But that’s a danger of the one-sided story because although RLB has suffered some intense selling pressure lately, this GambleFi token is not dead.

Quick update on RLB’s underwhelming performance

Since our previous report on Rollbit (RLB) went live, the token has notably underperformed against the broader crypto market.This sustained weakness can be attributed to early whale investors liquidating portions of their holdings, but there is also some good news.

An early investor exits RLB

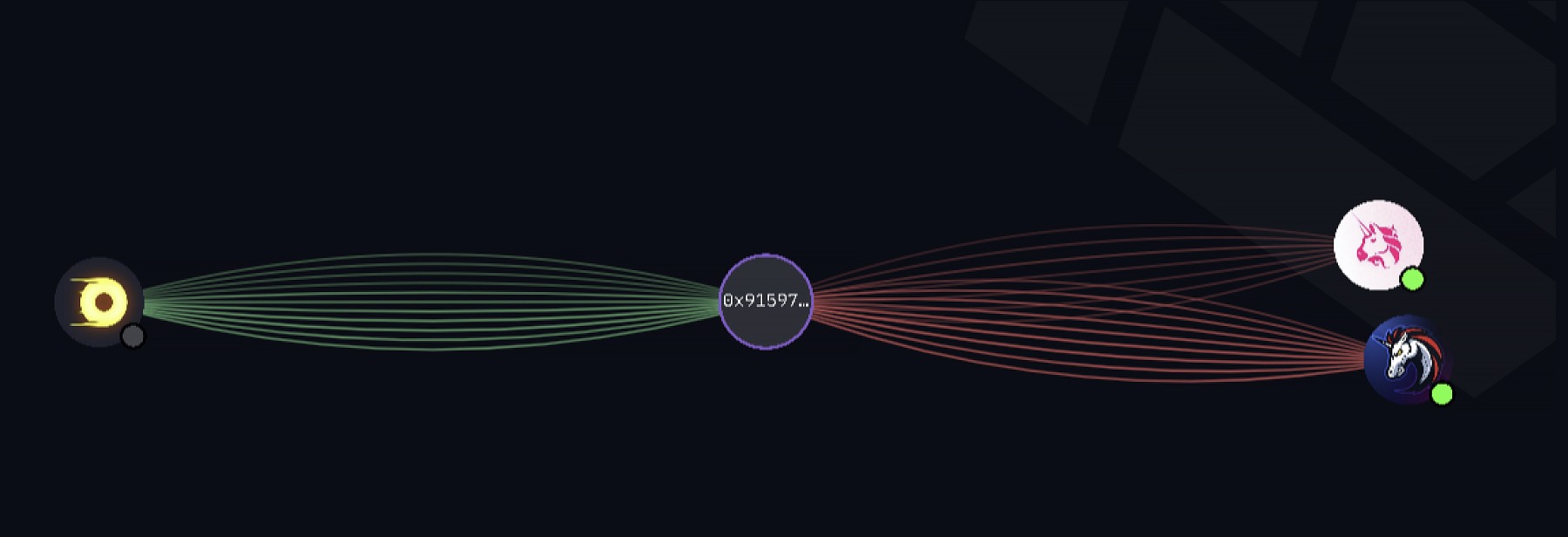

Most notably, a single giant whale wallet has aggressively continued unloading its position following our initial coverage. This whale has dumped 34.401 million RLB tokens at an average price of $0.180, representing over $6.192 million in selling pressure.

After analysis, it's evident that this whale address is an early Rollbit investor, obtaining RLB at very low prices. However, it's important to note that it is not an insider or part of the Rollbit team. This clarifies the decision to profit-take at current prices, and the wallet is now empty of RLB.

Second whale takes profits but reconsiders fully exiting

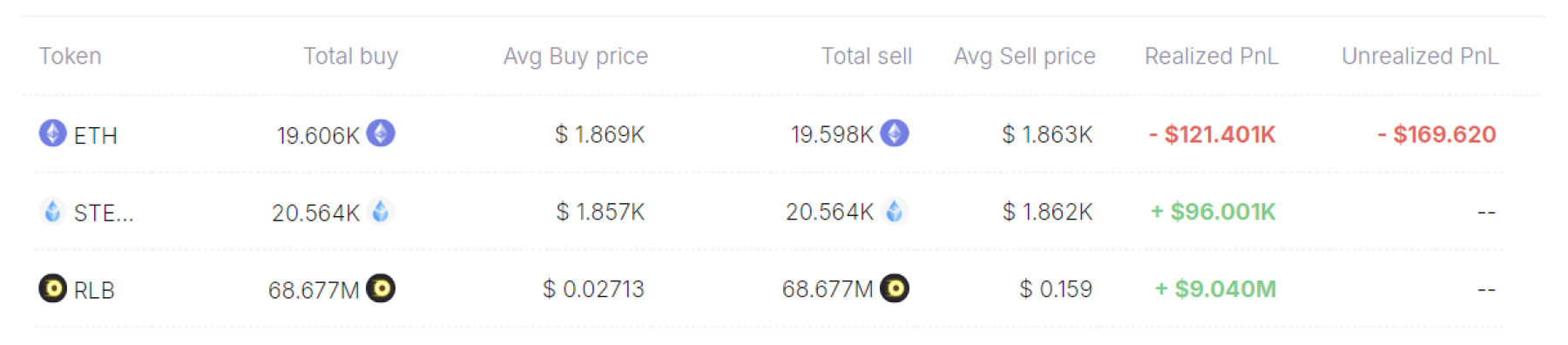

However, this whale wasn't the only significant contributor to the drop in RLB prices. Another early investor in RLB has been exerting pressure on the price over the past month.This whale, previously identified earlier in the year as a significant RLB seller in our tweet, has now completed the sale of 68.677 million Rollbit (RLB) tokens. These were initially acquired at $0.027 per token and sold at $0.159, totalling $9.040 million.

In a separate wallet, the whale sold 11.480 million RLB at an average price of $0.219, adding another $2.514 million. The whale has offloaded 80.157 million RLB, totalling $11.554 million in sales.

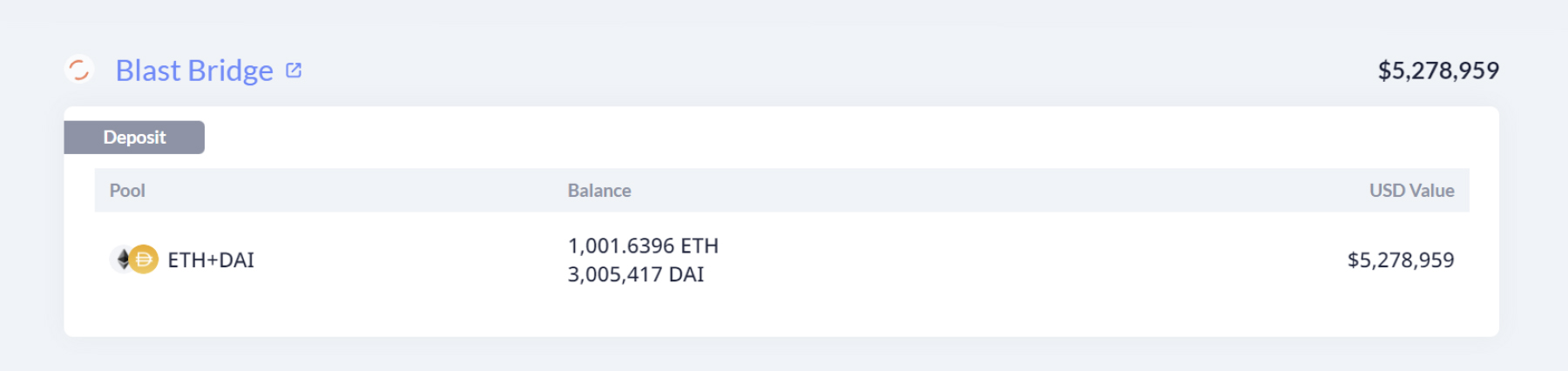

Before these sales, this wallet was one of the largest holders of RLB and one of the earliest investors in the platform. Notably, most of these sales were made to diversify, and the investor also allocated $5 million of his portfolio into Blast, the new layer 2, which will likely do an airdrop soon, which is the main reason he decided to sell.

However, the good thing is that this whale is building up a position in RLB again at these prices and has yet to give up on Rollbit like the other whale. Instead, after his massive sales, he started building a position in RLB again.

In the past two days, alongside his initial RLB position, he expanded his holdings by acquiring an additional 2 million tokens at an approximate price of $0.15. This move elevated his balance from 14.9 million to 16.9 million tokens, now valued at $2,587,423 in his wallet.

This action suggests that the whale perceives RLB as a favourable buying opportunity at current prices and may reenter the market as the price declines.

Cryptonary’s take

While recent selling pressure from early RLB whales has caused underperformance, there are signs this could be slowing. One whale is now out, while the other has started rebuilding a position after taking profits.As these remaining tokens get distributed to new long-term holders, much of the excess supply will be absorbed. This is expected to ease selling pressure and allow more organic price discovery aligned with platform growth and token utility.

Near-term uncertainty persists, but the long-term thesis and use case for RLB remain intact. We will monitor on-chain data around major holder behaviour as the situation evolves. For RLB to perform well, selling these early whales would need to slow down. This would enable RLB to play catch-up, given its still-promising fundamentals.