Top 10 Airdrop Opportunities for 2026 (Part 2)

You made it to Part 2 — perfect timing. The easy airdrop era is fading, but the new era is way better: clear incentives, fixed timelines, and rewards that actually make sense. Here are the top opportunities we’re watching for 2026, plus the safest and most efficient ways to position…

In this report:

- Where incentive structures are already live and measurable

- How to engage efficiently under updated points mechanics

- Which participation strategies favor smaller and mid sized accounts

- How to manage activity without introducing unnecessary directional risk

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

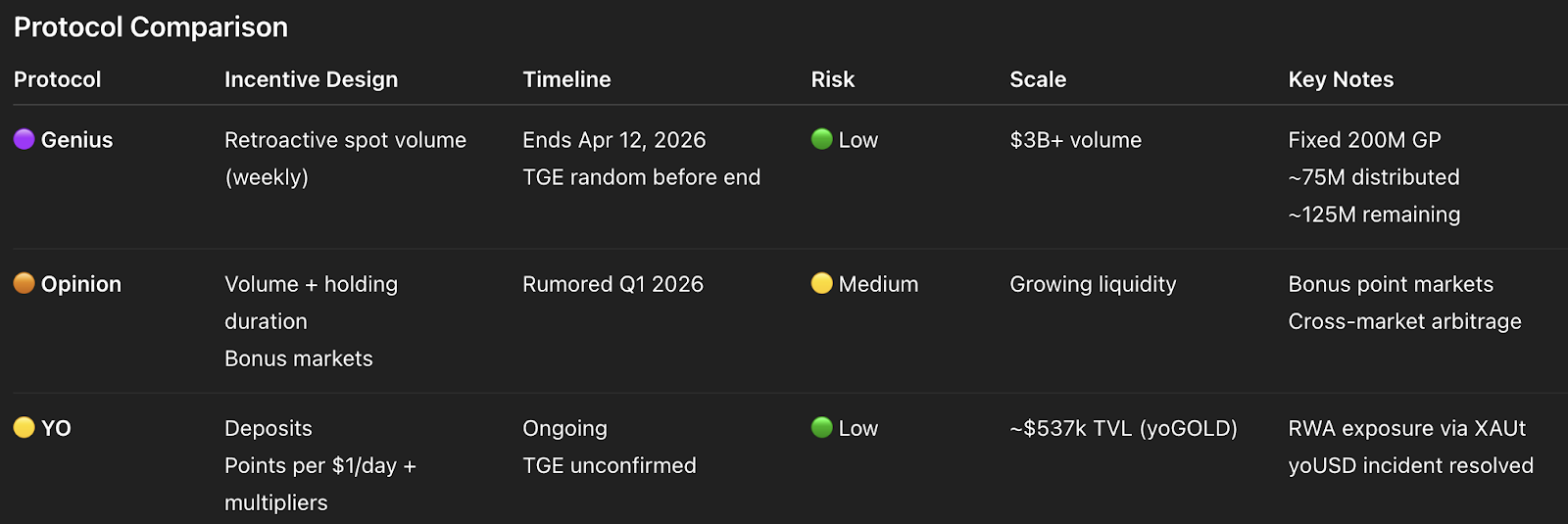

Protocol Overview Comparison

Genius

Genius is a trading terminal that has seen rapid adoption since launch, processing over $3B in spot volume at the time of writing. The project is backed by YZI Labs, the investment arm associated with Binance.Genius has published one of the most explicit and tightly constrained points programs currently active. Emissions, timelines, and trader protections are clearly defined, and the team has committed in writing to a token launch within the current season. Full documentation is available directly through the Genius points portal.

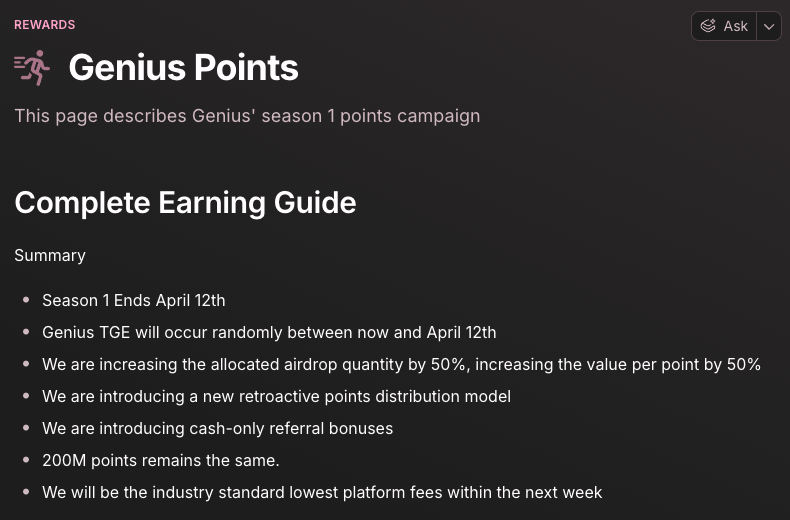

Season 1 is scheduled to end on April 12, 2026, with the $GENIUS token launch occurring randomly between now and that date. The team has also increased the total airdrop allocation by 50 percent, increased the value per point by 50 percent, and transitioned to a retroactive weekly distribution model designed to discourage bots and favor consistent organic traders.

