Trump vs. Harris: Election odds and crypto market reactions

The 2024 election draws nigh, and with it comes a flurry of questions such as: Who is best for crypto? What does each candidate think about crypto, and what will happen if either wins? We encourage you to hold tight and not be afraid because we are here to answer all your questions.

In this report:

- The impact of the 2024 U.S. presidential election on the crypto market, analysing both Trump and Harris's stances.

- Insights into how the crypto market is reacting to the current election odds and correlations with Bitcoin’s price.

- Detailed evaluation of each candidate's potential policies, focusing on regulation, taxes, and industry support.

- Possible market outcomes based on different election scenarios and their implications for crypto assets.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

All eyes on elections

The upcoming US presidential elections are a critical event that could significantly influence the direction of the crypto industry. With Donald Trump and Kamala Harris vying to become the 47th President of the United States, the stakes are higher than ever—not just for global politics but also for our industry too. The outcome could shape regulations, investor sentiment, and the future of digital assets worldwide.As anticipation builds, everyone is speculating, positioning, and hedging to all possible outcomes, ensuring they are strategically aligned based on their research, expectations and convictions. Here is what the market expects is going to happen:

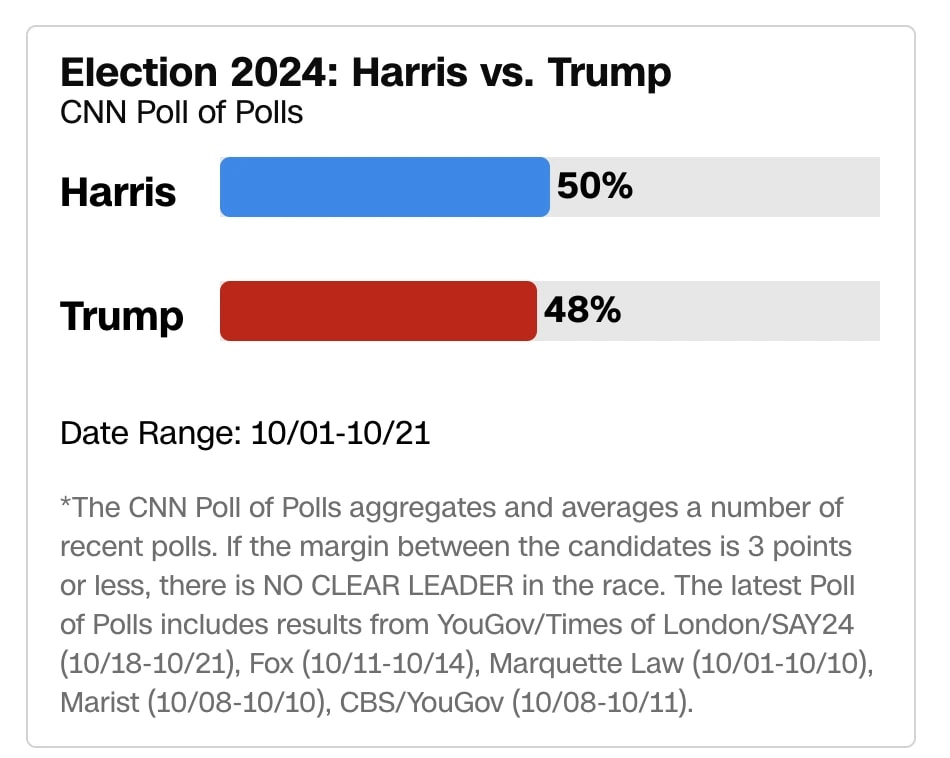

According to Polymarket, an innovative betting platform, Trump’s odds of winning are 28% higher than Hariss’s. It’s the same story on Drift, another prediction market. Trump is leading on both of them by a considerable margin.

Even though Polymarket/Drift thrive on the idea that markets can aggregate information more effectively than individual experts due to the stakes involved, we tend to believe that, in general, the crypto market is biased towards Trump.

We can get evidence of that by following the Trump-Harris spread and Bitcoin’s price. As the spread gets wider, Bitcoin’s price tends to increase, which confirms that the crypto market wants Trump to win.

The correlation between the Trump-Harris Spread and BTC’s price is also positive and quite significant, with a value of 0.49.

Thus, we believe that the odds might be a little exaggerated due to how most crypto natives want Trump to win.

To investigate the odds further, let’s look at traditional polls such as CNN. Interestingly, in contrast with PolyMarket and Drift, both candidates are head-to-head here.

Therefore, it is possible that the prediction market odds may be skewed in favour of Trump. Although he might have a higher probability of winning, the actual odds remain nearly equivalent to a coin toss.

Since it is a close race for both of them, let's dig into what crypto would mean if each of them got into power.

Donald Trump

Trump has been seen as a very crypto-friendly candidate, no wonder the market wants him to win. He has been vocal about crypto, bitcoin, and bitcoin mining and was able to effectively tap into the values of the crypto audience by talking about self-custody, unsustainable debt and lack of clear regulatory framework for crypto assets.Here is what we know about how Trump intends to approach specific issues the crypto industry faces.

Securities and Exchange Commission (SEC)

One of Trump's most considerable promises has been to fire the current SEC chair, Gary Gensler. This is big because Gensler is notoriously hostile regarding digital assets. This shows Trump has done some homework and chosen his side.As per him, he doesn’t want the innovation to leave overseas. He wants the future of Bitcoin and crypto to be built in the United States of America and, therefore, is committed to bringing regulatory clarity to the market. This is very bullish on crypto startups and the industry overall.

Taxes

Further, Trump is seen to be optimistic regarding taxes for digital assets, as he wants to clarify tax policies on digital assets. We take this as bullish because more guidance and clarity in this field means more people can safely get involved.Bitcoin mining

Trump has also been pretty vocal about his support for Bitcoin mining, as he has met with many of them and raised money from them. As we mentioned, he wants Bitcoin to be “made in the USA”. Again we take this as a very bullish stance.Banking

He has also been very open regarding national banks being involved with blockchain. He has said he will end Operation Chokepoint 2.0 (an effort by regulators to restrict banking services from interacting with crypto businesses) and vehemently opposed Central Bank Digital Currencies (CBDCs). Again, all this is very bullish and resonates with the crypto industry, as it will give banks and more prominent players a much easier time interacting with the crypto space.The scoop

Overall, Trump is actually quite bullish when it comes to these critical issues. He has taken a bullish stance regarding crypto and his winning the presidency will provide a very bullish future for the industry and, of course, it is bullish for our bags.Kamala Harris

Surprisingly to most, Harris is not actually that anti-crypto, and we think she would bring a much easier hand than the Biden administration has been. In our opinion, Harris has said the least she can say about the crypto industry. Although, in our research, we did find a few points.Securities and Exchange Commission (SEC)

Harris has not made any direct reference to easing Gensler's grip on the digital asset space. However, she did say that her administration would “encourage innovative technologies… like digital assets while protecting our customers and investors.” Although this doesn't mean anything concrete, we think her administration will be more open to digital assets, whereas we saw Bidens as hostile toward them.Taxes

Harris’s stance on taxes is her administration's most aggressive stance out of everything on her list. She wants to roll back Trump's tax cuts, increasing corporation and capital gains tax. We take this as bearish towards crypto because more capital gains will be taxed, and will lead to market sell-offs.Bitcoin Mining

We see Harris’ stance on Bitcoin mining as neutral. She has not directly commented on the matter but is a big believer in climate justice. However, we think she is more open to innovation and could bode well with Bitcoin mining. Overall we believe there isn't enough said by her about this topic to make a justifiable claim on its bearishness or bullishness.Banking

We saw the Biden administration take a very hostile approach to banking and crypto companies, with many banks admitting that interaction with crypto companies was oftentimes very difficult. However, with Harris being more open to things of the future, like AI and digital assets alike, we do believe she will be more comfortable with this topic. We give this a neutral rating because of the administration's ambiguity on this topic.The scoop

Overall, we think Harris is neither bullish nor bearish regarding these key issues. As we said in the beginning, her administration has said as little as possible about this topic, leading us to believe that, at the very least, they are more open to crypto and blockchain technology than the previous Biden administration.But wait, there is more.

