Well Oiled Machine?

As we are all aware, consumer prices across the board have increased significantly over the past few years. Many people are struggling to make ends meet, and this has had a huge impact on the economic health of countries around the world.

In the first part of this series, we dove into fiat currencies and how central bank policy affects the money supply, how they attempt to control inflation, and why inflation isn’t necessarily a bad thing when at reasonable levels. However, there are a few other major contributors to inflation that monetary policymakers have little control over.

In this journal, we will dive into the global supply network, commodities, and energy and how these factors affect inflation!

Disclaimer: This is not financial nor investment advice. Only you are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR

- The global supply chain is the beating heart of the world economy. Raw goods are transported for processing, processed materials are transported to assembly plants, and finished goods are transported to retail.

- Any disruptions to port facilities, shipping, as well as supply/demand have an effect on consumer prices.

- The cost of raw materials also has an effect on prices paid for finished goods.

- Energy supplies have been rocked by conflict, especially in Europe.

- Despite this, a lot of the factors that have contributed to high CPI figures are getting better.

- Read on to find out why!

Shipping Makes the World Go Round

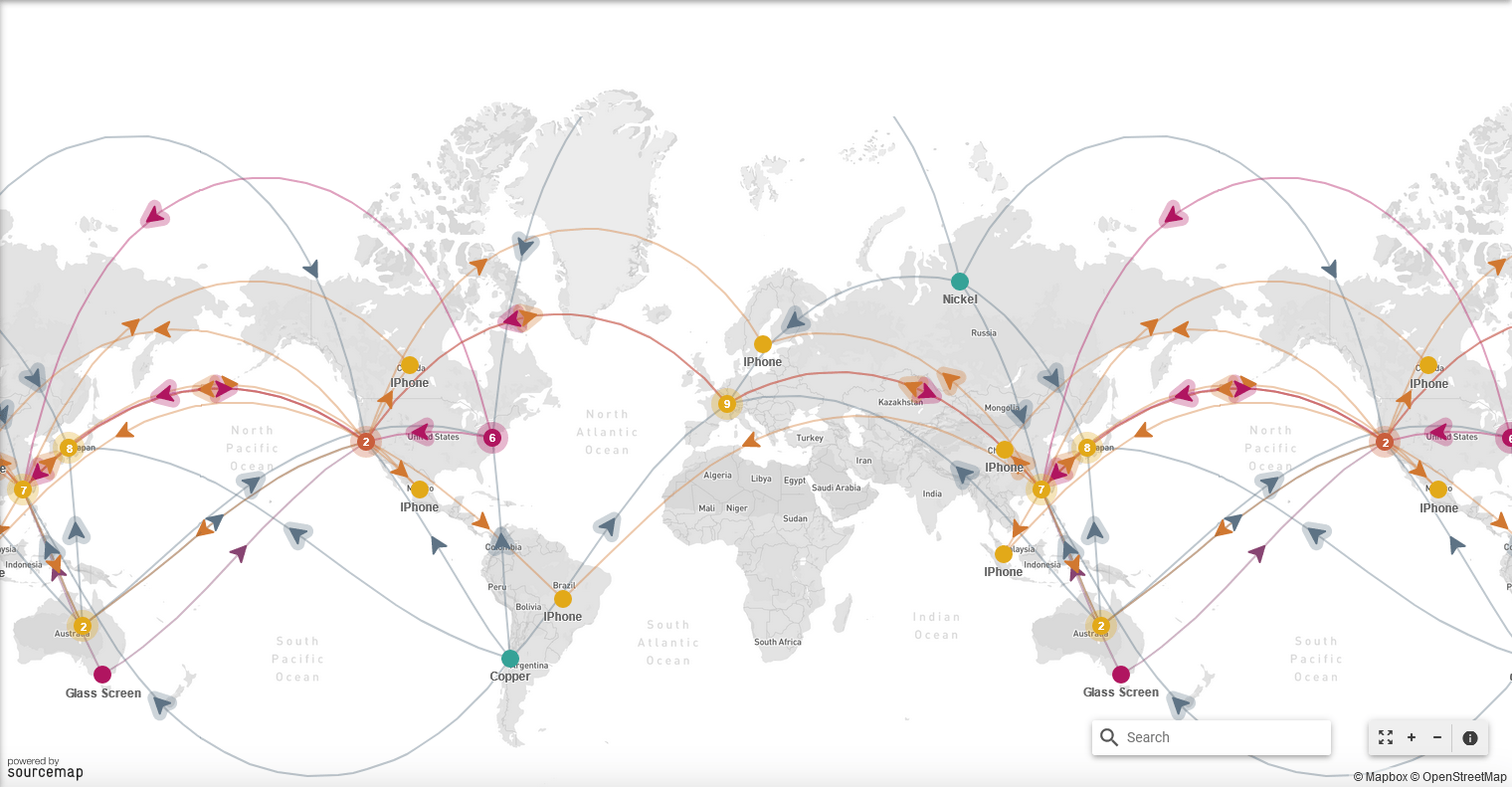

Simply put, the global supply chain network is the engine that drives the global economy. Most consumer products require hundreds of inputs which are transported to where they need to be via supply chains. Raw materials are collected and shipped to production plants where components are produced. These components are shipped to assembly plants, and then the finished product is shipped to distribution centres and finally ends up at retail stores.

The above map shows the supply chain to produce an Apple iPhone. As can be seen, it is quite extensive and involves tens of countries and production/distribution centres. Every consumer product has supply chains that look similar to this. Around 11 billion tons of cargo are shipped per year – that’s 1.5 tons for every person on the planet.

Any disruptions to supply chains have a huge effect on the costs and availability of products and can lead to shortages, more expensive products on the shelf, and ultimately contributes to inflation. COVID caused a significant drop in consumer demand, whilst at the same time, global lockdowns were detrimental to the operation of port facilities all around the world. Workers were unable to go to work, and traffic was substantially reduced as a result.

Once lockdowns were lifted and economies started up again, there was a huge increase in consumer demand as people started spending and the stimulus was flowing. This strained and continues to strain supply chain networks, and we have seen huge backlogs in shipping in key export countries such as China.

Baltic Dry Index (BDI)

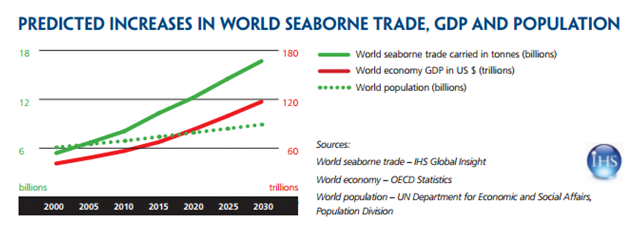

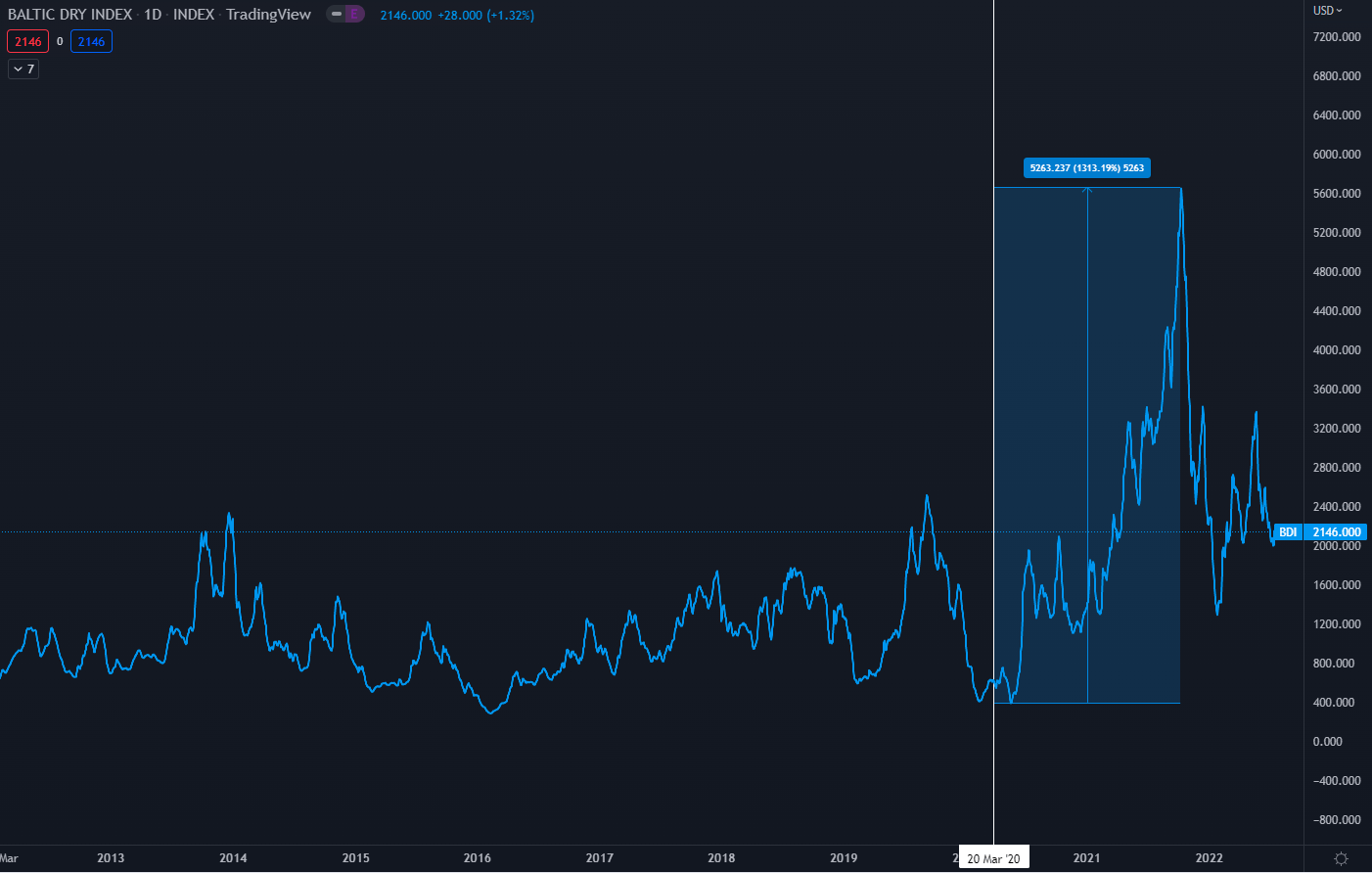

The Baltic Dry Index is a measure of how much it costs to ship a basket of raw materials (iron, steel, coal, cement, etc.) around the world. The index is often used as a measure of the demand for raw materials – higher BDI represents higher demand for shipping of these materials/commodities, which (in theory) means that industry and construction is booming. Conversely, a lower BDI means that there is less demand for these materials due to excess inventory, reduced construction activity, etc.

The above chart shows the BDI figures going back to Q2 2012. As can be seen, there was a clear drop-off leading up to March 2020, which suggested a drop in demand and economic activity as the COVID pandemic began affecting policy around the world. Lockdowns reduced economic activity in almost every area of many countries globally. The subsequent huge increase in BDI going into 2021 coincided with economies opening back up.

What we witnessed was the inability of shipping companies and other distributors to meet the sudden increase in demand for raw materials and construction as lockdowns were lifted. Ports and crews had been working at reduced capacity - both as a product of reduced demand and strict COVID policies implemented around the world. When economies opened again, and demand for materials increased, supply chain infrastructure was slow to restart. This led to the parabolic increase in costs for these services we can see through all of 2021.

The BDI is important because high transport costs for raw materials inevitably lead to higher production & construction costs, and these costs are ultimately passed on to the consumer. The result is a net contribution to inflation as consumers pay more for most products because companies increase prices to compensate for higher production costs.

The other factor to consider is that shipping costs have been coming down from peak back to “normal” levels. We believe this could be an important factor in determining when inflation has peaked since consumer prices should reflect the reduced transport costs in most supply chains.

Commodities & Energy

We’ve discussed the costs of shipping basic commodities and how this affects prices – but what about the commodities themselves? To start, let’s define what the term “commodity” encompasses. A commodity is a basic good used in commerce, usually as inputs in the production of goods or services. Commodities are usually raw materials – iron, coal, grains, gold, beef, oil, gas, etc.Typically, during times of high inflation, commodity prices tend to rise. Since commodities are the primary input to produce various goods, this ultimately leads to a rise in consumer prices. However, commodity prices can also increase when economies are booming and demand is increased. This has not been the case in the last year or two. Conflict, continued lockdowns, and policy has affected supplies which have aggravated prices, contributing to inflation.