At the time of writing:

- Total Season 1 supply is fixed at 200M GP

- 75M GP have already been distributed

- 125M GP remain to be earned

- Weekly emissions are capped at 10M GP

- No inflation, no expansion, no dilution

How Points Are Earned

Genius points are awarded exclusively through spot trading volume. Transaction count does not matter. Referrals do not contribute to points. All volume is evaluated retroactively and distributed once per week.Effective volume is calculated using a weighted model:

USDT ↔ USDC spot volume is weighted at 0.5x

All other spot pairs are weighted at 1.0x

Weekly distributions are pro-rata but include internal weighting designed to prevent large accounts from monopolizing emissions. This ensures smaller traders receive meaningful allocation as long as participation is consistent.

Points earned through trading volume prior to program changes remain fully intact and honored.

How to Engage

- Create your Genius account and connect your wallet.

- In the top right, click Deposit.

- Select Solana as the network and choose Deposit USDC.

- Test with a small amount first. Confirm it arrives before sending size.

- To confirm your funds landed, click Holdings (top left) to view balances.

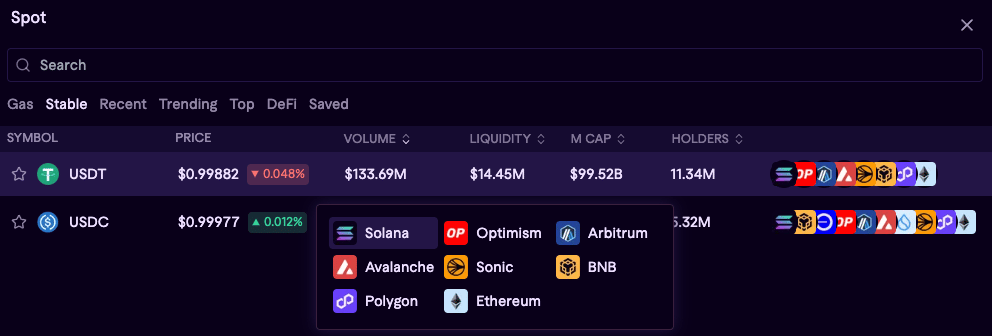

- To generate spot volume, go to Swap (near the top left of the interface).

- Click Swap + Bridge.

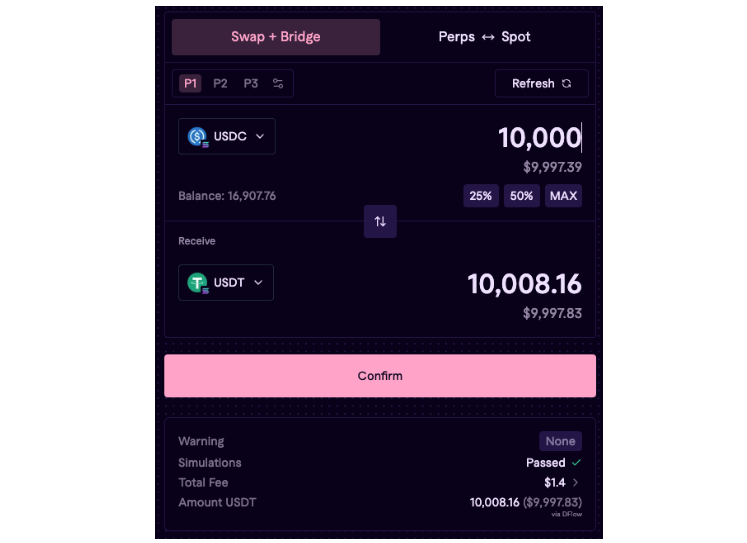

- Set the swap to USDC → USDT (or vice versa), enter your amount, and review the preview.

- Confirm the trade, then repeat on your preferred cadence.

This approach allows users to participate without relying on leverage, referrals, or directional exposure.

Practical Notes

The reason for prioritizing stablecoin to stablecoin swaps is risk control.Using volatile assets such as SOL or BTC introduces unintended exposure. If price moves quickly while volume is being generated, users can incur losses that materially outweigh the value of points earned. In most cases, that tradeoff is not justified in an airdrop driven strategy.

Swapping USDC ↔ USDT allows users to generate spot trading volume while keeping portfolio value relatively stable. Price drift between major stables is typically minimal, making the strategy easier to sustain.

Key considerations:

- Stable pairs are weighted lower for points, a deliberate tradeoff for reduced volatility

- Always review execution previews before confirming swaps

- Start small, understand execution costs, then scale gradually

- Avoid over-trading. Points are distributed weekly, not per transaction

- Some users may choose to experiment with non-stable pairs to evaluate whether higher effective volume offsets the added price risk. That decision is best made on an individual basis, informed by risk tolerance, execution quality, and overall portfolio context.

- Monitor for anti-bot measures; multi-account strategies may be penalized.

