Venture Capital 3.0 | A Cryptonary Investment

Are you tired of traditional venture capital funds controlling the crypto market? Imagine if transparency was mandatory and only the smartest crypto minds ruled the game. Welcome to the world of Venture DAOs.

Today, we invite you to join us on an exciting journey as we explore an impressive project. We firmly believe that the market is vastly undervaluing its potential, and we're here to show you why.

TLDR

- Venture DAOs provide seed capital, networking, and mentorship to jump-start new DeFi projects. They will replace traditional Venture Capital funds.

- New Order is a community-led venture DAO for DeFi, with a killer team and impressive track record.

- They’ve incubated five successful in-house projects and accelerated 13 others with DeFi Base Camps.

- New Order has nearly $28M in assets, and the fair price for $NEWO token is between 6.5x and 22x the current price.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your full responsibility and yours only.

The problems with traditional venture capital

Let's start by looking at the traditional venture capital (VC) landscape, where the largest VC fund (Andreessen Horowitz) has more capital than half of the world’s countries and controls many markets, including crypto. But, as we've seen time and time again, traditional VC funds can be a double-edged sword. While they may help build the space, they often do so to extract short-term benefits.For example, Three Arrows Capital (3AC) helped many projects grow, but eventually caused significant losses for most of them by gambling away the projects’ treasury funds. The lack of transparency and accountability for VCs caused significant losses for the average retail investor caught in the crossfire. The 3AC collapse sent crypto prices tumbling down with BTC dropping to $17,500 and ETH falling under $900.

But what if decentralized organizations ran the venture funds? What if transparency was mandatory, and only the smartest crypto-native brains ruled VCs?

This is the potential of the project we're exploring today. We believe that the transparency and decentralization of DAOs could fundamentally change the way we invest in crypto.

So, join us as we uncover the future of crypto investing. We're confident that you'll come away with a deeper understanding of the possibilities of venture DAOs and why this project is poised for success. Get ready to level up your portfolio and be part of the next revolution in crypto!

