Will my Altcoin bags go back to All Time Highs?

Often, when you talk to any individual involved/invested in crypto that has been around since at least 2017, there’s a common belief system you notice: “All coins will go back to their respective all-time highs”.

Psychologically, this belief is mainly derived from the Bitcoin cycles where every bear market was followed by a new bull market that drove its price to new all-time highs.

Is it a myth, a legend or is it a fact? Let’s debunk this.

We’ll use two separate routes:

- First, using statistics from previous cycles

- Second, we’ll cover the topic from a fundamentals perspective

Statistics

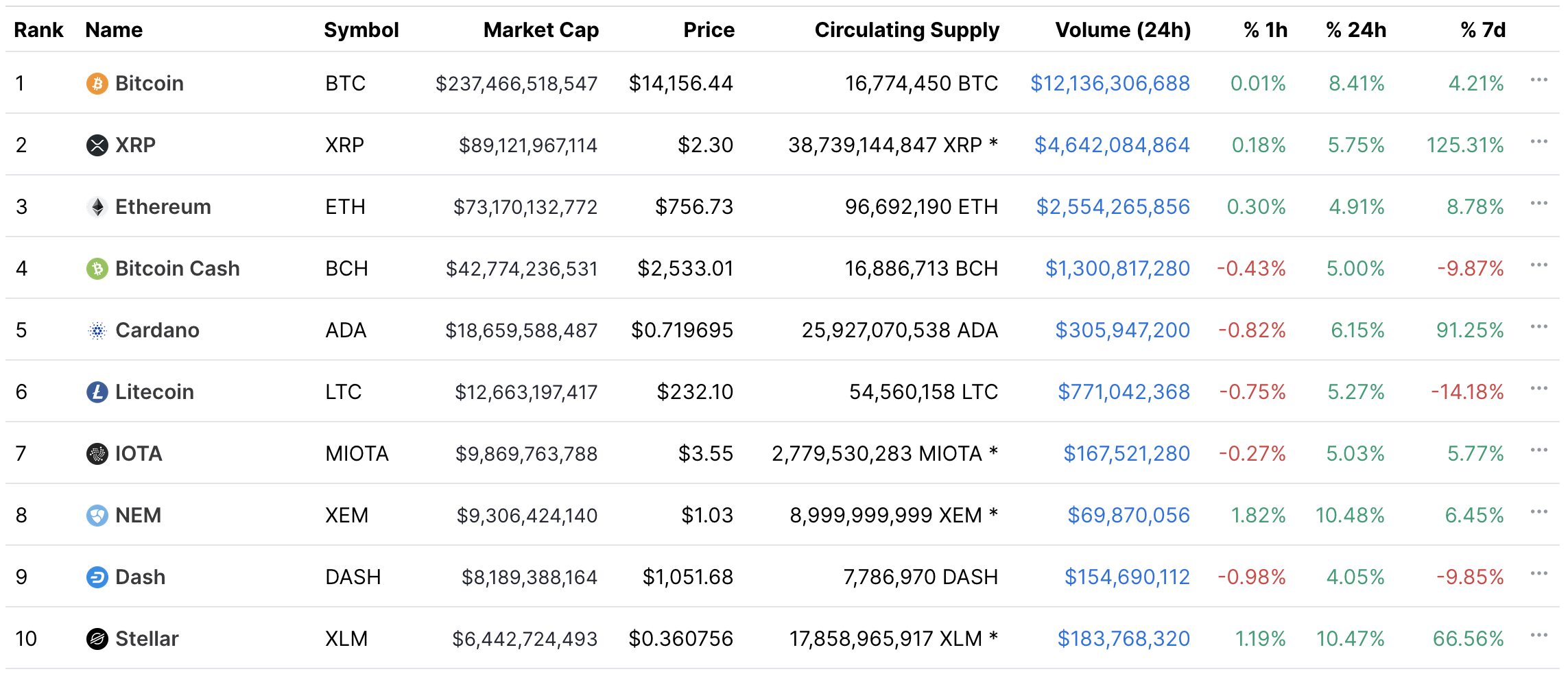

We’re going to look at the Top 10 coins by market capitalisation at the height of the 2013 cycle (30/11/2013 - 04/12/2013) and then track their performances through the 2017 cycle.