Additional Incentives

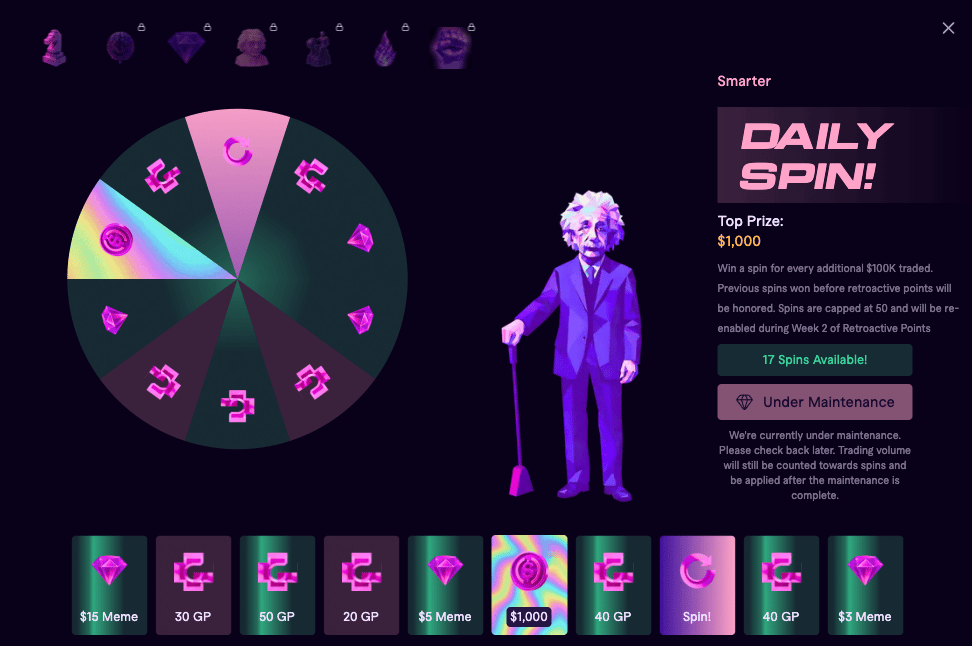

Genius also includes a spin wheel mechanic that awards bonus GP and cash prizes based on incremental trading milestones. Spins are earned for each additional $100K in spot volume, capped per user. Previously earned spins are honored, and the feature is being re-enabled alongside the retroactive points rollout.

At the time of writing, trading fees are temporarily set to 0%, with a small execution fee refunded at the end of the period. Referral rewards are now paid exclusively in cash, not points, and only apply to future volume once fees are live.

Strategic Context

Genius is positioning itself as a long-term trading terminal. Fixed supply points, explicit timelines, and a written token commitment materially reduce uncertainty relative to most ongoing programs.The retroactive weekly distribution model shifts emphasis away from timing games and toward consistent participation. Weekly emissions are fixed, points are allocated transparently, and activity is evaluated in discrete intervals rather than real time, which reduces the advantage of burst trading or one-off volume spikes.

As with most terminal and venue based airdrops, the base case expectation should be to monetize the token following distribution and rotate capital into subsequent opportunities. That said, final execution will depend on liquidity conditions, valuation at launch, and how the market prices the terminal relative to peers.

The appropriate decision will be made closer to TGE, with market structure and incentive design as the primary inputs rather than assumptions made in advance.

A full step by step video walkthrough covering account setup, deposits, and volume generation is available below.

Opinion

Opinion is a rapidly growing onchain prediction market on BNB Chain that is emerging as a serious competitor to Polymarket and Kalshi. Volume has scaled quickly, the interface is polished, and market depth across core events continues to improve.

There are persistent rumors that Opinion intends to front-run Polymarket’s eventual airdrop, making early participation here particularly time-sensitive. Regardless of sequencing, the platform sits squarely within a category that has historically rewarded early, consistent users.

Prediction markets increasingly function as real-time information aggregators, often pricing outcomes before traditional markets or media narratives adjust. From an incentive perspective, this creates a natural fit for volume-based and holding-based reward systems.

