In order to play the game you have to be in the gameAfter a monumental rally since the start of 2021, we've seen a sharp correction which keeps feeding itself on a seemingly unending streak of FUD. Despite the recent correction, we cannot say that the crypto market has not significantly advanced this year.

- BTC (June 2020): $9,000

- BTC (June 2021): $32,000

- ETH (June 2020): $250

- ETH (June 2021): $1,950

The FUD Cycle

Given that 65% of the Bitcoin network hashrate comes (or came) from China, all crypto-related news stemming from this region is very important. News from China is rarely covered by western media given the cultural and linguistic barriers. However, when it's bearish these barriers magically fall off and all news make it internationally.- Crackdown on large-scale mining operations

- Crackdown on retail participation with high leverage

- Crackdown on banks allowing crypto-related transactions

One thing is certain however, the centralisation of the hash power in China is being reduced because large-scale mining farms truly shut down and are already in action to move elsewhere. While in the short-term it is not bullish for prices, in the long-run it is. Why? Because Bitcoin's biggest threat was always its centralisation in China and this has just been alleviated.

This cycle of FUD has sent prices plummeting as investor confidence dropped.

The Hedge

We did not sell the top nor do we claim to have done so. Also note that people that claim to have successfully shorted the top have, more often than not, been shorting this entire bull rally. Be wary of such people/groups as they're only trying to sell you a dream.There are no certainties nor guarantees in financial markets, only probabilities. Our first thesis preceding any else is that the crypto market will succeed over time and that will reflect in its prices - so do know that this is the base premise of any judgement or action we may personally take. We remain very bullish on our long term horizon on the crypto market with a particular emphasis on DeFi.

With that said, we do acknowledge when we are wrong and also act on it. Our current market condition thesis is that prices will remain range-bound before finally breaking to the upside. We gauge this using the Total Market Cap, why? Because individual assets can be subject to manipulation but an index is lot tougher to change at will. Hence, if the range breaks to the downside, our current market condition thesis would prove to be wrong and we are prepared for such a scenario.

The Total Market Cap is ranging between $1.35T and $1.7T. Today, we are seeing the range low being tested and here are the two possible scenarios:

- Bullish: Rebound towards $1.7T before reclaiming it

- Bearish: Break $1.35T and head towards sub-$1T

If the Total Market Cap closes a daily candle under $1.35T, we'll be protecting the value of our portfolio by taking two simultaneous shorts on BTC & ETH at whatever prices we get upon such closure - these are not for speculation, only for capital protection. Both shorts will cover the value of our portfolio in USD-terms (approx).

Invalidation: Daily reclaim of $1.35T - in which case we'll take a loss on the shorts and consider it a premium we had to pay as insurance.