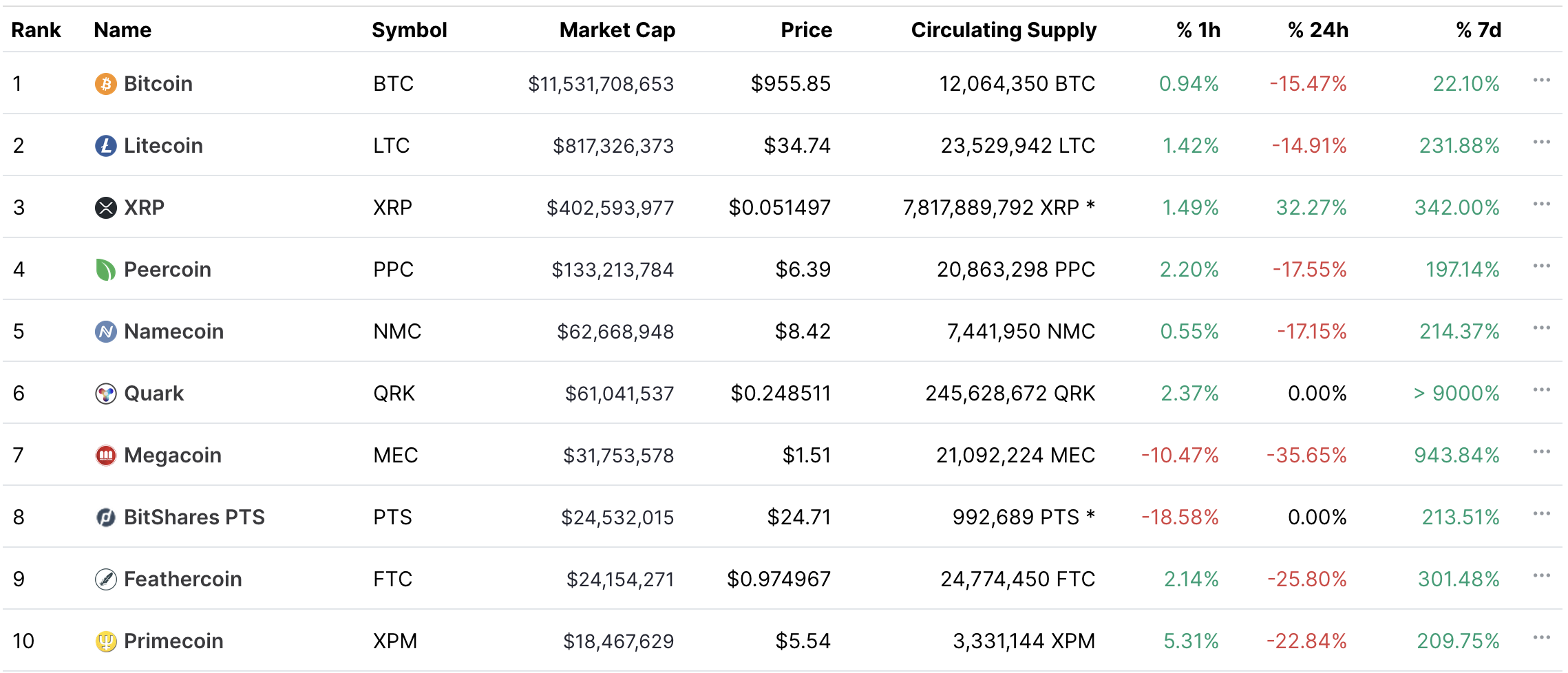

This is a historic snapshot of the “Top 10 MCap” list taken from 1 December 2013:

If you look at the 7 day % performances you can tell that this was a euphoric time which tends to signal the top of a market. Our topic here is Altcoins, therefore Bitcoin won’t take part of this statistical analysis. After all, Bitcoin’s performance over the years is quite famous to say the least.

