Trading and investing during the chop markets is less about picking the right coins, and it is much more about having the right mindset. Most investors lose at the mental game of investing, where instead of being disciplined, they end up making emotional decisions and risking too much or taking bad positions.

This is especially true to individuals who are sidelined and in cash who panic and feel compelled to "do something" when markets get volatile. The FOMO, or the fear of missing out, leads them doing too much during these downtimes which then ends up in them losing money that could have been avoided if proper discipline and patience were used.

The reality is that not being impulsive and staying in cash until the market changes is usually the safer method of long-term investing. Avoiding the sustained chop or downtrend and taking emotion out of investing allows us to capitalise on stable returns, like yields or airdrops.

In this article, we want to zero in on five key principles that play a key role in tackling the market:

- The power of patience

- Managing fear & greed

- Risk management

- Mental resilience

- Overcoming overconfidence and cognitive biases

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

The power of patience: The key to outperforming the market

One of the least valued virtues of successful investing is patience. Most traders feel that one should always be in a position to make profits, yet the reality is that over-trading is usually a path to losses. Holding and staying in stables is a strategic way of keeping your money tied up safely until the market turns and shows us it's time to get in. As the saying goes, "Not having a position is a position as well".For instance, consider an investor who buys an altcoin on a whim when it pumps up by 10% on a random day; there is no data to support it, but they imagine that this is the bottom. They didn't have patience for the trend to turn and simply guessed the dip was over. Within a few weeks, they find out their impatience has hurt them, and now the coin is down another 70%-90% in a few weeks.

This happens regularly and should remind you why patience is not just a virtue; it's a necessity. A wait-and-watch approach that makes us wait for more ideal situations like a stronger uptrend in the markets, improved macro situation, or improved fundamental indicators will provide much better risk-reward over time.

Avoiding the temptation to chase every pump places you outside 90% of losing traders/investors. For instance, even if an asset pumps 15%-30% in a couple of days, zooming out, it might still be down 70%-90% in a broader downtrend-jumping out of FOMO often means buying into a losing position.

