Top 7 RWAs projects to supercharge your portfolio for '24/'25

Real-world assets (RWAs) have become a trending crypto narrative in 2024. This is unsurprising: crypto doesn’t exist in isolation, and there’s immense value in bringing off-chain assets on-chain.

Underlying the crypto revolution is blockchain technology, a game-changer that is now facilitating the tokenisation of off-chain assets. Blackrock’s CEO Larry Fink set the ball rolling when he spoke on the future of tokenisation earlier this year; the hype around RWA tokens has been rising ever since.

Here’s the thing: RWA assets aren’t exactly new; they’ve been around for a long time, with stablecoins being a prime example. But today, we are talking about bringing traditional real-world assets on-chain.

More importantly, what opportunities exist for you when traditional real-world assets are now represented as tokens on the blockchain?

Let’s dive in.

TDLR

- RWAs are the next frontier in Web3- tokenising real-world assets like real estate, art, and securities onto the blockchain.

- The battle is heating up in the tokenisation of treasuries and bonds - but one project is uniquely positioned to win because it has the backing of a TradFi giant.

- You can earn real yields in the emerging RWA private credit market; the most undervalued project in this three-way tussle offers the highest upside.

- The infrastructure plays a crucial role in bridging traditional and decentralised finance for RWAs – we highlight an incumbent and challenger in RWA infrastructure.

- Could there be that one platform to rule them all? We shine the spotlight on the first regulated exchange for trading all types of RWAs.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

A brief recap into Real World Assets (RWAs)

Real World Assets (RWAs) are the tokenised representations of physical assets on the blockchain. They enable the decentralised buying, selling, and transfer of traditionally non-digital assets in the digital economy.Despite previous stagnation, the RWA market shows signs of increased user activity, suggesting potential growth.

However, the game has changed with the entry of investment management giant BlackRock into the RWA space through its blockchain arm, BUIDL. This move has significantly altered the competitive landscape, as BlackRock's vast scale and resources pose a formidable challenge. To gain a deeper understanding of how and why Blackrock is positioned to dominate the space, we invite you to explore our previous report on RWAs.

Nonetheless, projects that offer RWA products alongside additional services or infrastructural support for other RWA initiatives may be better positioned to navigate this competitive landscape.

The RWA projects that we profile some RWA sectors and projects that may step out of Blackrock’s shadow to shine and present the best bullish play going forward.

The current state of RWAs

The RWA sector has blossomed into a diverse ecosystem which includes various types of tokenised assets. On a broader scale, they can be classified into:- Tokenised treasuries and securities

- Private credit

- Real estate, art, collectibles, etc

- Infrastructure and much more

Tokenised treasuries

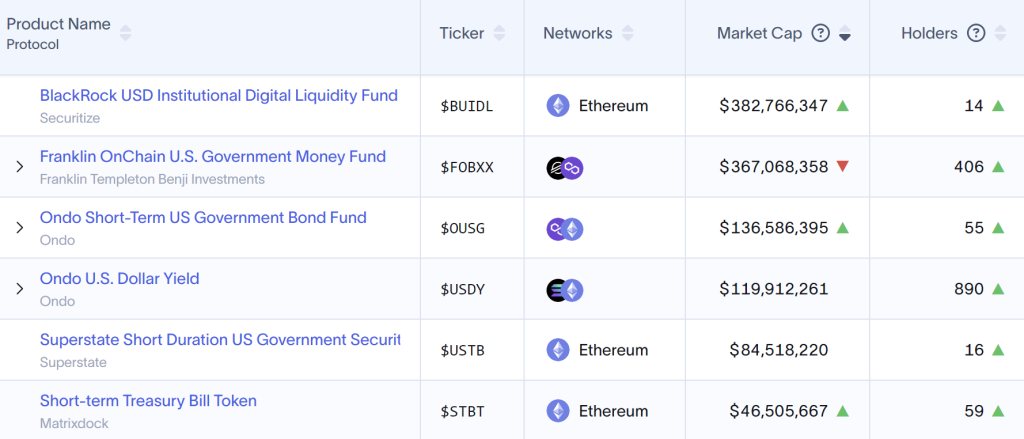

U.S. Treasuries are often considered debt securities that the United States issues to finance government expenditure. They are considered safe investments in the market irrespective of traditional volatility.Now, tokenised U.S treasuries are the digital form of these securities traded on a blockchain. Popular tokenised treasury providers in the current market include:

- Franklin Templeton

- Blackrock

- Backed Finance

- Ondo Finance

- Superstate

- Hashnote

- Matrixdock

Amidst the TradFi platforms, one decentralised RWA protocol is making waves, rising within the ranks of tokenisation – we are referring to ONDO finance. This project, with a current market cap of over $1 billion, stands out due to its unique position and potential for long-term growth, bolstered by its strategic partnerships.