Venture DAOs explained

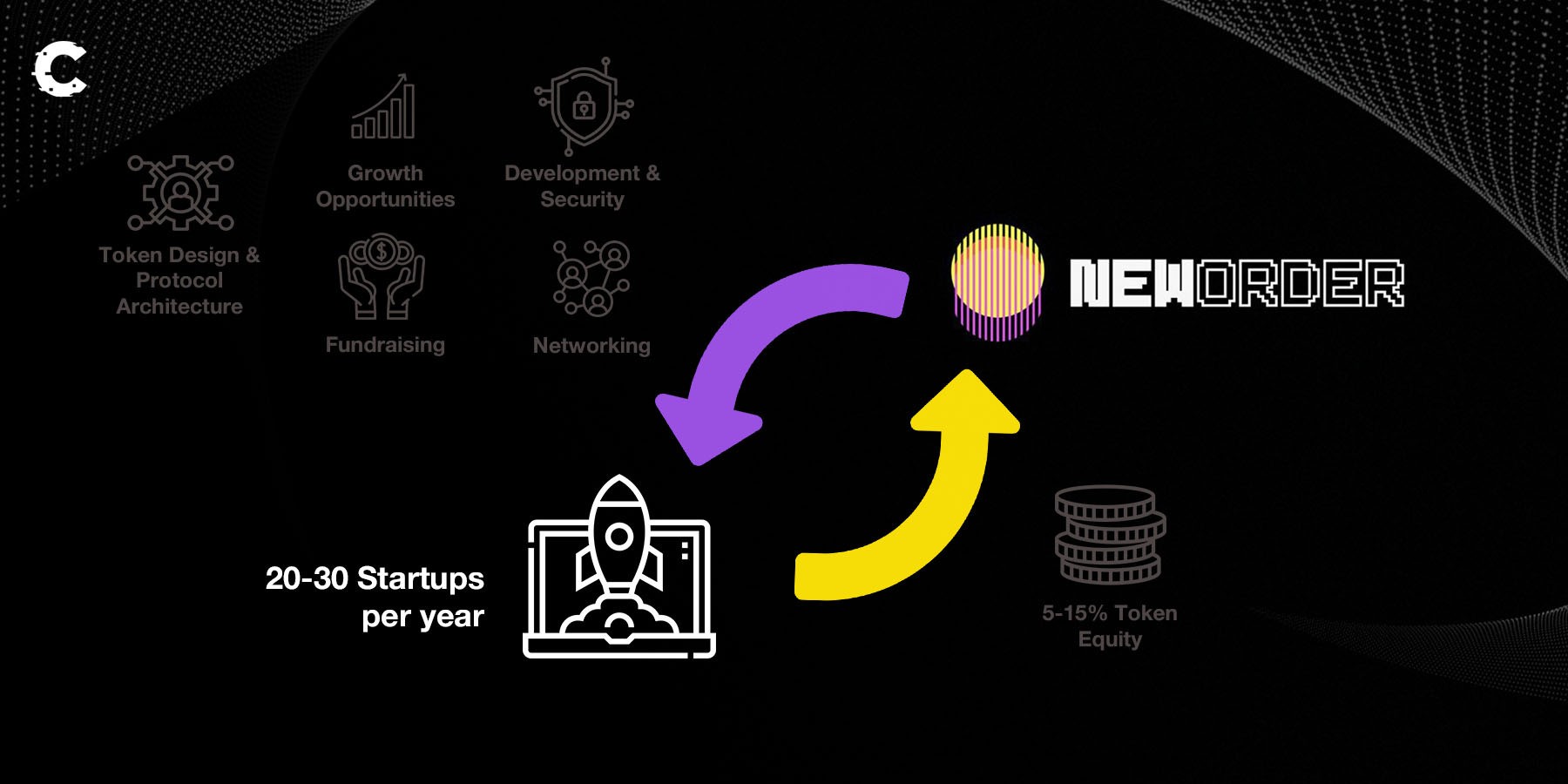

In general, venture DAOs operate similarly to your standard startup incubators.- Burgeoning crypto founders reach out to the DAO for assistance in incubating and/or accelerating their product (incubation vs acceleration).

- The DAO leverages its network of experts to assist the startup and fast-track its growth, often providing seed capital.

- Once launched, the new project allocates a percentage of their token supply to the DAO.

- While not all of these projects will be grand successes, the DAO relies on the Power Law - with a small number of grand slams bringing the vast majority of returns

New Order was founded on the idea that the coordination obtained through the DAO model can bring about a new era of collaboration - with the community as a co-founder.

For their helping incubating/accelerating projects, 5–15% of a project’s total supply is earmarked for the New Order treasury.

Their DAO Structure

Their core team boasts an impressive lineup with experience on both the accelerator and the founder sides:- Eden Dhaliwal, former head of crypto at Outlier Ventures,which maintains an ongoing partnership with the DAO. Dhaliwal also mentors at many top accelerator programs.

- Marek Laskowski, a Ph.D. computer engineer and former senior research scientist at BlockScience

- Sami, a long-time researcher at Messari (a top crypto research firm) and founder of Redacted (a DeFi project in the Curve ecosystem)

- Che, co-founder of Redacted and noted DeFi investor.

Lastly and most importantly, the community holds a significant role in New Order. They wield the power to influence treasury investments, voting on candidate projects as well as the day to day (and long-term) operation of the DAO.

I’d recommend all readers check out New Order’s 2023 thesis as it outlines the level of expertise this team brings to the industry. It was this thesis that had us start taking a close look into their DAO.

New Order’s investment track record

If we’re going to evaluate this DAO as an investment vehicle, we need to take stock of their previous venture experiments.In traditional venture capital, it’s again important to remember the Power Law. As previously mentioned, this states that the vast majority of returns will come from a very small number of venture investments. On the average, only about 4% return 10x or more . If a VC firm is producing such successes at a record of 10% or better, it is a major outperformer.

