If you’re here then you believe a bull market is coming, just like us. In fact, we believe we are in the beginning stages of one 👀

So, what’s our game plan to pick out the most profits without risking too much? And, what are we buying?

Here it is👇🏼

Here's our master plan:

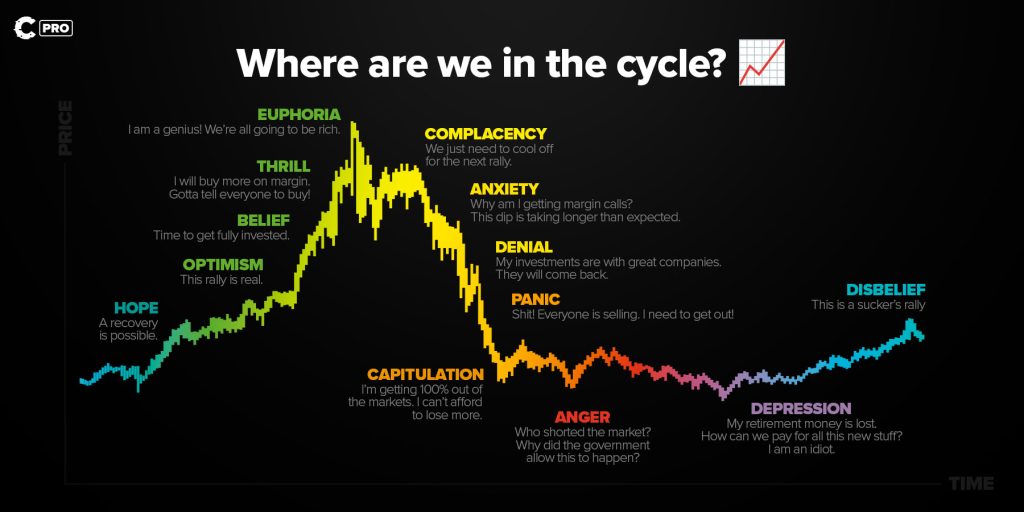

- Figure out when we've hit the bottom (that’s done, unlikely we go down under $15,500).

- Determine where we are in the cycle.

- Start stocking up during the "depression/disbelief" stage.

- Go full throttle in the "hope" phase, once we've confirmed our position.

Note: when we say "all in," we're not talking about “betting the house”. We mean betting all of the money we specifically allocated to crypto.

Disclaimer: This is not financial or investment advice. Any capital-related decisions you make are your full responsibility and yours only. The information made available in this report is NOT for replication. The purpose is to share the thought process behind our decision-making for entertainment purposes only.

