Top 10 Airdrop Opportunities for 2026 (Part 1)

Airdrops remain one of the few areas in crypto where asymmetric upside still exists without requiring aggressive leverage or directional risk. Our members have been making 6 figures since 2021 every year, we have been early for Arbitrum, Optimism, Jupiter, Hyperliquid and Lighter and countless more 5-6 figure opportunities. If you want to make asymmetric returns in 2026 even with small capital, here's what you should know...

In this report:

- How incentive design in 2026 differs from prior cycles

- Where onchain activity is being measured and rewarded today

- Which protocols still offer favorable participation dynamics

- How to engage without relying on leverage or directional exposure

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Introduction

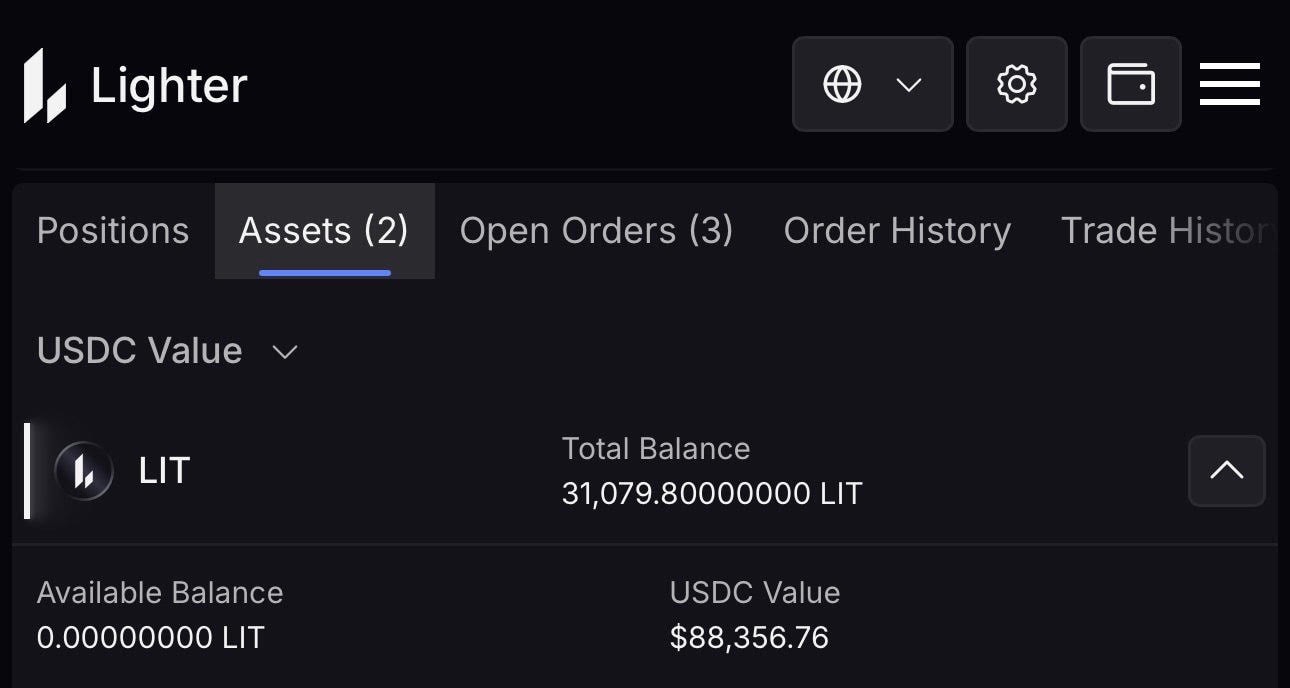

We closed 2025 with one of the most impactful airdrops of the year through Lighter. Many Cryptonary members who interacted early captured substantial airdrop payouts. Even smaller portfolios secured their first multi thousand dollar airdrop, showing that anyone can participate in airdrops and make money regardless of capital size.

We identified Lighter as a high conviction opportunity in the summer, well before the perpetual DEX meta gained traction across crypto Twitter. Following the early success of Hyperliquid, it became clear that additional protocols with similar incentive designs would emerge as catch up plays. Lighter fit that profile, with reward mechanics that favored early engagement and ongoing interaction before broader attention arrived.

Participation did not require directional trading. For members who did not want to read charts or take on price risk, a delta neutral approach was recommended. By holding opposing positions, users could remain active on the protocol while allowing funding rate differences to help offset spreads and fees. More consistent interaction generally led to higher point accumulation, but rigid weekly activity was not a prerequisite.

One distinction is worth emphasizing. The goal was never to determine which perpetual DEX would ultimately win. From an airdrop perspective, that question is secondary. What matters is capturing distributions early, monetizing them when liquidity allows, and recycling that capital into subsequent opportunities or rotating it into higher conviction assets. This capital flywheel is what allows airdrops to compound and, for many participants, has proven to be one of the fastest and lowest risk paths to building a first six figure portfolio.

Perpetual DEXs represent some of the clearest airdrop opportunities due to their activity driven reward structures. While they are often perceived as complex or high risk, many of these protocols can be engaged with conservatively. The broader 2026 opportunity set also extends beyond perps into other sectors where participation may be more straightforward for some users.

This report is not intended to be read once and set aside. Airdrop strategies work best when treated as an ongoing process, especially in a space that evolves quickly and rewards timely execution. While this report provides the foundational framework, real time updates, adjustments, and discussion live inside the Cryptonary Discord as conditions change throughout 2026.

Best Practices Before you Start

Before interacting with any protocol, tooling and security need to be addressed first. A large portion of participants are coming from the Solana ecosystem, and while that experience transfers conceptually, the EVM environment introduces different risks and requires a more deliberate setup.1. Wallet Selection

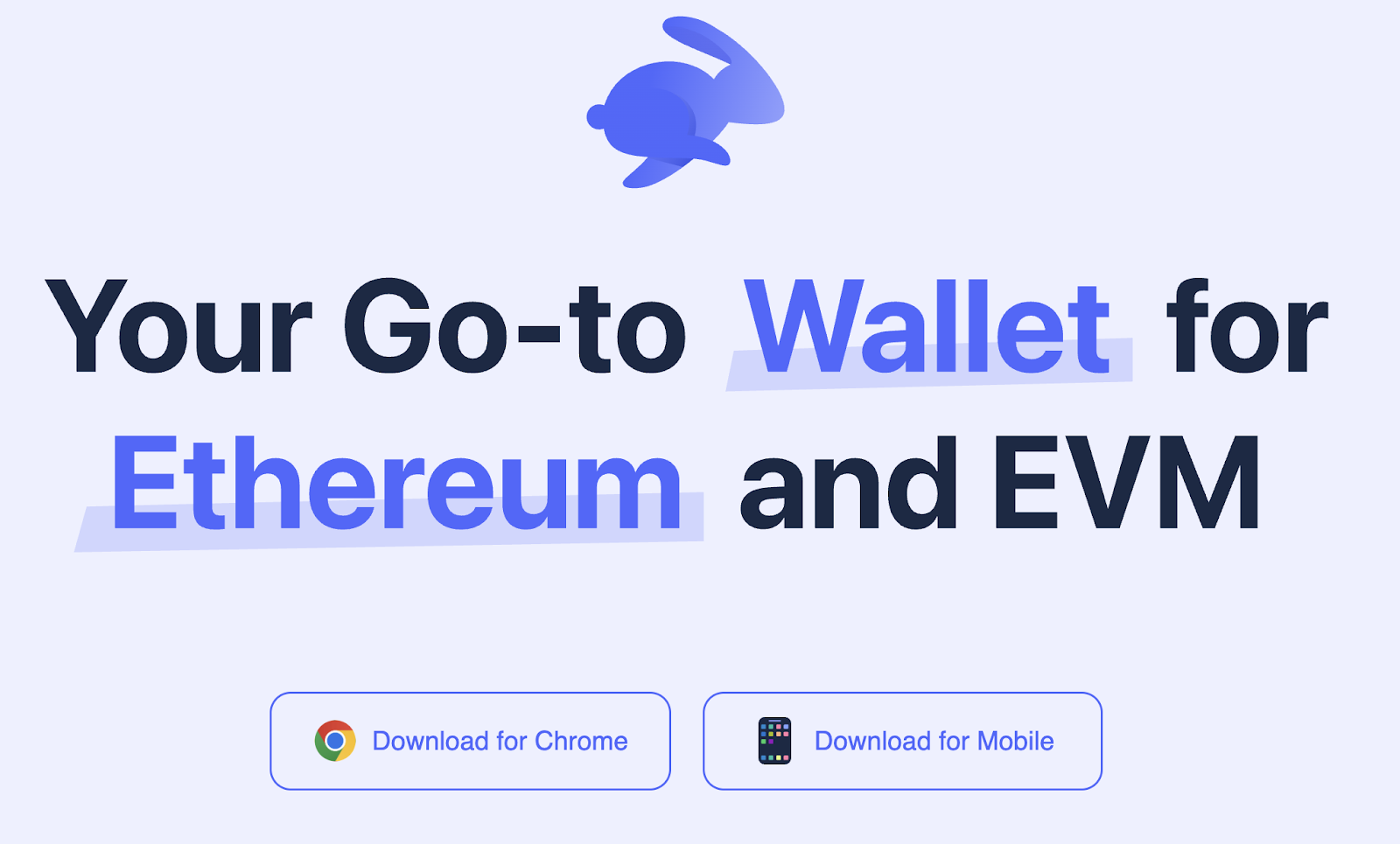

For EVM based airdrops, Rabby Wallet should be considered the default choice. Rabby offers clearer transaction previews, stronger permission management, and broader compatibility across emerging EVM protocols. These features materially reduce the likelihood of signing unintended or malicious transactions.

Phantom remains an excellent wallet for Solana native activity, but it is not optimized for complex EVM interactions. This becomes especially relevant when dealing with contract approvals, multi step transactions, and newer protocols where clarity around permissions matters.

Using the right wallet reduces friction and meaningfully lowers operational risk.