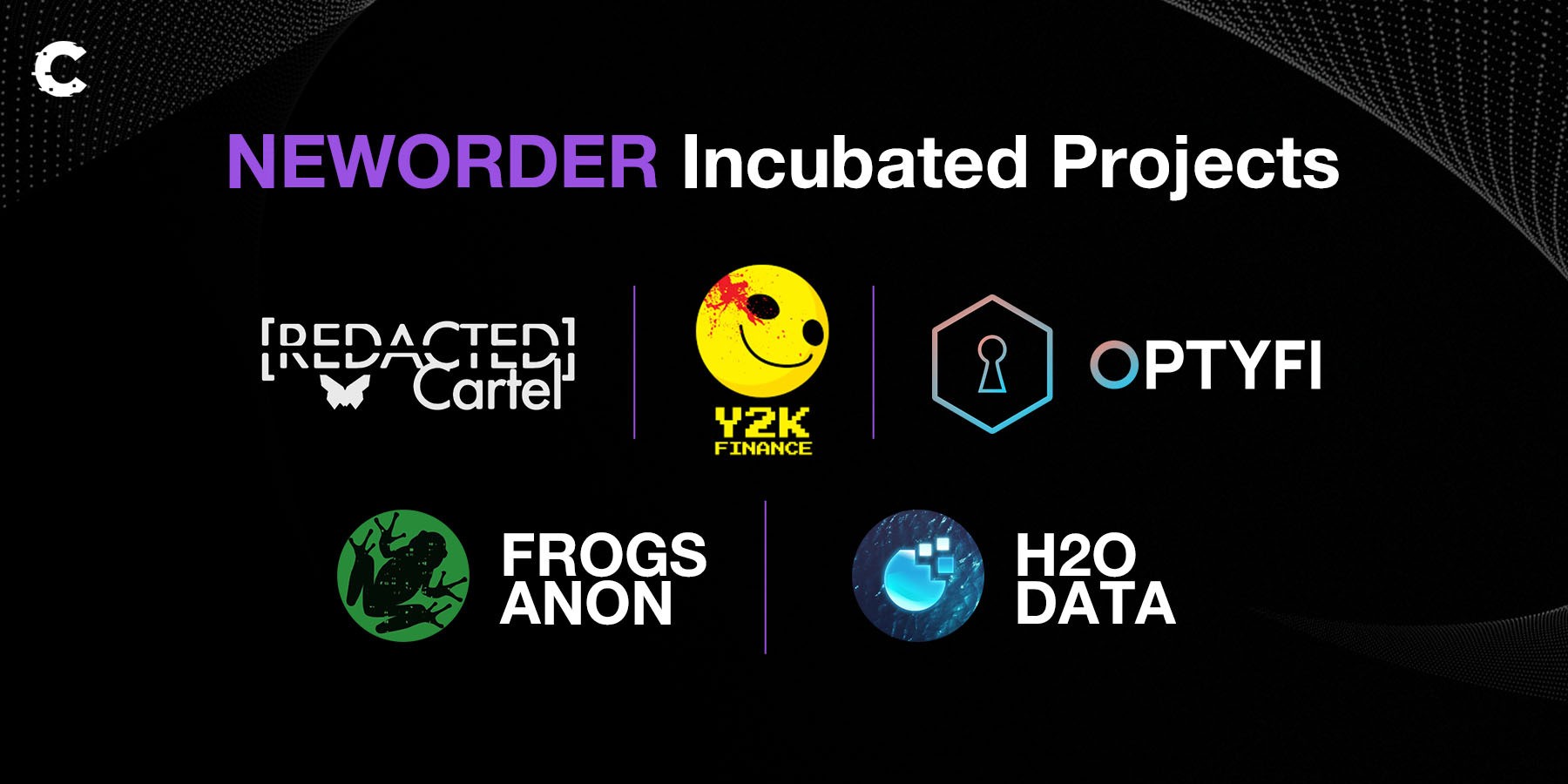

New Order has incubated five products in-house that are currently live. The most notable of these are Redacted and Y2K, each of which sports over $100M in FDV (fully diluted valuation) and has a strong market presence in their respective sectors. With New Order owning 5-15% of each project, the project has made some healthy returns (roughly 100x’s) on their ~$100K investments.

Other projects incubated by New Order include H2O, Frogs Anonymous, and OptyFi

Projects currently being incubated by the busy DAO include Motherboard, Sector Finance, and Wynd

In addition, New Order has accelerated 13 other protocols with their DeFi Base Camps. You can read more about these upcoming projects by checking out New Order’s announcements (Cohort 1 and Cohort 2).

The $NEWO Token

“Well this is great and all, but should I ape?” — Hold on, friend, let’s first take a look at the $NEWO token and its value accrual mechanism.

