Update on our 30x options coin: Opportunity or exit signal?

This report is outdated and no longer reflects current market conditions or our investment thesis. Please don’t act on the information here. For the latest picks and insights, visit our Asset & Picks tool or check our most recent articles

Do you remember our options winner? Yes, that one we profiled for a 30x upside.

For ease of reference, we are talking about Lyra Finance, a DeFi powerhouse for options trading. Last week, the coin scared many investors when it recorded a sudden and jaw-dropping 80% crash.

This happened despite months of development and adoption and very promising stats.

What exactly happened here?

In this report, we will address why the prices have fallen dramatically and discuss other updates and exciting developments since our last update.

TLDR

- The price of Lyra plummeted significantly because of token migration. Lyra tokens will be converted to LDX tokens on a 1:1 basis with the same supply.

- The distribution is expected in Q3 2024.

- Generally, DeFi has been underperforming massively. However, our options winner has been making significant progress in terms of fundamentals.

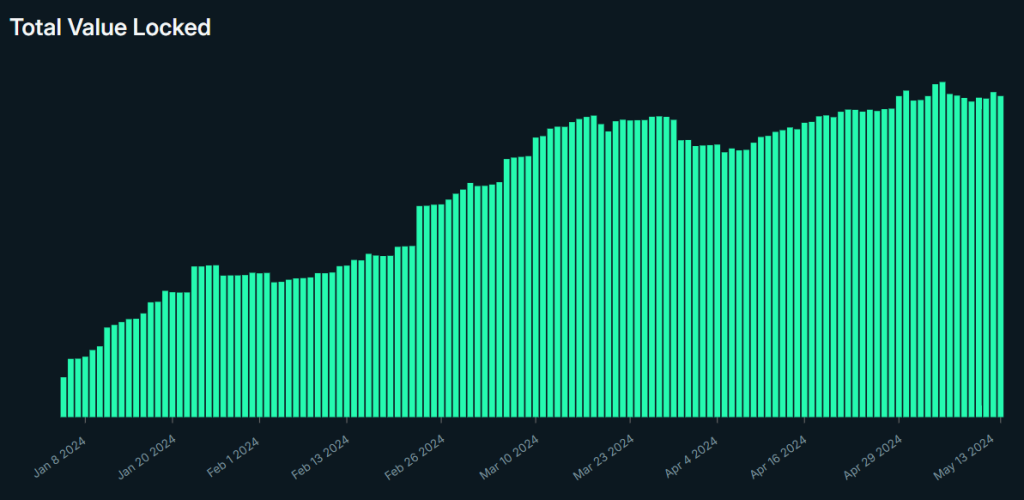

- The launch of the Lyra chain has been successful; Volumes and TVL have seen a significant increase.

- Lyra is launching a new exciting product that will attract a lot of EigenLayer stakers.

- We remain bullish on Lyra as our options winner.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Why did LYRA "crash"?

On May 10, LYRA's trading price dropped by a massive 80%. Many people who had LYRA in their portfolios freaked out, and many are still worried and not quite sure what to expect.

However, fear not—this dump was expected, and there is nothing to worry about. The main reason for the recent Lyra meltdown was a scheduled token migration.

Lyra Finance is migrating from the LYRA token to the LDX token, and the Lyra token no longer represents anything.

The LDX token will be the native token of the Lyra Derivatives Network, a composable ecosystem of derivatives products. Its total supply will be identical to that of the LYRA token, and each LYRA/stkLYRA holder will have a 1:1 claim on LDX tokens.

The snapshot for the migration was taken on May 10; afterwards, the Lyra token became useless.

For people holding/staking Lyra tokens, you need not worry, as you will receive the equivalent amount of LDX tokens once they become available in Q3 2024.

But why did Lyra need a new token?

Lyra is shining despite general weakness in DeFi

Decentralised Finance (DeFi) has been one of the most hyped and promising applications of blockchain technology. Its promise to solve issues of accessibility, transparency, and efficiency and replace traditional finance has attracted many investors and users.Due to its potential to replace traditional finance and change lives, DeFi has previously attracted a lot of capital. As a result, many innovative platforms were born and thrived in previous market cycles.

