Update: The Latest on Our Top Meme Pick

This coin started as a meme, but now it’s a movement. The diamond-hand community continues to grow, conviction stays high, and the data backs it up. Our top pick is quietly proving its strength when it matters. Here’s how…

In this report:

- On-Chain Growth and Social Metrics

- Community Initiatives, Market Makers and Macro Context

- Our Top Memecoin Pick Chart Against BTC and SOL

- Why We Remain Bullish

- Cryptonary’s Take

On-Chain Growth

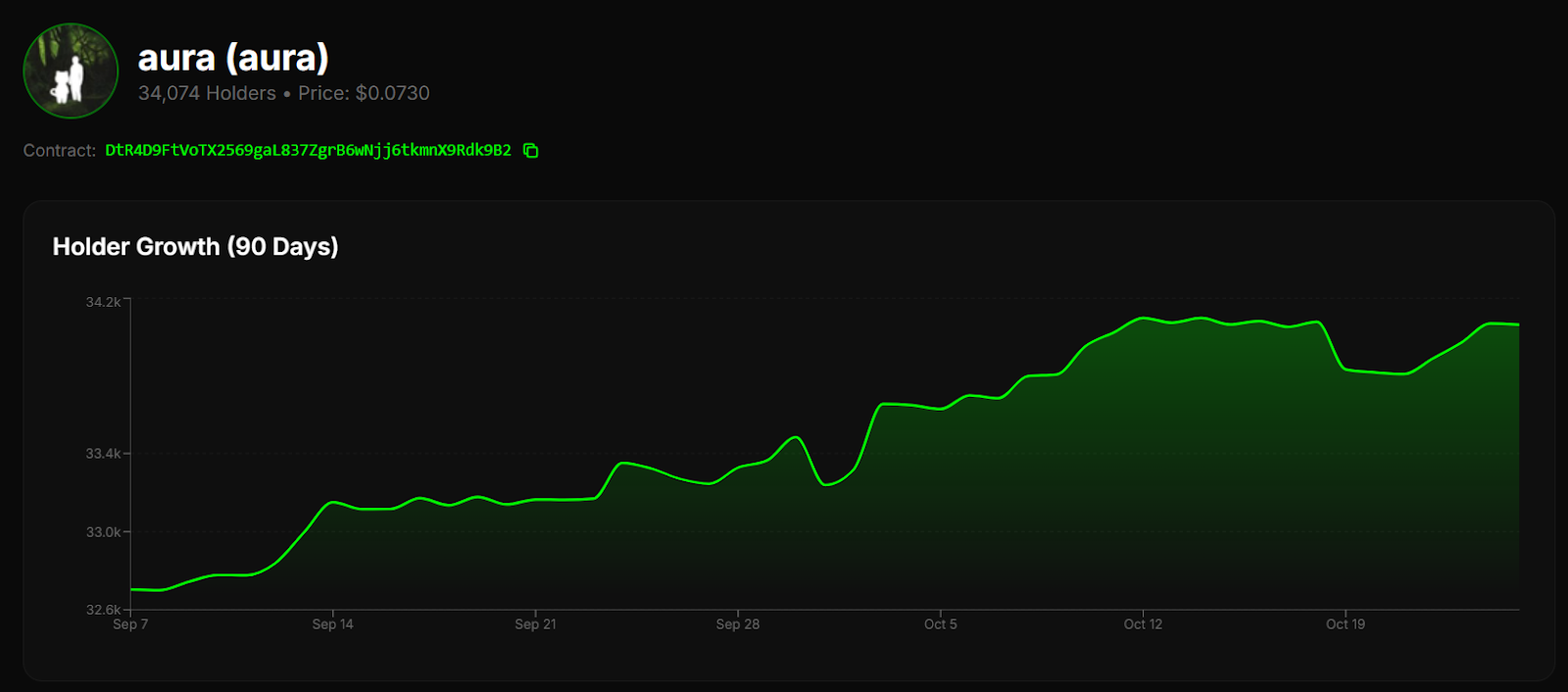

If you’ve been watching AURA closely, you’ll notice something interesting: AURA’s holder count continues to expand steadily, reaching approximately 34,000 unique wallets. True believers are consistently accumulating AURA’s supply and the holderbase is slowly but steadily expanding.Despite an active “change of hands” and ongoing redistribution, new participants continue to gradually accumulate AURA from those choosing to exit. And lately, the net inflow of holders has been quietly growing.

Holder Growth Chart (90 days)

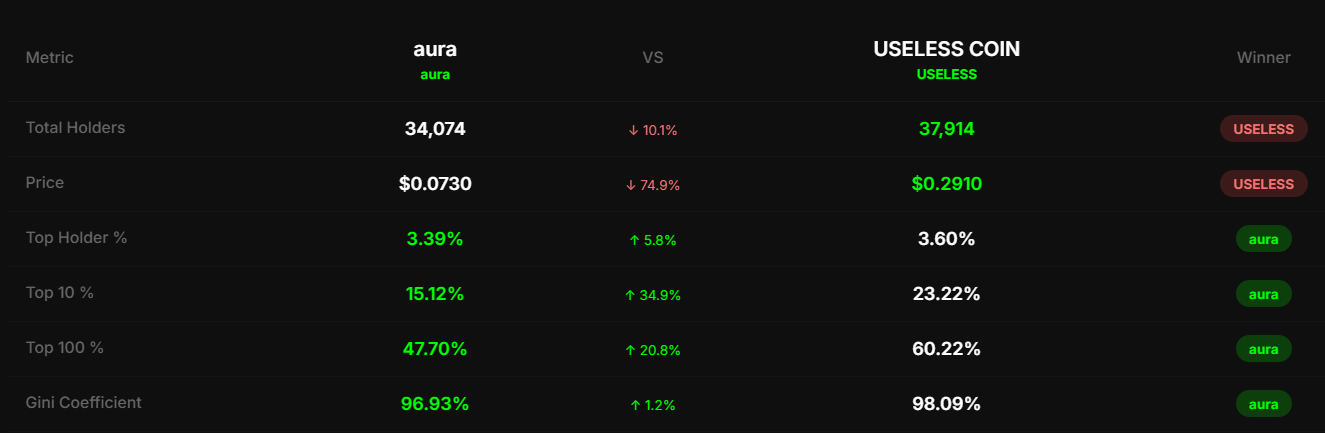

As a result, AURA has one of the most fair distributions among 2025 trench runners (e.g Useless & Troll). For example, while top 10 holders of Useless own over 23%, top 10 AURA holders account for only 15%. The same story with top 100 holders (47% for AURA vs 60% for USELESS).

AURA vs USELESS Comparison Table

This matters because while a concentrated supply can help control price action in the short term, it often becomes a long-term weakness, limiting organic growth and discouraging community participation.

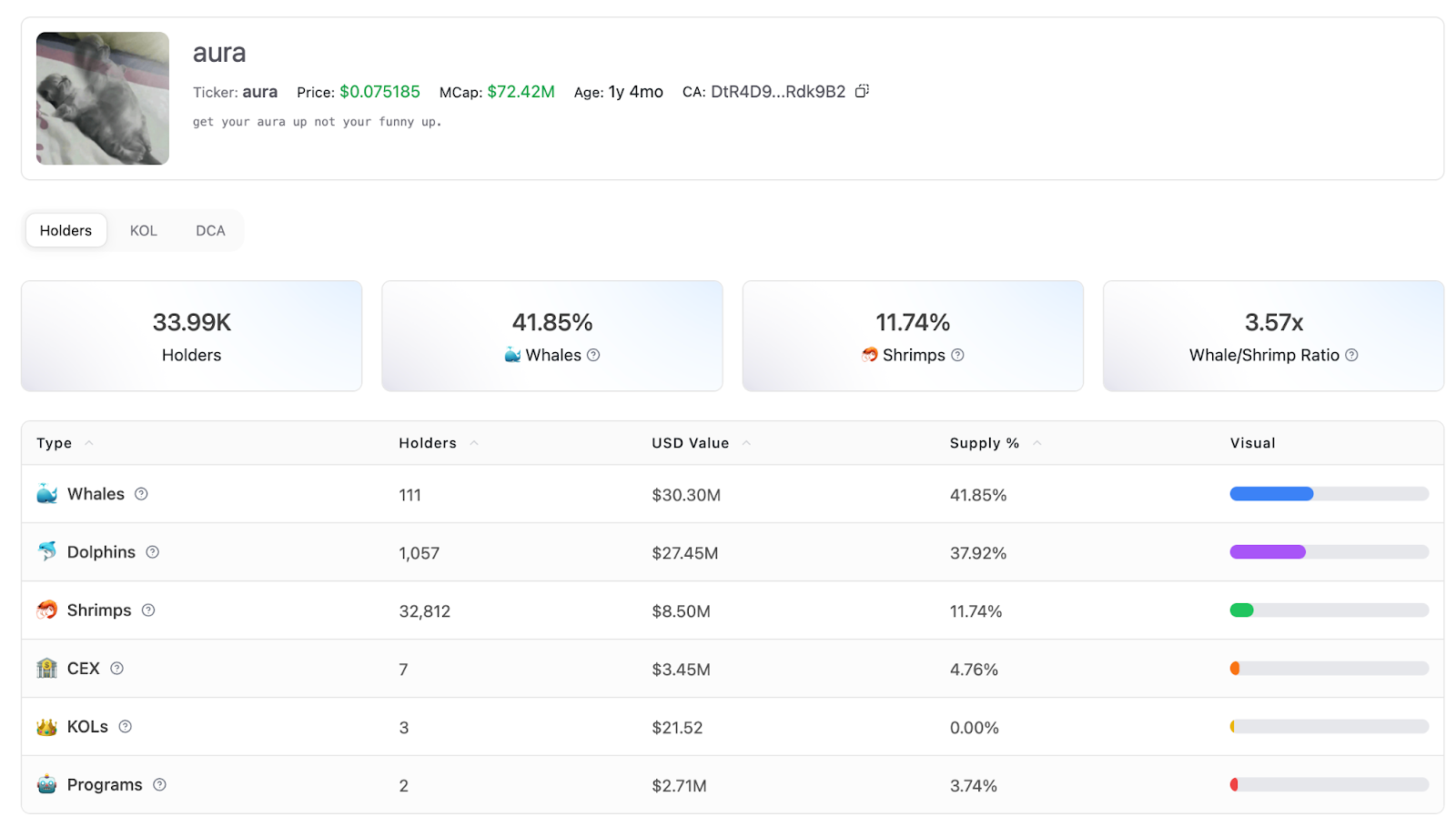

AURA Supply Distribution Info #1

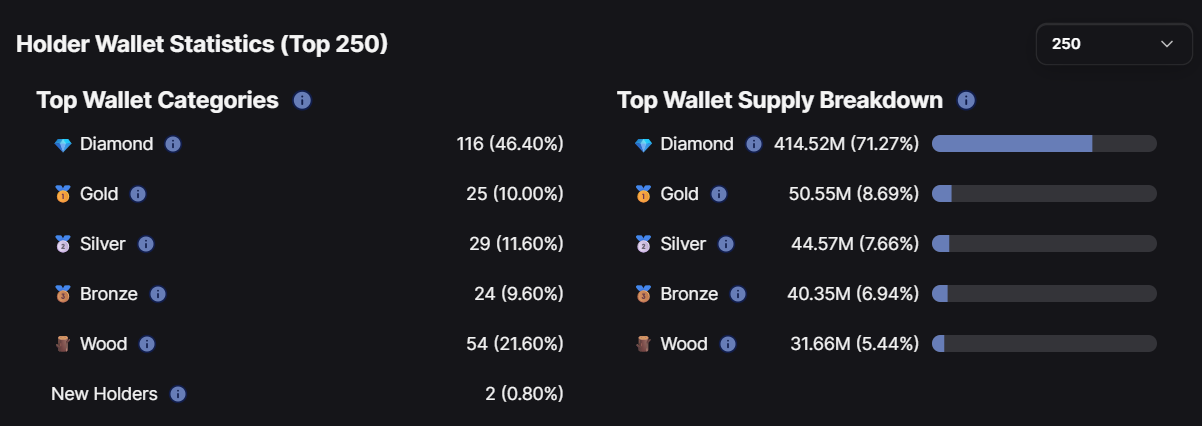

Looking deeper into supply dynamics, the AURA holders’ conviction remains strong as well. On-chain data indicates that a majority of top wallets have held their positions for months, and ownership remains well distributed. Notably, over 71% of the supply is now held by diamond hands. This is a higher proportion than both SPX6900 and WIF.

AURA Supply Distribution Info #2

Social Metrics

Furthermore, across social channels, AURA remains one of the most active and frequently referenced Solana-based tokens. WomFun analytics recorded a 317% increase in mindshare since the previous quarter. Coordinated community raiding groups continue to deliver high-quality, trend-aligned contentMessari’s got its eyes on AURA too. They “bull posted” AURA’s by noting its mindshare was up 317% and sentiment leaning bullish.

