But the winds shifted in 2022 - we were already in a bear market, FTX happened, and and outages plagued the Solana network.

And for a long time, many questioned if Solana could stay afloat amidst all the hurricane-style headwinds.

But truth be told, the Solana ship appears to be made of sterner stuff.

The crypto winter of 2022 tested the mettle of many crypto projects. However, signs are emerging that Solana may be among the most resilient.While the skies haven't fully cleared, Solana has shown impressive resilience. Its price has outperformed rivals, fundamentals have strengthened, and developer momentum gained steam.

In our deep-dive analysis, we explored whether Solana's rally is merely a dead cat bounce or the start of a sustained ascent to new highs. We delved into fundamental analysis and on-chain analysis. We also interviewed the Solana Labs, the Solana Foundation, and various DeFi projects on the Solana network.

This is a long read, but it is worth it. Come and find out why we believe Solana is a compelling long-term bet.Key takeaways

- Fundamentals like network upgrades, new innovations like SuperTokens, and developer momentum position Solana well for future growth.

- On-chain metrics show long-term holder accumulation and efficient use of liquidity on Solana.

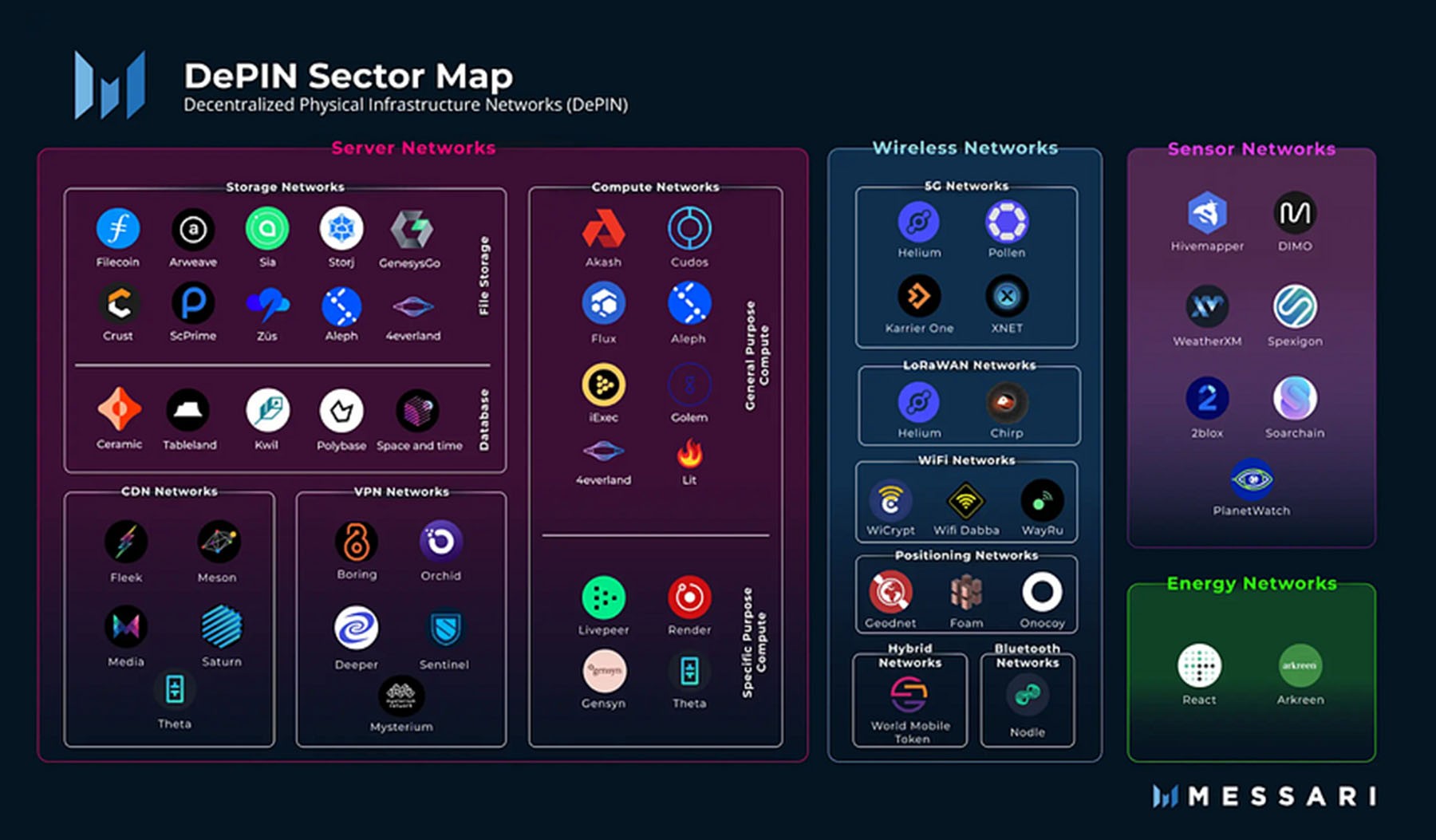

- Major narratives to watch in 2024 are LSD-Fi, real-world assets (RWAs), and decentralized physical infrastructure (DePIN).

- Risks to monitor are future FTX estate SOL unlocks (about $500M worth coming by 2025) and competition from Ethereum layer 2 solutions or new blockchains.

- By 2025, a price target of 0.05 ETH/SOL is reasonable based on historical ratios and Solana capturing 5% of Ethereum's market value.

- This implies a SOL price of $150 to $500 depending on Ethereum's price.

Disclaimer: Not financial nor investment advice. Everything stated in this report is for entertainment purposes only. Any capital-related decision you make is your responsibility and your responsibility only.

What's the big deal about Solana?

Ethereum has solidified its position as the leading smart contract platform, prioritising decentralisation and security - core tenets of blockchain technology. Its strength is facilitating high-value transactions, focusing on censorship resistance and trustless execution.However, Ethereum needs help meeting the surging demand for low-cost, high-volume applications like micropayments, gaming, and social media.

While we remain confident in Ethereum's layer 2 scaling roadmap, it is important to recognise Solana as a compelling alternative for certain use cases. As discussed in an April 2021 article, Solana's unique design balances decentralisation and security while optimising usability, throughput, and scalability.

This strategic positioning makes Solana well-suited for applications involving high transaction volumes and low-value transactions. For example, Solana shows promise for:

- Decentralised Infrastructure (DePIN): Solana's scalability proves instrumental in efficiently coordinating physical infrastructure through on-chain operations.

- Gaming & Digital Collectibles: Solana's design facilitates seamless operations in blockchain-based gaming and NFTs involving numerous low-value transactions.

- Micropayments: Solana's negligible fees and scalability attributes make it well-suited for enabling frictionless micropayments.

- Social Platforms & Loyalty Programs: The onboarding of millions of users and constant posting and tipping support demand high scalability—precisely where Solana excels.

- Retail Access to Real-World Assets (RWA): Solana's high throughput and low transaction fees position it as fitting for handling retail transactions associated with tokenised real-world assets.

5 fundamental factors that will propel SOL to new highs

All the points above sounds good, but isn't it a little too late? Why deep dive about SOL after the price has already skyrocketed?Well, it seems Solana is actually just starting out. #WAGMI!

Here is a rundown of these fundamentals that will serve as catalysts to propel SOL to reach new highs.

