Want a piece of the $39B leader on Solana? Let’s dive into Jupiter

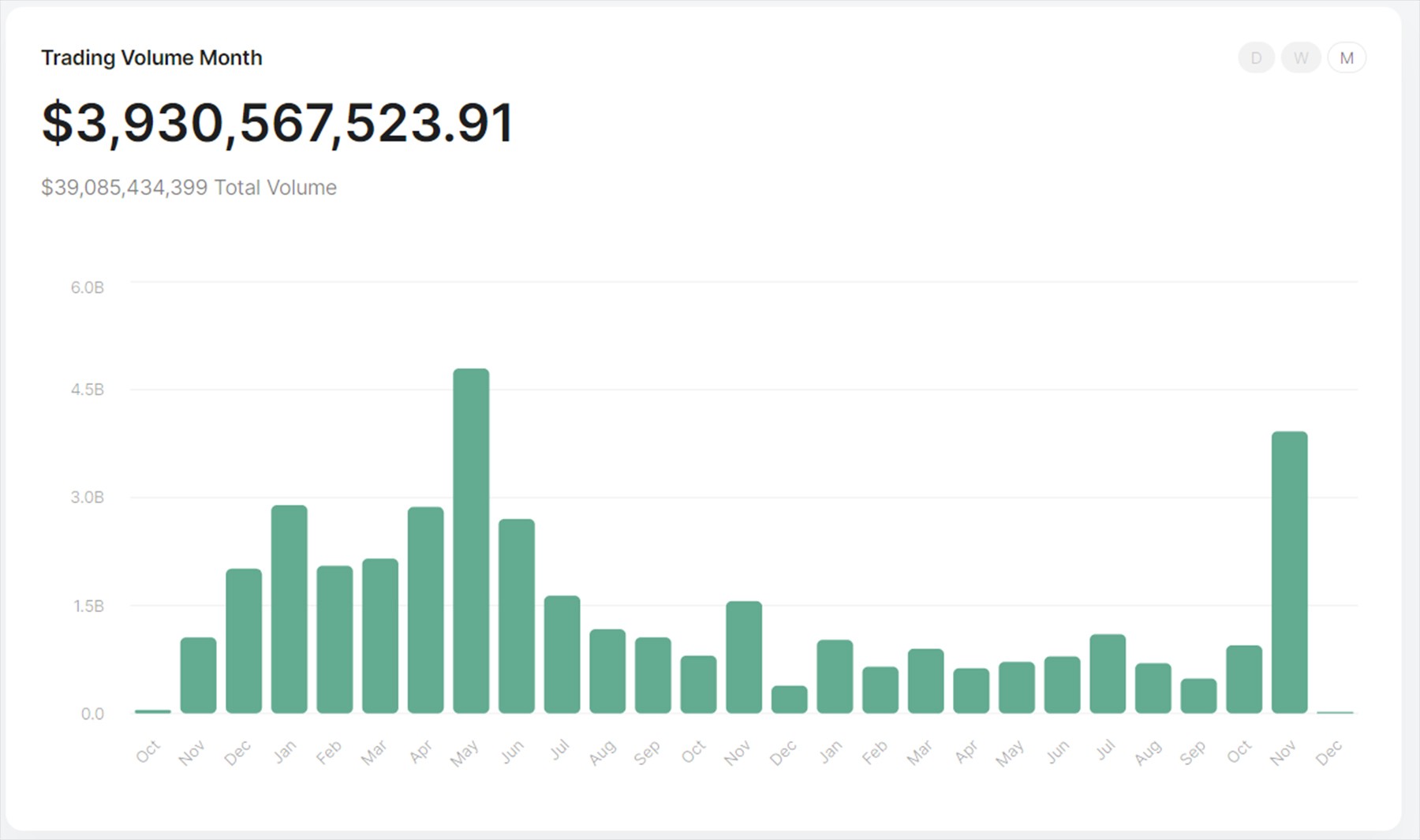

Jupiter remains the indisputable leader in decentralised trading on Solana. With an impressive $39 billion in swap volume, it stands at the forefront. What's more? It is poised to become a foundational cornerstone of the Solana ecosystem.

In this exploratory report, we delve into Jupiter's meteoric ascent. An ascent driven by a groundbreaking free swap aggregation service that has secured a massive 80% market share. We also examine the new frontiers Jupiter is boldly venturing into. These span perpetual trading, stablecoins, education platforms, launchpads, and more.

By the end of this article, you'll gain insights into Jupiter's remarkable journey. You also discover the optimal ways to participate in upcoming JUP airdrops. Sounds interesting? Let’s dive into it.

Key takeaways

- Jupiter dominates Solana trading with 80% market share via its free swap aggregation service.

- Its path to revenue includes a recently launched decentralized perpetual exchange based on GMX's proven model.

- It plans to launch an SUSD stablecoin offering high 10-12% yields through leveraged liquid staked SOL.

- Jupiter is strategically expanding into launchpads, venture funding, education platforms, and more.

- 40% of total Jupiter's JUP token is allotted for community airdrops.

- Tokenomics details are still unclear; stay tuned for updates on a valuation model.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

The heart of Solana trading

Jupiter’s core product is its swap aggregator. It is a platform used to gather liquidity for traders seeking the best possible prices with minimal slippage.The aggregator has achieved $39 billion in total trading volume. It executed over 100 million transactions. And more than 955,000 unique wallets used it.