Stats

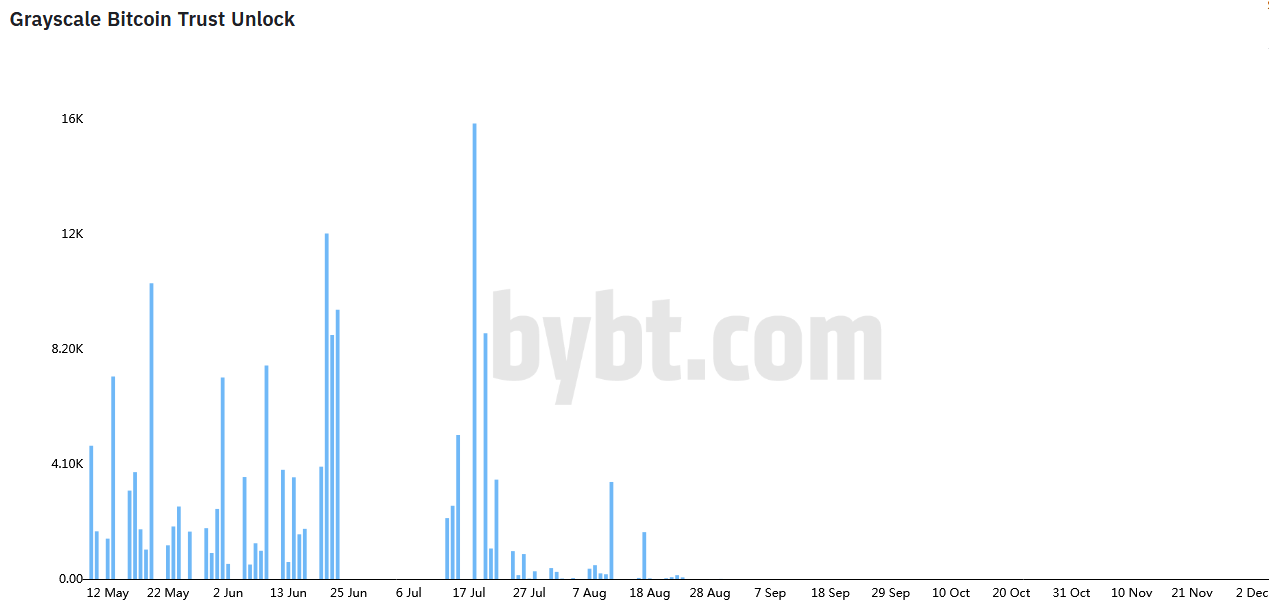

There have been several events in the previous few weeks that are influencing the market. Let’s break down some of the key points, and what they could potentially mean going forward into Q3 2021.GBTC Outflows

Throughout all of 2020 we heard news of the Grayscale Trust locking up huge amounts of Bitcoin, more than tripling holdings to over 650,000 BTC. Grayscale has a release schedule for this BTC; therefore, it is possible to know in advance when large amounts of liquidity will potentially hit the market.

We can see that between the 19th and 22nd of June there is set to be 34,630 BTC released from the fund. Additionally, another 39,540 BTC is due for release between the 12th and 21st of July. The combined total for these releases in USD value (at current prices) is over $2.4billion.

It is important to note that not all of the BTC released will be sold, but a portion of it inevitably will and so these unlocked coins could produce some volatility. Expect to see more of this narrative flying around as people make the assumptions that all unlocks mean they get sold on the market which is usually untrue - a portion though probably does get sold as stated.

In between the 23rd of June and the 12th of July there are 0 BTC being unlocked from the Grayscale Bitcoin Trust, this should in theory reduce selling pressure on the market from the end of July onwards.

Miner Outflows

On-chain data suggests that even though miners have shut down operations in China, the number of BTC being sent by miners to exchanges is at the lowest number in over a year. This is surprising, since we believed that miners would still be in the process of selling accumulated BTC to cover the costs of relocating their operations outside of Chinese jurisdiction.[caption id="attachment_121295" align="aligncenter" width="1964"] Source: CryptoQuant[/caption]

Source: CryptoQuant[/caption]

However, there has already been a couple of large miner sell offs in the last 4-5 weeks. We believe that it is likely that these sales were pre-emptive and would explain the recent lack of transfers. We hypothesise that if this is the case, and miners pre-emptively sold off their stash in advance of the China ban, then we would say there is a good chance that the majority of the selling pressure from this source is already behind us.

Who’s Selling?