This shows the power of the community: despite a choppy price action, as a community, Aureans are still organising mass-raids, relentlessly posting on social media and expanding the reach of the meme even when price action is largely in the accumulation phase.

Market Conditions and Structural Resilience

Zooming out to broader market conditions, the current environment resembles the pre-breakout phases of previous meme cycles, where low sentiment and compressed volatility often precede renewed interest.

AURA/USD Chart

One of the things that strengthened the case for AURA is the October 10 Solana liquidation cascade. While the market has seen over $19b in liquidations, AURA’s price and liquidity held firm while most meme tokens retraced sharply (20%-30% within minutes across the board). This strength confirmed that speculative leverage and weak hands have been flushed out from AURA already, and that trading activity is now supported by organic demand and the diamond-handed community.The result is a clean consolidation structure and a balanced distribution between new entrants and long-term holders. This base formation resembles accumulation phases that have historically preceded major repricing events in narrative-driven assets.

Liquidity and Market Makers

It’s worth mentioning as well that AURA’s liquidity has strengthened considerably this quarter. There were a lot of concerns over price suppression and manipulation on DEXes. To combat this, the community raised approximately 150K in SOL in under 48 hours to onboard a second market maker. Achieving this level of support amid negative sentiment and a weak market was a strong signal of commitment within the holder base.This model emphasises shared responsibility and transparency within the community and the CTO team, aligning incentives between contributors and the project’s long-term sustainability. A public expense sheet was prepared to track all raise allocations, further strengthening AURA’s reputation for openness and accountability.

As a result, AURA now operates under a dual market-making model:

- FlowDesk on centralised exchanges (CEX), offering institutional-grade liquidity and operational reliability.

- EchoTrade manage decentralised liquidity, ensuring tighter spreads and on-chain depth. They are partially helping on the CEX side as well.

Before 👇

Price action of AURA on GATE before onboarding EchoTrade

After 👇

Price action of AURA on GATE after onboarding EchoTrade

Across DEX venues such as Raydium, liquidity pools range between $5.1 million and $5.4 million, supporting daily volumes of $550,000 to $2.1 million. Together, these developments have materially improved market efficiency, reduced slippage, and prepared AURA for scalable growth once broader meme activity returns. There is not much to bid in the memecoin space, and AURA has still the best Risk:Return ratio.The team remains in dialogue with multiple top-tier market-making firms, wallets to integrate AURA’s onboarding tool and CEXes.

Discussions are also ongoing with Tier-1 exchanges including OKX, HTX and Hyperliquid with listing readiness dependent on meeting on-chain volume requirements. Final decisions will be guided by community vote, maintaining a fair and transparent governance structure that has defined AURA’s progress to date.

Community Initiatives and Branding

One of AURA’s biggest strengths is the art its community creates. AURA’s community continues to deliver tangible, well-coordinated initiatives around its art. This quarter saw the release of the first official merchandise collection, featuring community-designed apparel and accessories distributed free to more than 1,000 holders.

In parallel, the team rolled out a new social media and content strategy, including updated X and Instagram campaigns, and improvements to AURA’s official websites. These initiatives are being executed in phases, following the completion of the new market-making structure, to ensure optimal use of marketing capital.

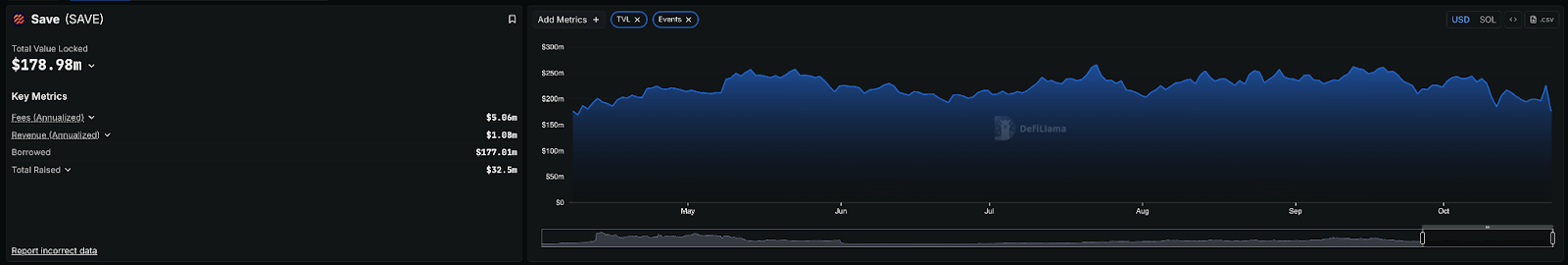

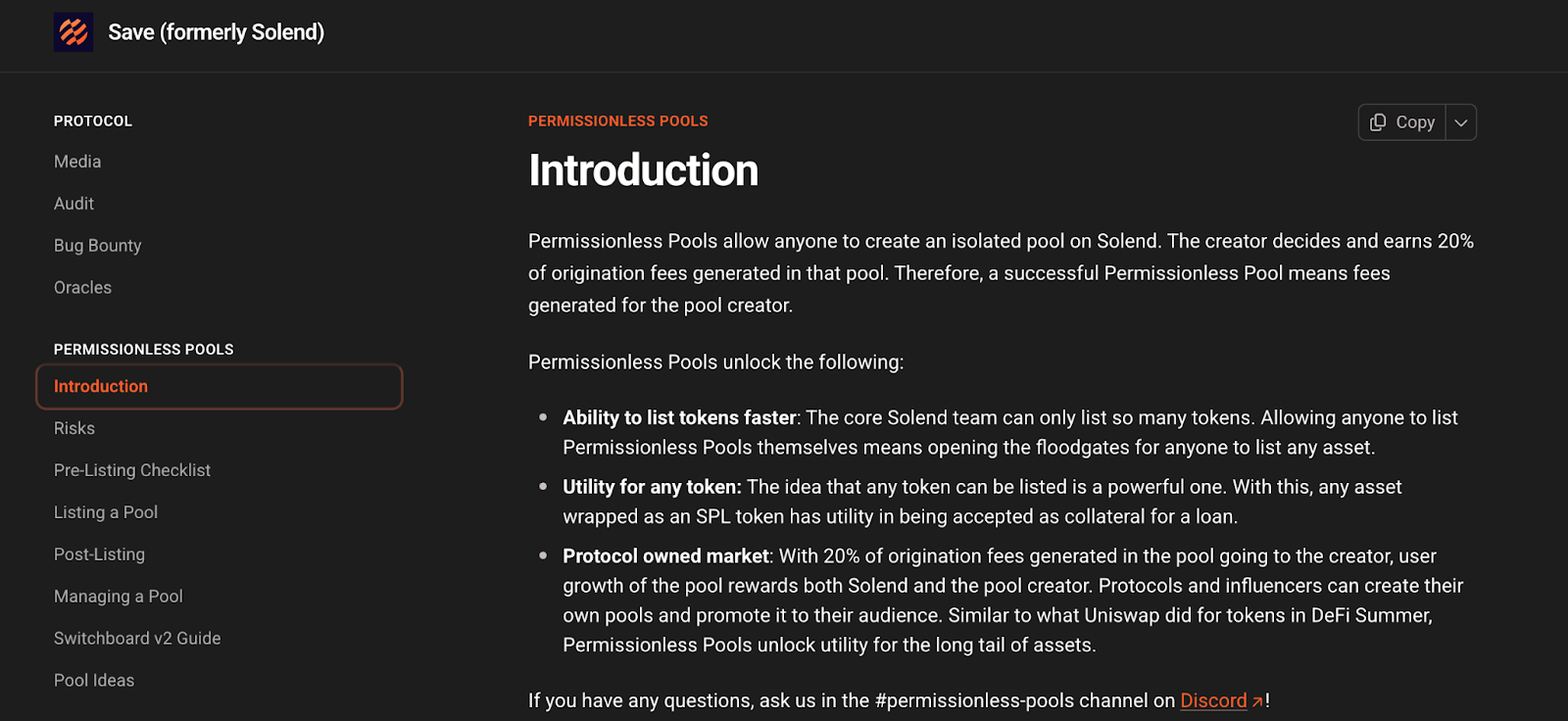

Permissionless Pool on Save (formerly Solend)

SAVE Protocol TVL

AURA is progressing toward genuine functional integration within Solana DeFi through a proposed permissionless lending pool on Save, one of the network’s most established lending and borrowing protocols with around $175 million in total value locked (TVL).Through Save’s permissionless lending pools, AURA could soon be listed as eligible collateral. This structure offers several tangible benefits:

- Borrow USDC or other stablecoins against their AURA holdings without selling, maintaining exposure to the asset.