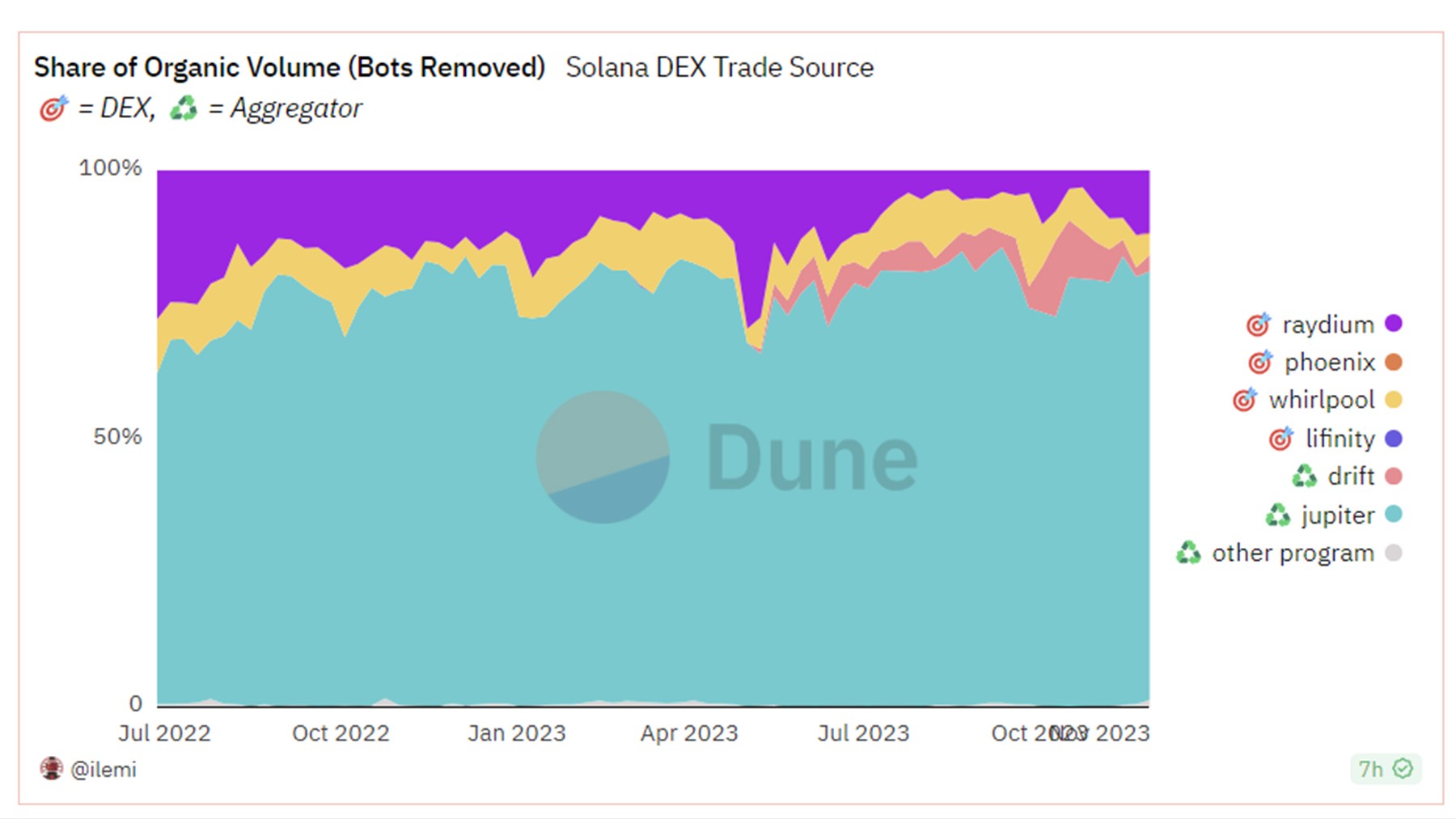

The aggregator also currently represents 80% of the organic swap volume on Solana, underscoring its dominant position in the Solana ecosystem.

Jupiter leads in swap aggregation on Solana, leveraging its specialised routing system. This advantage allows Jupiter to spread orders across various DEXs, giving it a competitive edge in pricing compared to other platforms. The recent upgrade, Metis, enhances performance by 5.22%, enabling Jupiter to navigate more efficient routes and execute complex trades.

Critically, Jupiter's widespread platform adoption is contingent on its strategic decision to offer its swap aggregator for free. This wise move positions Jupiter as the pioneering market leader, creating pricing barriers for potential later entrants.

Some may argue that adopting a zero-fee approach poses a risk by potentially leaving revenue opportunities untapped. We counterargue that the accrued benefits of network effects and market share gains outweigh the near-term revenue trade-offs.

Later in this report, we will explore why this concern may not be as significant as it seems.

Moreover, Jupiter has demonstrated its commitment to innovation in 2023 beyond providing better pricing and undercutting competitors. It has introduced two new features accessible through its platform to reflect its ongoing efforts to enhance user experience and maintain its competitive edge.- Limit Orders: Jupiter allows users to set specific price limits for buying or selling a token. The limit order will execute when market prices meet the user's preset limit price. Additionally, Jupiter can collect a 0.1% fee on limit orders as a platform fee.

- Dollar Cost Averaging: Jupiter's dollar cost averaging tool lets users automatically schedule recurring buys or sells of a token over set time intervals. This reduces exposure to volatility risk compared to single bulk orders.

The path to revenue

So, if Jupiter charges no fees as a DEX aggregator, and the only transactions it takes a fee on are limit orders, how will it increase its revenues?Well, Jupiter's swap aggregator brings people to the platform. However, it is strategically building a whole ecosystem around this with different products to get on the path to revenue.

These products are all still in the very early stages of development, but they could eventually be the driving force behind revenue for Jupiter.

Let's explore them.

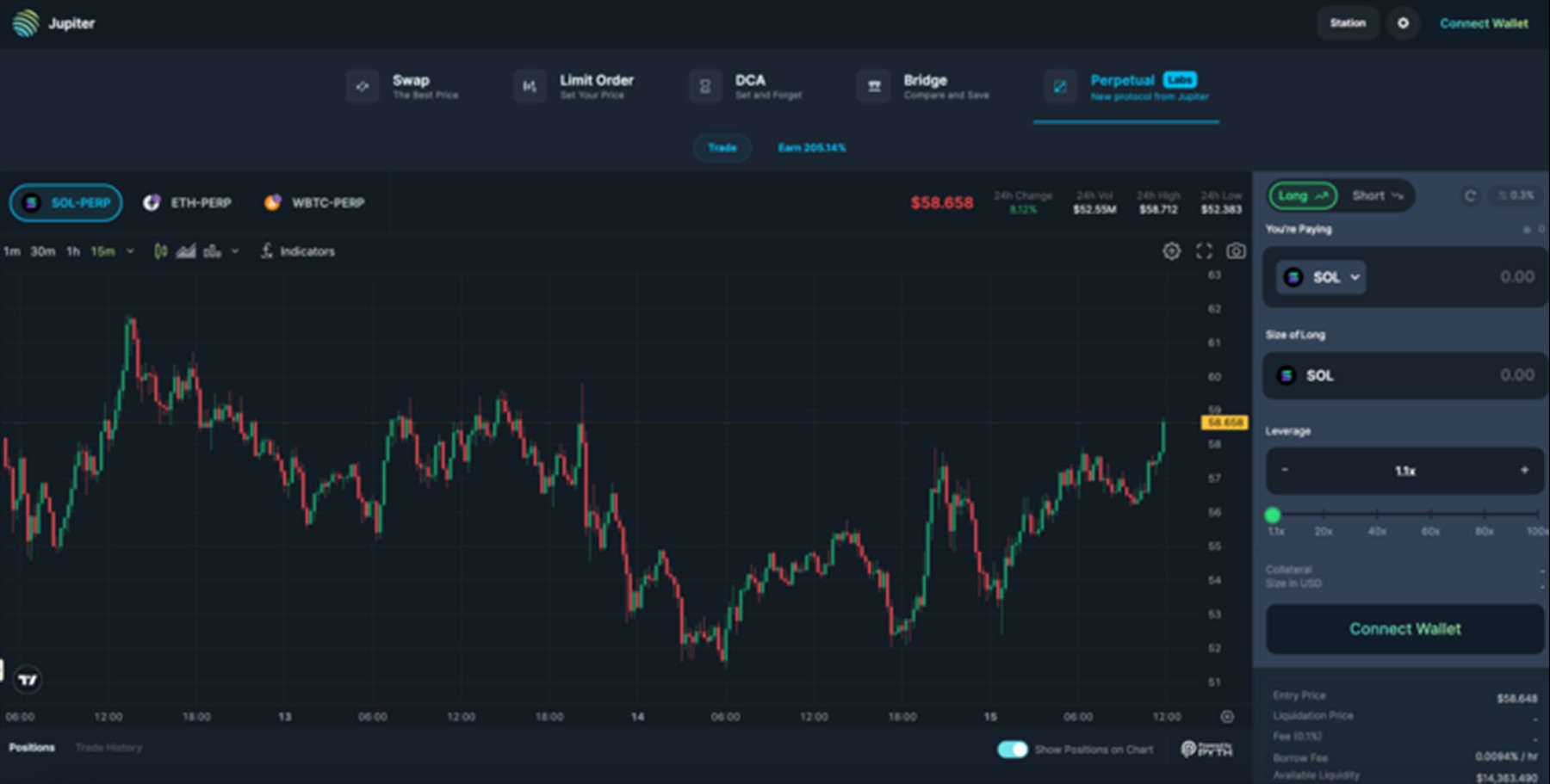

Perpetual exchange

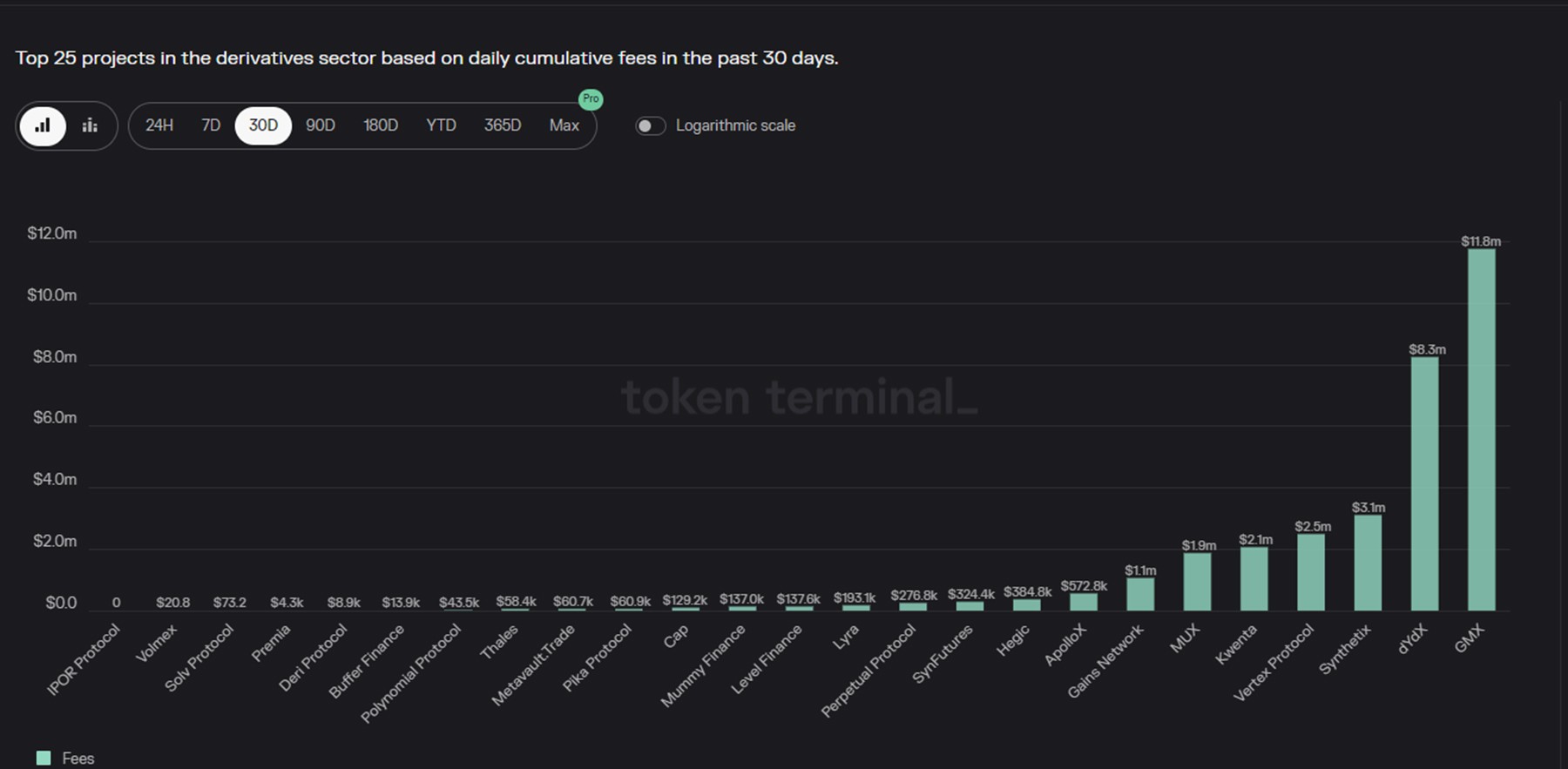

Jupiter recently launched its decentralised perpetual exchange following the introduction of its aggregator platform earlier in November. Given the clear product-market fit and lucrative economics demonstrated by existing decentralised perpetual exchanges like GMX, it's unsurprising to see Jupiter expand into this sector as its second venture.Over the last 30 days alone, the category leader GMX earned $11.8 million in fees, validating the profit potential of decentralised perpetual trading platforms. Notably, Jupiter's newly launched offering closely mirrors the design principles and mechanics underpinning GMX V1.

