exhausted or is there more upside potential ahead?

Let's find out!

Key questions

- What's behind TON's impressive 53% surge while other crypto coins stumble?

- How are Telegram's ad revenue changes and Tether integration fueling TON's ecosystem?

- Could TON's Open League and mini-apps be reviving the P2E narrative in unexpected ways?

- Why did a major VC make its "largest ever" investments in TON, and what does it mean for the future?

- Is our original 8x potential still on the table, or has the landscape shifted?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

A brief recap of TON market updates

In March 2024, Telegram founder Pavel Durov announced that Telegram channel owners would receive 50% of ad revenue, and all payments would be settled on the TON blockchain via TON tokens. This was a key development for advertisers and content creators on the messaging platform, and it triggered an immediate reaction.

After the switch from Euros to TON for payments, a record 156,574 on-chain wallets were activated on March 31, the highest number then. This move was deemed to inculcate a circular economy, where the revenue is split evenly between creators and Telegram itself, with the closely linked TON asset.

The switch to TON-based ad campaigns turned out to be extremely accessible and cheap compared to Telegram's earlier cost for hosted marketing. Before, the minimum cost per CPM, which covers 1000 impressions, was around $2.15. Currently, it is 0.1 TON per CPM, which is about $0.75.

But that's only the start of the development flywheel for the TON blockchain.

On April 19, TON announced a partnership with Tether to enable instant USDT cross-border payments on the platform for Telegram users. Additionally, 11 million in TON incentives were included, 5 million of which will boost rewards in USDT/TON liquidity pools across TON Dexes, and 5 million TON will be given to users for depositing $USDT to @wallet_tg's Earn campaign.

A couple of months after the partnership, the numbers are pretty impressive. On June 26 2024, the USDT stablecoin supply on the TON blockchain had surpassed $500 million. This directly indicates the demand for USDT-TON on the blockchain and the rise of user interaction on the network.

This rise in TON's network activity is attributed to the ecosystem's growth. This is where The Open League and Telegram's mini apps come into play.

TON's ecosystem meteoric rise

When evaluating a blockchain network on fundamentals, the perceived value of the network is often directly related to the level of activity. If the number of participants is low, the value of the network will be low. Many Layer 1 networks face this issue – they are not able to attract enough users to generate a sustainable intrinsic value.So far, in 2024, this is not a problem for TON.

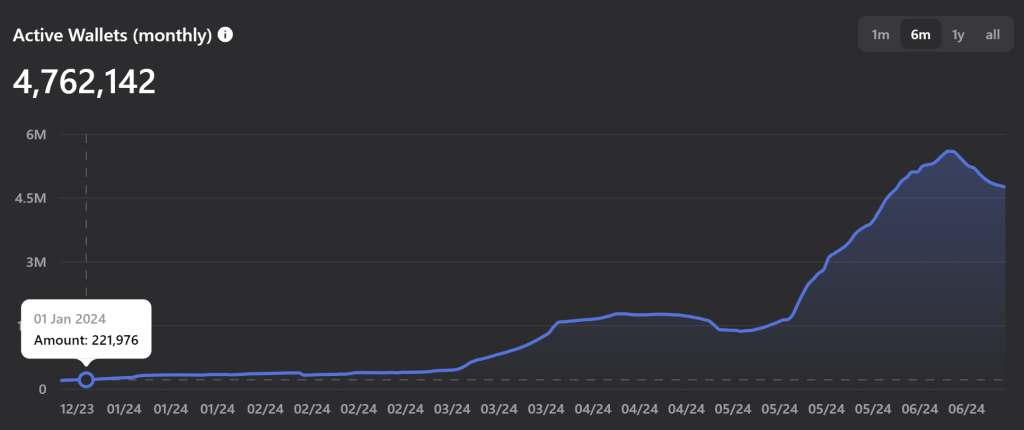

Since the beginning of the year, the number of active on-chain wallets that set at least one transaction during a 30-day window has risen more than 2000%, from 221k to 4.7 million at the moment.

