Turn stablecoins into more money: 3 stablecoin airdrop strategies for pros

Since we expect the market to continue to be choppy in the coming months, stablecoins remain one of the most effective ways to stay positioned without taking on unnecessary risk. In Part 1 of this series, we explored how Ethereal, Level, and Reservoir provided low-risk entry points into high-upside airdrop ecosystems. For those who acted early, the benefits are already beginning to materialise.

In this second edition, we're turning our attention to three additional opportunities: Huma, OpenEden, and Noble. Each brings a unique angle to the stablecoin thesis-whether through real-world credit, tokenized treasury exposure, or native asset issuance within the Cosmos ecosystem. What they share is a common emphasis on capital efficiency, security, and underfarmed airdrop potential.

This guide breaks down how we're approaching each protocol, why we think they matter, and what to watch for as incentives continue to evolve.

Let's dive in…

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Huma Finance (Solana)

Huma Finance is a PayFi protocol bridging real-world lending to DeFi. It enables borrowers to access credit based on future income, such as payroll or invoices-while connecting stablecoins to tangible economic activity.

Backed by Distributed Global and ParaFi Capital, and valued at $38 million, Huma has processed over $4 billion in transaction volume since inception - demonstrating strong traction in the real-world asset (RWA) space. Following the launch of its permissionless deployment on Solana in April 2025, the platform is now open to all users. As of mid-April, Huma boasts over 30,000 depositors and $90 million in active liquidity-respectable numbers, but still modest when compared to its backing, valuation, and long-term ambitions.

Classic Mode participants currently earn a 10.5% APY, offering a rare combination of stable yield and structured airdrop exposure. For airdrop farmers, the strategy is straightforward: deposit stablecoins, accumulate Feathers (non-transferable loyalty points), and position early for what could be one of Solana's largest RWA-token distributions to date.

Strategy: Classic vs. Maxi Mode

When you deposit into Huma, you'll choose between:- Classic Mode (PST): Earns real APY (10.5%) + Feathers

- Maxi Mode (mPST): No yield, but earns significantly more Feathers

Your choice comes down to capital needs and conviction.

- Classic Mode is ideal if you want consistent APY while still farming rewards.

- Maxi Mode is optimal if your sole focus is maximizing Feather accumulation for a potential airdrop.

How to Farm the Huma Airdrop (Solana)

- Step 1: Get USDC on Solana: Use a wallet like Phantom and fund it with USDC.

- Step 2: Visit Huma: Go to Huma Finance and connect your wallet.

- Step 3: Choose a Mode: Pick between Classic (PST) or Maxi (mPST):

- Classic = yield + points

- Maxi = no yield, maximum points

- Step 4: (Optional) Lock Your Position: Locking boosts your Feather multiplier significantly:

- No lock: 1x (Classic) or 5x (Maxi)

- 3-month: 3x (Classic) or 15x (Maxi)

- 6-month: 5x (Classic) or 25x (Maxi)

- Step 5: Deposit USDC: Approve the transaction. You'll receive either PST or mPST based on your selected mode.

- Step 6: Monitor Rewards: Feathers accumulate automatically and are tied to your wallet. They cannot be traded or transferred. If you exit via Jupiter, any lockup-based multipliers will be forfeited.

Exiting Your Position

If you've selected a no-lock position-or your lockup period has ended-you can exit through one of the following methods:- Direct redemption via the Huma dApp:

- Navigate to the Portfolio tab

- Select your position

- Request redemption back into USDC

- Redemptions are processed within 1-7 days

- Instant exit via Jupiter:

- In the Portfolio tab, switch your position from Maxi Mode back to Classic Mode

- Once converted to PST, head to Jupiter Aggregator

- Swap PST → USDC instantly for real-time liquidity

Recommendation

Given the current reward structure and the likely timeline for a token launch, our strategy is to enter with a 6-month lock-in Maxi Mode. This earns a 25x Feather multiplier, making it one of the most capital-efficient stablecoin airdrop farms live today-especially if the airdrop doesn't occur until late Q3 or beyond.That said, this strategy is best suited for those who don't need access to the capital during the lock period. If liquidity is a priority, consider using a shorter lock or staying flexible in Classic Mode.

As more integrations come online-such as Kamino or Meteora supporting PST/mPST as collateral-rotating into Classic Mode or looping via money markets may unlock additional upside through real yield or leveraged Feather compounding.

Here is how it's done

OpenEden and Upshift (via cUSDO)

OpenEden brings real-world yield into DeFi by tokenising U.S. Treasury bills into on-chain assets. Its stablecoin, cUSDO, is fully backed by short-duration sovereign debt, enabling users to earn low-risk, dollar-denominated yield on-chain. With over $120 million in TVL and fewer than 15,000 users, OpenEden remains significantly underfarmed-making it a prime candidate for stablecoin-based airdrop strategies.

The platform's "Bills" points system tracks cUSDO usage across protocols like Pendle, Euler, Morpho, Spectra, and Upshift-each offering different multipliers and reward structures. Among them, Upshift stands out not only for its efficiency and dual rewards, but also for being backed by top-tier firms including Dragonfly, Hack VC, Robot Ventures, and 6MV, with additional institutional support from August Digital. Meanwhile, OpenEden itself boasts ecosystem participation or partnership signals from giants like BlackRock, BitGo, Galaxy, Ripple, Arbitrum, and BNP Paribas-underscoring the credibility of the RWA thesis it's built on.

Farming Strategy: OpenEden + Upshift

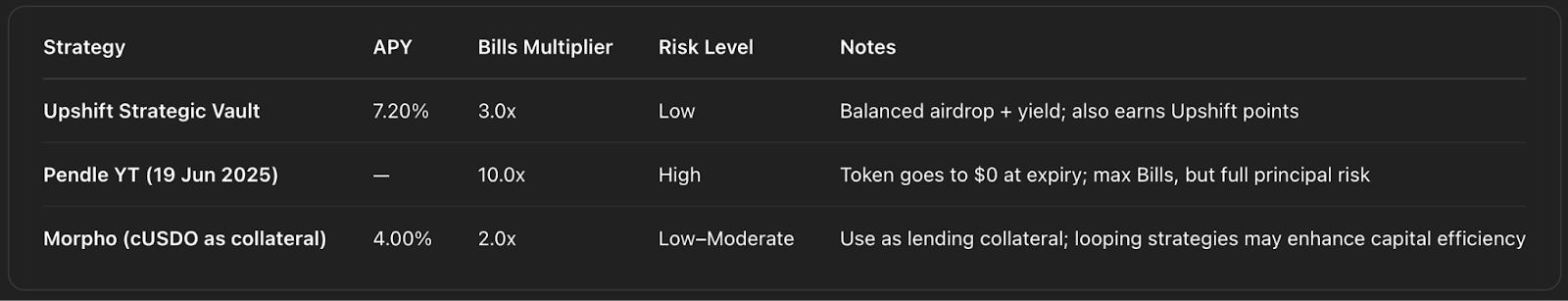

The most straightforward route is through Upshift's Strategic Vault, which offers a 3.0x Bills multiplier and an estimated 7.2% APY. This vault also earns Upshift Points, giving you dual exposure to both ecosystems ahead of potential token launches.Like many other protocols we've covered, there are a number of different options when it comes to parking our liquidity-each with its own balance of yield, risk, and airdrop potential:

Here's a breakdown of the top strategies based on current data:

How to Farm the OpenEden + Upshift Airdrop

- Step 1: Acquire cUSDO (contract address 0xaD55aebc9b8c03FC43cd9f62260391c13c23e7c0)

- Step 2: Choose a Strategy

- Step 3: Track Rewards

- Step 4: Exit Anytime

Recommendation

For most stablecoin farmers, the Upshift Strategic Vault is the cleanest strategy available right now. It offers:- A solid 7.2% APY

- 3.0x Bills from OpenEden

- Upshift Points for a second potential airdrop

- Full flexibility with zero lockups

Here is how it's done

⚠️ Note: A separate Pendle YT strategy for Upshift also exists for those looking to farm the protocol independently.

Noble

Noble is a Cosmos-native blockchain purpose-built for secure, compliant asset issuance across the interchain. Through its integration with the M^0 Protocol, Noble enables the creation of USDN (Noble Dollar)-a stablecoin fully backed by U.S. Treasury Bills that accrues yield automatically on-chain.

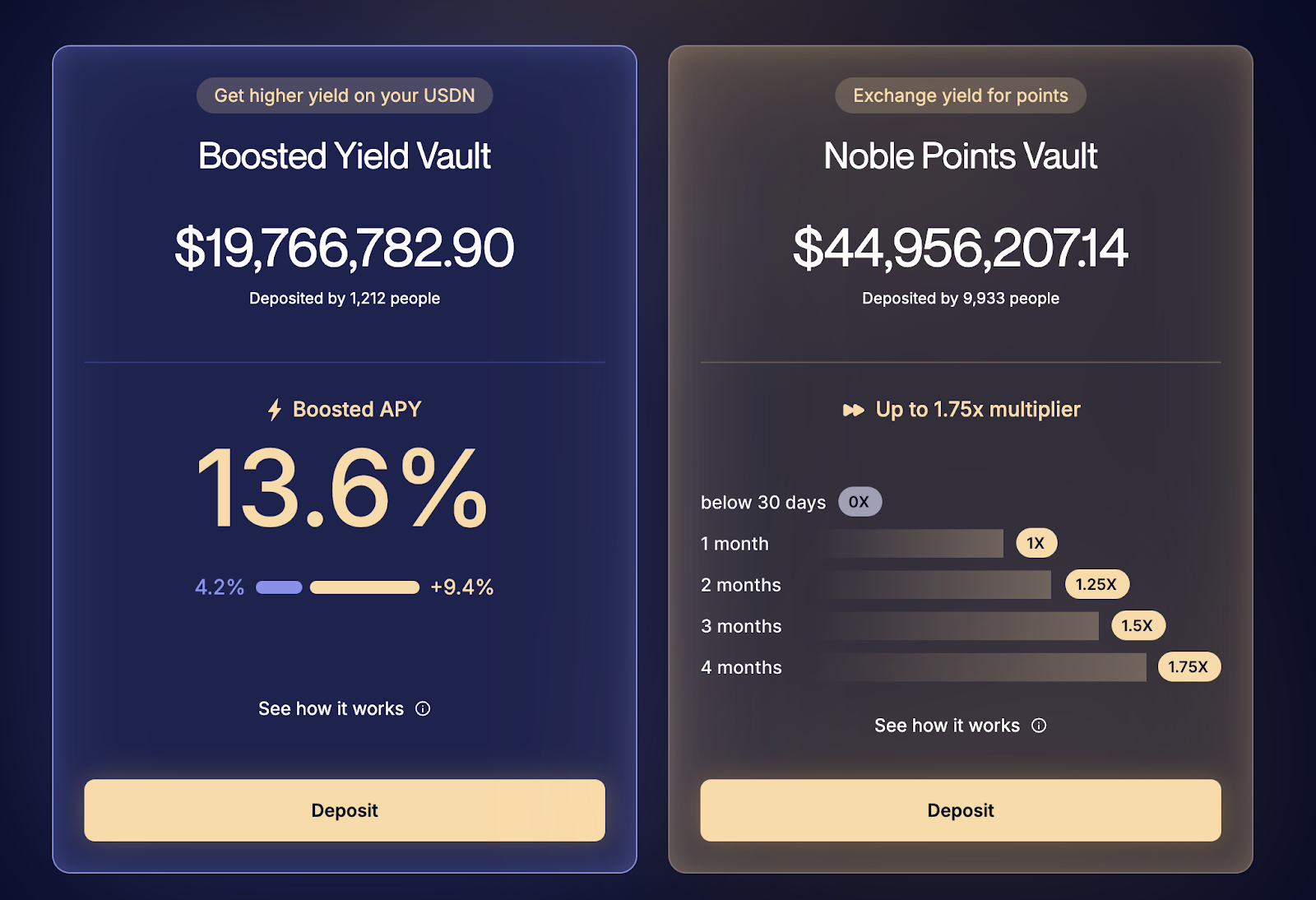

Backed by Paradigm, Wintermute, Polychain, and Circle Ventures, Noble raised $15 million in its Series A (Nov 2024) and has already onboarded top-tier stablecoin issuers like Circle and Ondo Finance. Despite this institutional support, participation remains light: as of now, only 9,933 users have deposited into the Noble Points Vault, with TVL hovering around $45 million-a clear signal that the protocol is still significantly underfarmed relative to its potential.

How to Farm Noble Points: Step-by-Step Guide

- Step 1: Set Up a Cosmos-Compatible Wallet

- Step 2: Bridge USDC to Noble

⚠️ Note: Gas fees on the Noble chain are paid in USDC. Be sure to bridge a few extra dollars beyond what you plan to farm with.

- Step 3: Swap USDC for USDN

- Step 4: Choose a Farming Vault

Time-sensitive: Unfortunately, there are approximately 73 days remaining in the current Noble Points program window. If starting today, the maximum multiplier attainable is 1.25x, short of the full 1.75x reserved for a 120-day hold.

Vaults are managed at: points.noble.xyz

⚠️ Note: Be sure to deposit the full amount you plan to farm with, upfront-adding additional funds later will reset your multiplier.

Whether you prefer to prioritize yield or accumulate points toward a potential airdrop depends on your individual goals and liquidity needs. Both vaults offer stablecoin-native strategies with no exposure to token volatility.

Here is how it's done

Cryptonary's take

The macro picture remains uncertain, with rate cuts in limbo and liquidity still fragmented-signaling a clear lack of broader risk appetite. In this environment, a defensive strategy still remains key: farm with stablecoins to minimise downside while accumulating airdrop rewards that can be rotated back into USDC for future opportunities.Protocols like Huma, OpenEden, and Noble act as active tools to extract value from stablecoins - blending airdrop potential with steady yield to keep us engaged without taking on unnecessary volatility. Collectively, they help us build a robust war chest, positioning us to act decisively when the next major trend emerges.

We'll be watching closely as summer unfolds. If momentum returns, we pivot.

Until then, we farm, accumulate, and prepare rush, just precision.

Stay early. Stay liquid.

Cryptonary, OUT!