The crypto market is not always a zero-sum game where one project has to die for another to thrive.

Crypto is big and diverse enough to offer many winning gems—and today, we present you with another Layer 1 blockchain, the Aptos protocol, which has been quietly building up momentum.

However, we will be focusing on a project within the Aptos ecosystem - it has rallied over 51% over the past day to reach a new all-time high on March 21.

This project has a serious price discrepancy and is undervalued even today.

Let's dig in!

TDLR

- Aptos is an emerging Layer 1 blockchain gaining significant traction and momentum in 2024.

- Within the Aptos ecosystem, an under-the-radar DeFi project has been quietly building and recently surged 51% to new all-time highs.

- This DeFi project, focused on decentralised exchanges and lending, is severely undervalued compared to its on-chain performance metrics.

- It dominates around 50% of Aptos' total value locked (TVL) yet has a tiny market cap, representing a major valuation discrepancy.

- The project has strong tokenomics with reducing emissions, is rapidly expanding product offerings, and is a key driver of Aptos' user growth.

- Our projections show the potential for a 9.5x - 15x upside in the token's price from current levels as it plays catch-up to its fundamentals.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

What is Aptos?

The Aptos blockchain is a revolutionary platform designed to address the limitations hindering blockchain technology's mass adoption. It has a focus on scalability, safety, reliability, and upgradeability. It aims to establish a new era for Web3 infrastructure, enabling developers to deploy decentralised applications (DApps).A relatively new blockchain in the ecosystem, Aptos leverages the Move programming language, which allows the protocol to boast a transaction throughput of 150,000 TPS at maximum capacity. It can employ such high transactions due to its parallel execution environment and Proof-of-Stake consensus mechanism.

Why is Aptos building momentum in 2024?

One key objective of the Aptos protocol is to provide the foundation for a unique DeFi ecosystem fueled by a community of builders. Over the past year, they have progressively onboarded multiple dApps, liquidity protocols, and investment platforms, and now the adoption is starting to unfold in the larger landscape.

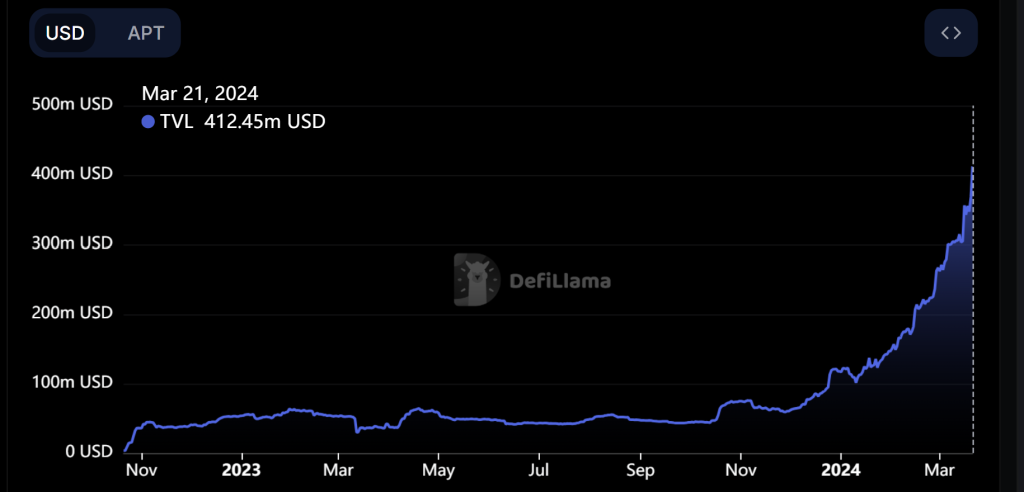

From the beginning of January to March 21, 2024, Aptos' total value locked or TVL has risen from $116.7 million to $412 million. That is a 255% year-to-date increase, which is a remarkable feat. Major protocols like Thala, Amnis Finance and Aries Markets have led the charge, and we will discuss how Thala is at the forefront of this entire ecosystem.

Additionally, it is important to note that Aptos is establishing several key partnerships at the intersection of real-world assets (RWA) and AI, bringing more positive tailwinds for the network.

Recent key announcements include:

- Aptos' native integration with Ondo Finance USDY.

- Partnership with Microsoft AI.

- Top-flying AI/Depin projects like IO.net, Ritual, and Nimble Network are deploying on the network.

Thala Labs: The leading protocol on Aptos

DeFi is a key segment of the crypto industry, and many DeFi users rely on DEXs or DEXs aggregators to execute DeFi strategies. Thala Labs is a DeFi platform that stands out in the Aptos ecosystem.

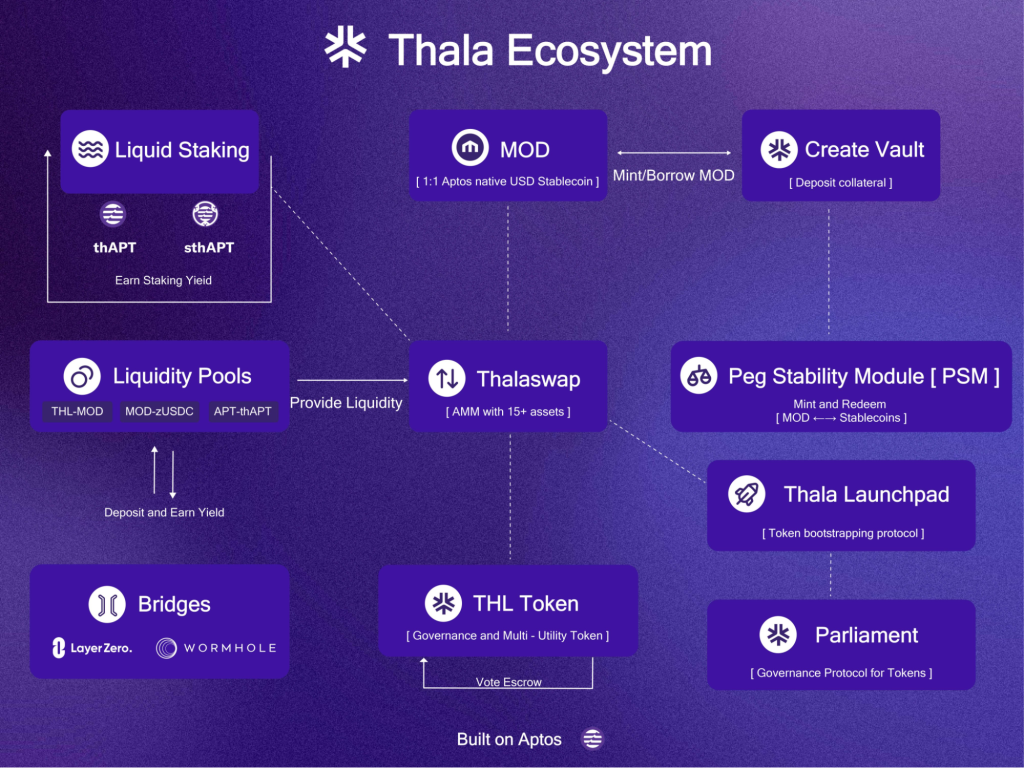

Thala is a decentralised finance (DeFi) protocol native to the Aptos blockchain. The protocol revolves around two key products: Move Dollar and Thala Swap.

Right now, Thala is the most dominant DEX on Aptos, as it is responsible for more than 70% of the DEX volume on the Aptos network and represents around 50% of Aptos' TVL. It owns a major piece of the DeFi vertical, with its AMM capitalising on growing on-chain activity, its CDP enabling seamless and capital-efficient borrowing, and its LSD product facilitating scalable $APT yields. It also has a launchpad to bootstrap new protocols, and more features are in the pipeline.

Long story short, Thala is at the forefront of Aptos' emerging narrative. Its wide and interconnected suite of products has positioned it to capitalise on all catalysts that Aptos has lined up.

THALA's value proposition

Thala differentiates itself from other market competitors by its unique horizontal expansion strategy.Unlike other protocols, such as PancakeSwap and LiquidSwap, which concentrate on developing products with a single niche category, Thala offers a diversified suite that includes many DeFI products.

Since the launch of its Liquid-Staking derivatives, Thala's TVL has skyrocketed. Its LSD protocol is anticipated to be a key product, distinguishing itself by offering stakers a commission-free experience. This feature sets it apart from other staking services that levy fees. The liquidity of LSDs also provides a vital advantage for stakers who value liquidity on staked APT.

Tokenomics

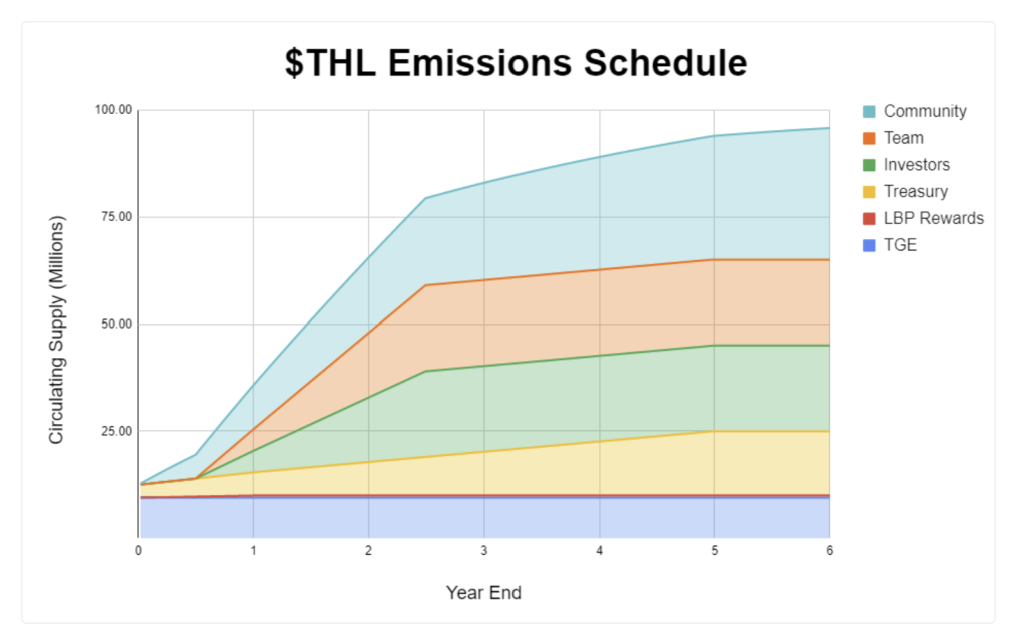

Thala's tokenomics can appear quite inflationary at first glance.The total supply of THL tokens is 100 million. Now, while the token distribution is designed to ensure that active users of the protocol earn THL tokens, the allocation for the Team, Advisors, and Investors is very high.

The distribution is listed below:

- Community: 35%

- Investors: 20%

- Team and Advisors: 20%

- Treasury: 15%

- Token Generation Event or TGE: 10%

As illustrated in the chart above, 18 months after TGE (TGE was in January 2023), 50 million THL will be in circulation. The circulation supply is 31.98 million.

Now, here is the positive catch. According to a recent announcement, starting March 13, THL emissions have been reduced by 50% across all weekly epochs from now on. This move has been initiated to decrease inflation and utilise unallocated THL for the protocol's development.

With the emission reduction, THL's current emission of $10 million THL has dropped to $5 million THL annually, and there is speculation that emissions can drop further by 50%.

So overall, the tokenomics is less inflationary now, considering these new factors.

Market expansion and onboarding

Thala has an incubator called Thala Foundry, which runs as a joint incubator with Aptos Labs. This incubator supports several high-quality DeFi and AI teams launching from Q2 to Q3 2024. The first of such projects is Echelon Markets, which is currently in testnet.Thala will also be announcing expansion plans to new Move ecosystems soon.

There's also a hint of adopting the Velodrome airdrop model.

The long-term vision is to transform the THL token into a deflationary, utility-driven asset, which serves as a proxy for the broader Aptos ecosystem.

On-chain health

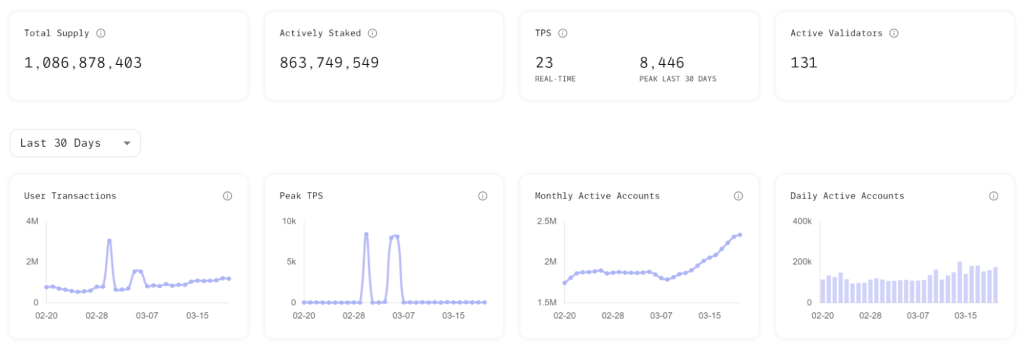

This particular part is interconnected with Aptos, as the parent blockchain has witnessed high on-chain activity over the past 30-days.Since Thala is not a blockchain, its transactional activity is recorded on the Aptos analytics. Since it comprises around 50% of Aptos' TVL, it is safe to assume that most of the activity is based on Thala Labs.

Aptos has registered an impressive number of daily active accounts, over 100,000 each day over the past month. The monthly active accounts have also gradually increased over the past year, peaking at 2.3 million in March. These numbers are seriously impressive to the point that they feel slightly inflated.

That is scepticism, speaking from a research point of view. Still, considering user transactions over a million per day, this data might have more truth than false accumulation. From an on-chain point of view, this is a major positive tailwind for both Aptos and Thala, which can organically increase the market value so much further over the next few months.

Miscellaneous factors

From a social presence, Aptos has a decent market presence with over 490,000 followers, where each tweet has decent organic engagement.Thala Labs is not as widely followed, but the project is beginning to find its footing, with over 340% increase in followers over the past 30-days.

The key partnerships mentioned earlier should also be kept in mind. Beyond the announced partnerships, the fact that Blackrock and other major AMCs are betting big on tokenisation also means the RWA narrative is coming, and Aptos is uniquely positioned to ride the wave.

Valuation exercise

To understand Thala Labs's valuation, we need to compare it side-by-side with its parent blockchain, Aptos.Let us tabulate some hard datasets.

When we compare Aptos and Thala, there is an obvious discrepancy in the market cap valuation.

Aptos is valued 62x times higher than Thala Labs. Thala Labs is just one of the protocols on Aptos, but it is very competitive when the TVL is compared. Thala is responsible for 47% of the TVL on Aptos, which means a huge price-value discrepancy exists.

When the revenue generated is compared, Thala's annualised fee is almost 2x higher than Aptos's, and its Price-to-sales ratio is also ideal at 25.6x. For Aptos, the P/S ratio suggests an overvalued protocol.

However, the key difference here is that Aptos cannot be solely valued based on how much revenue it generates since it is an L1 blockchain with other value propositions.

However, with Thala Labs, there is a major price discrepancy, where its true value is lagging behind its on-chain demand. $THL market cap is currently less than 50% of its TVL on Aptos, which means the market value for THL should be much higher than its current price.

Now, considering Apto's market cap, bullish tailwinds and positive catalysts, it is reasonable to state that the token could rise to at least $10 billion in 2024-2025.

Hence, Thala's strong TVL market share and use case should allow the token to be worth 10-15% of Apto's market cap at its bullish peak. Therefore,

- As a base case, THL should reach a $1 billion market cap, i.e. 9.5x at $28

- As the bullish case, THL may reach a $1.5 billion market cap, i.e. 15x at $45

(It is important to note that the base and bullish case may vary by +/- $3-5, considering token emissions will be there over the next few months.)

Technical analysis

Thala's native token, THL, reached a new all-time high a while back, reaching a peak of $3.18.

The asset is currently under price discovery mode, as it has rallied by more than 145% since March 13.

Its year-to-date ROI is around 293%, with long-term support at $1.29.

While the price may continue to rise as it is riding bullish momentum, an ideal correction down to $2-$2.30 will be a range to bid buy market orders.

The Relative Strength Index or RSI also indicates an overbought position, but we have noticed assets record multiple highs after reaching an OB position.

Cryptonary's take

Thala's current market predicament is a classic case of "buy high, sell higher".The token reached a new all-time high of $3.13 on March 21, so it seems to be a bad time to buy the asset. However, with established on-chain activity and a legitimate product, investors need to keep the long-term in mind.

THL's value discrepancy with respect to its market value, coupled with other bullish tailwinds, should push the asset higher in price. With a market cap of under $100 million at the moment, it is certainly not an over-valued bet.

We expect Aptos and Thala to perform in correlation, with Thala taking over from a relative ROI performance perspective. We will keep a close eye on this project to stay ahead and make necessary changes to our price target if required.

Cryptonary Out!