2. Security Extensions

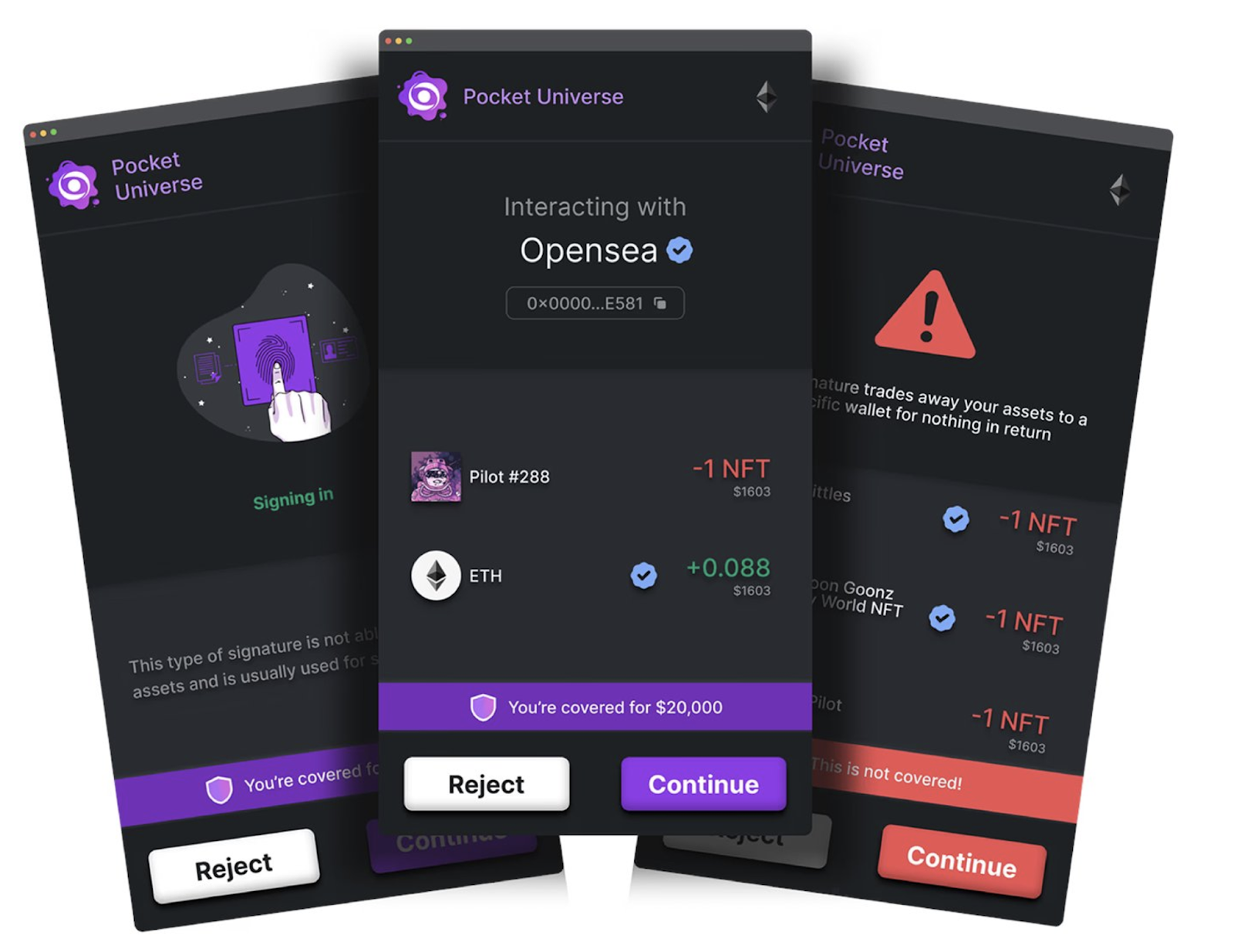

Transaction simulation is no longer optional. Before signing any transaction, you should know exactly what is being executed.Two Chrome extensions are strongly recommended:

- Pocket Universe

- Scam Sniffer

Combined with Rabby, this setup meaningfully reduces exposure to common exploit vectors and user error. It will not eliminate risk entirely, but it significantly improves the odds of avoiding preventable mistakes.

For readers who want a deeper dive into operational security and threat models, additional context is available here.

Now, let's dive into airdrops...