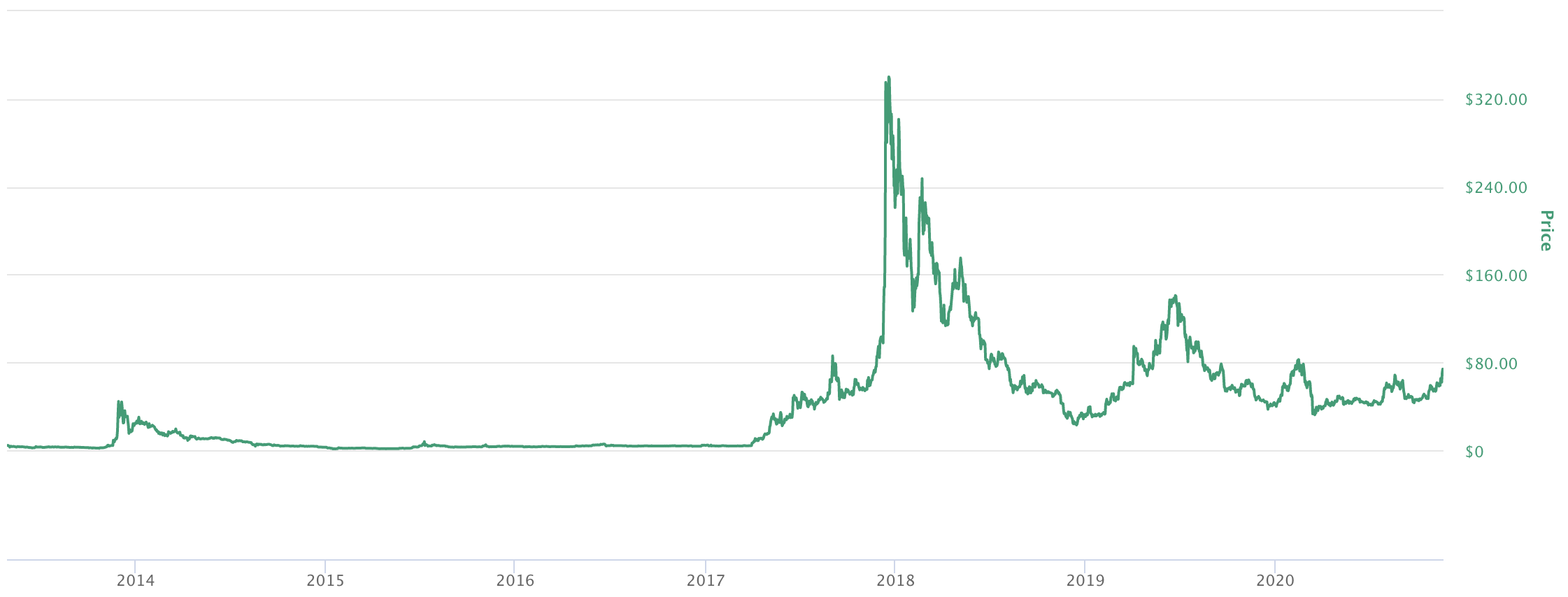

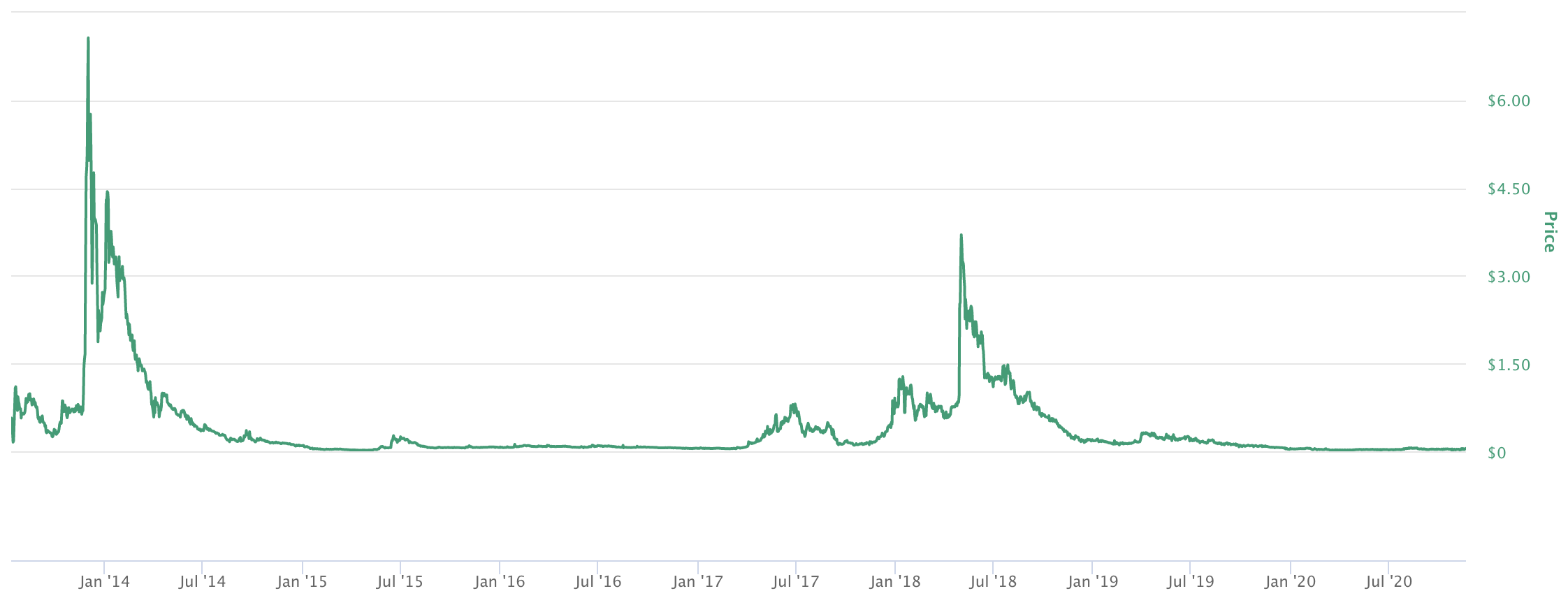

Litecoin (LTC)

Sometimes dubbed the crypto-silver in the “Bitcoin is Gold” narrative, LTC survived the 2014 bear market as we all know and remained part of the Top 10 but fell from the 2nd spot to 6th.

