Top 10 Airdrop Opportunities for 2026 (Part 3)

You made it to the final part. We saved the best for last. If you’ve been following the series up to this point, congratulations. The setups covered here represent the most impactful opportunities on our list. These are live platforms where activity today is expected to translate into real dollar value at distribution. You can’t miss this one…

This report focuses on how to participate correctly. How to structure trades, control costs, manage risk, and avoid burning capital while farming incentives that have the potential to materially affect portfolio outcomes.

In this report:

- Trading stocks, commodities, FX, and crypto on perpetual DEXs

- Using bots and automation to maintain activity passively

- Structuring and hedging prediction markets

- Leveraging protocol mechanics to lower real costs

- Why execution choices matter more than position size

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

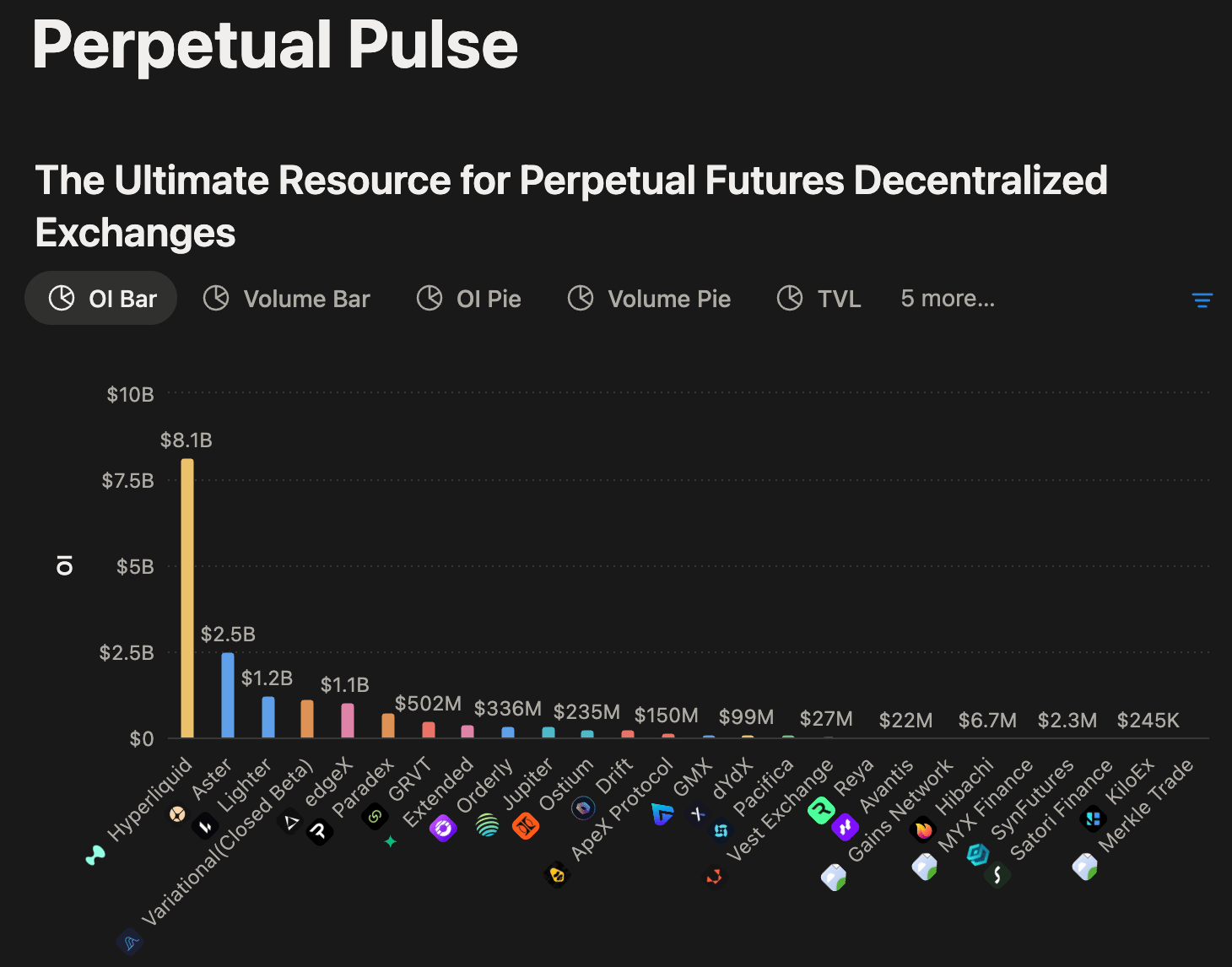

Perpetual DEXs

Shared Strategy Framework

All perpetual DEXs covered in this report operate under broadly similar incentive structures. Points are typically distributed on a weekly basis and are driven by a combination of trading volume, open interest, and duration held, with explicit penalties for wash trading or obvious attempts to game the system. Some protocols layer in additional incentives through asset-specific bonuses or temporary market-level boosts.The objective across all of them is the same. This is not about directional price speculation. It is about maintaining open interest with minimal net exposure while allowing incentives to accrue over time.

Perpetual DEXs and prediction markets are likely to deliver some of the most meaningful airdrops this cycle for a simple reason. They generate real revenue. Trading fees are collected continuously, and a portion of that economic value is often redistributed back to users through points programs and eventual token distributions. That feedback loop makes these incentives more durable than purely inflationary systems that rely only on emissions.

Funding is a key variable in determining how efficient these strategies are. In some cases, positive funding can meaningfully offset execution costs and slippage. In others, it will not. Monitoring funding rates across venues is therefore essential, particularly when running delta-neutral or cross-exchange setups.

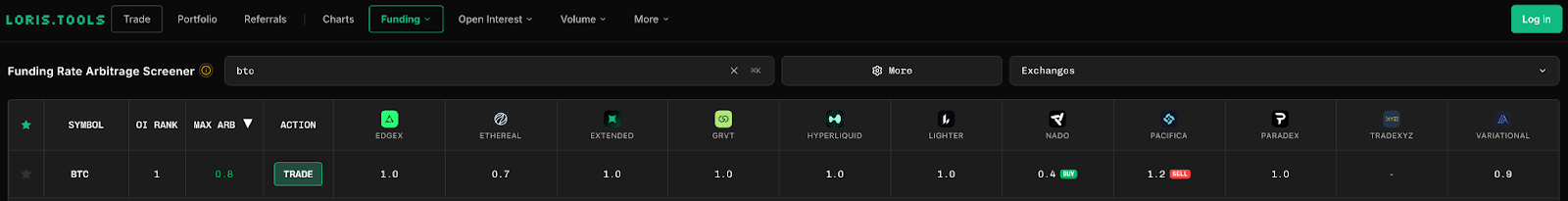

The following tools are useful for tracking funding, pricing, and arbitrage opportunities across perpetual venues:

- https://fundingview.app/dashboard

- https://smartbitrage.com/opportunities

- https://perpstats.octav.fi/

- https://arbitrax.site/

- https://loris.tools/

There is also an important tradeoff at the asset level. BTC markets generally support larger position sizes with lower slippage and cleaner execution, making them better suited for capital-heavy strategies. Altcoin markets can sometimes offer higher point efficiency, but they often come with thinner liquidity, wider spreads, and more volatile funding. In some cases, funding helps offset those drawbacks. In others, it does not. This balance needs to be evaluated continuously rather than assumed.

Across all perpetual DEX strategies, the common theme is efficiency. The protocols differ, but the principles remain consistent. Manage exposure, monitor funding, choose assets deliberately, and allow points to accumulate without introducing unnecessary costs or operational risk.

Variational

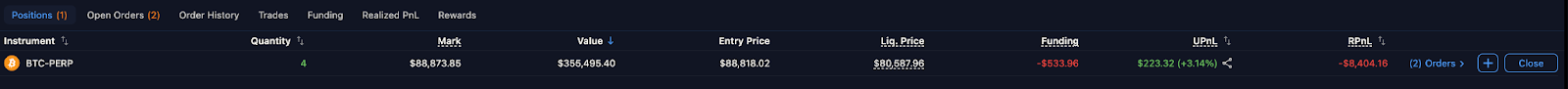

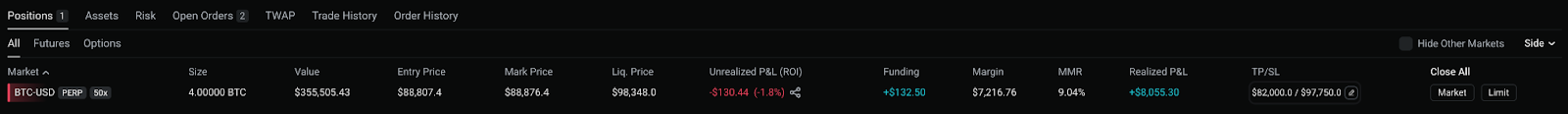

Variational is a zero-fee perpetual DEX, which makes it particularly well suited for delta-neutral funding strategies where execution efficiency and position maintenance matter more than directional exposure.A practical implementation is straightforward:

- Long BTC on Variational

- Short BTC on Paradex

Because both Variational and Paradex are zero-fee perp DEXs, MARKET ORDERS can be used without meaningfully impacting cost. This simplifies execution, reduces leg risk, and helps ensure both positions are established and adjusted cleanly.