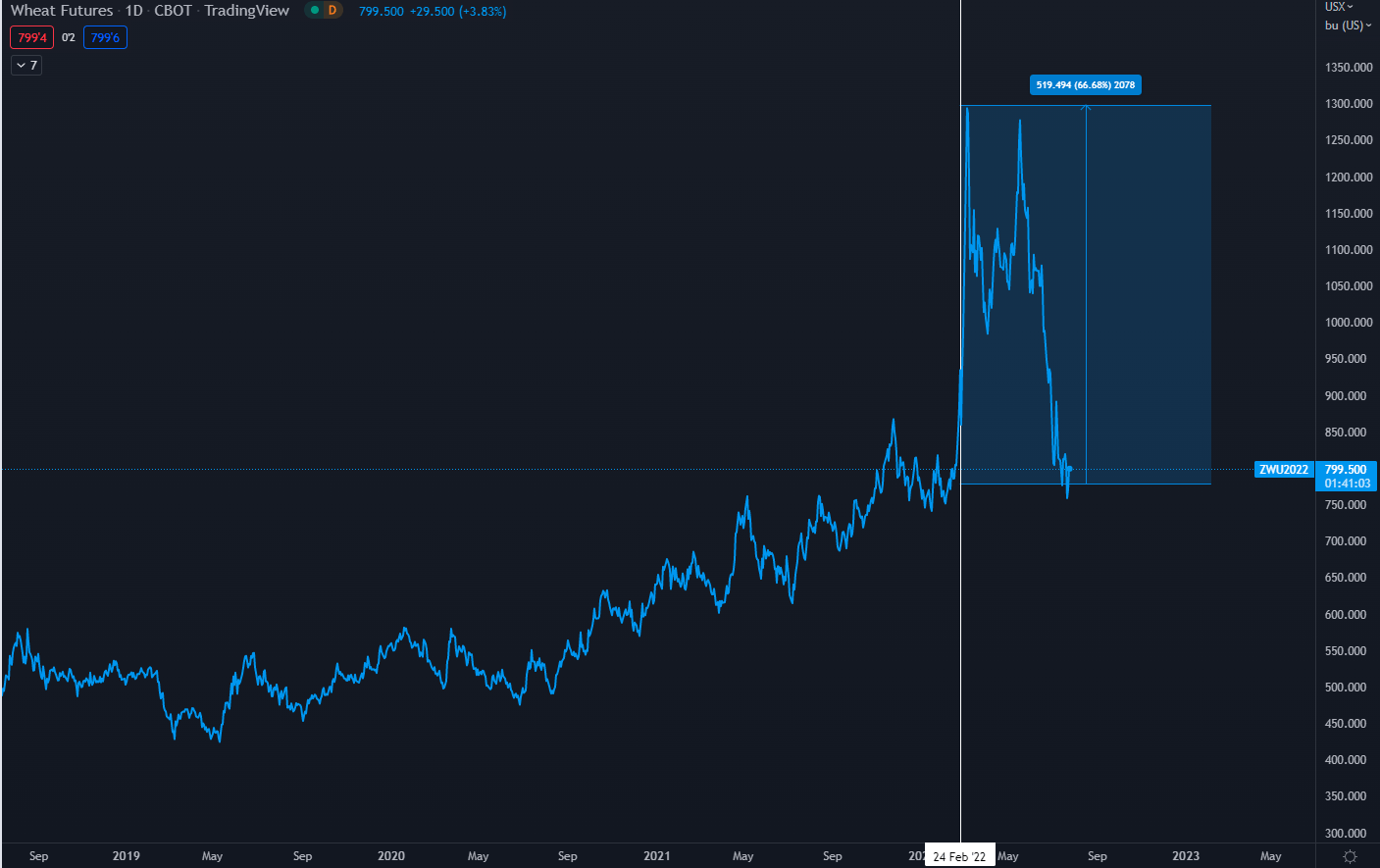

Taking the example above (wheat futures), we can see that the expansion of the conflict in Ukraine earlier this year was a major shock to global food supplies. Ukraine is a top producer of wheat, maize, and other agricultural products. The blockade and reduced production due to the chaos of war have contributed to higher food prices across a variety of products. However, in recent weeks we have seen prices stabilize back to relatively normal levels.

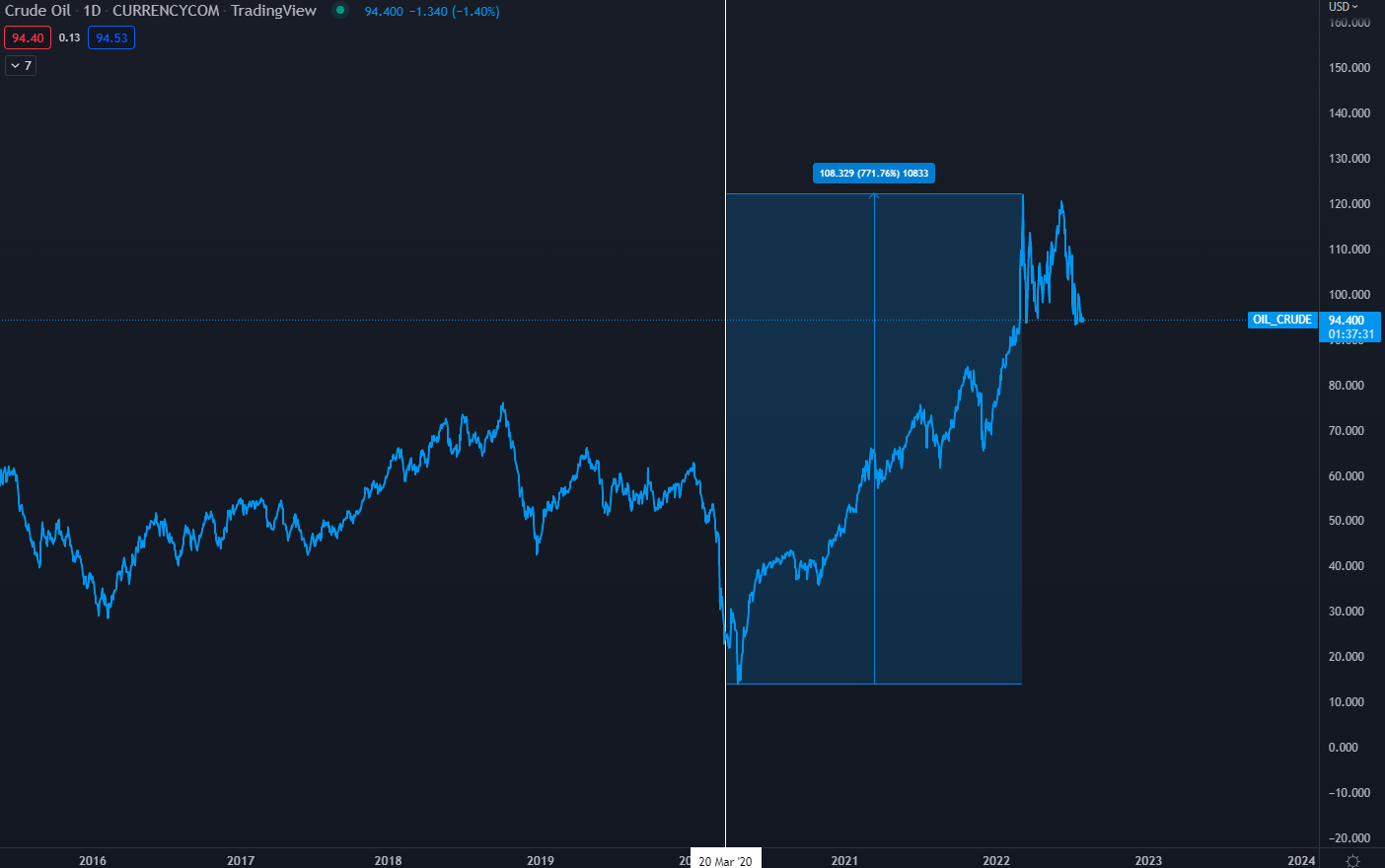

Energy is required for everything within the global economy, and the price of crude oil affects the cost of almost every consumer product/service. Again, the relationship between energy and the economy is one of supply and demand – higher oil prices could indicate either high demand (booming economy), or reduced supply (disruptions etc.).

For example, the lockdowns and reduced economic activity due to the worsening pandemic in 2020 can be seen in the chart above with the collapse of oil prices. The subsequent re-opening of economies and the high demand have driven oil prices higher and higher all through 2021/2022. The most immediate effect of higher prices is that consumers are spending more at petrol pumps.

The not-so-obvious effect is that any petroleum-based products – fertilizers, plastics, clothing, etc. –cost more to produce since oil is used as a primary input for many manufacturing processes. Oil and energy costs have widespread implications for consumer prices. Factors that affect the price of oil include geopolitical tensions, instability in key oil-producing countries, and OPEC (Organisation of Petroleum Exporting Countries) production limits, amongst others.

Gazprom

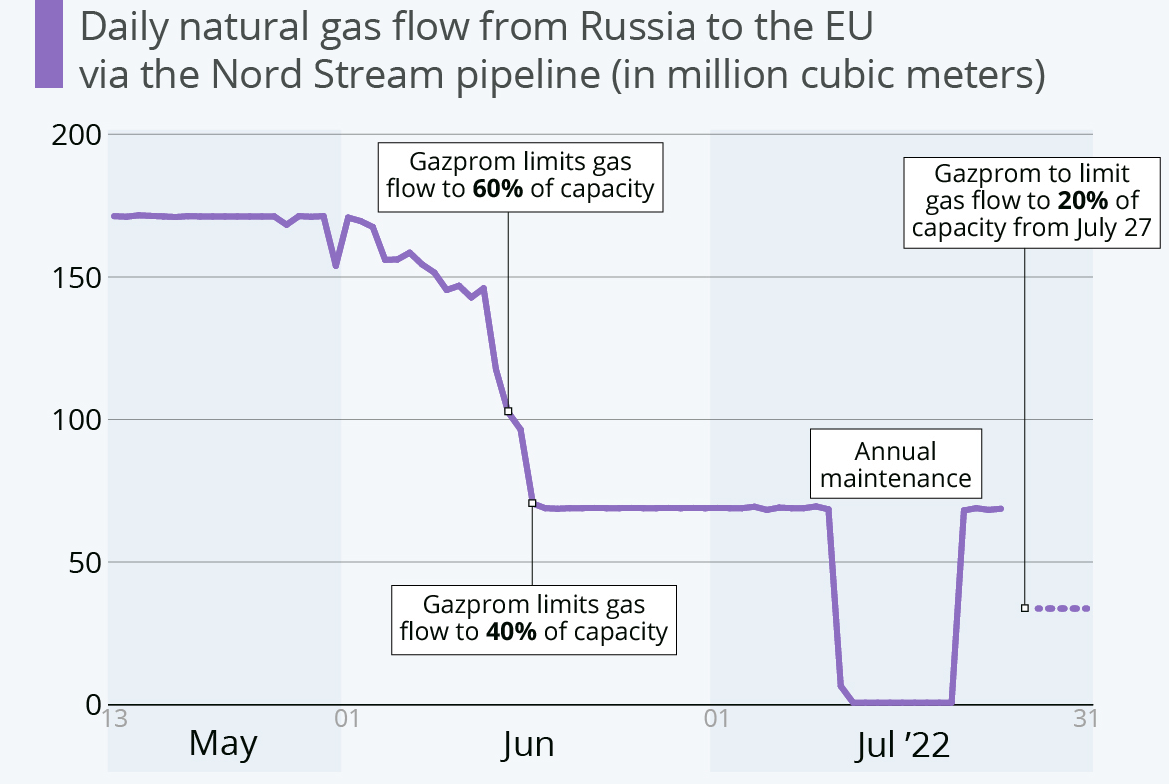

The ongoing geopolitical tensions between the West and Russia have had dramatic effects on energy supplies to the continent. Gazprom, Russia’s government majority-owned energy corporation, has begun limiting gas supplies to Europe. This is most likely in response to Western sanctions. This is causing problems for countries in the EU – Germany is very dependent on Russian gas to fuel its industry and produces very little natural gas.

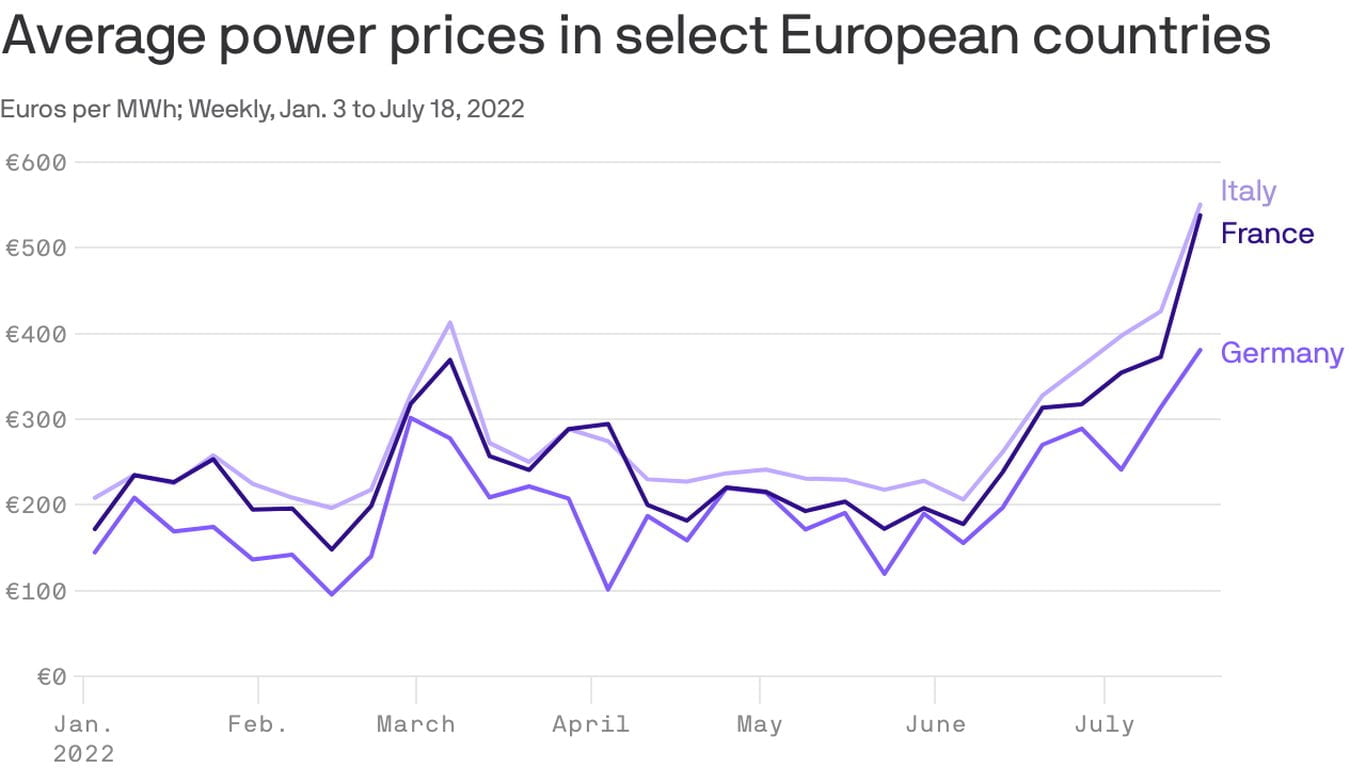

There are fears that a complete halt of gas flows to Europe via the Nord Stream pipeline would immediately send Europe into a general recession, exasperating an already difficult situation. The Nord Stream pipeline was already operating at just 40% capacity – towards the end of July 2022, this was reduced by a further 50% to 20% capacity. Energy prices across Europe continue to increase, which contributes significantly to inflation.

European nations with a high reliance on Russian gas have been trying to stockpile enough to get through winter. However, with continued reductions and no political solution in sight, it is speculated that countries like Germany will have to begin rationing energy supplies throughout winter. This will, of course, be detrimental to the EU and will likely lead to GDP contraction in a lot of countries, especially in Eastern and Central Europe.

Conclusion

Although the situation is improving in many ways, with supply chains becoming more efficient and meeting demand and food prices coming continuing to trend down in many areas, the energy situation in Europe is still bleak. Having said that, we believe that although inflation remains high in a lot of developed countries, the factors that led to high CPI prints have largely peaked. Economies are not yet out of the woods, but we believe the developments outlined in this journal are, for the most part, a step in the right direction.It is essential to avoid becoming too US-oriented when monitoring the macro environment. Markets do tend to react to decisions made by the US Federal Reserve. Still, the situation in Europe has a significant impact on global markets - European economies are some of the largest in the world.

We will be closely monitoring CPI prints in major economies, and, as always, CPRO members will be kept up to date with any developments!