Let's delve further into it.

Ondo Finance: A RWA product backed by Blackrock

In a sector largely dominated by TradFi players, Ondo Finance presents an opportunity to ride the capitalist wave. ONDO provides an institutional-grade DeFi platform offering earning opportunities, asset management, and tokenisation of financial products.Think about financial vehicles such as U.S Treasuries and money market funds. ONDO builds DeFi protocols around them, such as its flagship product, OUSG or Ondo Short-Term US Government Treasuries.

One of the key products offered by ONDO is OUSG, or Ondo Short-Term US Government Treasuries. This product, while not fully aligned with the principles of decentralisation, offers stability, low-risk, and predictable stablecoin yields. It is a permissioned token, meaning only whitelisted addresses by Ondo can access, mint, and transfer OUSG tokens. The minimum $100K mint requirement also indicates that this product is tailored for high-net-worth individuals.

Now, this particularly contradicts the idea of DeFi, but OUSG’s main advantage is that a significant majority of its portfolio is currently in Blackrocks’ BUIDL.

Technically, it is safe to state that Ondo is not really built on the ethos of decentralisation. With this RWA protocol, we need to accept that it is building an extensively secured and standardised infrastructure, but in collaboration with TradFi platforms (we have discussed Blackrock’s BUIDL in our previous report; please check it out for further context).

Ondo also has other DeFi products, which include:

- OMMF provides exposure to US money market funds.

- OSTB provides exposure to short-duration investment-grade debt securities.

- OHYG provides exposure to high-yield corporate bonds.

Overall, if the RWA narrative picks up momentum in the long run, it will be led by projects like Ondo Finance because of its partnerships and backing. The team behind the projects also has years of experience, including past employees from Goldman, Bridgewater, Millennium, and MakerDAO.

ONDO is a strong bet in the RWA Tokenization sector.

In the U.S. tokenised treasury market, only Ondo Finance is a high-value bet because of its product, OUSG’s market share. Every other protocol’s flagship product has less than 100 holders, whereas OUSG has 890. Ondo has clear market dominance in this sector; hence, it is the only token worth covering at the moment.

We will release a deep dive on Ondo Finance if the protocol becomes more attractive, and it will outline potential price targets for the 2024/2025 bull market.

Private credit

RWA protocols involved in private credit allow users to earn real yields by investing in businesses raising funds for a loan. These protocols facilitate organisations, deal structures, and borrower repayments. This is where RWA lending comes into place.The functionality of these RWA protocols is straightforward; they charge interest on loans, pass on a major portion of the revenue to token stakers and liquidity providers, and use native tokens to incentivise early participants.

This sector has been generally dominated by three protocols: Maple Finance, Goldfinch, and Centrifuge.

Let us figure out which project offers the most attractive investment opportunity.

Active loans and default rate

Like other tokens in the crypto market, RWA tokens can sometimes rally due to hype, whether organic or otherwise. However, you must go beyond the hype to evaluate RWA protocols in the private credit sector based on the fundamentals. Factors to assess include active loans, earned fees, and default rates.

The total value of active loans in the private credit market is $7.6 billion. That is a whopping amount, but it is important to note that $7 billion can be attributed to Figure, a TradFi platform.