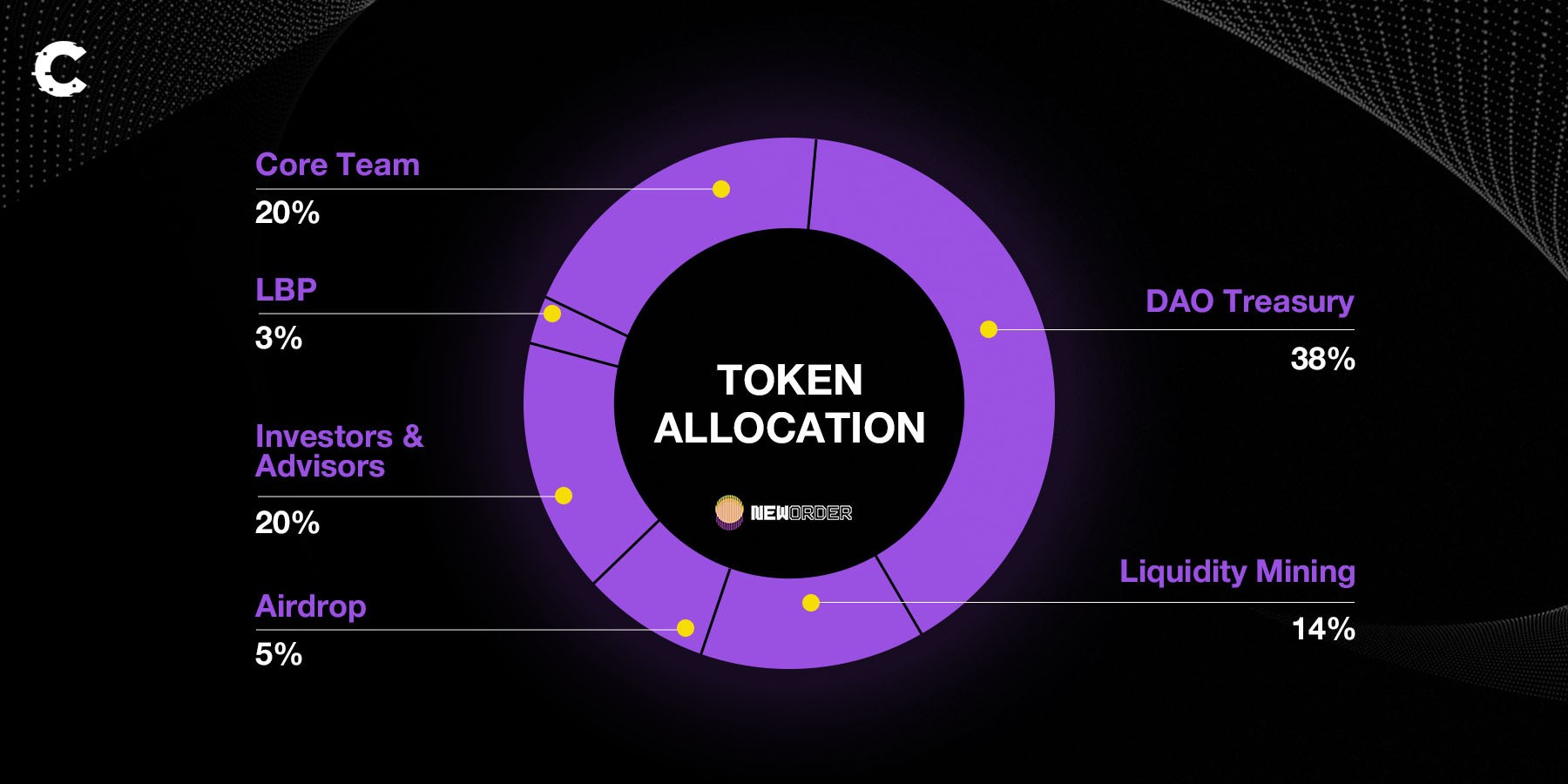

$NEWO’s value is derived from the power its holders have over directing the treasury via the Treasury Sub DAO (a small committee that manages it). In a way, it is a proportional claim on the treasury assets.

Holders are able to lock their tokens for up to three years to obtain $veNEWO (vote-escrowed $NEWO). Locking tokens demonstrates long-term conviction in the protocol, and hence comes with some bonuses in terms of governance power, protocol emissions, treasury yield sharing, and incubated project airdrops.

Several projects have already confirmed airdrops to $NEWO stakers (equivalent to $veNEWO holders):

- Y2K Finance — 2% airdropped to stakers, 8% goes to New Order Treasury

- H2O Data — 4% airdropped to stakers, 15% goes to New Order Treasury

New Order DAO’s funds

Remember how we mentioned that, in theory, the token is a claim on a portion of the treasury? Understanding the value of the treasury will give us a better handle on the fair valuation of $NEWO.