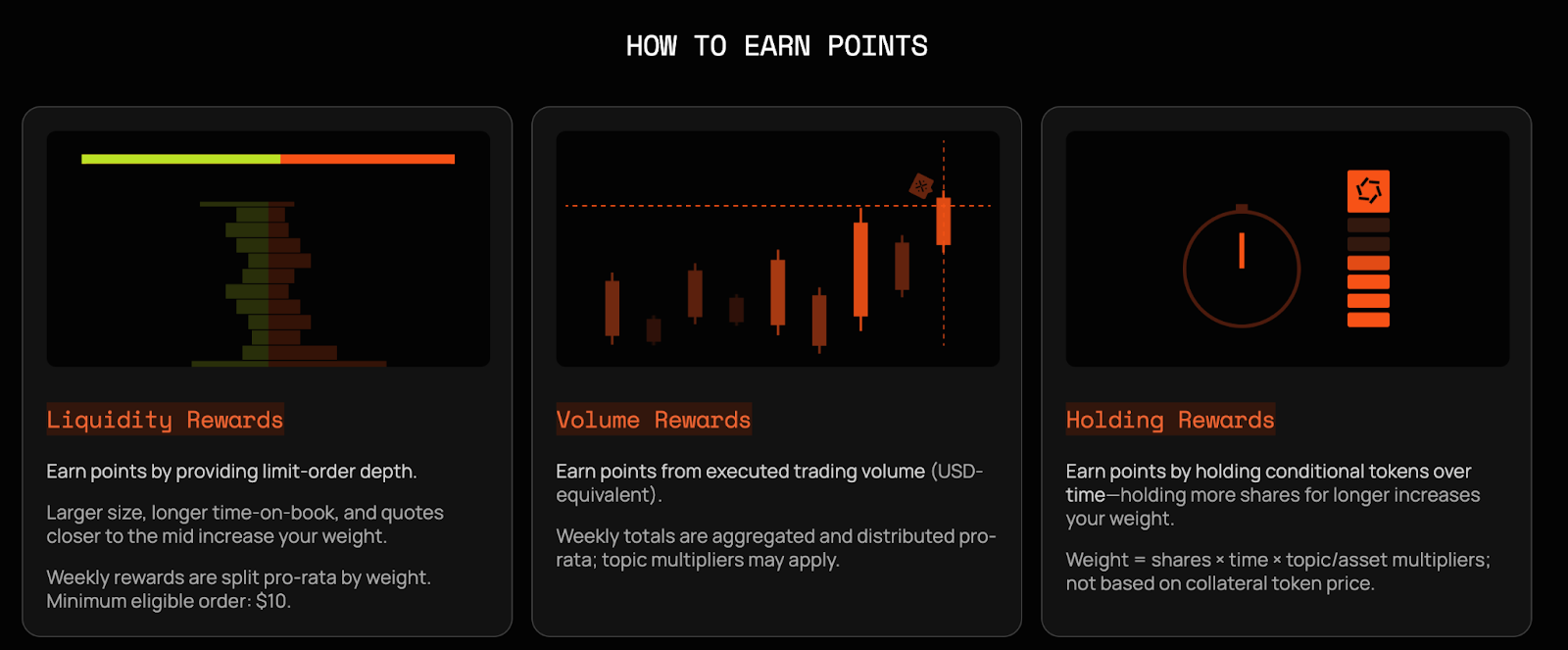

Airdrop Thesis

Opinion’s rewards system is driven by executed volume and position holding, with additional multipliers applied to select markets. Activity is evaluated over time rather than per transaction, which favors sustained participation over short bursts of trading.

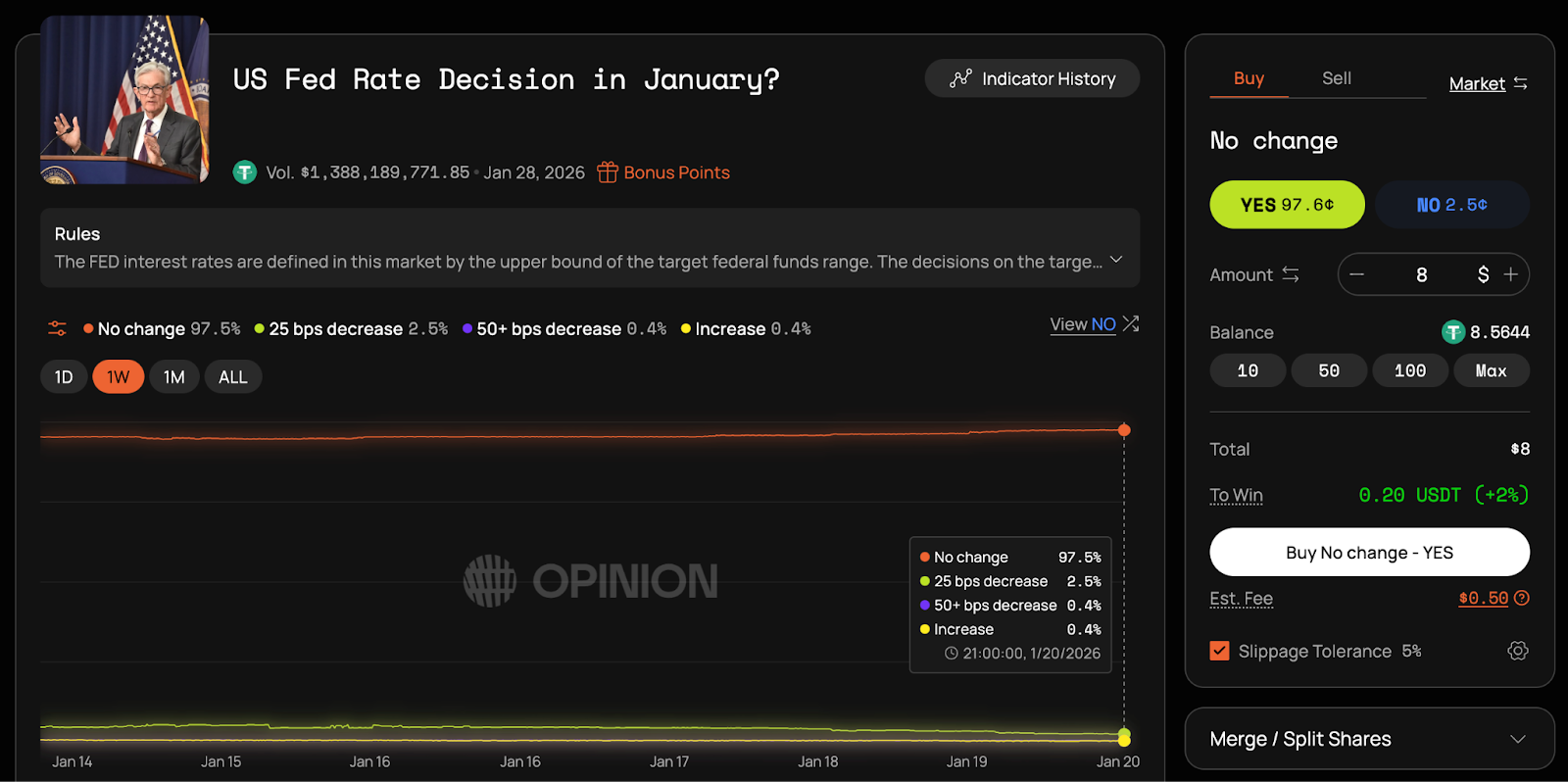

The Testnet Points Program has concluded, but the ongoing Opinion Pioneer Program rewards social engagement and community participation with points that could qualify for mainnet rewards. Markets tied to macro events, economic releases, and widely followed assets tend to attract the most liquidity and, in some cases, qualify for bonus point multipliers. This makes them particularly efficient for users looking to generate activity without unnecessary complexity.

How to Engage

To fund your account, you will need USDT on BNB Chain.- Click the money icon in the top right of the Opinion interface

- The app will detect available USDT in your wallet

- Approve the deposit transaction

Example Trade Flow

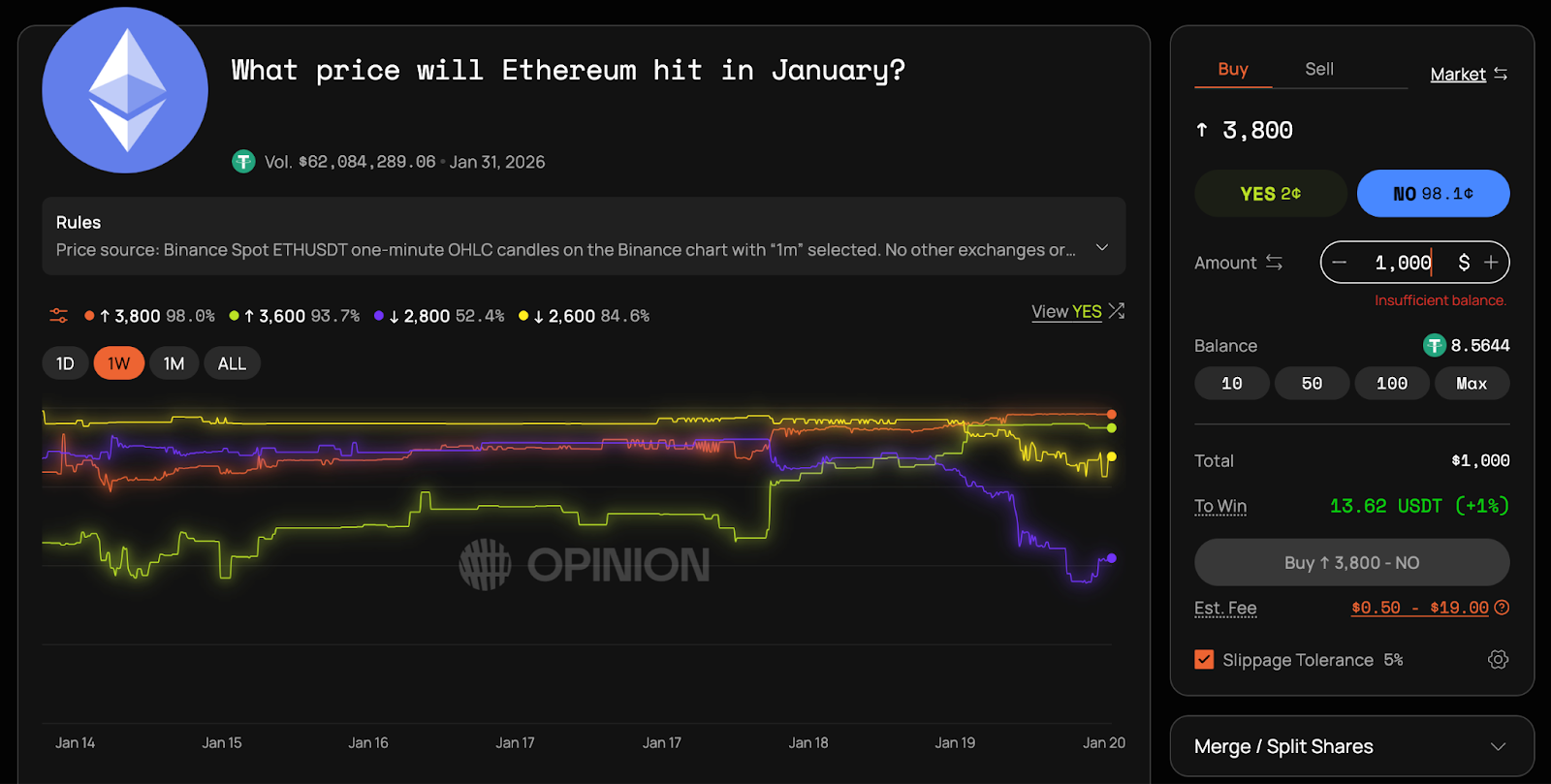

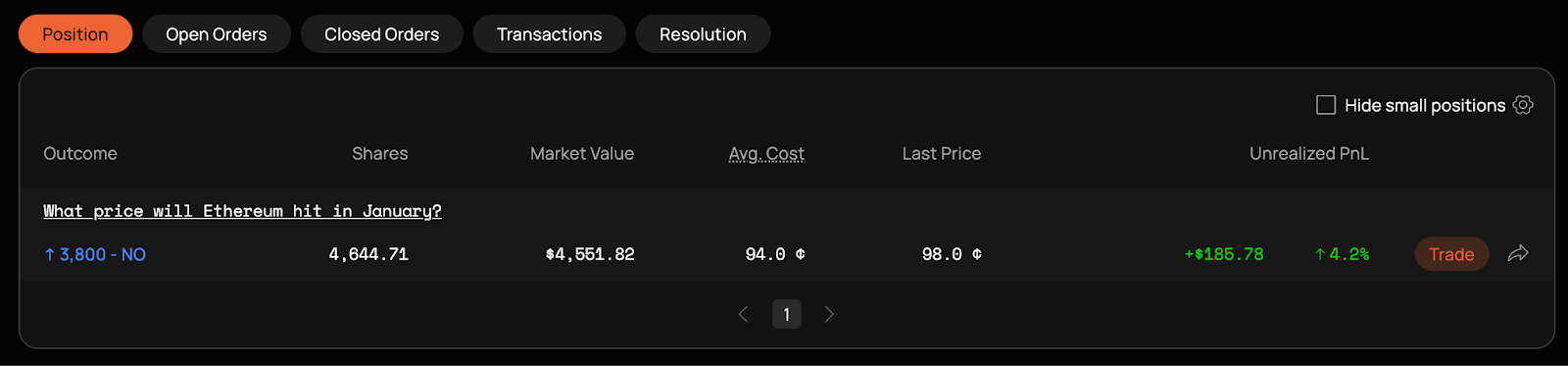

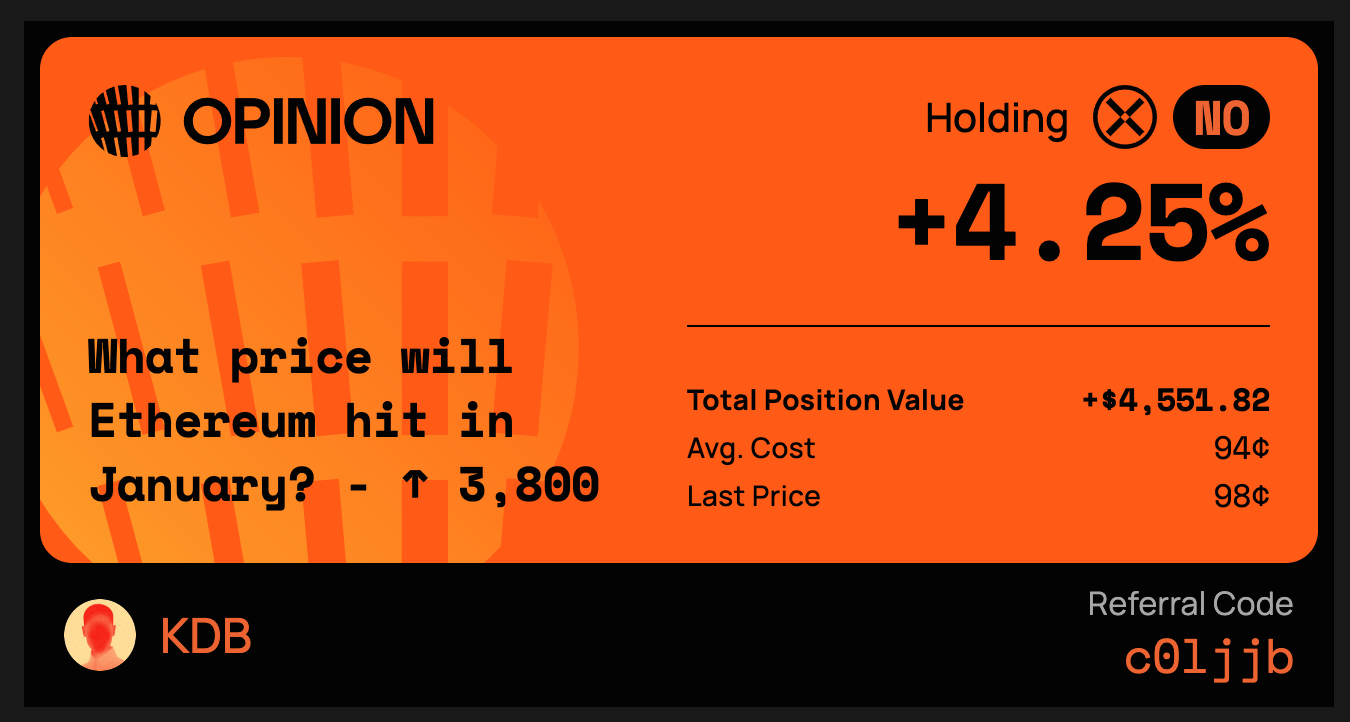

One straightforward example is positioning around short-dated price threshold markets.Example: Ethereum does not hit $3,800 by the end of January

- Navigate to the Ethereum price market

- Select the relevant outcome (BUY, NO)

- Place a market order for immediate execution

- Adjust slippage tolerance to 1%

- Consider using a limit order if you are not in a rush or prefer to reduce execution fees

- Hold the position through expiry

This approach generates executed volume and qualifies for holding-based rewards while keeping exposure easy to reason about.

Markets with clear end dates and high liquidity are generally the most practical starting point.

