X-Report 4.0: An Awaited Adventure

We have made multiple investments over the past 12 months and for the most part they have worked out quite well. We're always striving to put our money behind the new financial system, a fairer system that will help millions of people access fair products and a real free market: Decentralised Finance (aka DeFi).

Within this new financial system, there exists multiple sectors/verticals which we have broken down in this journal. One part of one of these sectors is something we've been looking to invest in for a very long time but the options were very limited, the winner wasn't really on the market yet... until now.

Here, in this fundamental research report, you'll find all details regarding this product and its token.

Note: Not available to US residents due to regulatory reasons.

Story Time

Let's wind the clocks back to 2016, when Bitcoin had not yet delved into the five figure territory (i.e. $10,000+), an exchange called BitMEX came out with a new product called "Perpetual Swaps" which is also often referred to as perpetual futures. Usually, futures contracts have an expiry date and when that time comes, the price of the contract needs to settle at the price of the underlying in spot markets. This ensured that the contracts would eventually converge to the right price but they never really caught traction in crypto because they seemed complex for retail.You see, for a retail audience, futures are a way to lever up and speculate. You can't really explain to them "sir, your contract has expired, if you'd like to maintain your position in the market you'd have to roll it over to the next contract" - there's a chance that this even went above your head!

Well, the solution was to create a contract that had no expiration, one people would use to speculate on Bitcoin and it would give them access to cheap leverage, unlike margin where large interest is charged. The problem was: no expiration = no way to maintain price close to the underlying and that is where BitMEX came in with the concept of the Funding Rate - the backbone of perpetuals.

The above may not interest everyone but this one here definitely should. The introduction of this new product that was complex on the inside but simple to understand on the outside made BitMEX the king on the crypto streets for multiple years and it did it very fast. You know Alameda Research? The guys behind FTX led by Sam Bankman-Fried? Their story started as market makers on BitMEX and they occupied two spots on the BitMEX leaderboard which was like having a star on Hollywood's Walk of Fame back then - legends were born on BitMEX and it was all thanks to this one product. Of course, we cannot ignore that the marketing of it with 100x leverage also helped tremendously.

Quick Note: BitMEX is no longer king because of regulatory reasons - find out more here.

BitMEX's success, followed by ByBit, Binance Futures and FTX is majorly owed to perpetual futures which tells us that the demand is most definitely there and its unlikely to go anywhere. The exchanges we just mentioned though are all centralised, what if Perps went DeFi?

Introducing dYdX

dYdX is a derivatives exchange that offers both margin trading and perpetual futures, all in a decentralised manner on Ethereum.

Given the regulatory pressures and the natural cycle of innovation, the money flow and flood of users will likely head towards a decentralised derivatives exchange - especially if it is competent.

The exchange was launched in mid-2018, a time when only serious builders were in this space because the money was very thin and there were little to no rewards over the short-term. Led by Antonio Juliano, dYdX is the father of DeFi Perpetuals and has been progressing forward since their inception but they never released a token until now.

Exchange Mechanics

In DeFi, there are two ways to go for an exchange in regards to bringing liquidity: orderbooks or liquidity pools.- Orderbooks: Harder to gather high liquidity but can tolerate higher risk because of low slippage execution.

- Automated Market Maker/Liquidity Pool: Great way to bring liquidity to illiquid pairs but large order execution can result in massive slippage.

dYdX has off-chain orderbooks but keeps all transactions settlements on-chain, this helps increase speed and reduces gas costs. Traders can put an order in the books and if another trader comes to execute a trade against that order then the smart contract simply ensures those funds are still there and then executes the trade.

Right now, dYdX operates on Layer-2 using Starkware's StarkEx which uses zero-knowledge proofs. This has made the experience very relatable to centralised exchanges which eases the onboarding process.

DYDX, The Token

Token still not live on the market but incoming on September 8th 2021 at 15:00 UTC.

Product first, token second is an aspect we love seeing with DeFi projects because it drastically reduces the possibility of a team doing a scammy money grab - dYdX wouldn't have built a state of the art exchange that held through the September 7th 2021 crash when Coinbase and Binance couldn't handle it if they just wanted to run a quick scam.The purpose of the token is to decentralise the protocol. So far, all decisions have been made by the founding team and that is needed until that protocol is put on the right path and tracks. Once that's done, decentralisation comes into play and this is when a DAO (decentralised autonomous organisation) needs to be built to govern the platform. They have issued the token by the "dYdX Foundation" and have also made a statement that they will not be pursuing exchange listings which is all part of staying on the good side of the law in our opinion and perhaps a smart move too (we're not lawyers so our take is not worth much on this topic).

The DYDX token is a governance token by design that also reduces holders' trading fees on the exchange. There is no revenue sharing - yet. Honestly, when you pass governance to token holders it just becomes a matter of time until they vote revenue sharing into existence.

The Airdrop

This is BIG because the airdrop did happen and it'll likely be sizable. On February 18th 2021, we released a journal titled High Reward, Low Risk that showed two DeFi platforms that are likely to airdrop tokens to people who use them. Those of you whom have used dYdX on L2 (except US users) have become eligible for an airdrop just for having used it! The only cost was literally paying gas fees.Trading volumes between $1,000-$10,000 get ~1,150 DYDX tokens

Trading volumes between $10,000-$100,000 get ~4,350 DYDX tokens

Trading volumes between $100,000-$1,000,000 get ~6,400 DYDX tokens

Trading volumes of $1,000,000+ get ~9,000 DYDX tokens

To see earned reward and claim it on Sept 8 2021 at 15:00UTC, go here and connect your wallet: dydx.community/history

Valuation: The Maths

Buckle up, here come the numbers.

The total number of tokens is 1,000,000,000 (billion) but the initial circulating supply is meant to be ~80 million out of which 25 million worth of airdropped tokens have been subtracted and sent and into the treasury because their users did not meet trading requirements which now puts the initial circulating supply at just 55 million tokens; or 5.5% of the total supply.

This is both a blessing and a curse.

Blessing: Pumps price

Curse: Pumps price likely too fast which makes it hard to invest in at launch and brings too high of an FDV

What people care about is the Market Cap, the one CoinGecko and CoinMarketCap show on their homepage and that is calculated using the circulating supply. On the other hand, the fully diluted valuation (FDV) which is calculated using the total supply is often disregarded even though it fundamentally shouldn't - for some reason people only care about it in a bearish market and completely disregard it in a sideways or bullish market.

Assume a sideways/bullish market which is roughly what we have here, how will the market value it. Well, let's run a relative value analysis:

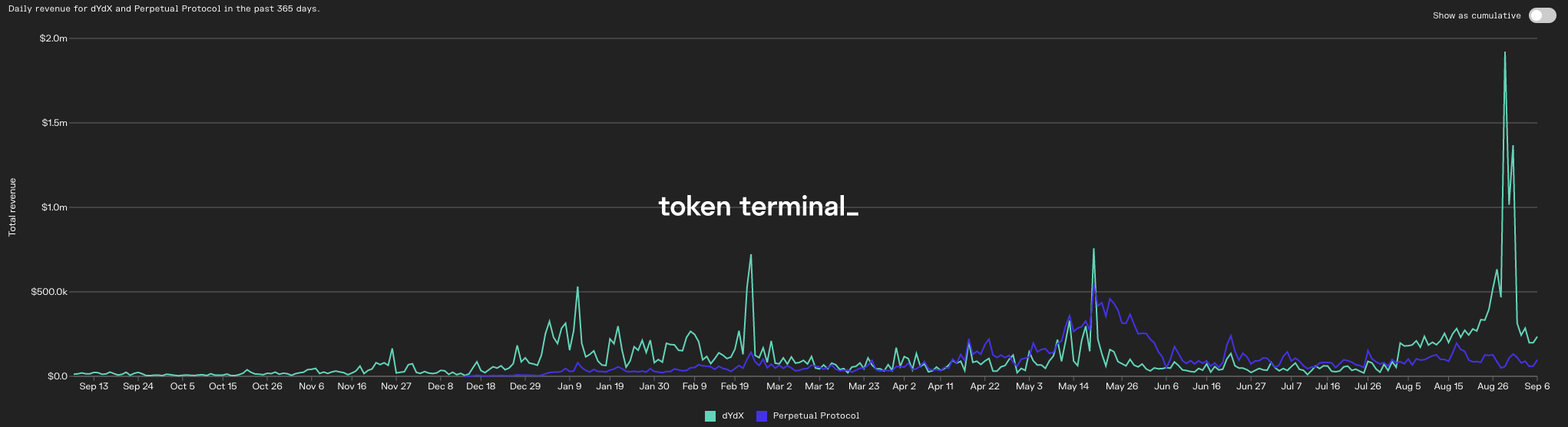

Perpetual Protocol is its competition and it's currently valued by the market at $900 million in MCap, but we must also note that dYdX is larger, older and has higher revenues.

Relatively speaking, the market should value DYDX at around $1 Billion in MCap which sets a token price of ~$18. Meaning the airdrop for the lowest trading tier is ~$20,000!

If the market were to rank it higher, given its history, moat and investors these are the different potential prices by MCap rankings:

Top 100: $17.30

Top 75: $32.30

Top 50: $63.60

Top 25: $135.50

Top 10: $510.90

Now obviously these are guideline prices and not a prediction. Our opinion is DYDX will reach over $20 within its first few days of trading.

Given the uncertainty, low float, likely large pump and unknown listing venues we will not be adding DYDX as a long-term investment until we have more clarity - nothing beyond the airdropped amounts we've gotten which should be reasonable exposure for now.

A long-term valuation will need to take into consideration the FDV as the total supply will be circulating, in addition to a 2% yearly inflation - it is one we plan on providing once we see further clarity.

Summary: Those who did read the original journal about interacting with dYdX are likely about to be handsomely rewarded, on the other hand looking for entries at listing is a gamble given the pumponomics involved over the short-term.

Disclaimer: THIS IS NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

TLDR

- Not Financial Advice

- Perpetual Futures are a popular and growing product in crypto

- Decentralisation is where money will likely flow from an innovation and regulatory standpoint

- dYdX is a decentralised perpetuals exchange built on Ethereum, functional since 2018

- DYDX token airdrop likely to be worth ~$20,000+

- Token fair price at ~$18

- Long-tem target will be updated in here once more clarity is provided from the market.