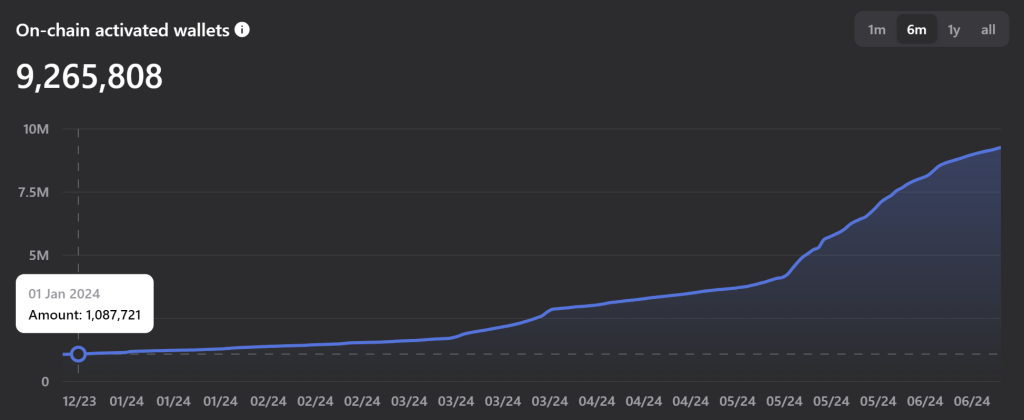

The number of on-chain wallets activated surged 750% from 1.08 million on January 1 to 9.2 million. For context, the blockchain announced its plans last year to onboard 30% of its users by 2028. Their target was around 3-4 million in 2024, but the reality has already surpassed expectations.

As mentioned earlier, the Open League and the rise of Mini Apps on TON have played fundamental roles.

Let's examine them more closely to understand their extent of impact.

The Open League- TON's ecosystem incentive

In our first report, we mentioned TON Foundations' $156 million incentive program and considered it a major reason for being bullish on the protocol. It has proven right on the button, as the Open League has witnessed massive success.Their website shows over $40 million in Toncoin has been distributed across different categories. The Open League is pretty straightforward: multiple projects compete monthly to earn rewards, and the users get rewarded for project interaction. The competition is divided into:

This is a bi-weekly or monthly competition between top TON projects, where they compete for a massive prize. Five seasons have been concluded since March, resulting in $9.3 million in rewards for the projects.

