But speaking of shiny new coins, one such project is Ethena --it is after the "Holy Grail" of money, bridging the gap between DeFi, CeFi, and TradFi. This project hits all the right notes—it offers a synthetic dollar protocol with an innovative approach to maintaining its peg. Furthermore, it is backed by prominent VC firms and promoted by respected voices in the industry.

However, beneath the hype, there's also the undercurrent of controversy.

In today's report, we will examine Ethena in depth. We will consider it from an investment perspective and provide you with our assessment of whether there is potential or opportunity here.

Let's get started…

TLDR

- Ethena is a new DeFi protocol offering a synthetic dollar stablecoin (USDe) pegged to the U.S. dollar through innovative trading strategies.

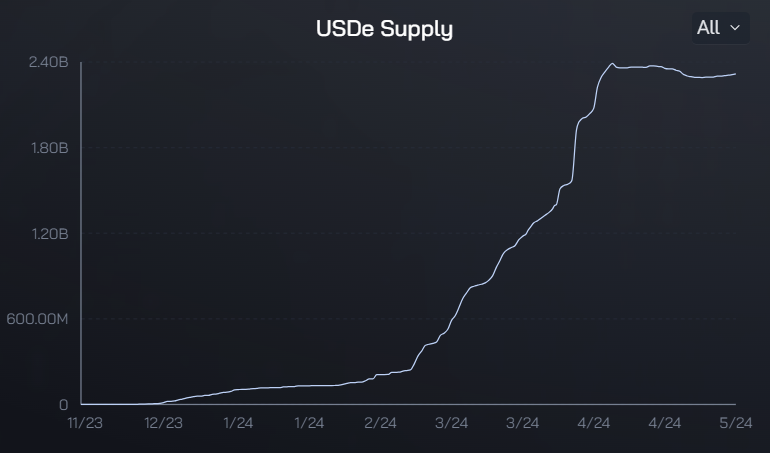

- It has gained significant traction, with over $2 billion in total value locked and attractive APY yields of around 23%

- However, Ethena's approach carries potential risks, such as negative funding rates, stETH de-pegging, custodial issues, and exchange failures.

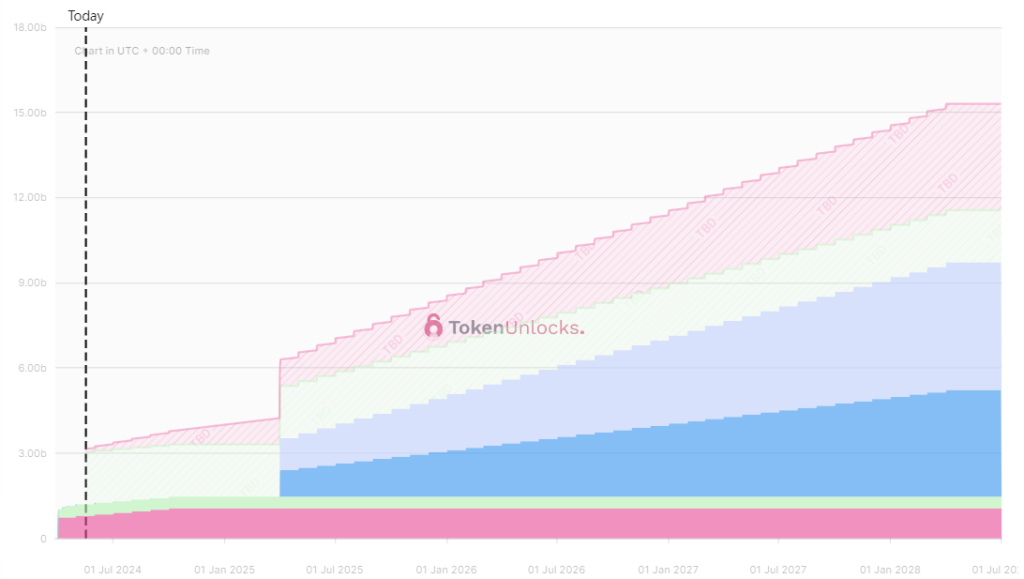

- The native token ENA has poor tokenomics: a low circulating supply, massive insider allocation, and an upcoming supply unlock.

