The DeFi movement is here to stay, the only reason is that there are functional products behind it that create a fairer and more inclusive financial system. Despite much of the vaporware that is being launched and traded on decentralised exchanges, there are certain projects and teams offering something very appealing to users and that will probably appeal to many more.

One of these projects is Aave, which has received an Electronic Money Institution from the UK’s FCA. For reference, only two other companies have received this: Revolut & Coinbase.

The DeFi Effect

DeFi is only one sector in the cryptocurrency world, how does its boom and gloom affect other coins and tokens? First, let’s discuss the effect on Bitcoin which is not involved in this movement even if the idea of digital cash was first perfected by it.

The Case of Bitcoin

Bitcoin has a hard-cap, by consensus, at approximately 21,000,000 coins. For any asset to appreciate in price, demand must be higher than the supply. This either comes by an increase in demand with stability in supply, decrease in supply and stability in demand or ideally increase in demand with simultaneous decrease in supply. Ultimately, nothing reigns over the basic laws of supply and demand, not even the almighty Bitcoin. The demand is certainly increasing on Bitcoin due to geopolitical factors, but Decentralised Finance users are also using Bitcoin to earn higher than usual yield on it.

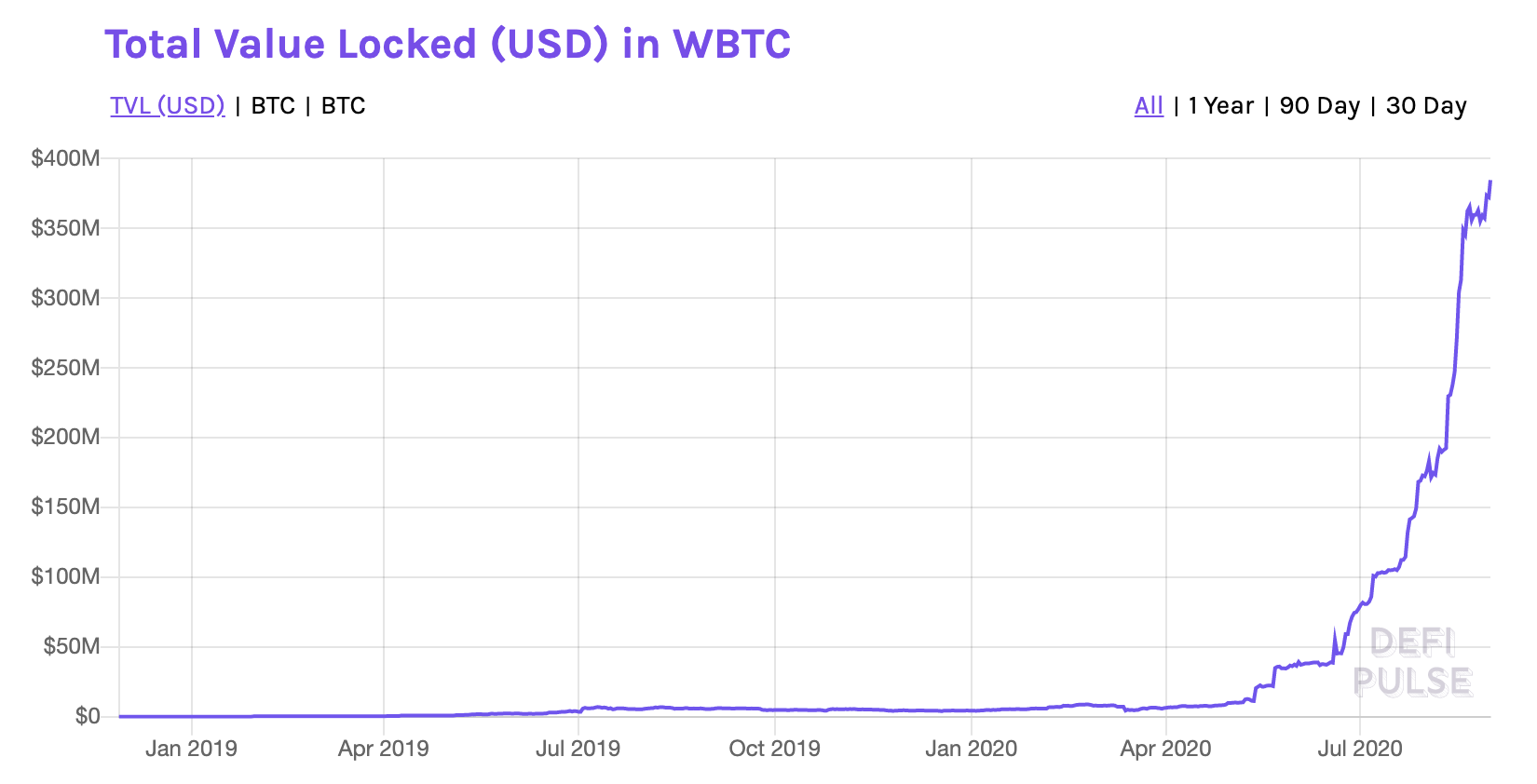

Here’s the even more bullish fact: to enter the DeFi space and earn yield, the Bitcoins need to be tokenised in order to live on a different chain (usually Ethereum now). This is done via a process called wrapping. Wrapped Bitcoins (wBTC) have increased parabolically in the past few weeks.

[caption id="attachment_16989" align="aligncenter" width="1650"] Source: DeFiPulse[/caption]

Source: DeFiPulse[/caption]

In the above chart, you can see how much Bitcoin value (~33,000BTC) has been locked in DeFi. Most of the users requesting wrapped Bitcoins are requiring them to earn yield on them and hence locking them for a certain amount of time which reduces the circulating supply.

The Case of Crypto (as a whole)

The amount of capital flowing into DeFi is setting records by the day. Unfortunately, it does sound like a bubble is starting. Bubble of course go parabolic first, a euphoric event where almost everyone is able to make large returns in a very short period of time. However, the average participant (majority) has no emotional control and becomes greedy very quickly. When the scales eventually tip, he ends up being a bag holder.

The train has just left the station and looks like it has much more fuel in it as the number of users currently using and taking advantage of DeFi is still low. Old gen projects have just begun rebranding as DeFi in some sort of way, unfortunately it seems that many of those chains are doomed or else if they had an actual product they wouldn’t be rebranding in this specific moment in time (Tron is an example).

The utopia outcome would be more users flocking into DeFi, taking advantage of it, no Ponzi schemes being created, fully regulated space and an infinite parabolic curve. But we don’t live in a utopia, which makes this highly unlikely.

Disclaimer: None of the opinions expressed should be construed as financial advice or a recommendation to buy anything under any circumstance.