And this makes sense—why would you not want to participate in memes with 100x potential?

But for those with a risk-averse appetite, we've got you covered.

LPDfi offers a relatively new sector (we covered it briefly last year here) that may not be used by the layperson, but we are confident that it will be integral to the future of DeFi.

DEXs, lending protocols, LSD-Fi, and anything with a liquidity pool or TVL, will benefit from at least one of the services LPDfi offers.

So, without further adieu, let's dive in!

TLDR

- In a market where most of the attention is on meme coins, we dive into the fundamentally sound yet overlooked LPDfi sector.

- The projects in this sector enable the tokenisation of liquidity positions for extra yield.

- We kick things off with one LPDfi protocol tapping into the Wormhole and Pyth infrastructure across multiple chains—a potential airdrop is on the horizon.

- Then, we analyse a cross-chain credit market bridging USDC liquidity and yield opportunities. While the TVL is currently underwhelming, a potential 10x awaits its token.

- The star of the show combines the powers of LPDfi and liquid staking with a unique token for a massive $37M TVL. We see a 40x potential here.

- Despite the promising LPDfi concept, execution has been lacking so far due to the lack of DeFi interest. But don't count it out - this sector is primed to thrive when DeFi volumes pick up.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

LPDfi recap

LPDfi (Liquidity Providing Derivatives) is a new sector that provides liquidity across chains and protocols. Like LSD-Fi, LPDfi allows liquidity providers (users depositing into DEXs and lending protocols) to tokenise their positions and trade those on the market.Of course, like LSD-Fi, this opens up the possibility of additional yield for those LP positions over and above any yield accrued by the LP position.

The LPDfi protocols themselves extract fees for the management of these positions.

In essence, everyone wins. Users of these protocols have access to yield previously unavailable, liquidity-based protocols like DEXs, etc., gain access to liquidity they previously couldn't, and the LPDfi protocols make bank while doing it.

This all kicked off with Logarithm Finance's launch in July 2023. Using the LSD-Fi model, Logarithm created something new and generated interest (and free marketing) due to the similarities between the concepts of LPDfi and LSD-Fi.

Unfortunately, Logarithm is still in beta mode, so they don't have a product yet.

We'll never know why they launched the whitepaper without a solid roadmap—they spilled some serious alpha to the rest of the market and didn't capitalise on it quickly enough.

Obviously, the rest of the market lapped it right up…

Let's dive into some of the protocols that have actually been launched.

Pike Finance - Airdrop potential

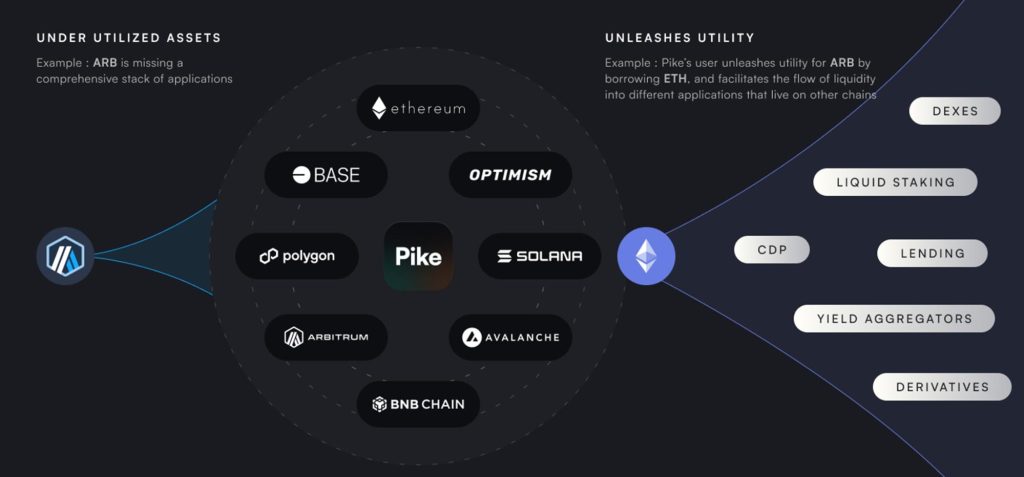

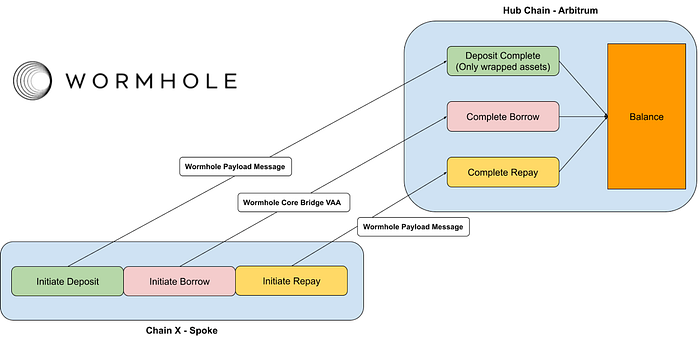

Pike is another recently launched LPDfi protocol that leverages the Wormhole infrastructure and Pyth's price oracles. This project is shooting much higher than Synonym or even Logarithm. Currently supported chains are Ethereum, Arbitrum, Optimism, and Base.Pike differs from Synonym because it caters to a wider variety of potential users - their goalposts are wider.

By funnelling liquidity into relatively underdeveloped chains (like Arbitrum), Pike and other LSD-Fi protocols can spread liquidity and reduce the demand on all chains by distributing supply more evenly.

For example, Ethereum has the most liquidity of all ecosystems. But it doesn't have to be that way.

TradFi sends liquidity to where it is needed - they have central banks for that, trade agreements, and so on. However, the case for crypto is that generally, once liquidity is locked in a chain, it's there for good.

Fortunately for the airdrop hunters, Pike does not yet have a token.

You know what that means—get some volume in; you never know what could happen down the line. And especially because Pike is accessible through Arbitrum, you can transact with cheap gas, so there are no excuses for not positioning for a possible airdrop here.

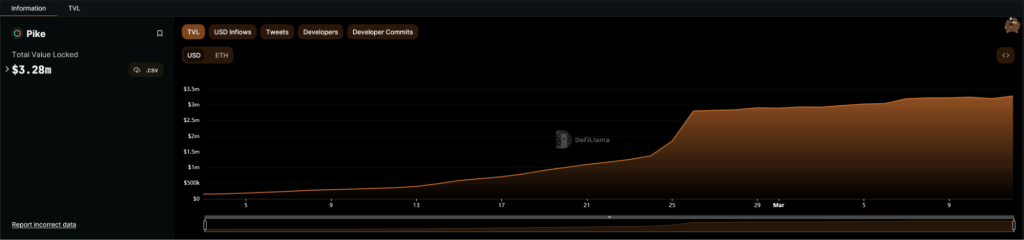

In terms of TVL, attention is not on DeFi at the moment.

We would expect these numbers to pick up as we head deeper into the bull market.

Synonym (SYNO) - 10x potential

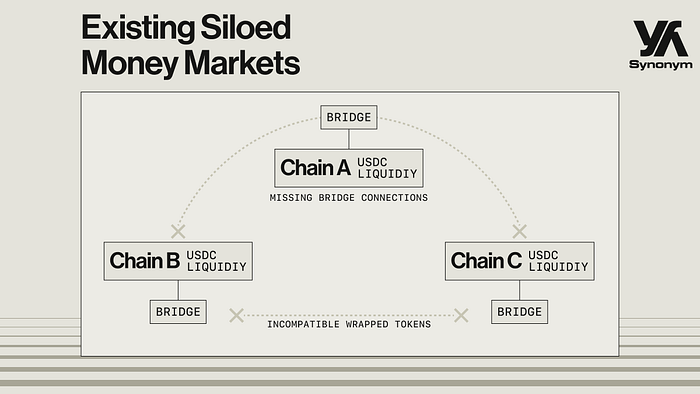

Synonym Finance is a "cross-chain credit market" leveraging the Wormhole infrastructure to facilitate money markets across Ethereum, Arbitrum, and Optimism.The project is on our radar because the New World Order DAO (NEWO) team is behind it.

The Synonym value proposition comes from its ability to bridge USDC liquidity, yield opportunities, and other active farming opportunities between chains.

The whole idea is that you can open an LP, lend, or borrow position across any of Synonym's supported chains (Ethereum, Arbitrum, Optimisim), and that position is just as valid on any of those chains as it is on any of the others.

Sounds complicated?

Here's an example:

- A Neanderthal apes an LP position with UNISwap on Ethereum and gets an LP token in return.

- The same Neanderthal decides, "Fk this; gas fees are too high, and I want to degen on Arbitrum."

- The Neanderthal could close his LP position normally or transfer it to Arbitrum and take a loan against that position (subject to liquidation, etc.)

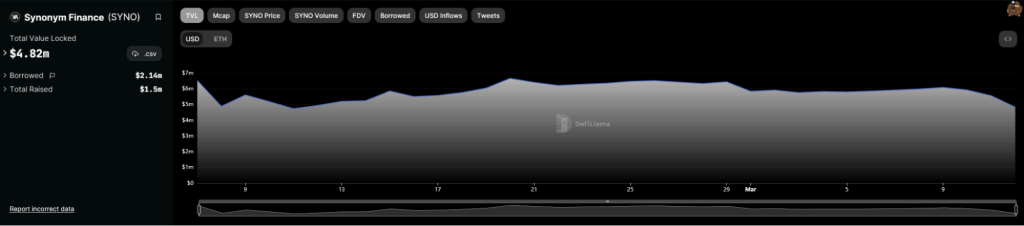

However, the metrics paint a bleak image.

Synonym launched at the beginning of February.

Now, the TVL figures look underwhelming, to say the least. $4.82 million is a drop in the bucket compared to the total DeFi TVL, sitting at $178 billion. And it's stayed around those levels for the last few weeks.

Still, we'll give a valuation.

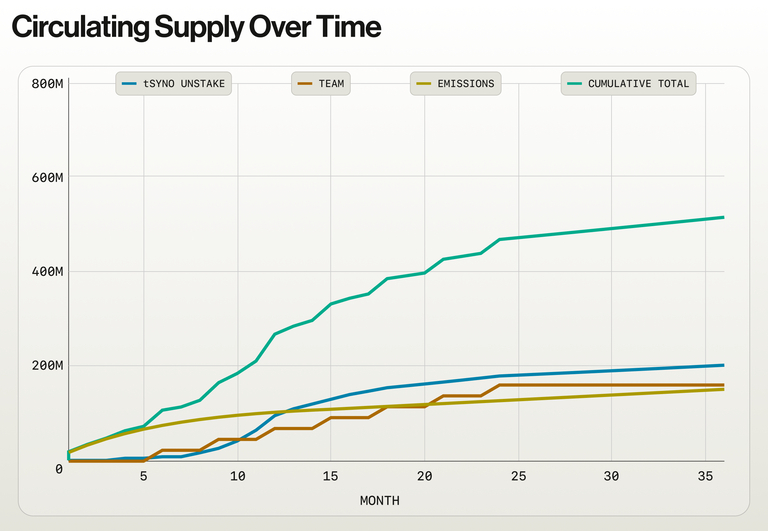

SYNO token

- Mcap: $1.5 million

- FDV: $34 million

- Circulating supply: 35.3 million

- Max supply: 800 million

Now, this looks a bit more reasonable. But we're still faced with 200%+ inflation within the next year.

Given the metrics and the fact that the whole sector is fairly underpriced, our valuation for SYNO would be a simple 10x from here.

This translates to a market cap of $15 million and a token price of $0.45.

Considering the space is extremely underdeveloped and TVL metrics are underwhelming, we don't expect huge things in the immediate future.

Consider this target conservative, though, and we'll likely revisit it once attention is back on DeFi.

Vector Reserve - 40x potential

Vector Reserve is another new player on the scene.Remember, we're working with a (relatively) new sector —Vector is arguably the "big boy" of the LPDfi sector, boasting a $37 million TVL.

This is significant - more than 20 times bigger than its competitors.

Why?

Their "Superfluid" staking mechanism allows users to stake their LP tokens rather than the ETH or Liquid Staking Tokens (like stETH). They do this through their vETH LPD token, which is backed by ETH liquidity positions across all supported chains.

Although impressive TVL numbers have yet to be printed, Vector is on to a winner with this model. They are capitalising on the best of both worlds—the demand for liquidity (LPDfi ) and the demand for liquid staking (LSD-Fi).

vETH accomplishes both, and if we were to pick a winner (albeit early in the sector's growth), it would be Vector.

VEC token

VEC is the governance token, operating like any other governance token, complete with sVEC (like vTHOR).Here are some statistics:

- Market cap: $26.5 million

- FDV: $213 million

Nevertheless, Vector is the clear (current) winner within the LPDfi sector.

In terms of valuation, owing to the utility and use case of vETH and in line with our anticipation of a 15-20% market share, we expect VEC to achieve a $1 billion market cap this cycle.

At the current circulating supply, this places VEC at a price of ~$853 (owing to the fact only 1.25 million VEC are circulating).

In total, this offers the potential for a ~40x return.

Cryptonary's take

Although the concept of LPDfi is excellent, the execution to date has been lacking.There simply is no interest or activity within DeFi that matches the type of rallies we have seen in other sectors—again, mainly in memecoins.

However, it's not all doom and gloom.

We're confident that DeFi will have its day, and LPDfi is well-positioned to benefit massively from higher volumes across all sectors of DeFi.

Deep liquidity is absolutely essential for DeFi to thrive - any sector that enhances the capabilities of the current DeFi landscape can only be on to a winning formula.

For now, the attention is on memecoins and AI coins. However, if you are willing to play the long game and not feel left out by the performance of other market segments, you'll get your chance at those Xs with LPDfi.

We will monitor this sector and return with updates once DeFi is back in the limelight.

Who knows, we may yet get a DeFi summer of 2024.

Watch this space.

Cryptonary, OUT!