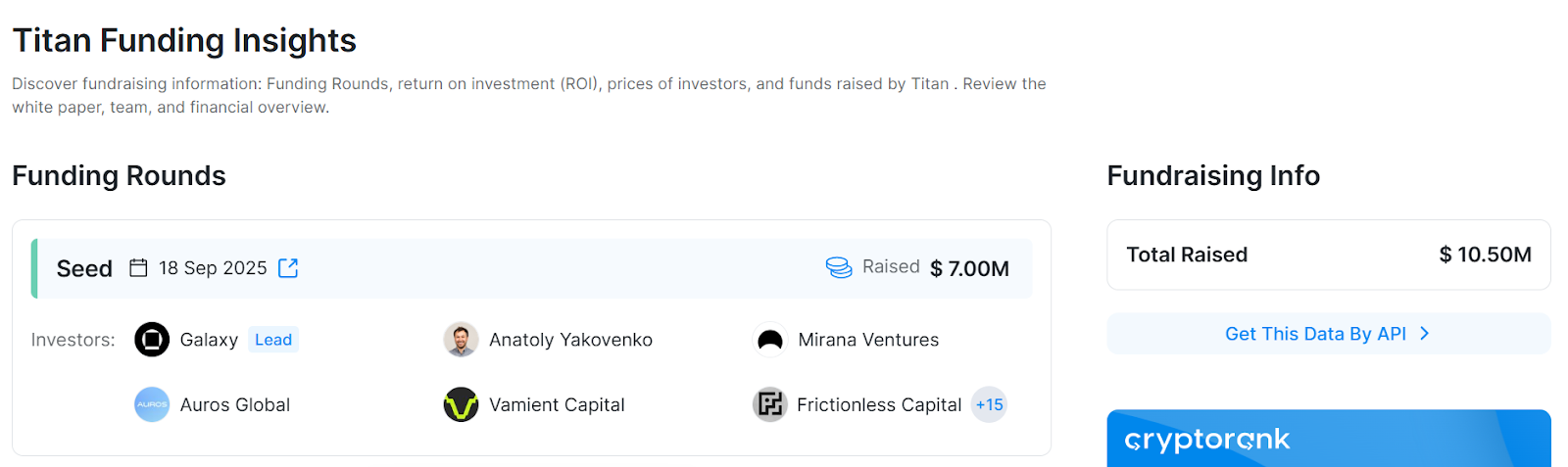

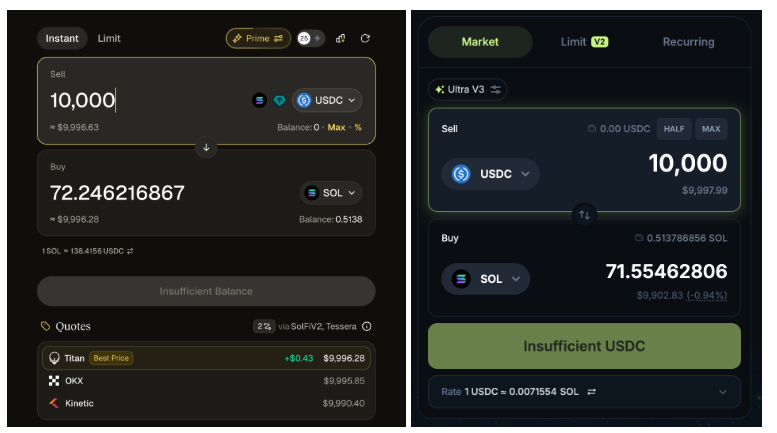

Titan

Titan is a next generation DEX aggregator built on Solana, designed to optimize liquidity routing and execution quality across the ecosystem. Functionally, it competes with existing swap venues like Jupiter and Kamino, but approaches aggregation with a heavier emphasis on price improvement and performance.

The team has raised a meaningful amount of capital, with Galaxy participating as a notable investor. Galaxy remains one of the most influential institutions in the Solana ecosystem, which adds credibility from an ecosystem alignment and long term support perspective.

Airdrop Thesis

Swap aggregators are some of the cleanest airdrop candidates. Activity is organic, easy to sustain, and naturally repeatable. Rather than asking users to change behavior, Titan simply asks them to route behavior they are already doing through a new venue.Titan also layers in additional engagement mechanics such as:

- Occasional partner missions with other protocols

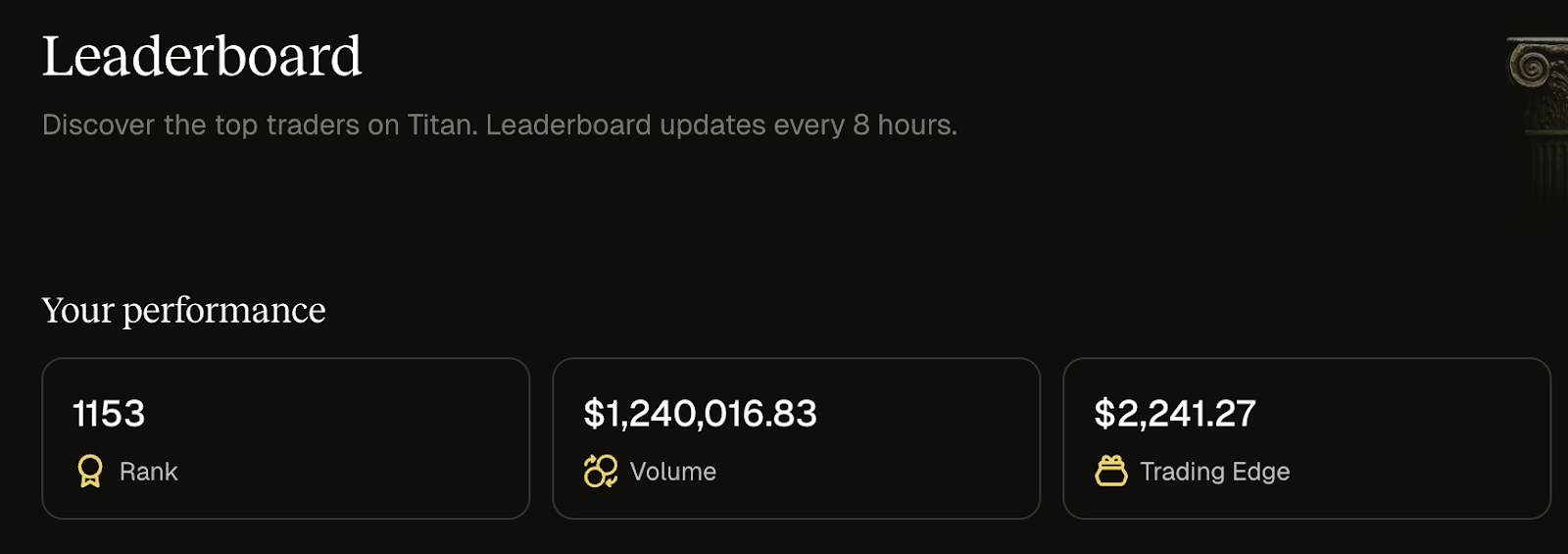

- A public volume leaderboard that gamifies usage

- Ongoing incentives tied directly to real swap volume

How to Participate

Titan is intentionally simple. Instead of swapping on Jupiter or Kamino by default, route your regular Solana swaps through Titan instead. That is it.Practical guidance:

- Use Titan for routine SOL, USDC, and ecosystem token swaps

- Participate in partner missions when they appear

In many cases, Titan already offers equal or better price execution than Jupiter, which means participation does not come at a cost to users.

