What does the Dogecoin ETF mean for the memecoin market?

Dogecoin has never played by the rules. It was born in 2013 as a joke. No VC rounds, no glossy whitepapers, just a Shiba Inu meme and a community that turned it into internet money. Twelve years later, DOGE is preparing to step into the same arena as Bitcoin and Ethereum through the first-ever Dogecoin ETF.

Dogecoin has been on our radar for months, and we've tracked its moves closely in our Market Direction tool. Now, it's at the center of one of the biggest shifts in memecoin history, the launch of the first U.S. Dogecoin ETF.

Dogecoin's story has always been different. Born as a joke in 2013, it grew into the world's biggest meme asset, powered by culture, community, and Elon Musk's spotlight. We've followed DOGE consistently, calling its structural setups and upside moves well ahead of time.

Now, the launch of the DOGE ETF marks a new chapter. This is the first time a memecoin gets its own U.S.-listed product, bringing DOGE into the same conversation as Bitcoin and Ethereum in the ETF space. It is not a spot fund but a futures-based vehicle, and that distinction matters for impact.

This report looks at the ETF itself, what history from BTC and ETH ETFs tells us, how Dogecoin's structure is positioned, and what the ripple effects could be for the wider memecoin sector. We also lay out the key risks, the opportunities right now, and our stance going forward.

So let's dive in!

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Quick Recap on DOGE

The strength is what stands out. While thousands of tokens have come and gone, Dogecoin has survived every cycle, carried by one thing: culture. From Reddit funding Olympic teams in 2014 to Musk's tweets sending it vertical in 2021, DOGE proved memes could scale and evolve. By 2025, it was still moving nearly 2 million daily transactions, making it one of the busiest blockchains, not bad for a "meme", right?

Why Dogecoin is different

- First meme to achieve mass adoption

- Cultural brand as strong as Bitcoin's seriousness

- Real transaction activity since DOGE is designed as internet currency

- Survived multiple cycles without fading into irrelevance (something which even a lot of utility projects are unable to achieve)

Now comes the shift. The ETF launch adds a new layer to Doge's identity. $DOGE is still the people's meme coin, but now it's also a Wall Street product. That dual role is what makes this moment unique. Culture on one side, capital markets on the other. At this crossroads, Dogecoin is becoming the bridge between memes and mainstream finance.

To understand the scale of this shift, we need to break down exactly what's launching and why the structure matters.

The Dogecoin ETF Explained

The DOJE ETF, backed by Rex Shares and Osprey, debuted on NYSE Arca last week. It is the first U.S.-listed product dedicated to a memecoin, making DOGE the third crypto asset after Bitcoin and Ethereum to earn its own exchange-traded fund. That milestone alone signals how far memes have come.But the details matter. DOJE isn't a spot ETF that holds Dogecoin directly. Instead, it is a futures-based product, allocating about 80% to DOGE futures contracts and the rest to U.S. Treasuries for stability. This structure mirrors how Ethereum first entered the ETF arena in 2023, when the SEC allowed futures exposure but delayed spot approvals.

Why futures instead of spot? The SEC remains cautious about market manipulation in spot memecoins, and DOGE's "no utility" narrative doesn't help. Futures, already cleared through the CFTC, give regulators more comfort and provide a framework with custody and oversight.

For investors, this means two things. First, accessibility improves, traditional accounts can now allocate to DOGE without touching crypto wallets or exchanges. Second, the flows are likely to be smaller than spot ETF debuts, since futures funds typically attract tactical traders rather than long-term allocators.

The bottom line is that DOJE is a structural step forward. For the first time, memes are entering the ETF era, and Dogecoin is leading the way.

Knowing how DOJE is structured is the first step. The next is to know what happened when Bitcoin and Ethereum entered the ETF market. Their launches give us a playbook for how DOGE might react.

Lessons from Bitcoin & Ethereum ETFs

When Bitcoin's first spot ETFs went live in January 2024, they rewrote crypto market history. Inflows topped $50 billion within the first year, vaulting BTC into mainstream portfolios alongside gold and equities. Liquidity deepened, spreads narrowed, and Bitcoin's role as a macro hedge became far harder to ignore.Ethereum's path was slower. Futures ETFs in 2023 had muted traction, but once the spot ETH ETFs launched in May 2024, flows accelerated. Even in their first week, ETH funds saw $44 million in net inflows, modest compared to BTC but enough to validate Ethereum as a core crypto holding for institutions.

For Bitcoin and Ethereum, ETFs were about unlocking massive institutional inflows. For Dogecoin, the futures ETF will likely play out differently. The capital flows may be modest at first, but the cultural legitimacy it grants DOGE could be far more powerful than short-term price action. This is less about Wall Street numbers and more about cementing memes as an investable & legitimate category.

Bitcoin and Ethereum ETFs showed us how powerful regulated products can be in shaping narratives and flows. But Dogecoin's launch sits at the heart of a much bigger trend, the explosive rise of the memecoin market.

The State of the Memecoin Sector

Memecoins have always been crypto's wild card, but in this cycle they've evolved into a sector that can no longer be dismissed as noise. From a niche corner worth just $20 billion at the depths of the 2022 bear market, the memecoin sector has swelled to $55.5 billion as of September 2025, a 175% rebound that mirrors crypto's broader recovery but with far higher beta.This resurgence wasn't accidental. It coincided with Bitcoin's push past $112,000, ETF approvals unlocking institutional flows, and most critically, Solana's dominance as the meme launchpad of choice. Pump.fun alone has accounted for more than 70% of new meme launches this year, turning Solana into the epicenter of meme speculation. The chain's speed and ultra-low fees made it fertile ground for tokens like WIF, POPCAT and FARTCOIN, all of which went from obscurity to multi-billion valuations in months. Competing chains like Base and Avalanche have begun hosting their own meme economies, but Solana's head start remains unmatched.

Cyclical Recovery: From Bear Lows to Bull Cycle Peaks

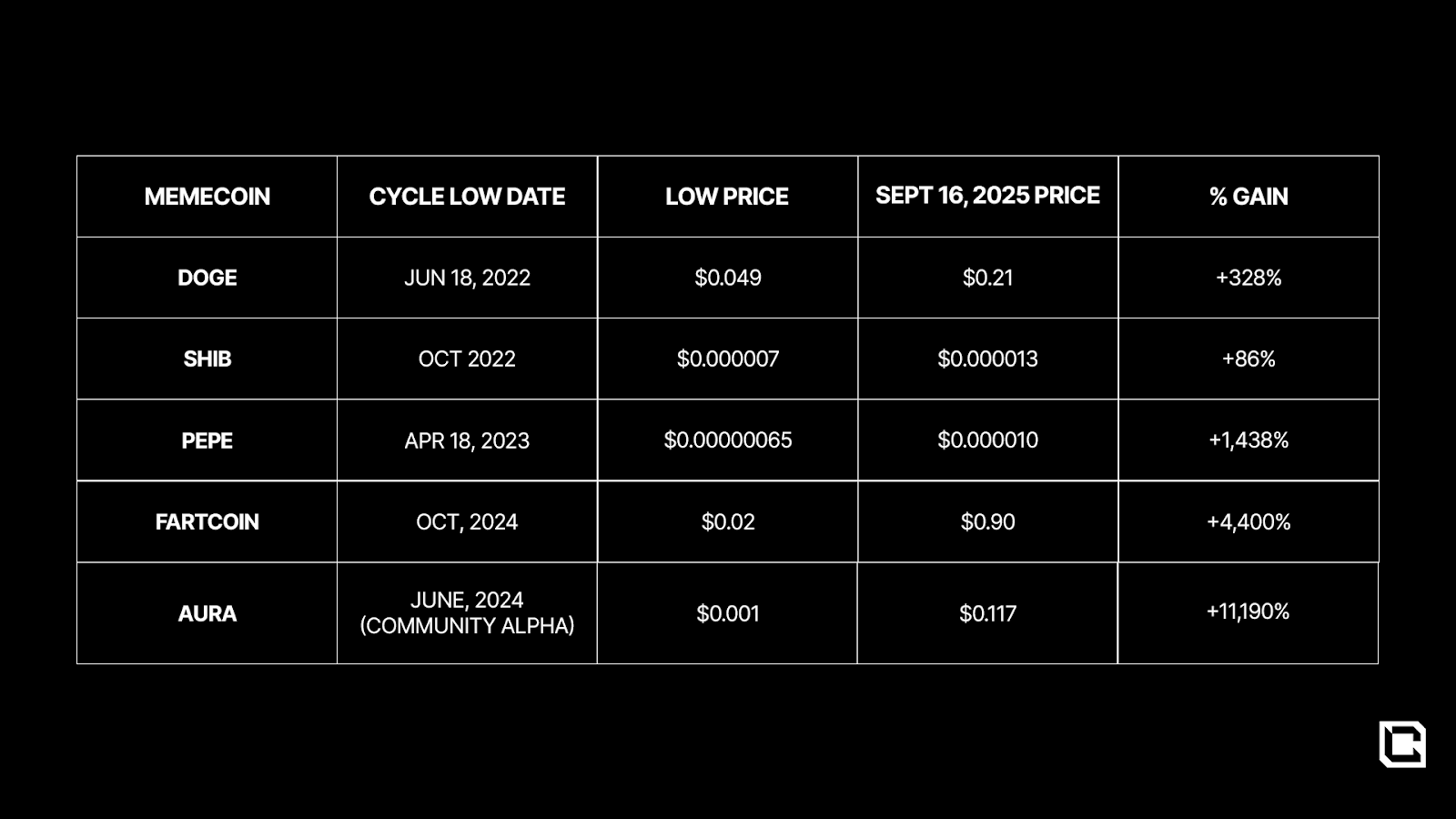

The current cycle traces back to the 2022 bear bottom, when sentiment was crushed by the FTX collapse and memecoin caps slid below $20 billion. Since then, the rebound has been ferocious. By September 16, 2025, the sector had added more than $35 billion in value, with both veterans like DOGE and SHIB and newcomers like FARTCOIN and AURA riding the wave.The table below captures the scale of the move, showing the percentage gains in price and market cap from cycle lows (or launch lows) to current levels:

Key Takeaways from the Cycle

- Veterans vs Newcomers: DOGE and SHIB still anchor the space, delivering steadier gains of 85-330%. But the eye-popping multiples came from newcomers, AURA (+11,000%).

- Solana's Grip: Four of the biggest winners (BONK, WIF, FARTCOIN, POPCAT) were Solana natives, proving the chain has become the default arena for meme speculation.

- Market Cap Transformation: DOGE remains king with a $31B cap, but new entrants flipped from microcaps into billion-dollar assets in less than two years.

- Volatility Reminder: Many of these tokens retraced 70-90% from their ATHs, showing that while meme rallies are fast, corrections are brutal.

The Bigger Picture

The numbers show that memecoins have become a cyclical play within crypto itself, amplifying bull runs, collapsing harder in bears, and repeating with each new wave of retail and cultural engagement. With 70% of memecoins historically failing within a year of launch, survivorship bias explains much of the table above. Still, those that survive not only multiply in price but also anchor narratives that keep retail engaged.Solana's meme economy is the proof of concept: pump-and-dumps coexist with cultural hits, but collectively they sustain activity, fees, and attention. And now, with DOGE leading the charge into ETF territory, the sector could be entering a new phase, one where memes are not just speculative side bets but recognised, institutionalised assets.

The sector's performance sets the stage for what's coming next. With DOGE's ETF debut and rival filings from BONK and TRUMP in the pipeline (potentially more coming), the memecoin story is now about legitimacy, regulation, and whether Wall Street will embrace the chaos and the Internet culture.

Other Memecoins in the ETF Arena

Dogecoin may be the first meme to secure its Wall Street ticket, but it won't be the last. Its ETF debut has triggered a wave of filings and speculation around whether other popular memes can follow in its footsteps. The appetite is real, both from ETF issuers looking to replicate DOGE's first-mover buzz and from communities eager for legitimacy.Current Filings and Probabilities

Two names stand out in the U.S. filings pipeline: BONK and TRUMP. Both were submitted by REX Shares in mid-2025 under the 1940 Investment Company Act, the same path DOGE took for its futures-based ETF. Bloomberg's estimates put their approval odds at 40-50% by year-end, though timing will depend on how the SEC digests DOGE's performance in its early months.- BONK: Solana meme, Bonk-ecosystem-driven with strong cultural weight. Market cap $1.9B. Filing emphasizes Solana's growing retail traction.

- TRUMP: Politically charged token with $1.75B cap. While volatility is extreme, the filing banks on cultural relevance.

Technical Analysis

DOGE/USDT (Weekly Timeframe)

On the weekly chart, Dogecoin is showing a strong bullish structure. Price has been forming higher highs and higher lows, with a clean consolidation range now established between $0.205 (support) and $0.2875 (resistance). Currently, DOGE is consolidating around $0.25, which also coincides with the neckline of a double-bottom formation that completed in mid-June 2025.

Structurally, this double bottom formed after DOGE broke out of its long-standing downtrend line in November 2024, followed by a successful retest of both the trendline and the weekly 200 EMA in April 2025. That retest validated the structure and created the base for the current rally. The neckline retest at $0.25 is now pivotal, a break above $0.2875 would open upside to the $0.35–0.40 zone, with the main weekly timeframe target set at $0.57.

Key support levels are defined at $0.233 (intermediate), $0.205 (major weekly), and the weekly 200 EMA around $0.153. On the upside, targets remain $0.35–0.40 initially, followed by $0.57 for larger positional plays. Weekly RSI is trading at 53, with an average near 51, leaving plenty of room for momentum to expand higher without appearing overstretched.

DOGE/BTC (Weekly Timeframe)

The DOGE/BTC pair continues to mirror structures we saw in 2014–2021. After its explosive breakout in 2021, price has retraced into a multi-year pennant that has persisted until today. On the weekly timeframe, DOGE is currently trading just below its 200 EMA around 0.0000024 BTC, which also aligns with immediate resistance.For the bullish thesis to confirm, DOGE needs to flip this EMA and resistance level into support, and then break out of the pennant it has been trading within since 2021. If this happens, the upside is significant: +131% to TP1, and as much as +253% to TP2 against Bitcoin. Weekly RSI sits around 50 with an average of 47, showing neutral positioning and plenty of upside space if momentum builds.

This chart underscores the relative strength potential of DOGE not only in USD terms but also against BTC, a key signal for broader meme coin sector flows.

Note

This analysis focuses on DOGE's weekly structure, which highlights the macro breakout setup. For readers seeking daily updates, short-term pivots etc, these are covered regularly in our Market Direction Tool (MD Tool) twice a week on the Cryptonary website.We will now need to confront the vulnerabilities that still shadow this market.

Cryptonary's Take

The Dogecoin ETF is a stress test for whether memes can transition from internet culture into regulated finance. Doge has the liquidity, brand power, and community depth to carry that weight, and its ETF debut sets the stage for the sector's next phase. For us, the message is clear: this isn't about utility, it's about adoption. If inflows hold, Doge becomes the index coin for an entirely new asset class.This acceptance by Wall Street cracks open the floodgates for the sector's liquidity. Traditional investors who would never set up a wallet now have a regulated gateway into memes, and early weeks of ETF launches historically attract peak inflows. This means liquidity will first rush to DOGE, but history also shows it doesn't stop there. When the leader moves, liquidity cascades into peers, lifting the entire sector.

This is where positioning matters. While DOGE commands headlines, the asymmetric opportunity often sits in smaller-cap names riding the wave (e.g AURA)

But the opportunity comes with risk. Memecoins remain volatile, hype-driven, and fragile in structure. This ETF does not erase those realities, it amplifies them. The difference now is that volatility sits on Wall Street's rails. That's why we see this as a rare alignment of liquidity, structure, and sentiment that deserves attention.

We've tracked Doge through every move, and this moment is where speculation meets legitimacy. The ETF gives it fuel, but the community gives it direction. Whether this cycle ends in a supercycle or a reset, one thing is certain, Doge has kicked the door open, and the whole meme sector will follow.

Cryptonary OUT!