The challenge, however, is that newer entrants have a harder time getting a foothold because decentralised trading is a competitive sector—major projects like Uniswap, Curve, Raydium, etc., already account for a major share of that market.

Yet, we found a relatively new DEX making a significant stride in this sector. It also has the direct support of one of the biggest centralised exchanges in the market. Yes, it sounds contradictory for a DEX or AMM to have ties to centralised entities, but for Aerodrome Finance, this contradiction is the sauce for success.

We've previously highlighted Aerodrome Finance as a proxy for Base's potential success; now, we're digging deeper to estimate its upside potential.

Let's dive in!

TDLR

- Aerodrome Finance is the premier DEX on Base. It combines a decentralised structure with centralised support—a contradiction fueling its success.

- AERO's strengths include $715M TVL, $33M daily volume, and $2M+ weekly fees. The innovative AERO/veAERO system incentivises long-term holding and governance.

- Why is this an undervalued giant? Metrics suggest a significant upside compared to peers like Uniswap and PancakeSwap.

- Post-Ethereum's Dencun upgrade, Base saw 175% user growth and a 261% TVL increase, hitting $1.75B. Aerodrome is its liquidity hub, outpacing even Uniswap on Base.

- ROI targets: We see an 11x upside tied to Base's goal of onboarding 1B users.

- AERO's inflation (83% by 2025) is a concern, but strong on-chain metrics and Base's growth make it a compelling, mid-risk opportunity.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Introducing Aerodrome Finance

In our March 2024 report on Base Network, we mentioned that Aerodrome Finance was a good proxy for exposure from the Base Network.Another positive catalyst around the same time was that Coinbase Ventures invested an undisclosed sum in the project. Since then, Aerodrome Finance has witnessed significant on-chain activity.

Aerodrome Finance is an automated market maker and liquidity platform that acts as the Base network's central liquidity hub. It combines an advanced liquidity reward system with a governance structure based on vote-locking, which generates user incentives.

Imagine a marketplace where people can swap cryptocurrencies. Aerodrome Finance wants to make this marketplace efficient by rewarding users who help it grow. In operations, traders are expected to get better prices when swapping tokens, and liquidity providers earn native tokens as rewards for contributing to the liquidity pools.

Aerodrome Finance has two key tokens: AERO and veAERO.

Utility token (AERO): This is like regular money you use on the platform. Users can buy this token on exchanges and also get this token by providing liquidity.

Governance token (veAERO): You can think of this as a special membership card. Users receive this by locking up their AERO tokens for a while. The longer you lock your tokens, the more voting power you get. This lets you influence decisions about the platform, like which pools get rewarded. In exchange, these voters collect 100% of the fees and incentives from the pools they support.

The relationship between AERO and veAERO develops a self-reinforcing cycle of liquidity. The prospect of rewards attracts users to the platform, leading to more purchases of AERO tokens. And it works – more than 14,000 veAERO lockers vote weekly to direct AERO rewards to the most productive liquidity pools.

Tokenomics

Aerodrome Finance has two tokens:- AERO: ERC-20 utility token

- veAERO: ERC-721 governance token

The initial circulating supply was 500M tokens, with 50M unlocked as AERO and 450M locked as veAERO tokens. The initial distribution chart is listed below:

- AERO

- Voters Incentives: 40M -8%

- Genesis Liquidity Pool: 10M - 2%

- veAERO

- Airdrop for veAERO Lockers: 200M- 40%

- Ecosystem Pools and Public Goods Funding: 105M- 21%

- Aerodrome Team (Auto Max-Locked): 70M-14%

- Protocol Grants: 50M, 10%

- AERO Pools Votepower: 25M- 5%

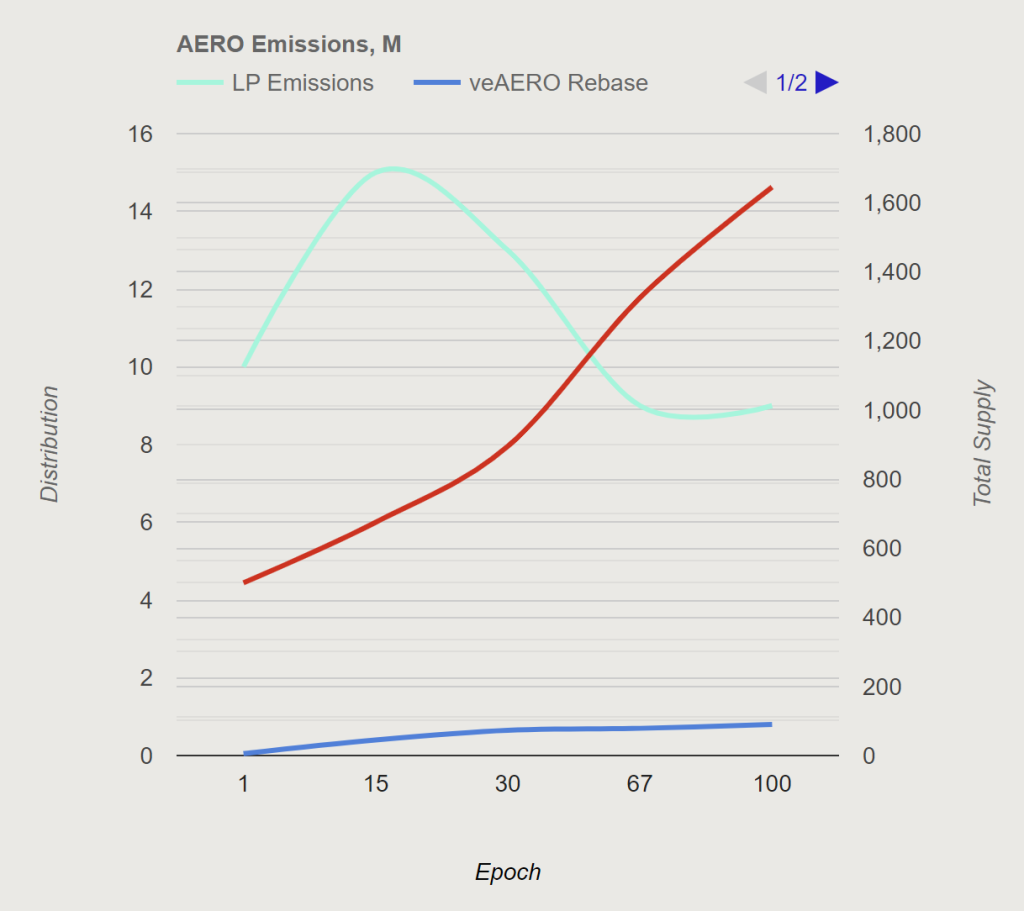

In the first 14 weeks or epochs, 10 million AERO releases were administered, with a 3% daily increase. This emission rate started decaying at 1% from week 15 onwards to reduce the overall token inflation over time. We are currently at epoch 40.

The projected emission schedule is charted below:

The current circulating supply of AERO tokens is 479 million, rising 858% since its launch in August 2023. However, since week 15, the total emission supply has been decreasing by 1% per epoch, currently sitting at 13,575,147. This will continue until token emissions reach under 9 million per epoch; this is projected to happen around the 67th epoch.

After that, veAERO voters will take control of Aerodrome's monetary policy through the Aero Fed system, which voters will decide between:

- Increase emissions by 0.01% of total supply

- Decrease emissions by 0.01% of total supply

- Maintain emissions unchanged as % of total supply

After the 67th epoch, sometime in June 2025, emissions will continue to increase by 0.01% each week. The total circulating supply will reach around 850-880 million tokens.

Investment thesis

We are bullish on Aerodrome Finance primarily because of its essential role in the Base Network and our confidence in Base's prospects as an ecosystem.The 'Base' effect

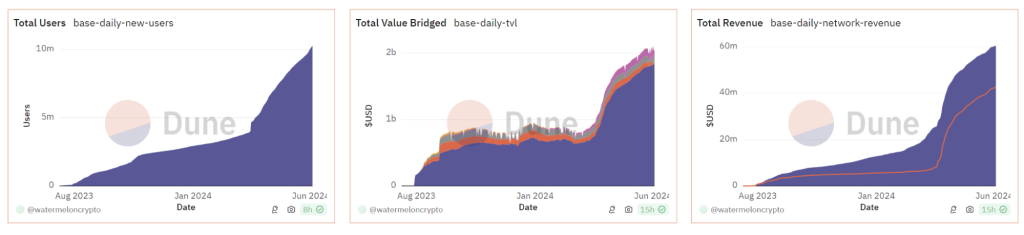

Even though L2s are losing the momentum they had earlier in the year, there is clear evidence that people are actively using these networks (Check our L2 narrative report for more context).Amidst the competitive L2 ecosystem, Base has managed to acquire a major chunk of the market in 2024. It was launched in August 2023 but witnessed a parabolic rise in activity after the Ethereum Dencun upgrade in March 2024. The reduction in transaction fees registered a flurry of activity on the network, and the statistics highlight the same.

The chart shows that the total number of users, TVL, and total accumulated revenue rose sharply in March 2024. From a number-centric point of view, the growth registered was,

- Total Users from March 1 to date: 3.7M to 10.2M, i.e. 175% increase

- TVL from March 1 to date: $481M to $1.75B, i.e. 261% increase

- Total revenue from March 1 to date: $19.7M to $60.4M, i.e. 206% increase

- Total profit(part of revenue) from March 1 to date: $16M to $42.5M, i.e. 165% increase

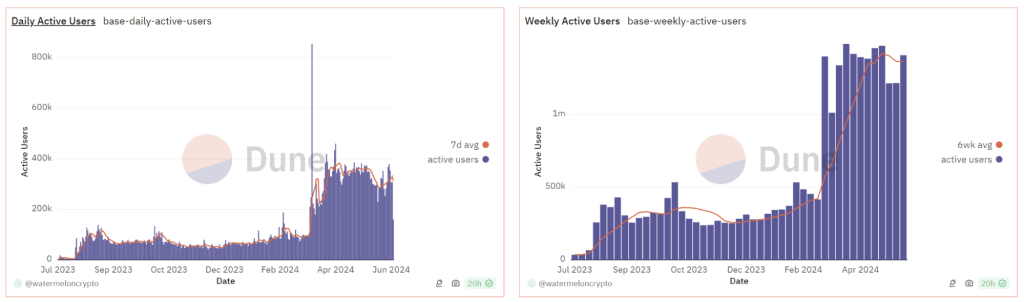

Additionally, it is important to note that the number of daily active users (DAUs) and weekly active users (WAUs) has remained constant.

As illustrated above, the 7-day average DAUs has remained above 300,000 since March, and the 6-week average WAUs is above 1.36 million. This further strengthens Base's case as a popular layer 2 network.

Compared with other L2s such as Arbitrum and Optimism, Base also leads the number of daily transactions or transaction count. However, Arbitrum has a higher number of active addresses in its ecosystem. Overall, Base is a legitimate L2 ecosystem with over 250 active DeFi protocols; this is where Aerodrome comes into play.

Aerodrome's on-chain strength

Base doesn't have a native token, and Coinbase hasn't shared any plans to release one. Therefore, Aerodrome Finance's AERO is in the driver's seat to benefit from Base's market success.

For starters, Aerodrome is the largest DeFi protocol on Base, according to the TVL metric. The total value locked on Aerodrome is $715 million, recording over $33 million in its 24-hour token volume. For what it's worth, Aerodrome is also ahead of Uniswap on Base, solidifying its case as the main DEX on the network.

Since Aerodrome is the central hub of the Base network, most of the projects launching on Base use Aerodrome to drive liquidity. Hence, there's a demand for AERO from these projects. From a business model perspective, this demand can drive substantial capital flows into AERO.

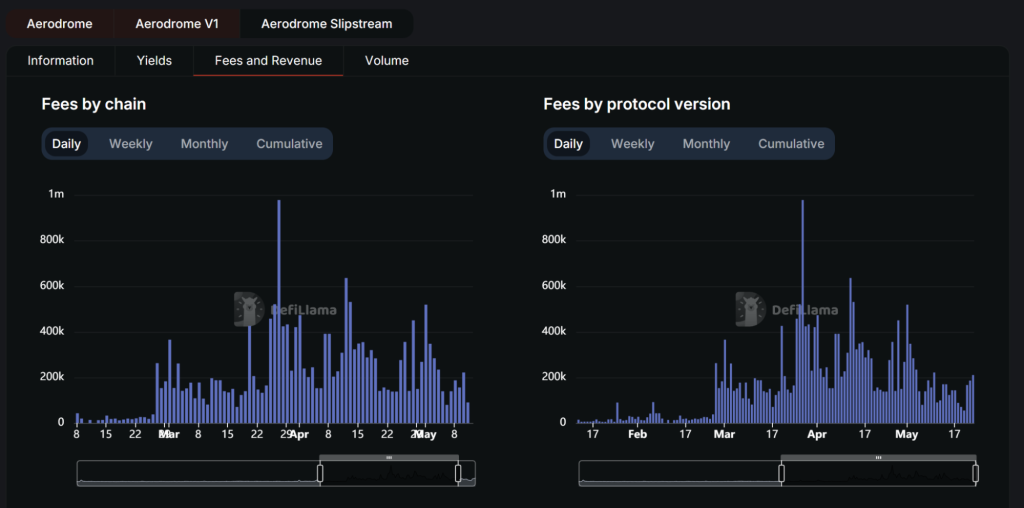

From a revenue perspective, Aerodrome has been generating strong numbers for a prolonged period. It has been generating revenue since March and boasts more than $2M in weekly fees.

The revenue numbers showed an aggressive spike in May 2024 when Aerodrome processed $3.3B in volumes with the help of its Slipstream protocol. For context, Slipstream is Bases' leading concentrated liquidity solution.

Valuation exercise

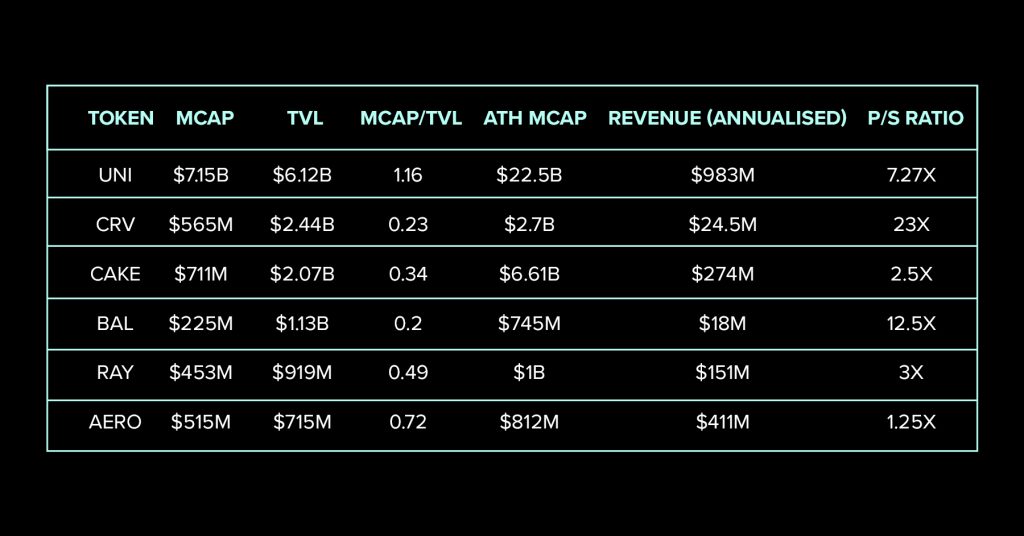

Aerodrome Finance's market cap is currently $515 million, which is already pretty huge. Hence, estimating the ROI from here becomes a bit tricky, especially when you consider the inflationary tokenomics.So, to have a valid estimation, we conducted a comparative analysis between Aerodrome and its current market competitors. While the list of competitors is huge, we are only considering the projects that are ahead of Aerodrome in terms of total value locked or TVL.

The list of competitors includes:

- Uniswap

- Curve Finance

- Pancake Swap

- Balancer

- Raydium

A few clarifications before we draw an estimate for the Aerodrome:

- We are utilising the ATH market cap rather than the ATH price because the circulating supply of most of these tokens has increased since their market peak. Since Aerodrome also has an inflationary token, comparing it with other ATH market caps rather than ATH prices makes more sense.

- The price-to-sales ratio is calculated by dividing the circulating market cap by annualised revenue. A lower value suggests the project is undervalued, and revenue outpaces valuation.

- TVL data has been drawn from DefiLlama since it includes all the DeFi protocols on the respective network

- The Market Cap/TVL ratio gauges the protocol's health. Similar to the P/S ratio, a lower value suggests that the network has more demand than its valuation dictates. A ratio under 1 is undervalued, 1-4 is fairly valued, and above 4 is overvalued.

From a Market Cap/TVL ratio perspective, almost every network is undervalued besides Uniswap, but Curve Finance and Balancer are extremely undervalued, with 0.23 and 0.2 ratios, respectively. Where both these falter is that they also do not generate high revenue, witnessing the larger P/S ratio of the bunch.

Aerodrome Finance boasts the best P/S ratio of 1.25x, while its Market Cap/TVL ratio is also under 1. Data from earlier also indicates that its TVL has grown rapidly over the past few months, and the expectation is that it will continue due to the Base network.

You can argue that Raydium is also an equally enticing opportunity based on its lower market cap, market Cap/TVL and P/S ratio. However, Raydium does not have the same bullish catalysts in the form of Coinbase Ventures and the Base network that supports Aerodrome.

Therefore, based on the current market dynamics and the fact that Base is trying to onboard 1 billion users, Aerodrome will be involved in every protocol built on the L2.

With on-chain activity and revenue leading its market valuation, Aerodrome Finance can potentially match its competitors' ATH-market cap when DeFi protocols welcome retail flows in the second leg of the bull market in 2024-2025.

- Base case

- Bull case

- Best case

It is important to note that the above valuation targets include the projected circulating supply of 880M tokens by June 2025. Hence, AERO holders must lock their holdings or participate in the governance voting on liquidity pools to receive incentives and remain safe from AERO's inflation.

How to buy AERO

- AERO token address: 0x940181a94a35a4569e4529a3cdfb74e38fd98631

- The token is available on the native Aerodrome (Base) platform, Uniswap V3 and Coinbase.

- To buy on AERO on Aerodrome Finance, go to the website and connect your wallet.

- Change the wallet network to BASE

- Swap AERO for popular tokens such as $USDC, $ETH

- Uniswap V3 and Coinbase can be ideal if users are more comfortable on those platforms.

How to lock AERO on Aerodrome Finance

- Visit Aerodrome.finance/locks and connect your wallet.

- Click the blue "Create Lock" button

- Choose the duration and amount to lock and execute a smart contract by clicking the "Allow AERO" button.

- Allow the smart contract to execute from the connected wallet (need to have ETH in Base for gas)

- Users will not hold a minted veNFT that holds locked veAERO

- Users will be able to view Locked ID on the Aerodrome dashboard alongside locked time, locked amount and voting power

Technical analysis

Since March 2024, the token has been up 5x after the Dencun Upgrade. However, since peaking on April 12, the token has slowly undergone a correction of 58%. Over the past month, the token has undergone sideways consolidation and tested a minor orderblock at $0.60-$0.85.The long-term major order block remains at $0.33-0.45, a key support range. To trigger a second bullish leg, the ideal bullish direction for AERO would be closing a daily position above $1.30.

Cryptonary's take

Aerodrome Finance has an aggressive token emission schedule. The circulating supply will increase by 83% by next year, making it volatile in terms of investment.However, the positive on-chain development and activity surrounding the Base network and Aerodrome Finance are hard to ignore.

Most important Aerodrome metrics are leading token prices in terms of performance, and as highlighted, multiple ratios infer an undervaluation. Hence, while inflationary, the opportunity is still a mid-risk trade considering its bullish catalysts.

Users can get involved in veAERO voting and governance to avoid inflationary pressure to receive liquidity rewards.

That is the ideal way to generate passive income while holding AERO tokens to counter inflation.

Until next time, Cryptonary out!