Open interest is intentionally maintained on both platforms. Points accrue independently on each venue, while funding differentials determine the net carry of the combined position rather than directional price movement.

Historically, Paradex has exhibited stronger funding rates. When positions are held over multiple days, funding earned on Paradex has often been sufficient to offset slippage and incidental execution costs.

That said, Paradex has announced upcoming changes to its funding rate structure. Once those changes go live, the relative attractiveness of each leg may shift, and it may become optimal to flip the structure:

- Short BTC on Variational

- Long BTC on Paradex

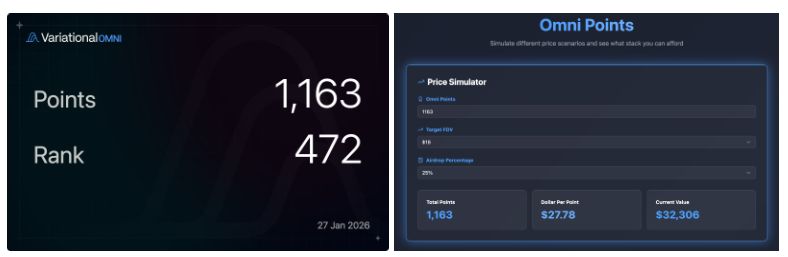

Achieving a true zero cost basis when farming perpetual protocols is virtually impossible. That said, the points accrued through this strategy should meaningfully outweigh any residual expenses over time. Paradex XP is already trading around 0.2 OTC, and Variational is rumored to be targeting a Q3 distribution. If 25% of total supply is distributed at a 1B FDV, the implied value per Variational point would be approximately $28.

Users can model alternative assumptions using the official calculator below:

https://variationalomni.com/pointscalculator

As with any cross-venue strategy, it is prudent to start with small capital. Confirm that funding, execution, and points accrual are behaving as expected before scaling position size. Once validated, exposure can be increased incrementally.

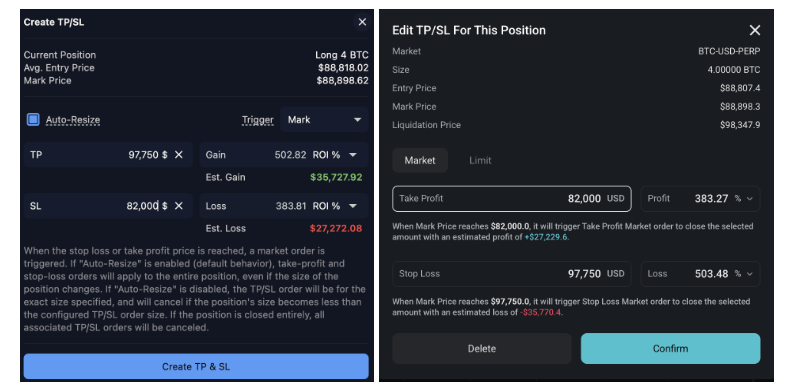

Risk management remains critical. Liquidation prices should be set far enough away to avoid forced closures during routine volatility, including overnight. As an additional safeguard, matching stop-loss and take-profit orders can be placed at identical price levels on both venues to ensure positions close simultaneously in adverse scenarios.

The objective is not to optimize funding in isolation, but to maintain durable, compliant open interest across both platforms while minimizing exposure, execution risk, and operational stress.

GRVT (Gravity)

Successful perp farming depends on understanding platform-specific mechanics that reduce execution and carrying costs. GRVT combines several of these features in a way that rewards deliberate execution.Key mechanics:

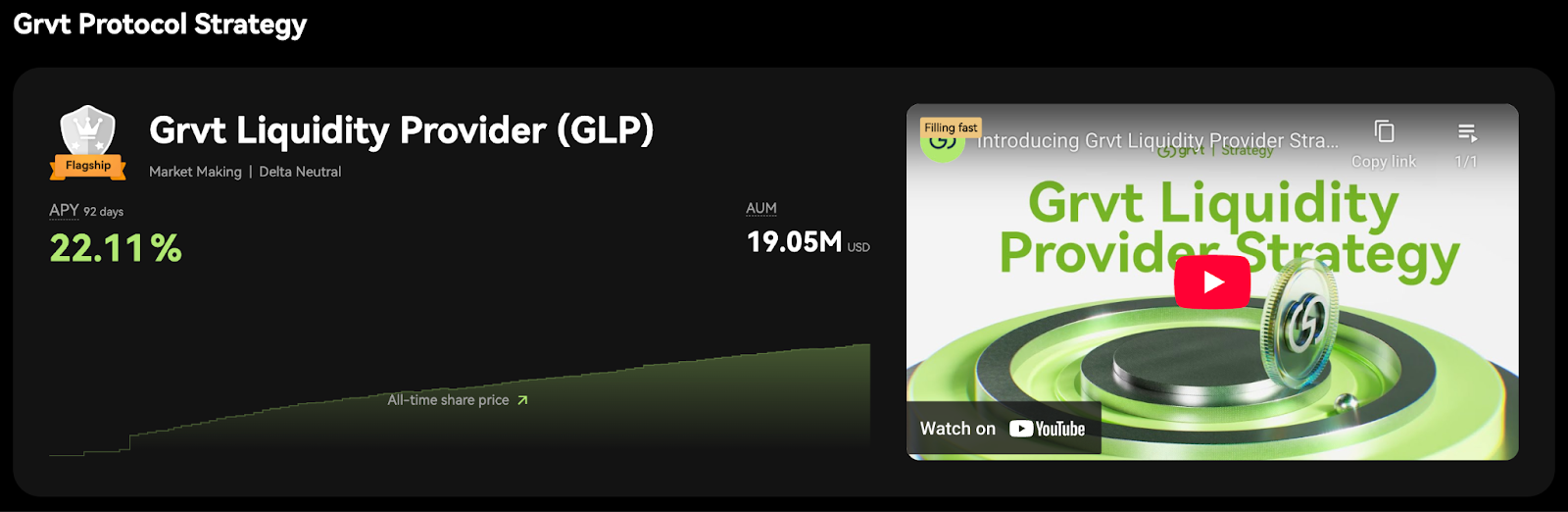

- Passive point accrual via GRVT vault deposits

- GRVT Liquidity Provider (GLP) currently offering approximately 22% APY

- 10% yield on idle trading equity, paid weekly

- Maker rebates on limit orders, meaning users receive a rebate rather than paying a fee

The maker rebate is a meaningful advantage. When opening positions via LIMIT ORDERS on GRVT, users are rebated, not charged. This directly reduces execution costs and, in some cases, results in a net credit rather than a fee. Screenshots showing negative fees reflect rebates paid back to the trader, not costs incurred.

A practical structure is:

- Open a position on GRVT using limit orders

- Once filled, open the opposite position on a second perp DEX

- Long on GRVT via limit order

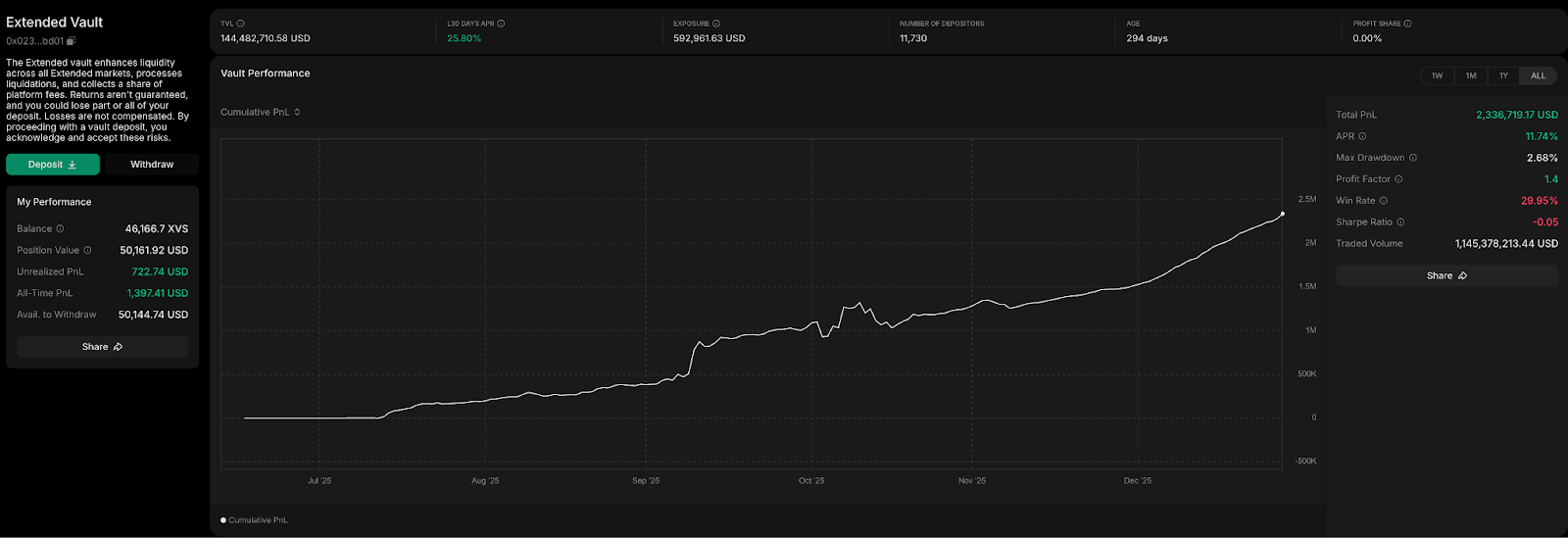

- Short on Extended via market order

Extended also allows deposited capital to be used as margin while continuing to earn yield, improving capital efficiency on the hedge leg.