1. Nearly 100% uptime year-to-date

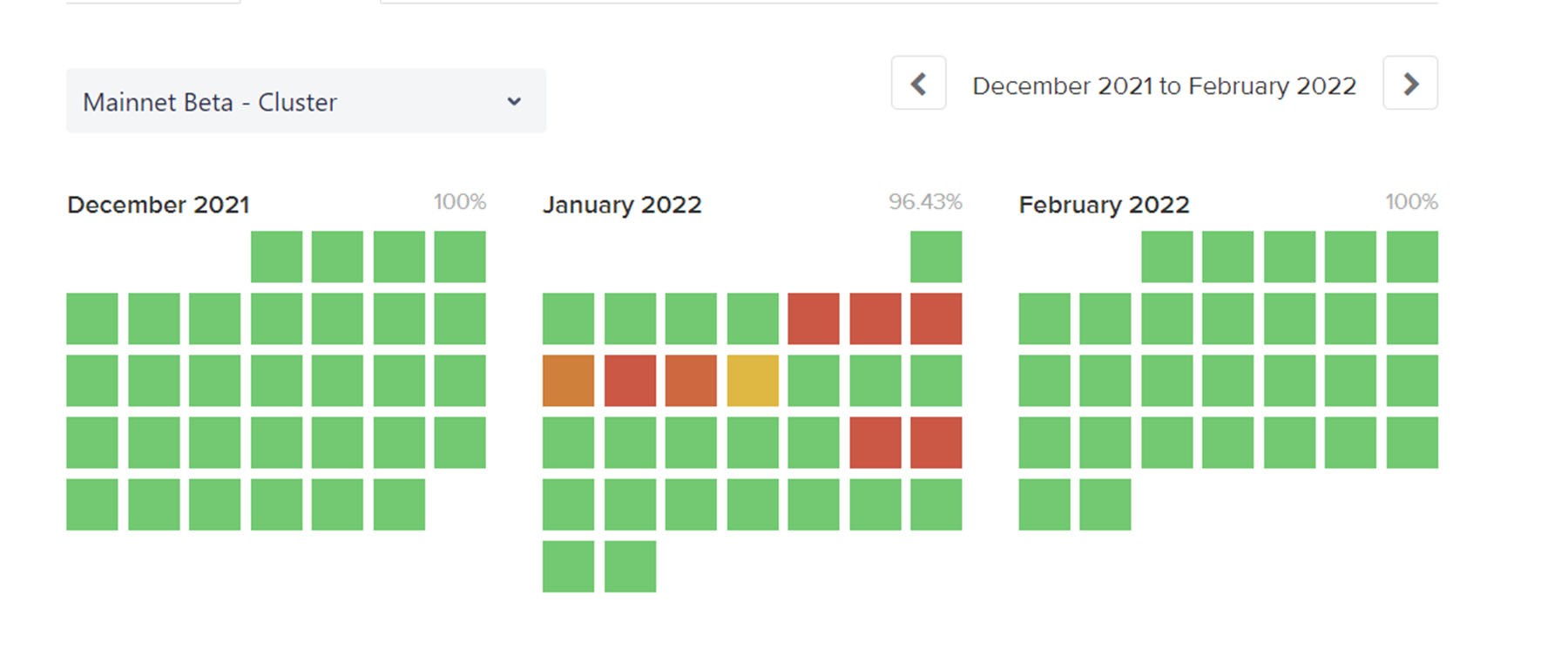

One of the key issues Solana faced in 2022 and the start of 2023 was its constant struggle with blockchain outages. Users began to lose trust in the reliability of the blockchain.

However, a notable transformation occurred in the first half of 2023. Solana has had only one outage in February and none for the remainder of the year. This signifies a substantial improvement in network stability, nearing nearly 100% uptime year-to-date, with the last quarter showing consistently positive performance.

The introduction of the 1.14 network upgrade played a pivotal role in resolving these outages, enhancing speed and scalability. It has put Solana in a stronger position to focus on innovation rather than patching bugs.

2. The 1.16 upgrade

After 1.14, the next significant upgrade was the v1.16 upgrade, which introduced substantial benefits to the Solana network and its users, enhancing the platform in several key ways.- Dramatic RAM Usage Reduction for Validators: v1.16 introduces a substantial drop in RAM requirements for validators, decreasing from ~120GB to ~39 GB. By shifting from RAM to disk-based account indexing, operational costs and hardware requirements for validators are markedly reduced. This efficiency gain improves overall network performance and lowers barriers to entry for new validators, promoting further decentralisation and enhancing security.

- Confidential Transfers for Privacy: Integration of Confidential Transfers, based on zero-knowledge proofs, enables encryption of token balances and transaction amounts on SPL tokens. Unlike anonymity alone, this prioritises confidentiality without sacrificing security. The privacy upgrade makes Solana more appealing, especially for users who value transaction confidentiality.

- Enhanced Support for Zero-Knowledge Proofs: v1.16 brings improved support for zero-knowledge proofs via alt_bn128 syscalls, streamlining the development of complex, privacy-oriented dApps. This expands Solana's use cases and value proposition, making it adaptable for diverse applications and attractive to a wider developer/user base.

3. Firedancer: The next big step for Solana

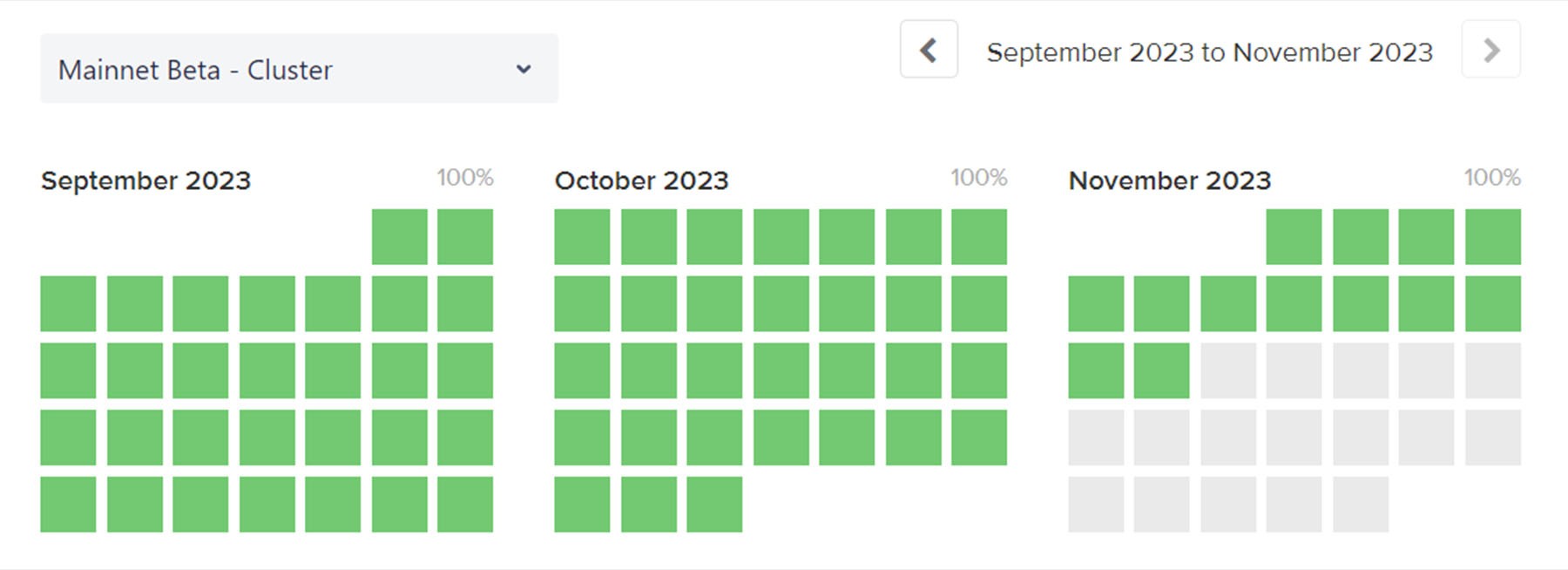

Blockchain networks' scalability and transaction throughput hinge on efficient data propagation, with Solana emerging as a leader in data capacity.However, current limitations in Solana's transactions per second (TPS) and block time necessitate a transformative catalyst, and Firedancer, a revolutionary Solana validator client by Jump Crypto, presents a compelling solution.

At the Breakpoint event, Firedancer's introduction on the testnet showcased a remarkable performance leap, surpassing the existing Solana Labs client by 10 to 100 times.

Firedancer is crucial because it changes how Solana scales. It moves the limitations from software to hardware, aligning with the idea that as technology gets better, Solana can handle more transactions. While reaching 1 million TPS might take a bit of time, Firedancer sets the stage for big improvements in scalability.

The tests on the testnet show that Solana's efficiency notably improves when running on Firedancer, suggesting it can handle more transactions as hardware evolves.

This anticipated improvement positions Solana competitively, potentially reaching 5,000 TPS or even 10,000 TPS in the medium term—a substantial enhancement compared to the current 500 TPS for non-vote transactions.

The ongoing testnet on Solana currently showcases an early iteration of Firedancer, colloquially referred to as 'Frankendancer,' and it is projected to transition to the Solana mainnet in the first half of 2024

The complete Firedancer suite is anticipated to go live on the testnet in the second half of 2024. This phased-release approach strategically places Firedancer as a significant catalyst for Solana's development.

4. SuperToken: Catalysing innovative use cases

Solana has rolled out a major innovation called SuperToken, previously known as Token2022. This new token standard will eventually replace Solana's current SPL standard.SuperToken is important because it enables developers to build novel use cases not previously possible on Solana. In some cases, SuperToken unlocks functionality not even achievable on Ethereum, giving Solana a competitive edge.

SuperToken adds a tremendous amount of new capabilities. To highlight why this is impactful, here are some examples.

- Immutable ownership: Prevents unauthorized token transfers, ensuring secure transactions

- Confidential transfers: Enables private transactions via zero-knowledge proofs, enhancing DeFi privacy

- Interest-bearing tokens: Allows tokens to accumulate interest, enabling staking rewards

- Transfer fees: Facilitates sustainable community funding by redistributing percentages of fees

- Transfer hooks: Triggers custom programs during token transfers, allowing use cases like royalty distribution

- Non-transferable tokens: Prevents token transfers, suitable for ticketing to prevent scalping

So, let's break it down: SuperToken introduces a range of functions, and to highlight its significance, consider this example shared by the Head of Strategy at Solana.

Solana's new SuperToken enables both permissioned and permissionless DeFi activities on the same platform through features like transfer hooks.This showcases why we believe SuperToken acts as a significant catalyst for Solana, considering the endless possibilities of use cases it enables.For example, a fund could issue a token that requires KYC verification to transact using SuperToken's permissioning capabilities. But they could still allow that token to be traded on a decentralized exchange (DEX) on Solana against permissionless tokens like USDC. The DEX could have transfer hooks programmed to only allow verified, KYC'ed users to trade the permissioned token.

This is significant because until now, permissioned DeFi required separate platforms or layers. With SuperToken's features like permissioning and transfer hooks, Solana can have fully integrated permissioned and permissionless DeFi in the same ecosystem. Users won't have to go to different apps or layers to access permissioned assets.

For example, a fund could exchange its tokenized US Treasuries for USDC on a permissioned DEX pool enabled by SuperToken. Then in the same transaction, swap that USDC for permissionless SOL with users that lack KYC, blurring the lines between permissioned and permissionless DeFi.

This level of integration between permissioned and permissionless activities is unique and could enable a wide array of use cases, facilitating institutional adoption. The example mentioned earlier, involving the 'transfer hooks' function in SuperToken, is just one illustration of its capabilities.

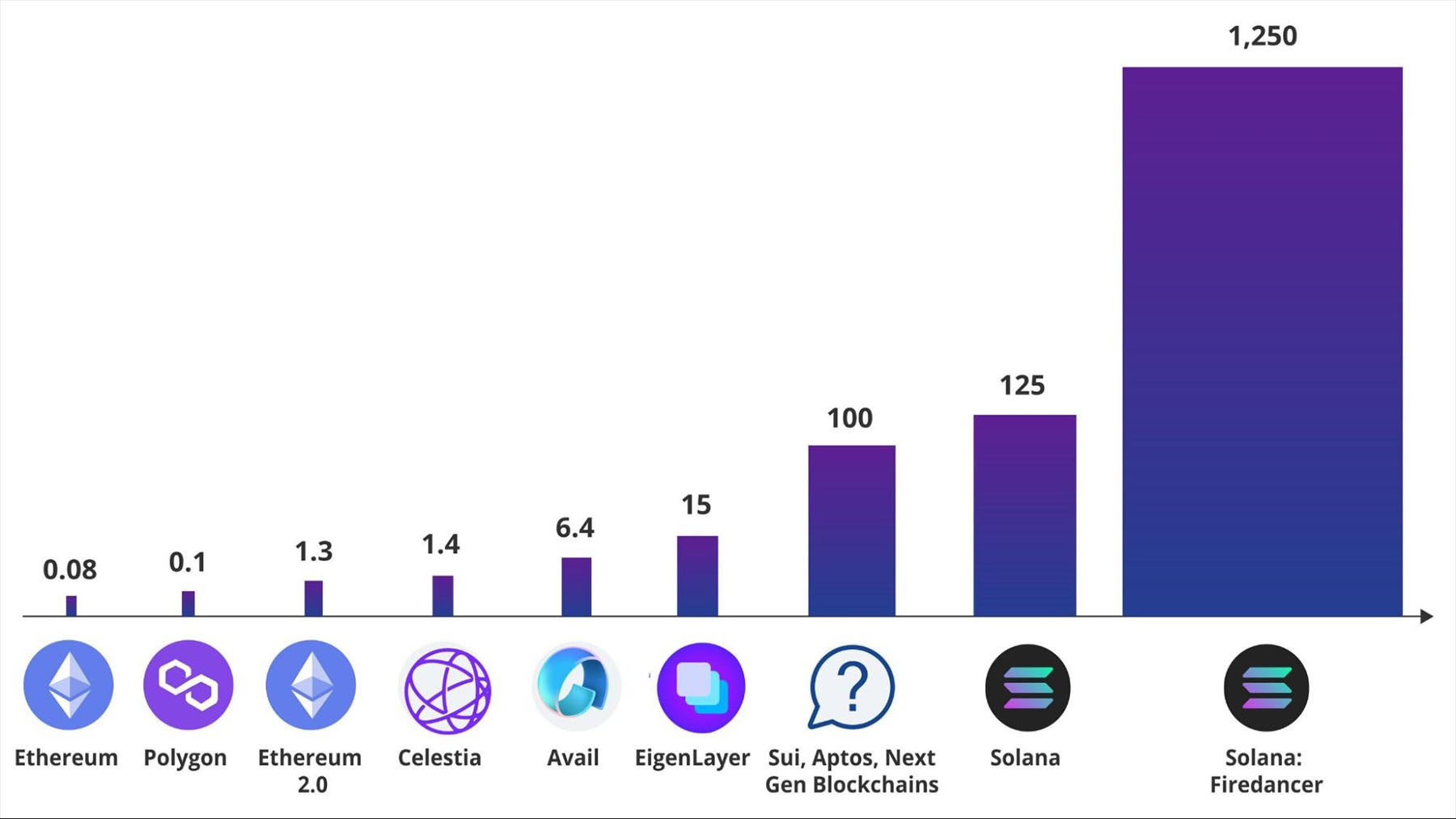

5. Driving ecosystem innovation with VC funding

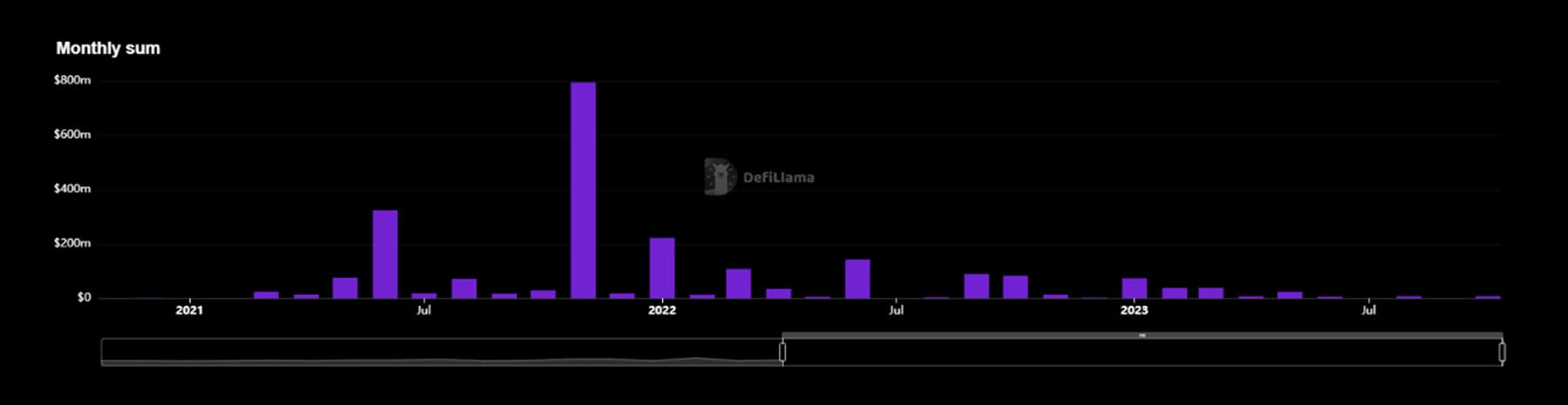

Venture capital (VC) is pivotal for crypto innovation, but monthly inflows decreased 83% from $3 billion in 2021 to just $500 million in 2023, indicating sharply reduced risk appetite.

Solana has followed suit with an 85% decline in monthly VC funding, dropping from $115 million in 2021 to $17 million in 2023. This steep drop signals heightened vulnerability to the broader crypto funding drought

However, it's important to note the broader context. While Solana's 85% decrease is severe, the crypto industry also faced a substantial 83% VC funding drop. This suggests Solana's acute challenges are not isolated but symptomatic of broader ecosystem issues.

However, it's important to note the broader context. While Solana's 85% decrease is severe, the crypto industry also faced a substantial 83% VC funding drop. This suggests Solana's acute challenges are not isolated but symptomatic of broader ecosystem issues.

Solana hackathons have attracted over 50,000 participants and resulted in 3,000+ project launches, per Solana Foundation data. Past winners have raised $600 million in follow-on funding collectively.

Despite declining VC funding, Solana persists with hackathons. The recent Hyperdrive event offered $50,000+ prizes and a $1 million total prize pool.

