A secret weapon, once known only to industry insiders, is now turbocharging Uniswap and causing a seismic shift in the crypto landscape.

Are you ready to unravel the truth behind the lucrative bribes that will turn Uniswap into an unstoppable force, outsmarting even its fiercest competitors?

This protocol has been garnering great attention, capital and its token is designed in a way that makes it benefit directly from that growth.

That token has a 30x potential 👀

TLDR 📃

- When it comes to decentralised exchanges, there are two clear frontrunners: Uniswap and Curve.

- Uniswap has the brand recognition, but it also has a big problem . Users are losing out on potential gains due to the underlying mechanics.

- Money is fleeing to the greener pastures of Curve, where a “bribing” system offers additional rewards for liquidity providers.

- Bunni evens the playing field by providing a bribing system for Uniswap.

- Bunni improves upon Curve’s design by preventing whales from dumping on the heads of retail users without suffering critical losses themselves.

- Bunni’s total value locked has been growing steadily, and with a 30x potential in TVL , even a small slice of the pie can mean a major boost for Bunni’s token price.

- Conviction level: 15%

Setting the scene

Uniswap and Curve hold great positions in the DEX market. They offer the best rates because their pools hold lots of capital. And when those rates attract new customers, that pushes rates even lower. This is how monopolies are born.With two big players divvying up the market, you might think there’s no room for a new player. Bunni is carving out a niche by addressing weaknesses in both DEXes while combining their best features.

Bunni is best understood as a utility that delivers one of Curve’s strategic advantages to the Uniswap V3 platform.

Uniswap is the unquestioned market leader, but it has a significant problem. Crypto users who contribute tokens to Uniswap’s liquidity pools lose out on potential gains. Recent analysis has shown that more than half of the liquidity providers on Uniswap would have been better off simply hodling their assets instead of depositing them in Uniswap pools.

Uniswap still leads in volume, but liquidity providers are flocking to Curve, which provides higher rewards in the form of “bribes.” These bribes help offset the "impermanent loss" suffered when the prices of the assets they provide move in opposite directions.

Let’s look at an example:

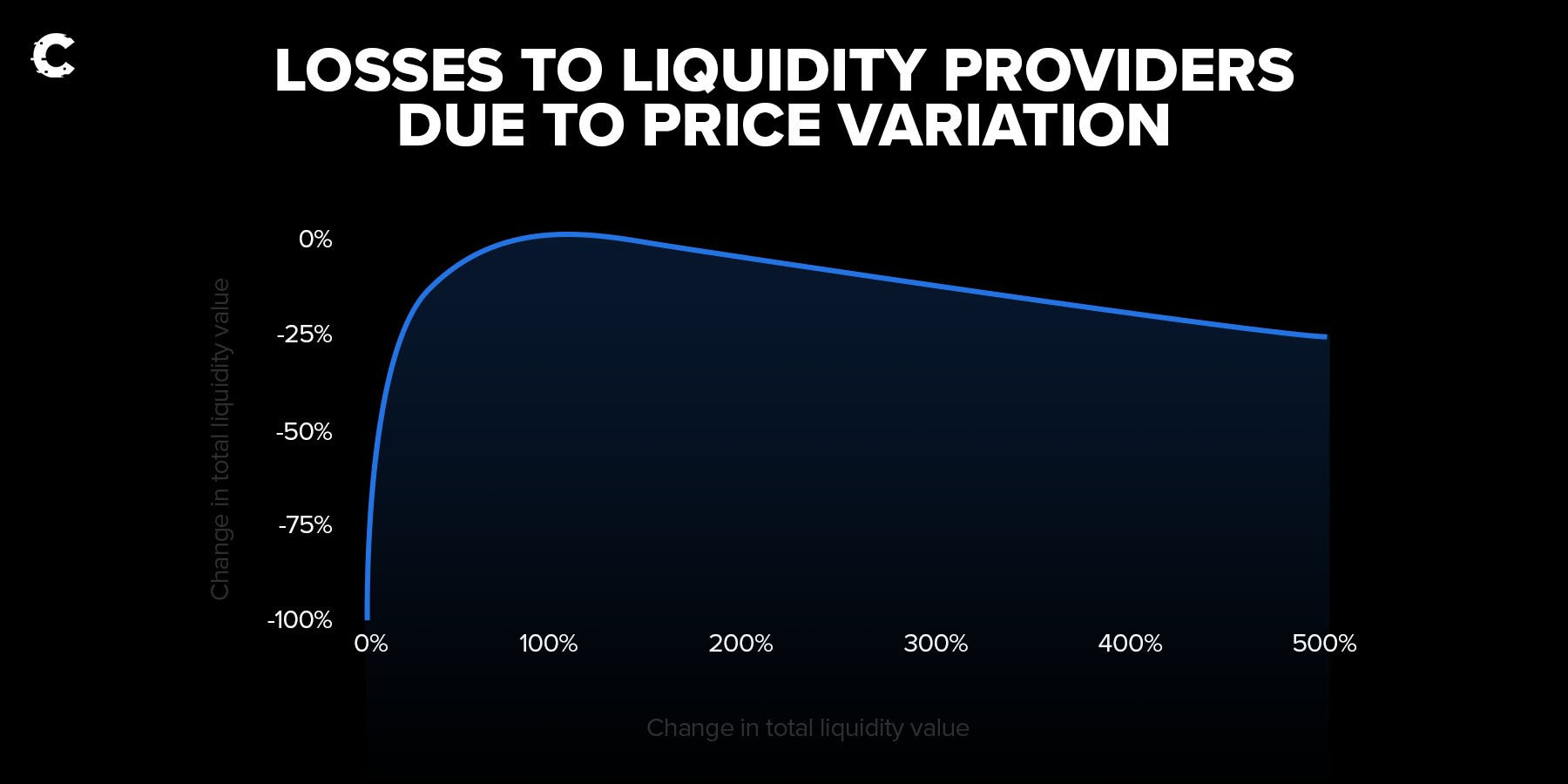

Suppose Bob is providing liquidity to a Uniswap ETH-USDC pool. He deposits equal amounts of ETH and USDC and collects trading fees from users swapping between them. That’s how liquidity providers make their profits.

Now let's say ETH’s price suddenly triples. That would be nice — but not for Bob. Due to the impermanent loss caused by the constant rebalancing that occurs in Uniswap's design, Bob would miss about 20% of the gains he would have realised by simply holding his ETH and USDC.

Similar results would occur if the price of ETH dropped. Due to IL, any drastic movements result in lower returns for LPs. And this is crypto, where high volatility comes with the territory.

Bribes to the rescue

This dynamic created an opportunity for Curve, which adopted a distinctive “bribes” strategy to boost yields for LPs. Ever since May of 2021, shortly after it put bribes in place, Curve has enjoyed faster growth than Uniswap. Bribes give Curve the edge because it can offer deeper liquidity pools and better rates for traders.Bribes — in polite company they’re called “governance incentives” — make governance more efficient and engage token voters. Here’s how bribes work at Curve:

- Curve conducts a biweekly governance vote to determine the allocation of CRV rewards to liquidity pools (eligible pools are known as “gauges”) on its platform. It is these gauge votes that DeFi protocols are after. CRV holders can lock their tokens for veCRV in order to vote.

- DeFi protocols deposit bribes for their gauges into the bribe marketplace. For example, Frax may bribe FRAX pools or Badger DAO may bribe BADGER pools. The bribes are sent to voters as a reward for voting to support the bribers’ gauges.

- At the end of the voting period, CRV rewards are distributed proportionally to gauges depending on how many votes they received. The gauges with the most bribes generally receive the most votes.

- Liquidity pools receiving higher CRV rewards generally end up being more popular due to this influx of additional rewards — this is what the outside DeFi protocols hope to get out of their bribes: deeper pool liquidity.

Bunni levels the playing field

Launched by Timeless Finance in October 2022, Bunni is an innovative protocol that has established the foundation for a bribe market on Uniswap. This is a game-changing development, as liquidity providers no longer have to choose between the DEX with the highest volume and the DEX with the best yield.Curve’s straightforward gauge model doesn’t work with Uniswap’s architecture because on Uniswap, each LP position is represented as a unique ERC-721 NFT. On Uniswap, you would need a separate gauge for every single LP position.

Bunni has created Uniswap V3 liquidity pools that are represented as ERC-20s. Bunni’s DAO discusses which Uniswap pools to add as well as the upper and lower tick ranges, taking the guesswork out for LPs. The pools can now be bribed in Curve style using Redacted’s Hidden Hand marketplace.

Bunni has already enticed several large players to begin offering bribes, including Frax Finance, Aura, Stargate, Liquity, and Badger DAO.

Not just a farming token

Bunni’s liquidity incentive token, LIT, is the backbone of the protocol. While it shares some features with Curve’s CRV, it includes improvements that align the incentives of token holders and liquidity providers.In Curve’s design, LPs earn higher rewards by locking their CRV (converting it to veCRV), but locking is not required. Large accounts can still earn CRV rewards by providing liquidity and exiting their positions and dumping their CRV rewards onto the market.

In Bunni’s design, LPTs must both provide liquidity and lock up their LIT (converting it to veLIT) to receive token rewards. The more liquidity they provide, the more veLIT they must hold to maximise their rewards.

Instead of distributing standard LIT tokens, Bunni rewards LPs with oLIT — call options to buy LIT at a discounted price. This rewards loyal users who provide liquidity and lock up their LIT, encouraging them to compound their rewards and provide more liquidity as LPs.

Due to its high inflation rate and limited use for smaller holders, CRV is often swapped for cash or ETH, which hurts LPs. Selling oLIT can be seen as a continuous token sale, giving the protocol’s treasury sustainable income. It’s a win-win-win.

Bunni’s path to success

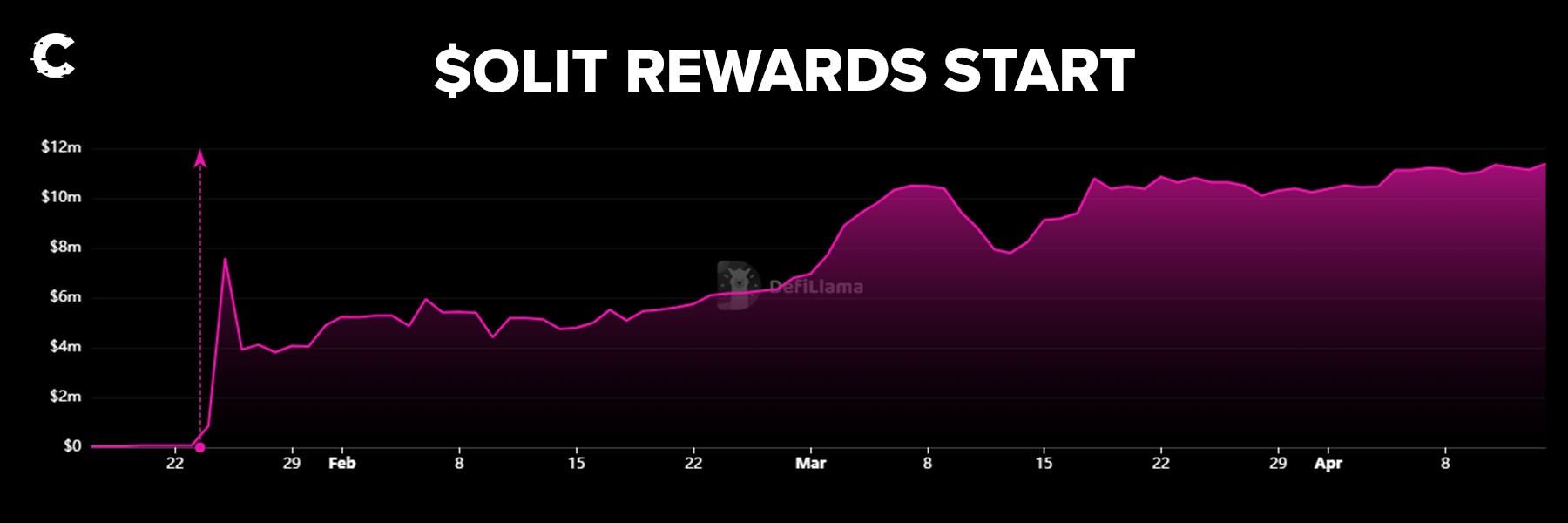

Bunni has seen impressive adoption in its first few months, surpassing $10 million in total value locked. A peek into governance forums confirms that the team has been successful in spreading the word. Each week, more projects add Bunni gauges to incentivise Uniswap pools.

For Bunni, the road to success simple. More partnerships lead to more pools and TVL, which leads to more market acceptance and more partnerships.

And remember: Bunni LPs must hold LIT to receive inflationary rewards. That means the more TVL, the more buying pressure on LIT. In the end, Bunni’s goal is to carve out as much TVL from Uniswap pools as possible — and they’re off to a great start.

Going a bit deeper down the rabbit hole (no pun intended), Bunni is using its growing treasury to do some bribing of its own — directing BAL rewards to its LIT-WETH Balancer pool. This further compounds rewards for users with a long-term stake in the protocol.

Uniswap V3 forks — a red flag?

The licence for Uniswap V3 code expired on April 1st. As a result, anyone can fork this code and build their own version. In fact, new forks are popping up at a rapid pace (source). Uniswap’s popularity makes it easy to be bullish on V3 adoption.A common complaint about Uniswap’s UNI token is its lack of value accrual. Uniswap has repeatedly balked at turning on a “fee switch” that would direct some trading fees away from LPs and to UNI token holders. Forks fighting among themselves over the best way to attract value by modifying this code could draw many new eyes (and dollars) into the Uniswap ecosystem.

For Bunni, it doesn't matter which forks survive. If they plan on incentivising liquidity (which most new projects do), Bunni is the perfect solution. This leads to more pools, more TVL, and more bribes.

Valuation exercise and price targets 💰

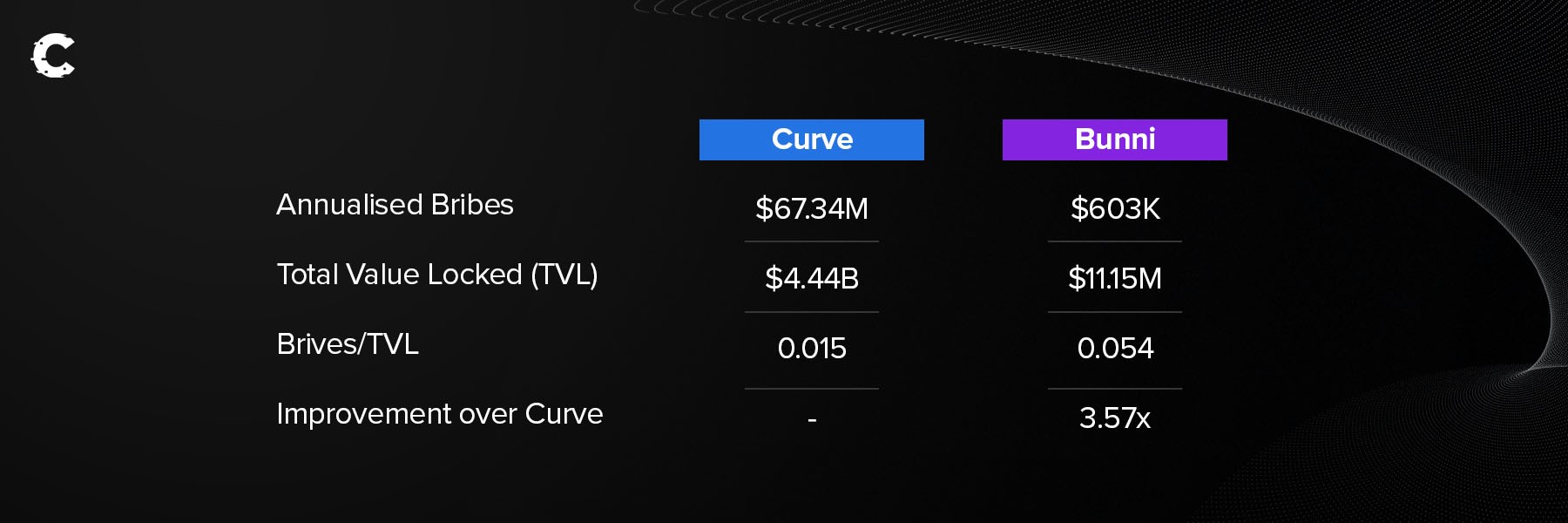

Let's do a "gut check" to see if Bunni's bribe market is on par with Curve's.Although Bunni's biweekly rewards of approximately $23K may seem small compared to Curve's $2.6M, they are actually quite impressive. When normalised according to TVL, Bunni is ahead, with a 3.5x improvement over Curve.

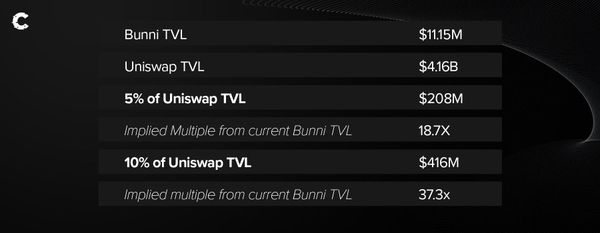

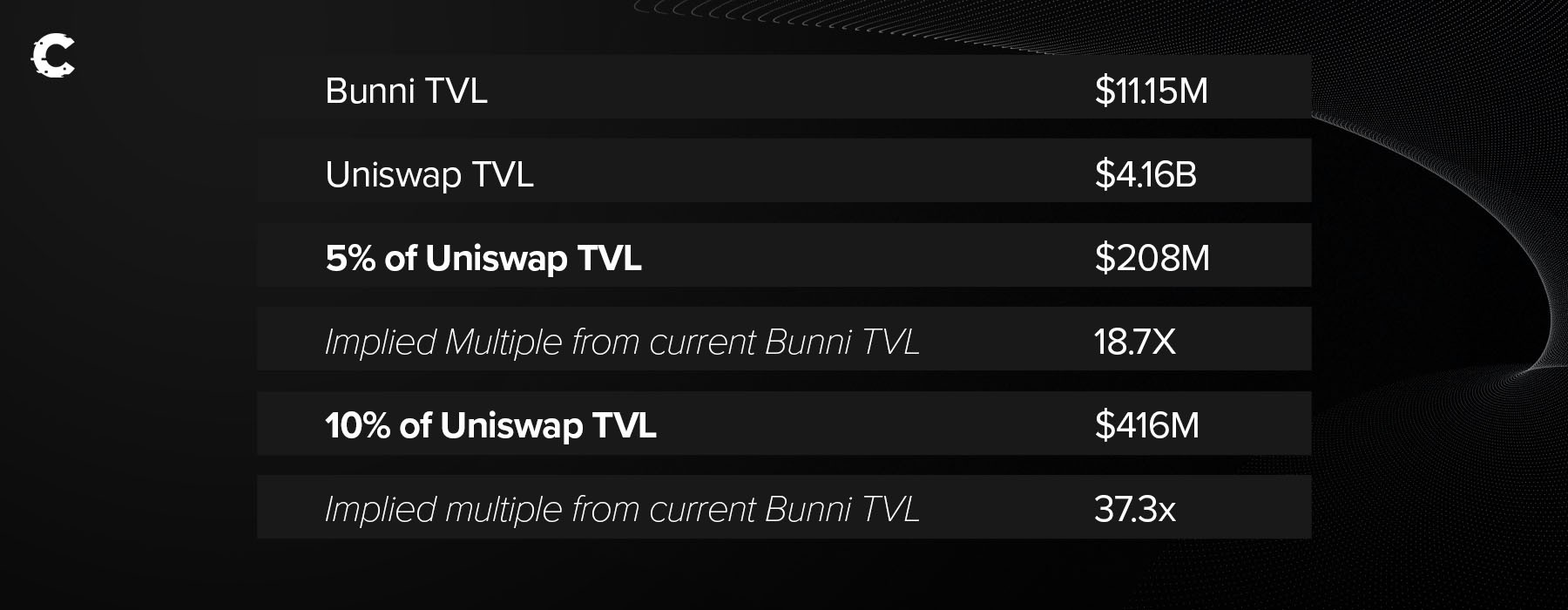

This check supports our notion that the market cap of LIT should roughly scale with its TVL, given its strong tokenomics. For TVL targets, we look to Uniswap.

It’s not realistic to think that Bunni will account for 100% of the TVL in Uniswap. Bunni is not ideal for a every group or pool. Some sophisticated LPs and large pools containing only centralised stablecoins (like USDC and USDT), Bitcoin, and Ethereum will do fine without Bunni.

That said, we believe Bunni can attract 5-10% of Uniswap's TVL over the next couple of years. Let's crunch some numbers to see where this brings our price targets.

At today's price of $0.0977 per LIT, this puts our price targets at $1.82-$3.65.

Invalidation criteria

We may reduce our position in LIT or look for alternative investments in the same space if certain triggers are met.- Either of the two largest Uniswap V3 active liquidity management protocols (Arrakis and Gamma) venture into Bunni's niche by supporting bribes. These protocols command impressive TVL and would present a daunting challenge. However, they are currently busy competing amongst themselves and seem to have no plans to challenge Bunni.

- Bunni's success depends on the ongoing dominance of Uniswap. If Uniswap were to lose its position as the top DEX, Bunni could be in trouble. The team could potentially pivot to another platform, but we will look to reduce our LIT position if Uniswap's volume dominance falls below 40%.

Cryptonary’s take

Conviction level 15%

Conviction level is based on our experts' confidence in an investment's probability of success based on past performance and the challenges the investment may face in the future.Bunni brings Uniswap and its liquidity providers into the modern world of DeFi. With Bunni, the Uniswap ecosystem could one day match Curve in attracting and nurturing liquidity providers.

Bunni’s sustainable token design aligns the incentives of the platform's user base. This discourages dumping and rewards long-term conviction in the project.

Bunni is a great example of a project positioning itself to capitalise on the success of a proven DeFi staple, and we want to be a part of it.

Action points

Here is how we plan to manage our entries and exits for LIT:- The price action has finally cooled off coming out of the first couple months of trading. We will add here and continue to accumulate each month below $0.20.

- First profit-taking will be at $1, where we will exit one third of our position.

- Second third will be sold at our lower price target of $1.82.

- Final third of our position is to be sold at our upper price target of $3.65.