Since its creation in 2009, Bitcoin has ruled all cryptocurrencies. It is the largest cryptocurrency by market capitalisation, volume and has the broadest market effect. This is a natural progression though, this asset class is still new and it’s expected that the first-mover stays at the top at the start. To put in perspective how early it is in this asset class, consider that Apple’s market cap is 5 times larger than the entire crypto-market.

Bitcoin: Useless?

Short answer: Of course not. Bitcoin has proven that it can have a place in this upcoming society and can switch the world from analogue (cash) to digital and from centralised to decentralised.

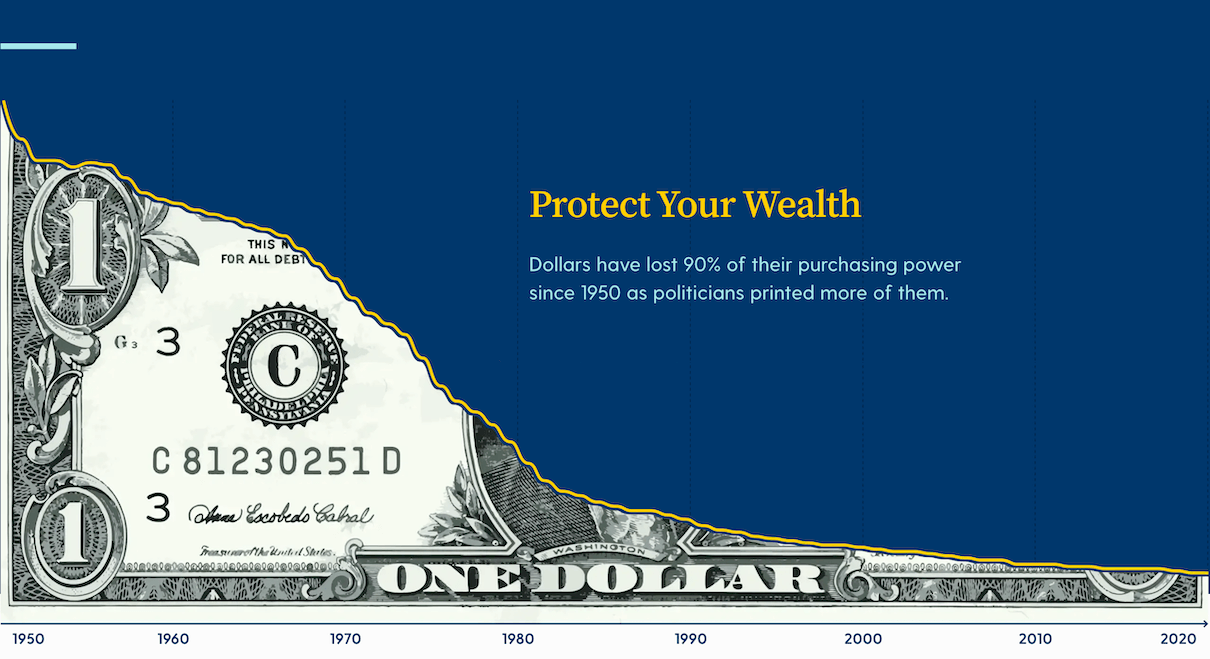

When Satoshi wrote the Bitcoin whitepaper, the vision was for a sort of peer-to-peer electronic cash solution. One of the reasons behind its creation was the excessive printing of cash from central banks and the lack of accountability. Which called for a “code governance” era.

As everyday cash, this is not possible (now) due to the low throughput of the Bitcoin blockchain and the high fees. Fees are also unlikely to drop over time because as mining becomes less profitable, the only source of income of miners (those maintaining the network) are fees.

Instead, Bitcoin’s value proposition somewhat shifted over the years. It went from P2P cash to a hedge against the exact broken system that pushed Bitcoin to be created, a simpler way to name it: a hedge against inflation/fiat devaluation. In the latest quantitative easing run of 2020 by the Federal Reserve, corporations and well-known investors were forced to consider Bitcoin and large amounts of capital were poured into it.

But Bitcoin has more properties, important ones too like censorship-resistance. That is pushing some countries to recognise its value. In the case of Iran, this may be a way to beat US hegemony, that’s why the government has allowed the Central Bank to fund imports with Bitcoin purchased from licensed Iran-based BTC miners.

The Financial System Shift

There is no doubt that something needs to be done for this devaluation of currencies, as it cannot continue forever. This is causing a lot of capital to take a chance with Bitcoin. Since this is one of the most, if not the most, important topic today outside money is flowing into Bitcoin more than any other cryptocurrency.

This has a positive point, it introduces the legacy financial system guys to the new financial system and familiarises them with the concept related to it (wallets, transfers, etc.).

Ethereum vs Bitcoin

It’s unfair to say “vs” because each of these assets serves a different purpose and has a different value proposition. Bitcoin is a value-protecting asset, or at least that’s how it’s being used whereas Ethereum is more like an entire financial system with all its complexities that lets anyone come in and build products (smart contracts).

DeFi: The Future of Finance

Putting aside all the exit-scams and fraudulent attempts some people have and are making using the DeFi hype, Decentralised Finance really is the future of finance. You’ll only know it if you’ve interacted with a DeFi protocol.

The censorship-resistance, decentralisation, trustless ecosystem is a big step in the right direction for finance and that’s what DeFi is. More importantly, it’s no longer an uneven playing field where only the big corporations or banks can create financial products or only the wealthier people can access certain financial products (this has pros and cons).

Ether’s Value

Ether (ETH) is the native asset used to transact on the Ethereum blockchain. That means every DeFi transaction has to use Ether for it go through in the future of finance. That’s big but the problem is the economic model of Ether just isn’t there, because when Ethereum was created “Tokenomics” weren’t really a thing.

So why did ETH’s price increase during the DeFi summer? Because of its speculative value, people speculating that Ether’s economic model would get fixed alongside a few other problems.

One of the main things people were waiting for was Ethereum 2.0 (more details here) which makes the Tokenomics of Ether much better by reducing the supply through staking. The second awaiting proposal implementation is EIP1559 which solves the sky-high fees problem and also causes a frequent burn of circulating ETH with each transaction which reduces the supply when demand is increasing which should positively impact ETH’s price in theory.

Can Ether topple Bitcoin?

Our honest opinion and educated guess is yes, but not now. Now the stage is set for Bitcoin, this draws more people into crypto and once the Bitcoin narrative starts fading away a bit Ether can take the number 1 spot by market capitalisation.

The way we see it is everyone is very excited about digital “Gold” but Ethereum is in some sense more like a very well developed tech company everyone will be using.

To give a sense of time, we believe this is possible in the next 5 years, it’s not in the short or medium term.

Now to give a sense of the numbers, assuming Bitcoin’s market cap and price remain the same (very hard to believe it won’t increase) then Ether would need to cross $2,300 in price for that to happen.

Though the question is: by that time, how much is a dollar worth anyway?

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.