A trading platform that will make you go ***!

Product first, token second has been an excellent guide in crypto. Most products when launching release a whitepaper laying out the roadmap, functionality and value of their token. It is important to realise that a whitepaper is simply a written down and planned out idea. Actual implementation of the functionality and protocols is the hard part. Cardano has planned for smart contracts, but they are still not operational.

At its essence, a cryptocurrency accrues value for the protocols which it has implemented and not those which it has planned. In very rare cases the developer team behind the whitepaper is skilled enough that the potential reward of them bringing their whitepaper idea to production outweighs the risk of investing in their token. However, in the present case we have an extremely skilled developer team, with a deployed protocol in closed beta, yet no concrete whitepaper.

Disclaimer: THIS IS NOT FINANCIAL OR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

The project in question is Wootrade (WOO) which is being developed by Kronos research. Kronos Research is one of the top market makers and quantitative trading firms in the world processing $45 billion in trading volume per month. They are also the Designated Market Maker (DMM) for Binance, Huobi, OKEX and others.What is Wootrade ?

Wootrade is a liquidity darkpool that exchanges and institutions can use for access to deep order books and liquidity. Darkpool, refers to a liquidity pool in which all transactions carried out are hidden. Professional trading teams can link their own trading dashboards via API or use Wootrades’ customizable trading dashboard. The customisable trading dashboard is also an advanced retail platform, WOO X, where any user can take advantage of the professional trading tools and zero fees available. The Graphical User Interface (GUI) can be tried out here.

Unlike traditional exchanges, users are not charged fees for making transactions and using Wootrade services. It’s free to use for the end-user.

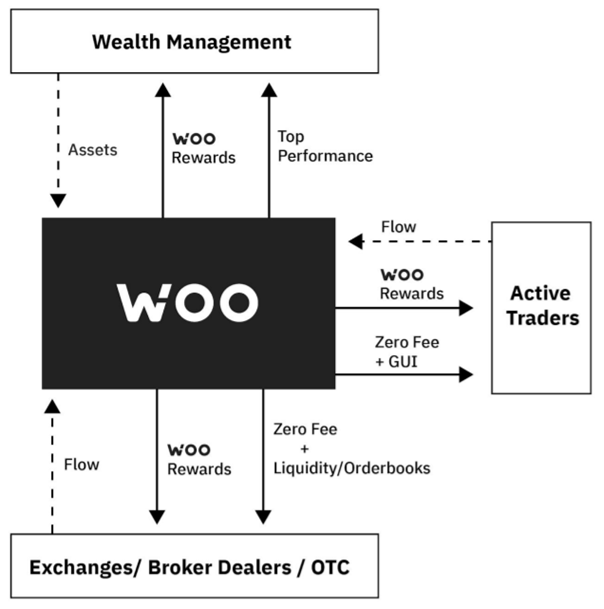

The zero-fee model is an important part of Wootrades’ value proposal and user acquisition strategy, with the institutional users enabling this for retail users. This is how it works:

- WOO X Users: Feeless trading and best price execution.

- Market makers: Increased flow and higher revenues, can quote tighter and deeper in the absence of aggressive HFT strategies.

- Other exchanges and trading platforms: More active market makers, optimized trading environment and can offer lower fees. Some exchanges that connect directly to Wootrade’s network can eliminate the need to compensate market makers altogether.

The zero-fee revenue model has been proven by traditional finance and is being adapted to DeFi. At its core, Wootrade is a deep liquidity network that can be integrated across exchanges, wallets, DeFi protocols, institutional trading desks, and even blockchains.

The WOO Token

WOO is a ERC-20 token used to acquire benefits, investment opportunities, discounts and rebates on the Wootrade network. It is traded on multiple major exchanges (Huobi, gate.io, Dodo, Uniswap and others). WOO trading pairs are not offered by either Coinbase, Binance or FTX.

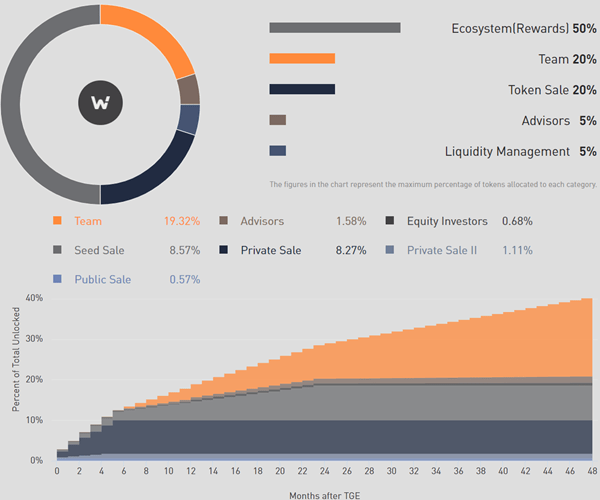

WOO is a capped-supply token with a total supply of 3 billion tokens. WOO tokens are bought back and burned each month with 50% of the revenue from Wootrade. In the five months which buybacks have occured 7.7m WOO tokens have been burned. WOO tokens will also be utilized for the decentralized governance of Wootrade and to gain access to zero-fee trading for both institutional and retail users on the Wootrade network. The WOO tokens’ use cases are:

- Payment: The token can be used to eliminate or reduce fees, like a standard exchange token. Regular traders have zero fees but trading teams using Wootrades’ API tools will have fees. The fees can be reduced by using and holding WOO tokens.

- Staking: Users can gain access to copy trading or direct investment in a top-performing trader of their choosing by staking WOO tokens and other cryptocurrency pairs.

