World liberty financial: Trump's latest crypto venture

Imagine a DeFi project with the financial clout of a political movement, the branding of a global powerhouse, and a narrative that promises to "Make DeFi Great Again." This is World Liberty Financial (WLFI) a DeFi protocol backed by the Trump family and a vision to reshape how financial markets operate. But beyond the flashy headlines and political endorsements, what does WLFI really offer?

In this report, we dive deep into WLFI's claims, explore its unique position in the DeFi ecosystem, and dissect whether it's a groundbreaking project or a centralized cash grab disguised as decentralization. We'll also break down WLFI's ambitious financial strategies, the asset allocations that raise eyebrows, and the high risks associated with the project's centralized revenue model.

We're here to uncover the facts, analyze the data, and give you a clear, no-nonsense view of what WLFI means for DeFi and the crypto market.

Let's dig in…

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is WLFI all about?

World Liberty Financial (WLFI) is a politically branded DeFi platform that aims to merge decentralized finance with US financial dominance. Unlike most DeFi projects, WLFI is heavily tied to political influence, leveraging the Trump brand to promote stablecoin adoption and lending services.At its core, WLFI operates as a lending and borrowing platform built on Aave v3, but instead of introducing new financial tools, it repackages existing DeFi infrastructure under a politically charged narrative. The project's stated goal is to position US-pegged assets at the centre of global financial settlements, reinforcing the dominance of the US dollar in digital finance.

However, the WLFI tokenomics and governance structure set it apart from other DeFi protocols. Unlike Aave or Curve, where governance tokens play a role in staking, collateral, and voting, WLFI's token is non-transferable after purchase and offers no direct financial benefits like staking rewards or yield. Instead, governance decisions are made through a centralized entity closely tied to the Trump family.

Beyond its financial model, WLFI also promotes its "Macro Strategy" token reserve announced recently, which holds Bitcoin, Ethereum, and select DeFi/RWA tokens.

Is WLFI really different from other DeFi Projects?

One of the biggest selling points of World Liberty Financial is its claim to be an innovative DeFi platform pushing financial accessibility and stability through crypto. But when we break it down, does it actually bring anything new to the space, or is it simply a rebranded, politically affiliated investment fund?WLFI markets itself as a decentralized protocol focused on stablecoin adoption, lending, and tokenization. But when we analyze the mechanics, governance, and revenue model, the cracks start to show. Instead of pioneering new DeFi technology, WLFI relies on existing protocols like Aave v3, and its governance structure is one of the most centralized in the space.

Here's how WLFI compares to major DeFi projects like Aave, MakerDAO etc:

- Governance: Unlike Aave or MakerDAO, which allow token holders to actively participate in proposals and votes, WLFI's governance token is locked and non-tradable (for now), meaning users have no real say in the protocol's decisions.

- Revenue flow: While platforms like Curve distribute earnings to liquidity providers and stakers, WLFI directs 75% of its profits to a Trump-affiliated entity. This setup raises concerns about whether WLFI truly benefits its users or if it's just another financial vehicle designed to channel funds into a political network.

(Source: Gold Paper)

- Product innovation: Aave and MakerDAO introduced novel DeFi mechanisms-Aave revolutionized lending pools, while Maker pioneered decentralized stablecoin collateralization. WLFI, on the other hand, is simply deploying Aave v3 with a different branding.

- Liquidity & market presence: Aave and MakerDAO have deep liquidity and proven stability, while WLFI's entire model revolves around leveraging political influence to gain traction rather than building organic adoption.

WLFI tokenomics: A governance token with no financial utility

The WLFI token plays a central role in the platform's governance, but unlike traditional DeFi governance tokens, it lacks financial incentives such as staking, yield, or direct profit-sharing. This structure raises questions about its true value proposition and whether it's designed more as a political fundraising tool rather than a genuine decentralized asset.Breakdown of allocation:

- 35% - Token Sale → The largest allocation, supposedly for broad participation, yet the identities of buyers remain undisclosed.

- 32.5% - Community Growth & Incentives → Positioned as a way to boost engagement, but without clear governance mechanics, it risks being a controlled distribution tool.

- 30% - Initial Supporter Allocation → A significant insider share that could concentrate power among early backers, raising concerns given WLFI's political affiliations.

- 2.5% - Team & Advisors → A small cut, but with a team lacking deep DeFi expertise, its effectiveness remains questionable.

Token supply & distribution

- Total Supply → 100 billion WLFI

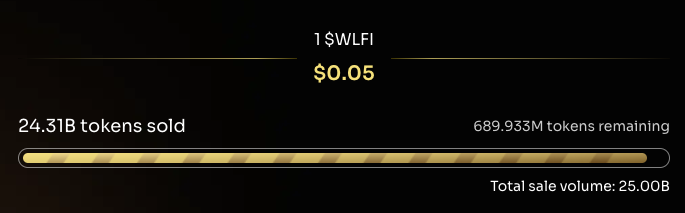

- Initial Token Sales → Two major sales have taken place so far:

- First Sale (Sept 2024): 21.3 billion tokens sold at $0.015 per token, raising $319 million

- Second Sale (Feb 2025): Tokens sold at $0.05 per token (3.01B tokens sold already, 690M remaining), raising $150 million

- Total Raised So Far → $469 million

These figures suggest strong market demand. But here's where things get murky: WLFI token buyers do not receive a stake in platform profits, nor do they have the ability to freely trade their tokens. The WLFI token is purely for governance but with no clear path to value accrual or liquidity.

WLFI asset allocation: Where is the money going?

With over $469 million raised, WLFI's asset allocation strategy has become a focal point of scrutiny. Unlike traditional DeFi projects that reinvest capital into protocol development, liquidity incentives, or community growth, WLFI's treasury appears to be operating more like a crypto hedge fund-accumulating assets, making strategic purchases, and even frontrunning announcements.WLFI's asset breakdown

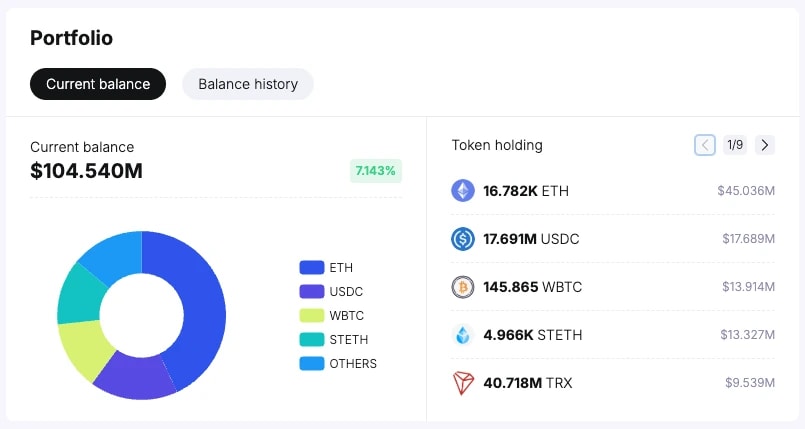

World Liberty Financial (WLFI) currently holds an on-chain portfolio valued at approximately $104.54 million, with a significant portion allocated to Ethereum (ETH), stablecoins, and Bitcoin (WBTC).The allocation suggests a conservative approach, balancing high-liquidity assets like ETH ($45.25M), USDC ($17.69M), and WBTC ($14.03M) with selective exposure to DeFi and RWA-focused projects. Additionally, WLFI maintains stETH ($13.39M) while keeping a $9.64M position in TRX

Beyond its core holdings, WLFI has notable investments in DeFi and infrastructure tokens such as AAVE ($721K), LINK ($676K), ONDO ($433K), and ENA ($359K), indicating an interest in both established protocols and emerging real-world asset (RWA) projects. The portfolio also includes MOVE ($2.36M).

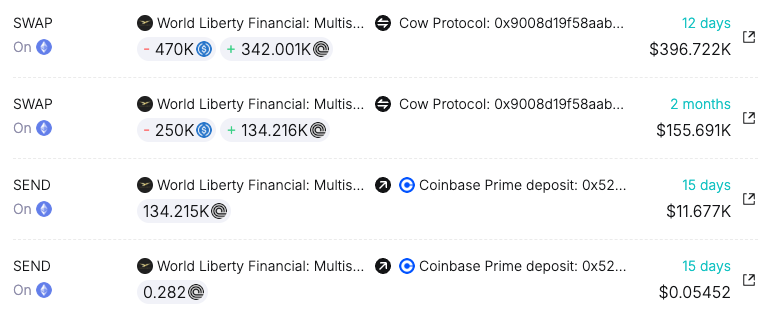

However, a major development came on February 4th, when WLFI moved $307.41M worth of assets from its on-chain wallets to Coinbase Prime for treasury management and operational liquidity. The transfer included 73,783 ETH ($212.6M), 552.92 WBTC ($52.7M), and significant holdings in AAVE, LINK, ENA, MOVE, ONDO, and USDC.

This move suggests that WLFI is either consolidating funds for strategic investment, seeking greater security and liquidity management, or moving its funds off-chain.

WLFI's insider trades?

On February 6th, WLFI quietly accumulated 342,001 ONDO tokens ($470K)-just days before publicly announcing a strategic partnership with Ondo Finance. This raises an important question: was WLFI front-running its own announcement? The timing suggests that the fund was already positioning itself ahead of the news, potentially anticipating a price reaction once the partnership was revealed.

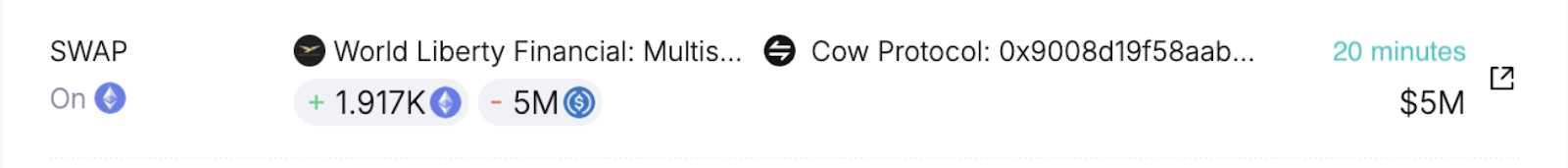

This wasn't an isolated event. On February 13th, WLFI made a well-timed Ethereum purchase, acquiring 1,917 ETH for $5M at an average price of $2,608-just before the NYSE proposed a rule change to allow ETH staking on Grayscale's spot Ether ETFs. The pattern is clear: WLFI isn't just investing in key sectors like RWAs and ETH; it's front-running major market events.

Even more concerning is Eric Trump's repeated bullish posts about ETH leading up to these announcements. Did he know what was coming? These moves raise serious questions about insider advantage and market integrity.

Is WLFI an attractive investment?

With its token locked, governance meaningless, and revenue funnelled to insiders, the biggest question remains: what real value does WLFI bring to DeFi?While traditional projects introduced groundbreaking financial mechanisms, WLFI appears to repurpose existing DeFi infrastructure while marketing itself as a revolutionary platform.

- It lacks any new lending mechanism.

- It doesn't distribute revenue fairly.

- It is controlled by a centralized entity, not a DAO.

Risks involved in WLFI

Centralization & governance risks

Despite its DeFi branding, WLFI operates more like a centralized investment vehicle. The Trump family holds key roles, yet governance remains largely opaque. Holders of WLFI tokens have no financial rights, as they are strictly non-transferable, making them effectively useless beyond voting. Additionally, the fact that 75% of the protocol's revenue flows to a Trump-affiliated entity raises serious concerns about who actually benefits from this ecosystem.Political uncertainty

WLFI's close ties to Trump's brand introduce a layer of political and regulatory risk that few DeFi projects face. If the political landscape shifts, WLFI could find itself on the wrong side of regulatory scrutiny..Insider-Driven market moves

The recent ONDO acquisition, made just before revealing a strategic partnership, raised some concerns. While traditional hedge funds and institutional players engage in similar behaviour, in DeFi, such insider-driven accumulation contradicts the ethos of transparency and fair market participation. With no clear regulations governing this space, retail investors could easily find themselves on the losing end of WLFI's market manoeuvres.Lack of true innovation

At its core, WLFI does not introduce any new technology or financial primitives. Instead, it relies on existing infrastructure like Aave v3, repackaging familiar DeFi lending mechanics under a politically charged brand. While its marketing is aggressive, there's little technical differentiation from well-established protocols. Without a strong competitive edge, WLFI risks becoming a temporary hype cycle rather than a sustainable force in decentralized finance.Tokenomics & liquidity risks

WLFI has raised $469 million, yet its token model offers almost no financial utility to holders. The tokens are non-transferable, meaning investors can't exit their positions or trade them on secondary markets. WLFI token holders are left with governance rights but no economic incentives. In its current form, WLFI's tokenomics serve insiders far more than retail participants.Cryptonary's take

World Liberty Financial is making big moves in DeFi, but not in the way most would expect. With deep political ties, major capital deployments, and a focus on tokenized assets, it's clear that WLFI is playing a different game. Its centralized control, insider-heavy allocations, and strategic market positioning raise questions- is this true DeFi innovation or just a politically driven financial vehicle?The biggest red flag for us is the governance structure and revenue flow. WLFI token holders have zero real utility beyond governance, and even that seems more symbolic than functional. 75% of net revenue flows directly to a Trump-affiliated entity, which is a setup we rarely see in true DeFi protocols.

At this point, WLFI is walking a fine line between innovation and controversy. It has the capital, the political reach, and the market positioning to make a serious impact whether it's a sustainable DeFi powerhouse or just a well-branded financial vehicle remains to be seen.

The lack of transparency, insider-heavy allocations, and questionable market moves cast a shadow over its long-term credibility. Given these concerns, we would advise staying cautious and thinking twice before getting involved with the project.

Peace!Cryptonary, OUT!