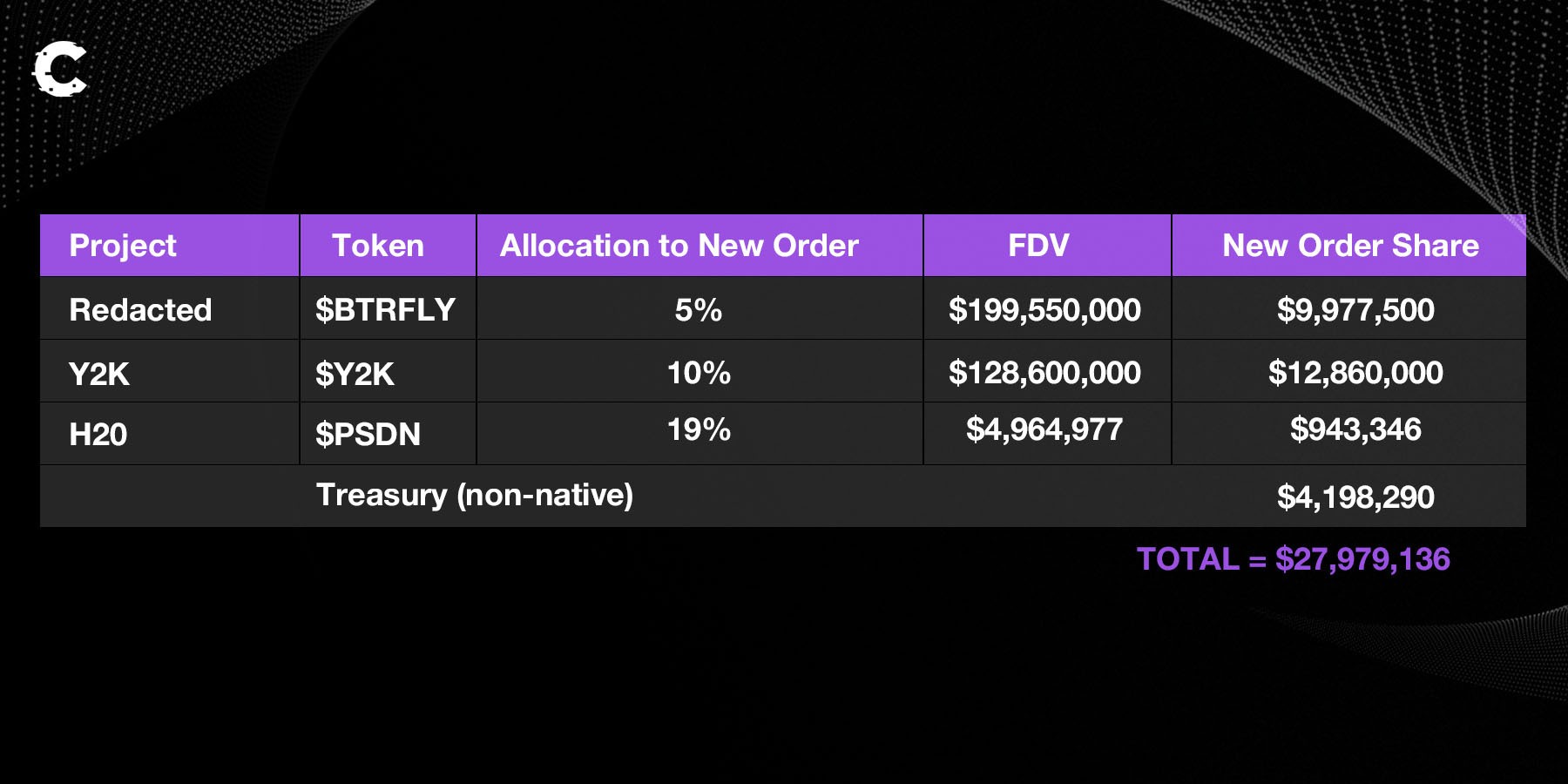

New Order DAO’s assets can be divided into two subsets:

- The Treasury ($4,198,290): These are the assets held by the DAO to run their operations and make investments. This capital is divided between $ETH (30%) and stablecoins [$USDC, $USDT, $LUSD](70%).

- Investments/Equity ($23,780,846): These represent the equity owned by the DAO in the projects they helped grow. What’s more is that this number only represents three projects so far, as these are the only ones with launched tokens. So in reality, this number may increase substantially with future token drops.

In our view, a bet on the New Order token is a bet that either:

- The projects listed above will appreciate greatly (they are ranked around the #400–1000 mark amongst all cryptos according to CoinGecko)

- OR any of the remaining projects not included will outperform the general market

- OR the current price does not align with price multiples of others in the same sector

$NEWO Price Targets

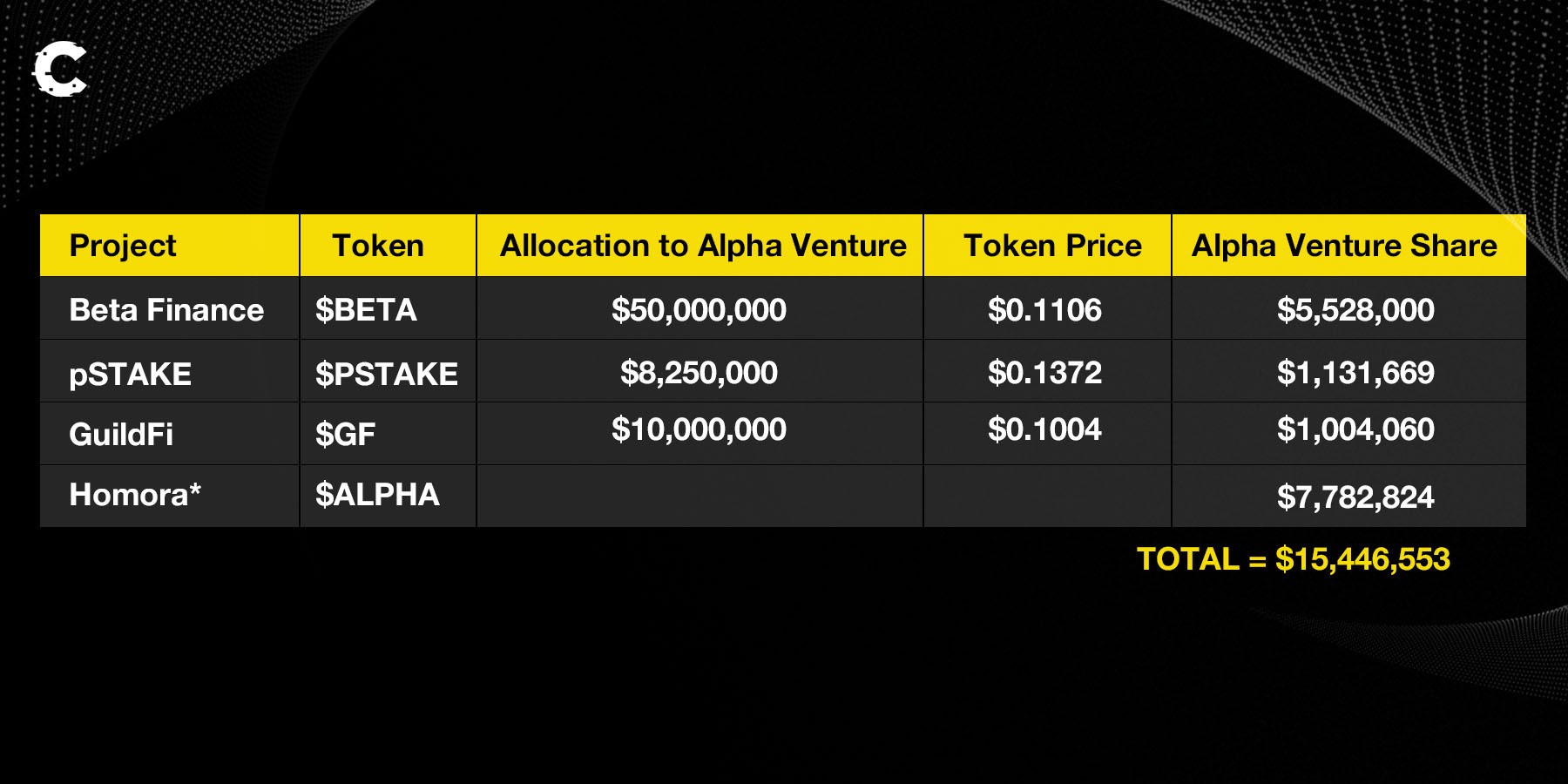

As a means of developing our price targets, we will be comparing NAV multiples with Alpha Venture DAO. Alpha Venture works similarly to New Order, in that it develops in-house projects and helps incubate/accelerate outside protocols.Of its projects, Beta ($BETA), pStake ($PSTAKE), and GuildFi ($GF) have token distribution plans to stakers, which can be compared to what I’ve already investigated for New Order. On top of these, 80% of the revenue generated from Homora (a leveraged yield farming and lending tool) is distributed to the stakers — I’ve also included this in the calculation. Note that Alpha Ventures only has its native token, $ALPHA, in its treasury wallet; hence why the treasury isn’t listed here.