Rather than rely on a traditional Central Limit Order Book system and incentivisation of professional market-making institutions, both Jupiter and GMX opted for a simpler passive liquidity provider model.

Here, ordinary investors contribute assets to a pooled basket (called GLP on GMX and JLP on Jupiter), which automatically takes the counterparty side for customer trades.

As a reward for bearing the associated risks and serving as the exchange's reserve, liquidity providers receive 70% of the fees. These fees, earned through hourly borrow fees and 0.1% charges for opening and closing positions, compound into the price of JLP, generating profits. for liquidity providers.However, the liquidity provider model isn't without vulnerabilities. Provider assets are inherently exposed to losses from customer wins or exploitation of design flaws. For example, outdated oracle prices open the door for arbitrage against mispriced assets. Prolonged losses could also hit providers when a pool of large traders bet correctly on a prevailing market trend. Mitigating such downside risks requires vigilant oversight measures - strict position limits, high carry costs, and swift oracle updates.

Recognizing the vulnerabilities posed to liquidity providers under the current exchange design, Jupiter has taken a measured approach - capping the initial JLP pool at $15M with room to expand more cautiously over time. This signals the Jupiter team understands the risks entailed in their model and aims to roll out changes prudently rather than chasing rapid growth.

By tapping into the liquidity furnished by JLP holders willing to take on risks for revenue share, Jupiter's exchange enables users to trade assets like ETH, SOL and BTC with up to 100x leverage.

The exchange architecture provides spread-free trading similar to GMX, with customer orders executed at current market prices based on price feeds from Pyth.

Jupiter's comparatively high fee structure, including elevated borrowing rates, suggests the platform targets amateur retail traders rather than sophisticated professionals or whales expecting lower rates - such as the 0.05% charges on dYdX.

This enables substantially higher revenue capture in the near term, although at the cost of deterring more advanced traders who tend to be sensitive to total fees accrued over longer holding periods. Ultimately, trading on Jupiter's decentralised exchange is more expensive than rivals when assessed based on longer time horizons.

However, Jupiter's commanding 80% control of Solana's spot trading market reduces sensitivity to its pricing model among target users. Like Google Flights, which retains loyal users despite higher booking fees thanks to convenience and dominance, Jupiter Perpetual Exchange will likely inherit traders from its deeply entrenched aggregator interface.

Still in beta without tracking volumes or revenues, Jupiter’s perpetual exchange is primed for success. Tapping into a ready base of retail traders across Solana translates into a valuable source of fee income, nicely offsetting its 0% aggregation fees. Although execution risks remain, the scaffolding mirrors GMX’s winning formula.

LST stablecoin

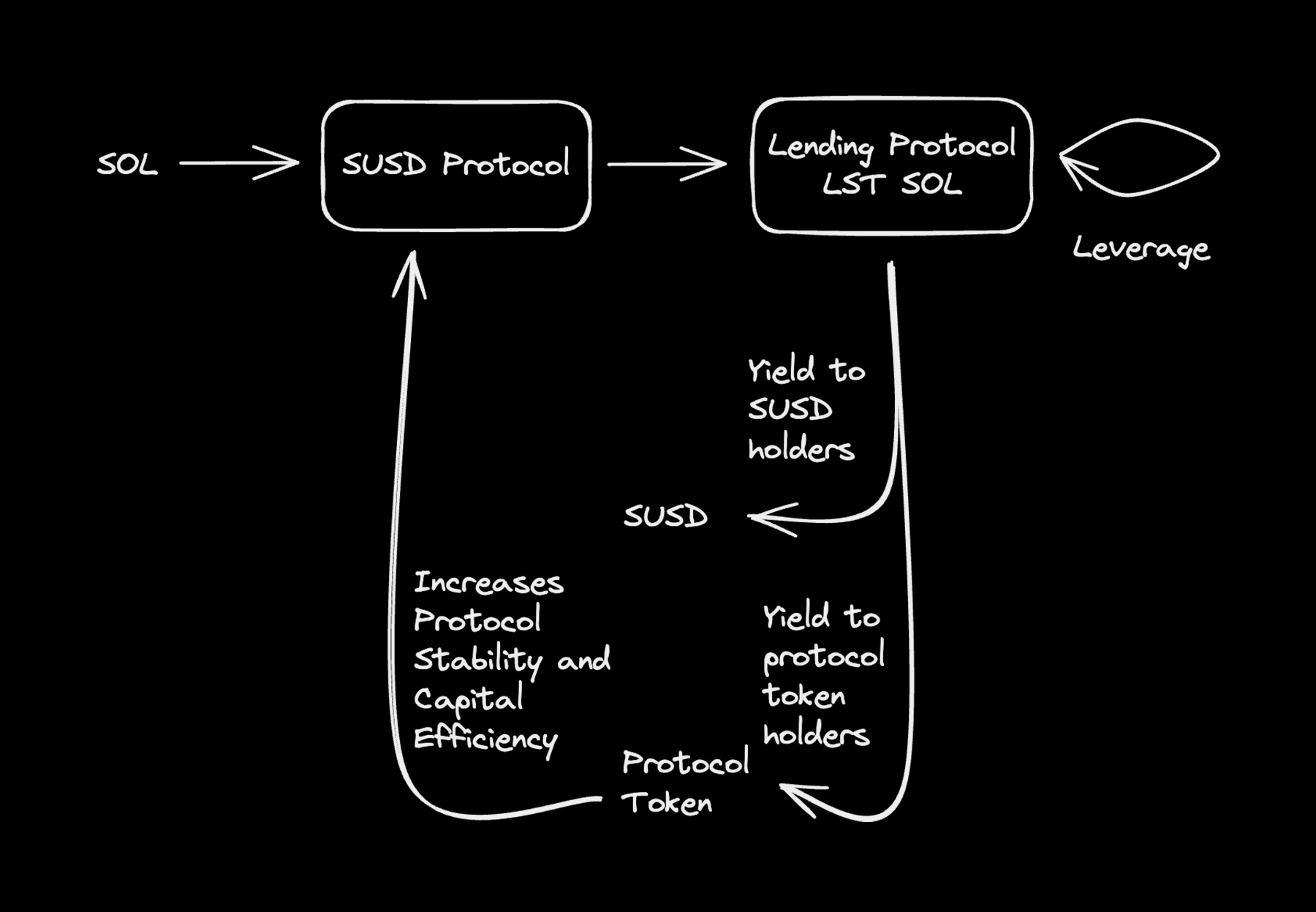

Jupiter's new product, not yet launched, is an experimental venture introducing LSD-Fi on Solana. The goal is to bring stablecoins to Solana in a decentralised way, presenting SUSD—a stablecoin backed by staked SOL.Users engage with SUSD by depositing SOL, initiating a minting process similar to LSD-Fi protocols on Ethereum. The stablecoin's yield comes from staked SOL, providing earnings for SUSD holders.