- Reverse liquidity mining: Institutions get paid to trade and take away liquidity from the platform by becoming a PRIME node. Flow providers such as exchanges or trading communities can stake 5 million WOO tokens to achieve PRIME status and get paid for every dollar of trading stemming from their community.

- Collateral: WOO can be used as collateral to trade with WOO X derivative products with reduced fees and other incentives.

- Partners: Wootrade exchange partners who do not have their own token can adopt WOO as their platform token to encourage higher trading volume.

- Governance: Staked tokens accrue voting points.

Wootrade began to scale in 2020 when institutions realized the benefits of deep order books and zero-fee transactions. The network currently executes trades of 20+ institutional clients. Wootrade is not able to disclose details of institutional clients’ trading volume. This situation isn’t unique to Wootrade as other institutional-facing platforms don’t even reveal the names of their clients. Early DeFi protocols were hampered by high fees and slippage. Wootrade was uniquely positioned to take advantage of this with their deep liquidity and in house market makers. Subsequently they created the first WooFi pools on Binance Smart Chain (BSC): BNB/BUSD, DOT/BUSD, BTC/BUSD, ETH/BUSD, and LINK/BUSD.

WOO for the user

WOO X launched in Beta at the end of March 2021, allowing anyone who staked WOO to access over 30 assets with deep liquidity and zero-fee trading. Only around 700 users have registered, with about a third of those using the platform for trading. Trading volume fluctuates between $5 million to $35 million per day. As WOO X Beta grows, and its user base expands trading volume is also expected to grow.

On 25th June 2021, WOO X Beta will move to the next phase. The WOO X team will no longer be the limiting factor on who signs up and trades. Early WOO stakers on WOO X Beta will be able to give out referral codes.

WOO X will probably do a few more “last call” waves of invites prior to the snapshot in late June, after which Beta sign-ups will be closed without a referral code.

End of July, WOO X will fully open up, even to users without an invite code. That includes the Beta version of the WOO X Mobile app. WOO X Futures is also targeting a July or August release.

Product release dates and upcoming milestones

- Open Betalaunch - June 25th

- Includes updated staking program with trading incentives and initial referral program for WOO X Beta stakers

- Open Betawill have a pure spot mode for non-leveraged trading

- Open Beta will have support for API trading

- WOO X Mobile Beta - end of July

- WOO X Futures - late July or August

- Social trading - Q4 2021

The Wootrade network is showing rapid growth with ever growing institutional volume, with 8.45 billion USDC volume in May. The rapid listing of new tokens also helped facilitate an increase in volume. 128 million USDC of DOGE was traded on May 4, 2021, a few weeks after being listed on the network. Due to the superior pricing execution offered by Wootrade smart order routers such as DODO and 1inch used the WooFi pools with increasing frequency. The 5 BSC WooFi pools with about $3.7m in total value locked transacted over $890 million in trading volume, with fees of only ~0.05% per transaction.

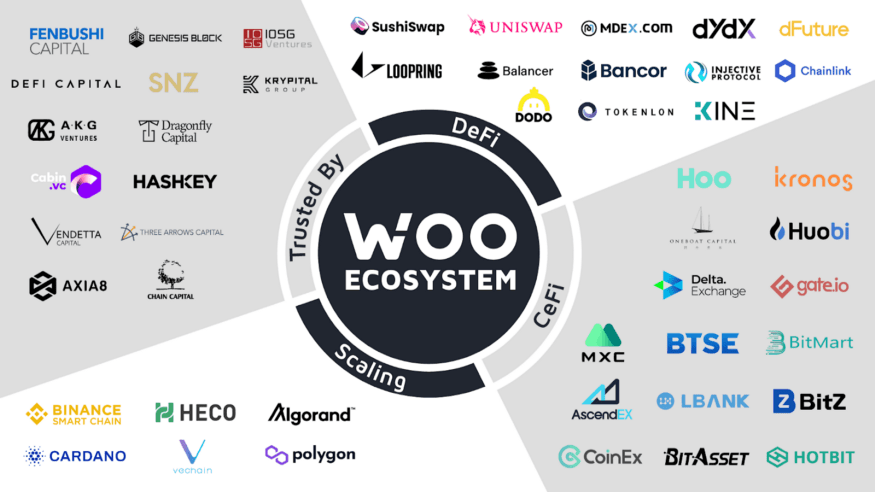

There is also a large network effect in place. As the network grows in size, it becomes more attractive to higher capital users due to the diversity of flow and amount of liquidity available along with the trust that is established. This opens up even more markets for the Wootrade network to scale into over time. The current network is shown below.

Wootrade offers a liquidity platform that can seamlessly and quickly be integrated with most blockchains and their protocols. WOO has recently announced integration with Algorand, Polygon, plans for Solana. Additionally they provide liquidity for multiple centralised and decentralised exchanges as can be seen in the above diagram. Liquidity is something universally required across all blockcahins, and with the addition of each blockchain the network effect increases. Wootrade is feasible due to an industry leading market making firm deciding to ‘decentralise’ their proprietary skills. This is possible by market making in house and utilising their advanced order routing engine to allow any exchange or protocol to take advantage of their ‘alpha’, as long as the client holds their token. This creates a demand for WOO tokens, to enable users to take advantage of the zero fees and deep liquidity being offered by Wootrade. The success and value of WOO ultimately hinges on the performance of Kronos Research. With a proven track record and functioning protocol with astounding liquidity numbers, they are in an excellent position for future success.