[caption id="attachment_263435" align="aligncenter" width="1800"] Overall, Alpha Ventures has generated about $15.5M in value[/caption]

Overall, Alpha Ventures has generated about $15.5M in value[/caption]

As a reminder, here is the NAV calculation again for New Order👆

Further note that no “future revenue” was included for either Alpha Venture (via Homora) nor New Order (via Redacted and Y2K).

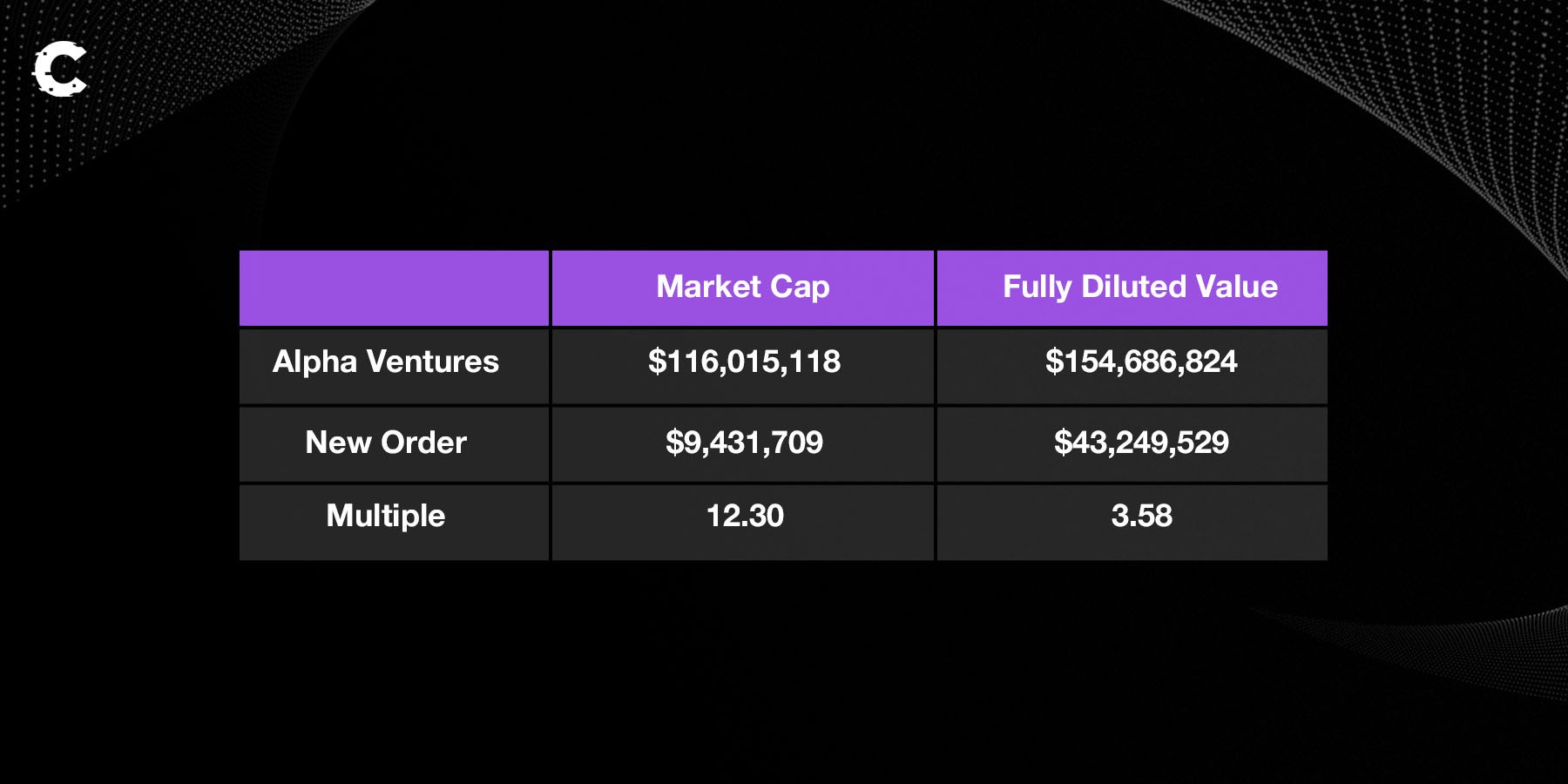

If we compare the current (as of 21 February, 2023) market cap and fully diluted valuations of each project, we get the figures below. I’ve included the “multiple” as a measure of how much larger Alpha Venture is than New Order.