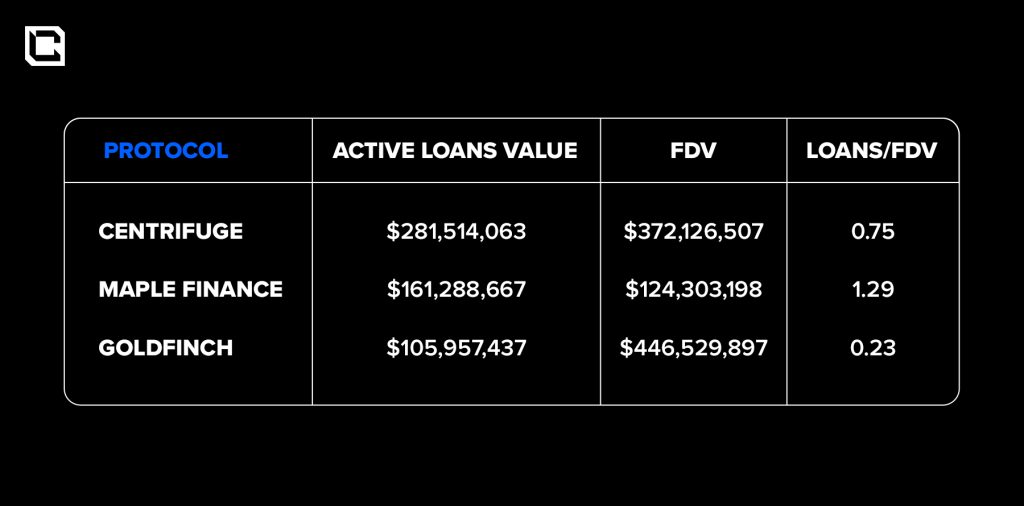

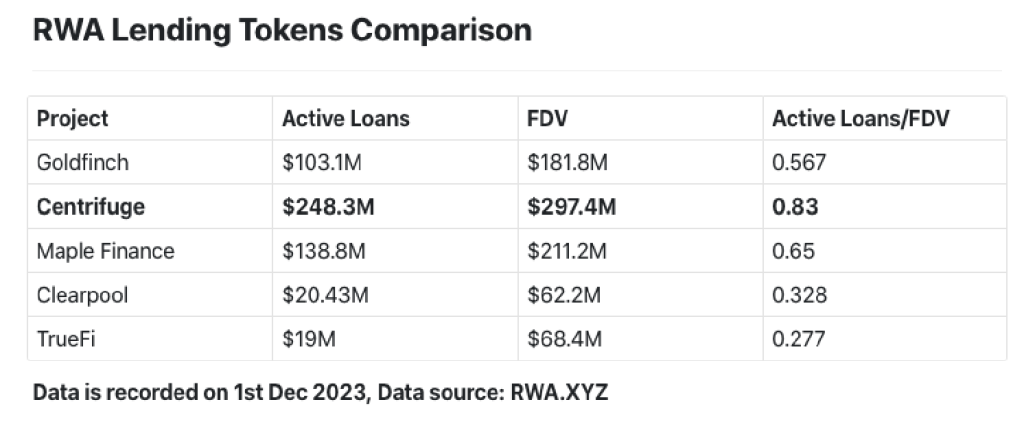

Comparing the rest of the three protocols, we see that Centrifuge has the largest number of active loans. However, to know how these loans impact valuations in this sector, we need to compare active loans with FDV value.

Based on comparing active loans with FDV, Maple Finance or $MPL is currently the most undervalued project in the category. Interestingly, Maple has also facilitated the highest total loans (refer to the chart above) at $1.89 billion, second only to the Figure platform, which is a TradFi platform.

The average base APY supported by Maple was also around 8%, but the defaulted loan amount was the highest.

Overall, Maple Finance or $MPL is the front runner in this Private Credit section, and it can be a good investment to build your conviction around. With a market cap under $100 million, Maple Finance is one RWA project to consider based on the product they have developed.

Centrifuge: A worthy mention in private credit

While Maple Finance makes a case for being the most-undervalued protocol right now in the private credit sector, Centrifuge also makes a good case for investment. While Maple Finance does have a better Active Loan/FDV value, Centrifuge currently possesses:- Lower defaulted loan amount, i.e. $28,532,872 vs Maple’s $55,334,921

- Higher active loan value, i.e. $281,845,881 vs Mapples $159,859,928

- Better avg. base APY, i.e. 8.70% vs Maple’s 8.02%

It is also important to note that Centrifuge was the most undervalued protocol in December 2023 and only recently swapped spots with Maple Finance.

Therefore, Centrifuge is also a good bet in the Private Credit sector. However, we are giving Maple our first preference since its market cap is lower and the opportunity cost is better with Maple Finance.