Risk and Effort Profile

This is one of the lowest effort opportunities in the report. There is no lockup, no complex strategy, and no directional risk beyond the swaps users are already making. Execution quality is competitive, and activity maps cleanly to potential future rewards.For users looking to get started immediately without changing workflow, Titan is an ideal entry point.

Here's a step-by-step video tutorial:

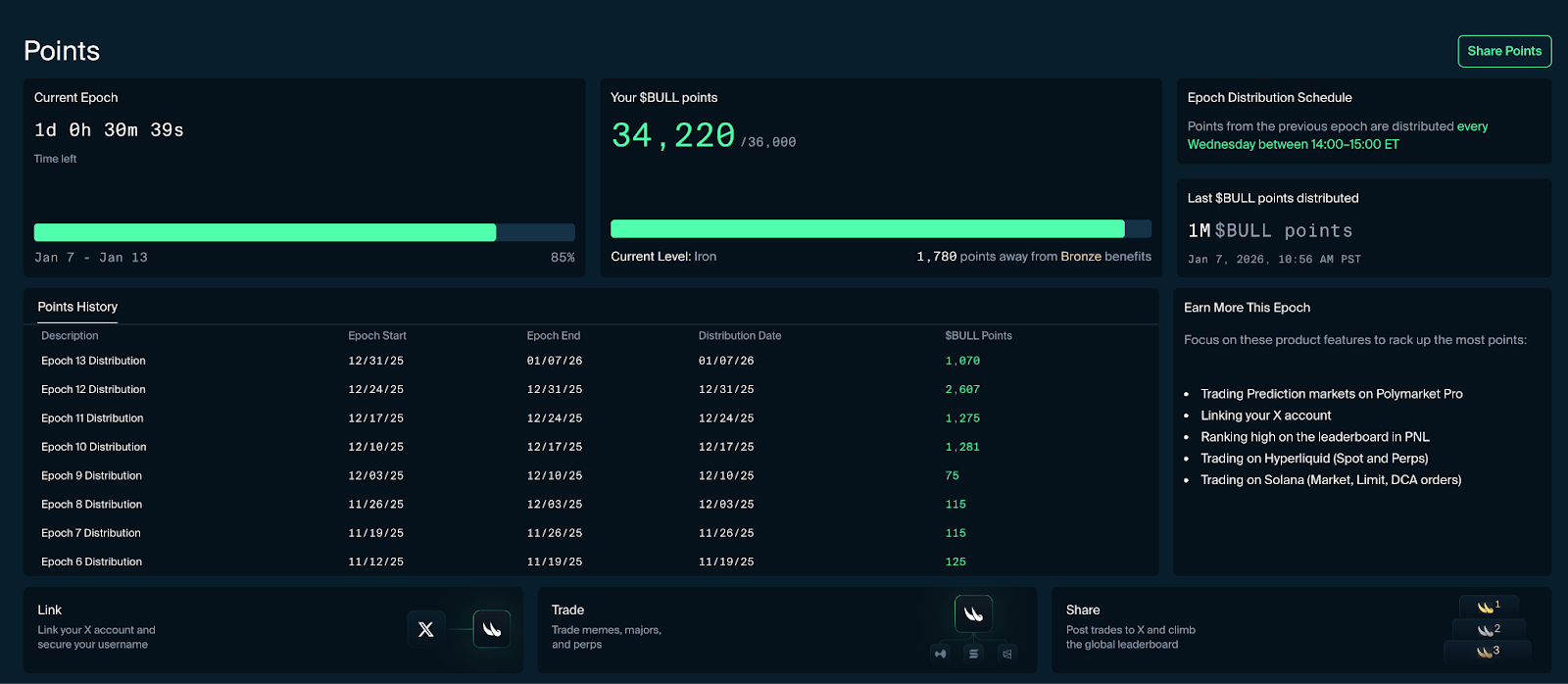

Bullpen: 2 in 1 Opportunity with Polymarket

Bullpen is a professional grade trading terminal that layers access to multiple sources of market activity, including integration with Polymarket and execution via Hyperliquid builder codes. It is designed for sophisticated interaction with both prediction markets and derivatives liquidity.The project has drawn backing and visibility from notable participants in the space, including Ansem as an angel investor, which increases both its reach and its integration into active trading communities.

Airdrop Thesis

Bullpen has an explicit points program that distributes rewards on a weekly basis. These points are accrued through platform activity and are expected to play a role in any future Bullpen token distribution.

More importantly, Bullpen’s Polymarket integration creates exposure to a second potential distribution. Polymarket leadership has confirmed that a token is planned following its U.S. rollout, with timing dependent on regulatory progress and product expansion. Polymarket has also raised a substantial amount of capital, including strategic investment from major institutional players, which increases the likelihood of a meaningful user focused distribution.

Once a Bullpen token or Polymarket token materializes, distribution will likely be followed by strong narrative amplification. At that point, visibility driven by investors and prominent traders is where liquidity emerges and where taking profit becomes possible.