The 2013 peak around $40 is a blip compared to the 2017 cycle where price topped around $340, a 750% increase from peak to peak.

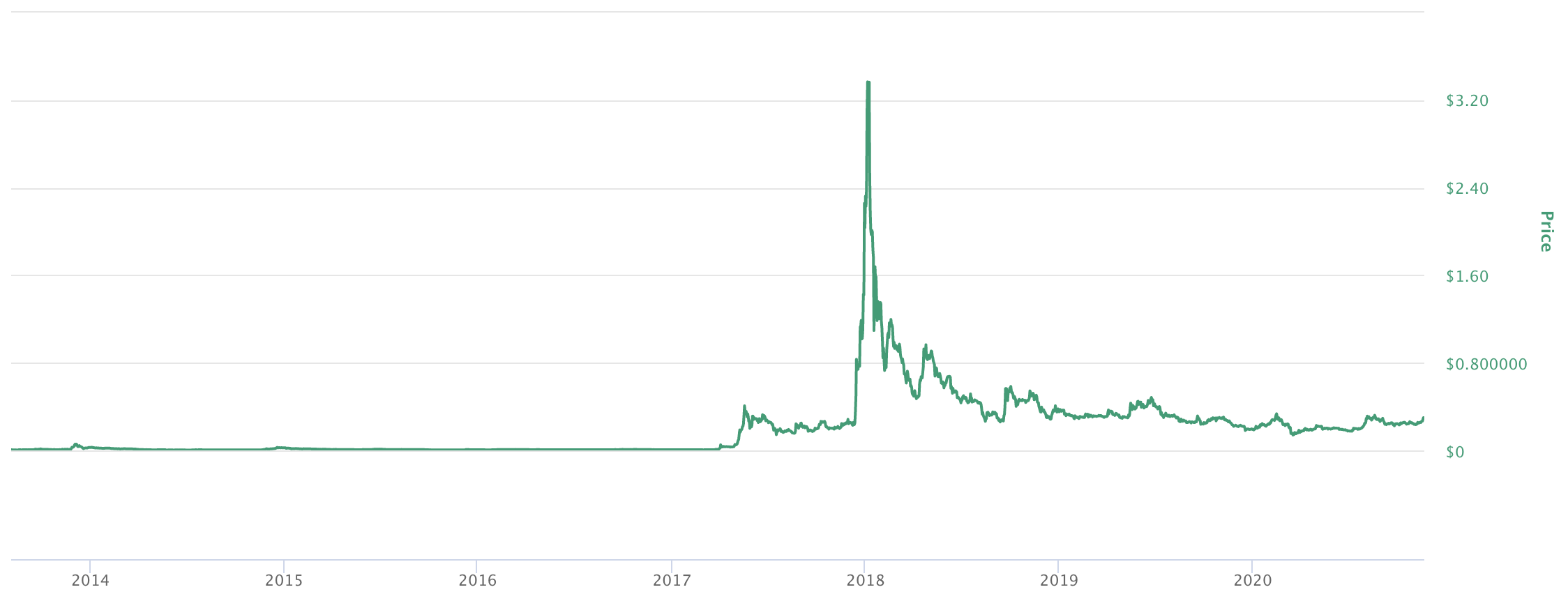

XRP

Retained 3rd largest MCap spot (if we exclude stablecoins).

Once again, the 2013 peak of $0.057 is a very small dot compared to the 2017 high of $3.37, a 5,812% increase from peak to peak.

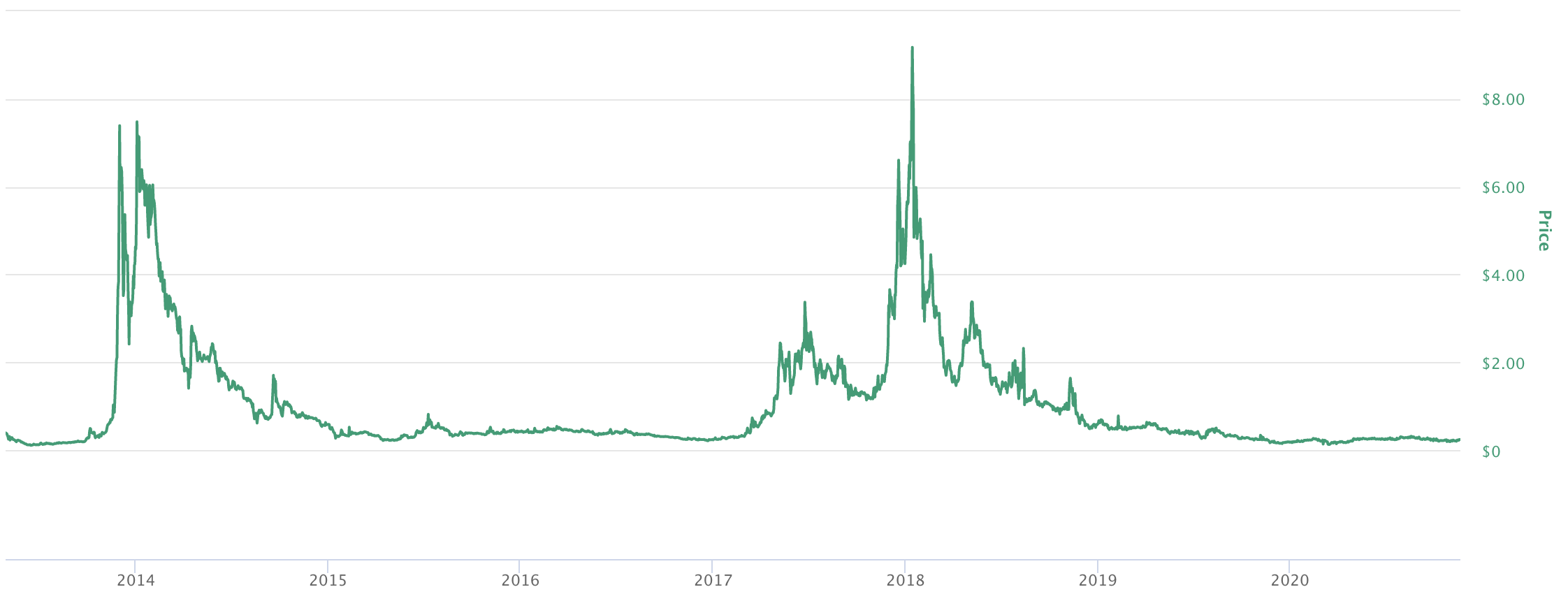

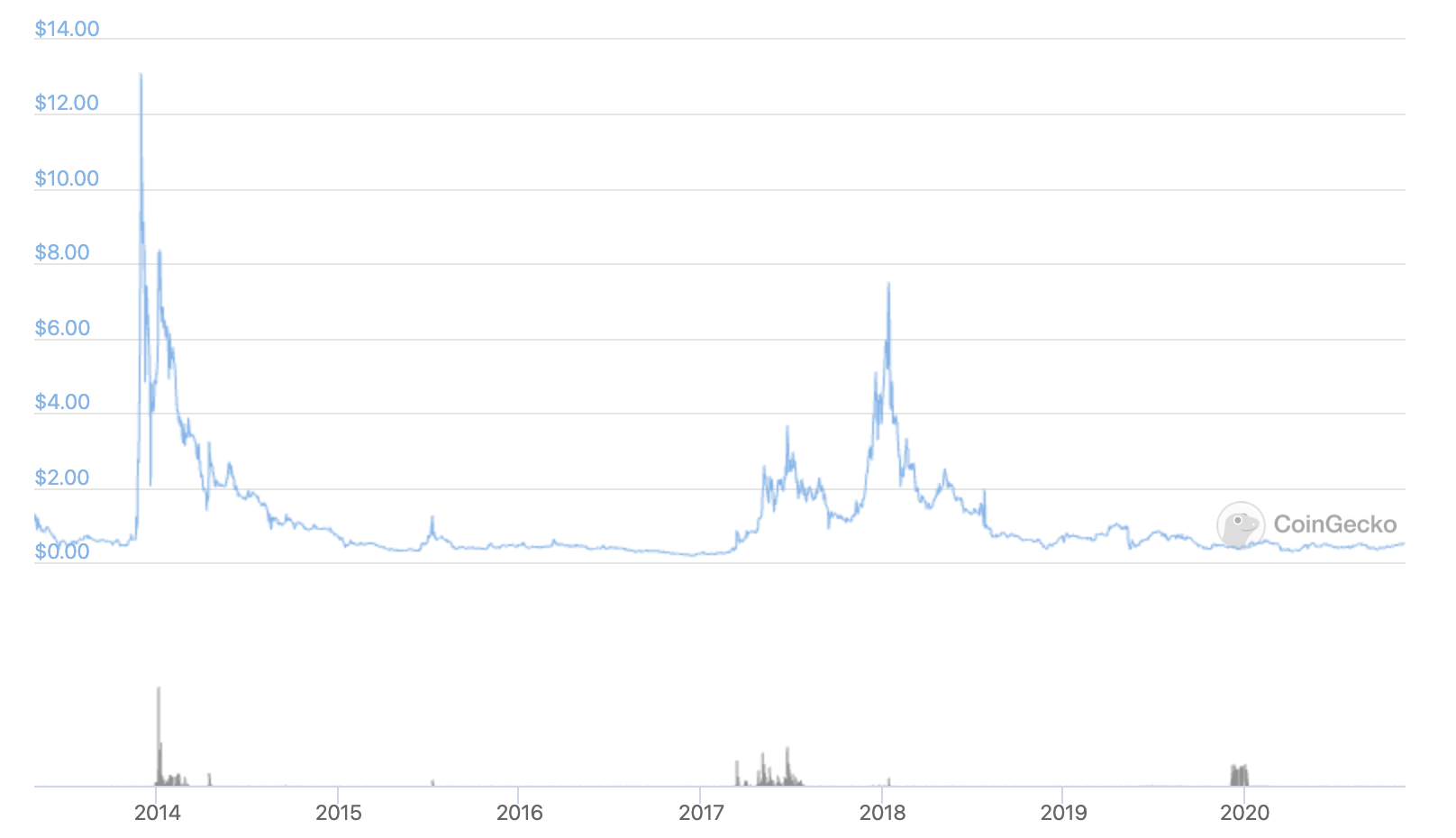

Peercoin (PPC)

Peercoin was the innovator behind the Proof-of-Stake (PoS) consensus algorithm that many chains have adopted or are adopting like Ethereum. Calling it useless or innovation-less would be highly unfair.

Its 2013 peak was $7.5 while its 2017 peak was $9.18, a 22.5% increase from peak to peak which is very insignificant in the wild world of cryptocurrencies. Today, PPC is ranked 695 by market capitalisation.

Namecoin (NMC)

This network was forked from the Bitcoin code and had the additional capability of storing data within its blocks.

Its price peaked at $13 in the 2013 cycle and $7.5 in the 2017 one, a -50% decrease from peak to peak. That means anyone who “held a bag” from the euphoric part of the 2013 cycle, never broke-even let alone realised any profit.

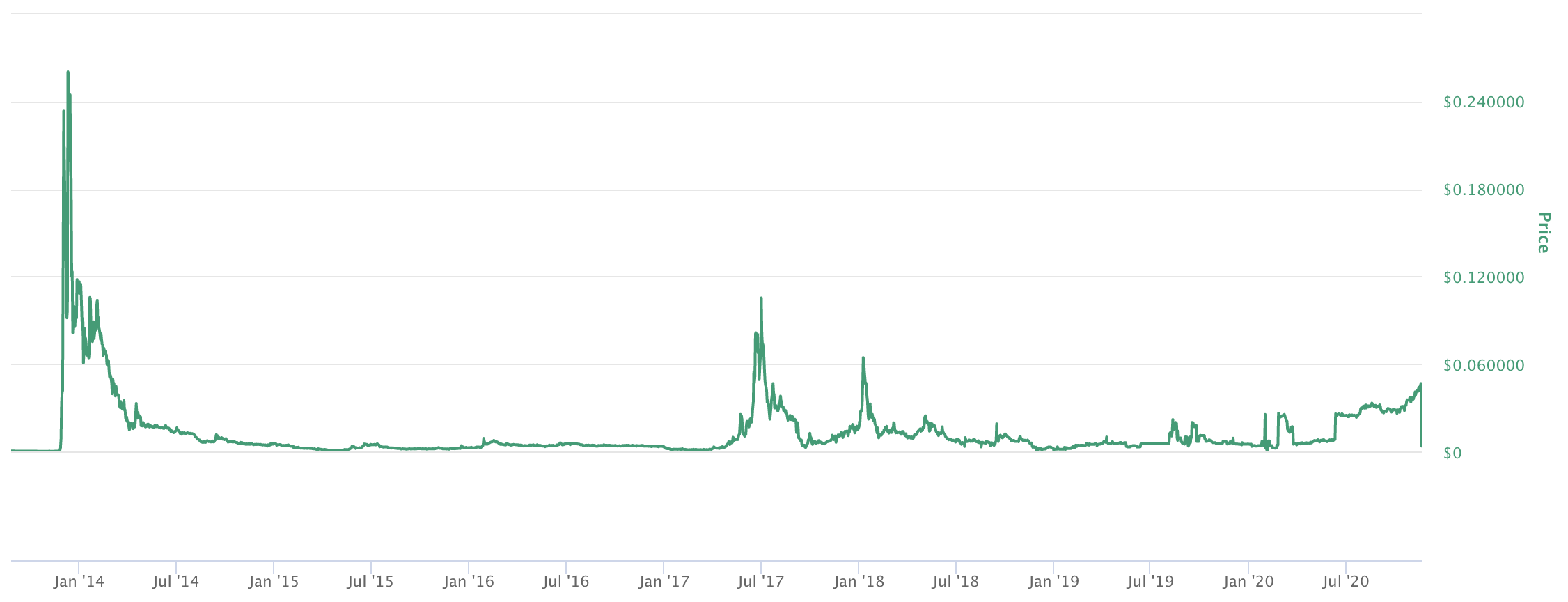

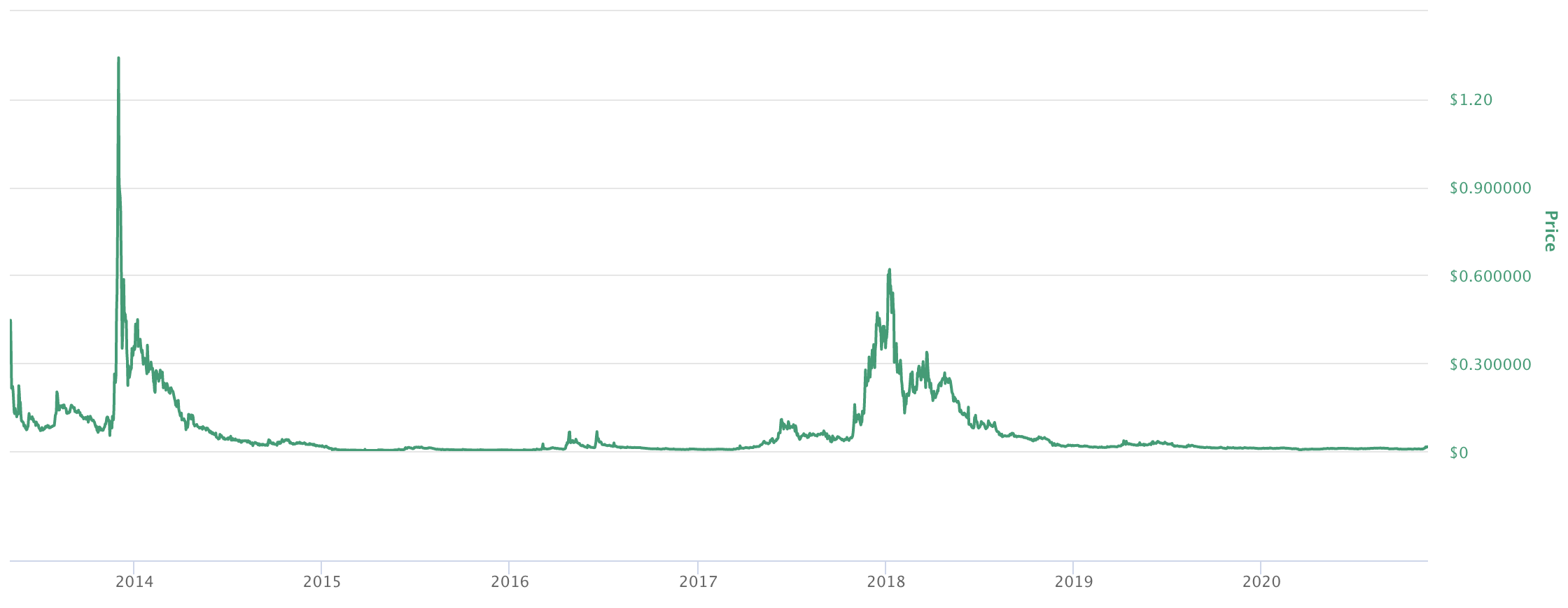

Quark (QRK)

QRK is one of the many cryptocurrencies to come out as the payments system for online transactions.

2013 price peaked at $0.26 while the 2017 bubble peak barely got it to $0.10, a -61.5% decrease from peak to peak.

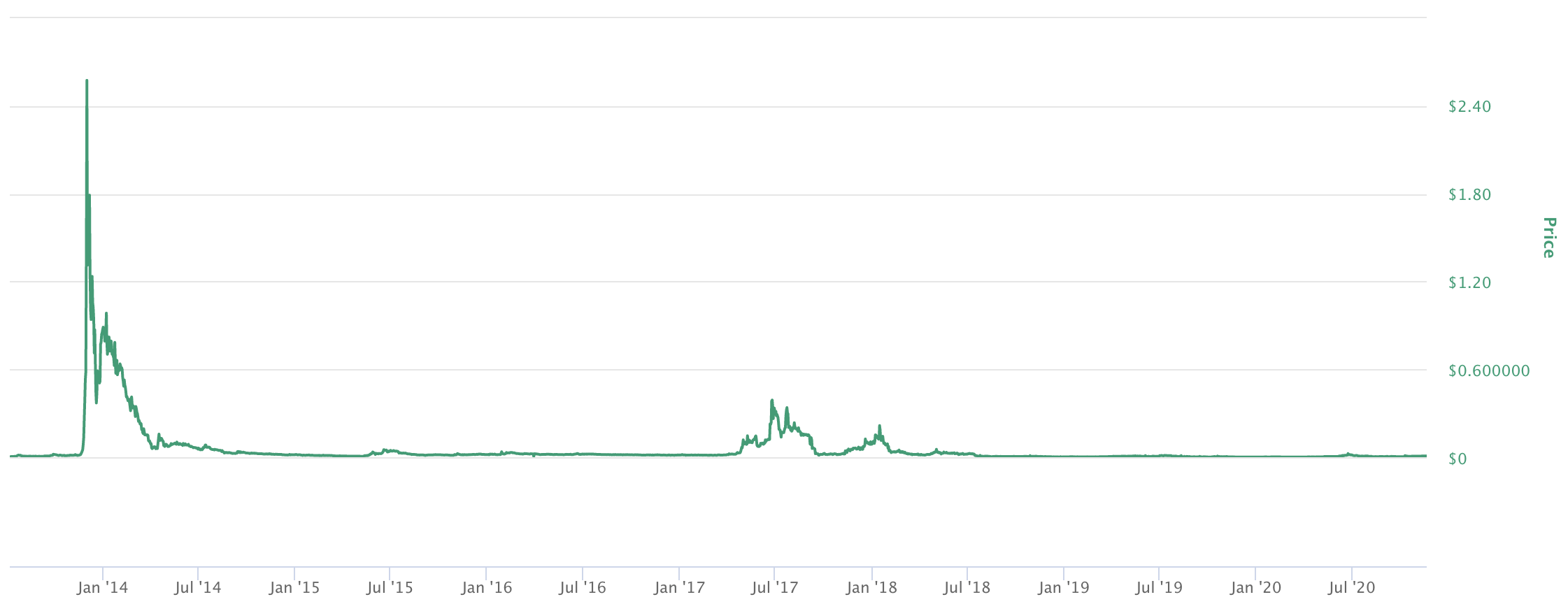

Megacoin (MEC)

Dubbing itself as “a new type of decentralised currency”, Megacoin is one of the mega-fails which now sits at ranking 1526 in MCap.

The 2017 peak of $0.39 is a blip compared to the 2013 peak of $2.58, a -85% decrease from peak to peak.

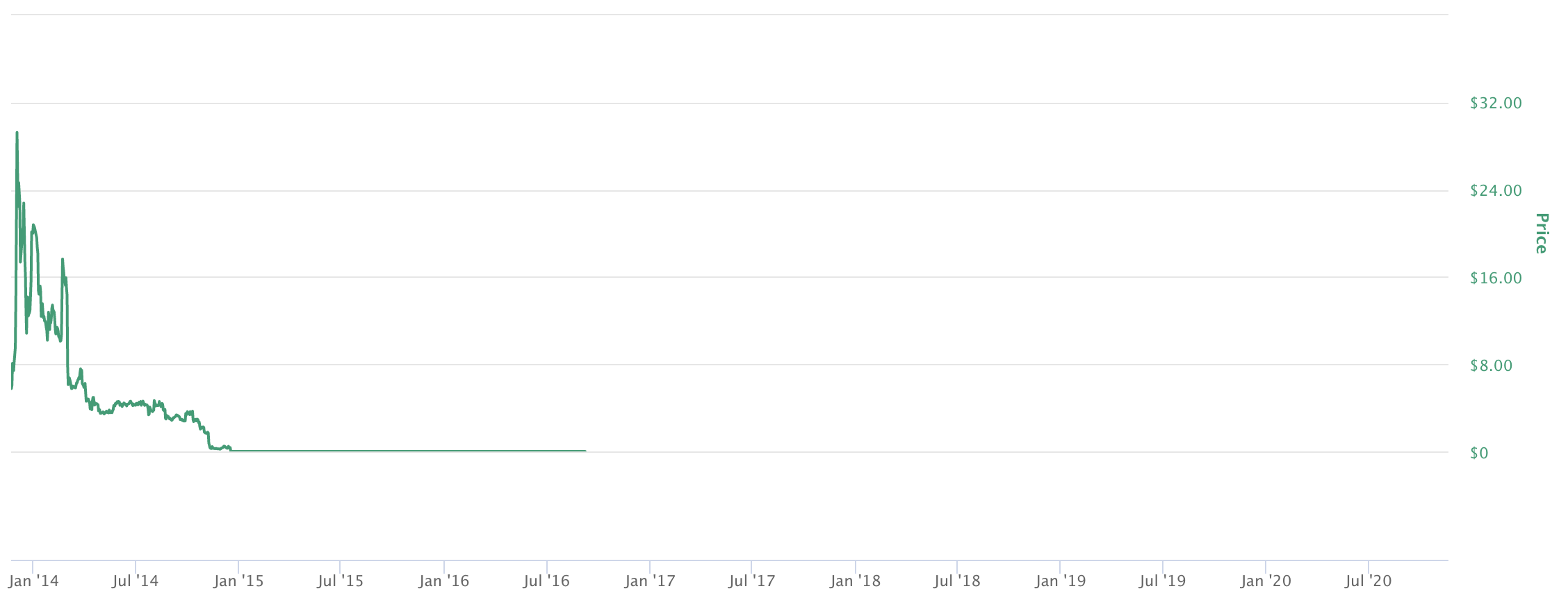

BitShares PTS (PTS)

The team behind this was fast enough to capitalise on the 2013 bubble before outright scamming people and selling all their coins, that seems to be the story that the chart tells. From old reddit posts, we’ve found that they called themselves a DAC (Decentralised Autonomous Company).

PTS’ price did rally by about 300% but then experienced ultimate death and extinction, basically a -100% decrease from peak to peak.

Feathercoin (FTC)

Promoted as user friendly, secure, having low fees and fast settlement, FTC today is ranked 747th in the MCap list.

Price peaked at $1.34 in 2013 and $0.615 in 2017, a -54% decrease from peak to peak.

Primecoin (XPM)

Marketed as an “innovative cryptocurrency”, XPM now sits at 1053rd in the MCap list with less than $10k in daily trading volume.

Price peaked at $7.07 in 2013 and $3.70 in 2017, a -48% decrease from peak to peak.

Stats Summary

|

Top MCap Coins (2013 cycle) |

2013 Peak |

2017 Peak |

Peak to Peak Increase/Decrease |

|

Litecoin (LTC) |

$40 |

$340 |

750% |

|

XRP |

$0.057 |

$3.37 |

5,812% |

|

Peercoin (PPC) |

$7.50 |

$9.18 |

22.50% |

|

Namecoin (NMC) |

$13 |

$7.50 |

-50% |

|

Quark (QRK) |

$0.26 |

$0.10 |

-62.50% |

|

Megacoin (MEC) |

$2.58 |

$0.39 |

-85% |

|

BitShares PTS (PTS) |

$30 |

$0 |

-100% |

|

Feathercoin (FTC) |

$1.34 |

$0.615 |

-54% |

|

Primecoin (XPM) |

$7.07 |

$3.70 |

-48% |

Fundamentals

Let’s be frank and very openly honest: ~90% of this market is made up of scams or incompetent projects.

Bubbles happened as a result of Bitcoin’s meteoric rises and the saying “a rising tide lifts all boats” applies here.

Most of these coins have pumped on “nothingness”, no fundamental reason or actual usage behind them with a good economic model. They pumped from speculation.

Speculators come in two forms: those that anticipate and those that chase. Those that anticipate are people refer to as “smart money”, they place bets and await for some herd to lift prices. Those that chase are referred to as “dumb money” who buy near the top and are too greedy to sell. They end up holding a bag, either dumping at the bottom from hopelessness or awaiting some sort of increase to sell which represents a lot of selling pressure.

Given the uselessness and selling pressure, these coins never make it back to ATHs and fail miserably (as they should).

2013 vs 2017

We’d love to say the market is getting smarter as time goes by, but it would not be an honest answer. The greed is the same, the bubbles are the same and the results also look like they’re about to be the same.

The difference between cycles is mainly the marketing if we are being frank. 2013 saw Bitcoin’s first attempt at 4 figures, it was a model for success. New projects tried to capitalise by creating “the new and better Bitcoin” and adding the term “coin” at the end of their name gave them some sort of credibility back then.

In 2017, the marketing came as “speed” and “scalability” with new blockchains and smart contracts mimicking Ethereum.

2017 vs Now

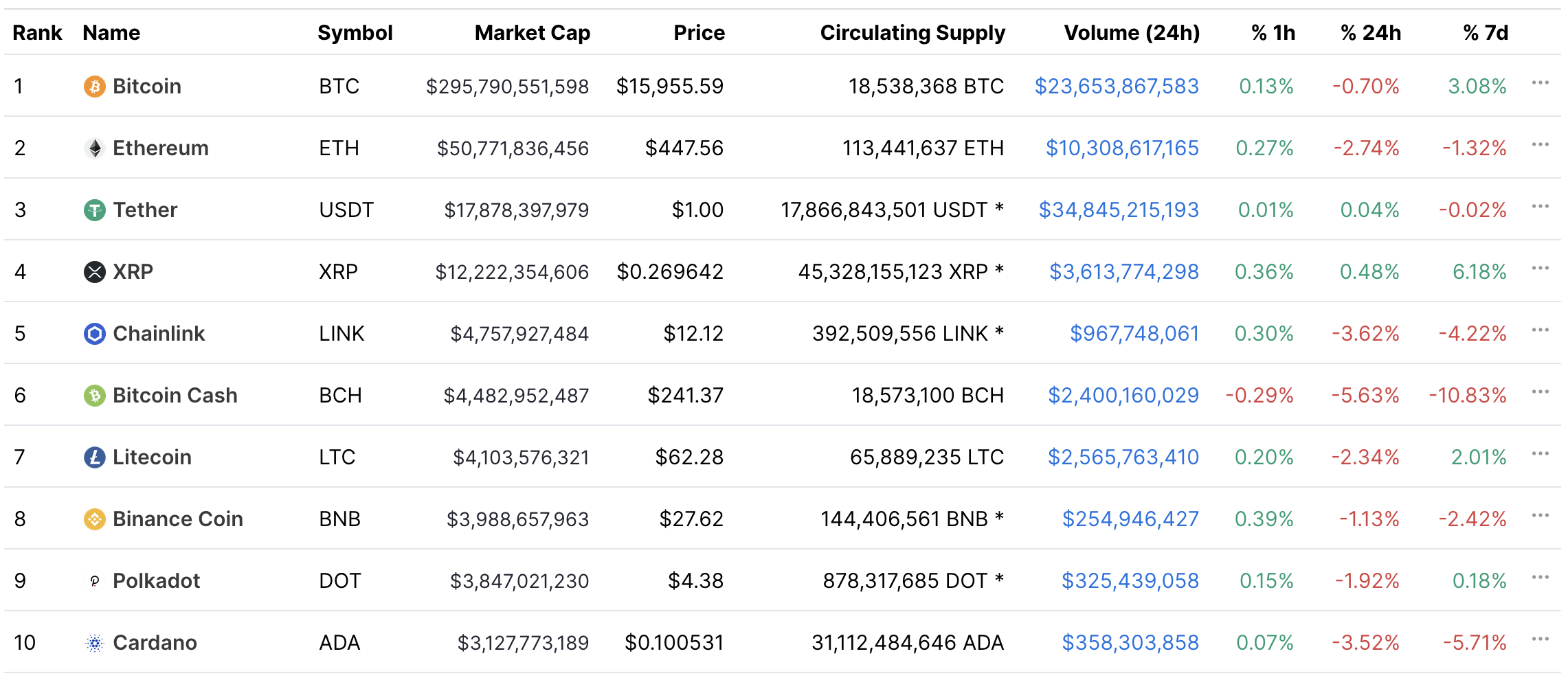

This is the Top 10 MCap list near the 2017 top

And this is the current Top 10

A good portion of them is either falling down the list or is already completely out of it.

Do you see the pattern? We do.

We have a theory, a well researched theory as to which new coins will make up the Top 10 list in the new cycle. There's yet again a marketing switch between 2017 and 2020, additionally some new low/mid-cap projects are working hard and delivering actual products (unlike the ICO era which was filled with roadmap promises). These would be coins that can cement a place throughout multiple cycles in the Top 10 list.

We're going to discuss our theory in the next few days in Discord Pro, where there's an existing channel for members to directly ask us questions and create an open conversation.