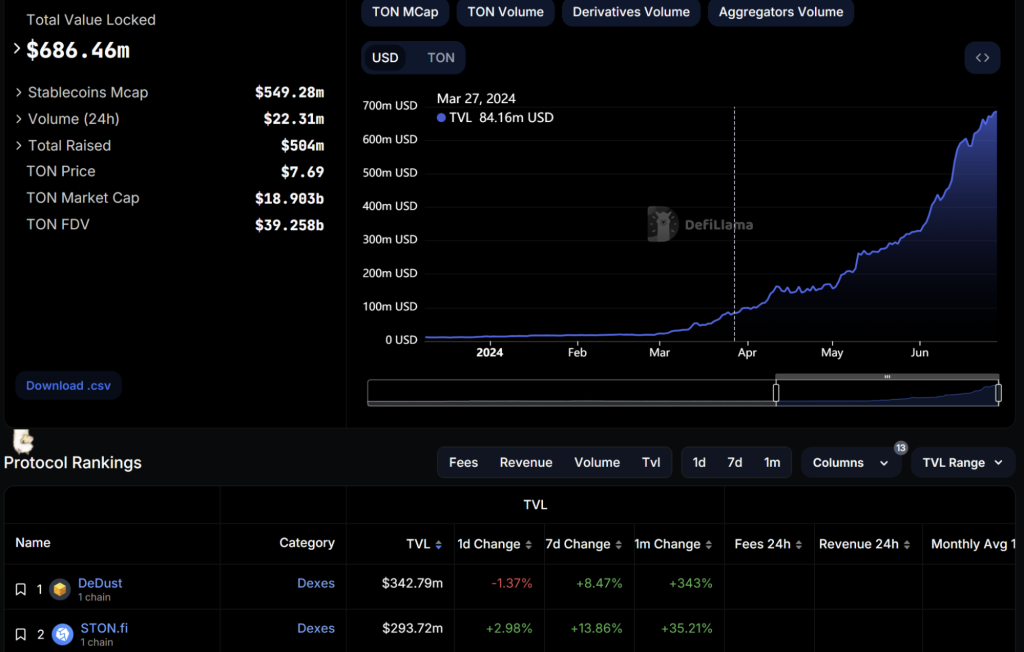

The success of the Open League can be visualised when TON's TVL growth is evaluated. Since the end of March, the TVL value has jumped from under $100 million to $686 million. DeDust and STON.fi, the DEX predominantly involved in the Open League, represent more than 90% of the TVL. This is a direct inference of how much capital inflows have been mitigated through these platforms onto the TON network.

Mini Apps- reviving the P2E narrative

The exemplary rise of Notcoin kick-started the Mini apps narrative of TON. The project took the larger crypto ecosystem by storm as the click-based game registered 20 million sign-ups within 26 days of its release. In comparison, Axie Infinity managed only 2.78 million monthly users at its peak in 2022. It also took the game a whole year to accomplish the milestone.Notcoin revived a very simple concept: A play-to-earn meta. Axie Infinity rose to popularity on this foundation in 2021, and Notcoin was able to re-establish the same interest. People were playing the game and receiving tokens, which eventually led to one of the largest token airdrops of the year. Over 80 billion tokens were distributed worth over $2 billion at the time.

While Notcoin is no longer playable, it hasn't stopped other P2E apps from taking centre stage. Projects like Hamster Kombat, Catizen, Yescoin, etc, have stepped up and brought millions of users into the TON ecosystem.

Following a blueprint similar to Notcoin, most of these games are click-based, offering potential airdrops and farming opportunities for the participants. Notcoin did the same. Players received in-game tokens for playing regularly, which were claimable on the TON blockchain.

When $NOT was officially launched, the in-game tokens could be swapped for $NOT tokens, therefore realising real tangible value. The opportunity is quite enticing, and the user activity on the new games is pretty insane.

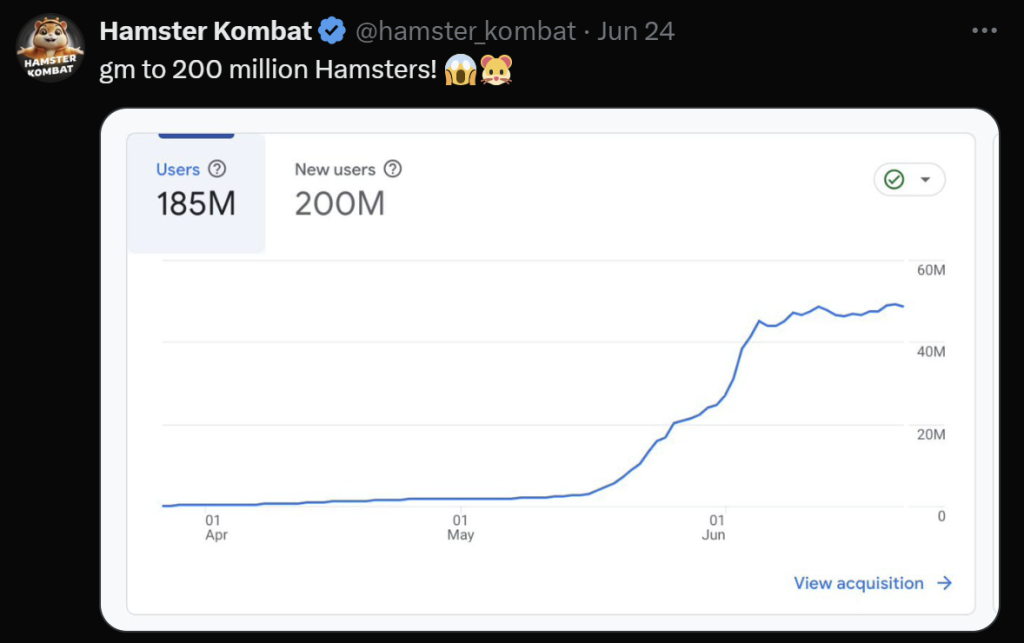

Hamster Kombat recently claimed to reach a whopping 200 million new users. That statistic is downright crazy. Considering that projects like Solana and Ethereum have less than 20 million and 10 million monthly active users, this 200 million number is pure madness.

