Over 1,000 days of bear market and 980 days of sub-$1 prices, BTC is nearing all-time highs with strengths, ETH is crossing important psychological marks and DeFi is booming, what about my XRP bag? When will it pump? Is the downtrend finally ending?

First and foremost let’s start with a very important point:

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

Price Action

XRP moves differently than the rest of the market, it does not have “slow” moves, everything is accelerated. The 2017 boom cycle, the final major run, took 56 days for Ether, XRP did the whole thing in half that time. Of course, this accelerated movement is not only applicable to the upside.

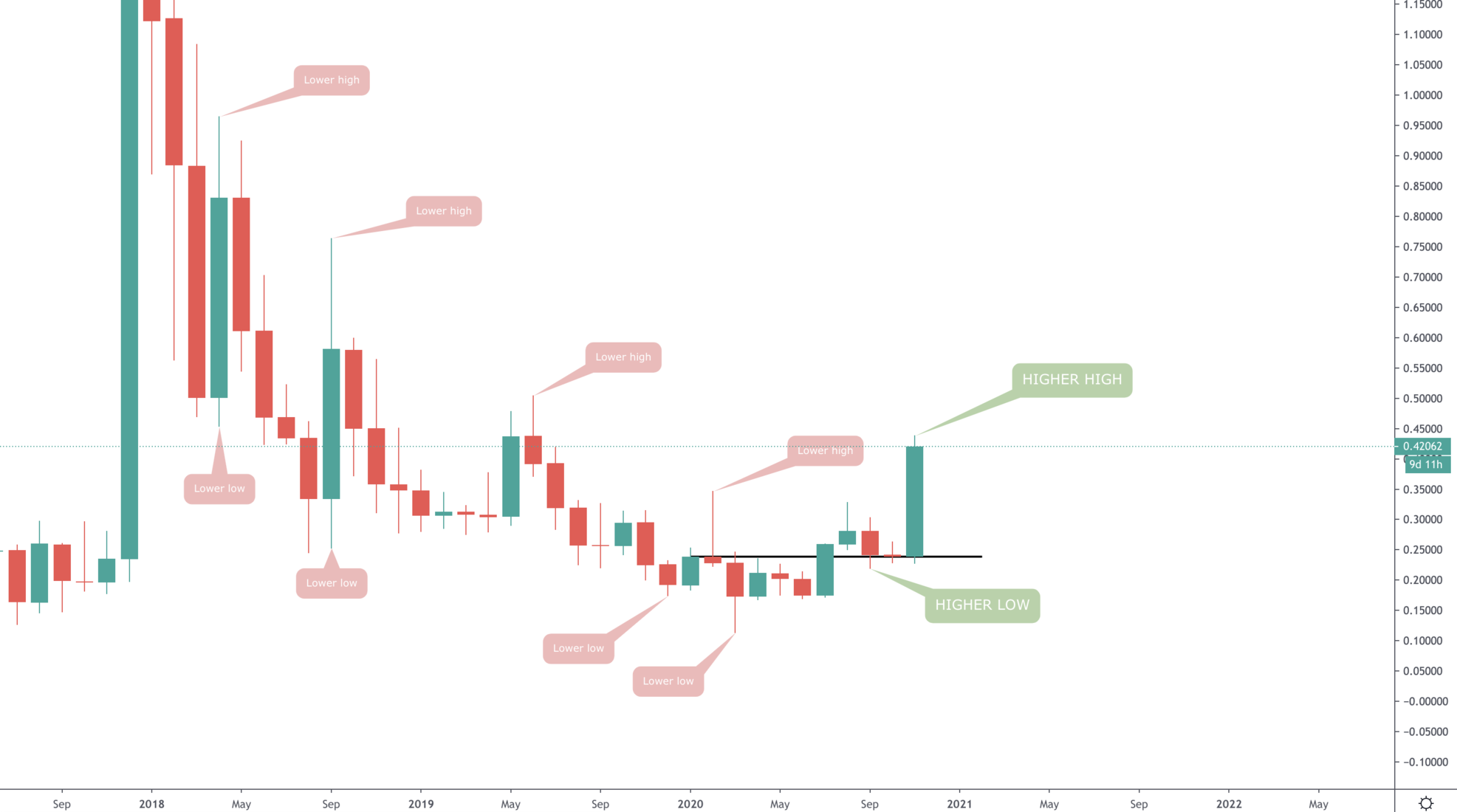

While XRP moves in an accelerated fashion, it does not mean that it responds to different rules of technical price action. The simplest and most robust form of price action analysis is analysing the high timeframe trend.

Uptrend Definition: Higher Highs (HH) and Higher Lows (HL)

Downtrend Definition: Lower Highs (LH) and Lower Lows (LL)

The crucial part is determining whether an asset’s price is in a downtrend or uptrend and then checking to see where the bullish or bearish structure breaks.

XRP has been in a perpetual downtrend since the 2017 top of $3.30, continuously registering lower highs and lower lows. For the FIRST time since the top, XRP’s price has set a HIGHER LOW on the monthly timeframe + today XRP set the first HIGHER HIGH which confirms the trend change.

Trading Volume

“Volume must confirm the trend”

As we saw in the section above the trend is changing from bearish market structure to bullish market structure. With any trend change, there must be an association with an increase in trading volume to confirm the validity of the new trend.

The change in market structure is associated with an increase in trading volume which gives confidence that the odds of success for that new trend are decent.

When will XRP outperform?

Since the March crash, Bitcoin went up by 390% and Ether by 480%, XRP has only done 275% from trough to top. So the question is: when will XRP outperform? Especially given that XRP is a smaller cap than the aforementioned too which makes large moves easier.

This is where we must visit the BTC and ETH pairings, because when they are bearish it means BTC & ETH will be outperforming but when these pairings are bullish then XRP will outperform BTC & ETH.

XRP/BTC

The failure to hold 2500SATS is what pushed us to short this pairing as explained in this video.

Fundamentally, this is not difficult to envision because as BTC pulled a superb rally and is approaching all-time highs, all attention is naturally focused towards it. But the larger part of this BTC outperformance has likely ended, what’s left is smaller. Of course, XRP could also be increasing in price alongside BTC, but this talks about percentage outperformance.

A reclaim of the current resistance level at 2500SATS would very likely start a new era for Alts, in this case XRP.XRP/ETH

XRP/ETH did pull a good outperformance at the 0.001 mark but it did not hold for another retest. Price broke all the way down to the [0.0005-0.00055] support and went for a big rally today.

The market structure on these pairings has not changed with confirmation "yet", the creation of a higher low is crucial to signify trend change like we have seen on the fiat chart.

Where caution is neededAs we just stated, XRP is an "accelerated mover" but there's one specific aspect we must remain cautious of: Jed McCaleb. He still holds a significant portion of the supply (3%) and doesn't look like he'll stop selling anytime soon. Each time some of his XRPs were unlocked and free, he sold. Here are his known addresses (1, 2, 3, 4) that could signal incoming selling pressure.

Where To? (TARGETS)

Trend seems to be changing, the stars may be aligning but where is the destination?

There are multiple resistances overhead that XRP must cross. $0.47 crushed the 2019 rally and $0.79 crushed the 2018 rally, so both of these are crucial to cross with strength. Above it, what remains is mainly psychological barriers like the $1 and $2 marks and the ATH at $3.3.

The optimistic approach for new ATH, given new retail money flows in viewing XRP as the "cheap" coin, is reaching the [$5-$7] pocket. This gives XRP a market capitalisation of $250B-$350B which is realistic if the overall crypto rally continues and grows into the Trillions region.

Summary

XRP is an “accelerated mover”, it hits suddenly and hits quickly. Against fiat pairings, the change in trend is here and volume confirms it. Against BTC & ETH the outperformance is very likely nearing with an incoming trend change on them as well.

These are all charts that communicate extra information that most people miss, therefore we seek info in them.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.