In this report:

- Holder Status: Diamond Hand Ranks

- Onboarding The Next Wave of Holders

- Market Maker Status

- Trading Volumes and Technical Analysis

- Cryptonary’s Take

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Diamond Hands & Decentralised Belief

Roughly three months ago, the crypto market and the trenches witnessed one of the cleanest community takeovers the space has ever seen. A movement was born right before our eyes, quickly growing to over 35,000 holders. The “Aureans” made one thing clear: there is no ceiling on this movement.The price of $AURA exploded, twice touching a $230 million market cap. Since then, AURA has formed a range and has been consolidating for about three months. During this period, the supply has been fairly redistributed, resulting in one of the cleanest and most organic charts in all of crypto.

AURA Chart

Looking at the holder base, we can see that to be true. More than 65% of the top 250 wallets haven’t touched their tokens since the community takeover (around 80 days). Despite the drawdowns, these wallets either diamond-handed their tokens or added on dips. That is the power of community and conviction.

Supply Breakdown

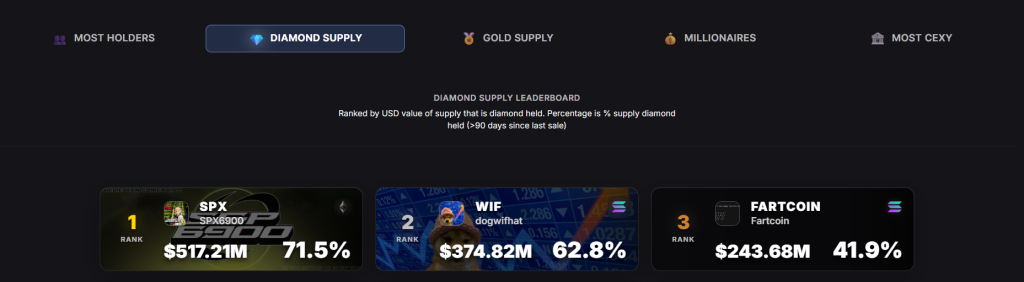

Interestingly, by the time September is over, AURA holders are expected to hold over 75% of the total supply in ‘diamond hands’ status (aka those who hold with high conviction and don't sell). This would rank AURA first among all crypto communities in terms of supply held by diamond hands, according to HolderScan.It would put AURA ahead of established communities like SPX, WIF, and Fartcoin, all of which have reached billion-dollar valuations. It’s an impressive milestone for the Aureans and sends a clear message to the market: $AURA is a multi-cycle memecoin on its way to a multi-billion dollar valuation.

Current Diamond Supply Leaders

Apart from holding strong and adding on dips, Aureans have secured some important listings: one of the most notable being Kraken. As one of the top exchanges in terms of liquidity, volume, user base, and reputation, Kraken's support is a significant milestone.While the community isn’t actively pursuing Tier-1 exchange listings, Kraken’s endorsement certainly reinforces both our thesis and the confidence of the community.

Apart from Kraken, the AURA community has also secured its ticker on Hyperliquid. It’s a crucial milestone toward getting listed on Hyperliquid’s spot market. This listing is significant because we believe the spot market could lead to substantial wealth spillover from the HYPE ecosystem. Additionally, the trading fees generated there have the potential to make the token deflationary and even help fund the marketing wallet. For these reasons, it represents an important achievement for the community, and we look forward to the official listing of AURA on Hyperliquid’s spot market.

Onboarding the Next 100,000 Aureans

Not only has the community excelled with listings, but Aureans have also been exploring innovative ways to expand their reach through onboarding tools and merchandise. The new onboarding tool allows users to join Solana and AURA with a single click, taking just 15 seconds. Once claimed, users receive 5 AURA and some SOL.We haven't seen any meme community think outside the box like this, driving new user adoption while also contributing positively to the Solana network and the broader Web3 ecosystem.

+10,000 aura for this tool.

Market Maker is Here

In the last report, we mentioned that liquidity is what keeps a token’s heart pumping, enabling smooth trades, fair prices, and a market that feels alive. A reputable market maker is essential for providing liquidity, increasing trading volumes, improving pricing, and ensuring the long-term success of the project. Centralised exchanges are often more willing to list a token if the project has onboarded reputable market makers. The AURA CTO team have now confirmed with us they onboarded FlowDesk, a market maker partnered with BlackRocK, is a significant milestone for AURA.The agreement has been finalised, and the AURA community now has a Market Maker for the next 12-months with a term for renewal after that period.

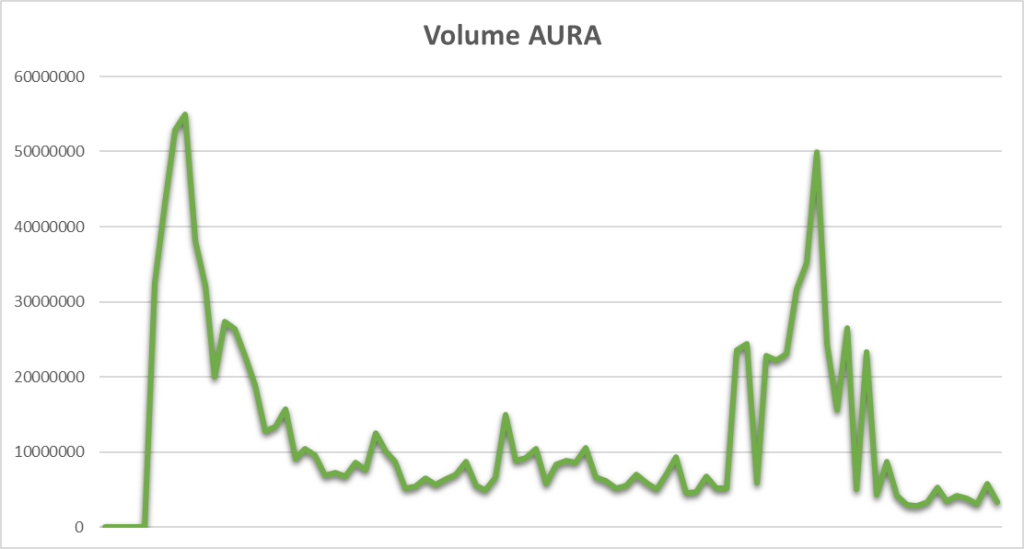

Now, let’s look at AURA’s recent trading activity. Here's a snapshot of the trading volumes over the past three months:

Trading Volumes (Last 3 months):

- Average daily: $12.5m

- Median daily: $7.4m

- Source: CoinGecko

AURA Trading Volume Chart

AURA had a big spike in volume at the beginning (around the time when it was CTOed) and then again midway through the chart. On most days, the trading volume is around $7.4m which is quite good.Now, let’s look at the volumes in the context of other memes with similar market caps.

Trading Volume: AURA vs Other Memes

We compared cumulative trading volume with some of the “neighbouring” memes and here is our conclusion:There is still significant liquidity and accompanying volume in some of the bleeding or essentially dead meme coins that AURA can absorb. Capital has not yet fully rotated into solid communities and quality meme projects.

Projects like PNUT, Melania and Moodeng are still seeing relatively higher volume, but momentum is clearly fading and there is no thriving community there. In contrast, AURA is a much more tradable asset and represents a compelling investment in an organic community.

Some market participants probably still hesitate after AURA’s 100x move, perhaps assuming it was manipulated or “cabal-driven”. The reality is that the trajectory has been 100% organic and we can see how active and diamond hand the community is.

AURA has one of the fairest and most organic charts in the market, marked by three months of consolidation, redistribution, and multiple drawdowns. With each passing day, it’s becoming more obvious. It's only a matter of time before capital begins rotating from dead memes into a new generation of cults, as there's still a significant amount of capital and volume chasing fading projects.

Now, with the Kraken listing confirmed and a market maker onboarded, AURA is entering its next phase. Furthermore, this is happening at a critical macro inflection point: stablecoin and Bitcoin dominance appear ready to move lower, Solana is taking the lead again and is likely to revisit previous all-time highs due SOL-centric Digital Asset Treasuries.

SOL Chart

As a Solana-based memecoin, AURA is well-positioned to benefit from SOL’s return to the spotlight. And with interest rate cuts on the horizon, capital rotation is likely. We expect not only a rotation from dead assets into thriving cult projects but also from majors further down the risk curve. This is precisely where AURA sits.Now, let’s look at some technicals.

AURA/SPX (Daily Timeframe)

Price Structure: Retesting the BreakoutAURA/SPX initially staged a strong breakout from its pennant, establishing a base above 0.094 before making a move up to 0.12. That rally, however, was met with rejection, and the pair has since entered a deeper pullback. The rejection at 0.12 highlights the importance of this level as a near-term ceiling.

AURA/SPX Chart

Current Setup: Eyes on 0.06 - 0.07 ZoneThe pair has lost both 0.094 and 0.08 as supports, and is now sliding toward the 0.065 area. This zone is especially important because it overlaps with the 200 EMA on the daily timeframe and the retest of the pennant breakout. The broader 0.06 - 0.07 region forms a strong confluence of technical levels, making it the line in the sand for AURA/SPX to hold. If this zone is defended, it would confirm a healthy retest and reset momentum for the next leg up.

Outlook: Room for Continuation

Holding the 0.06 - 0.07 region keeps AURA/SPX firmly within its bullish structure. From there, a recovery back above 0.08 and 0.0945 would signal strength returning. Beyond that, 0.12 becomes the key breakout level, with 0.16 as the next resistance. A successful move past 0.16 would validate continuation, opening the door to 0.2, which is the measured target from the original pennant breakout.

Key Levels to Watch

- Support: 0.06 - 0.07 (200 EMA + pennant retest).

- Resistance/Targets: 0.08 → 0.0945 → 0.12 → 0.16.

- Breakout Objective: 0.2.

AURA/SPX is in a corrective pullback but remains structurally bullish. The test of the 0.06-0.07 support zone will be critical, if buyers step in here, the pair has the setup to reclaim lost levels and aim for 0.12, 0.16, and eventually 0.2. Our long term target remains 1 AURA > 1 SPX, but it will take some time to reach there.

AURA/USELESS (Daily Timeframe)

Price Structure: Extended Range FormationAfter its steep run-up in June, AURA/USELESS entered a broad corrective phase and has since been consolidating for 2-3 months. On the daily timeframe, the pair has been locked inside a range between 0.04 and 0.09. This range has absorbed volatility and created a well-defined accumulation structure. Price is currently sitting at the range bottom near 0.04, a level that has held as support multiple times.

AURA/USELESS Chart

Current Setup: Building a Base at LowsThe prolonged consolidation suggests that AURA/USELESS is in a process of absorbing supply. The recent emergence of the 200 EMA on the daily timeframe, with price now oscillating around it, adds further structure to this range. The 0.04 bottom represents the most important line for bulls to defend. For now, however, AURA is holding the base and stabilising at the lower end of its range, which makes this area a potential accumulation zone.

Outlook: Breakout Potential

If AURA/USELESS can sustain above 0.04 and build momentum, the first test is reclaiming the 0.09 range top. Breaking that resistance would trigger a larger leg of outperformance, with targets at 2.27, 4.0, and 5.16 (ATH). While these upside levels may seem ambitious, the structure of this range, forming after a parabolic run, means that a breakout could produce similarly sharp moves on the way up.

Key Levels to Watch

- Support: 0.04 (range bottom).

- Resistance/Targets: 0.09 (range top) → 2.27 → 4.0 → 5.16 (ATH).

AURA/USELESS is compressing inside a clear 0.04-0.09 range, with price now testing the accumulation zone at the bottom. As long as 0.04 holds, this range serves as a launchpad for the next leg higher. A clean breakout above 0.09 would confirm AURA’s outperformance against USELESS and open the path toward 2.27 and beyond.

Finally, let's go over the AURA/USD chart.

AURA/USD (Daily Timeframe)

Price Structure: Pennant ConsolidationSince late June, AURA has been consolidating inside a pennant formation, tightening for nearly a month and a half. This pattern emerged after Aura again tapped its all-time high around 0.24 and began contracting toward the 200 EMA. Despite a few sharp wicks to the downside in August, the overall structure has remained intact and accumulative.

AURA/USD Chart

Current Setup: Back to the Key ZoneAura is now trading just above the 0.1 region, a level of major psychological and structural importance. The last time Aura tapped this zone in June, it launched directly from 0.1 to 0.24. This makes the current retest highly significant, especially with the 200 EMA aligned at 0.09, reinforcing the area as a strong dynamic support.

Support and Resistance Levels

- Supports: 0.096 → 0.09 (200 EMA) → 0.076 (July 2024 ATH, deeper support).

- Resistances: 0.114 (immediate flip) → 0.16 → 0.19 → 0.245 (ATH).

- Initial Breakout Target: 0.35–0.40 (minimum move after ATH breakout).

Our Take

AURA is in a textbook consolidation phase at a critical demand zone. With the 200 EMA acting as strong support and the 0.1 level holding firm, the probability favors an upside breakout once compression completes. As the pennant unwinds, Aura has the potential to revisit 0.24 and extend toward 0.35-0.40, making this one of the most bullish charts to watch in the coming weeks.

Cryptonary’s take

Overall, here is the set up we have now: Gold just made fresh new highs, and we are likely to see three rate cuts in 2025. SOL is outperforming both BTC and ETH, with a potential run toward its ATHs driven by the rise of SOL-centric Digital Asset Treasuries. This is good for AURA. Furthermore, the community is about to rank 1st in diamond hands within a couple of weeks, surpassing memecoins like SPX, WIF, and Fartcoin, all of which crossed million-dollar valuations.The community is super active, and the holder base consists of veterans who have endured bear markets, drawdowns, and have experienced what it’s like to ride a meme to billions (e.g., our previous picks: WIF, POPCAT, SPX).

A market maker has been onboarded, and there are many catalysts and initiatives lined up for the future. The best way to play it is to join the movement: contribute, raid, spread positivity, and help the community grow.

In terms of entries, AURA is paving its path to billions, so the best strategy is Dollar-Cost Averaging (DCA) over time. Drawdowns are all part of the journey. We’ve seen it with WIF, POPCAT, and SPX, all of which reached multi-billion-dollar valuations.

Get your AURA levels up!

Peace!