At current market prices, Alpha Venture’s market cap is >12x the size of New Order, while its FDV is 3.5x the larger

“But wait,” you may be saying, “I thought the NAV for New Order was larger. Why would its market cap be smaller?”

In my opinion, the market is currently undervaluing New Order’s value and future growth while perhaps overvaluing that of Alpha Ventures. Just how drastic is this underpricing? Let’s take a look at the ratio of each project’s NAV to its market cap and FDV. Alpha Venture’s multiples here will give us an idea of how to fix a fair price for New Order.

The market is pricing Alpha Ventures at a multiple of 7.5–10x while pricing New Order at a multiple of 0.3–1.5x, depending on if you’re looking at market cap or FDV.

This leads us to conclude that the “fair” multiple for New Order DAO is somewhere between 6.5x and 22x the current price (if the market efficiently prices New Order and Alpha Ventures), as shown in the blue table below.

This may be further improved with successful launches of fresh New Order DAO projects, increasing valuations of current projects, and/or improving market liquidity conditions.

These are the target token price and corresponding market caps for $NEWO. For point of reference, note that a market cap of $210M would place $NEWO at #195 for all crypto projects according to Coin Gecko, at current prices.

While I believe both DAOs have the potential to increase their market capitalizations, New Order certainly looks like it has more room to run in favorable market conditions.

New Order | Risks

For small cap projects, it is generally recommended to size your investments accordingly. Outside of the standard recommendations, let’s walk through some of the unique risks faced by New Order.- Maintaining project runway is doubly important for a Venture DAO. The current burn of the project is about $576,000 per quarter, which gives the DAO a little less than two years of runway from the current treasury ($4.2M) if we don’t account for incubation/acceleration investments. We will watch this closely, checking in at least once a quarter to see if there are increases/decreases. We will update you, of course.

- The progress of incubated/accelerated projects. These are what are going to make or break the success of the DAO. The New Order blog is a good place to check for updates.

- Token vesting has begun for the investor allocation (20% of total). Along with the team vesting (also 20% of total) that is set to begin in May, a total of ~$500k worth of tokens will be released on a monthly basis. Pay attention to larger wallets dumping vast tokens. You can watch large holders here.

- Competition for incubated/accelerated projects. During our research, I’ve noticed that a few New Order investments are not unique. In particular:

-

- Smilee is competing with GammaSwap in the world of shorting impermanent loss.

- Caviar will be in the same arena as SudoSwap in the NFT AMM (Automated Market Maker) game

- While not completely overlapping, 0xKYC is playing in the field as Masa and other soulbound token (SBT) identity protocols. However, the privacy that 0xKYC provides definitely sets it apart.

-

Invalidation Criteria

Price action would have to completely wipe out mainnet liquidity to become an invalidation criterion (you could check this by looking at the treasury’s allocation to SushiSwap here). Outside of, these are the important metrics we will be watching:- If the project is running low on runway (6 months or shorter), with no obvious path to shoring up the reserves, we will exit.

- If Outlier Ventures ceases its connection with New Order, we will take this as a sign of loss of trust and will exit. However, this is unlikely, as Outlier has skin in the game via its $NEWO allocation.

- A possible breakdown in command within the DAO, whereby DAO members are unable to actively voice their concerns. We would also exit in this case.

- Insider sales pressure. This could be a sign of a loss of conviction. We will be monitoring token flows to see if large holders are dumping. If so, we will decrease our position and/or exit entirely.

Cryptonary’s Take

We appreciate you sticking it out to the end to fully digest this project!New Order DAO has continued to impress us with their diligence and expertise. Their launches of two grand slams (Redacted and Y2K) and the potential of many others in such a short time is very exciting. Observing the DAO continue to not only operate, but build and incubate during bearish times has given us confidence in their long-term viability.

Even if you choose to pass on the $NEWO token specifically, we think it’s wise to keep tabs on what these groups are helping build. This is truly the cutting edge of innovation in crypto.

Action Points

Assuming none of our invalidation criteria are met, here’s how we are managing buys and sells.- As a long-term investor, we’re buying $NEWO monthly as long as it is below $0.10. If that runs for a year, great. If only for a month, that’s fine too.

- Selling 25% at the $0.50 psychological level.

- Selling 75% at $1.10. As the previous all-time high ($1.17) aligns nicely with our price target ($1.20), We would exit completely just below this (at $1.10) as these levels could provide heavy resistance.

- New Order main site

- 2023 Thesis

- CoinGecko

- Documentation

- Medium (one, two)

- Treasury wallets

- Governance (forums, snapshot, venture discussions)