How We Recommend Using It

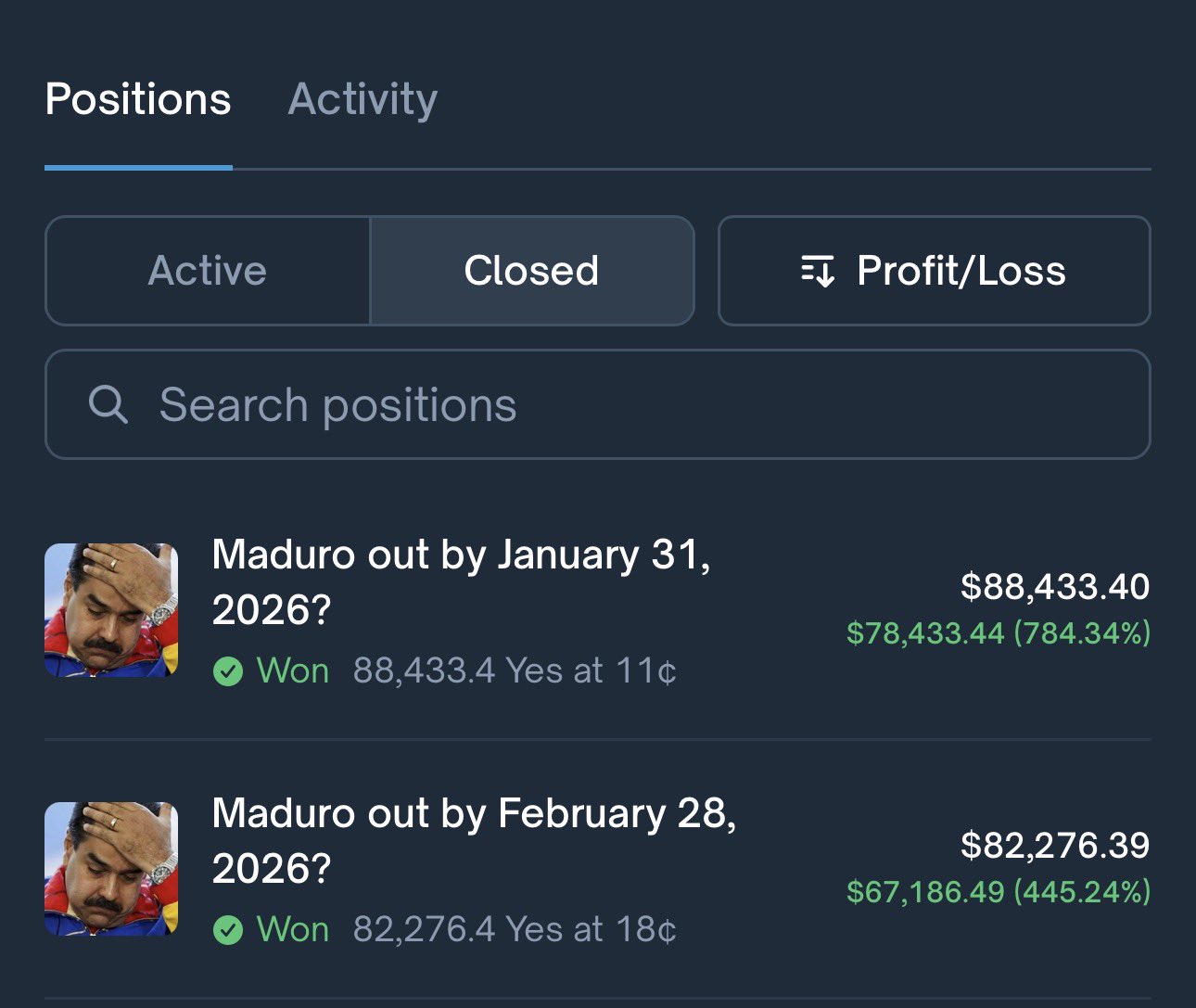

This is not about endorsing gambling behavior.While Polymarket supports markets such as sports outcomes, the real edge lies elsewhere. The recommended approach is to focus on outcomes that are highly constrained, time bound, or where informational advantages exist.

Examples include:

- Regulatory or legal deadlines

- Company earnings

- Political or corporate events with narrow outcome ranges

- Markets where informed or repeat participants consistently position early

One illustrative example was the Polymarket participant who placed a large position on Maduro being captured well before the event occurred, a trade widely viewed as being driven by insider level information. These are the types of situations we monitor. Bullpen provides the tooling to identify, size, and manage this type of exposure while simultaneously accruing points through platform activity.

Here's a step-by-step video tutorial:

Strategic Angle for 2026

Prediction markets remain structurally inefficient compared to spot and perpetual markets. Liquidity is fragmented, participants are unevenly informed, and tooling is still maturing. That gap continues to create opportunities for disciplined users.Bullpen’s integration with prediction markets creates a distinct activity profile that is likely to be rewarded over time. This is an area we will actively track throughout 2026, and any repeatable or high confidence setups that emerge will be shared with users as they develop.

Risk and Effort Profile

This is a moderate effort opportunity.It requires more thought than simple swapping or routing volume, but it does not require constant trading or leverage. Capital can be deployed selectively and activity can remain episodic rather than continuous.

Tydro and Nado - Ink Ecosystem Positioning

We first highlighted Ink and its core protocols in November, well before activity accelerated and point programs became explicit. Since then, both Tydro and Nado have continued to add structure, tooling, and visibility around how participation is tracked. While this is no longer a discovery phase, the incentive window remains open and increasingly well defined.Rather than spreading activity thin across the ecosystem, a higher signal approach is to concentrate on two protocols that capture both passive and active participation. Tydro anchors persistent capital deployment through lending, while Nado captures higher impact trading and liquidity activity. Together, they align cleanly with how Ink is indexing onchain usage.