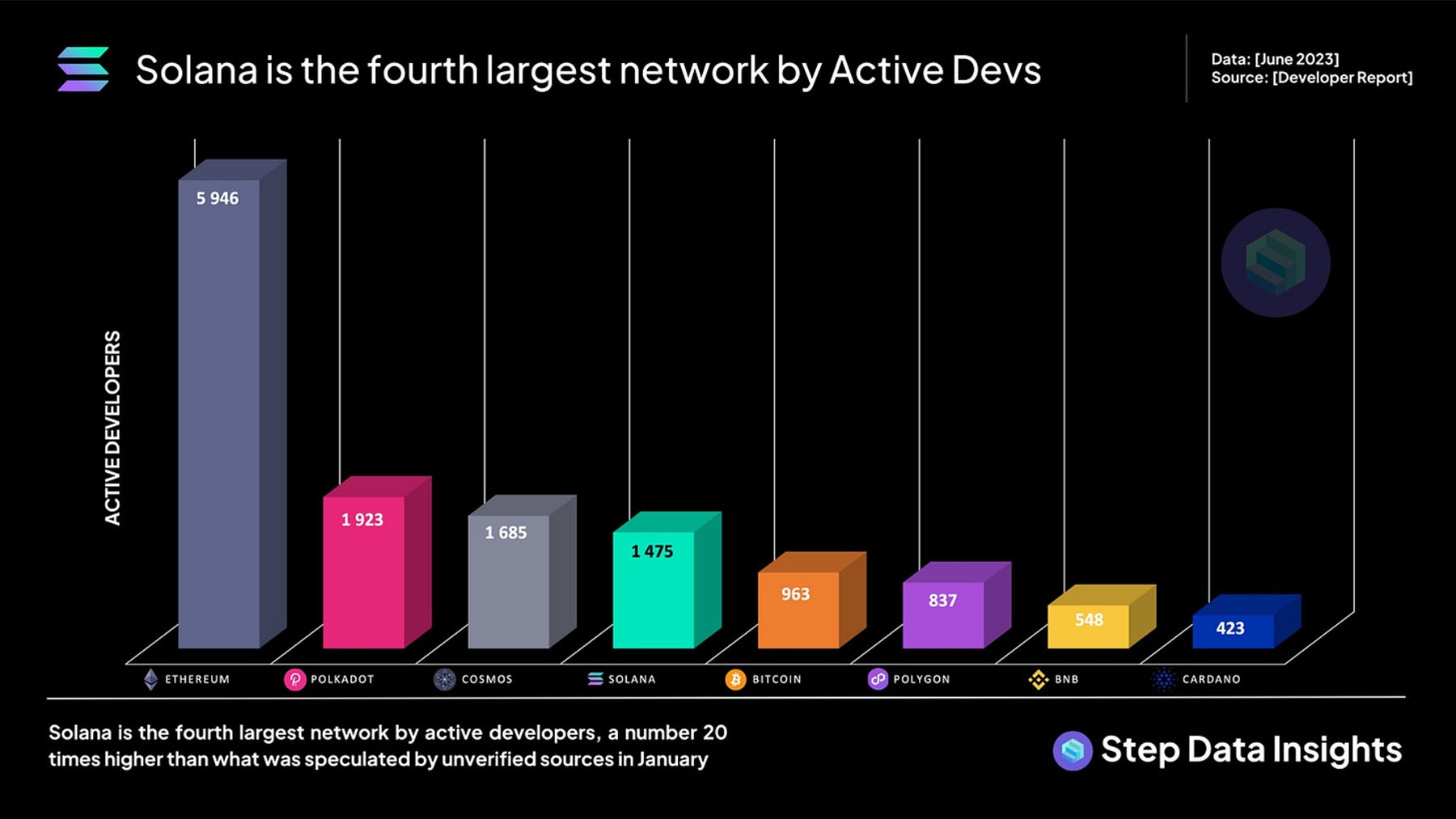

This strategy has shown some success - Solana ranked 4th by active developers in Q3 2023 with 1,475, even without VC funding.

Solana has mirrored the severity of the broader VC decline. Yet, its developer momentum and hackathon-driven innovation efforts demonstrate strengths that can reignite growth when the market turns favourable.

3 on-chain metrics that support the bull case for Solana

Now that we have delved into all the fundamentals that position Solana for significant growth, we can move on to on-chain metrics.These metrics provide us with insights into Solana's short- and long-term trends.