From a liquidity perspective, GRVT vault deposits typically have a 2–7 day redemption window, though withdrawals are often processed within roughly 48 hours in practice. Extended imposes a 24-hour initial lockup, after which capital can be withdrawn at any time.

From a valuation standpoint, GRVT points are rumored to be valued in the $20–$40 range, while Extended points are rumored to trade closer to $2–$4. While these figures are speculative, they help contextualize where effort and capital efficiency are likely best spent.

Taken together, GRVT’s vault points, GLP yield, trading equity yield, and maker rebates can meaningfully offset operating costs, making it well suited for structured, delta-neutral farming strategies.

Ostium

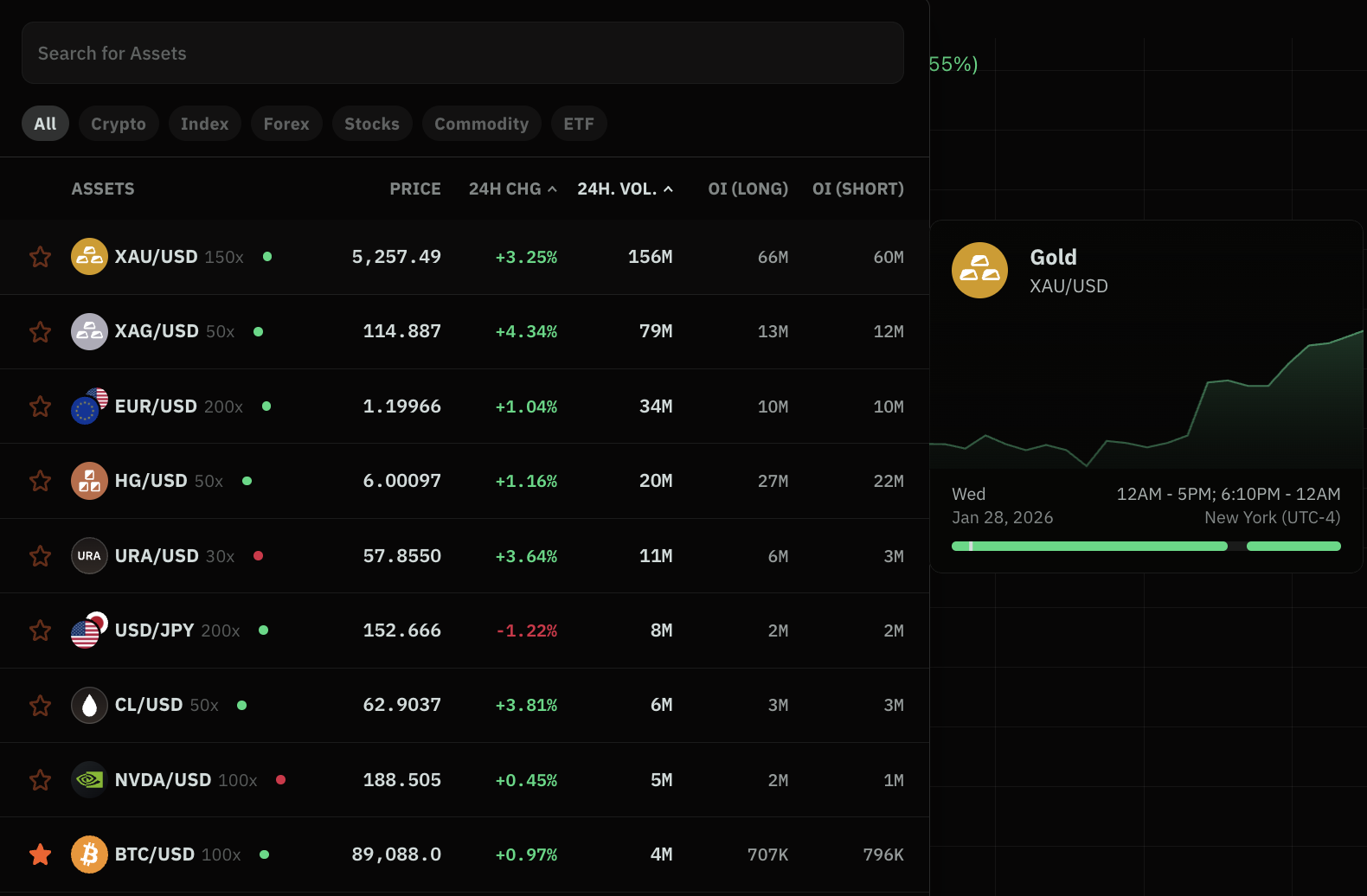

Ostium is one of the stronger platforms for trading non-crypto perpetuals, including commodities, FX, and equities, while also supporting crypto markets. This makes it useful for users who want point exposure across both traditional and crypto assets.

There are two primary ways to participate:

- Actively trade perps across commodities, FX, equities, and crypto

- Deposit capital into the vault for passive yield and point accrual

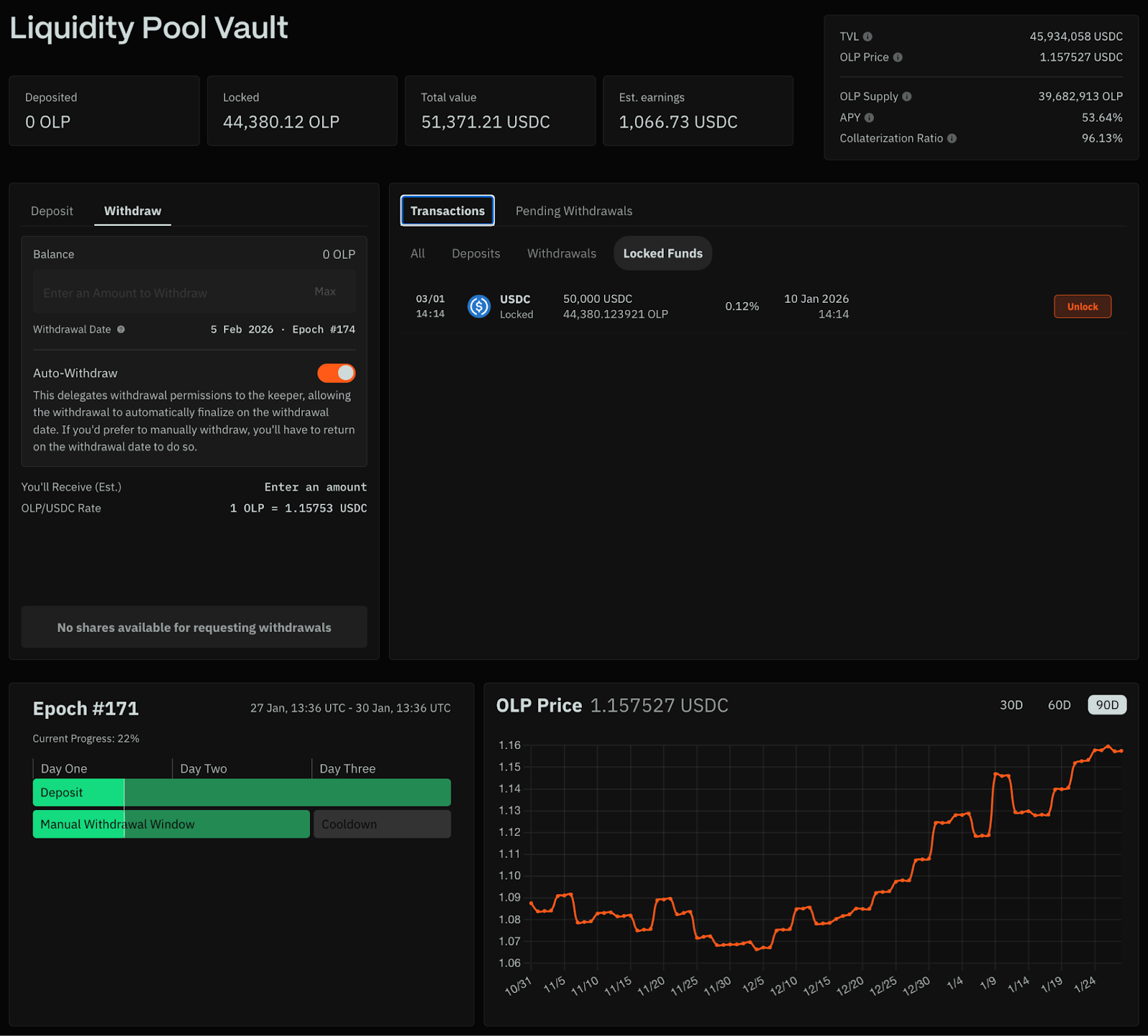

For users who prefer lower operational overhead, vault deposits are the simplest option. Capital deposited into the Ostium vault earns yield while also accruing points, without the need to maintain continuous open positions. The tradeoff is liquidity. Withdrawals typically have a longer unlock period, approximately 10-14 days, which should be factored into sizing decisions.

Trading activity on Ostium has been strong, with impressive volumes across commodities, FX, and crypto markets. A token generation event is rumored for Q1–Q2, and point value estimates currently range from approximately $1–$5, depending on final distribution and valuation assumptions.

Ostium also completed a meaningful funding round in December, which suggests growing institutional interest and platform traction. While funding does not guarantee a token launch, it meaningfully increases the likelihood of a TGE relative to earlier-stage protocols.

Points are calculated and updated weekly on Sundays, and Ostium provides a live leaderboard that shows your share of total trading and LP volume for the week. This transparency makes it easy to track relative contribution and assess whether activity levels are meaningful.

Users should also pay attention to asset-specific boost multipliers, as certain markets periodically receive higher point weighting, allowing points to accrue more efficiently when activity is concentrated in incentivized assets.

Overall, Ostium is best suited for users who want diversified exposure beyond crypto alone, are comfortable with scheduled trading hours on traditional markets, and prefer longer-duration or more passive positioning through vault participation.

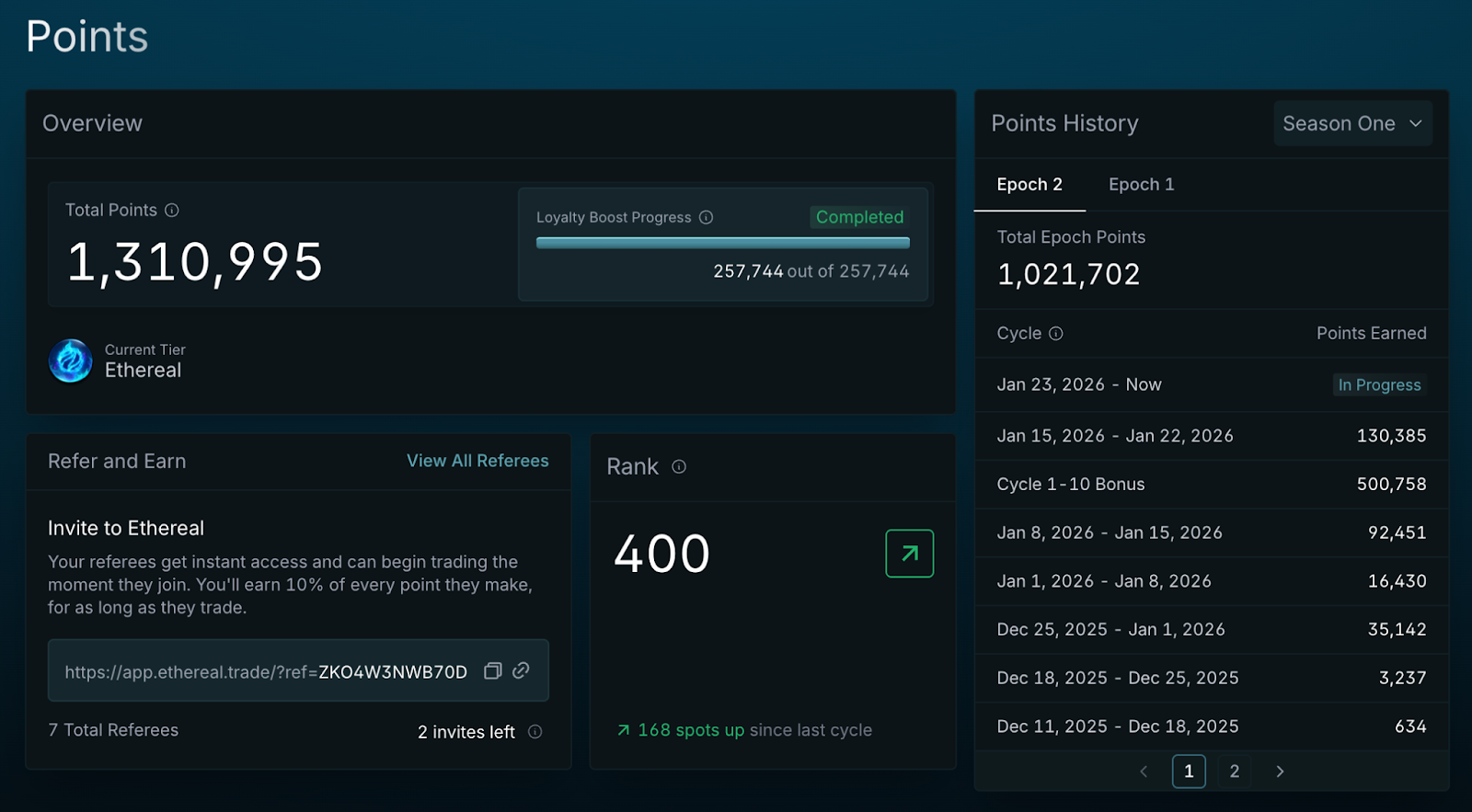

Ethereal

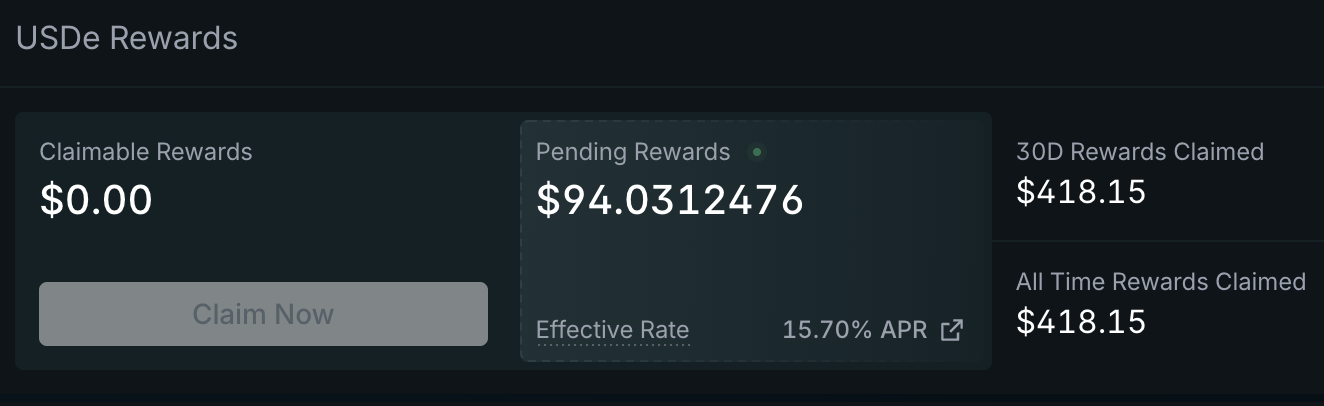

We previously covered Ethereal during its pre-deposit campaign, and and as a result many Cryptonary members already qualified for an Ethena airdrop. Ethereal remains attractive for both existing and new users. Rewards are driven by ongoing trading activity rather than historical participation, meaning participation today is fully competitive with earlier phases.Ethereal operates one of the most explicit and transparent reward systems currently live among perpetual DEXs through its USDe Trading Rewards program. Each week, up to 25% of exchange fees are routed to a rewards pool and distributed pro rata based on a user’s average share of total platform open interest across all markets during the reward period. Total rewards are capped at 27.1828% APR, calculated against a user’s average margin balance and inclusive of both USDe balance and trading rewards.

The snapshot window runs from Wednesday at 23:59 UTC through the following Wednesday at 23:59 UTC, and positions begin qualifying once they have been held for at least one hour. Both long and short positions qualify equally and there is no enrollment requirement. Rewards are distributed with a seven-day delay, so what you receive each week reflects the prior week’s activity.

In practice, this means open interest is time-weighted. Position size matters, but so does how long that size is maintained during the snapshot window. Increasing size later in the period still contributes, but only proportionally to the time it is active. At the same time, execution still matters. Market orders incur fees, volume contributes to broader incentive dynamics, and funding impacts net carry. The advantage of Ethereal is that users are being paid to maintain compliant open interest while farming points, allowing part of the operating cost to be offset by the rewards mechanism itself.

Ethereal also enforces anti-gaming rules. Opening offsetting positions across multiple accounts or behavior intended to manipulate the rewards process may result in exclusion. This enforcement improves the durability of the program for legitimate participants.

In addition to the USDe Trading Rewards program, Ethereal is expected to introduce its own standalone governance token. Continued participation positions users for that distribution without requiring early involvement. There are also rumors of future expansion into prediction markets, which would further increase Ethereal’s incentive surface over time.

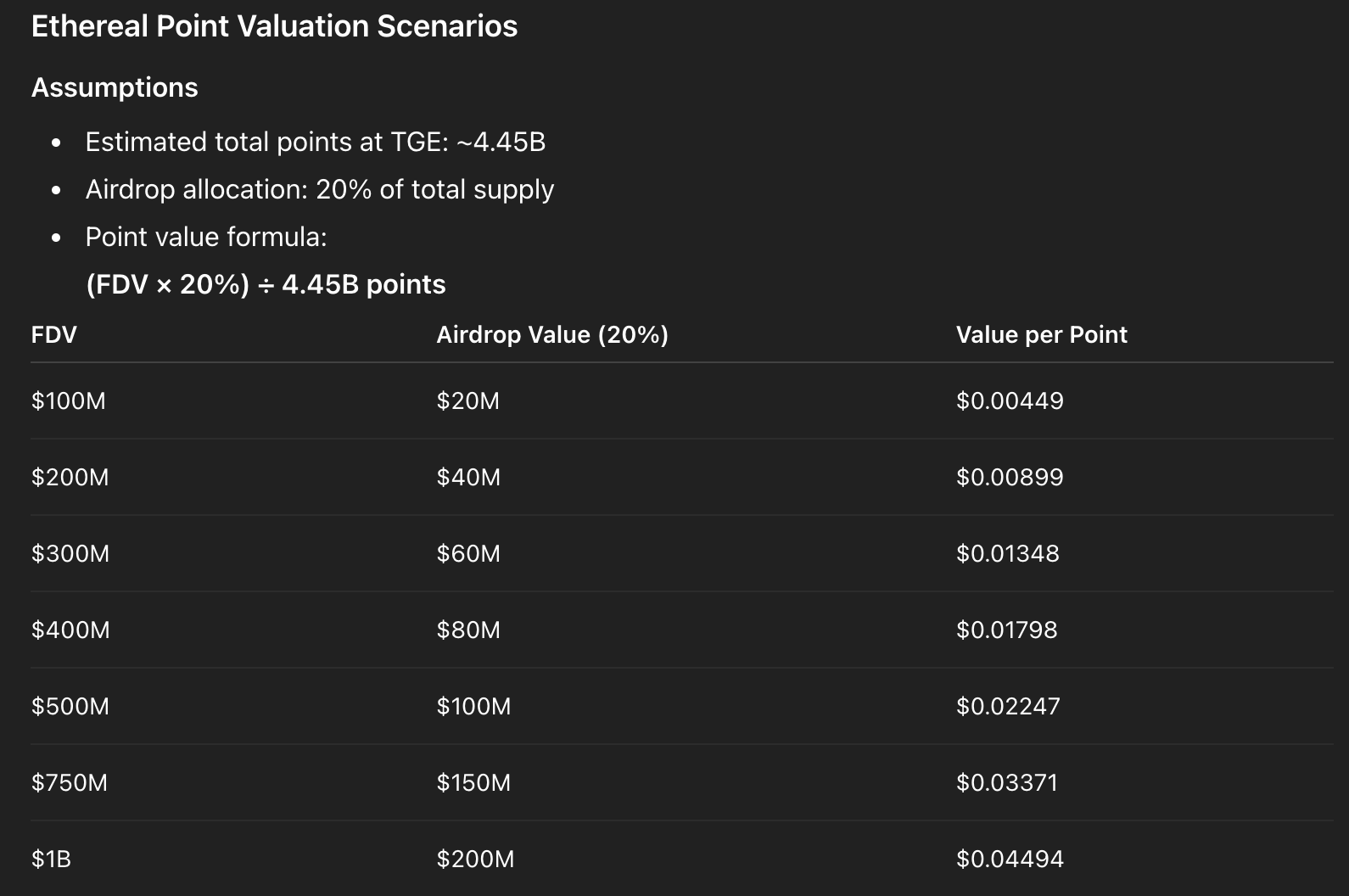

Based on current confirmed emission rates, a six-month assumption implies approximately 4.45B total points distributed by the time of TGE. Under a 20% airdrop allocation, implied point values vary materially depending on FDV assumptions. These estimates are speculative, but they provide a useful framework for thinking about expected value per point.

For readers who want to review the mechanics directly, Ethereal has published full documentation for the USDe Trading Rewards program here:

https://docs.ethereal.trade/trading/usde-trading-rewards

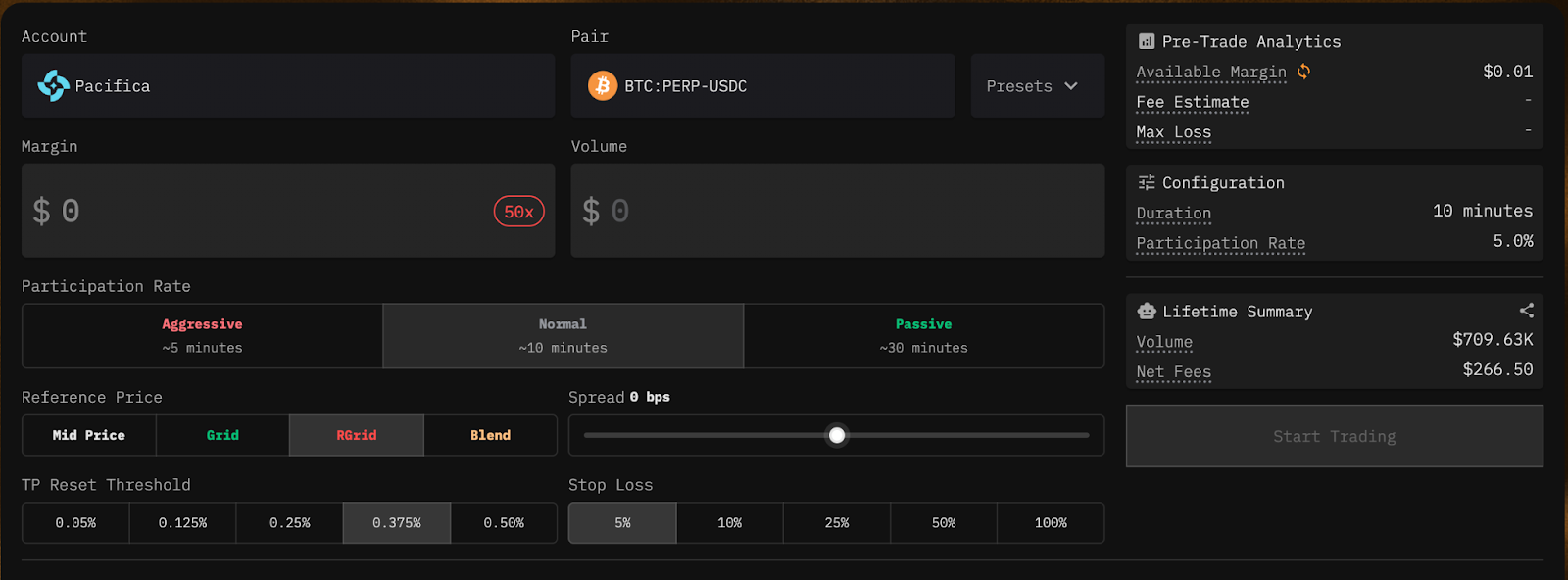

Pacifica

Pacifica does not rely on a complex yield or rebate mechanic. The opportunity here is straightforward and execution-driven. Points are earned through trading activity, with volume, open interest, and consistency all contributing to point accumulation. There is no special vault structure or rewards redistribution layer to optimize around, which makes Pacifica more about how trades are executed rather than where capital is parked.From a cost-efficiency standpoint, limit orders make the most sense on Pacifica. Maker fees are currently 0.015% versus 0.04% taker fees, so executing passively reduces unnecessary costs while still generating qualifying volume and open interest for points. In practice, this pairs well with routing the opposing leg of the trade elsewhere via a market order, ideally on a venue where funding rates can help offset execution costs. The goal is simply to accumulate points as efficiently as possible while keeping total trade friction low.

Tools such as loris.tools are useful here, as they allow traders to compare funding rates and identify which venues are best suited for the active leg versus the passive leg at any given time. Pacifica fits cleanly into this workflow as the limit-order venue.

One feature that does make Pacifica stand out is its built-in AI trading assistant. This is an early example of native AI integration directly into a trading terminal. While it should not be treated as a replacement for structured delta-neutral strategies, it can be helpful for surfacing trade ideas, monitoring conditions, and exploring market context.

Pacifica has also introduced a points boost mechanic that rewards consistency rather than size. Trading on 5 out of 7 days unlocks a maximum 22.5% points boost. This requirement can be satisfied with minimal activity, even extremely small trades, making it easy to maintain eligibility without increasing risk exposure.

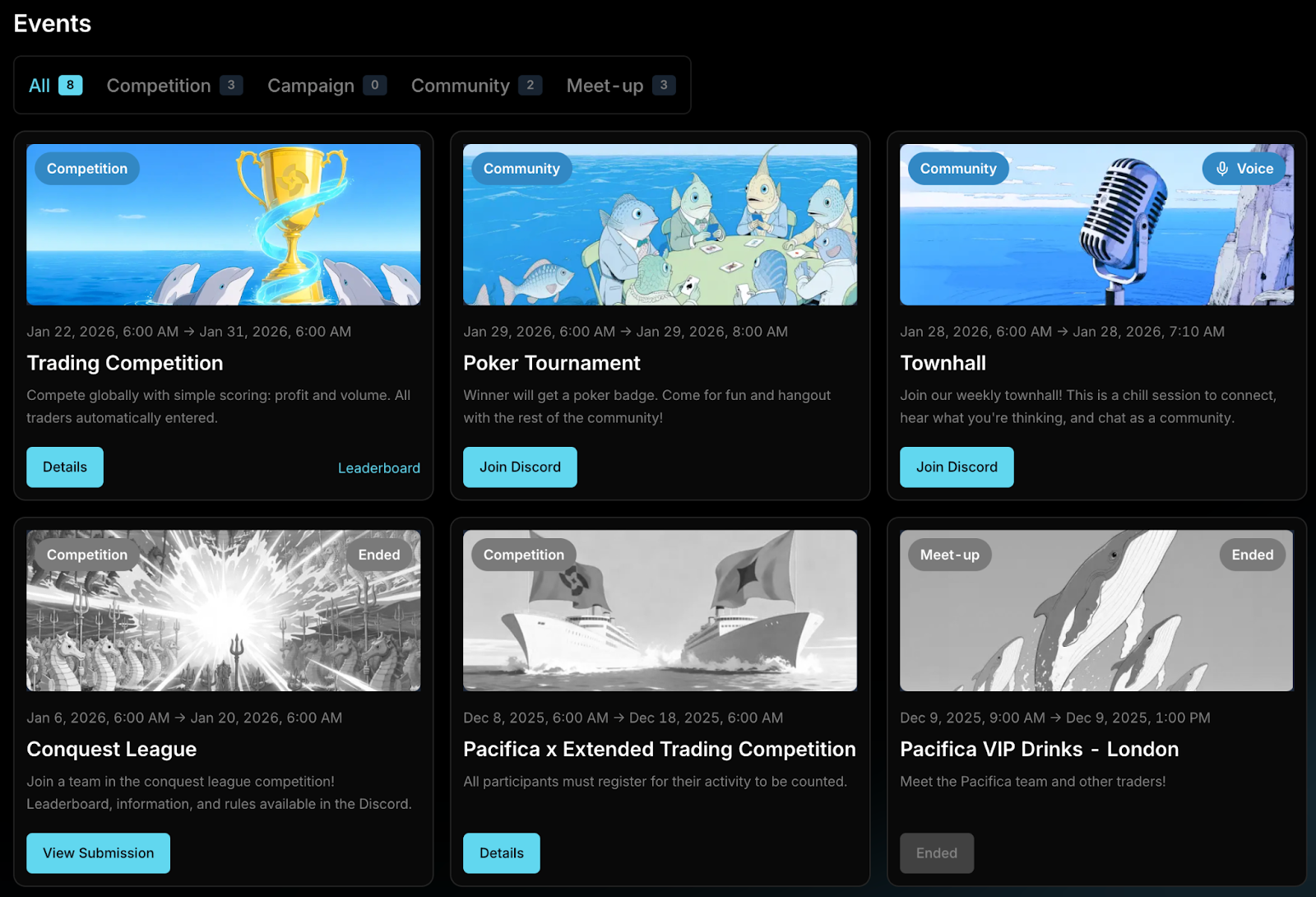

Beyond baseline trading activity, Pacifica periodically runs trading competitions and community events that may offer incremental point upside. These are situational rather than core to the strategy, but worth monitoring when active.

Current OTC estimates for Pacifica points reportedly range between $0.25 to $0.75 per point. As with all OTC pricing, this is speculative and subject to change, but it provides a reasonable reference frame for evaluating effort versus potential reward.

Overall, Pacifica is best approached as a clean execution layer within a broader delta-neutral framework. There is no need to over-optimize mechanics that do not exist. Use limit orders, manage the opposing leg intelligently, maintain activity consistency, and treat the platform as a reliable point accumulator rather than a yield engine.

Trading Bots and Automation Tools

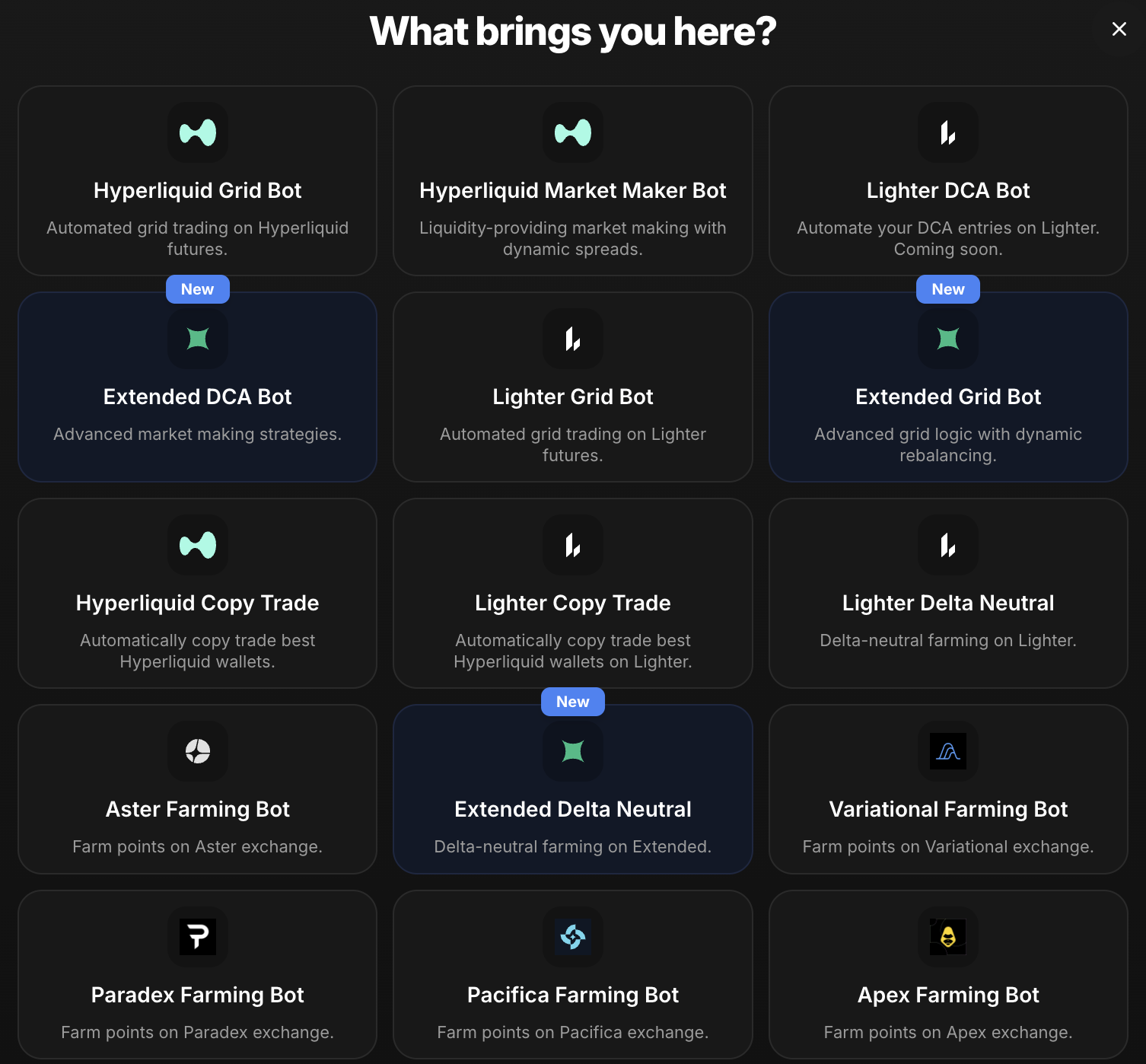

One trend worth flagging briefly is the emergence of third-party trading bots designed specifically for perpetual DEXs. As perp venues mature, tools like Tread, Dextrabot, and similar automation platforms have started to gain traction by offering semi-automated execution for grid trading, market making, and delta-neutral strategies across multiple exchanges.

For users seeking a more passive approach, these tools can help automate execution and reduce the need for constant manual intervention. They are particularly useful for maintaining consistent activity, managing limit order placement, and scaling repetitive strategies across venues such as Pacifica, Hyperliquid, Extended, Variational, and Paradex.

That said, these tools should be approached cautiously. Even well-intentioned teams introduce additional smart contract, API, and execution risk. Best practice is to use a separate wallet with experiment-sized capital, avoid granting unnecessary permissions, and revoke API access immediately after use. Automation can improve efficiency, but it does not eliminate risk.