Hamster Kombat's YouTube channel has managed to accumulate more than 20 million subscribers in a month, and they left a sneaky remark on Mr Beast's online claim.

Other mini-apps on TON have similar outlandish numbers. They are listed below:

- Catizen = 21 million users / 3 million DAUs

- TapSwap = 50 million users / 17 million DAUs

- Yescoin = 20 million users / 5 million DAUs

We interacted with multiple mini-apps, and a legitimate farming and airdrop opportunity is present, although it would take a bit of time and effort.

The positive snowball effect for TON

The root advantage of both the Open League and the mini-apps for the TON blockchain remains the increasing number of user participants. The Open League and mini-apps have successfully attracted people to the ecosystem. However, credit is due in other areas as well.- Telegram-Ton relationship:

However, TON continued to build its network capabilities independently, and in September 2023, they officially collaborated yet again. TON was chosen completely on merit. Block time is under 5 seconds. It is exceptionally fast, and the long-term plan is to onboard Telegram's huge user base of 900 million.

- UI/UX feasibility

- Tether integration and Telegram wallet

The speculation is that non-native crypto users are also entering the Web3 space through this mindset. The user base plays games and earns tokens, deriving monetary value directly from the same Telegram application.

Retail is clearly present in the TON ecosystem right now. While most apps are nascent, the blockchain is meeting its early targets of improving user experience and network participation.

All the above factors collectively have allowed TON's market value to increase during a period of bearish conditions. While most tokens faltered in value between April and June, TON witnessed a new all-time high on June 12.

In summary, market capital, on-chain activity, KOLs, and bullish momentum seem to indicate that everything is falling into place for the TON network.

Lingering concerns

Right now, the larger crypto market is massively bullish on TON, and rightly so. Since our first report, the network has continued to grow, and its progression rate is way faster than expected. Which begs the question: What can topple the TON hype train?Well, there is an Achilles heel to every protocol, and TON also has its potential weak spots.

VC investors

Last month, Pantera Capital announced that they made their 'largest investment in history' in the TON network. In March, they acquired TON at a significant discount, which was speculated to be about 40% lower than the market price.The actual investment amount was undisclosed, but some speculated that the investment was above $200 million. This assumption was drawn from the fact that they made a similar investment in Solana earlier this year, which improved their crypto Fund by 66%, valued at roughly $300 million in April.

On June 21, another development revealed that the venture capital is raising more funds for a second TON token investment. Other VCs and investors involved are listed below:

- Runa Capital- $6 million in 2021

- DWF Labs- $10 million at around $2 in 2022

- Mask Network- Undisclosed amount in 2022

- MEXC- Undisclosed amount in 2023

- Animoca Brands- Undisclosed amount in 2023

- KuCoin Ventures- Undisclosed amount in 2023

- Mirana Ventures- $8 million in 2024

- Pantera Capital- Speculated to be $200+ million in 2024

Longevity of mini-apps and incentives

TON's value-driving forces might carry limited potential. For the time being, the Open League is bringing activity due to its incentives. Mini-apps carry a similar allure, so the argument remains whether this is sustainable.Historically, P2E protocols have maintained momentum for only a brief period. Axie Infinity, a bunch of metaverse tokens, is the initial participants' derived value. In the current bull market, most of them are irrelevant.

Right now, the task is to retain the explosive momentum that TON has generated. DEes like DeDust and STON.fi do have long-term viability, and better mini-apps can possibly create and sustain the current circular economy established on the blockchain.

Market valuation

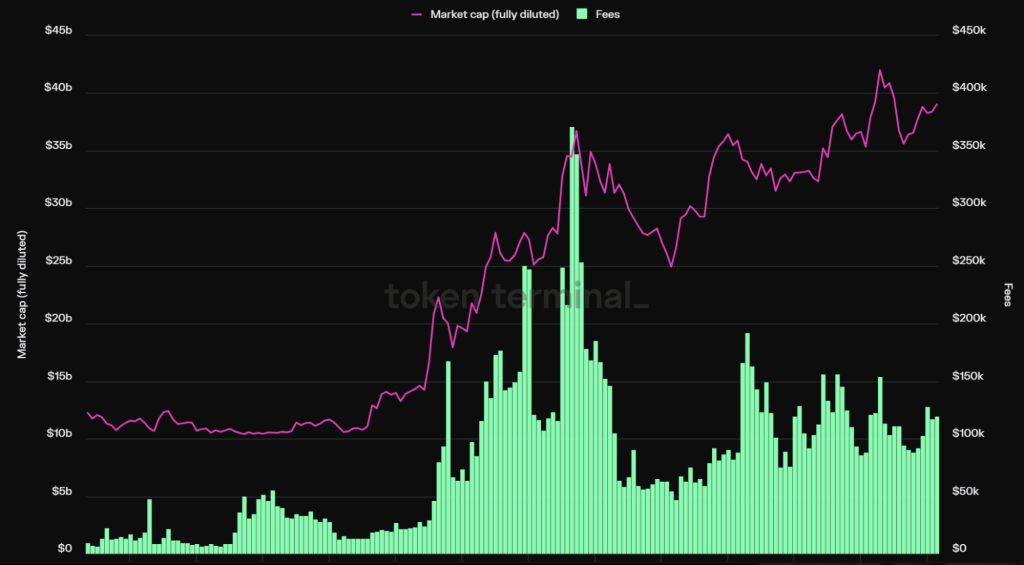

In our initial report, we mentioned that TON is a low-risk opportunity with an 8x potential. It was trading around $5 at the time and is currently up by 54% at $7.60.From an on-chain perspective, TON has improved drastically.

The annualised fees in March 2024 were around $22 million. They have been up 90% since then, clocking in at $41.82 million. As mentioned earlier, the TVL has also increased, so the logical reasoning would be that the price target should increase as well.

However, for now, we are sticking with our previous price target because of the concerns that have been shared in the previous section. We are confident that our previous targets will be attained, but we need to consider the fact that TON is already a massively valued crypto asset.

There could be potential for raising our price targets, but we would like TON to reach our initial targets first before we estimate another higher valuation.

Technical analysis

TON has been in a long-term uptrend for a good few months now, while Bitcoin has been range-bound. This has been a very positive and strong performance considering the wider market.TON is close to its all-time highs, and a break above $8.30 would put TON into price discovery and potentially send TON substantially higher.

However, TON is pushing closer and closer to its main uptrend line without making more meaningful new highs. This is a sign of slight exhaustion.

TON has created a bearish divergence on the 3D timeframe in overbought territory. This formation usually results in a price move down.

If TON's price were to move lower, it has several major horizontal supports beneath the current price—the first at $6.78 and the next at $6.00.

In the short term, the upper Yellow Box between $6.00 and $6.24 may be a good long-term buying opportunity. If price were to pull back more substantially, the area to add TON with greater USD sizes would be between $4.44 and $4.83.

Cryptonary's take

Overall, our stance remains unchanged on TON. We think it is on the right track to deliver on our initial 8x potential. It is one of the projects moving in the right direction with its on-chain activity, sentiment, and user integration. Retail is present, there is real value being carved on the blockchain, and they are defying the odds under bearish conditions.From a 2024/2025 objective, the bullish play with TON remains active. The long-term development might undergo alterations as VC continues to become more involved in the ecosystem. Still, for the time being, if you already invested in TON, it should retain its spot as a low-risk play for the next leg of the bull run.