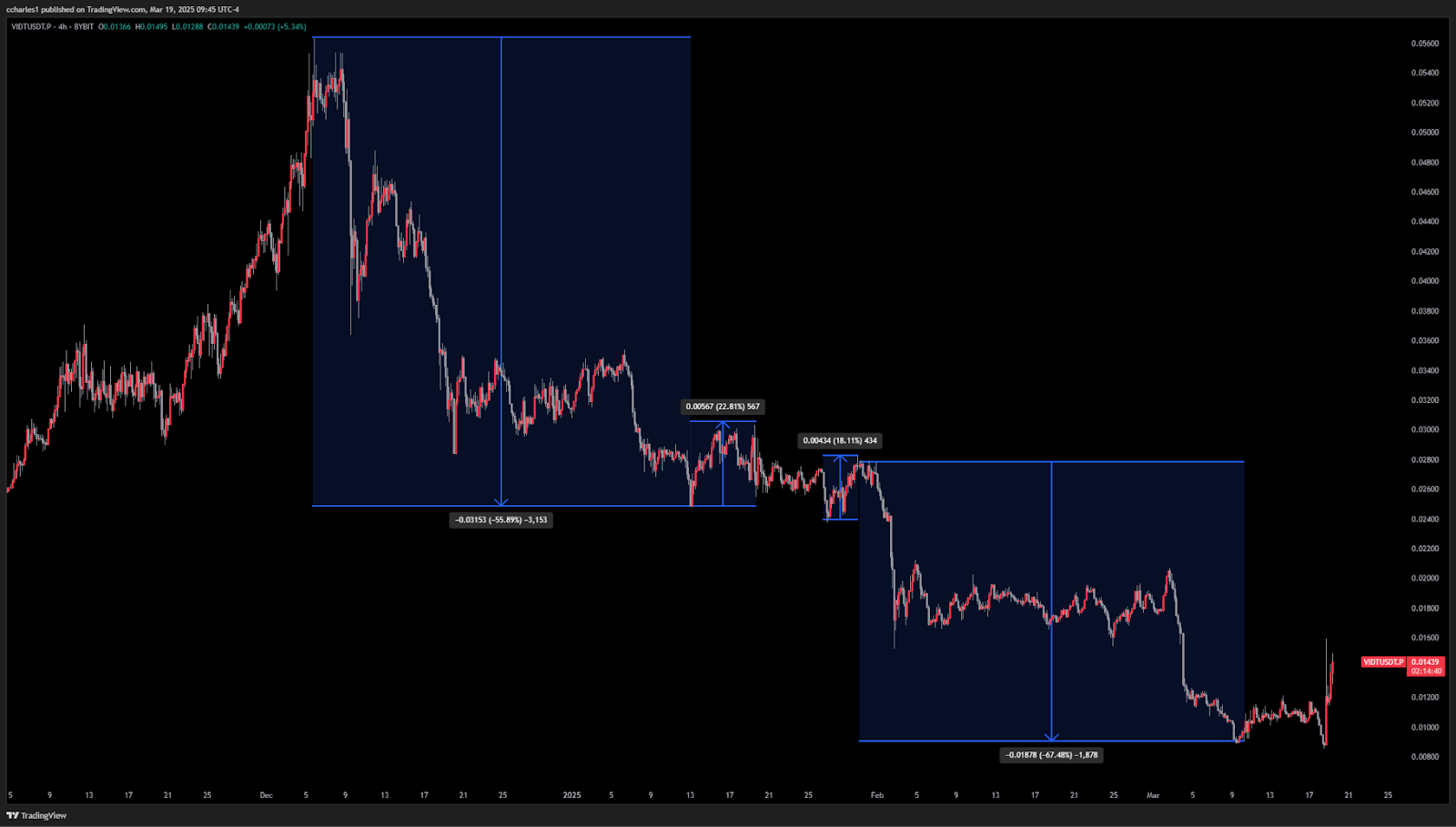

In the chart below, we can see this happen play-by-play. The coin dropped about 55%; then it proceeded to pump 20% a couple of times after. Then, fast forward 3 weeks, and the price is down another ~70%. This is why it's important to take things slow and not FOMO just because the price is up. This pattern is very common in altland.

Therefore, don't buy the downtrend. Sticking in stables until it's clear what will happen in the market, like waiting for a bottom formation or accumulation phase, allows you to make logical, level-headed decisions rather than being driven by impulse to the mood swings of the markets. After all, as long as markets exist, there will always be another big opportunity worth waiting for.

Action plan:

- Create an investment plan

- Remind yourself to think before you act

- Create a plan to get back in; don't do it on a whim

- If you feel like you need to do something, refer back to the plans you made

Managing emotional reactions: Fear and Greed

Greed and fear are the two strongest emotions we feel when investing and trading alike. Greed will get us to hold onto losing trades or bad investments in anticipation of a miracle reversal in price, it usually never happens, and fear of missing out (FOMO) will try and get us to buy at the worst times possible. Controlling and being aware of these feelings is essential to staying on target and maintaining longevity in this game.Greed can sneak up on you at any time. It can sneak up on you even scrolling on X; imagine you see people flexing that they made 100% in a week. Your emotions might instantly scream at you to get in a position so you can feel that you aren't missing out or leaving money on the table. History, however, shows that chasing the hype rarely ends well.

Most of the people who enter based on FOMO often exit liquidity to the early speculators. The disciplined investor, who stays put in their stables, can wait patiently for rational entry points to get in or just avoid the noise entirely; having faith that opportunity in the markets always comes around again is key.

However, let's not forget that fear & greed work in both directions. A sudden crash in the markets often triggers panic and typically drives you to sell, even when you had planned on holding on for the long term. This can be due to loss aversion or wanting to keep the profit you have made so far.

The cure to these emotional swings is through having a plan and being disciplined. By staying in stables and being selective when you're investing, you avoid a lot of this rollercoaster. As investors and longer-term traders, we are not here to be glued to charts all the time, nor are we here to take a trade every time the market moves in a certain direction. Investing like this means you're allowed to be more rational, making better investment decisions based on strategy and not emotion.

Action plan:

- Practice mindfulness before making financial decisions

- Use a cool-off period before pressing buttons (10-15m), especially when you feel emotional

- Stay away from sources that make you feel FOMO & Greed

- Zoom out the chart, which helps us see bigger trends and avoid getting caught up in day-to-day volatility.

Discipline in risk management: Staying steady

Effective risk management is the cornerstone of any successful investor. Most traders risk exposing themselves to exponential losses by trading too much in hopes of more significant returns and instead get higher losses.The truth is, staying in stablecoins and waiting for the next play is probably the best way to outperform the market in the next couple of weeks/months. Doing this is a responsible approach to risk-taking that separates risk-aware, long-term thinkers from those with poor risk management.