1. Exchange balances

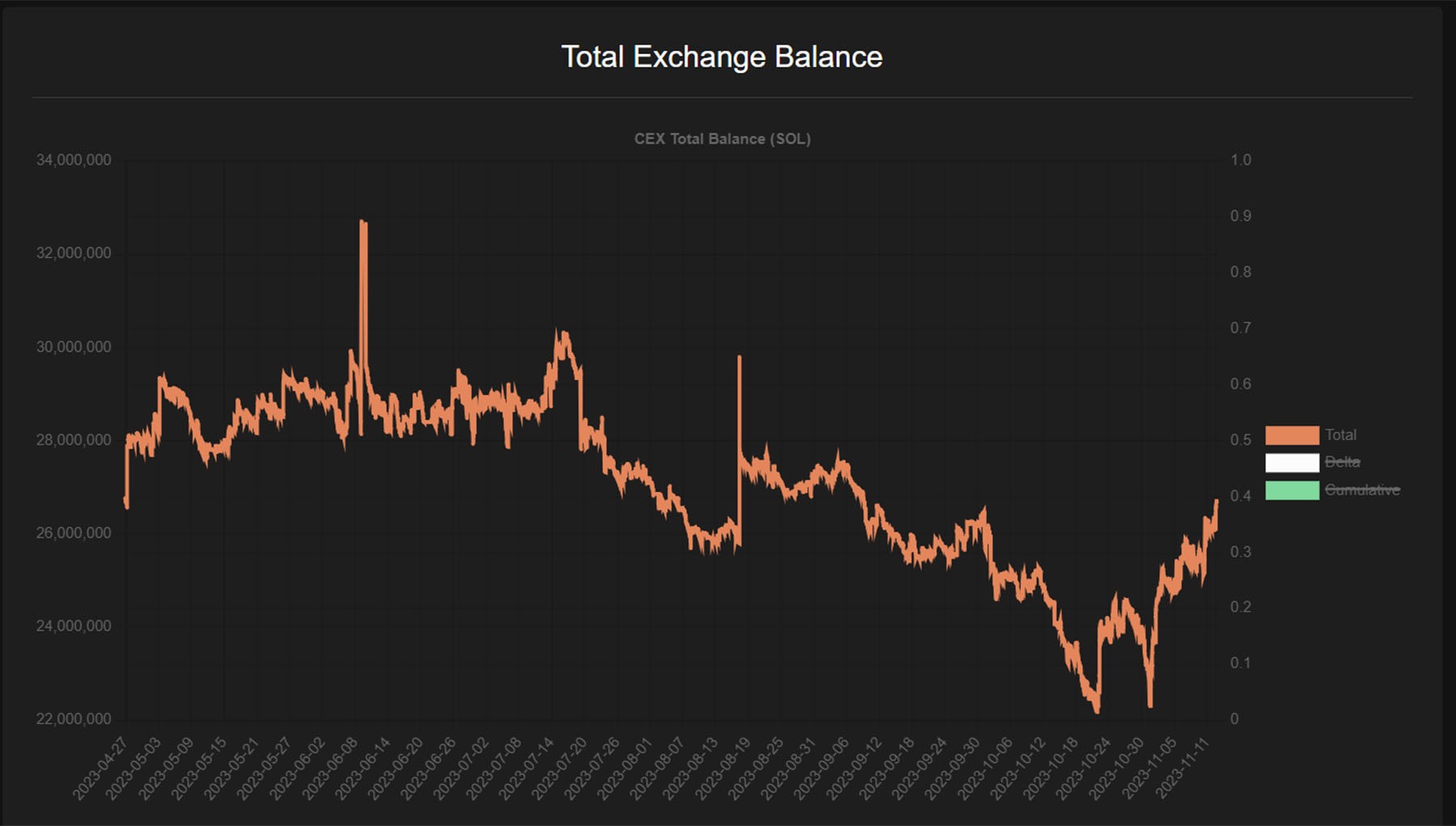

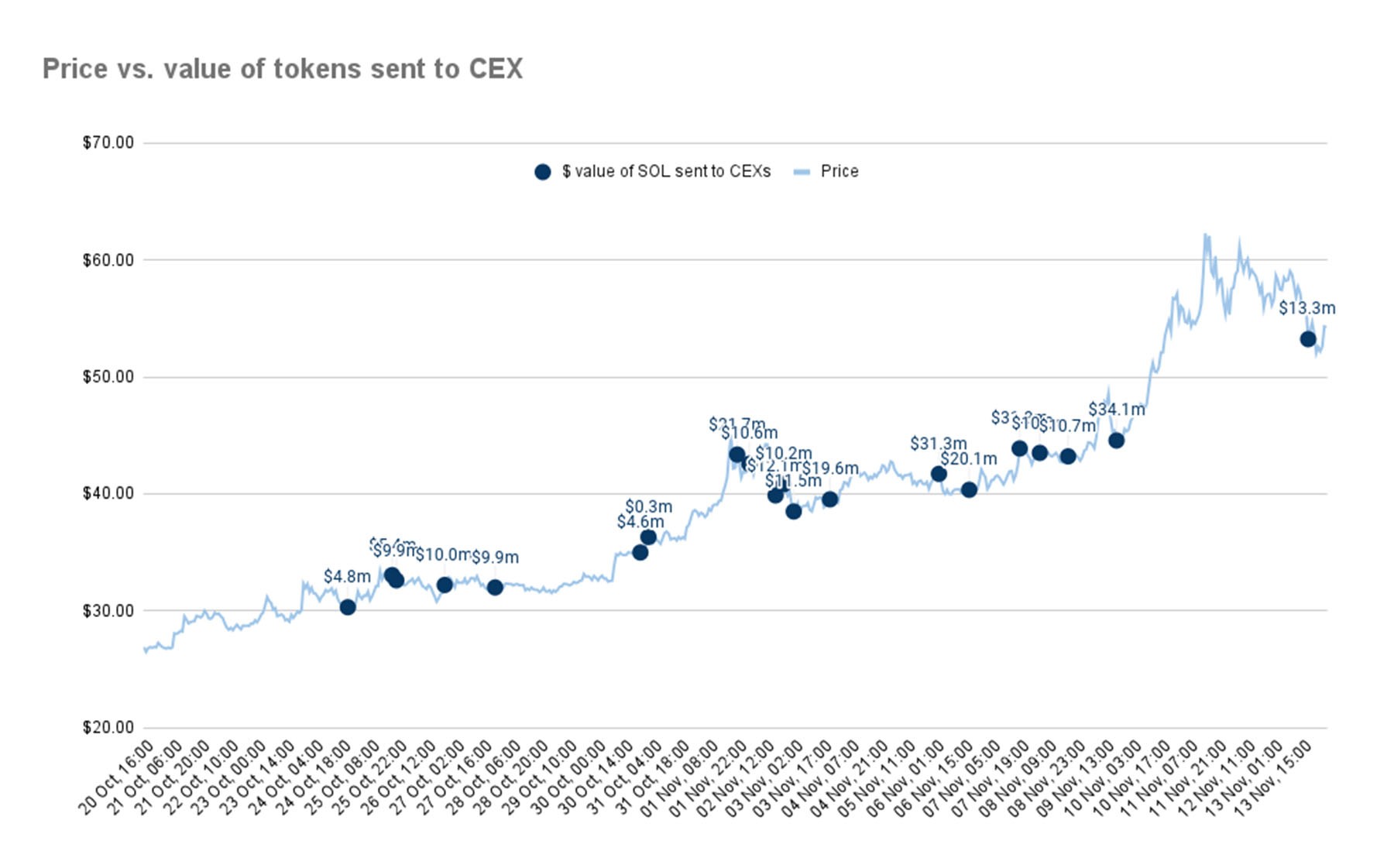

Since Q2 2023, SOL exchange balances have been in a steady downtrend, signalling net outflows and accumulation by longer-term investors. Declining exchange balances typically reflect buying interest as coins move off exchanges into private wallets.However, we have recently observed an aggressive uptick in exchange inflows, likely reflecting some profit-taking after SOL's surge, as well as the selling of SOL by the FTX Estate.

Some profit-taking is expected following major rallies. For SOL to appear more bullish in this metric, we would like to see the uptrend that began as the SOL price increased to stall or decline signaling the accumulation of SOL.

2. Solana active stake

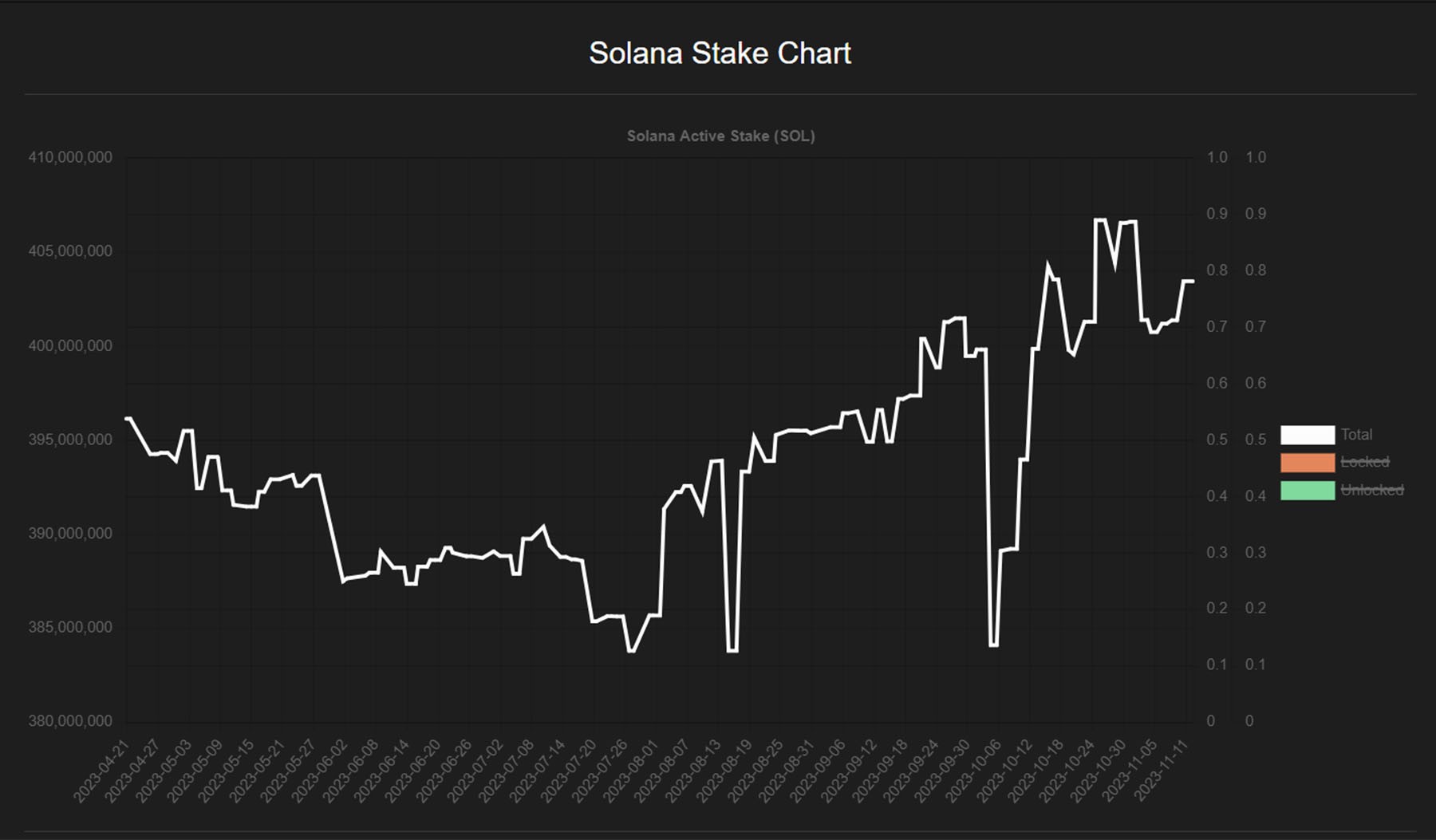

However, looking at other metrics, we can see that long-term holders remain strong, presenting a more positive picture.Over the last 30 days, SOL has experienced a remarkable 145.5% surge in value. Despite this substantial short-term increase, the total staked SOL saw a modest uptick, growing from 393,974,958 to 403,457,048, representing a 2.4% increase.

This measured rise is a noteworthy signal that stakers have remained resolute in holding onto their SOL holdings despite the significant price appreciation.

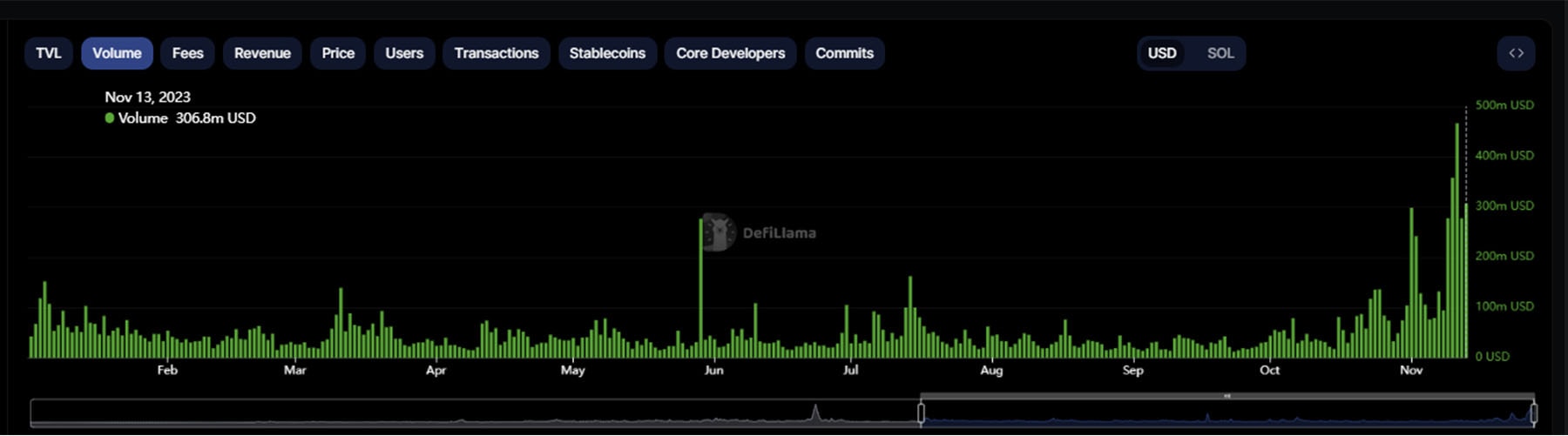

3. Growing trading volume

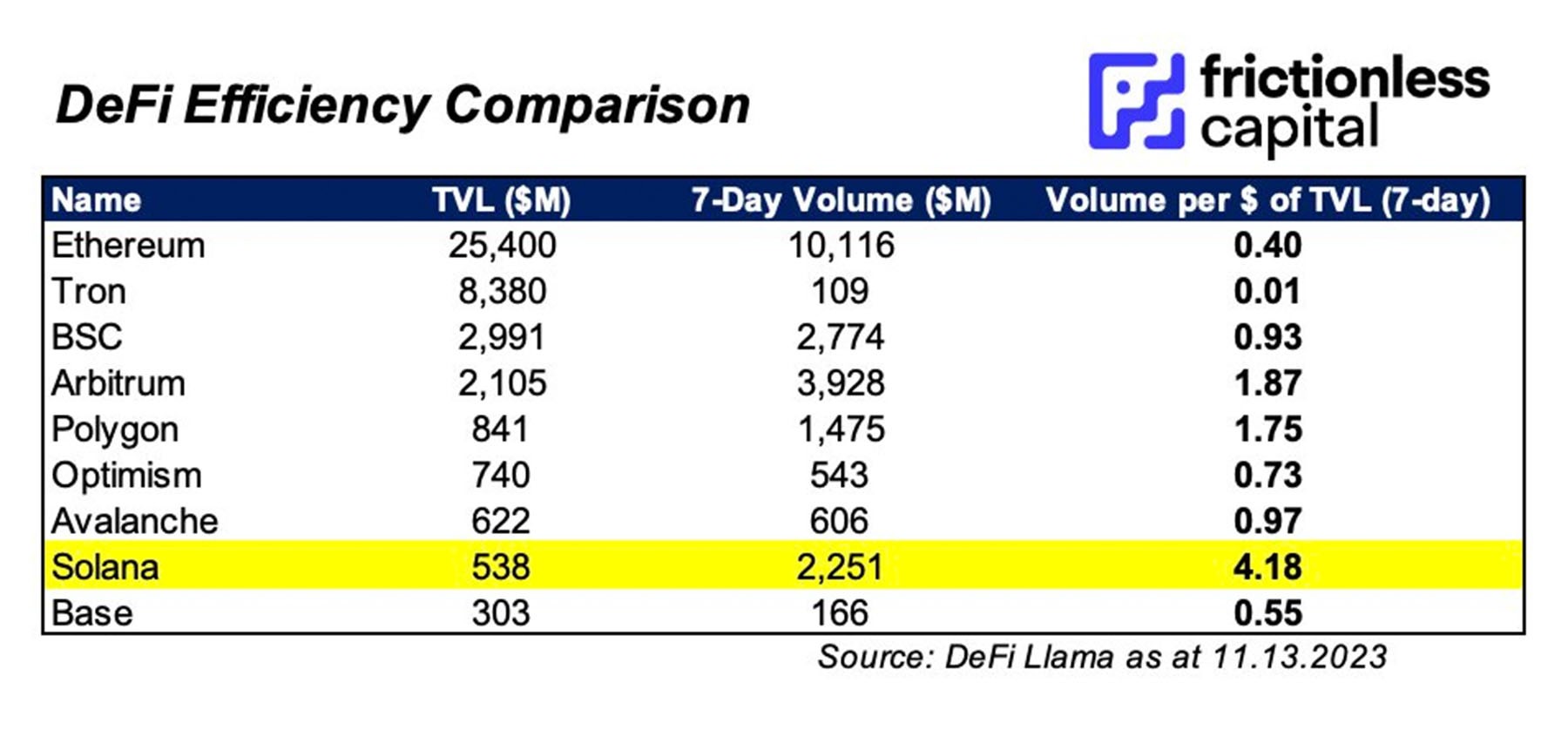

Moreover, usage has not lagged behind the price increase of SOL as trading revenue on Solana reached a yearly high this week at $466 million, while Solana's TVL sits only at $514.89 million. On Solana, using central limit order books (CLOBs) and concentrated liquidity market makers (CLMMs) is feasible and widespread. This distinction becomes apparent when Solana achieves significant trading volume with a relatively modest TVL.

On Solana, using central limit order books (CLOBs) and concentrated liquidity market makers (CLMMs) is feasible and widespread. This distinction becomes apparent when Solana achieves significant trading volume with a relatively modest TVL.

Over the past seven days, Solana has generated around $4.2 in volume for every dollar of TVL, surpassing Ethereum by over ten times

This underscores the importance of the volume/liquidity ratio, emphasizing that it's not just about the amount of liquidity but how efficiently and actively it is employed. This trend is expected to persist in the foreseeable future.

3 exciting narratives to watch in the Solana ecosystem

One thing that is often said about Solana is that there is not enough new liquidity entering the ecosystem and that there are not a lot of investment opportunities on Solana like on Ethereum inside the ecosystem.We see three key narratives that will change this in 2024. As the ecosystem matures, these three areas are what will bring in new liquidity to Solana.

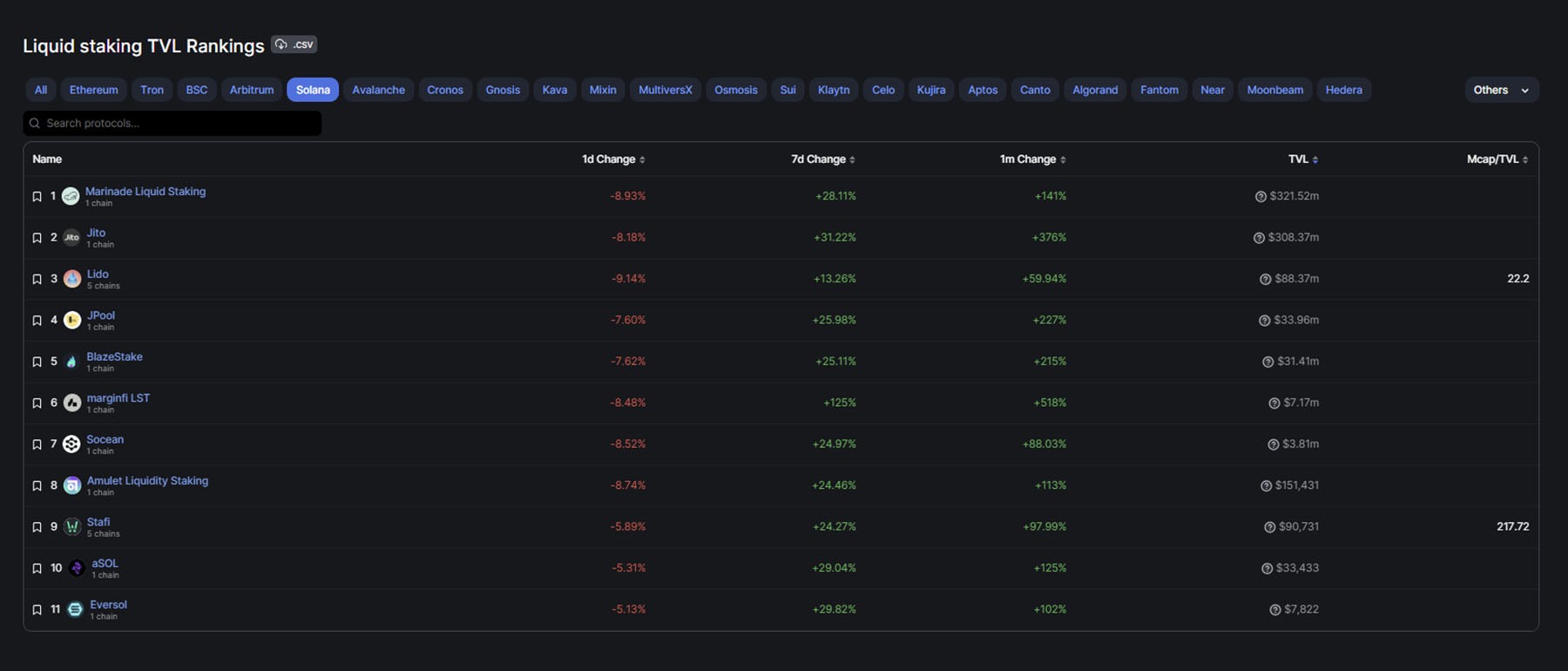

1. LSD-Fi

Liquid staking has already been a significant narrative on Solana since the start of 2023, and every liquid staking protocol on Solana has experienced a meteoric rise in TVL since the beginning of the year.This trend was amplified this month, with Jito, the second-largest liquid staking protocol, witnessing an increase of +376% in TVL.

Currently, however, only 3.87% of SOL sits in liquid staking protocols, which is still a very low amount. This is because, unlike ETH, SOL does not have a long lock-up period for stakers, and staked SOL is generally already more liquid.

However, this does not negate the use case of liquid staking for capital efficiency in DeFi, allowing staked interest-bearing tokens to be used within DeFi protocols. This is why we think the start of LSD-Fi protocols, which are DeFi primitives built on top of liquid staking protocols, will be a massive step for Solana to attract new liquidity.

One example is stablecoins over collateralised by SOL, leveraging liquid staking tokens to generate yield.

This concept already exists on Ethereum with protocols like Lybra Finance. Recently, the largest DEX aggregator on Solana Jupiter has been the first to propose a design to launch a similar stablecoin on Solana. Solana's advantage over Ethereum is that its staking yield is higher, averaging 7-8% on the highest-yielding liquid staking protocols. This means that if a stablecoin backed by staked SOL were to launch, its yield would average around 7-8%, based on staking reward & outperforming the yield users can earn on ETH-backed stablecoins.

We are looking forward to more designs like this that leverage LSTs to create products for users to generate higher returns on their assets on Solana.

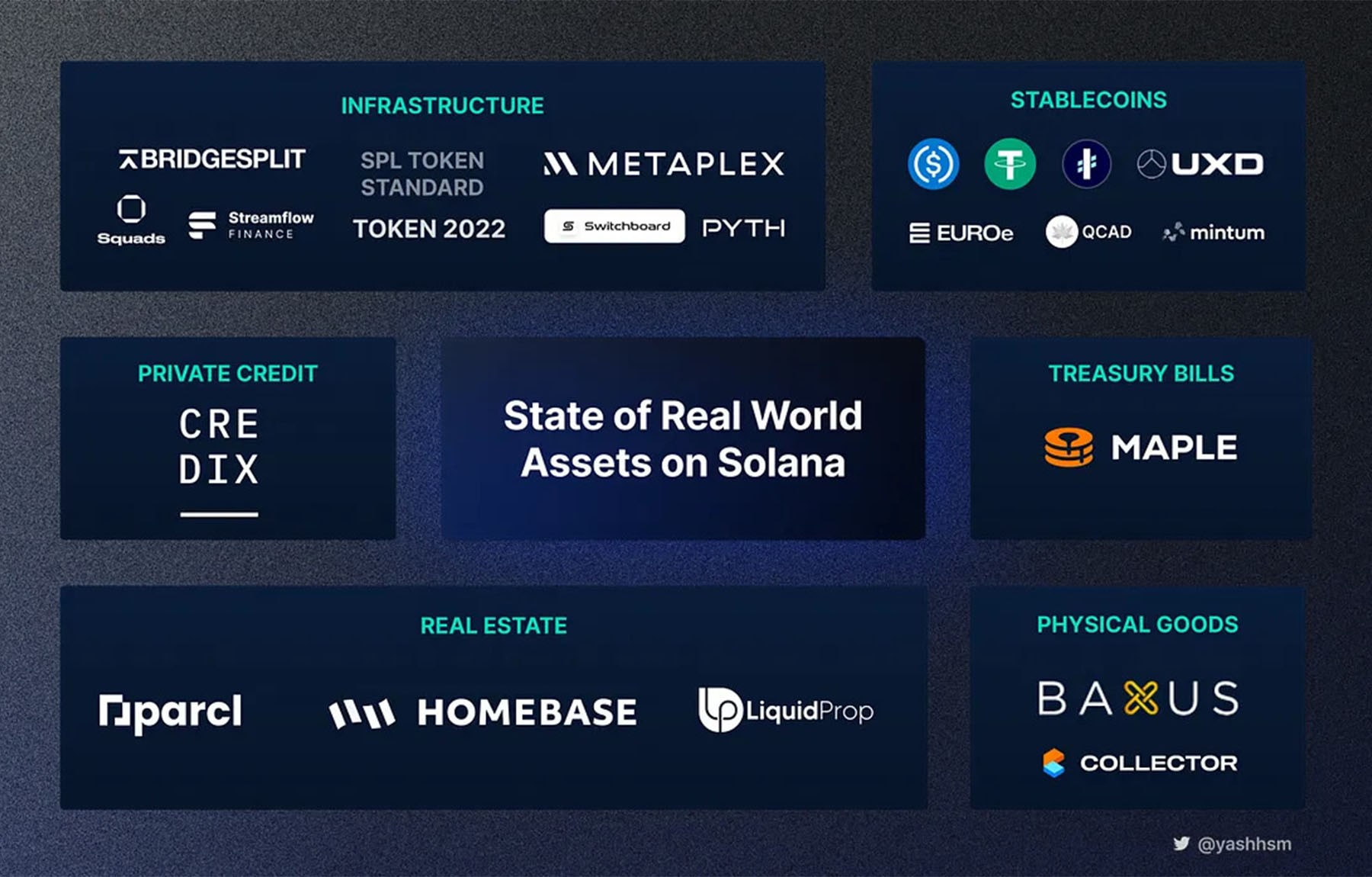

2. Real-world assets (RWAs)

Another sector in which we expect a lot of innovation on Solana is the real-world-assets sector (RWA). There is already a large ecosystem of RWA protocols on Solana, as shown in this image (which is too large to cover)

The recent launch of SuperToken marks a pivotal moment, promising to unlock new possibilities and enhance existing protocols within the Solana ecosystem.

This transformative development is underscored by a suite of features integral to RWA protocols:

- Confidential Transfers: SuperToken enables private token transfers, ideal for institutions prioritizing transactional privacy.

- Transfer Hooks for KYC: SuperToken facilitates KYC implementation on RWA tokens, allowing RWA issuers and protocols to launch compliant tokens and navigate regulatory requirements.

- Interest-bearing Tokens: SuperToken revolutionizes the Solana ecosystem by facilitating the creation of tokens that accrue interest over time, mirroring the behaviour of traditional bonds.

3. DePIN

We see LSD-Fi and RWRA as two short-term narratives on Solana primarily driving demand, given the appeal of these financial primitives to users.However, in line with our thesis on Solana's market positioning, the emergence of Decentralized Physical Infrastructure Networks (DePIN) has more enduring potential.

Looking forward, DePIN represents an exciting phase in the evolution of digital asset-based networks, utilising blockchain technology to coordinate and optimise the usage of data storage and computing resources. At present, Solana stands out as the optimal blockchain for launching DePIN protocols.

Two prominent DePIN protocols have recently moved to Solana.

Originally hosted on its own layer 1 blockchain, Helium migrated to the Solana blockchain in April 2023, marking one of the most significant layer 1 blockchain migrations to date.

Similarly, Render Network, a decentralised computing network, successfully upgraded its core infrastructure from Ethereum to Solana on November 2.

The decision of these protocols to migrate to Solana signals that it is the ideal platform for launching DePIN solutions.

We anticipate a wave of new DePIN protocols launching on Solana, presenting fresh opportunities and attracting new users to the Solana ecosystem.

Potential risks to watch in Solana

While the report thus far has consistently supported our bullish stance on Solana, we must address potential risks and considerations crucial for making informed investment decisions.Here are two key risks we anticipate for SOL in the next 2-3 years, which should be closely monitored.

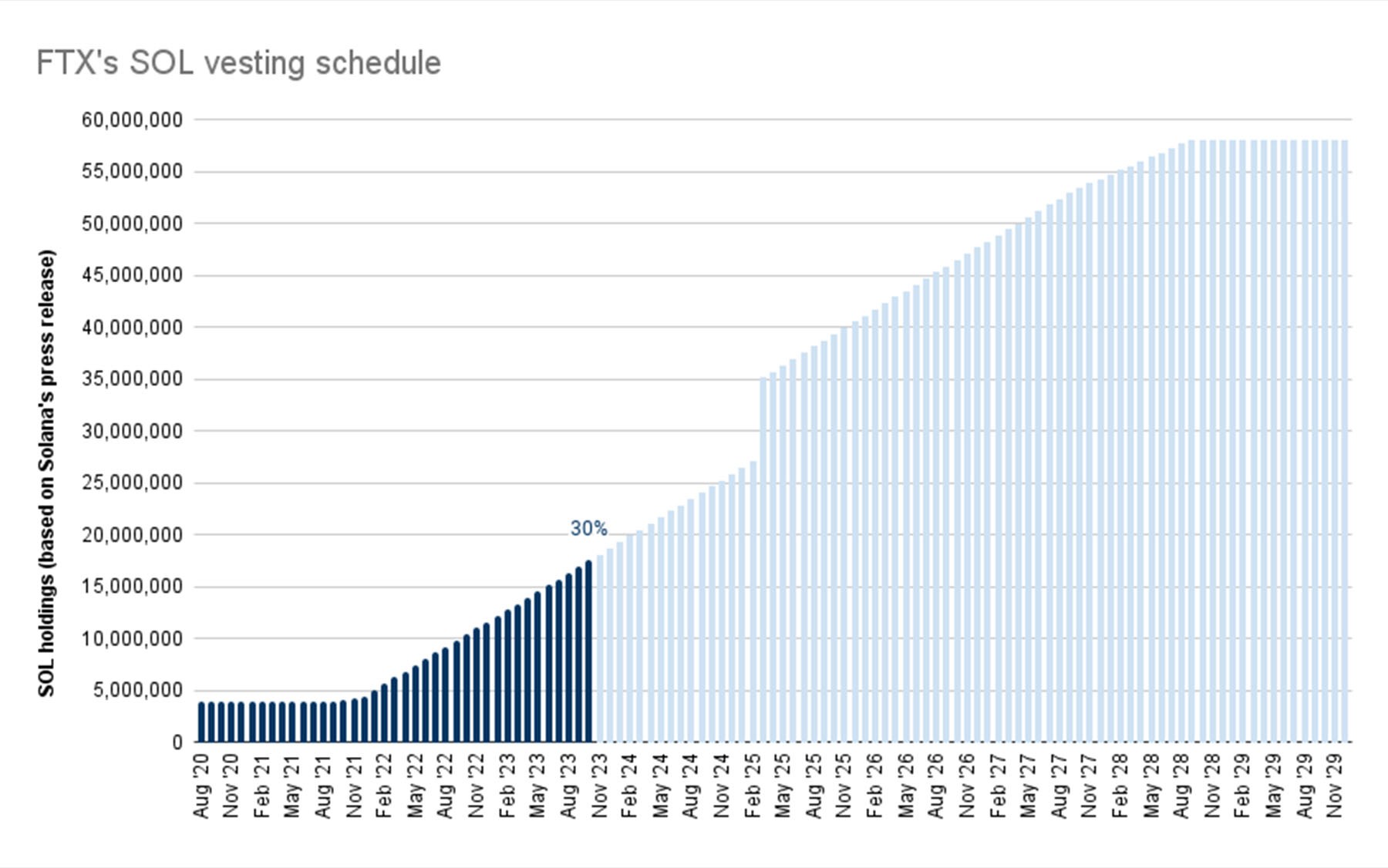

FTX estate holdings

The FTX estate still holds $3,251,514,416 in vested SOL, scheduled to unlock over the next 6 years. This introduces additional selling pressure on Solana, with a total of 58,086,686 SOL vestedAs of now, 17,543,782 SOL has been unlocked. This amount is expected to increase to 26,437,269 by January 2025, representing an additional 8,893,487 SOL that will be unlocked. That's equivalent to $497,267,672 worth of SOL in selling pressure.