We may go on to do a deeper dive into Maple Finance or Centrifuge if either protocol generates better numbers over the next few weeks. In that deep dive, we will highlight potential price targets for the 2024/2025 bull market, so stay tuned.

Real estate, art, collectibles, and more

Apart from financial instruments, there’s an increase in the tokenisation drive for physical goods and tangible assets such as real estate, art, and collectibles.Real estate is often a great investment, but additional fees involved in the buying process can make it expensive overall, and its illiquidity can make it tricky to sell off when you need cash fast. The entry barrier is also high, especially in terms of saving up a deposit, so real estate is also not readily accessible to a wider market or population.

That's where RWA protocols step in. By tokenising physical assets, investors can own parts of real estate, arts, and luxury goods to get a fraction of the upside without breaking the bank.

Parcl

Parcl is a turbocharged real estate trading platform running on the Solana blockchain. It lets users jump into specific markets and invest or trade real estate in real-time, with the option to go long or short with up to 10x leverage. Compared to old-school real estate investments, which are often slow-moving and not very flexible, this is a game-changer.Parcl mixes real estate price action with DeFi (Decentralised Finance), offering a fresh way to invest, hedge, and tap into real estate from all corners of the globe in a more fluid and cost-effective manner.

One cool thing about Parcl is how it uses machine learning and location data to track the price per square foot/metre in any neighbourhood or city, updating in real time as things change. Parcl’s biggest advantage also lies in the backing of Parcl Labs. Parcl Labs is focused on residential and geographical data analytics.

Parcl Labs stands out for its capability to deliver precise, up-to-the-minute real estate data analytics, bolstering property investments. This feature enables users to forecast real estate market movements worldwide with remarkable precision and trustworthiness.

As a result, Parcl Labs holds a distinctive advantage in providing real-time data not only to Parcl but also to other stakeholders. This serves as a protective barrier against potential competitors.

Parcl has decent tokenomics and incredible upside targets, considering it lives up to its potential. Please check our deep dive into Parcl to learn more about the project.

Propy

Propy is an RWA protocol that is a real estate transaction platform. It facilitates faster closing processes and allows users to link property ownership to NFTs or other digital assets. Such a setup increases liquidity for the real estate market and enables digital possession in a fractionalised manner.The PRO token is used for governance and utility and is heavily utilised in minting property deeds and other basic functions in the ecosystem. Propy is fairly undervalued at $138 million, with decent tokenomics.

On-chain-wise, Propykeys, a way for users to mint a digital address corresponding to tangible real estate, is currently on the rise. Unique wallets and transactions are both on the rise, indicative of an active user base.

These factors add to Propy's conviction as a potential bullish play as a real estate RWA token. Please check our deep dive into Propy to learn more about the project.

Infrastructure for RWAs

When discussing infrastructure-based RWAs, our focus is RWA projects facilitating interoperability between the traditional finance world and the digital asset ecosystem. So, we are looking at projects connecting TradFi with crypto in the context of RWAs or projects setting up the infrastructure or a marketplace for traditional assets to get tokenised.In that context, one project which might benefit from the eventual rise of the RWA narrative is Chainlink.

Here’s why.

Chainlink is unlocking RWA interoperability

Chainlink is a decentralised oracle network enabling smart contracts to access off-chain data fees, web APIs, enterprise systems, and more. It bridges the blockchain and traditional markets, allowing access to external data and events.But Chainlink doesn’t tokenise assets, so why are we considering it an RWA play?

Well, Chainlink solves three of the main requirements that tokenised RWAs need. They are:

- Access to real-time world data

- Secured cross-chain transfer

- Connectivity to off-chain data, irrespective of any network

Another reason Chainlink satisfies the RWA narrative is because it can provide all sorts of services for tokenised real-world assets. Think about it: every tokenised RWA has to be backed by a real physical asset. With Chainlink Proof of Reserve, you can bring that backing data onto the blockchain, showing everyone that the token is legitimately backed.

Hence, multiple financial market institutions rely on Chainlink to connect with the world of blockchains. Some popular organisations include Swift, DTCC, and ANZ Bank. Chainlink is also the leading platform for tokenised RWAs in the Web3 ecosystem, supporting protocols such as Backed, Brickken, Matrixport, and TUSD.

Chainlink has received further credibility as a ‘RWA bet’ from K33 Research. It is important to note that LINK might not outperform the top RWA tokens. Still, similar to Ondo Finance, it will be one of the projects that will benefit when the RWA narrative picks up momentum in the future.

We have conducted a deep dive analysis into Chainlink; check it out for insights into the upside you can expect from LINK through the 2024/2025 bull run.

IX Swap: Could this be an overall winning bet?

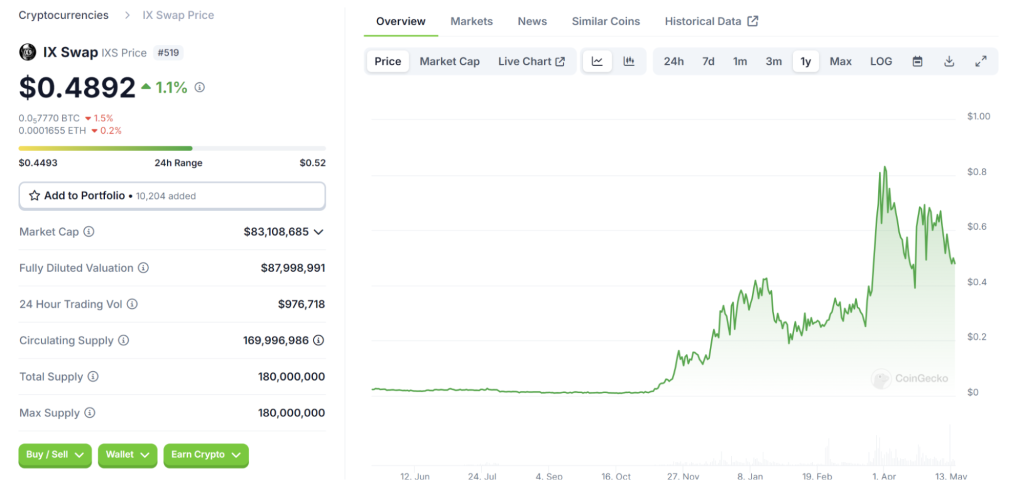

The final project on our radar is IX Swap, a DeFi platform focusing on security token offerings (STOs), liquidity pools, and staking. It is also the first regulated automatic market marker for real-world assets, like a UniSwap, but for trading RWAs.Unlike the other projects, the quantifiable data for the IX Swap is limited, but we are making an exemption here to profile IX Swap in this report.

Reasons to be bullish with IXS

- A Unique Product: IX Swap is alluring because it is the first platform to combine security tokens, liquidity pools, and staking in a single ecosystem. The team also built through the 2022-2023 bear market before launching it.

- Coinbase Investments: Coinbase Global is one of the key investors in IX Swap’s group of companies, which implies a convergence of traditional finance and decentralised technologies. Coinbase’s backing adds credibility to IX Swap, allowing more potential suitors to take IXS’s vision towards a compliant and efficient platform for trading RWAs.

- Tokenomics: The IXS token has strong investor-friendly tokenomics. Its total supply is 180 million, of which 170 million are already in circulation. The token is also deflationary, as net fees collected from each IXS service contribute to buybacks and burns for the IXS token.

Looking ahead with IXS

With a market cap of $83 million, the IXS token has a high float of $0.94, which is always a good sign from an investment perspective. Last month, the token reached a new all-time high of $0.94. IXS is one of those RWA protocols which can be great from both a short-term and long-term point of view.

Cryptonary’s take

Real-world asset tokens picked up strong momentum towards the end of 2023, but their momentum has buckled since the turn of the year. While it is still a trending narrative in 2024, besides Ondo finance, most assets are down close to 50% from their all-time high.However, this is not really a make-or-break development. RWA is a narrative that will only progressively improve as adoption rises. There is a valid case for tokenising traditional assets and bringing them on-chain.

Over the past month, the collective cryptocurrency market has been on a downturn, but the total RWA TVL registered reached a new all-time high of $6.57 billion on May 10th. Hence, even though price action is weak across the entire crypto market, the activity and adoption of the RWA sector are definitely on the rise.

One of the biggest positive developments is the emergence of blockchain-based offerings by established TradFi giants. While this comes at the cost of decentralisation, their success can help generate greater trust and confidence among regulators, issuers, and investors.

The RWA narrative will continue to grow in 2024, and we are here for it.

Until next time,

Cryptonary Out!