However, memecoins have been attracting substantially more bids than DeFi tokens in the current cycle.

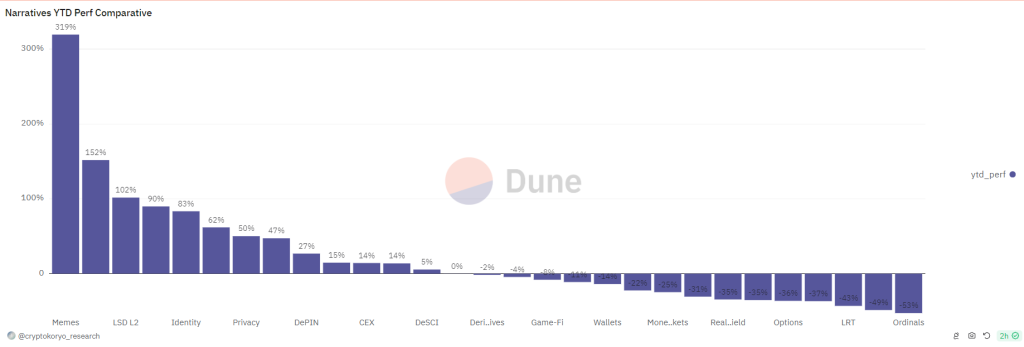

If we look at the year-to-date performance of different narratives, memecoins clearly dominate the market, while derivatives and options' returns are negative.

It is the same story with trading volumes: The meme sector is currently the absolute king of all narratives and sectors, while options lag far behind.

As a result, Defi coins are lagging significantly in terms of price. Nonetheless, Lyra has managed to score a 4x gain from the bottom to the top.

Despite the Defi sector's strong underperformance, progress isn't stopping, and our options winner is only getting better. Some factors driving Lyra's outperformance in the DeFi sector have necessitated the transition from the LYRA token to a new LDX token.

Latest updates on Lyra

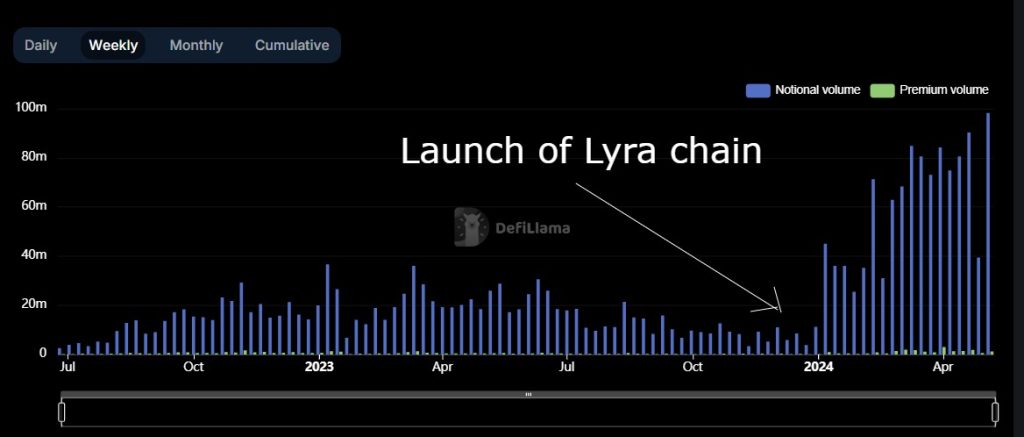

In our last update, we noted that Lyra had just launched its "app chain." While that launch was ambitious, there was also a lot of uncertainty ahead, with no clear indicator of whether the strategic decision would yield positive returns.

Fast-forward to today, and we can clearly see that launching derivatives-specialised L2 was the right decision, as it is evident on almost all fronts.

Volumes are the best indicator of whether a DEX and derivatives platform is performing well, and Lyra is crushing it on that front.

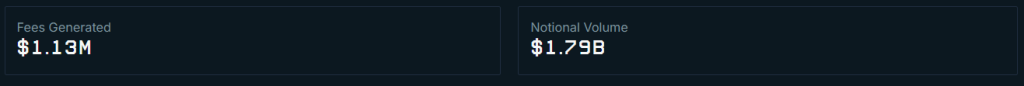

After introducing its derivatives-focused Layer 2 solution, Lyra experienced a significant surge in trading volumes. Within five months, the cumulative trading volume reached an impressive $1.8 billion, generating over $1.13 million in fees for the DAO.