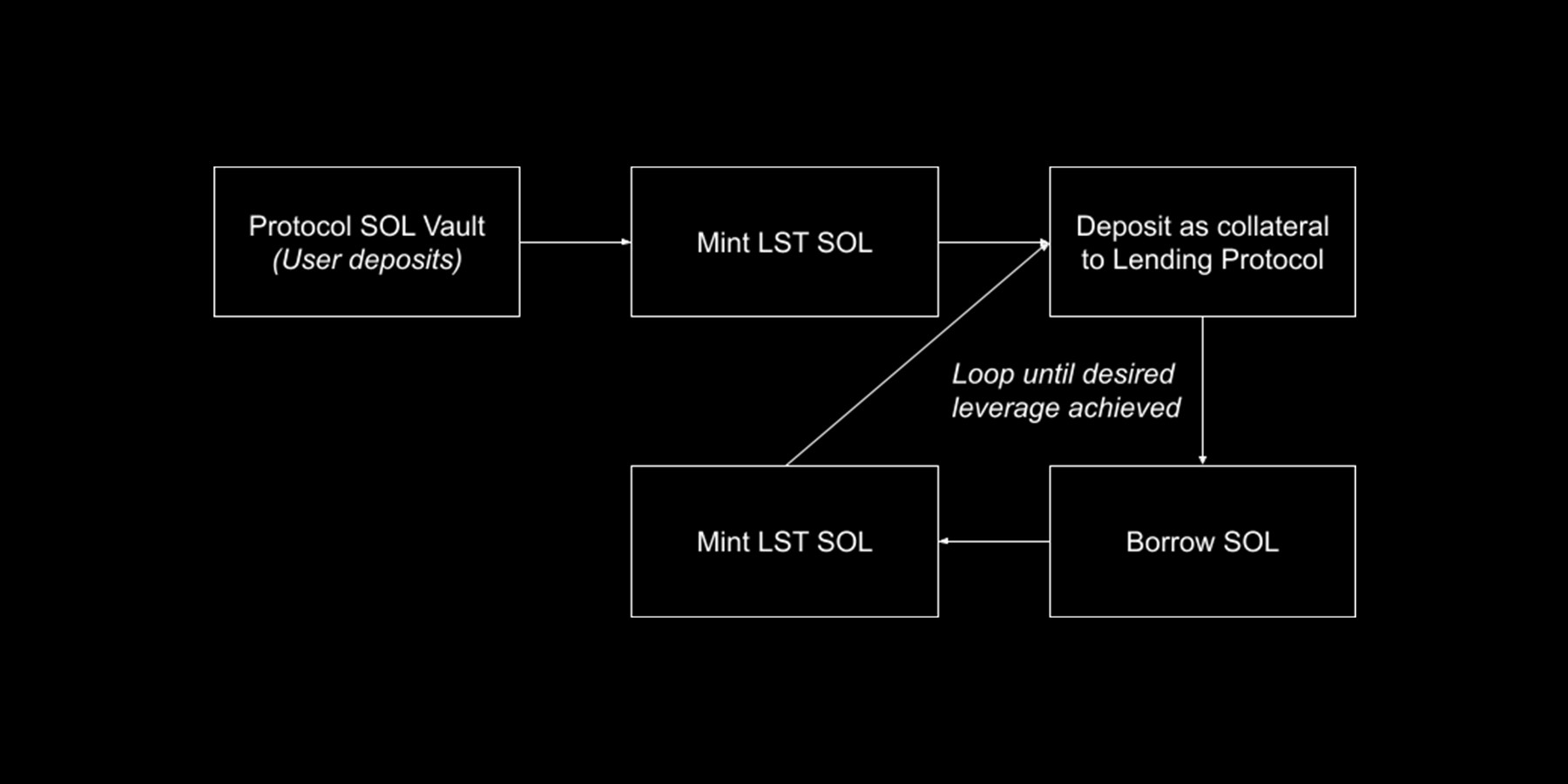

To boost yield, the protocol utilises liquid staking tokens, borrowing SOL and collateralizing them across lending platforms. The leverage adapts dynamically based on SOL lending rates and LST yield.

If the interest rate becomes too high, borrowing SOL becomes costly, impacting the strategy's effectiveness and lowering yield. In situations with high SOL lending rates and no additional yield, leverage is avoided.

According to the team, the expected yield from this strategy ranges from 7% to 17% and is expected to average around 10% to 12% in a healthy market.

This surpasses stablecoins backed by staked ETH, primarily due to higher Solana staking yields than Ethereum. It also outperforms the RWA-backed stablecoin from MakerDAO and sDAI, offering double the yield.| Stablecoin | Yield |

| Jupiter (SUSD) | 11% |

| Prisma Finance (mkUSD) | 9.1% |

| Lybra Finance (eUSD) | 8% |

| MakerDAO (sDAI) | 5.00% |

While this positions it as a highly competitive stablecoin, it's important to note the higher risk associated with SOL as collateral, which is generally considered less secure than ETH.

The complete design of the stablecoin is still under discussion, as not all parameters have been disclosed by Jupiter regarding how to ensure the stability of the stablecoin and its peg, such as the collateral ratio for users. However, its documents already outline substantial detail on how it aims to maintain stability. If you would like more details, you can access them here.The new product from Jupiter is more experimental than its aggregator and perpetual exchange. Despite this, it presents a significant opportunity due to its competitive stablecoin yield and alignment with a successful model on Ethereum.