Cross-Market Arbitrage (Advanced, Optional)

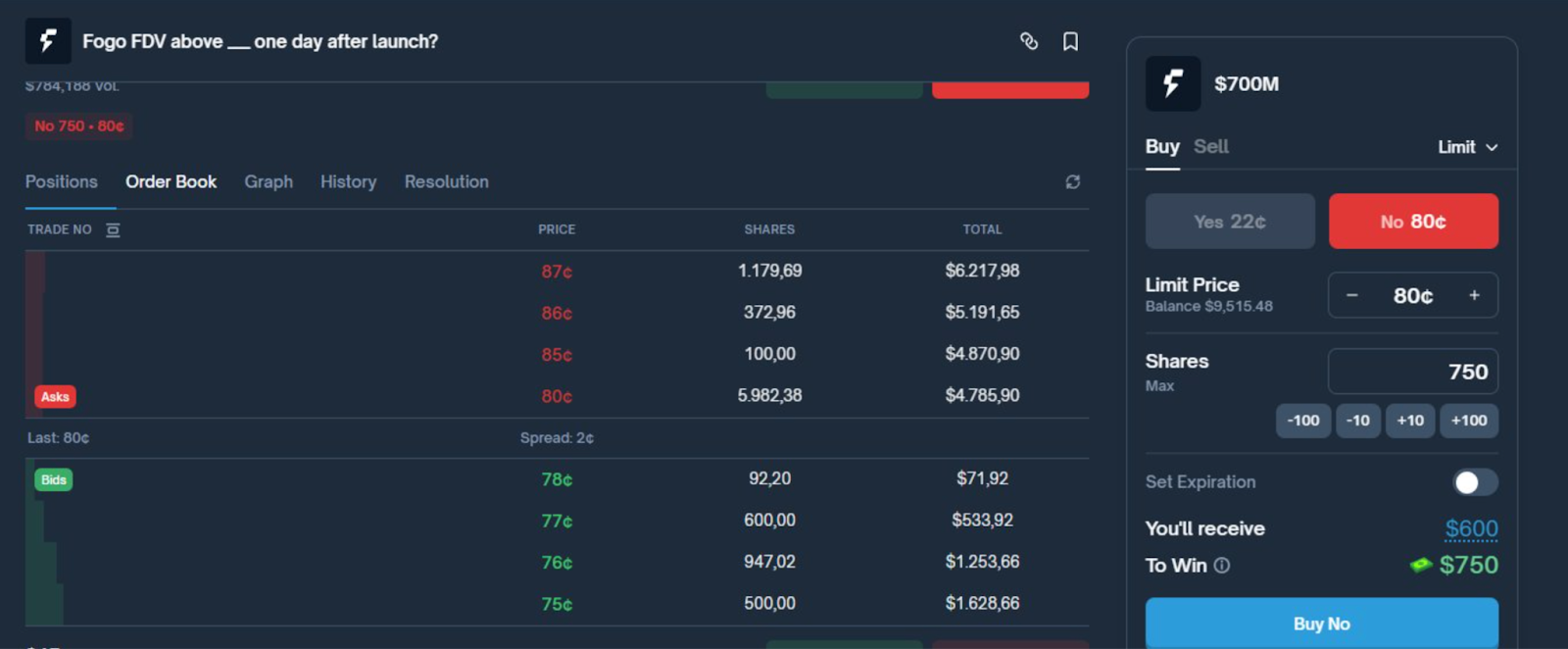

For more advanced users, Opinion supports simple cross-market arbitrage when identical or near-identical markets exist on competing platforms such as Polymarket.In some cases, the combined price of opposing outcomes across platforms sums to meaningfully less than $1.00. When this occurs, the position resolves profitably regardless of outcome while generating volume and holding exposure on both venues.

How it works

- Identify the same market on both platforms

- Prefer markets with short expiry and strong liquidity

- If YES + NO < $0.99, the trade locks in positive expectancy

- Buy 5,000 shares NO on Polymarket at $0.80

- Cost: $4,000

- Buy 5,000 shares YES on Opinion at $0.162

- Cost: $810

- Total cost: $0.962 per share ($4,810 total)

- Payout at resolution: $1.00 per share ($5,000 total)

- Locked profit: $0.038 per share ($190 total)

- Additional upside: Volume + holding points on both platforms

Practical Notes

The objective is to generate volume efficiently while minimizing unnecessary risk.Markets with short timelines and well-defined outcomes tend to be easier to manage. Macro events, company earnings, and price range markets are often well suited for this.

Some markets are flagged as Bonus Points eligible, such as major economic decisions. These can materially improve point efficiency for the same amount of capital deployed.

Fees, liquidity, and execution previews should always be reviewed before confirming trades.

Be aware of prediction risks: Incorrect outcomes result in full position loss, so size conservatively and diversify across markets.

A full step by step video walkthrough covering account setup, deposits, and volume generation is available below.

YO

YO is a protocol we have covered previously, but it is worth revisiting here because it demonstrates an important theme we highlighted in our 2025 review and 2026 outlook. Namely, the ability to earn both yield and airdrop exposure on more traditional asset classes directly onchain.In this case, the underlying asset is gold, accessed through Tether’s tokenized gold product, XAUt.

XAUt represents ownership of physical gold held by Tether. Notably, Tether is one of the largest holders of physical gold globally, and XAUt can be redeemed for physical delivery subject to eligibility requirements and minimum sizes. This gives the asset a materially different profile from purely synthetic or algorithmic representations of commodities.