- While farming the ENA airdrop or earning yield on USDe could be worthwhile, we are critical of ENA's investment prospects.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the R.R. trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Ethena

Ethena is a new player in the DeFi industry that recently launched a token and airdropped a portion of the supply to its users. We covered Ethena as an airdrop opportunity here.

If you missed our previous mention of Ethena, here's a quick re-introduction.

Ethena protocol, which introduced quite an intriguing innovation in the stablecoin sector, is a synthetic dollar protocol built on Ethereum. Its primary offering, USDe, is a synthetic dollar token designed to be an entirely native on-chain dollar asset within the crypto ecosystem.

Unlike traditional stablecoins like Tether and USDC, which are backed by real dollars or assets held by centralised custodians, Ethena uses a unique blend of crypto asset backing (BTC and ETH mostly) and financial instruments to maintain a peg to the U.S. dollar.

The Ethena protocol has seen significant growth since its inception. It boasts a total value locked (TVL) of over $2b and an average APY of 23%. The USDe token has been the fastest stablecoin to reach $2 billion in supply, a testament to its innovative approach and the market's confidence in its stability mechanism.

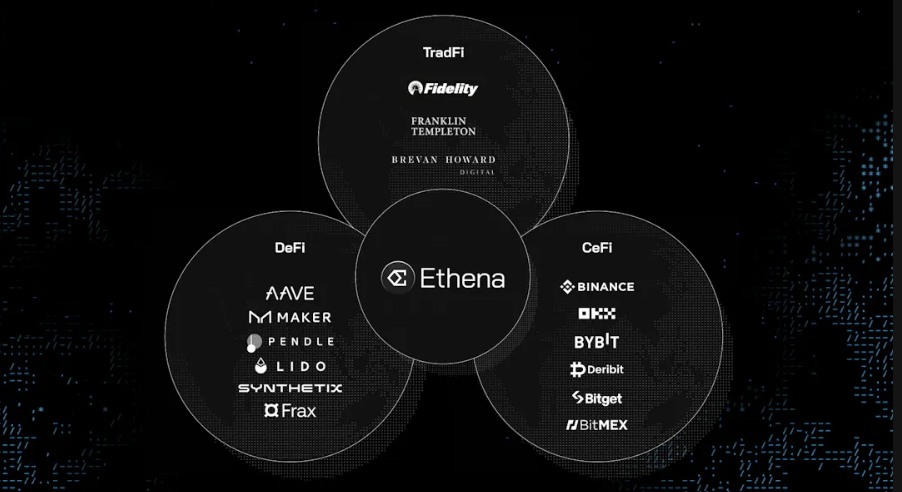

Ethena has ambitious plans to create "The Holy Grail" of money, bridging the gap between DeFi, CeFi and TradFi. It aims to create a unified financial landscape by leveraging USDe as a common currency and liquidity layer across these different financial systems.

In its roadmap for 2024, Ethena laid out its plans to focus on several key areas:

- USDe as money: Ethena aims to establish USDe as a widely accepted form of digital money, bridging the gap between traditional and crypto-native financial systems. Creating money is one of the killer apps of crypto, and Ethena aims to create the most widely spread form of money.

- The Ethena network: Once the platform has successfully created "money", the next step is to build an economy around it. The endgame for Ethena is to create its own network with USDe at the heart of it.

- Aggregated liquidity layer for CEXs and DEXs with USDe as the centrepiece: Ethena plans to create a liquidity layer that connects centralised and decentralised exchanges, with USDe as the primary asset, facilitating seamless transactions between them. It already has a significant size within most of the DeFi space and is now moving towards being a de facto stablecoin across CeFi. For example, ByBit recently integrated USDe for use as collateral in futures contracts. In other words, users can now use USDe as collateral when trading perps.

How it works?

The protocol leverages delta-hedging strategies to ensure the stability of the USDe value. By making staked Ethereum/Bitcoin as collateral, Ethena ensures the USDe value remains the same as the U.S. dollar.The platform buys the underlying asset (staked ETH/ BTC) and shorts it on centralised exchanges to collect funding fees. This strategy is widely known as "basis trade." Ethena is tokenising this strategy to offer yield on the U.S. dollar-pegged stablecoin. It's quite an interesting play!

It relies on custodians and centralised exchanges such as Binance, ByBit, and Kraken.

Ethena's innovative approach to offering yield on a stablecoin is certainly intriguing. However, when it first came to the market and started offering over 20% yield on USD, many started questioning the sustainability of this approach. It reminded us of another $11b stablecoin that also provided a 20% yield but eventually blew up, destroying many people's capital.

Let's dig deeper into potential risks and see whether this is another stablecoin fiasco quietly brewing in the crypto market.

Is this another Luna in the making?

The spectacular collapse of Terra's algorithmic stablecoin UST and its sister token LUNA served as a harsh wake-up call for the crypto industry. It highlighted the catastrophic risks arising from flawed stablecoin models and unsustainable tokenomics.While Ethena's synthetic dollar protocol USDe employs a fundamentally different approach than Terra's ill-fated UST, we have concerns over Ethena's ability to maintain its peg if market conditions change.

Automatic basis trade and offering yield on over $2b worth of stablecoins opens up doors for some high-risk scenarios that can theoretically lead to a collapse of Ethena.

Let's go through them one by one…

Funding risk

As previously explained, Ethena holds a delta-neutral position (holding the underlying asset and shorting it on CEXs) to collect funding rates. Thus, the funding rate of the short position is a primary source of Ethena's yield. The protocol earns from the position as long as the funding rate stays positive. However, the possibility of the funding rate going negative is still present.Historical data shows that the funding rate has exhibited a natural positive bias and contango. However, there have been periods (usually bear markets) when it has been negative.

In the bear market scenario, Ethena's approach would result in protocol losses, which can cause extreme selling pressure on USDe, consequently leading to a de-peg and a death spiral.

However, the team acknowledges potential risks and has an insurance fund for this scenario. Nevertheless, whether the insurance will be sufficient to keep the peg stable of a massive $2b stablecoin remains to be seen.

Liquidation risk

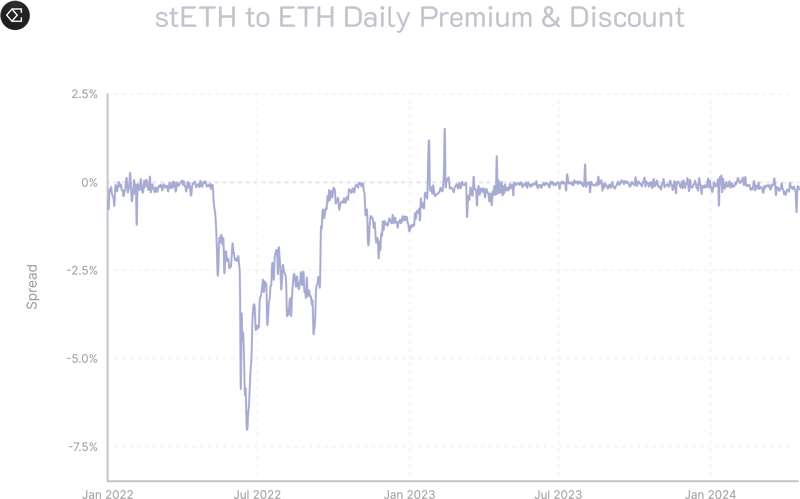

Ethena uses stETH as collateral for basis trades. Generally speaking, stETH is a yield-bearing asset, which makes it great collateral for trades. stETH accumulates Ethereum's staking yield and is thus designed to increase in value relative to ETH.However, history has shown that stETH might not always increase in value relative to ETH; it can actually also decrease in value (de-peg) relative to ETH.

Even though the market inefficiencies can be filled over time and the peg can be restored, volatility can cause cascading liquidations in the futures market, posing significant risks to the "stability" of Ethena's stablecoin USDe.

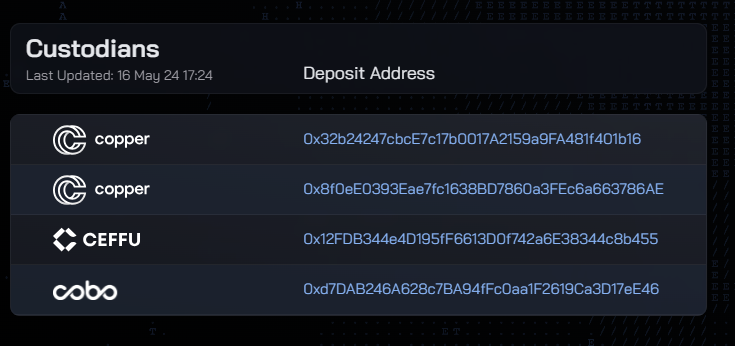

Custodial risk

Ethena relies on several centralised custodians for efficient asset transfer management and operational duties. Any failure in these duties could impact trading workflows and the availability of the mint/redeem USDe functionality.

The insolvency of any of these custodians could pose operational issues for the creation and redemption of USDe.

Exchange failure risk

Lastly, we have seen with FTX that no matter how big the exchange is, it can blow up and cause significant loss of funds to anyone holding funds on an exchange.Reliance on CEXs for funding rates is one of the significant risks in USDe's design. Even though CEX solvency checkers from services like CoinGecko and Defillama reduce information asymmetry and provide transparency, history has shown that CEXs are subject to hostile regulation, and deposited funds can be frozen, confiscated or lost.

Ethena's approach to exchange failure risks involves maintaining a diversified portfolio of derivatives across multiple exchanges, monitoring market conditions, and having a robust insurance fund to cover potential losses. This strategy aims to protect the value of the USDe stable peg and the collateral backing it, even in the event of an exchange failure.

All the risks mentioned above are correlated and tend to occur during bear markets. Therefore, monitoring potential risks while using the Ethena protocol is important.

Now, let's look at the tokenomics.

Tokenomics

Ethena's native governance token is ENA. The token has been airdropped to users who participated in Season 1. If you missed it, no worries—Season 2 is ongoing. We covered how to farm the Ethena airdrop here.The ENA token serves as a governance token, allowing holders to participate in the decision-making processes of the Ethena protocol. Additionally, staking ENA provides a boost for those who are farming Season 2 airdrop, but we wouldn't advise staking ENA.

Basic information:

- Mcap (circulating): $1b

- Mcap (fully diluted): $9.9b

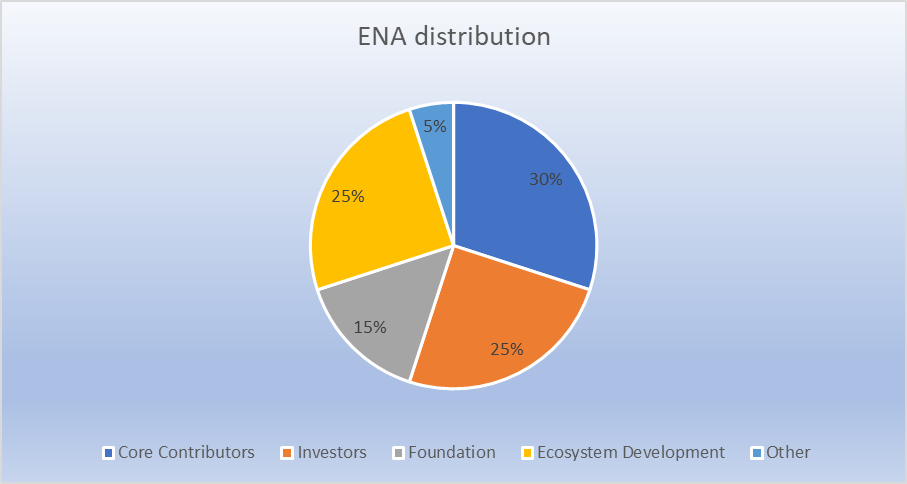

The distribution of tokens doesn't look nice either.

Insiders are allocated 70% of the supply, probably the highest insider allocation crypto markets have seen from legitimate projects.

Backers

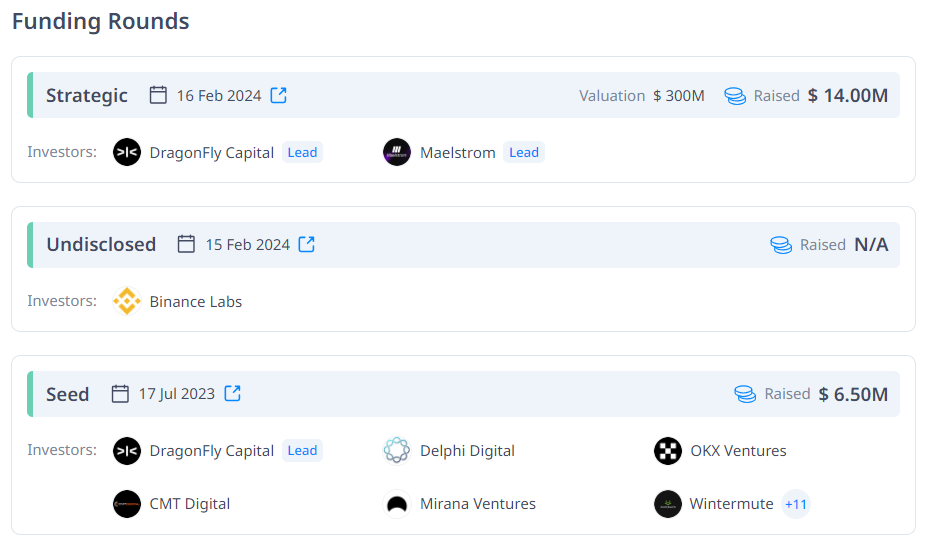

However, one thing Ethene can't shy about is the calibre of its backers. It raised over $20m at a whopping $300m valuation from prominent VC firms like DragonFly and Delphi Digital. Moreover, it also raised an undisclosed amount from Binance Labs.

Despite having strong backers, the tokenomics and risks on the horizon are putting us off.

The combination of low-float supply, lack of clear use cases for the token, terrible supply distribution, and huge upcoming unlock makes the investment prospects of ENA very problematic.

Cryptonary's take

Despite being a very innovative platform that tokenises trading strategies, this is a VC coin, a predatory distribution with terrible tokenomics.Unsurprisingly, many of these VCs are heavily shilling ENA on Twitter. We suspect their plan is to manipulate the price, drive hype, and dump on the market in about one year when their allocations will be unlocked.

Therefore, we wouldn't recommend investing in ENA.

However, not investing in ENA doesn't mean there is no opportunity here. Season 2 of the Ethena airdrop is currently ongoing.

You can still farm it using a step-by-step tutorial here. We recommend selling the airdrop received, as we don't see much utility in a token at this point.

Secondly, since we are in the bull market, the earning yield on Ethena's stablecoin is pretty attractive (around 23% APY on average). However, as mentioned earlier, USDe carries risks that users should be aware of.

Those risks are more likely to happen during a bear market. Therefore, since we are currently in the bull market, taking advantage of this opportunity might be a good deal.

Overall, the only value proposition we see here is farming the ENA airdrop or earning yield on USDe, but from an investment standpoint, we would think twice before investing in this.

Cryptonary Out!