The amount of SOL that unlocks will then steadily increase in 2025, as seen in the chart, and the details can be viewed in this spreadsheet.

While $497,267,672 sounds like a significant amount of selling pressure, it is important to note that in the few last months, the FTX Estate has sold 6,995,678 SOL, worth $283,004,537 at an average price of $40.45, and this has not halted SOL from rallying further.

Regarding the SOL that FTX can directly sell, the FTX cold wallets currently hold almost no more SOL. While they still possess some liquid SOL, it's staked in liquid stake solutions. A 1.25 million SOL is still locked, but it could be easily withdrawn and sold.

The FTX estate has sold 6,995,678 SOL without much price impact. We believe this liquid amount of SOL amount might slow down SOL's growth in the coming months. However, it shouldn't cause major downturns unless the overall market sees a significant decline in the coming months.

We also don't foresee the upcoming sales of vested SOL from the FTX Estate adversely impacting SOL from now until 2025 to the extent that it significantly underperforms.

However, in our valuation of SOL, we have considered this risk and adjusted our assessment of SOL relative to ETH downward, establishing a more conservative target.

Increased competition

The second risk for Solana is a more straightforward one that applies to any blockchain or protocol currently enjoying an advantage: increased competition.While Solana is currently at the top of its class in many aspects, there is a risk that existing or new blockchains may improve to outperform Solana. This outperformance may allow them to capture market share in its specific niches.

There are two points that we will be monitoring for this:

Ethereum's advancements in scaling and Layer 2 adoption

If Ethereum progresses more rapidly than anticipated with its scaling roadmap and embraces layer 2 solutions effectively, this could pose a risk for Solana. It becomes particularly noteworthy if Layer 2 solutions with comparable performance and capabilities to Solana emerge. Monitoring new layer 2 solutions like Layer N and Nil launching soon and comparing their performance with Solana will be important.Launch of a new layer 1 blockchain with similar objectives

Currently, no existing layer 1 blockchain can compete with Solana on its objectives of usability and stability. However, the potential launch of new blockchains with similar goals poses a risk. One blockchain we are monitoring as a potential competitor is Monad, which utilises a similar technology as Solana and is built on the EVM.So far, we don't perceive competition as a significant risk because these blockchains have a massive disadvantage. They've had less time to develop a community, culture, and ecosystem compared to Solana. Additionally, the Ethereum scaling roadmap has mostly experienced delays. However, if we observe notable developments that alter our thesis, our community will be the first to know.

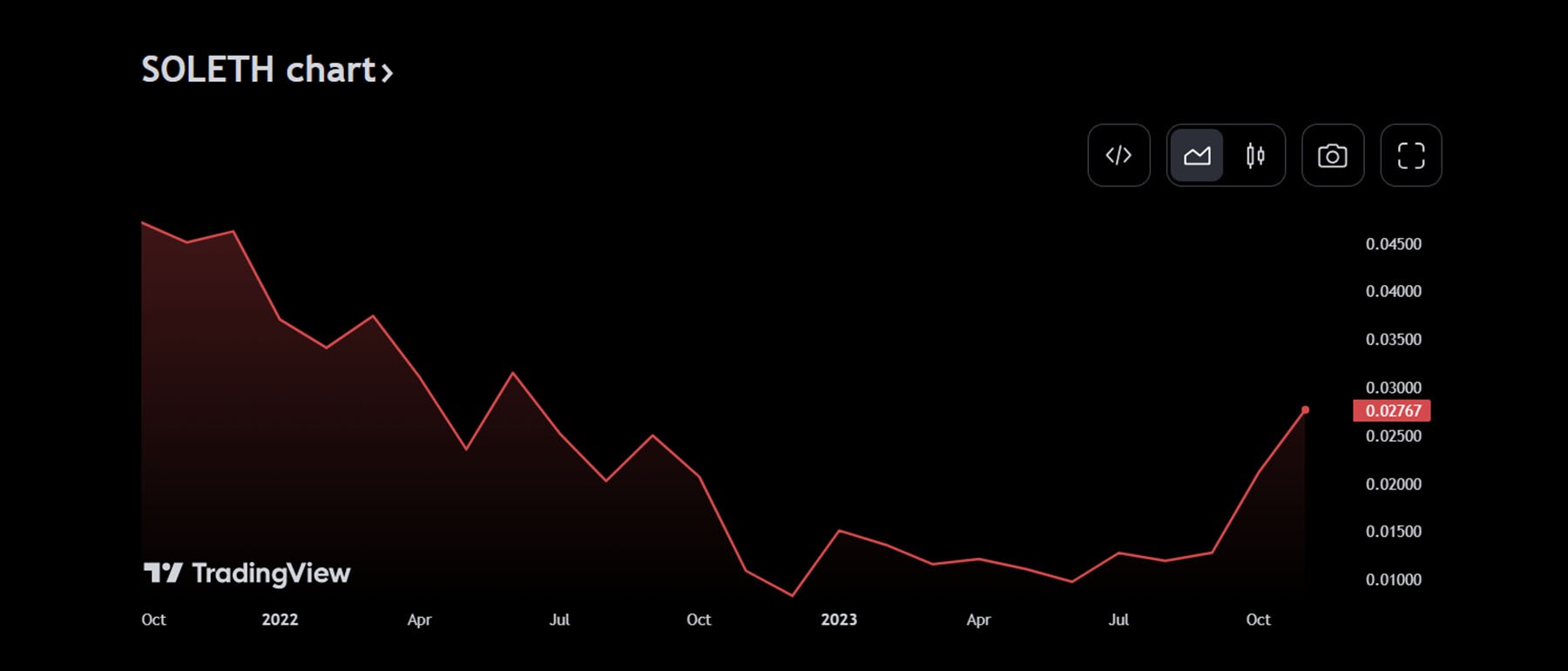

SOL price target 2025

As the leading smart contract platform, Ethereum represents the most appropriate benchmark for valuing Solana based on the logic of market share capture and growth potential. While crypto markets are speculative, using Ethereum provides a rational framework.The 0.05 ETH/SOL target implies Solana capturing 5% of Ethereum's value by 2025. This projection aligns with our belief in Solana's ability to carve out a significant share in the market.

Moreover, historical data further supports our valuation target. During the last bull market on October 1, 2021, SOL reached a ratio of 0.047 against ETH. Considering this historical precedent, our target of 0.05 ETH/SOL by 2025 appears reasonable and aligns with the potential dynamics of a bullish market.

With a 0.05 ETH/SOL target, price projections are:

- ETH at $3,000 → SOL Price = 0.05 ETH/SOL * $3,000/ETH = $150

- ETH at $5,000 → SOL Price = 0.05 ETH/SOL * $5,000/ETH = $250

- ETH at $8,000 → SOL Price = 0.05 ETH/SOL * $8,000/ETH = $400

- ETH at $10,000 → SOL Price = 0.05 ETH/SOL * $10,000/ETH = $500

Cryptonary’s take

In conclusion, Solana has not only demonstrated resilience during the crypto winter of 2022 but has solidified its position as a robust contender in Web3. While Ethereum remains a leader in decentralisation and security, Solana's focus on high-volume, low-cost applications complements these strengths.Looking forward to 2024, narratives such as LSD-Fi, RWAs, and DePIN present exciting growth opportunities for Solana's ecosystem. These narratives, combined with Solana's adaptability and efficiency, are poised to attract new liquidity and users to the platform.

For those considering exposure to SOL, strategic accumulation during market volatility, especially amid Bitcoin price declines or significant liquidations, is a recommended strategy.

For existing SOL holders seeking additional opportunities, exploring altcoins in emerging sectors like LSD-Fi, RWA, and DePIN can provide exposure to higher-risk, higher-upside potential within the Solana ecosystem. While our current analysis offers a comprehensive overview, stay tuned for future articles delving into specific investment opportunities within these sectors.

Additionally, we've released an article on Solana airdrop opportunities, offering a low-risk, high-reward avenue to gain exposure to the Solana ecosystem. This strategy aligns with our endorsement of exploring diverse avenues for growth.

As for our price targets for SOL in 2025, benchmarked against Ethereum, our projection is 0.05 ETH/SOL. This reflects our confidence in Solana's potential to capture market share and experience sustained growth. This target implies various price projections based on different Ethereum price scenarios, ranging from $150 to $500 per SOL.