Intro

As discussed in DeFi Derivatives So Far (if you haven’t read it, be sure to – it gives a great recap on the whole DeFi derivatives series), we are taking an innovative top-down approach, looking into key sectors that will define the crypto markets going forward.TL:DR

- DeFi & derivatives course coming to CPro soon

- Friktion volt 5 details – exclusive to Lightning OG holders

- GMX changing the AMM game

- Premia progress

DeFi & Derivatives Course – Cryptonary X Friktion

This sector has some of the biggest potential gains. Currently, there is a knowledge gap, and we consider it our mission to bridge that. That’s why, working with Friktion, we filmed a course on DeFi & derivatives.In the fun and engaging 6 lesson course we cover:

- What is a derivative,

- Why are they popular and how are they used,

- Common types of derivatives,

- Crypto and DeFi native innovations - such as DeFi Options Vaults, automated market makers and perpetual futures,

- CeFi vs DeFi,

- DeFi’s innovations and power,

- DeFi as a force for good,

- Risks to DeFi and derivatives,

- Going deeper into Options, DOVs and futures protocols, and the trade-offs they make.

Extremely excited for this to launch, and we know you’ll love it – watch this space!

What’s New with DeFi Derivatives?

Following on from the course, let’s have a look at what’s going on over at Friktion…Friktion

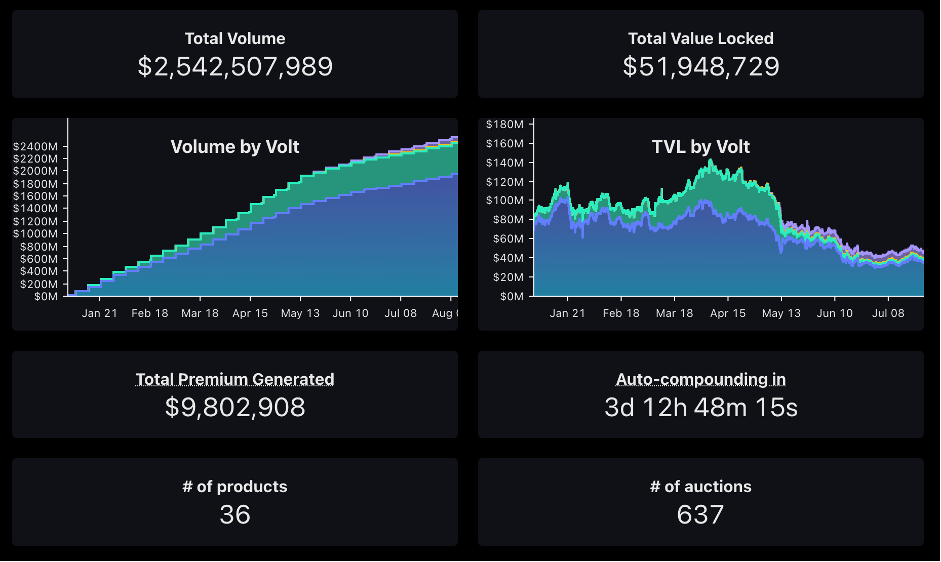

Friktion has been growing nicely, with new vaults and assets, fast shipping of products, and a great team behind it.At the time of writing our deep dive (early May 2022), there was around $1.7bn total volume, this has grown to over $2.5bn.

Total premiums were $7.2m, now $9.8m.

TVL has fallen from just over $110m to $50m, but with the current bear market and lower prices of assets deposited into Friktion, this is no cause for concern.

Volt 5

Friktion recently announced their next Volt, exclusive for Lightning OG NFT holders.For more information on the Friktion Lightning OG NFTs, read our deep dive (feel free to skip to the Lightning OG part, near the end).

The Volt is designed to keep your initial investment safe, whilst investing the interest payments into instruments such as call/put options that earn during sharp market moves.

Users can deposit SOL or USDC into the Volt, which will lend out the deposits using Tulip, then systematically allocate the interest payments into a basket of put/call options.

Portfolio Manager

We mention in the deep dive that Friktion is introducing a portfolio tracking system soon. Well, soon is now.Portfolio manager is the name, and it’s live. As you can see from the image below, it shows your portfolio value, return on investment (over its entire history), and weekly return, as well as some great visual graphs demonstrating the info. See this article for full details.

In their own words, “As DeFi ecosystems evolve across multiple Layer 1 blockchains, Friktion aims to enable users of any chain to access their risk-adjusted yield generation strategies”.

To support this mission, on 1st June, Friktion enabled cross-chain deposits from Ethereum and Avalanche, powered by Portal Bridge (by Wormhole).

This is the 1st step of many to the cross-chain future Friktion are aiming for.

GMX

GMX x Arbitrum Odyssey

See what the Arbitrum Odyssey is, and why it’s a potential goldmine, here.Essentially, it’s a series of tasks, and after you complete each, you’re rewarded with an NFT. We, along with many others, believe this will be a deciding factor in the rumoured Arbitrum airdrop.

After another protocol dropped out, GMX is now a feature in the Arbitrum Odyssey, meaning one of the tasks will be trading on the platform.

The Odyssey has been paused until Arbitrum Nitro is live, as the excessive load on the network was causing inflated gas prices, and it wasn’t showing the network in a positive light.

This is set for the end of August, and we expect the Odyssey to resume early September.

X4

X4 is the newest update to GMX, involving a new AMM (automated market maker) that gives pool creators and projects full control over the functions of their pool. This innovative approach is something we haven’t seen before.Usually, when a pool is created, the creator has limited control over its functions. X4 will create an AMM that allows custom behaviours, such as setting fees to any percentage, easy changing of fees, and different fees for different actions (such as buying or selling). Projects can pay LPs in a single token, rather than the standard mix of tokens. Check out this article for full details.

A hugely interesting concept, and one we’ll update on once it is out in the wild.

For the time being, this has been put on the back shelf, with GMX focusing on Synthetics…

Synthetics

GMX plan on using synthetic assets alongside the PvP (person v person) market-making model created by X4. This allows any asset with a Chainlink price feed to be traded, including real-world assets such as oil, gold, currencies, stocks and anything else.Essentially, the PvP AMM would allow anyone to create a market on GMX, and the synthetic assets allow markets for anything with Chainlink price feed.

GMX Cash Runway

In the GMX deep dive, we mention the fears around GMX’s cash runway – the team have taken notice of these rumours, and answered with the below:“Since there have been some questions on the long-term sustainability of the project we feel it is appropriate to address them here. The team currently has ~1.8 million held in USDC, this is sufficient to last 18 months till March 2024. Within 2022 we aim to continue growing trading volumes, and with the PvP model we may propose directing a percentage of fees to a treasury.

For example, if the PvP AMM is launched in about three months, the product can be left to run for a while and 10% of fees can be directed to a treasury at the start of 2023.”

Premia

Premia have recently launched on Optimism, adding to their arsenal of blockchains. They’re now live on Ethereum, Optimism, Arbitrum and Fantom.Premia DOV Funding

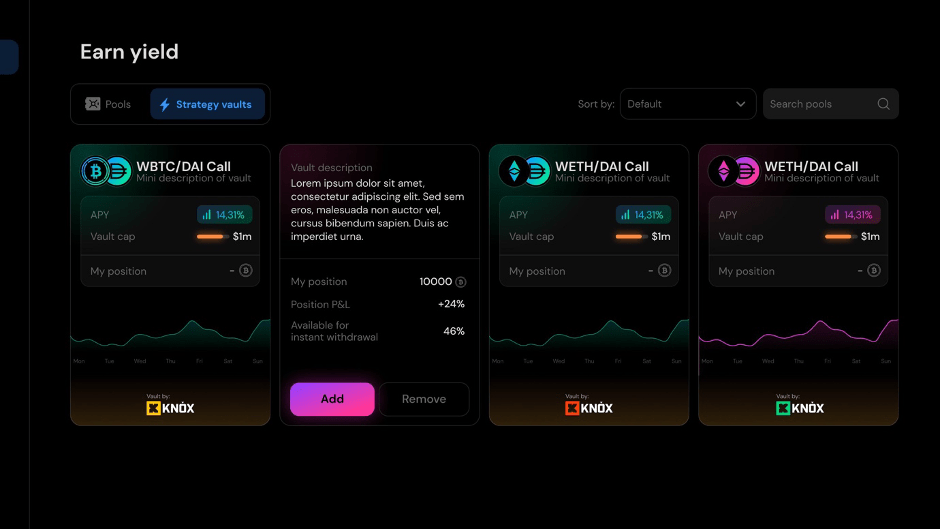

Premia funded 2 proposals for around $250k each, to build out DOVs that will directly integrate.Fort Knox is coming along nicely, we have seen the mock-up of their vaults which will be on Premia.

The Knox team told me they’re doing internal audits and integrations in preparation for an audit by veSoon.

Vaults.Pro progress is slower, with little publicly released. However, having spoken to the team, there seems to be a lot cooking up behind the scenes. We will check back in when more information becomes available.

V3

Premia held a community call on 17th June which had some interesting information on V3 – check it out here.The release has taken longer than anticipated, there has been some unforeseen issues, and it seems the team are building out a new model of V3, looking at delta-hedging, position builders, Premia native vaults as well as DOVs live, and more.

Full details of V3 in its new form will be released in the next few months. I'm told this will be in the form of a 6 part document series. When it comes out, we will post an update on its contents.

vePREMIA

Full details for vePREMIA have recently been released. It replaces the old staking model (xPREMIA), and means holders can now stake their PREMIA tokens and earn platform rewards on any chain (previously, only available on Ethereum mainnet).vePREMIA is used in governance voting, and, as with all ve-tokenomic models, the longer you lock the tokens for, the more rewards and voting power you receive. For full details, check out this article.

Dopex

Most importantly, Dopex has not yet launched its stablecoin.I highlighted many potential issues with the DPXUSD stablecoin in the deep dive, which was followed shortly after by the LUNA/UST collapse.

It’s good to see Dopex haven’t blindly launched their stablecoin. Hopefully, they’re either reworking a much more sustainable model, or even better, they have scrapped the idea altogether.

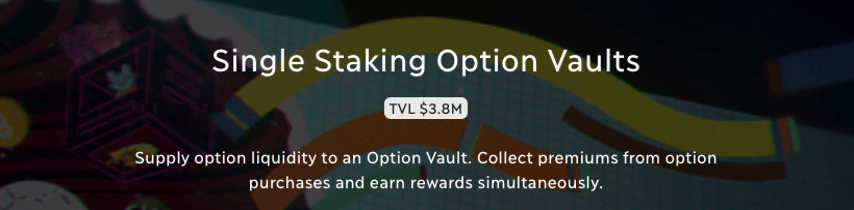

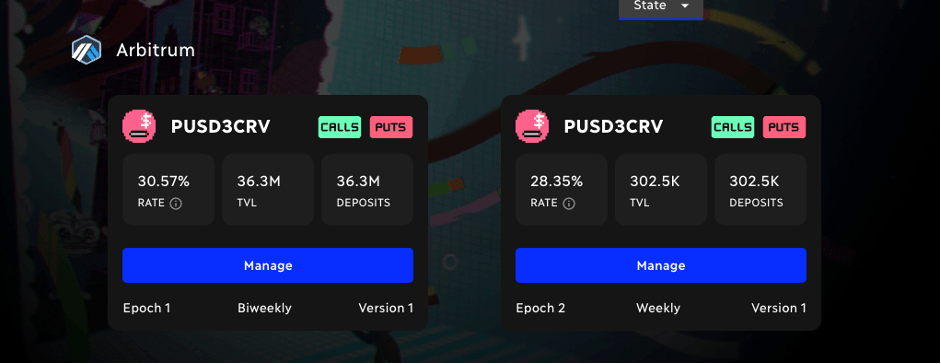

We mentioned in the deep dive potential liquidity issues. Initially, they bootstrapped the liquidity for their SSOV (option vault) pools, but weren’t able to utilise it, with around $60m of $63m DPX sitting idle in the pools.

Now, TVL is down from around $100m to $3.8m at the time of writing. The bear market can of course be blamed for some of this, but in comparison to Friktion, this drop is gigantic.

veDPX

veDPX is live, working in much the same way as other ve-tokenomic models. The longer you lock your DPX up for, the more veDPX you receive, which benefits from shared fees and governance rights. Great to see Dopex sharing fees with token holders, something new since we published our deep dive.At the time of writing (20/07/22), around 23% of the circulating DPX supply had been vote-locked for an average of 3.51 years. This works out at around 9.2% of the maximum supply. That’s an impressive number, and certainly good for DPX price action.

Interest Rate Vaults

Interest rate vaults are now live and have attracted considerable TVL (around $38m in the latest vault, although Dopex offers no analytics). Perhaps the reason we’re seeing so little liquidity in the SSOVs is that Dopex and their insiders have moved their liquidity out of the options vaults, and into the interest rate vaults (this is speculation, but would make sense).

Interest rate options for Curve pools certainly have a lot of potential, and we expect that interest rate options and swaps will be a big part of DeFi in the future. However, whilst interest rate derivatives themselves are vital tooling for financial infrastructure, Dopex’s ability to deliver this is certainly not guaranteed, and their future plans are very unclear, making them a risky protocol to be involved with.

We will be keeping an eye on how this product develops, and whether it could improve Dopex’s offering and make the protocol interesting, but as it stands, with all the information discussed in the deep dive, I will remain way away until I see meaningful and sustainable developments and growth.

Conclusion

Fear not, this isn't the last you will hear about DeFi derivatives from us. It marks the end of our derivatives series for the time being. However, when any sufficiently interesting protocol, concept or narrative comes along, you can be sure we'll be writing about it.Our finger will still firmly be on the pulse of DeFi derivatives and the protocols we have covered.

Oh, and you can expect a quarterly update report.