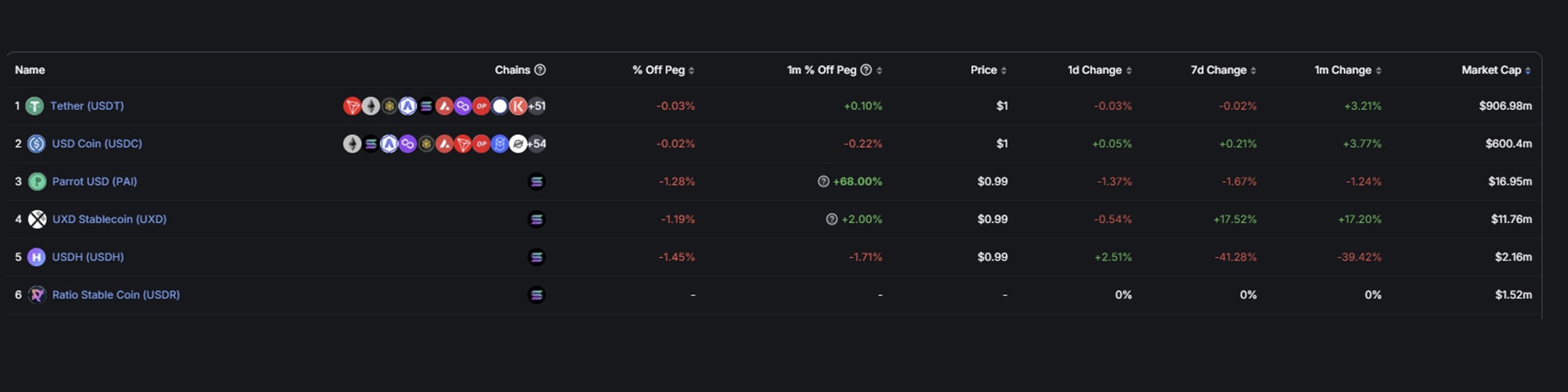

On Ethereum, Prisma Finance's mkUSD holds a $163,426,571 market cap, while Lybra Finance's competitor sits at $121,543,102. However, estimating its demand is challenging because a similar stablecoin doesn't exist with SOL, and the stablecoin market is, for now, still dominated by USDT and USDC, with alternative stablecoins not reaching a market cap higher than $16.95 million.

While we await more details to assess its impact precisely, the introduction of LSD-Fi to Solana stands out as a significant innovation. With yields that are more competitive than its Ethereum counterparts, it may attract capital, especially in less volatile markets where stablecoin yield gains significance for users. It's important to note that the product is still in the discussion phase, and its design is yet to be finalised. We anticipate providing a more detailed overview once these elements are solidified.

Diversifying revenue streams in all market conditions

It is interesting that Jupiter's approach to its two new products performs well in different market conditions.A perpetual exchange typically attracts higher volumes in more volatile markets, drawing in large numbers of retail traders seeking to speculate. This enables Jupiter to generate fees during these periods.

On the other hand, its decentralised stablecoin is more geared towards sophisticated actors looking to generate yield on their funds in less volatile markets. In these conditions, there is a high demand for stablecoin yield to compensate for the lack of volatility.

Jupiter's dual-product approach showcases versatility and positions the platform to capture opportunities across the spectrum of market dynamics, demonstrating that the team has put some thought into these product launches.

