WIF has become an undeniable blue-chip meme in crypto. It cannot be ignored anymore.

Bloomberg has covered meme coins, and WIF got a special mention; the kind of people who read Bloomberg are profit maxis at heart. If they are coming to crypto, they aren't coming for the technology. They are coming for profits, and WIF is currently one of the most profitable bets in the market.

But against this backdrop, memes are not appearing in Google trends; the bull market is just starting, and retail is yet to come.

And when retail eventually comes, ape'ing into WIF will be easier than ever.

Binance is now listing WIF for spot trading; other CEXs will follow suit, making it easier for normies to buy WIF.

So, what can we expect next in terms of price action?

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Updated price targets for WIF

In our initial coverage, we projected that WIF would hit a $1b market cap. WIF had already exceeded this expectation. So, where is WIF headed from here?Base case

Currently, WIF is valued at $1.4b, and Bonk's all-time high market cap was $3b.If you have read our last update on WIF, you probably know that we expect WIF to overtake BONK as the main dog in the Solana ecosystem.

The competitive landscape in the Solana ecosystem is shifting, with WIF positioning itself as a strong contender for the top dog's spot.

As WIF continues to gain traction and demonstrate its stickiness, it will attract more holders and traders from other meme coins, including BONK.

This migration of meme lovers will further boost the value of WIF, making it more likely to overtake BONK as the dominant dog in the Solana ecosystem.

Furthermore, as we progress into the peak bull market, we expect WIF and BONK to increase in value.

Given the reflexiveness, we give a multiplier to the WIF market cap and expect it to reach a $3b - $5b market cap.

Bull case

Do you remember this model?

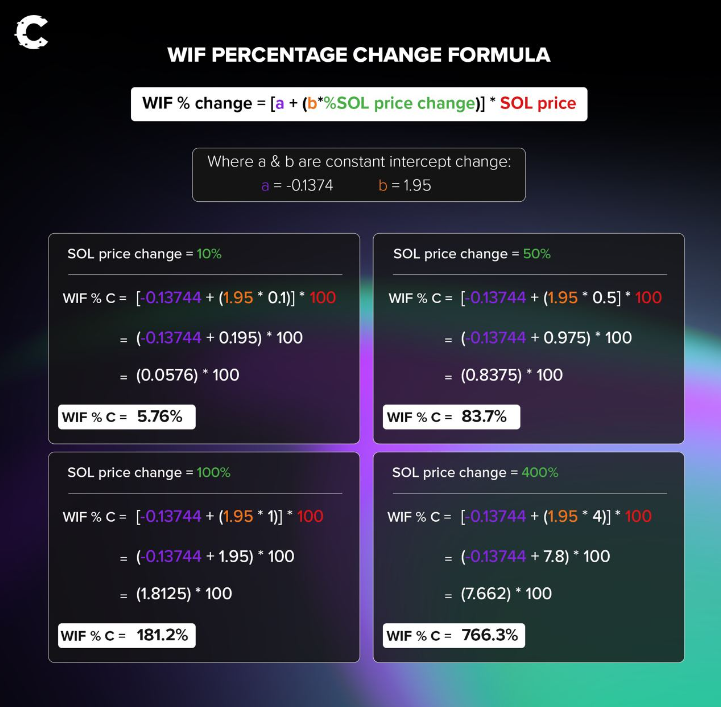

In the January update, our analysis showed that WIF acts as a beta asset for SOL. In other words, we concluded that WIF's price changed in the same direction but with a bigger magnitude.

Based on those findings, we presented a model projecting how much WIF price will increase based on SOL's price increase.

Since then, SOL's price has increased by 44%, while WIF's has risen by 407%. WIF performed better than we expected. However, it has been more volatile as well.

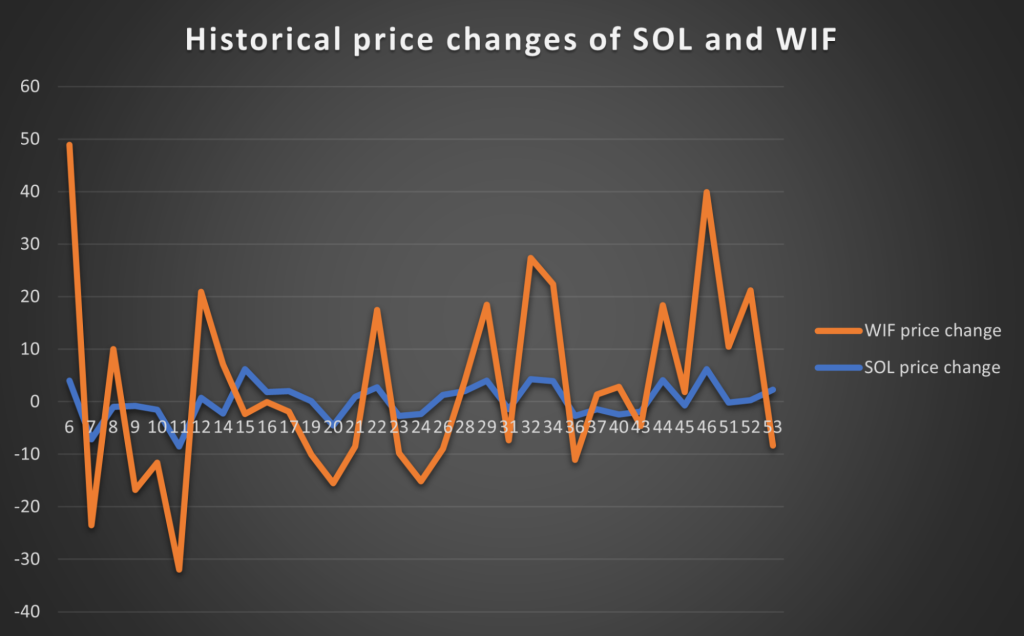

Below, you can see historical price changes for both SOL and WIF.

Looking at the chart, you'll see that WIF mimics the price direction of SOL, however, with a bigger magnitude.

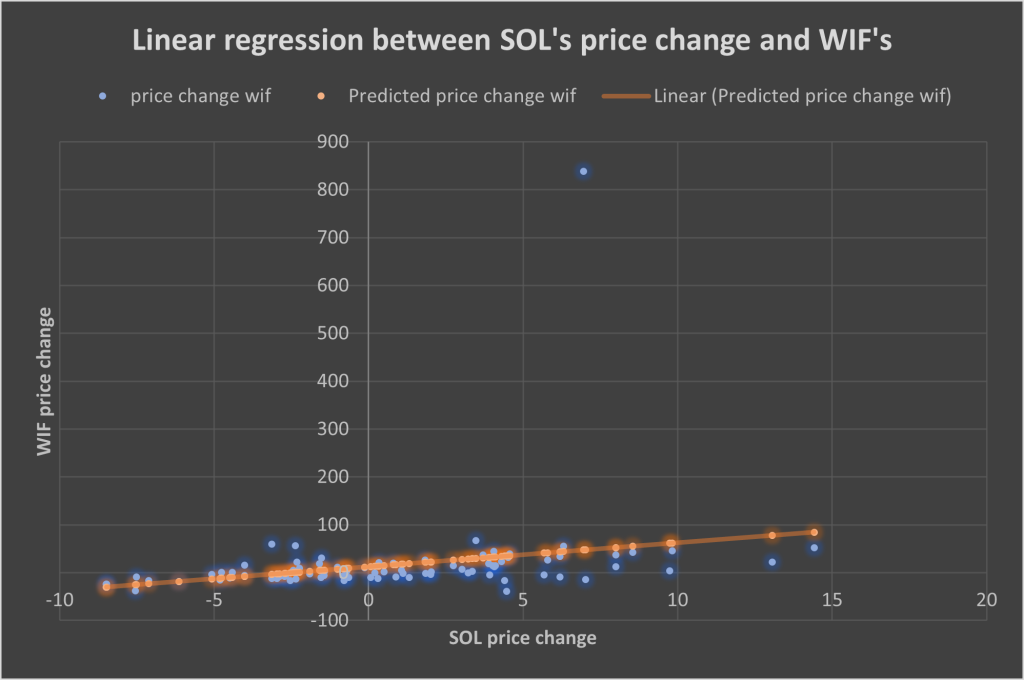

We will use the same approach to determine the future price of WIF, but since we have more historical data, we will have a bigger dataset.

Fresh data showed us that WIF still acts as a beta for SOL; however, now the beta coefficient is 5.02, and the p-value is 0.02.

Beta changes with more historical data. To build a bias-neutral model, let's use the average between the beta in our first model and the current beta, which results in 3.48.

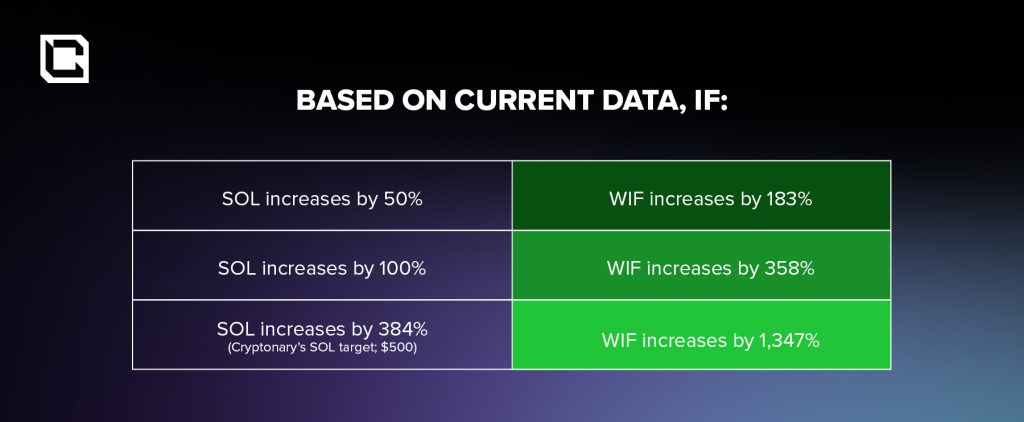

Based on current data, if:

- SOL increases by 50% | WIF increases by 183%

- SOL increases by 100% | WIF increases by 358%

- SOL increases by 384% | WIF increases by 1,347%

It is important to note that with more historical data, coefficients might change, and many factors will influence the price. Therefore, WIF's relative movement SOL, as presented above, is not set in stone.

The most important thing, however, is that this model shows that WIF still has enough room to grow.

Against this backdrop, we estimate a $5b to $10b market cap for WIF in the bull case.

Best case

Beyond a $10B market cap?We will come back to update this as the bull market progresses.

Hint: SHIB's all-time high gave us a ~$40b market cap. Could WIF pull this off?

Time will tell.

Cryptonary's take

So, in summary, we remain bullish on $WIF.If you are confident in $SOL, $WIF is still your beta play.

If you haven't taken any profits yet, securing some is recommended.

There is no need for FOMO; we will be watching markets 24/7 and informing our community of the latest developments.

Don't fumble the bag.

Cryptonary, OUT!