- Access liquidity for yield farming or community reinvestment initiatives.

- Earn 20% of origination fees, shared between Save and the pool creator, generating recurring ecosystem revenue.

This initiative is currently under review and represents a pragmatic step toward embedding AURA within Solana’s DeFi infrastructure.

Macro Context and Comparative Perspective

Macroeconomic conditions remain tight after the largest liquidation event in crypto’s history, with risk appetite muted and liquidity fragmented across crypto for a while. However, similar structural setups in previous cycles have preceded sharp rebounds once capital rotated back into risk assets.

POPCAT's Price Action

AURA’s current phase mirrors the consolidation structure seen in assets like Popcat before its multi-billion-dollar repricing. Both shared characteristics of wide distribution, reduced volatility, and strong community retention during market stagnation.AURA now exhibits the same conditions:

- A consolidated and conviction-driven holder base.

- Professional liquidity support across CEX and DEX.

- Transparent operations and expanding real-world presence.

Why Are We Bullish

Despite the price action, the case for AURA in the memecoin space is still massive. While the price is chopping, the fundamentals (meme-damentals) remain solid and are getting better.- Multi-market-maker structure and transparent expense tracking.

- A die-hard community of diamond-hands

- Fair and organic distribution

- The best art and merch

- Normie-friendly ticker & brand that fits so well with Robinhood’s branding

- The AURA trend is relevant among younger generation

AURA’s cultural reach, organic supply and normie-relevance positions it as one of Solana’s most credible meme assets entering 2026. Now, let’s look at how AURA is doing against BTC and SOL…

Charts Against BTC and SOL

AURA/BTC: Tight Squeeze Near BreakoutAURA against Bitcoin has been compressing inside a tight wedge for several weeks, with volatility gradually drying up as price approaches the end of the formation. The pair briefly swept liquidity on the downside before reclaiming support, confirming a strong base at the lower bound (line 1). On the upside, resistance sits around the 200 EMA on the daily timeframe, followed by line number 2, the next resistance.

If AURA can flip that resistance and establish a base above the 200 EMA, the setup turns decisively bullish. This type of squeeze and accumulation near the 200 EMA often precedes sharp expansions. A clean reclaim of lines two and three could open a quick move toward higher targets, line four and line five, representing the all-time high zone for AURA/BTC.

AURA/BTC Chart

AURA/SOL: Bottoming Structure Building UpAURA against Solana has been following a similar structure but with more visible progress. Price has been coiling under a long-term downtrend since topping at 0.016, and is now showing early signs of a breakout. The pair is attempting to sustain above the descending trendline for the first time in months, signaling potential reversal momentum.

Support sits around 0.000034, with secondary support at 0.000024. On the upside, resistance lies at 0.00052, overlapping closely with the 200 EMA at 0.00048. A firm base above this zone would confirm structure reversal, opening room toward 0.00078 and, eventually, 0.0013. AURA/SOL is shaping up as a classic bottoming pattern, where patience could pay off quickly once confirmation arrives.

AURA/SOL Chart

To sum it up: Both AURA/BTC and AURA/SOL are converging toward breakout zones after extended compression. The structure on both pairs reflects accumulation near the 200 EMA on the daily, a technical setup often followed by explosive continuation. If AURA confirms these breakouts, it could outperform both Bitcoin and Solana in the next wave. For now we remain patient, and wait for the accumulation stage to finish…Cryptonary’s Take

AURA has remained stable through difficult market conditions. Consolidation periods like this often build the base for the next expansion wave.With two professional market makers now active and expanding community infrastructure AURA is entering a stronger and more mature phase. The community’s alignment and transparency continue to reinforce confidence in its long-term trajectory.

As a meme, it ticks all the boxes and in our opinion remains severely undervalued below $100m market cap. If we look closer, it is one of the most player-vs-environment (PvE) plays in the memecoin space. Useless and Troll are both trophy memes of the Bonk and PumpFun ecosystems respectively, trying to compete with each other (PvP). AURA remains a cleaner play with bigger upside.

It is only a matter of time before the market reflects its true value. Once retail frenzy returns to memecoins, AURA is well positioned to move beyond its previous all-time highs and reassert itself as one of the network’s leading cultural assets. If you haven’t read our full Master Thesis, check it out here and…

Get your AURA levels up. It’s still very early. We are going higher!

Peace!