What is Liquid Staking?

Staked assets are inherently illiquid as they are locked with validators on Proof of Stake networks. This creates a conflict of interest for users wanting to secure the network and utilize their assets in DeFi to generate yield. Liquid Staking solves this problem by allowing users to deposit PoS assets (ie: SOL, ETH, LUNA) into a staking protocol that stakes the assets on their behalf. The protocol then issues users a 1:1 tokenized version of the staked asset, allowing them to earn staking rewards, secure the network, and deploy the liquid staking token in DeFi protocols for lending, collateral, or as a LP (liquidity provider). This unlocks another layer of yield for users. Liquid staking protocols allow users to unstake immediately for a nominal fee, a feature unavailable when staking directly with validators. This increases the mobility & liquidity of PoS assets, enhancing the financial freedom of users.

TLDR

- Liquid staking allows you to stake your tokens and also have them available to use in other DeFi activities

- Liquid staking promotes self custody by allowing users to remain in control of their funds

- Liquid staking enhances network security and increases liquidity in the PoS network

- Lido & Marinade are two of the top liquid staking solutions in crypto

You stake your tokens with a liquid staking protocol and they give you a token representing your stake. This way you earn staking rewards, and can use the liquid staking token in DeFi as you please!

Liquid Staking's Role in PoS Networks

Liquid Staking contributes to the security & decentralization of the network as well as the amount of liquidity available in its DeFi protocols. When staking with a centralized exchange like Kraken, users forfeit the possession of their tokens to the exchange. In other words, "not your keys, not your crypto." These tokens also become illiquid, as CEX's do not (yet) issue liquid staking tokens in return for staked assets.

Liquid staking protocols that swallow a large percentage of the circulating supply of a PoS asset (ie: ~18% of the entire LUNA supply is staked with Lido) raises high risk of centralizing the stake. Hypothetically, if the Lido DAO is governed by a few whales who own most of the LDO governance tokens, these whales could gain control over the entire network. It is important that staking pools are incentivized to distribute stake across a wide set of validators, ensuring decentralization. If there is not a proper incentive structure ensuring liquid staking protocols do so, we must simply trust that the staking pool will act in an equitable manner. The concept of trusting a centralized entity to "do the right thing" is against the ethos of cryptocurrency; we should aim to eliminate the need to trust. To my knowledge, no such incentive structure exists yet.

The rest of this report is dedicated to helping you learn about Lido and Marinade Finance, two leading liquid staking protocol’s. By the end of this report you should be able to decide whether you’d like to use them for staking.

Let’s start with a table providing some introductory information on the protocols.

| Supported Networks | Token | APY | Fee | TVL ($) | |

|---|---|---|---|---|---|

| Lido | Ethereum, Terra, Solana | stSOL, stLUNA/bLUNA, stETH | 4.8% (ETH), 8% (LUNA), 5.9% (SOL) | 10% | 11.58B |

| Marinade | Solana | mSOL | 6.67% | 2% | 1.4B |

What is Lido Finance?

Lido Finance is a DAO building a family of liquid staking protocols on Ethereum, Solana, Terra, and other PoS networks. Lido was started by Vasiliy Shapovalov, CTO of P2P Validation Services. P2P is a non custodial validation service offering staking for a series of PoS blockchains including Tezos, Cosmos, Polkadot, Solana, Kusama, Ethereum, Kava, and Terra. Lido was created in response to ETH 2.0 requiring significant capital (32 ETH) and advanced hardware & technical knowledge in order to stake. Lido eliminates this barrier to entry by requiring zero technical knowledge and allowing users to stake as little as .01 ETH. Lido generates revenue by collecting 10% of staking rewards, splitting this evenly between their validators and the Lido DAO treasury.

The APY when staking directly with the ETH2 staking contract is 5%. If you choose this route, you will not be able to move your ETH for an indefinite period of time. Withdrawals have not been enabled and there is no indicator they will be any time soon. If you stake with Lido you will earn .2% less a year; however, you can make up for that nominal loss through utilizing your stETH in DeFi. One strategy we implore you to research is providing liquidity into the stETH-ETH pool on Curve, one of the most liquid pools in crypto. Staking with Lido also allows you to redeem your stETH back for ETH, a feature unavailable if you stake directly with the staking contract.

Now, onto the next!

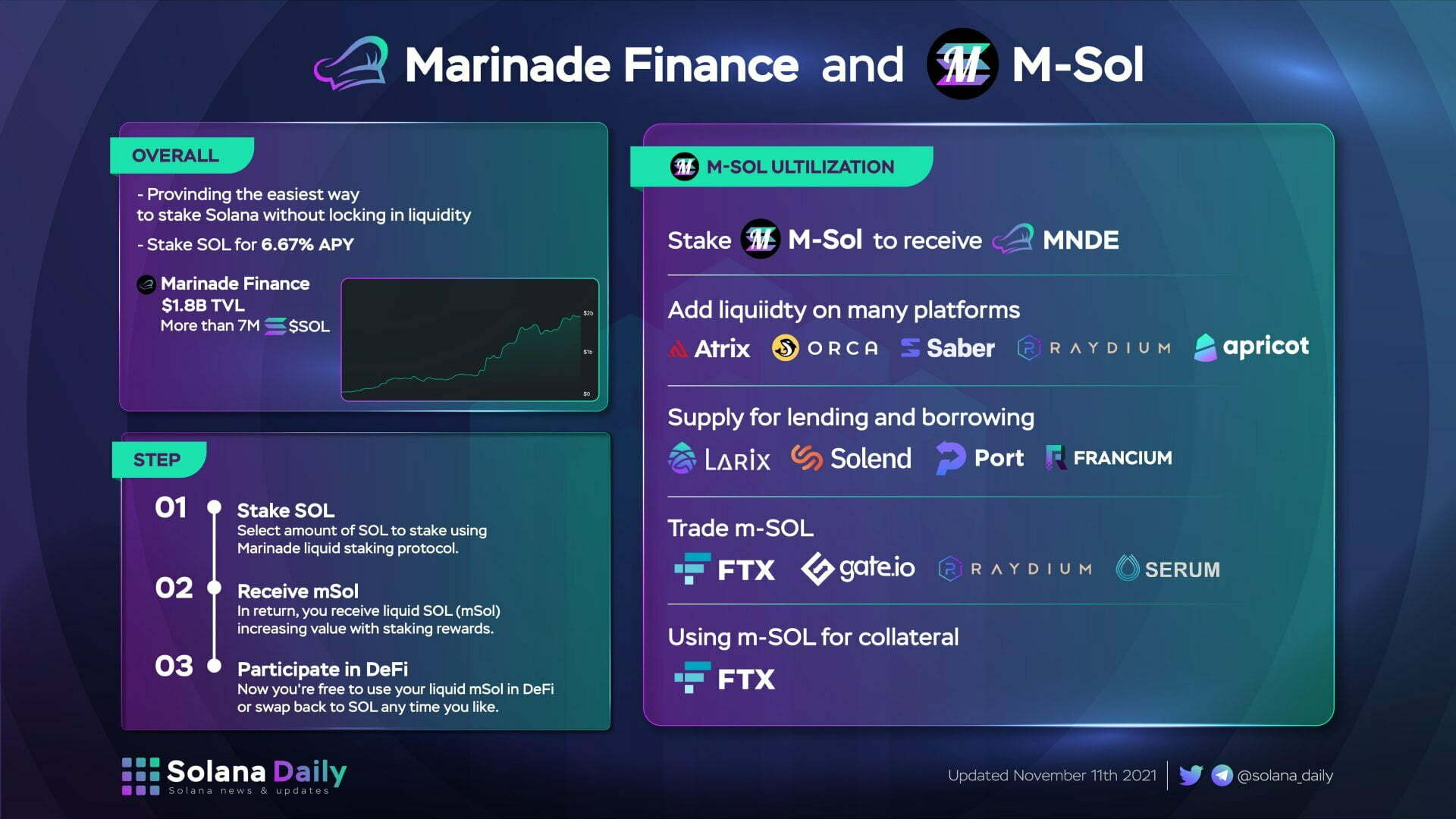

What is Marinade?

Marinade is the leading liquid staking protocol on Solana. It is a Solana native dApp and does not exist on any other chains. It was the first liquid staking solution on Solana, giving them first mover advantage on the platform. When you stake with Marinade you receive "marinated SOL" (mSOL) in return, a tokenized representation of the SOL you have staked. The price of mSOL always trades at a slight premium to SOL, as staking rewards accrue to the liquid staking token each epoch. The protocol generates revenue by collecting a percentage of staking rewards, as well as a nominal fee from users who choose to withdraw SOL immediately, foregoing the 2 epoch unlock period.

Breakdown of the Liquid Staking Market

As the prices of cryptocurrencies are extremely volatile, the USD TVL in a protocol is often a misleading statistic. This section is dedicated to providing statistics that illustrate Lido's dominance in the multi-chain liquid staking market, and Marinade's dominance on Solana.

Lido on Ethereum

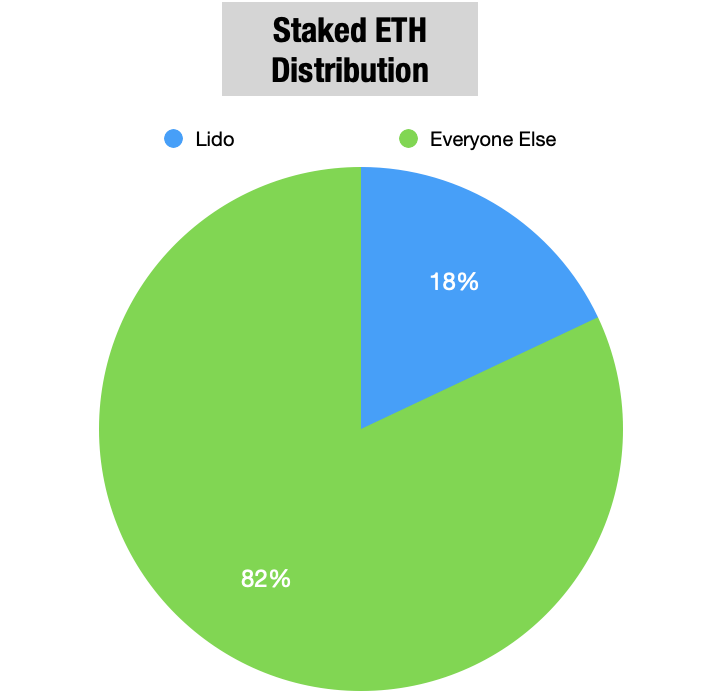

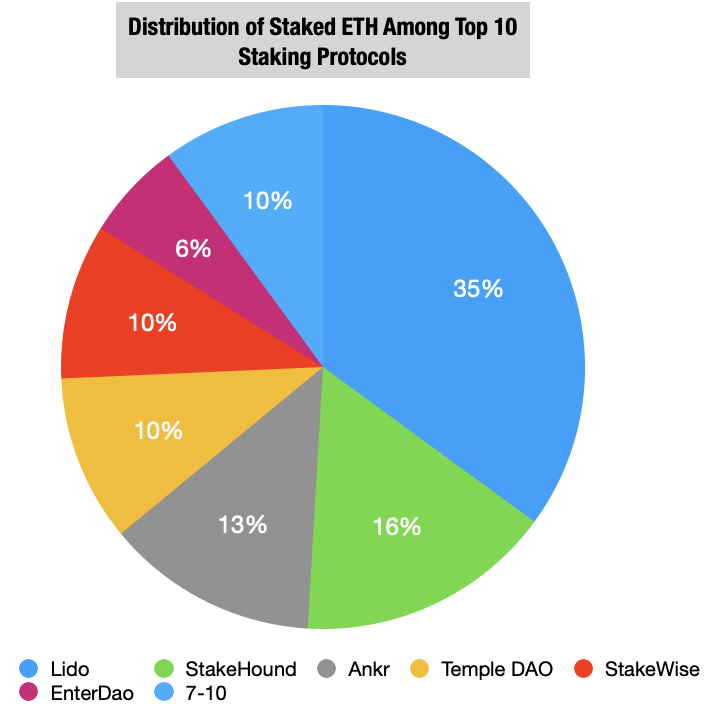

Out of the top ten staking protocols on Ethereum, Lido dominates with a 35% market share of staked ETH. Lido holds 17.5% of the entire staked ETH supply, the most notable statistic depicting Lido's undeniable dominance on Ethereum.

(Sources: Lido.Fi, Beaconcha.in)

(Sources: Defillama, Dune Analytics)

What makes Lido very unique is that it exists across multiple chains. In the table below you can see just how powerful Lido is. It is the leading staking solution on Terra, and the second most dominant on Solana behind Marinade.

Lido’s Multichain Dominance

| Launch | Stake | Rewards Paid | TVL ($) | % Circulating Supply | % of Staked Supply | Top DeFi Integration | |

|---|---|---|---|---|---|---|---|

| Ethereum | October 2021 | 1.6M ETH | 37,141 ETH | 6.19B | 1.2% | 17.5% | Curve ETH - stETH Pool (4.2B TVL) |

| Terra | March 2021 | 65M LUNA | 864,722 LUNA | 5.75B | 17% | 21% | Anchor Money Market (403M TVL) |

| Solana | September 2021 | 1.2M SOL | 17,052 SOL | 217.5M | 0.3% | Data not available. | Saber SOL - stSOL Pool (34M TVL) |

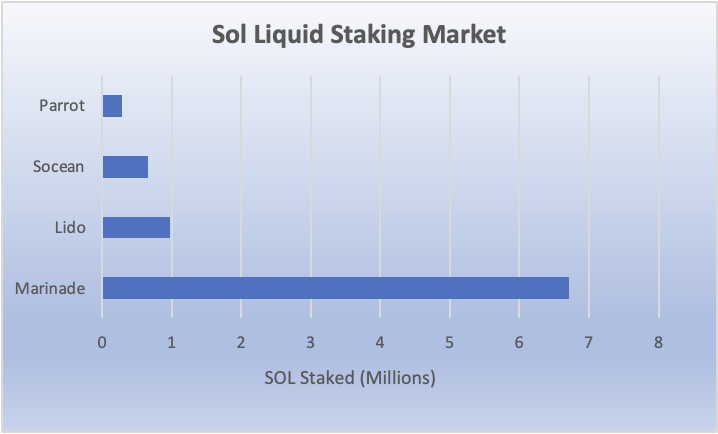

Comparing Lido and Marinade TVL isn't a fair battle. Marinade is solely focused on Solana while Lido is present on numerous Proof of Stake networks. Marinade also launched in March 2021, giving them a 6 month head start on Lido. Below we can see a table more accurately depicting the Solana liquid staking battle, tallying up the total amount of SOL staked with the top four protocol’s on the blockchain.

(source: validators.app)

Marinade’s Governance Token: MNDE

MNDE is a governance token that grants community members governance rights to create and vote on proposals to enhance the Marinade protocol. If you own at least twenty $MNDE tokens and confirm that on their discord, congratulations! You are officially a part of the Marinade DAO.

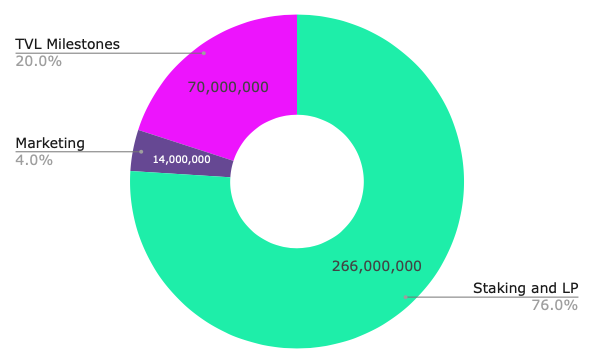

Like most Solana DAO's, governance will decentralize over time as an increasing number of MNDE tokens are distributed, onboarding more people into the DAO. Governance takes place off chain, mostly in Discord. MNDE issuance began on Sept 30, 2021 and is being distributed through liquidity mining incentives and "retroactive rewards" allotted to early users of the protocol. There was no token sale, no private investors, and no VC funding for the MNDE token. The token has a total supply of 1B. The distribution is as follows:

- 35% (350M) for Marinade community incentives broken down in the following categories:

- 76% to early farmers and LP's

- 20% for additional tokens to be distributed upon reaching significant milestones like TVL levels

- 4% marketing budget for bounties, contests, education, and fun

- 35% (350M) - DAO treasury

- 30% (300M) team allocation, with a 6 month cliff and 2 years linear vesting

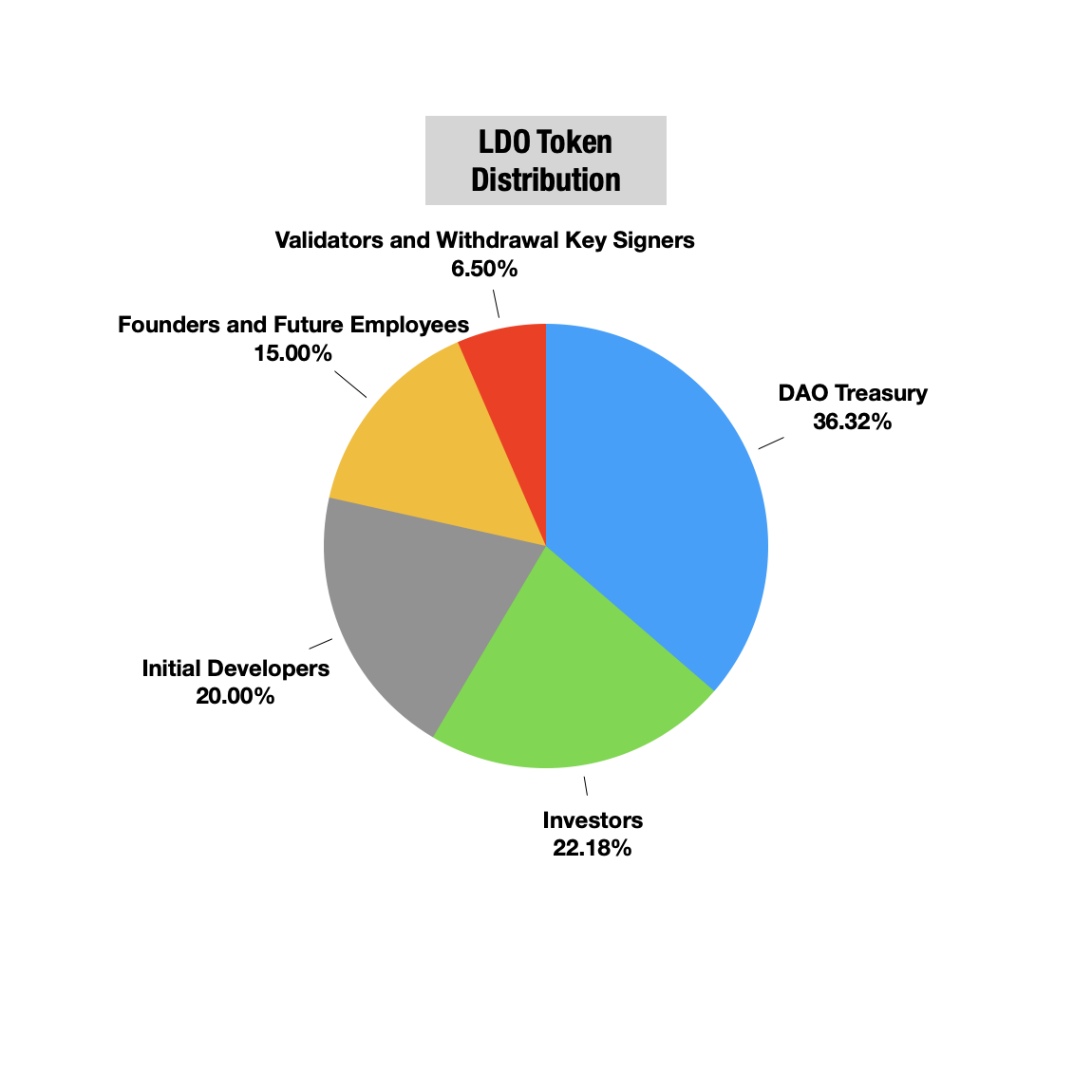

Lido has multiple teams working in parallel running staking operations across chains. However, the Lido DAO lives exclusively on the Ethereum blockchain. This means all on chain governance takes place on Ethereum, including proposals regarding Solana and Terra. This is an interesting case study in which Lido is using the trusted security of the Ethereum chain to carry out governance decisions on other chains. Similar to the MNDE token, the LDO token is exclusively used for governance. It is distributed as follows:

There was recently a large unlock of LDO tokens on Dec. 17th, so we recommend you tread lightly before apeing in. This leads us to a more burning question...

Governance Tokens: Where’s the Value?

It is key to remember the value of governance tokens do not necessarily reflect the value of the protocol it governs. Unless the token is designed specifically to accrue value as the protocol increases in TVL, theoretically, governance tokens may only be worth something to those who want to participate in governance. Paradoxically, buying governance tokens is likely the best way to get exposure to the growth of the protocol.

If you are interested in a protocol and care about its future direction, then it makes sense to buy tokens in order to take part in governance decisions and not necessarily as an investment. One of the beauties of crypto is that we all have a voice and we can all make a change. The true value in governance tokens is the ability they grant you to join the protocol’s community and participate in its evolution. If you want to get involved with these protocols, consider joining their discord or telegram groups. Let your opinion be heard!

Conclusion

Liquid staking is an integral primitive in cryptocurrency that will continue to gain popularity. Liquid staking helps the security and liquidity of PoS networks while also benefitting users, giving them the ability to gain extra yield. If you plan on hodling PoS tokens, you might as well stake them to gain the inflationary rewards. If you know of any liquid staking protocols you trust (and hopefully after this you do), you might as well stake with them so you can have more freedom with your tokens! This is the type of symbiotic relationship between large protocols and users that we love to see in crypto. Lido is the clear leader in this sector across all chains, and Marinade is the clear leader on Solana. We recommend keeping an eye on both.

If you hold ETH, staking with Lido is likely a superior decision than staking directly with the ETH 2 smart contract. With ETH2 smart contract your funds will be locked up for, well, god knows how long. With Lido you have instant liquidity. If you hold SOL, we recommend Marinade as they have more DeFi integrations. The main concern is that if a liquid staking solution swallows majority of the stake, it can raise risks of centralizing the network. In a follow up piece, we will discuss the methods in which these protocols promote (or inhibit) decentralization. We’ll also share some info on where you can deploy your liquid staking tokens in DeFi for extra yield. Remember anon, Decentralization is our only way to prevent crypto from becoming a new version of the old system.

Until next time Frens!

Sincerely,

Maven

@KingMaven_ on Twitter