We’re selling our 30X option and buying this hot DeFi asset

Options in crypto are extremely early in their development, with huge growth potential.

Options are an essential part of any financial market. So this is a sector with the potential to create generational wealth, if you back the winning horse.

Luckily, our team of researchers work around the clock to find those winners, just for you!

Today, we’re looking at a protocol with exciting potential.

Recently, we shared whether we’d Lost faith in our 30X option.

Competition has been heating up, and a rising contender has shown its strength.

Now, we’re in a position to share some serious alpha…

Never one to marry our bags, we’re selling our 30X option and buying… (find out below)

TLDR

- Premia has been slow to ship their upgrades. Lyra, on the other hand, has been fast and consistent.

- The Newport upgrade (Lyra’s launch on Arbitrum) has been a massive success. It already boasts almost double the TVL (Total Value Locked) and 125% more volume than its predecessor on Optimism.

- Lyra is set to revolutionise the DeFi options space. It allows other protocols to integrate Lyra’s back-end directly into their own protocols, and offers them a share of fees. This unlocks new audiences for Lyra, protects it from regulatory scrutiny, and acts as a “pick and shovel” play (a saying from the California Gold Rush, when miners made little money but pick and shovel manufacturers amassed fortunes).

- Lyra plans to fully decentralise and move to a vote-locked tokenomic model (where users lock tokens for up to a year to participate in governance and earn rewards).

- Lyra fees, trading volume, TVL, and daily active users suggest the protocol is mispriced when compared to competitors such as Premia and Hegic.

- We’re selling our $PREMIA, and buying $LYRA.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

Let’s get real

When we covered Premia in our 30X option report, it was extremely exciting.With major upgrades in the near future, it looked ready to transform the DeFi options space.

But their delivery has been snail-paced.

One of the most important lessons in crypto is: “don’t marry your bags”.

Continually evaluating your holdings without judgement or bias is the recipe for lasting success.

With that in mind, we present a new options protocol – one that's managed to exploit Premia’s slow delivery to snatch market share.

They've been shipping non-stop throughout the bear market and are showing no signs of slowing down.

Without further ado, we present to you…

Lyra – the future of options

Whilst Premia has experienced major delays on their V3 launch, Lyra has been shipping left, right, and centre…Newport Upgrade

Most notable was their Newport upgrade in January 2023.

With this, Lyra expanded to Arbitrum, tapping into an entirely new market.

Before, Lyra was only available on Optimism (Ethereum layer 2 scaling solution) and used Synthetix (synthetic asset provider) to delta-hedge (reduce the risk of liquidity providers losing money due to price movements).

This reliance on Synthetix and Optimism was often considered Lyra’s biggest flaw, for several reasons:

- The use of Synthetix is not capital-efficient (it requires significant investment to delta hedge).

- Liquidity providers on Lyra had to deposit sUSD (Synthetix stablecoin). This meant they took on risk due to the stablecoin’s mechanics.

- Optimism is the underdog in the Layer 2 race, lagging well behind Arbitrum.

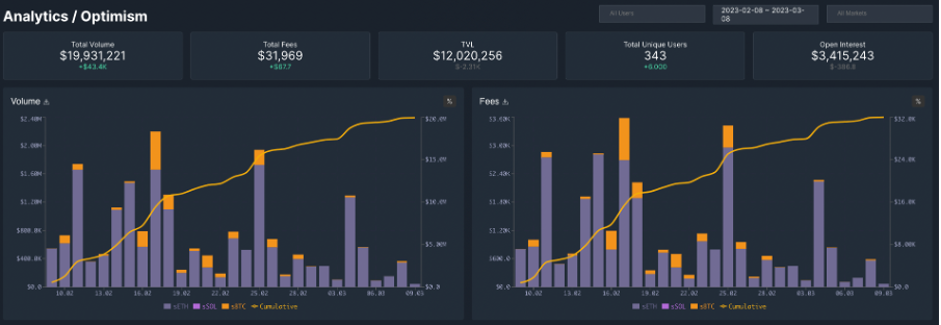

The effects of launching on Arbitrum are clear. In the last month, Arbitrum has seen $45M total volume, compared to Optimism’s $19.9M (as seen below).

Behind The Scenes Alpha

We promised you some exclusive alpha and here at Cryptonary, we always deliver!In the depths of Lyra’s governance channels and forums, we found some future upgrades that could rocket $LYRA to the moon.

The plug-and-play model

Lyra has moved to provide a back-end that other protocols can plug into their platforms. This model is innovative and potentially extremely rewarding.The protocol is moving to a business-to-business (B2B) business model, supplanting the business-to-consumer (B2C) model it currently uses.

A proposal for Kwenta to host Lyra’s options on their exchange passed. Starting as a six-month pilot programme which has just launched, this will act as a proof-of-concept project.

If all goes well, it will open the floodgates.

Options are extremely complicated, but they complement other areas of DeFi, such as DEXs (decentralised exchanges), asset management, and yield products.

As a back-end solution, Lyra will allow any protocol that passes governance to integrate its options.

The front-ends that integrate Lyra will receive income in the form of a 5-10% fee share. In turn, Lyra will have access to an entirely new customer base and earn the remaining 90-95% of fees.

Currently, no other platform has the capability to offer this. Lyra will have a first-mover advantage.

Sounds pretty bullish, doesn’t it?

What’s more, others are already looking to integrate, with a proposal for Coinstore to host Lyra in draft.

That’s not all. There are huge regulatory implications for this move. As Lyra won’t be consumer-facing, it won’t be subject to the same regulatory scrutiny.

Effectively, this removes almost all legal issues that arise from providing decentralised options.

It’s safe to say there are big things coming. Watch this space!

Full decentralisation and community governance

Another growth catalyst is on the horizon. Lyra’s developers have always planned to have the project become a fully-fledged DAO (decentralised autonomous organisation).

And we're seeing strides towards that vision with 2 LEAPs (Lyra Enhancement Action Proposals) in draft.

LEAP 20 proposes a new tokenomics framework, xLYRA.

xLYRA will be locked LYRA tokens that allow the holder to vote on governance proposals. The longer LYRA is locked, the more xLYRA and governance power the holder receives.

More recently, LEAP 51 presents a move to V2 governance. In short, this will shift governance to a fully autonomous on-chain system, allowing token holders to directly and fully govern the protocol, resulting in full decentralisation.

The numbers don’t lie

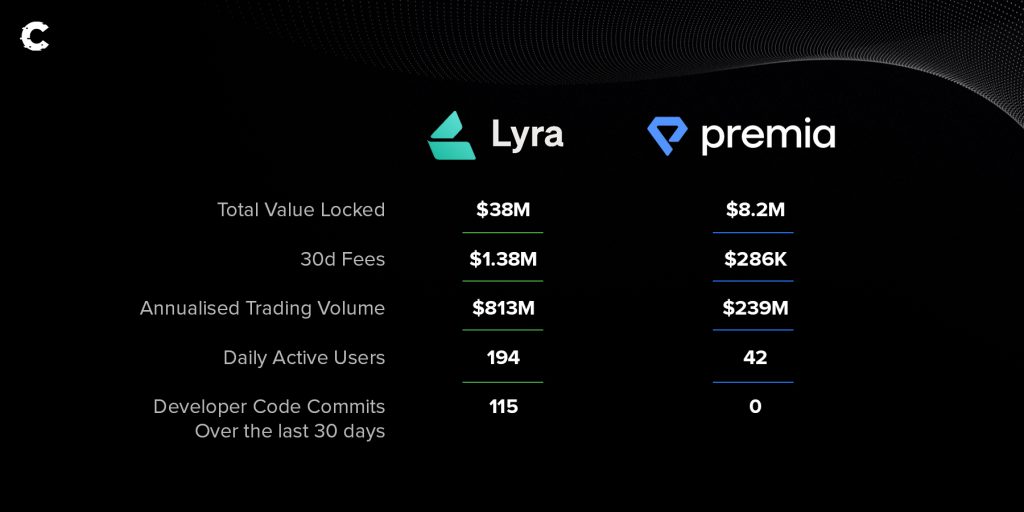

Currently, Premia and Lyra have the same market cap of $47M (as of March 8, 2022).Lyra’s fully diluted value (FDV – the market cap when all tokens that will exist are in circulation) is just over double Premia’s at $160M (compared to $75M).

These statistics suggest there is serious mispricing:

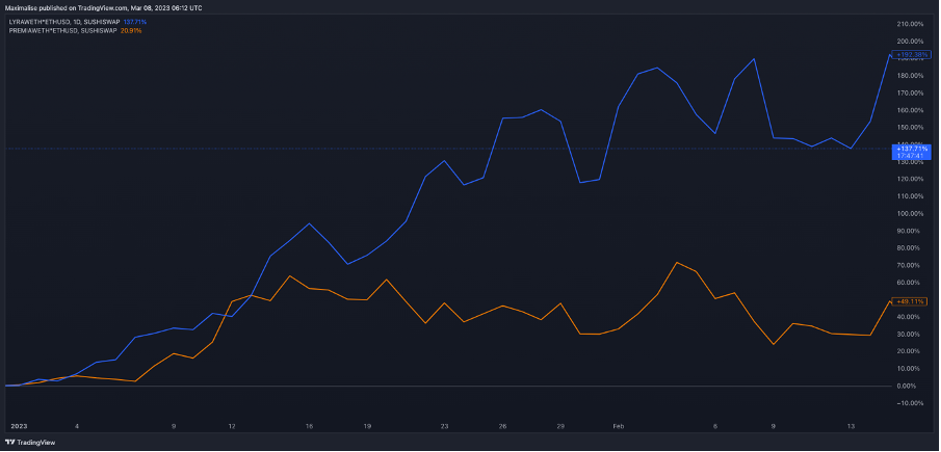

$LYRA has been massively outperforming $PREMIA so far this year. And we believe there’s more to come.

$LYRA’s current pricing is not in line with their fundamentals, and as Lyra continues to grow and improve, the future looks very bright.

Risks

- If the plug-and-play pilot on Kwenta fails, or the model is in some way unsustainable, this would change our view Lyra. This isn’t to say it couldn’t still be the winner, but we would need to re-evaluate.

- Ribbon announced Aevo in September 2022. It’s currently in phase 2 testing, with no set release date. This could be a potential competitor; we'll watch it as it develops, and update you when and if there is significant news.

- 20% of the supply is allocated to the core team and 10% to private investors (the majority of which unlocks on a regular schedule between January 2022 and January 2024). This means that over the course of this year, we'll likely see selling pressure, combined with a gloomy macro picture. As medium to long-term investors, this isn’t a concern for us, as unlocks end at the beginning of next year and we feel the current (bearish) macro picture is only temporary.

$LYRA technical analysis and entry points

LYRA, 1W chart

Due to the recent market-wide selloff, LYRA lost $0.15 as support. A loss of this level was our invalidation, so LYRA will now require a weekly closure above this level to resume upside.

Given Bitcoin's performance (more on that here) and our predictions for it in the coming weeks, LYRA will likely reclaim $0.15 as support and continue going up.

Above $0.2225, there aren't any technical levels, so $LYRA would be in upside price discovery.

Volumes have been increasing over the past few weeks (both buying and selling). This makes $LYRA more volatile than before, so trading comes with risks.

An ideal entry point would be after the weekly candle closure on Sunday, provided Lyra holds its support level of $0.15.

Price targets

Using the same logic we used to value Premia in our 30X option report is appropriate. The vision for the DeFi sector hasn’t changed (for more detail, click here).Essentially, we’re valuing Deribit (a centralised crypto options exchange) at 20X its annualised revenue. We anticipate the winning decentralised options exchange (Lyra) will reach that value within the next 12-24 months.

Our target FDV is $985,500,000 (calculated from Deribit data).

Lyra’s current FDV is $160,000,000.

This represents a 6X (calculated conservatively) gain over the next two years.

Our target, therefore, is $0.90 within two years.

Honestly, we believe $LYRA can go much higher in that timeframe. But, with the current macro picture, it’s best to be conservative.

Full calculations for this are available at the end of this report.

Invalidation Criteria

In either of the below circumstances, our investment thesis would be invalidated, and we would sell:- If Lyra’s FDV to fees (essentially the equivalent to price/earnings in traditional finance) ratio, which is currently 8.97X, rises above 30X.

- We use FDV to fees as it tells us how many years the protocol would have to earn the current yearly revenue to pay for its full value.

- This can be checked here.

- Another decentralised options protocol convincingly overtaking Lyra’s FDV-to-fees ratio.

- Lyra closing a weekly candle below $0.0975, as this would be in downside price discovery.

Cryptonary’s Take

Lyra is extremely active, with the LEAP platform seeing new proposals regularly, and a massive 115 developer code commits in the last 30 days (compared to Premia’s 0).When the protocol moves to governance V2, this growth will only increase, as token holders (who are highly motivated) take over decision-making.

Lyra’s competitive advantage over other decentralised options protocols is already clear. It boasts an active team and community, consistent and exciting upgrades, and looks like a prime “pick and shovel” play in the options market through its B2B focus.

The fundamentals emphasise this. Lyra is far in the lead in both trading volume and TVL.

And they’re just getting started...

Action Points

Provided none of the invalidation criteria is met, we're planning to buy and sell $LYRA at the following levels…Note, as mentioned at the beginning of the report, we're selling our $PREMIA to buy into $LYRA.

- We’re buying into $LYRA now, as it sits just above the $0.15 support level.

- Selling 25% at $0.30, for a 2X gain.

- Selling 25% at $0.60, for a 4X gain.

- At this point, we've already cashed out more than our initial investment, so we’ll allow the rest to run.

Full calculation

Over the last 3 months, Deribit volumes have fluctuated, but average at around $450M per day. To calculate the annualised revenue, we multiply that number by 365, then by 0.0003 (representing the 0.03% fee the platform charges). This equals $49,275,000.$49,275,000 x 20 (the price/earnings multiplier calculated as an average between centralised exchanges) = our target FDV, $985,500,000.

Lyra’s current FDV is $160,000,000.

$985,000,000 / $160,000,000 = 6.16.

6X is our target growth for Lyra over the next two years.