This remarkable growth underscores the success of Lyra's L2 solution in attracting traders and boosting trading activity.

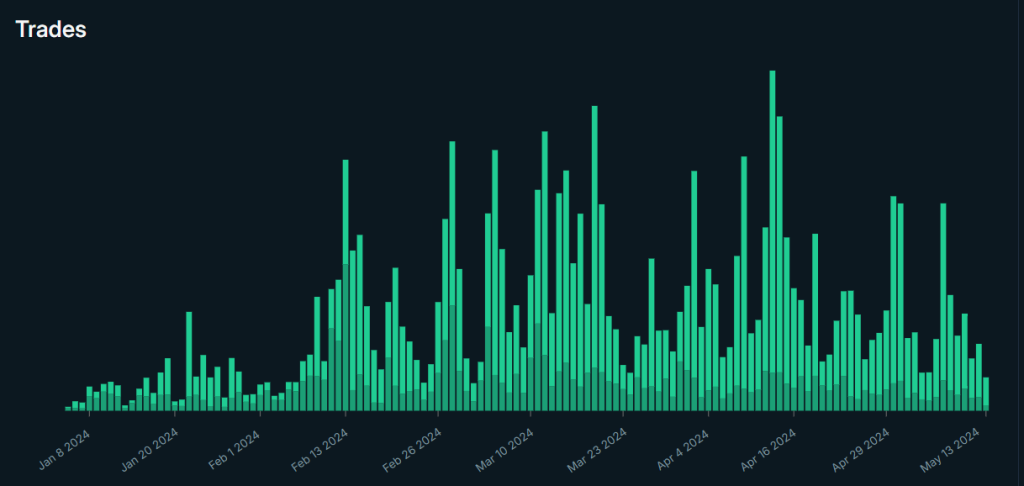

Unsurprisingly, the Lyra chain has been experiencing a steady growth in TVL and the number of trades since launch, again highlighting the positive impact of the decision to migrate to their own chain.

A new DeFi primitive

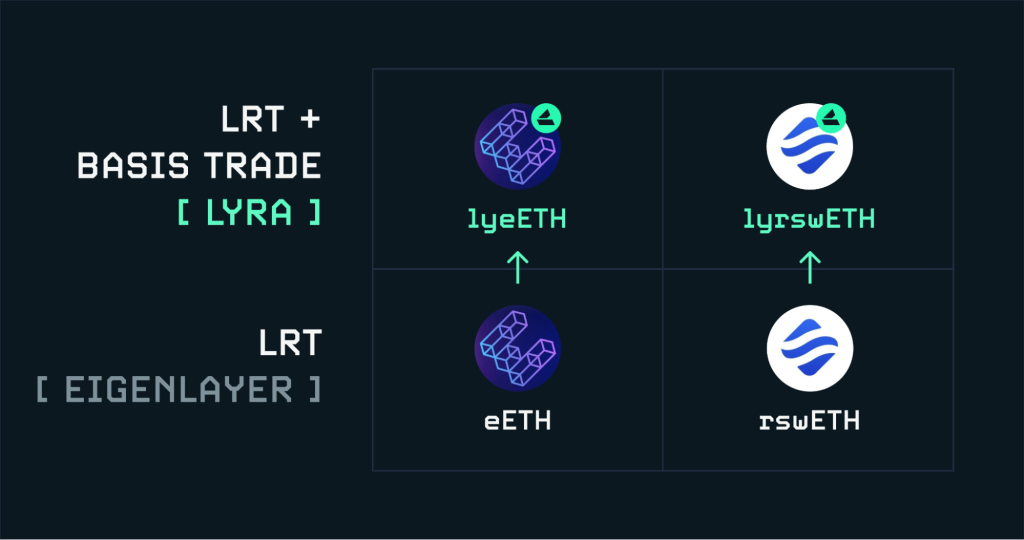

Lyra has introduced a new innovative feature focusing on tokenised derivatives yield on EigenLayer. This innovative feature allows users to earn an additional yield on their liquid restaking tokens (LRTs), such as rswETH and eETH. If you are unfamiliar with EigenLayer and restaking, check out this report.

The new feature tokenises "basis trade" and "covered call," which are popular trading strategies. By utilising these strategies, users can earn an annualised percentage yield (APY) ranging from 10% to 50% on their LRTs.

Essentially, it automates and tokenises complex perps and options trading, allowing the average Joe to benefit from these traditionally complex strategies.

The design is inspired by Ethena and its stablecoin USDe. Ethena holds stETH and shorts ETH on centralised exchanges to collect funding rates plus staking yield, which translates to holding a delta-neutral strategy and nice APY.

It proved to be a very popular product with a TVL of over $2.3b and fully diluted mcap of over $10b

Lyra is taking this strategy a couple of steps further. First, it focuses on restaked ETH, which will yield an additional yield compared with stETH.

Further, aside from the basis trade that Ethena uses, it executes a covered call options strategy, where traders would normally sell "call options" to collect premiums and hold the underlying asset as a hedge. If you are unfamiliar with options, we covered them extensively here and here.

The tokenisation of these two strategies is a significant development in the DeFi, as it provides users with an opportunity to maximise their returns on LRTs. By leveraging the power of tokenised derivatives yield, Lyra is helping to unlock new sources of yield for LRT holders.

We believe there will be significant demand for tokenised derivative yield on restaked tokens as EigenLayer currently has over $15b TVL. $15b of capital that is hungry for additional yield.

Generating a 5% yield for $15b capital would require AVSs to generate $750m per year in distributable fees. For comparison, there are only five crypto platforms capable of generating over $750m per year: Uniswap, Lido, Bitcoin, Tron and Ethereum.Solana, AAVE, MakerDAO, and others generate significantly less than $750m per annum. That means unless they have another Uniswap-like innovation in the EigenLayer ecosystem, there is unlikely to be sufficient real yield for $15b worth of capital.

Therefore, Lyra tokenised derivatives yield can find a great product-market fit as it allows restakers to tap into additional yield from the derivatives market. A successful launch, consequent marketing and adoption can drastically increase volumes and TVL on the platform because, unlike Ethena, all automated trades will happen on the Lyra chain itself.

Overall, migrating to their own L2 was clearly a good move. It boosted volumes on the platform and opened up doors for new products with the potential to be game changers.

However, if everything is sunshine and rainbows, why did the price of Lyra token nosedive?

Airdrop campaign

Lyra is starting the LDX airdrop campaign. The airdrop aims to bootstrap the new yield products we mentioned earlier, increase DEX liquidity on Lyra, and further incentivise trading on the Lyra chain.

We believe Lyra is one of the best option platforms with great potential. So, if you didn't have a chance to lock in an LDX airdrop via Lyra tokens but would like to, you can still farm an airdrop and contribute to the platform's success.

There are three ways to earn LDX tokens (via the points system)

- Trade: Earn 100 points per $1 fee paid on options and perps trades

- Yield: Earn 1 point per $100 deposited to Lyra per hour

- Invite: Earn 20% of invitee points and 10% of their invitee's points

Here is an action plan:

- Go to Lyra Finance

- Deposit USDC/USDT/ETH/stETH from Arbitrum/Optimism/Base

- (Optional) Trade on perps and options market

- (Not live yet, but soon) Deposit restaked ETH to their new DeFi primitive on EigenLayer

Cryptonary's take

Despite the market not favouring Defi tokens, our Lyra has been making great progress in shipping quality and innovation.We can see the positive impact of migrating to sovereign L2 to build a derivatives-focused platform; Stats show increased adoption and volume.

The sudden crash in price is nothing to panic about, as it was a planned consequence of migrating Lyra tokens to LDX tokens. The 1:1 distribution is expected in Q3 2024

Meanwhile, there is still time to farm additional LDX tokens by contributing to the platform by trading or simply depositing assets on the Lyra chain.

We remain bullish on Lyra and expect it to continue shipping and transform into a robust derivatives network.

Cryptonary, OUT!