Jupiter Start: Strategically unleashing growth tentacles across Solana

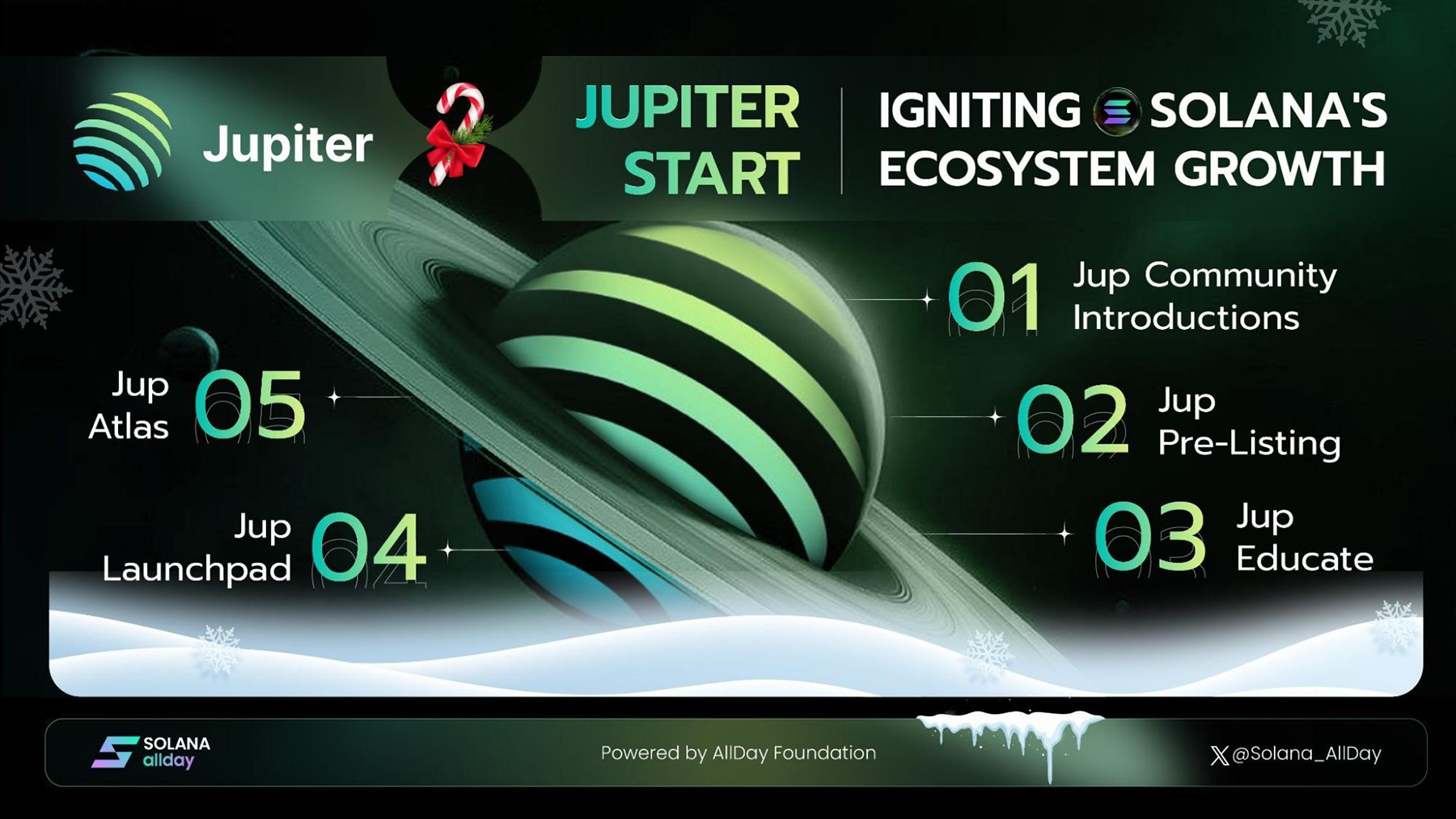

Beyond these two new products, Jupiter is set to launch another significant initiative called 'Jupiter Start.' This initiative aims to extend Jupiter's influence across the Solana ecosystem, enabling it to enter a different market by offering new products.Moreover, it positions Jupiter as the primary source of education in the Solana ecosystem for newcomers.

Jupiter plans to achieve this through a series of initiatives scheduled for launch from now through 2024. The first three initiatives of Jupiter Start will launch in December.

Projects expected to launch This month

Jupiter plans to launch the first three initiatives to retain customers and acquire new ones, with a heightened focus on providing education and activities for community members to participate in.Additionally, these initiatives aim to strengthen Jupiter's competitive advantage, enabling it to stay ahead in the evolving landscape of Solana.

Jupiter Community Introductions

The first initiative, Jupiter Community Introductions, is focused on retaining and engaging the Jupiter community. This platform will serve as a space for the community to learn more about new projects and tokens within the Solana ecosystem.Each introduction will span approximately a week, during which the featured project will be showcased on Jupiter’s Discord, allowing it to present itself to the Jupiter community.

Jupiter strengthens its customer relationships by giving the community early insights into projects and showcasing them on its platform. Simultaneously, Jupiter taps into community insights to vet these projects for potential collaborations.

Customers who contribute detailed research are rewarded, creating a community-driven research approach that lightens Jupiter's workload in vetting new Solana projects for partnerships.

Jupiter Educate

The second initiative, Jupiter Educate, is strategically designed to acquire and retain customers by positioning Jupiter as an authoritative voice in the Solana ecosystem.This initiative establishes an education platform where Jupiter showcases various projects to its users. Users can earn points or tokens by engaging with educational materials or performing specific actions. This positioning aims to establish Jupiter as Solana's primary educational platform, catering to new and existing users.

This builds on the preceding initiative where Jupiter involves the community in vetting projects. You can expect that, following vetting, these projects could qualify for participation in the education platform.

Notably, the first partner to join this program is Zeta Markets, the perpetual exchange.

Jupiter Pre-Listing

The final initiative, closely tied to Jupiter and its aggregator product, is Jupiter Pre-Listings. This initiative aims to facilitate the safe trading of new tokens on Jupiter.One potential risk for Jupiter is losing users when new tokens are launched. This risk arises because these tokens might be challenging to access on their aggregator. It could prompt users to migrate to existing decentralised exchanges (DEXs) where liquidity is available right from the launch. This movement can result in a loss of volume for Jupiter.

The pre-listing process, however, allows Jupiter to establish the necessary infrastructure for projects to be directly accessible on its platform, increasing visibility. Jupiter leverages its community to vet projects for approval within its pre-listings, a preventive measure against potential scams.

Overall, this strategic approach positions Jupiter to attract more trading volume during the launch of a new token. New tokens included in the pre-listing process would have immediate access to Jupiter's DCA and limit order functions.

Projects expected to launch next year

Then, we move on to the last two initiatives of Jupiter Start, which are expected to go live next year. These two initiatives are significantly larger and will launch another new product that Jupiter will launch.The focus for Jupiter here lies in creating a pipeline through which new projects can launch into the Solana ecosystem. Jupiter then serves as the connection that links these new projects to investors.

Jupiter Launchpad

Jupiter’s founder has stated that he is not a fan of many of the current launchpads on Solana. The goal is to address the current inadequacies of existing launchpad models. While there aren't many details available yet regarding the design of this launchpad, this announcement signals yet another significant product that Jupiter plans to unveil in 2024.Given the lack of details on the design, it remains uncertain whether the launchpad will add utility to the $JUP token or serve as a revenue source for Jupiter.

However, consider the success of launchpads in other ecosystems. For instance, Polkastarter has a market cap of $46,923,375. The largest launchpad project, DAO Maker, has a market cap of $215,198,035. Launching this project could introduce an additional layer of value to Jupiter. This potential value would be realised if the team successfully positions Jupiter as the premier launchpad on Solana.

Jupiter Atlas

The second initiative, Jupiter Atlas, has even fewer details available. The concept behind Jupiter Atlas is to support communities in investing in new projects through a public venture capital funding model. Currently, there are no specifics regarding the design or structure of Jupiter Atlas, but it appears that Jupiter is contemplating establishing a venture DAO, similar to what has been observed with projects like Seed Club and MetaCartel.This initiative encourages the Solana community to participate in VC-style seed funding for early-stage projects. It's important to note that no detailed information is public yet due to the legal complexities associated with private funding, making any comparison speculative.

The JUP token

After fully understanding everything that Jupiter does, it's time to delve into the JUP token, which will go live soon. Let's take a look at the token's design.The purpose of JUP

The initial purpose of JUP will solely be as a governance token, empowering token holders to vote on critical aspects of Jupiter.While direct utility may be limited at launch, the DAO will play an important role in shaping JUP's evolving utility and other factors like emissions over time. Regulatory and legal concerns likely influenced this decision.

We expect the DAO to decide the utility of JUP going forward, potentially adding features like revenue sharing or other utilities to the token.