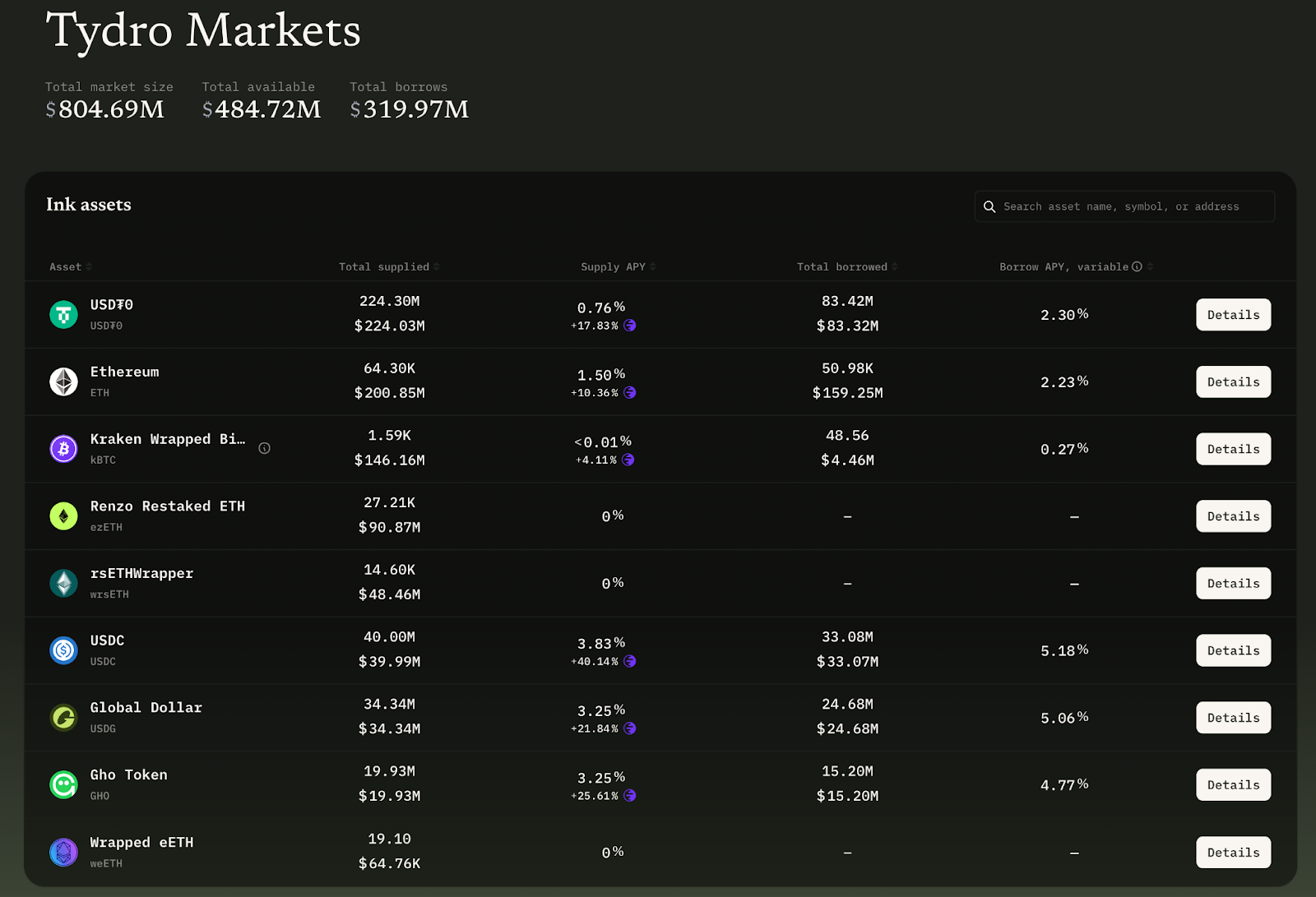

Tydro: Ink’s Primary Lending Market

Tydro is the dominant lending and borrowing protocol on Ink. It is built on a proven Aave V3 codebase, materially reducing smart contract risk relative to most early stage money markets.The core opportunity is straightforward. Supplying stable assets generates organic yield while ensuring all activity is logged onchain and attributed directly to the user.

USDG remains a conservative baseline asset, issued by Paxos and backed by regulated cash equivalents and short duration U.S. treasuries. That said, current estimates show USDC offering a higher supply APY, making it the preferred deposit asset when yield optimization is the priority.

Key characteristics:

- Predictable yield with minimal directional exposure

- Continuous on chain activity indexing

- Direct exposure to Ink based incentive programs

- No reliance on short term liquidity subsidies

While estimates should not be treated as guarantees, the tool provides useful context for sizing and expectations. Capital can remain deployed for extended periods, earn yield, and stay fully eligible for any retroactive rewards without requiring active management.

Here's a step-by-step video tutorial:

Nado: High Impact Activity for Ink Exposure

Nado is being positioned as the flagship perpetual DEX within the Ink ecosystem. Incentive mechanics have been communicated clearly, and the platform is now approaching the end of its private alpha phase.

How to Engage

1. Delta neutral trading within NadoNado supports both spot assets and perps, allowing users to construct delta neutral positions entirely within the platform. Using the NLP vault as margin, spot exposure can be hedged with perp positions while generating meaningful trading volume.