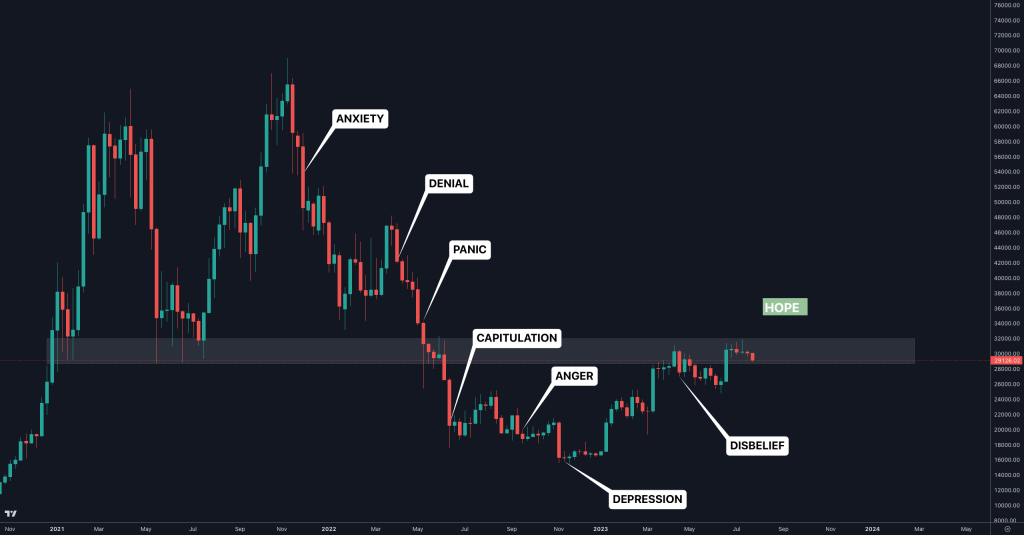

Right now, we're treading through the Depression/Disbelief phase of the cycle. This stage comes with sideways price sways, tiny upsurges, and a sprinkling of small crashes - factors that can pack a punch on altcoins.

Instead of going all-out on alts, we're opting for gentle, bite-sized purchases. This strategy shields us from severe drawdowns and keeps our portfolio on the sunny side.

Here's the exciting bit - we're primed with a trigger to launch us all-in on altcoins when the time is just right. When's that you ask?

In the crypto world, the "hope" phase kickstarts when BTC breezes past the $32,000 mark. Once we hit that milestone, we're on a fast track to $40,000+ and altcoins will follow suit.

However, until then, there's still a lingering risk of dropping back to $25,000 or even $20,000 - a scenario we'd rather avoid. While BTC could bounce back from such a hit, altcoins might not fare as well.

Some “stressful” news for you 😟

Peep at the "Gain" column, it's on a downward trend from one cycle to another. The reality check? Each cycle brings diminishing returns compared to its predecessor. Opportunities are slipping away, don't just stand by and watch!

On the bright side, there's some time to breathe. Cycles are stretching longer, and if we play by the numbers, a market peak might be on the horizon in Q1 2026, with euphoria likely surging in late 2025.

If you're feeling a pinch of urgency, well, that's entirely justified! Get your plan ready.

Okay Cryptonary, so what actions are YOU taking? 💵

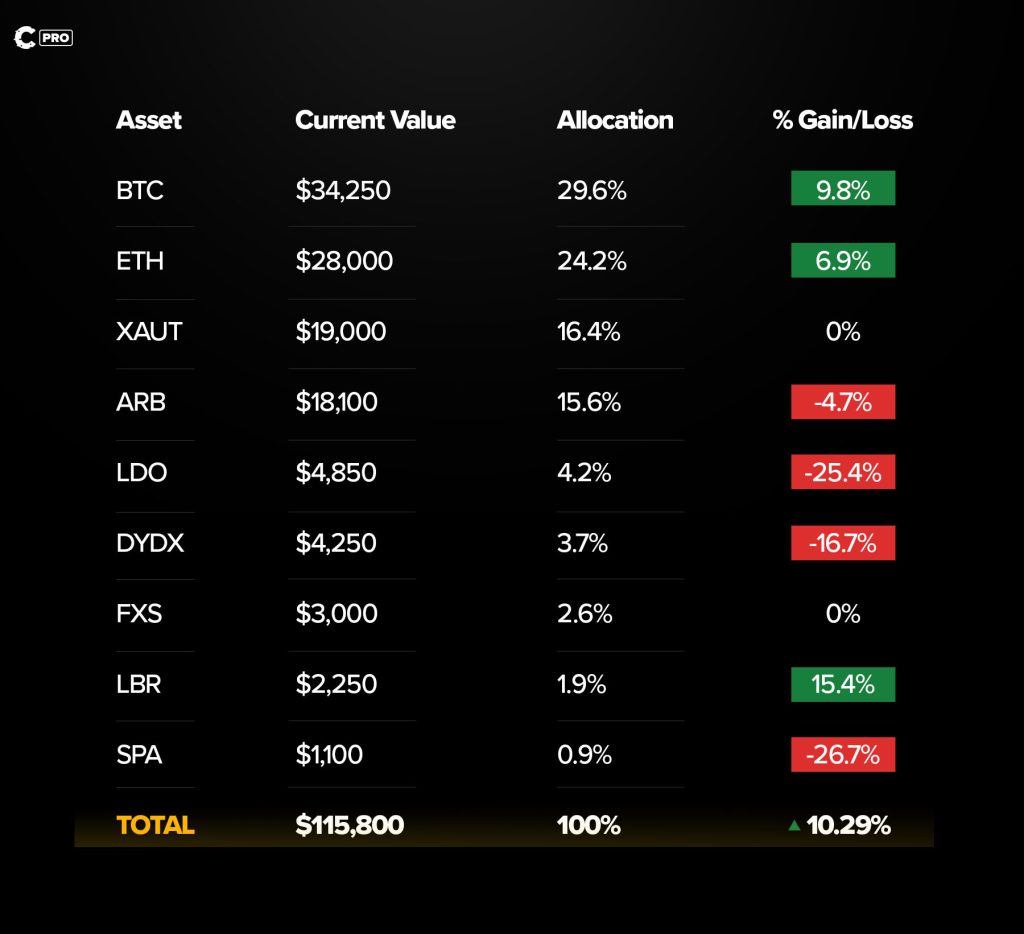

Here's a peek into our SITG Portfolio before we get started:

Just to clear things up, we steer clear of dollar stablecoins. Our go-to safe haven is XAUT (on-chain gold). As you can see, we've been playing it cool with altcoins, keeping allocations small to dodge heavy drawdowns and bide our time for that perfect, gain-loaded opportunity. Our only consistent heavy hitters are ETH and ARB.

Investing $10,000 💰

Considering our heavy (>50%) exposure to BTC and ETH, we're taking a break from these giants this month. Instead, we're dividing our capital between two promising bets: ARB & SNX.

ARB | $5,000

Our take on ARB? Super simple. We've shared our thesis before, but here's the bottom line:

ARB is the SOL of the upcoming cycle. No two ways about it.

SNX | $5,000

Remember how psyched we were about SNX back in 2020? We first clued you in back in September 2020 during the DeFi winter, when it was a steal at $2, and we watched it soar to over $30.

Fast forward to today, and we're seeing a déjà vu moment with SNX.

SNX is back in a sweet spot, between $1.50 and $3.10. And it's ready to breakout, backed by stronger than ever fundamentals. Yesterday, they bagged $500,000 in a day and launched a game-changing cross-chain solution, following Chainlink's announcement.

What does it all mean?

We're witnessing a project with a stellar product-market fit, exhibiting growth and accumulation signs. All this while being housed on the less-than-thrilling L2: Optimism. Imagine the numbers when they expand to Arbitrum (imminent given their dive into cross-chain comms).

We're all-in for SNX and we’re planning our exit strategy as follows:

- Unload 25% at $7

- Another 25% at $14

- 25% more at $25

- And the final 25% during the bull market's euphoria stage.

Increasing exposure to altcoins 🎢

Once we're firmly in the "hope" phase of the cycle, we're going all-in and shaking up our strategy. We'll liquidate our XAUT reserves, draw $5,250 each from BTC and ETH, and invest big as we climb the risk curve:

- $12,000 is going straight into LDO

- We're putting $7,500 in SNX

- DYDX gets a cool $5,000

- And FXS also scores a $5,000 investment

These assets, along with ARB, are our top picks to massively outshine in the upcoming bull market. And trust us, missing out isn't on our to-do list.

Investment summary 📝

- Invested $5,000 into ARB, selling 50% at $7.50 and the rest at $30.

- Entry price: $1.17

- Size: 4,275 ARB

- Invested $5,000 into SNX, selling 25% at $7, 25% at $14, 25% at $25 and the remaining TBD.

- Entry price: $2.77

- Size: 1,800 SNX

SITG addresses ⛓️

- Bitcoin: bc1qzpppmek8wh2vqymq06petmfwmhjj9k8vdxl389

- Ethereum: 0x8Be9987d18a10F770cADC94635CeDB2eF33B0f17

LFG!