What is going on between Binance and all these regulators?

Binance has been in the news a lot lately. The exchange was forced to stop business activities in Ontario and received a warning from the Japanese FSA and the UK FCA. This article will give you an overview of the whole situation and our approach to it.

What is the issue in Japan and Ontario?

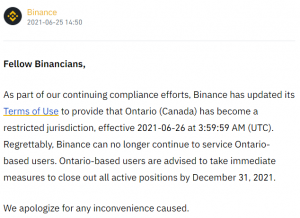

On June 25, Japan's FSA warned Binance that it was engaged in cryptocurrency trading business without registration. This was the start of a noisy week for the exchange. Usually companies look to be registered with a regulator before they start doing business in a country, but it appears that Binance has not done so in several countries. Binances' response to the problem in Japan was that they do not hold exchange operations in Japan and do not actively solicit Japanese users. To date, there are no new updates from the Japanese regulator or Binance about the warning, and it seems like it has blown over. The situation seems similar to what happened in 2018 when Binance had also received a warning from the FSA in Japan.Then, after Japan, there was another regulatory problem for Binance. The exchange had been avoiding registration in Ontario, Canada. Canadian regulator OSC announced in March that crypto exchanges have to reach out to the OSC staff until April 19 2021 to discuss compliance or face legal action, Binance decided to mark the country as a restricted jurisdiction. This means that if you are from Ontario you are not allowed to use Binance. This is also another sign that Binance seems to be purposefully avoiding contact with regulators.

The exchange also got in trouble in the U.K.

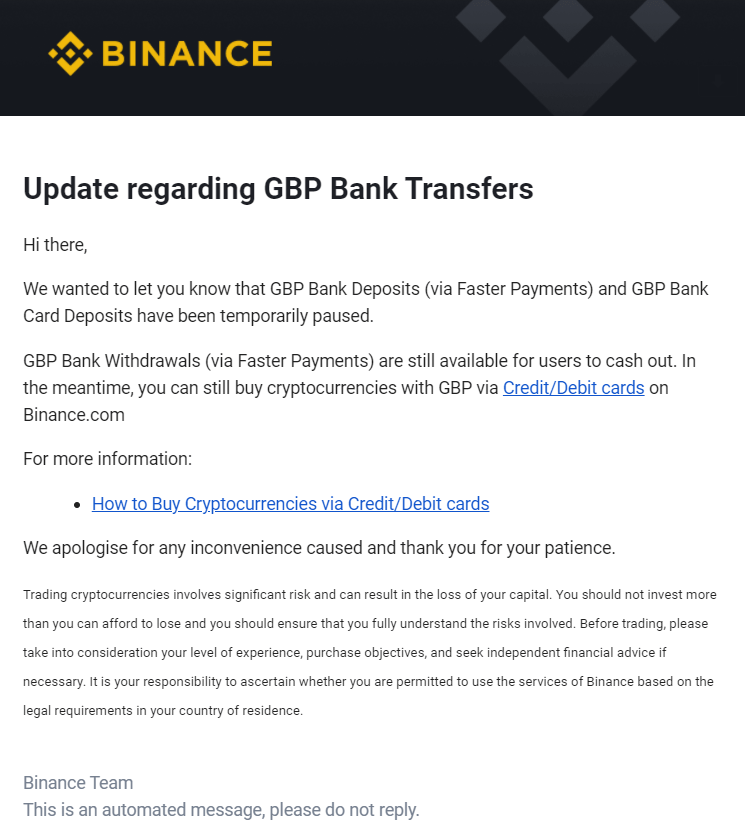

After these two problems, the exchange got into trouble with a regulator again. This time it was the FCA from the United Kingdom. The FCA published an announcement that it would ban Binance Markets Limited if it did not respond to a request for registration by Wednesday. The main reason why the FCA is concerned about Binance is the fact that it offers futures and margin trading without being registered to provide such products. Another issue is the fact that Binance does not have a strict KYC policy, along with the regulatory concerns about money laundering through the use of crypto. According to a tweet posted by Binance the warning by the FCA has not affected the services provided to its customers. The tweet released also looks like a standard Binance response usually posts after a major issue like this, and thus is not very encouraging.Later that night, UK registered Binance customers had their ability to make cash withdrawals suspended. Binance blocked customers with bank cards from depositing, having also previously suspended the ability to make withdrawals directly to UK bank accounts. Binance responded to the outages by saying they were temporary. At the moment, the only way a UK citizen can withdraw their funds from Binance is to go through bank cards and the payment system known as SEPA. Another way to withdraw funds to your bank account would be moving your cryptocurrency portfolio to another exchange and then withdrawing to a bank account from there.

It's hard to predict what Binance will do to solve the problem they have in the UK. One of the options would be to create a separate trading platform without margin or futures products which would then allow for regulation by the FCA. Another way to do it would be to copy FTXs' approach to regulation in the UK. FTX have added a mandatory question for users, so they can choose whether they want to use FTX as a professional trader or as a retail investor. This allowed for FTX to be compliant with UK regulations and registered with the FCA. The final route Binance could take is to promise the FCA that they will block UK customers from their platform and mark it as a restricted jurisdiction, similarly to what they did in Ontario.