The token distribution

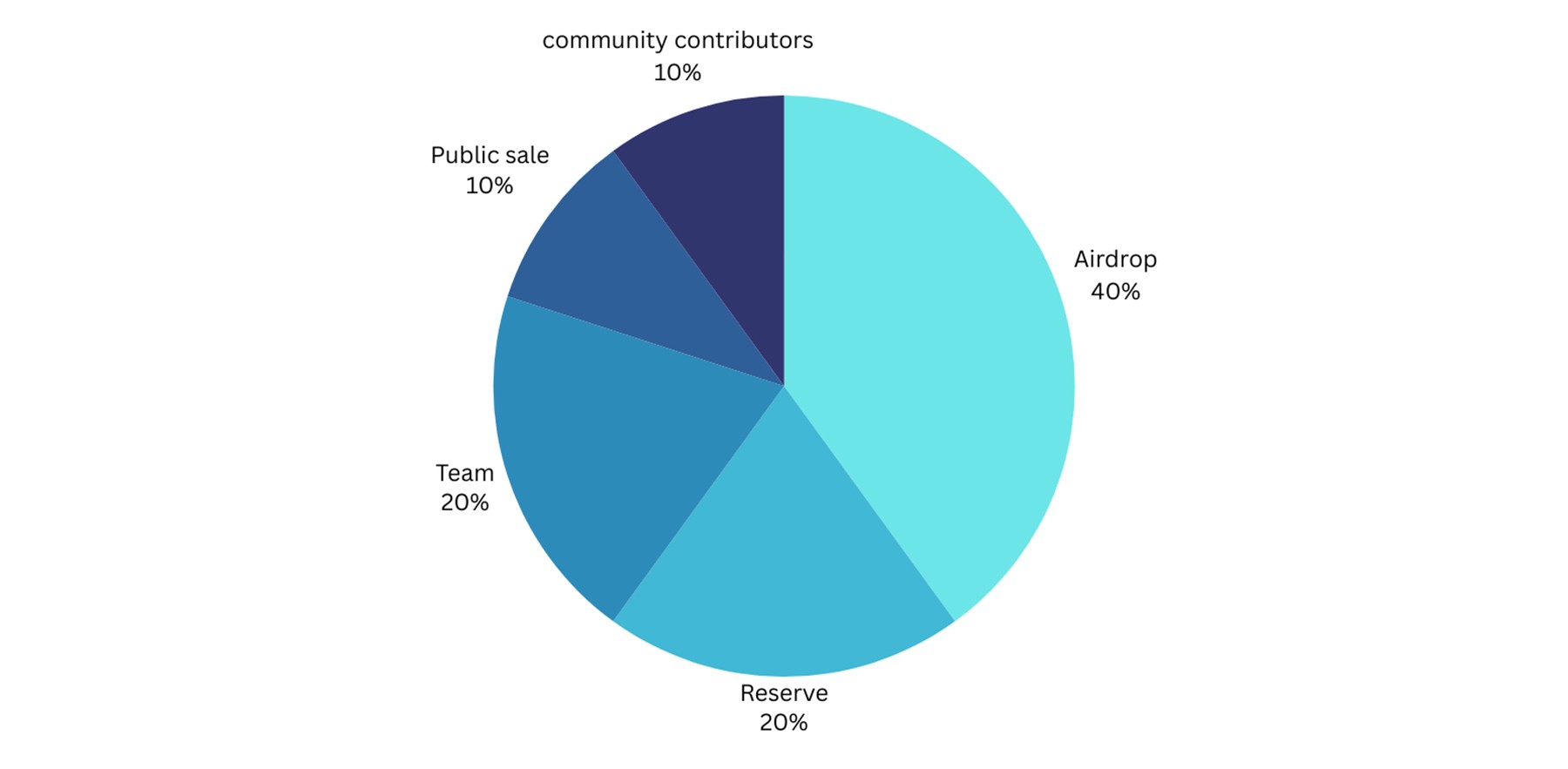

The initial distribution of the JUP token, according to what the Jupiter team has shared so far, is structured with a starting total supply of 10 billion tokens. This total supply could change in the future depending on decisions made by the DAO.Out of the initial 10 billion token supply, 20% is allocated to the Jupiter team. This share is subject to vesting over time. There's another 20% of tokens placed into a reserve allocation. This reserve will be locked for one year, with any unlocks communicated at least six months in advance.

For public sale, 10% of the total token supply is made available. An additional 10% of tokens are designated for community contributors and distributed over four years. Finally, 40% of the total supply is allotted for airdrops to the community.

Potential valuation for JUP

The team has not shared specific details about the circulating supply, emission schedule, or vesting schedules of the JUP token. Additionally, information on the public sale is scarce. While it's clear that public sale tokens will initially be locked, crucial details such as the duration, starting price, and the sale model are still undisclosed.These factors could significantly impact the valuation of JUP. Therefore, we currently cannot provide an accurate valuation model. We expect to share more details as additional information becomes available, hopefully before the public sale of JUP goes live. Then, we can decide whether to participate in this sale or not.

The JUP airdrop

From Jupiter's token, we currently have the most details on the JUP airdrop. The first round has concluded, during which Jupiter distributed 10% of the total supply (1 billion) to Jupiter users.You can find out the amount of the initial JUP airdrop you received by checking here.

The Jupiter team has yet to share the full details of the initial supply of JUP and what the emission schedule will look like at launch. Therefore, it is impossible to assign a realistic valuation to the initial airdrop.

However, if you have received the airdrop, you can use this calculator to display all possible scenarios and get a general idea of what your JUP airdrop will be worth.

Maximising future airdrops

Three additional rounds are upcoming for those who missed the first round. These rounds will allocate another 30% of the total supply to users.We expect these airdrop rounds to incentivise usage with Jupiter's newer products—the perpetual exchange, stablecoin, and potentially its launchpad—rather than just its established aggregator.

To maximise future airdrop eligibility, we recommend:

- Using the Jupiter aggregator organically when transacting on Solana

- Trading on Jupiter's perpetual exchange

- Engaging with the SOL-backed stablecoin when launched.

Cryptonary’s take

Jupiter emerges as the cornerstone of the Solana ecosystem. It boasts an impressive 80% market share through its aggregator. It is also diversifying into innovative products like the perpetual exchange, SOL-backed stablecoin, and the forthcoming Jupiter Start initiative. This establishes its dominance and charts a tangible path to revenue generation.While Jupiter represents a compelling opportunity for exposure to the dynamic Solana ecosystem, the current lack of details surrounding its tokenomics and public sale tempers our enthusiasm. The absence of this crucial information hinders the creation of an accurate valuation model, introducing a layer of uncertainty.

In light of these challenges, we're actively positioning ourselves to capitalize on Jupiter's opportunities. Our immediate focus centres on participating in the upcoming airdrop rounds. As details about the tokenomics and public sale unfold, we will provide a thorough update on JUP's potential as an investment.

As always, thanks for reading.

Cryptonary, Out!