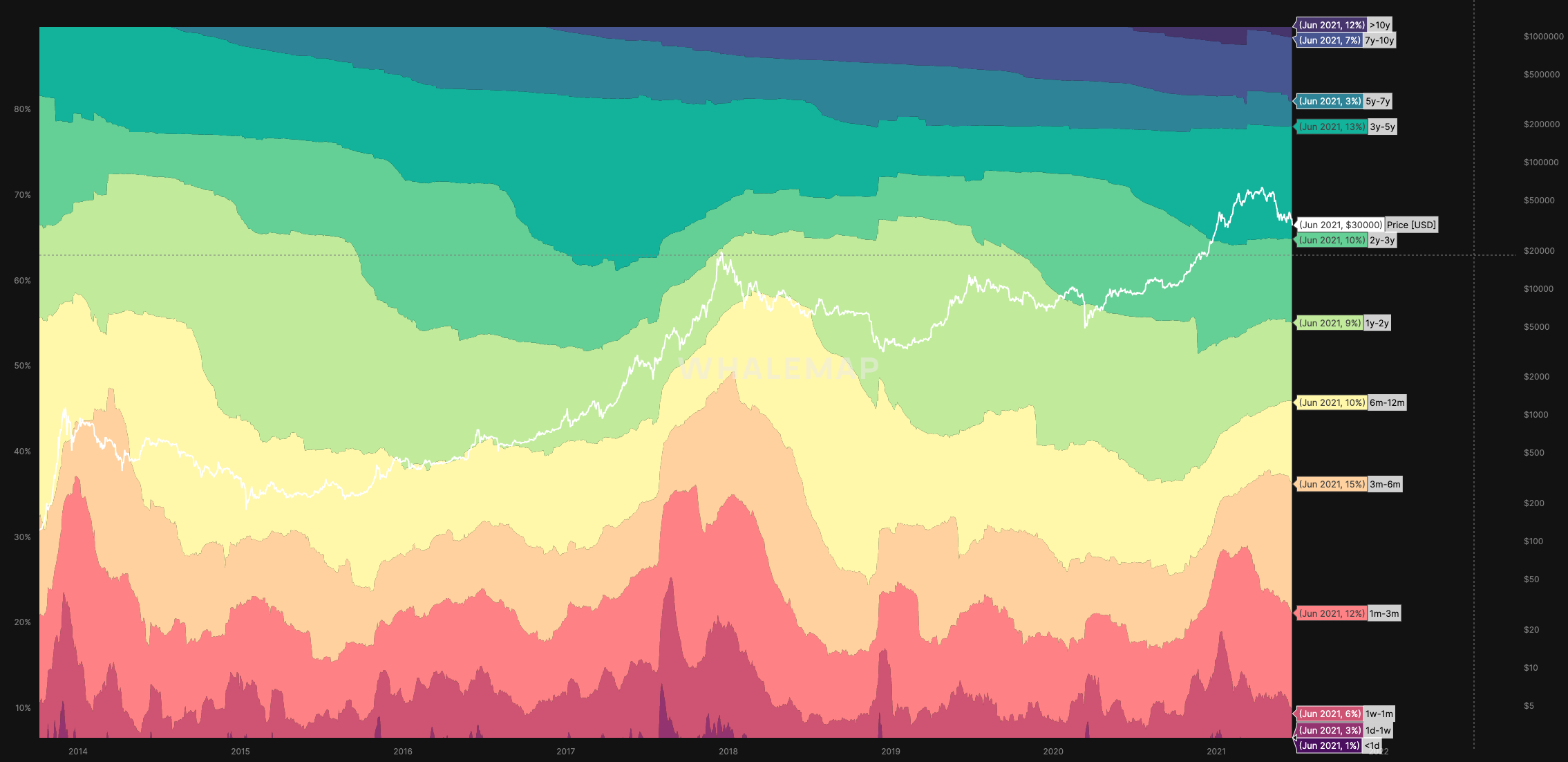

There is on-chain evidence suggesting that the majority of sellers are newer market participants (those who entered in the last 3 months), who bought in close to the local top of $50-55k+ and are now capitulating at a loss.[caption id="attachment_121299" align="aligncenter" width="2269"] Source: WhaleMap.io[/caption]

Source: WhaleMap.io[/caption]

Looking at the data for longer term holders (those holding for longer than a year), the price of BTC is now approaching the cost basis for many of them. The data suggests that longer term holders of Bitcoin have been accumulating between the May correction and the present. A notable example is Microstrategy with their 105,000 BTC at an average cost of ~$26,000, who recently completed their purchase of a further ~13,000 BTC for around $37,000.

May 2021: How Bullish for Crypto?

At the beginning of May we released this journal. In it, we analysed historical data to create a kind of rough timeline for which direction the market could potentially take in the next few months.Although the correction began in the middle of May and proved 2021 to be different from the mean, we still believe that there is value in the details of the journal. We can never state any prediction with 100% certainty, especially when using historical data. Things like FUD and the China mining bans are impossible to predict. Additionally, it is also impossible to time the market to any exact date, week, or even month.

However, we know now that the expected correction came early. This means the Q3 2021 prediction of a choppy/stagnant/bearish quarter is upon us. Although historical data is useful as a comparison, as investors we can never put ourselves in the situation where we are basing our entire thesis on one resource.

The series of events and news that hit the crypto market in the last few weeks has undeniably shaken investor confidence in the market. Taking into account all of the points above, we believe that this is simply one of many rough patches in the decade long history of crypto. The indecision and fear we are seeing in the market is largely warranted at the moment, at least in the short term.

Reevaluating Portfolio Sizing & Diversification

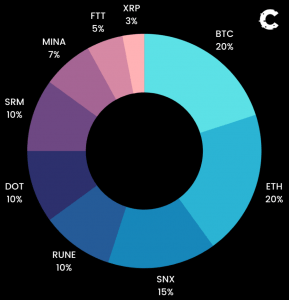

In most investment related activities, capital allocations are referred to in terms of percentages. This is done is to ensure consistent sizing of investments. It also ensures that the risk/exposure and performance of the assets held in the portfolio can be compared. In the case of the Cryptonary portfolio, the maximum allocation to any one asset does not exceed 20%. The smallest allocation in the Cryptonary portfolio is 3%. This is in XRP and the % allocation has been steadily decreasing as XRP has been sold in the previous months. Allocations must walk a fine line between being large enough to have an impact when they work out well, but also not large enough to ruin the investor if they do not work out. The allocations in the Cryptonary portfolio are split in such a manner.

Portfolio allocations and sizing are a complicated topic, but the Cryptonary approach is tailored towards a long term passive holding thesis. The allocations are diversified to the right degree that even with only a couple of assets working out, significant gains can be had. The diversity in investments also protects against the investor losing all their funds in case multiple assets significantly drop in price at the same time. As always any capital which is used speculatively (a betting bankroll, a stock investment account, a cryptocurrency portfolio) should be expendable and the investor should be prepared to completely lose their investment from the onset. It is necessary to separate emotions from actions when participating in markets. At least when decisions are made they should be decoupled from emotions at that point in time. It is human nature to have emotions from the performance of an investment portfolio. As long as they do not influence subsequent decisions this is expected and healthy.

Lastly and most importantly, the key factor that enables such an approach to the market is the entry point. By entry point we refer to the timing and price at which an asset was acquired. Decisions are made based on risk/reward. Securing an early entry to an asset maximises the potential rewards. Different entry points have different risk profiles for investments - something we've always publicly stated.

Most people have heard some version of the above, however at the end of the day, everyone’s situation, portfolio and risk tolerance is unique. A ‘worst case’ approach is beneficial to allow the investor to understand if they are overexposed because Risk of Ruin should simply not be allowed to exist. Assuming worst case scenarios - we're talking about overly pessimistic ones - are a great way to eliminate such risk.

Evaluating one's own situation, as each individual has different responsibilities, is also crucial in determining exposure limits. Any over-exposure should always be cut and sometimes that comes unintentionally after a large market rally, at which point taking even 5-10% profits becomes very important.

Crypto is also the new asset class which has experienced the most growth out of all asset classes such as stocks, commodities, bonds and others in the past 10 years. No one wants to be the person who used 10,000 BTC to buy two pizzas. We personally believe that there does not exist a better risk/reward ratio in any market. The balance between risk/reward is each individual’s decision. However, the most important goal is that the worst case scenario should never be catastrophic.

To win at the game, you have to be able to play the game. We intend to stay and play the game for as long as it takes to win.