Notably, Tread has raised external capital and is running its own points program, which adds an additional incentive layer for early adopters. Our team is still testing configurations and evaluating optimal settings. A dedicated report will follow once results are consistent and repeatable.

For now, trading bots should be viewed as adjacent tooling, not core infrastructure. They can complement manual delta-neutral strategies, but they are not a substitute for understanding execution, funding mechanics, or risk management.

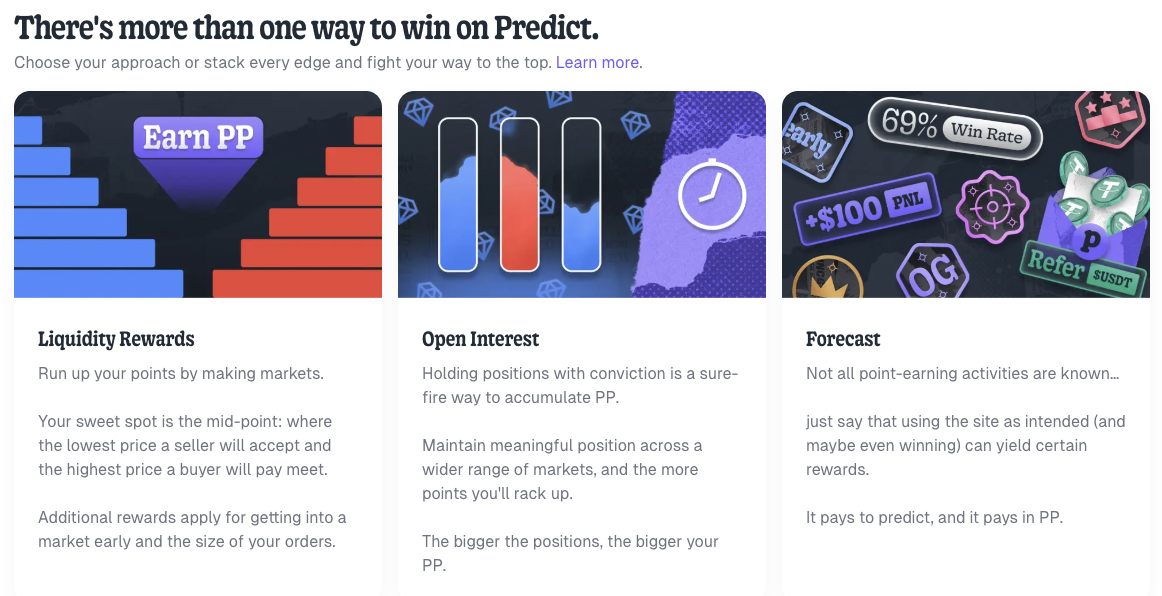

Prediction Markets

Prediction markets remain one of the most capital-efficient environments for point accumulation when approached pragmatically. The leading platforms now resemble structured trading venues rather than novelty betting products, where activity, sizing, and market selection matter more than constant repositioning.

This section focuses specifically on Probable and Predict.fun, which follow incentive mechanics similar to Polymarket but remain earlier in their lifecycle. As a result, incremental activity here can still generate outsized point returns relative to capital deployed.

Core Mechanics

Across both platforms, points are primarily driven by:

- Executed volume

- Open positions

- Duration held

- Market liquidity and structure

As with any new strategy or protocol, it is prudent to start with experiment-sized capital. Before committing meaningful size, users should verify that execution, settlement, fee behavior, and point accrual function as expected. This reduces operational risk and avoids learning costs being paid at full scale.

Probable & Predict.fun

The most efficient setups largely mirror what was outlined previously for Polymarket and Bullpen, with an emphasis on execution quality rather than prediction complexity.Markets that tend to work best include:

- Short-dated markets with clear resolution criteria

- High-liquidity outcomes where slippage is minimal

- Price threshold markets, macro releases, earnings, and well-defined events

In practice, recycling capital through multiple shorter-duration markets tends to outperform concentrating size into a small number of long-held positions when the goal is point accumulation rather than payout optimization.

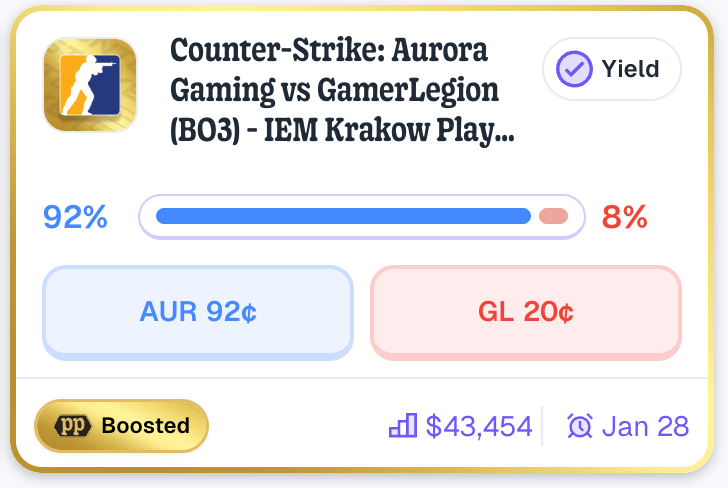

Split Shares (Short-Duration Markets)

One additional strategy worth highlighting is splitting shares, particularly on short-duration markets with clear settlement timelines.

When shares are split, a single deposit is converted into both the YES and NO positions for the same market. At settlement, one side resolves to $1.00 and the other to $0.00. The combined position therefore returns the original principal, before fees.

This method is not about outcome prediction. It is a way to:

- Generate qualifying volume

- Maintain open positions for duration-based rewards

- Accumulate points without timing exits

There will be fees associated with splitting and settlement, and those costs should be expected. However, in properly selected markets with adequate liquidity, the points earned over the holding period can meaningfully outweigh these expenses.

This approach works best on markets with:

- Clearly defined resolution dates

- Adequate liquidity on both sides

- Spreads tight enough to keep friction reasonable

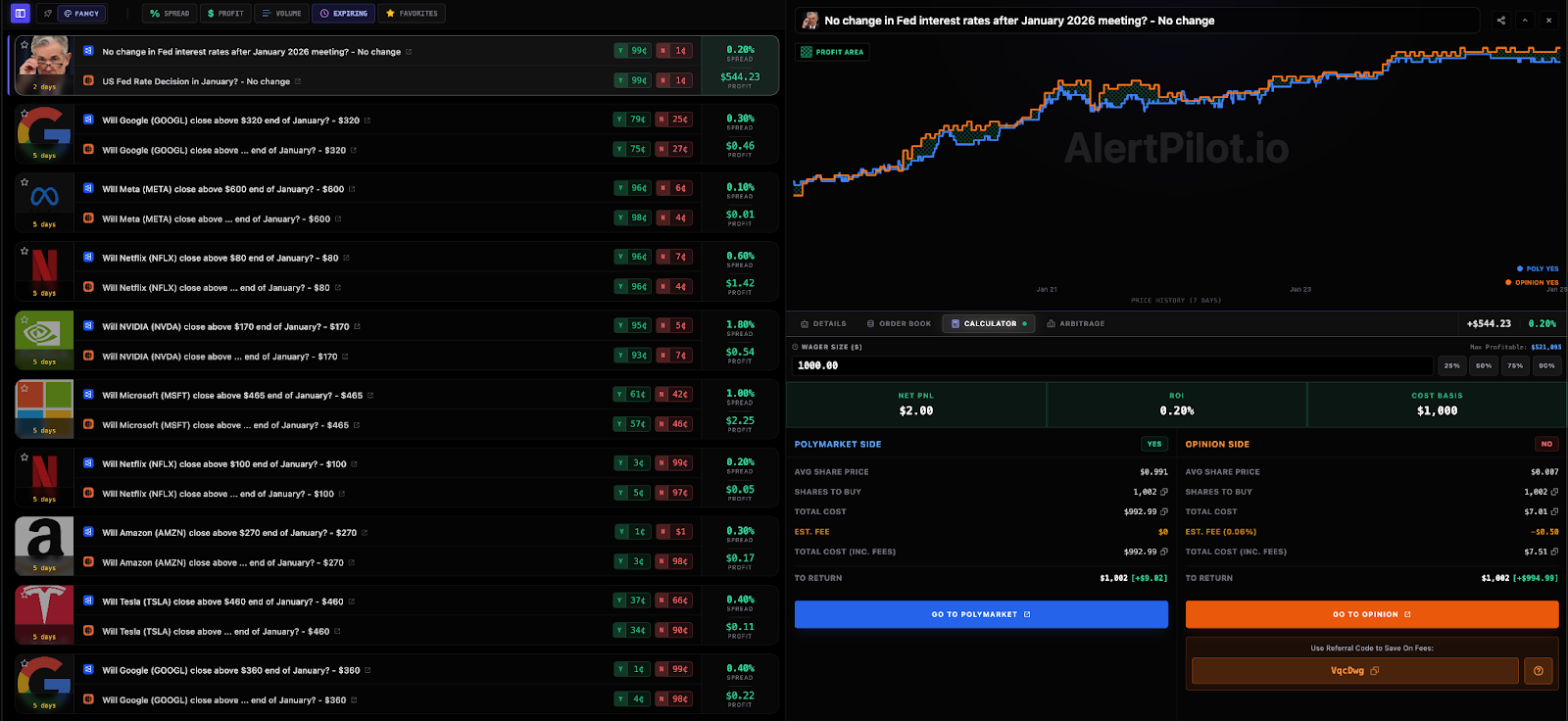

Tooling: AlertPilot

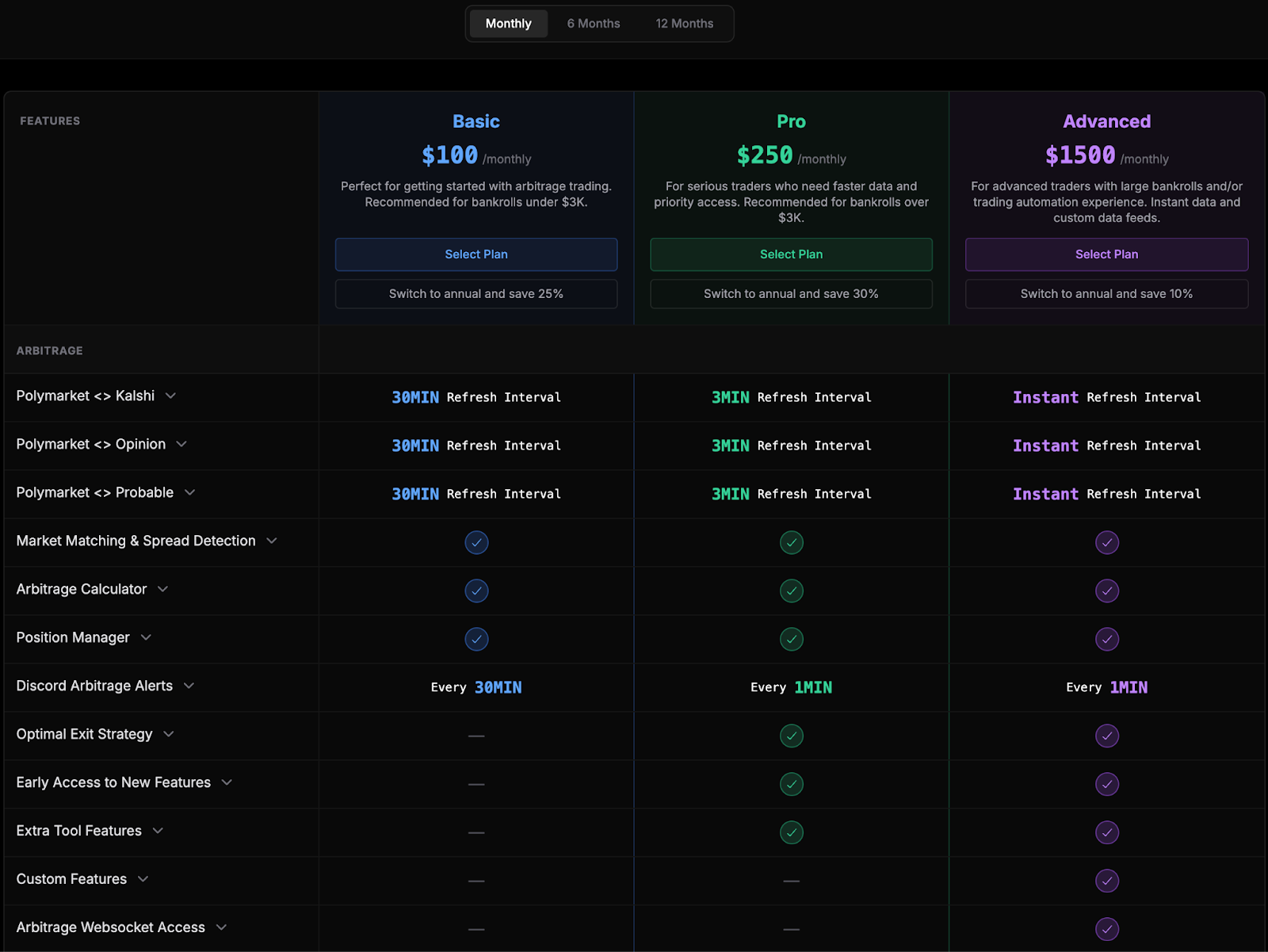

One tool worth highlighting is AlertPilot, which is designed for users actively farming multiple prediction market platforms and looking to reduce execution overhead.AlertPilot integrates with Polymarket and surfaces opportunities across Kalshi, Opinion, Probable, and Predict.fun. Rather than replacing strategy, it helps streamline execution and monitoring across venues.

Core functionality includes:

- Identification of overlapping or mispriced markets across platforms

- Automatic calculation of share sizes on each venue

- Fee- and slippage-aware execution estimates

- Portfolio tracking across multiple prediction market accounts

The pricing is non-trivial and unnecessary for smaller portfolios. Manual execution remains sufficient at modest scale. For well-capitalized users running multiple markets simultaneously, tooling like this can materially improve consistency and reduce execution errors.

At a larger scale, automation is less about convenience and more about preserving efficiency as activity increases.

Practical Takeaway

Prediction markets reward thoughtful market selection and consistency. Clear resolution criteria, sufficient liquidity, and reasonable time horizons tend to matter more than any single execution style.There is flexibility in how these platforms are used. Some users focus on straightforward directional positions on obvious markets. Others recycle capital across shorter-dated markets or use tools to streamline execution. What matters is choosing an approach that fits your time commitment and capital size, and staying engaged long enough for incentives to accrue.

When used intentionally, Probable and Predict.fun serve as a useful complement to perpetual DEX farming. They provide an additional incentive surface without leverage or funding risk, while still allowing participants to adjust activity levels based on preference rather than necessity.

Cryptonary’s Take

At this stage of the cycle, genuine “secret alpha” is increasingly rare. After Hyperliquid turned early participants into millionaires, airdrops moved into the spotlight and participation expanded quickly.Opportunities still exist, and new ones will continue to emerge. We will continue to surface them. What drives outcomes now is staying engaged long enough for an airdrop to actually materialize, while managing trades, costs, and exposure with intention along the way.

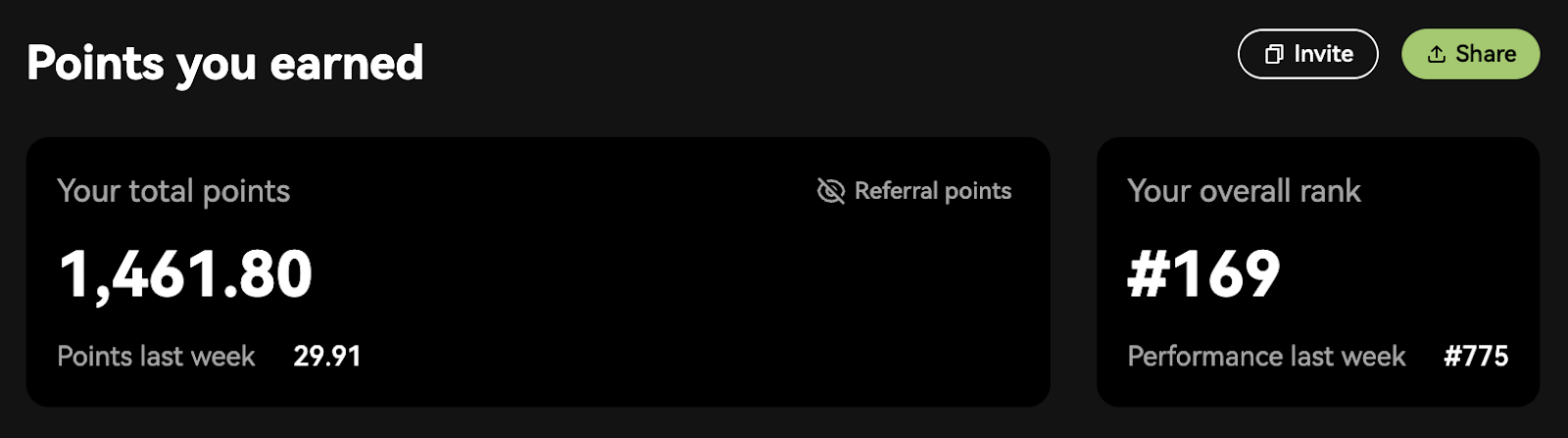

It also matters to periodically sanity-check your progress. Pay attention to leaderboards, point totals, and relative contribution. If the points you are accumulating do not feel proportional to the effort or capital deployed, that does not mean you should give up. It usually means you should adjust the approach, change the venue, or rethink execution.

Airdrop farming tends to reward patience, consistency, and basic discipline more than intensity. When applied steadily and with cost awareness, these strategies can meaningfully contribute to portfolio outcomes without requiring excessive risk or constant hands-on management.

Cryptonary, OUT!