Crypto is purple

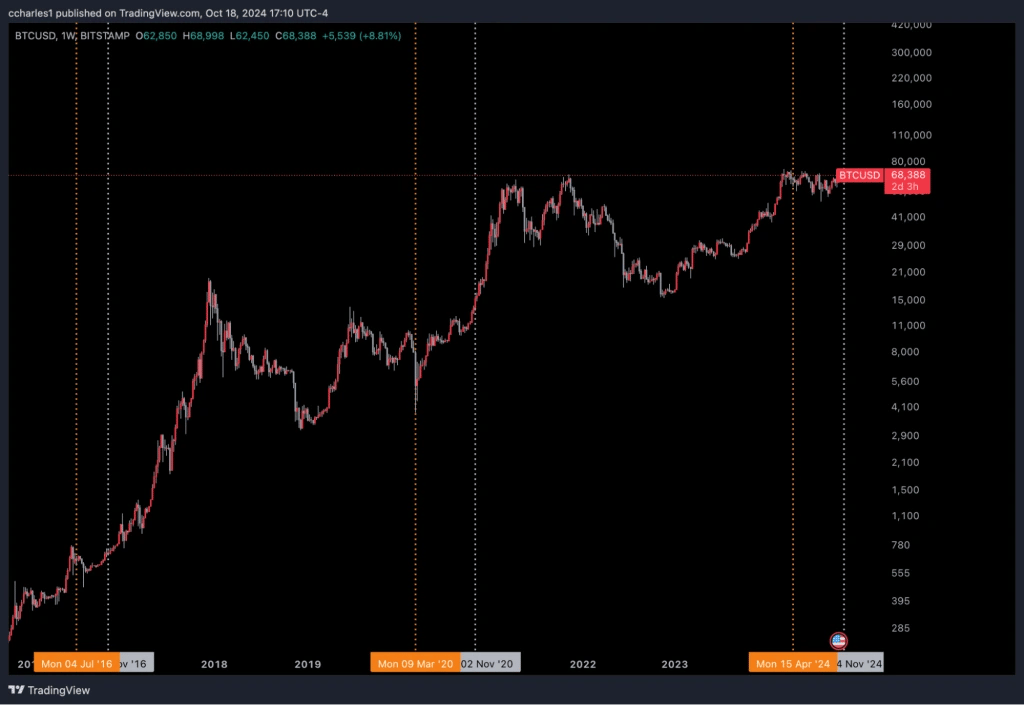

Yes, even though it might seem the Republican president would be best for our beloved crypto space, history actually shows that prices do not get affected by who's running the show; at the end of the day, the price seems to continue up and to the right.

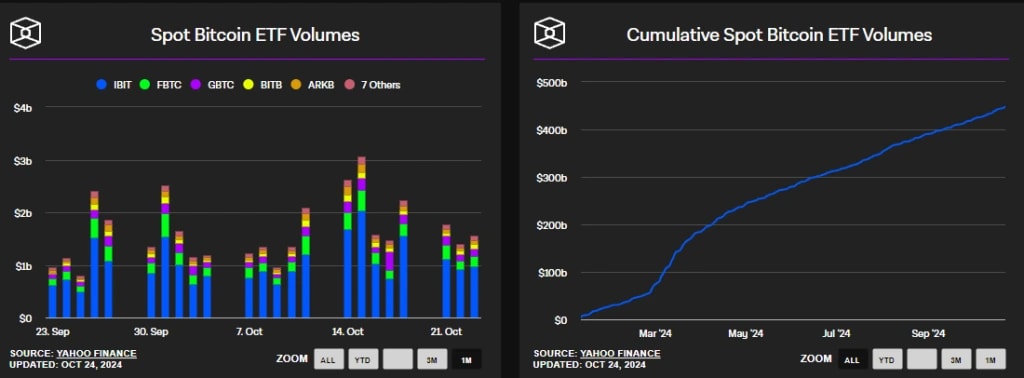

Additionally, crypto is now more mainstream than ever with the ETFs doing billions of dollars in volume monthly coupled with Blackrock and other financial giants coming into the space, it is painfully obvious that crypto is legitimized now. This means that regardless of who is in power, this space will continue to innovate and flourish. At the end of the day… Crypto is in a great place; in fact, it is in the best place it has ever been.

But that is our take narrative and policy-wise; here is how exactly we expect election outcomes to play out market-wise.

Election outcomes: 5 scenarios

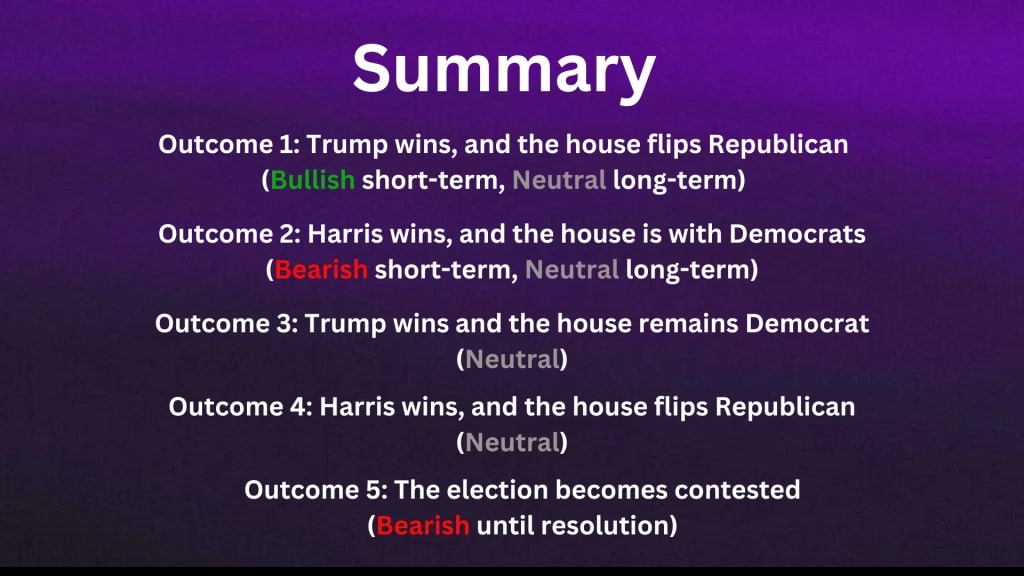

On November 5th, there are 5 possible outcomes we're potentially looking at. Below, we will cover all these scenarios and what each outcome may mean for markets.- Outcome 1: Red sweep (Trump wins, and the House flips to Republican).

- Outcome 2: Blue sweep (Harris wins, and the House is with Democrats).

- Outcome 3: Trump wins, and the House remains Democrat.

- Outcome 4: Harris wins, and the House flips to Republican.

- Outcome 5: The election is not settled and, therefore, becomes contested.

Outcome 1: Red sweep (Trump wins, House flips Republican)

Most likely outcome

- Fiscal spending is likely to continue to be strong.

- De-regulation in markets means a positive impact on risk-on assets such as crypto.

- Increased tariffs. This will likely support Bond Yields and the Dollar going higher. And this may be a headwind longer-term to another rally in risk assets.

- Possible fears over inflation re-igniting in the next 12 months.

- The FED may look to do slightly fewer Interest Rate cuts upon a Red sweep as they won’t want to accommodate a potentially more exuberant (in spending) Trump.

We likely see risk assets and crypto be strongly bid upon in a red sweep. It’s possible that we then see a strong extension of the bull market for another 2-3 quarters (into mid-2025). However, a Red sweep would be more supportive of some of Trump’s policies becoming enacted. These policies are inflationary (more strict on the border, meaning fewer workers, and tariffs, meaning prices go up), and therefore, we may see an acceleration in inflation in 9-15 months. Short and mid-term positive for Crypto, but question marks about the long-term if inflation reignites. ALTS/Meme’s will perform best under a Red sweep.

Outcomes 2: Blue sweep (Harris wins, House stays Democrat):

Very unlikely

- Business confidence would be low.

- Likely not much change in regulation in financial markets and this would likely hit Equities hardest, translating into a selloff in crypto as well.

- The dollar would likely move lower as Trump's proposed tariff policies would get priced back out.

This would be the worst outcome for Crypto in the short, medium and long-term. Markets would likely also struggle in the short and medium term. The likelihood of poor regulatory clarity would probably continue and most ALTS would potentially underperform BTC.

Outcome 3: Trump wins, House remains Democrat:

Unlikely

- Trump will find it difficult to get most of his policies enacted.

- The dollar probably moves higher as tariffs are further priced.

- Bond Yields are likely to move higher over fiscal spending worries.

- The FED is potentially less aggressive with its Interest Rate-cutting cycle.

Crypto will likely take this positively over all timeframes, but if inflation reaccelerates in 2025, that’ll most likely put an end to a risk asset rally.

Outcome 4: Harris wins, House flips Republican

Second most likely outcome

- Harris will struggle to get policies implemented with a Republican House.

- There is a likelihood of little change in terms of policies, and generally, markets will probably just take it in its stride.

- Regulation will likely still not be great and this will impact some sectors of the market. Not that great legislation-wise for Crypto.

- Equity markets will probably like this outcome, though. It’s less inflationary than a Trump will, but we’ll probably continue to see substantial fiscal spending.

For traditional markets (TradFi), they’ll likely take this in stride relatively swiftly after the election. However, crypto may be more significantly impacted as a Harris Presidency may mean less clarity on the regulatory front. This would likely see BTC still perform well, but ALTS would likely underperform. This is with a short, medium and long-term outlook.

Outcome 5: Election is contested

Least likely

Markets dislike uncertainty, and a contested election would extend this uncertainty, and within this, you might still see some TradFi hedging unwind, but most remain on, which could be somewhat ugly.

Summary: Risk assets would likely react poorly to a contested election, and we wouldn’t be surprised to see BTC sell off 5-15% under this outcome.

Cryptonary’s take

Regardless of who wins the upcoming U.S. election, the outlook for the crypto market remains neutral to bullish in the long term. Both candidates, Trump and Harris, show a degree of accommodation towards the industry. The market’s preference leans towards a swift resolution, as it craves the end of uncertainty to adapt to specific policy directions.Trump’s vocal and bullish stance on crypto, including his intentions to clarify regulations and support Bitcoin mining, aligns closely with market sentiment. His promise to remove regulatory roadblocks like SEC chair Gary Gensler is seen as a positive move for the industry’s growth, especially for U.S.-based startups.

On the other hand, while Harris has not been as explicit in her support, her administration’s signals suggest a shift from the hostility seen during the Biden years. This neutrality, coupled with a general openness to innovation, indicates a potential environment where crypto can still thrive, albeit at a more cautious pace.

Ultimately, whoever takes office, the market's primary desire is stability. With both candidates presenting non-hostile stances towards the industry, the election outcome is unlikely to hinder crypto's upward trajectory. The crypto market is likely to react positively once the uncertainty dissipates, setting the stage for continued growth and innovation.

Don’t fumble the bag!

Cryptonary, OUT