YO layers an incentive program and yield strategy on top of this exposure, allowing users to earn points while holding a real-world asset.

Airdrop Thesis

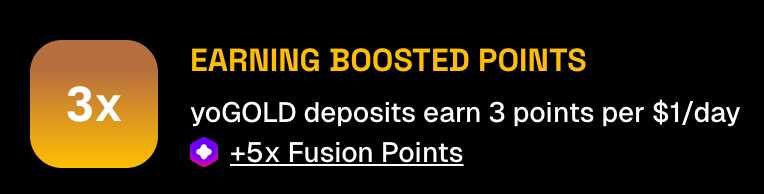

The yoGOLD vault allows users to deposit XAUt and earn points alongside yield. This creates a dual-track return profile: exposure to gold as an asset class, plus participation in an airdrop program tied to capital deployment rather than speculative trading.

Yield is generated via IPOR’s Fusion framework, which packages institutional-style carry strategies around XAUt. YO then overlays its own incentive structure, effectively creating a 2-in-1 opportunity where capital earns yield and airdrop points simultaneously.

At the time of writing, the yoGOLD vault has continued to attract capital, recently approaching roughly $500k in TVL. While still early, this indicates growing adoption rather than a dormant incentive pool.

Note: A recent slippage exploit in the yoUSD vault on Jan 13, 2026, resulted in a $3.73m shortfall, but it was fully covered by the team and did not impact yoGOLD or other vaults. A full postmortem was published here.

This setup aligns well with a broader 2026 trend toward tokenized real-world assets and onchain access to traditional markets, without requiring leverage or active trading.

Step by Step

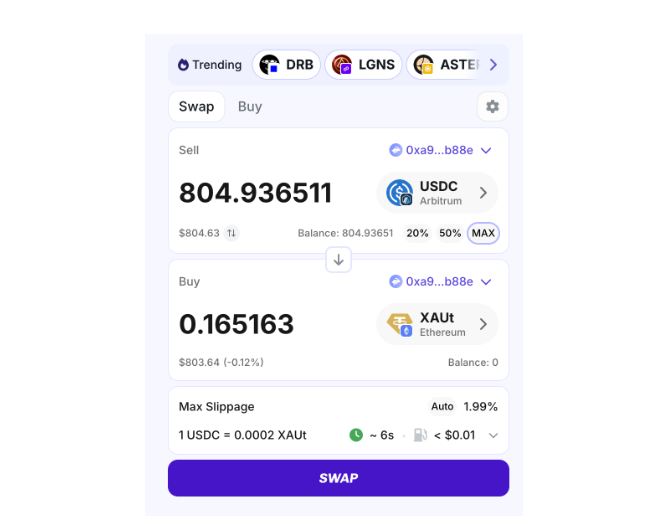

1. Acquire XAUt on Ethereum- Purchase XAUt on the Ethereum network.

- Contract address: 0x68749665FF8D2d112Fa859AA293F07A622782F38

- If your capital is not already on Ethereum, use Relay to bridge funds.

- Relay provides a clean execution path and reliable routing for this use case.

3. Deposit into YO

- Visit the YO website.

- Navigate to the yoGOLD vault and click Pre-Deposit Now.

- You will be prompted to sign two transactions:

- One approval for XAUt.

- A second transaction to complete the deposit.

- Your deposited XAUt will appear under your YO positions.

- Yield accrues automatically.

- Points accumulate based on deposited value.

- You can withdraw at any time by clicking Withdraw, reversing the process back into XAUt.

Practical Notes

Depositing into yoGOLD introduces direct exposure to the price of gold. Unlike stablecoin-based strategies, portfolio value will fluctuate with the underlying asset and positions should be sized accordingly.

That said, price exposure is transparent and easy to reason about. There is no liquidation risk, no leverage, and no dependency on active management.

Because points are earned through holding rather than transaction churn, this strategy favors patience over activity and pairs well with longer-term portfolio allocations.

Strategic Context

YO demonstrates how onchain infrastructure is expanding beyond native crypto assets into tokenized representations of traditional markets. Gold is a particularly instructive example because it combines deep global liquidity, real-world settlement, and conservative risk characteristics.

From an airdrop perspective, this is not a high-velocity farming opportunity. It is a capital-efficient way to remain eligible for incentives while holding an asset that many portfolios already allocate to in other forms.

As with most airdrop-driven strategies, the default assumption should be to evaluate any eventual token distribution opportunistically and rotate capital accordingly. Final decisions will depend on liquidity, valuation, and how the market prices YO relative to comparable infrastructure protocols at launch.

A full step by step video walkthrough covering XAUt acquisition, Relay bridging, and yoGOLD deposits is available below.

Cryptonary’s Take

Airdrops in 2026 favor structure, clarity, and disciplined execution. Programs with fixed supplies and explicit timelines allow capital to be deployed deliberately rather than in response to narratives or speculation.The opportunities in this report reward sustained, intentional activity. Points are tied to meaningful usage, and in many cases capital can remain productive through yield or conservative positioning while rewards accrue.

Results compound over time through understanding incentive mechanics, managing exposure carefully, and rotating capital efficiently after distribution. This report is intended as a framework & tutorial that can adapt as conditions evolve.

Cryptonary, OUT!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms