TLDR

- We are archiving NOS, POP, WIF, and SPX from our Assets & Picks

- The assets will now be in the new “Archived” section on our website

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

NOS

Nosana is a platform that aims to provide affordable, decentralised GPU resources for AI workloads, allowing GPU owners to earn $NOS tokens by renting out their idle hardware. It was one of our AI bets in crypto, due to its unique value proposition and AI-driven narrative. However, after careful consideration, we have decided to remove NOS from our picks list due to the following reasons:NOS has lost momentum: The market is no longer viewing NOS as a proxy for AI-narrative. We have seen many waves of AI in crypto, and players always prefer new tickers. We have seen AI16Z, GRIFFAIN, and AIXBT take the spotlight in the most recent AI wave. We believe that if the AI narrative continues to be strong, new players (tickers) will emerge, and the market will make bets on them. This invalidates our thesis on NOS as a proxy for the AI narrative.

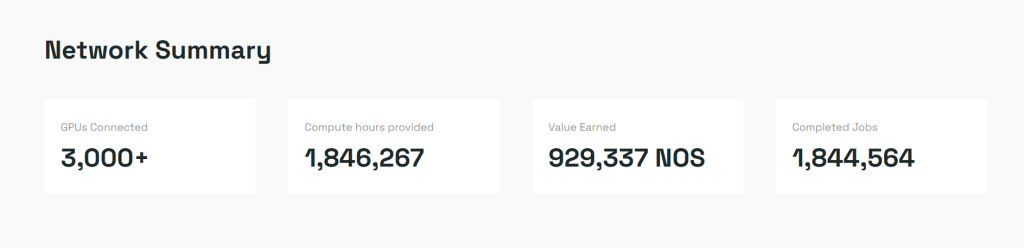

The demand for decentralised computing might still be strong in the long term, as fundamentally, NOS is still making progress. For example, the number of GPUs connected has exceeded 3,000. For comparison, when we published the original report, the number of GPUs was slightly over 1000. However, buying into the bleeding chart (the next point) isn’t the way to allocate capital in a fast world of crypto.

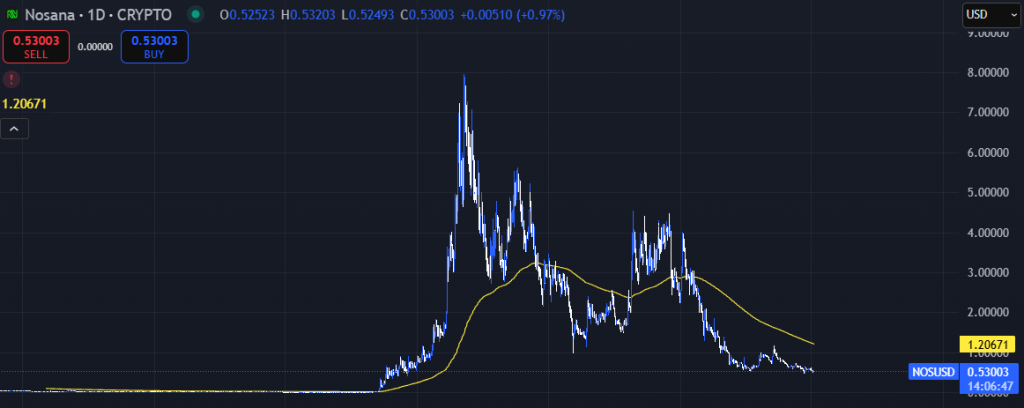

The chart: We derisked all our positions back in Jan - Feb, and as we expected, the market tanked shortly after that. However, the market has been recovering since Apr, and BTC is just below its all-time high at the moment. However, the NOS chart looks very weak, and it has been bleeding for months now. It lost its bullish structure and doesn’t represent a good setup for investing at the moment.

The chart against BTC is looking even worse. There is no momentum, and NOS is slowly bleeding against BTC. There is no point in investing in something (unless there is a very strong thesis) if it is not in a bullish structure against BTC.

Cryptonary’s take: We are cutting NOS from our picks and archiving the asset. The market isn’t viewing NOS as a proxy for the AI narrative, and the chart has been bleeding against USD and, more importantly, against BTC. Therefore, we don’t think NOS is a good asset to hold for the next 6-12 months. However, should the market structure change, we will reevaluate our stance on this asset.

POPCAT

Now, let’s move to memes. Yes, after riding from $0.003 to all the way above $2 (66,000% ROI), and taking profits back in Jan-Feb, we are archiving POPCAT from our picks. We love the cat and the meme, but we believe the trade is done, and there are better risk-to-reward opportunities out there.We think POPCAT’s growth will be subdued from here because the chart isn’t fresh and there are many bagholders which will likely limit the upside potential of this asset.

Cryptonary’s take: We still like the meme. However, since it is an asset that already had its day, it will likely underperform fresh narratives and assets. We think in terms of USD it will still perform okay, however, there are better R:R opportunities in the market. But, should the market present information that will invalidate our thesis, we are open to bringing the asset back into our list.

WIF

Now, let’s move to the OG dog that started the memecoin supercycle. The first meme that Cryptonary picked, and the first one that reached a $1b market cap. Furthermore, it is the first meme from trenches to get the “Holy Trinity of Listings” aka Binance, CoinBase, Robinhood. It ran from $0.004 to nearly $5. That is 120,000% ROI. Similar to POPCAT we have publicly derisked our positions back in Jan-Feb. We have decided to archive the asset today, as we believe the trade is done here as well.Looking at WIF’s chart, we can see, there are many bagholders here as well, and thus, resistances. Market participants generally like fresh charts or new narratives. Unfortunately, we believe the list of potential catalysts for WIF has dried up. It has lost its mindshare, even though it represents an important meme culture and there are still strong and culty community members.

Cryptonary’s take: We love the meme, and the dog still has the hat. In the coming quarters, WIF is likely to perform well as we expect the environment to be bullish. Additionally, it has the holy trinity of listings. There is still a chance that WIF can actually revive itself if, for example, retail comes back and WIF pulls off a PEPE-like move.

However, again, by holding WIF, you will likely end up with an opportunity cost. The upside is capped due to resistances and a high market cap. Newer memes and movements are likely to perform better.

For this reason, we are archiving WIF from our Asset & Picks. However, should the market present information that will invalidate our thesis, we are open to bringing the asset back into our list.

SPX

All our meme picks have been successful and are indeed very good memes that ticked all the boxes. SPX, being one of them, has a very strong cult behind it. Additionally, it's one of the few memecoins that can call itself a movement or a “mission coin”.However, there are a few issues with it. First of all, the SPX market cap is already around $1.2b, and thus the upside remains subdued. Even if it reaches $3b, that is barely 3x from here. Not the kind of return you would look for from a memecoin.

However, the downside remains huge as the “main character”, who owns more than 3% of the supply on public wallets, stated several times that he is going to sell half of the portfolio in Q4.

We are currently in Q3, and we expect whales will be frontrunning him, and will be rotating to better Risk: Reward plays. Therefore, despite us liking the meme, we believe it is not optimal to hold SPX at this point since there are better R:R opportunities in the meme sector.

Cryptonary’s take: We are archiving SPX from our Asset & Picks list because we think the upside doesn’t justify the risks with this asset. We enjoyed the ride from $0.01 to over $1.7, and now it is time to say goodbye. However, should the market present information that invalidates our thesis, we are open to bringing the asset back into our list.

Closing thoughts

Markets are dynamic… What was a top asset yesterday might not be the best pick tomorrow. We stay agile with our selections to reflect our latest market views and investment thesis.After careful consideration, we’re removing NOS, WIF, POPCAT, and SPX from our picks and archiving them here. Some of them can still revive themselves if the stars align. However, for now, we are archiving them until we see new information from the market that would invalidate our thesis.

Our barbell portfolio remains BTC, ETH, SOL, HYPE, and AURA, which is a very good, diversified and solid portfolio in our view.

For a more concentrated, tactical allocation targeting EOY 2025 and Q1 2026, we’re focusing on BTC, HYPE, and AURA as a barbell.

Enjoy the ride!

Peace!