For example, suppose that an investor chooses to risk just 10% of his capital on more risky investments after having achieved a few successful trades if they decided to raise the risk to 30% per trade because they got bored and greedy.

Most of the time, this is the trade where their huge loss will wipe out several earlier profits. Fast forward, and suddenly, they are down 30% when the market turns instead of what should have been only 10%. This is where risk management is essential. On the other hand, they could have been the conservative investor who remained patient, stuck to their plan, and outperformed the market by doing nothing.

Consistency is very much involved in risk management. Even when on the sidelines, we must never forget that even though things are slow now, when they pick up again, we must be ready to get the beach into action in a constructive way that is thoughtful and risk-aware.

Action Plan

- Pre-define risk limits per trade / per asset class (majors vs. meme coins)

- Use the barbell approach

- Never go all into a coin; always remember there are more opportunities incoming

- The best strategy to outperform is to just sit tight and not do anything irrational at the moment.

Building mental resilience: Accepting setbacks & waiting for opportunities

Let's be honest: being a successful investor requires a lot of mental fortitude. The constant exposure on social media, from peers, and other things like people posting high returns leaves us constantly up to the test of whether we can control what we feel.The best investors know that patience and self-discipline will always beat short-term excitement. Having the ability to weather disappointments and staying true to our plan is exactly what good investors do no matter what others are doing.

Things that test your mental game happen all the time. For example, if you decide not to buy a meme coin because you are comfy in your stables and it ends up giving a 100x return, the emotion of regret will try to invade your headspace, but as we have to resist such temptation and not fall into the greed trap because these opportunities come and go in abundance.

This thinking is something that separates you from emotional traders who get destroyed over time. Remember that staying disciplined and patient over time and NOT having FOMO towards other people's wins will give us long-term success.

Action Plan:

- Journal every trade you take (Our guides on journaling here and here)

- Journal trades you miss; this way, you know what to look for next time

- Journal why you are sitting in stables, and sort your emotions

- Accept that missing a trade will happen, and be okay

Overcoming overconfidence (for traders)

Overconfidence is another common trap when it comes to investing. Most traders believe that it is possible to time the markets and get it right every time, yet the reality is that even seasoned professionals struggle to achieve this. With this comes the idea that you have to be trading all the time, which leads to overtrading and poor decision-making.Overtrading leads to trading without having a plan, and doing this over time leads to losses repeatedly. We must always approach trades with a well-thought-out process beforehand. This applies to us while being in stables because there IS the urge to jump into trades; however, before doing so, we must always think back to the reasons why we are taking the position we are taking now, and if that reasoning hasn't changed, then there is no reason to look to take more trades.

Action Plan:

- Use data and not feelings to assess trades (think, WHY am I taking this trade?)

- Check for biases before making moves (Am I trading this based on data or feelings?)

- Limit the number of trades you take weekly

- After good trades, take some time off to avoid taking trades by inertia and overconfidence

Setting realistic expectations: Small and conservative returns are key

Lastly, unrealistic expectations are among the most significant factors that cause traders/investors to make poor decisions. Stablecoins will not provide enormous profits in the short term, but they provide predictability and security. That's a massive plus in a market environment where most traders lose since it is down-trending and choppy.Understanding that steady, incremental growth will usually outperform quick and high-risk strategies. Moreover, where the broader trends shift, you will have massive dry powder to bet big when the time is right.

Having reasonable, realistic expectations keeps disappointment over expecting overnight success at bay and reduces the temptation to be a madman. Successful and wealthy individuals know that becoming rich is not a sprint but a marathon, and you need to know when to stay risk-on and stay in stables.

Action Plan:

- Focus on capital preservation first and profits second

- Create long-term wealth-based goals

- Understand the advantages of taking things slowly in down markets

Cryptonary's take

The psychological aspect of investment is just as important as technical charting or technical analysis. Discipline over our emotions, using patience, and maintaining consistency are methods that will help us in the long run.So, if you are sidelined in stables, it's okay; just hold on and wait. You don't need to chase every market impulse, FOMO, into a trade because someone else made one or desperately wants to be in a position again.In choppy markets, zooming out helps - don't buy downtrends or cling to losing positions out of sunk cost fallacy, hoping for a miracle. Wait for the accumulation phase and a confirmed trend shift. As long as markets exist, another big opportunity will come, and you'll be ready for it.

That's it for us,

Stablenary OUT!