In this structure, liquidation risk is dynamic rather than static. Because spot assets are held alongside the perpetual position, changes in the underlying price directly affect the liquidation threshold. As the spot asset appreciates, margin value increases and the liquidation price moves further away. If the asset declines, the liquidation threshold tightens accordingly.

This makes the setup inherently more resilient than a pure perp position. Risk is not eliminated, but it adjusts in real time based on price movement, funding capture, and vault yield. When combined, vault returns and funding rate differentials help offset trading fees and execution costs while maintaining buffer during periods of volatility.

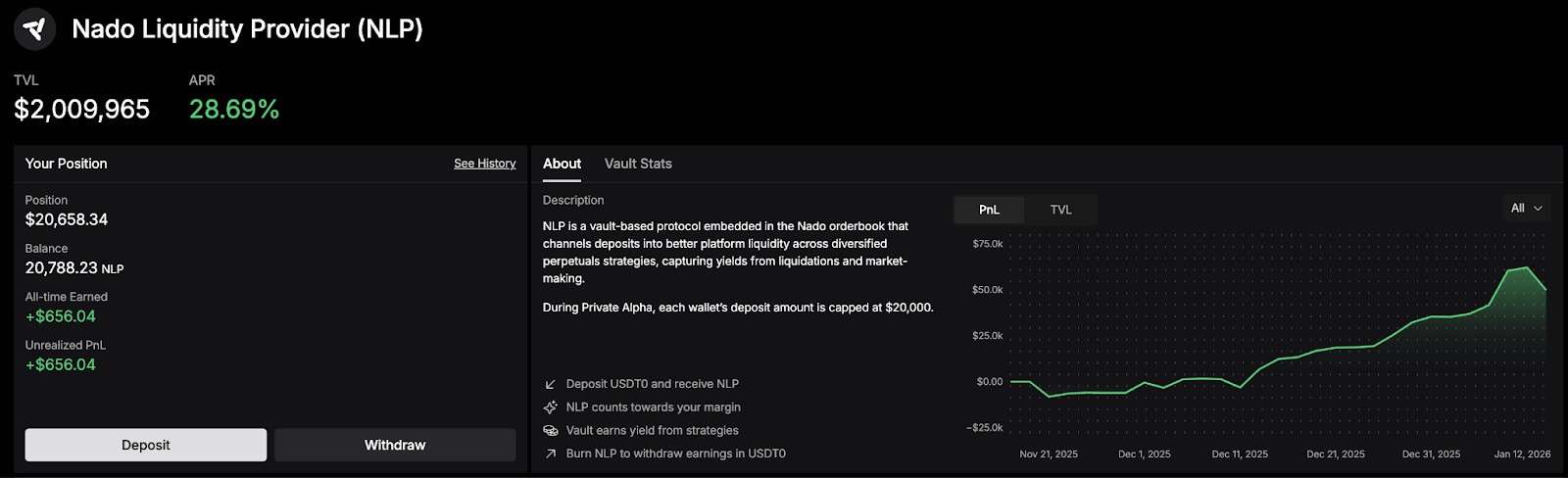

2. NLP Vault participation

For users who prefer a lower maintenance approach, the Nado Liquidity Provider vault has shown strong early performance during private alpha. Returns reflect low competition and early phase market making dynamics while still generating activity points. At the time of writing, the vault is fully allocated, with capacity reopening periodically as positions unwind or if the cap is adjusted.

Here's a step-by-step video tutorial:

Strategic Context

Kraken has raised significant capital and operates under a strong regulatory framework. Ink serves as a visible onchain extension of that strategy, making ecosystem traction and sustained activity structurally important.The sequencing of confirmations, from point programs to phased alpha transitions, implies a measured rollout rather than an immediate distribution. This places emphasis on sustained, correctly positioned participation over time, with timelines that likely extend into late Q2.

Risk and Effort Profile

- Tydro: low effort, conservative, capital efficient

- Nado: moderate effort, higher impact, optional complexity

We have seen sustained post TGE performance from exchange aligned assets such as Binance’s BNB and Bybit’s Mantle. Ink related distributions may fall into a similar category, depending on market structure, incentive design, and broader conditions at launch.

The appropriate course of action will be determined closer to distribution, based on liquidity, valuation, and ecosystem traction at that time.

Cryptonary’s Take

Airdrops in 2026 increasingly reward users who understand how activity is measured, how incentives are phased, and how capital can remain productive while awaiting distribution. The opportunity set favors structured participation over sporadic interaction.The protocols highlighted in this report share several characteristics. Activity is tracked deliberately. Rewards are tied to usage quality rather than surface-level engagement. Capital can remain deployed in ways that generate yield, volume, or both, creating flexibility as incentive cycles mature.

Effective execution remains the differentiator. Conservative position sizing, disciplined use of delta neutral structures, and thoughtful management of liquidation risk matter more than chasing marginal points. Capital rotation following distribution remains a core component of long-term compounding, with governance tokens evaluated based on liquidity, valuation, and ecosystem traction at the time they arrive.

In some cases, exchange aligned ecosystem tokens may justify longer consideration, but that decision should be made with data and market context.

This report is designed as a framework that can be revisited and refined as conditions evolve. Airdrops reward consistency, adaptability, and capital discipline over time. The advantage accrues to participants who treat airdrops as a compounding process rather than a one time opportunity.

Cryptonary, OUT!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms