Why memecoins are still the hottest sector in crypto

Many thought that memecoins were a cyclical trend that would fizzle out, just like the NFT craze or DeFi summer. But here we are: the meme sector is still the place where most gains are made and most conversations are centred. Let's dive into the sector and what's next...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Fun that's built to last

About 21 months ago, memecoins burst onto the crypto market, capturing most of the market's attention. It's been a wild ride, with staggering success stories and huge wins, but also plenty of rugs, scams, and extractions.However, despite everything, memecoins have been an enormous success as a product, and the market has accepted them as a new tradable asset class.

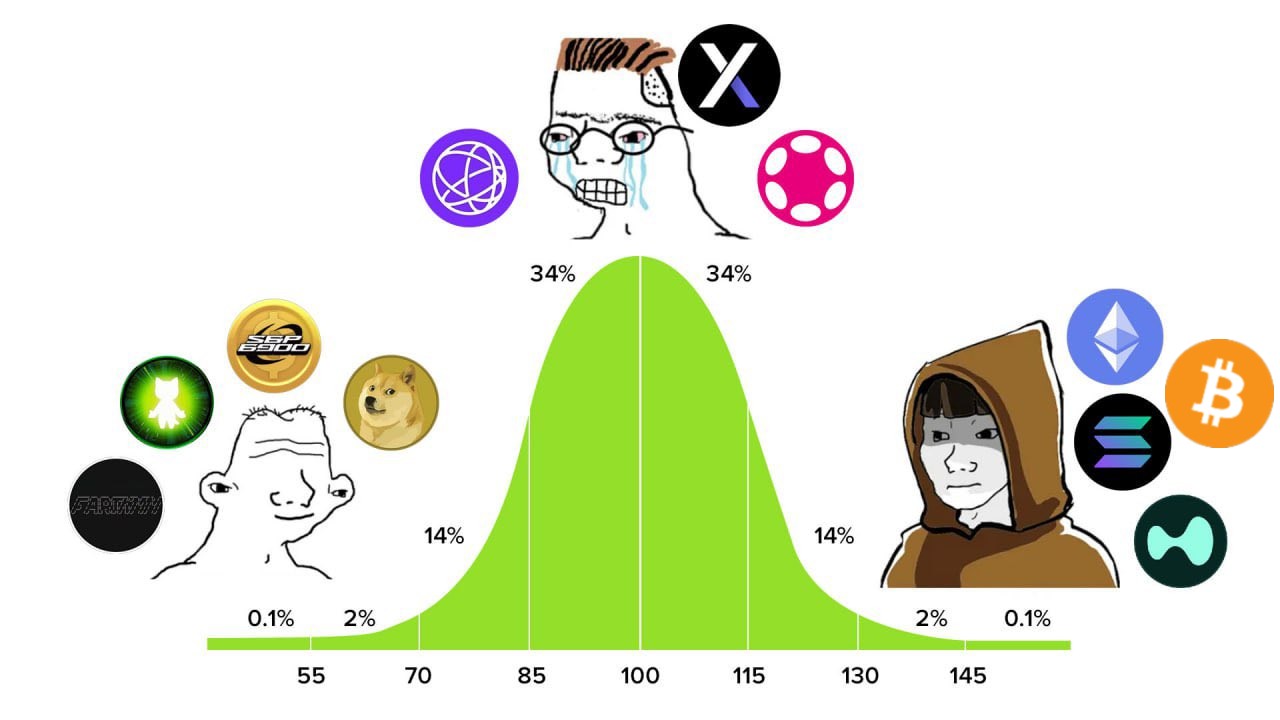

It might not be immediately obvious, but memecoins have demonstrated a remarkable product-market fit. They empower the average Joe to get life-changing gains and serve as the ultimate speculative tool for institutions. Want to bet on interest rate trends six months out or fade headlines like wars or tariffs? Memecoins' volatility and accessibility make them the ideal beta for traders and investors hunting high returns without substantial supply overhangs.

Here is what we are talking about:

- Polychain Capital, an early investor in Celestia, has dumped over $242 million worth of $TIA.

- Following a buyback announcement, Ethena team wallets reportedly sold $ENA tokens worth hundreds of millions.

- Ripple insiders and early stakeholders have faced allegations of selling $XRP during periods of legal uncertainty, with reports of over $500 million in sales by executives since 2017, despite vesting schedules.

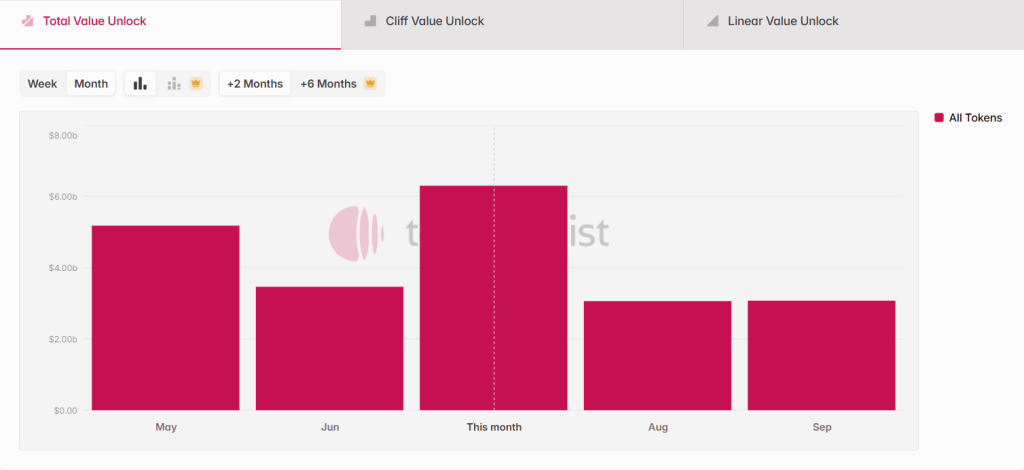

Why does this happen? As the crypto industry becomes increasingly institutionalised, venture capitalists (VCs) are entering new projects at extremely low valuations. By the time a token goes live, VCs are often up massively, creating a significant supply overhang. On average, the broader market sees $3 billion to $4 billion in token unlocks every month.

This is in stark contrast with memecoins that have fully diluted market caps from day 1, no supply overhang or predatory VCs that are up 50x-200x post Token Generation Event (TGE).

Money is made on memes

Therefore, when we look at success stories in 2024/2025, memecoins are the strongest-performing sector. We had multiple runners such as SPX6900, MOG, TURBO, PEPE, WIF, POPCAT, AURA, BONK, PENGU, etcWhile some non-meme assets, such as SOL and HYPE, have also had very strong performances, the spotlight and buzz have been overwhelmingly centred on memecoins. When it comes to the scale of returns, memecoins just dominate. No other sector has produced 50x, 100x, or 200x runners in the last 2 years.

Memecoins consistently deliver the highest returns, largely because they offer everyday retail investors a real shot at life-changing wealth. Are there rugs and extractions sometimes? Absolutely. But despite these risks, memecoins remain the purest form of speculation in the market.

Furthermore:

- Most utility tokens lack genuine utility. Even when they do, they fall into the "utility trap". In other words, the market prices these assets based on fundamentals and limits their upside.

- VCs still abuse the distribution, and unlocks are huge. By the time tokens gets listed on centralised exchanges, insiders start dumping on retail investors

- 99% of the market has no real product-market fit. There are only a few exceptions, like Hyperliquid, Jupiter, etc.

- Memes are easier to understand than highly technical utility coins (try reading EigenLayer's 19-page whitepaper).

It is safer to be in memecoins

We would even argue that it is safer to be in memecoins like AURA relative to utility coins. Even if we put aside the VC and insider flaws of utility coins, there are still executional risks and potential security threats. For example, when investing in Kamino ($KMNO), you are taking the risk that one day it might just get hacked or TVL gets drained. The token will likely plummet 50%+ within hours.Memecoins don't have any protocol-related risks, since there are no fundamentals or utility there. They lack the complex infrastructure of utility coins (e.g., smart contracts, DeFi protocols, or dApps). This absence reduces the risk of technical failures, bugs, or exploits that can cripple utility projects.

Furthermore, utility coins often face regulatory scrutiny. We lost count of how many DeFi, staking, NFT, and governance projects the SEC has prosecuted (e.g Uniswap, OpenSea, etc). Although the current US administration is more friendly compared to its predecessor, the regulatory risk remains.

This makes memecoins the purest market plays. A significant percentage of investors want just that: to get market exposure and navigate the risk-on/risk-off environments with no protocol-level or regulatory risks. Just speculative purity if you get it right.

We're neck-deep in an attention economy

There was a time when owning fertile farmland or sprawling factories was the ticket to wealth. Then came the internet boom, with tech giants ruling the roost. Now? It's all about attention. Narrative is king, and attention is the currency. With Trump at the helm of the world's #1 economy, this dynamic is stronger than ever. His every tweet, rally, or off-the-cuff remark sets the tone for what grabs eyeballs and moves markets. In this game, whatever captures attention wins, and that victory translates directly into liquidity flows.Memecoins are the ultimate beneficiaries of the attention economy, where capturing eyeballs translates directly to market cap. The asset is at a serious disadvantage if it can't capture attention. It should be easy to understand and relate to. That is why many utility coins struggle because no one wants to read 19 pages of a highly specialised, jargon-packed whitepaper. That is why no one cares about EigenLayer, StarkNet, Mina and many other utility coins these days.

Memes are the internet's love language. They are fun, easy to understand and shareable. Therefore, they often go viral easily, and price reflexivity with no supply overhang further adds fuel to headlines. Memes are also about human nature. People crave stories they can latch onto, communities they can join, and assets that feel like a ticket to the cultural moment or movement. Combine that with the desire to get rich, and now you have one of the best-performing asset classes.

Cryptonary's take

Our thesis on the meme sector is simple: Memecoins have emerged as a robust new asset class with strong product-market fit and ROI potential. Last year, we could argue that memes were just a cycle trade, but now we see them staying for longer and forming a new asset class, potentially reaching a trillion-dollar market cap as the sector matures.The Lindy effect suggests that the longer something survives, the more likely it is to keep going. In other words, since memecoins are still relevant and didn't die off like NFTs, the chances of them being relevant go higher as time passes. We already see this sector achieving escape velocity, transforming itself from just a trend into cults, movements and brands.

For this cycle, we think, for most investors, portfolios will consist of the safest and the riskiest end of the risk curve, omitting the middle: utility coins backed by VCs with their massive supply overhang. This trend will continue, and the liquidity will flow accordingly. The sector will continue to be the place many will look into to outperform BTC and the majors.

Our team adopted this strategy quite early and we were able catch one of the strongest winners in the meme category. We found:

- WIF at $0.004 ( ~120,000% ROI)

- POPCAT at $0.003 (~66,000 ROI)

- SPX at $0.01 (~16,000% ROI)

With Michael Saylor calling for over $250 trillion targets for Bitcoin, not having an exposure to this emerging sector can turn into a costly mistake. Years from now, you don’t want to regret missing out or selling too early on an asset class that's showing the power of community and fun.

Position accordingly.

Peace!