x402: The Future of Micropayments on the Internet

For nearly three decades, the internet has run on ads, not payments. Every time we read an article, watch a video, or use an app, we “pay” with our attention instead of money. That’s because sending tiny payments online was never practical. But that’s changing. Here’s what x402 is, why it matters, and and 3 assets positioned to benefit tremendously as this trend takes off.

TLDR

- The web has relied on ads because small payments weren’t feasible.

- x402 revives the forgotten HTTP code “402 Payment Required” using stablecoins for frictionless microtransactions.

- It enables direct payments between users, websites, and AI agents — no banks or middlemen.

- This could replace ads and subscriptions with fair, instant payments for every piece of content or API call.

- Early beneficiaries may include these 3 assets. Read the report for more details.

The problem with the Web

For almost thirty years, the internet has been powered by advertising. When we read news, watch videos, or use apps online, we rarely pay for them directly. Instead, we pay with our attention. Companies collect our data, show us ads, and that money keeps websites running. It’s the trade that made the modern internet possible:- free access for users

- ad revenue for publishers, and

- profits for advertisers.

The reason this happened is simple. There was never an easy way to make small payments online. Traditional payment systems like Visa and Mastercard charge a few percent plus a flat fee for each transaction. That might not matter when buying a $50 item, but it completely breaks down if you want to pay a few cents for an article or a single API request. Sending two cents and paying thirty cents in fees makes no sense. So instead of a web powered by tiny, direct payments, we ended up with a web funded by ads.

So, websites had three options:

- Put up paywalls and charge subscriptions.

- Run ads and give content away for free.

- Accept that small payments just weren’t practical.

Huge amount of ads on websites

When the internet’s first browsers were built in the 1990s, developers included an error code called “402 — Payment Required.” The idea was that one day, websites might ask for payment before delivering content. But the technology to make that happen never arrived. x402 revives that forgotten code, this time using digital currencies and blockchain technology to make instant, tiny payments possible.What is x402?

x402 is an open standard that brings payments back to the web itself. It builds on an old, unused part of the HTTP protocol, the 402 status code, which literally means “Payment Required.”When you visit a website today, your browser sends a request like:

The server then replies with the content (if it’s free) or an error (if it’s restricted).

With x402, a website can instead reply: 402 Payment Required

and include a note saying how much the content costs and how to pay, usually in stablecoins like USDC, sent over a blockchain such as Solana or Base

Your wallet (or your AI agent’s wallet) can then instantly send that payment. Once the site detects it, it sends back the content right away.

It’s a full payment flow built directly into the language of the web.

How It Works — Step by Step

- You ask for something — a web page, a data point, or an API response.

- The server says “Payment Required” — and gives you the cost and payment details.

- You or the agent pays instantly — usually with a small amount of stablecoin.

- You get what you paid for — instantly, no waiting, no middleman.

Why Is It a Big Deal?

The technology behind x402 matters because it finally makes micropayments practical. Stablecoins like USDC hold their value and don’t swing like regular crypto assets. Blockchains such as Solana and Base can process thousands of transactions per second at a cost so small it barely registers. That combination makes it possible to send a payment worth a fraction of a cent to anyone, anywhere, almost instantly. What was once impossible with banks and card networks becomes routine.There’s also a bigger shift happening at the same time. The next generation of internet users won’t only be humans but also AI agents. More and more interactions are happening between AI agents and APIs — not just between people and websites. For example:

- An AI assistant might read hundreds of news articles to summarise the topic.

- A research tool might call data APIs thousands of times to find insights.

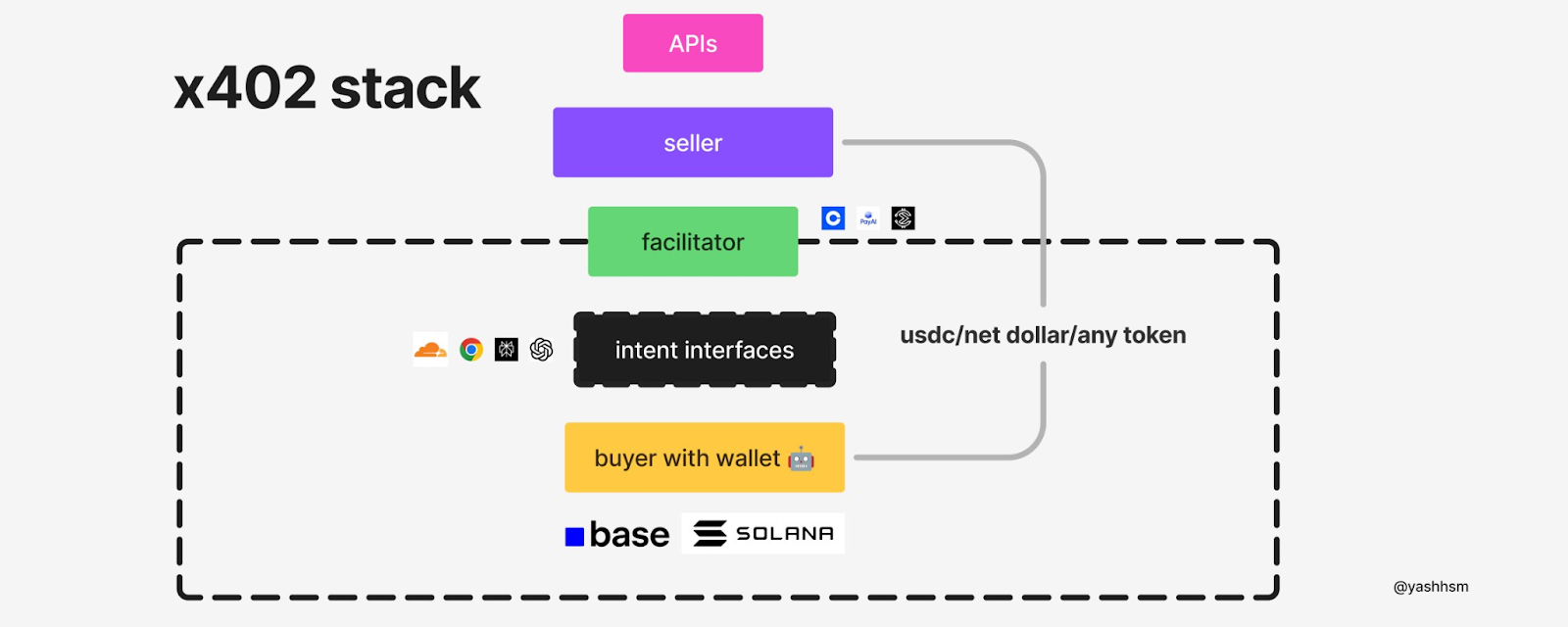

x402 component stack

If this vision succeeds, the internet could move away from its dependence on surveillance and attention. Websites would earn money directly from their visitors instead of advertisers. They wouldn’t need to track users across the web or chase clicks. They could focus on creating good content, priced fairly and delivered instantly. For users, that means a cleaner and more private web. For creators and developers, it means new ways to earn. And for AI systems, it means a clear economic framework to access the information they need responsibly.This makes the internet more sustainable, more private, and more aligned with real value.

3 assets for this narrative

In crypto, of course, the goal is to make money and be early on the trend. Right now, we don’t see a clear winner in this category that could deliver outsized returns. However, there are a few strong proxies for this narrative.The first is Coinbase’s $COIN stock, which trades on public markets. As an innovator and early backer of this technology, $COIN serves as a solid proxy if x402 gains traction, especially since Coinbase is currently the largest “facilitator” of x401 payments.

Technical Analysis: COIN

After a year-long base (mid-2022 to late-2023), Coinbase shifted to an uptrend and has been making higher highs and higher lows on the weekly. Price pushed into the prior ATH near 429, printed a new high around 444, and then retraced.Right now, COIN is ranging between 429 (resistance) and 281 (support). If 281 does not hold, the next high-probability area is the weekly demand at 261–235 (midpoint 249). That’s the first zone to look for responsive buyers within the prevailing trend.

If the weekly demand fails, major support sits around the weekly 200-EMA (203) and the 197 area of support. The last test of the 200-EMA in late March/early April led to a strong impulse from around 163 to new highs. Trend risk only picks up if weekly structure starts closing below these levels and forms lower lows.

COIN/USD Chart

The second is Solana ($SOL). As mentioned earlier, Solana stands out for its ability to process thousands of transactions per second at a fraction of a cent. It’s technologically well-suited to support micropayments.Additionally, many x402-related narrative plays are launching on Solana, similar to what happened with the AI narrative in 2024 (remember ai16z, Griffain, Zerebro?). If both the tech and narrative take off, speculation around Solana is likely to rise, which would be bullish for SOL’s price.

Technical Analysis: SOL

-

- Price Range: $120 – $190

- Bias: Neutral

- Add if breaks $163, or if dips to $120.

- Resistance: $185 – $190

- Support Zone: $120 – $125

- Breakdown Trigger: Break below $150

SOL broke down back into the $120- $190 range and is currently sitting exactly on the mid-range at $153.

To be bullish again, SOL needs to reclaim above $190.

Until this happens, SOL is locally more bearish than BTC as it currently stands just below the daily Breaker Block at $158- $163 (breaker blocks are formed when an orderblock is invalidated), and below the wick low from the Oct 10th crash.

A break above $163 and we would target the top of the range around $185 – $190.

Staying too long below $158- $163 and a close below $150 would give more credit to the bearish thesis and we would target $120 – $125 as the next support, which is the bottom of the weekly range and also the 200-Week EMA.

SOL/USDT Chart

Lastly, EigenCloud ($EIGEN) joined Google’s AP2 (Agent Payment Protocol) as a partner in September and showcased a demo integrating EigenCloud Storage with AI-to-AI x402. As a trust layer for Ethereum, there is significant early speculation that $EIGEN could be pivotal in scaling x402 micropayments by providing the necessary trust and security for these transactions

Top x402 assets according to CoinGecko

Technical Analysis: EIGEN

EIGEN is trading near all-time lows and attempting to base above 0.744 support. A new all-time low was printed on the Oct 10 flush around 0.584. Structurally, price has been in a daily downtrend since late February, a brief breakout attempt in early September failed after the October flush. On the broader view, EIGEN is trading inside a wide 0.66-2.10 range.

Immediate focus is 0.744. If 0.744 does not hold, the next area of support is 0.66. A decisive break below 0.66 would put the Oct 10 all-time low at 0.584 back in play and opens risk of further price discovery lower.

For strength, EIGEN needs to reclaim 1.208 to neutralize near-term pressure, then clear the 1.40–1.48 band (horizontal resistance along with the prior downtrend line + 200 EMA). Sustained closes above 1.40–1.48 would put the range high at 2.10 back on the table, a breakout there targets 2.85 (midpoint of a weekly supply zone) as the bull swing base case target.

EIGEN/USD Chart

There are more smaller plays on x402; however, at this moment, we don’t feel confident in them just yet. Therefore, the safest and optimal way to ride the narrative is just by riding $COIN or $SOL as proxies in our opinion.

x402 landscape

Cryptonary’s Take

x402 is still very new. It’s an open standard, meaning anyone can build on it. The first adopters will likely be websites, API providers, and developers experimenting with new pricing models.If it succeeds, it could become the missing economic layer the web has always needed, one that lets anyone pay or get paid instantly, for anything, without needing a bank or a middleman.

The web might become a place where every article, line of code, or data point can be accessed fairly, without ads, subscriptions, or friction — one tiny micro-payment at a time.

As this standard gains traction, the best way to position yourself early is through the assets most directly tied to its growth. In our view, three names stand out:

-

Coinbase ($COIN): the infrastructure play and early facilitator of x402 payments.

-

Solana ($SOL): the blockchain backbone enabling high-speed, low-cost micropayments.

-

EigenCloud ($EIGEN): the trust layer that can secure and scale these transactions across ecosystems.

These are the clearest and strongest ways to get exposure to the x402 narrative as it develops. If x402 takes off, these three assets are poised to benefit the most.

Peace!Cryptonary, OUT!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms