One minute you're planning a trip to the Bahamas, the next, you're signing up for a Tesco Clubcard.

To close the year, there are 3 questions on everyone’s mind:

- Has the market bottomed?

- When will the bull market return?

- Should you be buying?

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

1\ Federal Reserve (FED) must tackle inflation

Most countries are in inflation-fighting mode. They’re hiking interest rates and tightening monetary policy. It's as if they’re trying to engineer a recession to kill inflation (hint: they are).The FED must change its stance for a bull market to happen.

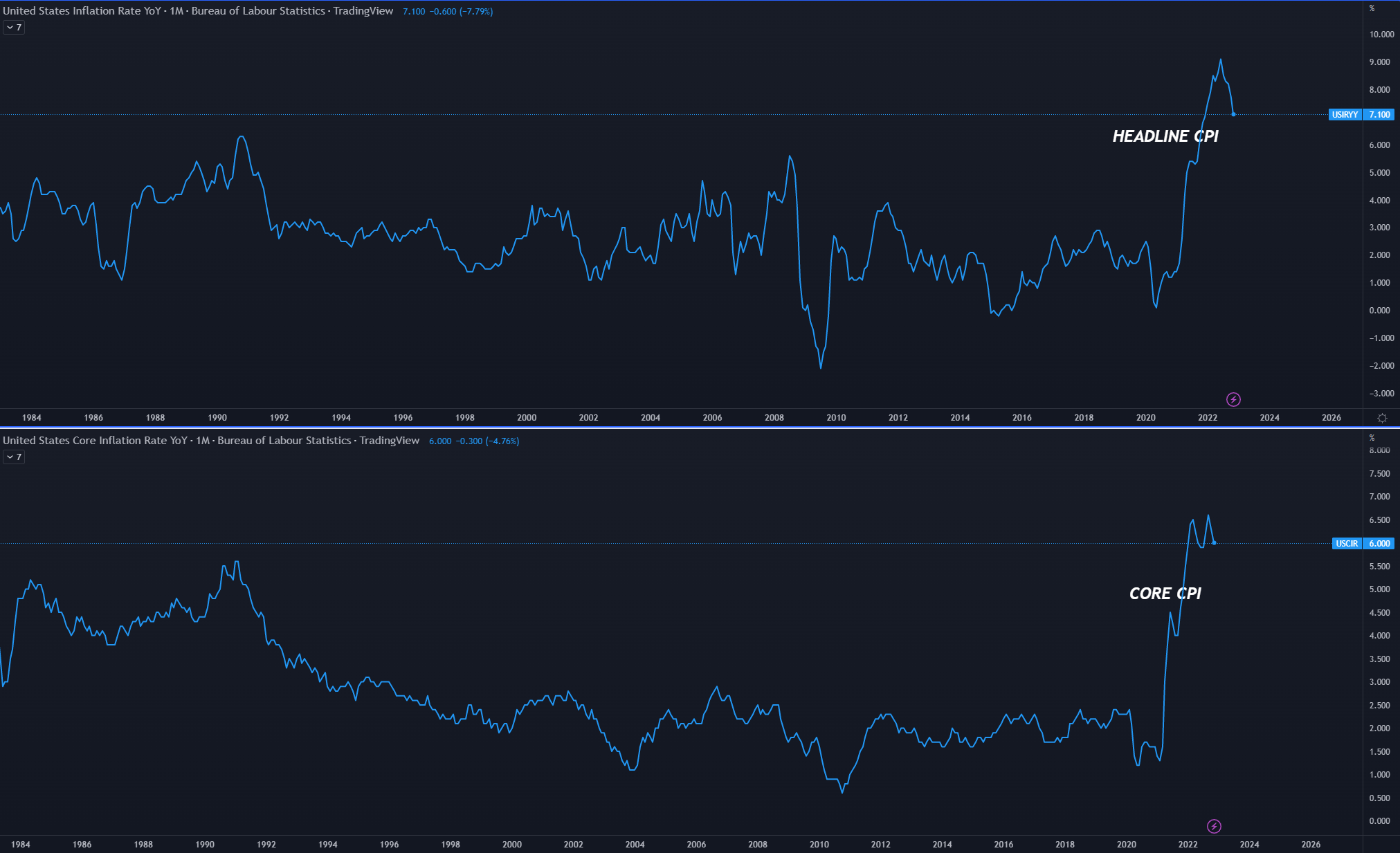

Thankfully, CPI (a measure of inflation) is down from 9.1% to 7.1% as of December 2022, and the drop is only speeding up. In our opinion, inflation has peaked, and if this is true, it signals a local bottom at the very least.

2/ We need a weaker jobs market

Thanks to “His Excellency, President Biden,” the US jobs market is holding strong. This means there’s competition for employees, which in turn means wages are up. This is counter-productive for the FED trying to fight inflation. The FED must kill job demand to get this under control.The FED is pushing for unemployment above 4.5%, it's currently around 3.7%. Only a few million more jobs to be lost then...

3/ The FED must stop hiking interest rates

The FED has stated they will stay the course with rate hikes for at least the next year. History has shown that whenever the FED hikes rates, something breaks. What will break? No-one knows. When it does, you can be sure the FED will have to backtrack.4/ Economic data: worse is better

The FED is likely eyeing two more 25 basis point rate hikes. One at the start of February and one at the end of March. The economic data they’ll be eyeing to make their decisions are CPI, Unemployment Rate and Housing Valuations. The worse the data, the more likely they are to change things up.So what signs should you look for?

- Consistent sub 0.3% month-on-month CPI prints over the next 3 months (prints here).

- US unemployment – the higher it goes, the higher chance of a pivot (found here).

- Changes in housing market valuations. Look for rent prices to trend downwards (found here).

5/ Bad equals good with market sentiment

Have you ever seen market sentiment this bad? With the collapse of FTX, this has to be one of the most depressing times to be in the market.Unless something catastrophic happens, things won’t get much worse. When sentiment is this low, it usually means the bottom is in. No one wants to sell at the bottom, right?

6/ What are the whales doing?

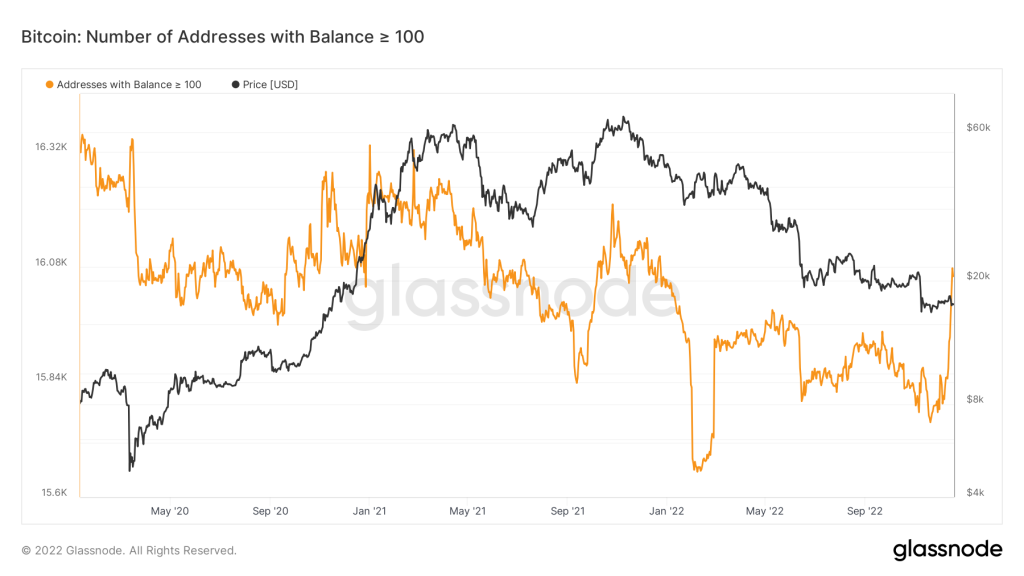

Our team did a deep dive into what the big BTC holders are up to. The number of BTC addresses that hold 100+ BTC is rising sharply. This means the whales are stocking up, not selling.Heck, if the big boys are buying, why shouldn’t we?

Also, if they’re stocking up, this means less BTC on the market, which means a decrease in supply. As we know, when supply goes down, prices go up.

7/ Bitcoin miners are making money

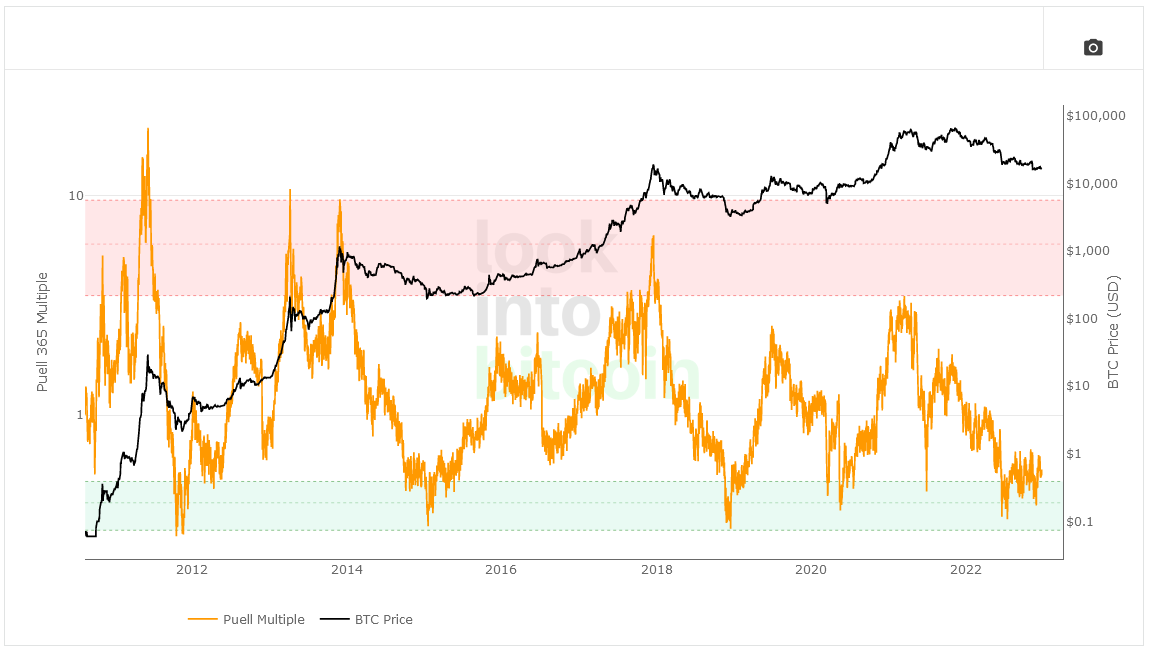

Keep an eye on the Puelle Multiple (PM). It's basically a formula that examines mining profitability.Miners make the world go around in crypto, so when they’re happy, we’re happy!

Usually, miner revenue is lower than normal when the PM is in the green area. This suggests a historically profitable area for those purchasing BTC. The PM has been in the green area since June 2022.

This is more confirmation that the bottom is in and sentiment is ready to shift.

8/ History doesn't repeat itself, but it sure does rhyme

The total crypto market cap is at a previous bull market high. In the past, this has signalled the bottom for many crypto bears.Now, just because it happened in the past, it doesn't mean it's going to happen in the future. However, this does strengthen the case…

Cryptonary’s Take

So, let's get back to answering your questions!Has the market bottomed?

My friends! We’ve gone over 8 metrics to see where we stand in the market cycle. Is the bottom in? We believe so. If not, it's damn close.

When will the bull market return?

This is one hell of a time to get into the market. We may not know exactly when the bull market is coming back, but it will. In the meantime it’s key you position yourself to best take advantage of the opportunities in front of you. Remember, bull markets may make you rich but it’s the bear markets that make you wealthy.

Should you be buying?

How is your risk appetite? The big risks on the table are macro ones. A major global recession would probably set things back quite a bit. We at Cryptonary are here for the long run, so despite the awareness that the market may drop another 10-20%, we will be actively investing every month.

Keep an eye on this report for further updates, save it to your favourites and join our Discord for more details.

Thanks for reading!