Yearn.Finance: The DeFi Yield Aggregator

Yield farming, also known as liquidity mining, has grown massively in popularity since the DeFi Summer of 2020 - who doesn’t like a bit of passive income? Yield farming is the process of taking crypto assets and putting them to work in various liquidity pools, lending platforms, and other DeFi protocols. The goal is to generate returns on otherwise unproductive assets (stablecoins included).

Farming strategies are often complicated and very time consuming. Moving around assets, interacting with various protocols, and managing multiple revenue streams is generally not a simple task. Yearn simplifies this process and allows anyone to benefit from advanced strategies they would be unable to execute themselves.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

Yearn.Finance

Yearn.Finance is a DeFi lending and yield aggregator built on the Ethereum blockchain. Yearn automates yield farming allowing users to deposit their funds and essentially set and forget. Smart contracts move deposited funds around various DeFi protocols looking for the highest returns with the least risk, putting user funds to work using various strategies.

Founded in early 2020 the Yearn.Finance platform offers a multitude of ways for users to simplify yield farming, providing users a degree of flexibility on how their assets are utilised. With over $3.78 billion in TVL Yearn is one of the largest DeFi protocols on Ethereum.

Yearn has a collaborative relationship with many DeFi protocols leveraging the huge amount of liquidity they can provide. For example, Curve Finance is a decentralised exchange offering low-slippage stablecoin swaps and liquidity. In simple terms the relationship between Yearn and Curve is complementary. As an exchange Curve benefits from the deep liquidity that Yearn provides, and Yearn benefits from the fees and rewards generated by that liquidity.

As a yield aggregator Yearn represents a key infrastructure of Ethereum DeFi. What we mean by this is that by design DeFi is permissionless and inter-operable and so other DeFi protocols are able to leverage the functionality of Yearn as they wish and build products on it. Alchemix is an example of a protocol that leverages Yearn for to create another innovative product. In TradFi this kind of co-operation is held back by administrative procedures and bureaucracy.

Yearn has several features that makes yield farming as easy as possible for the user. The key features are:

- Vaults – allows the user to deposit assets in one of the various yVaults and benefit from the advanced yield farming strategies implemented by the Yearn team.

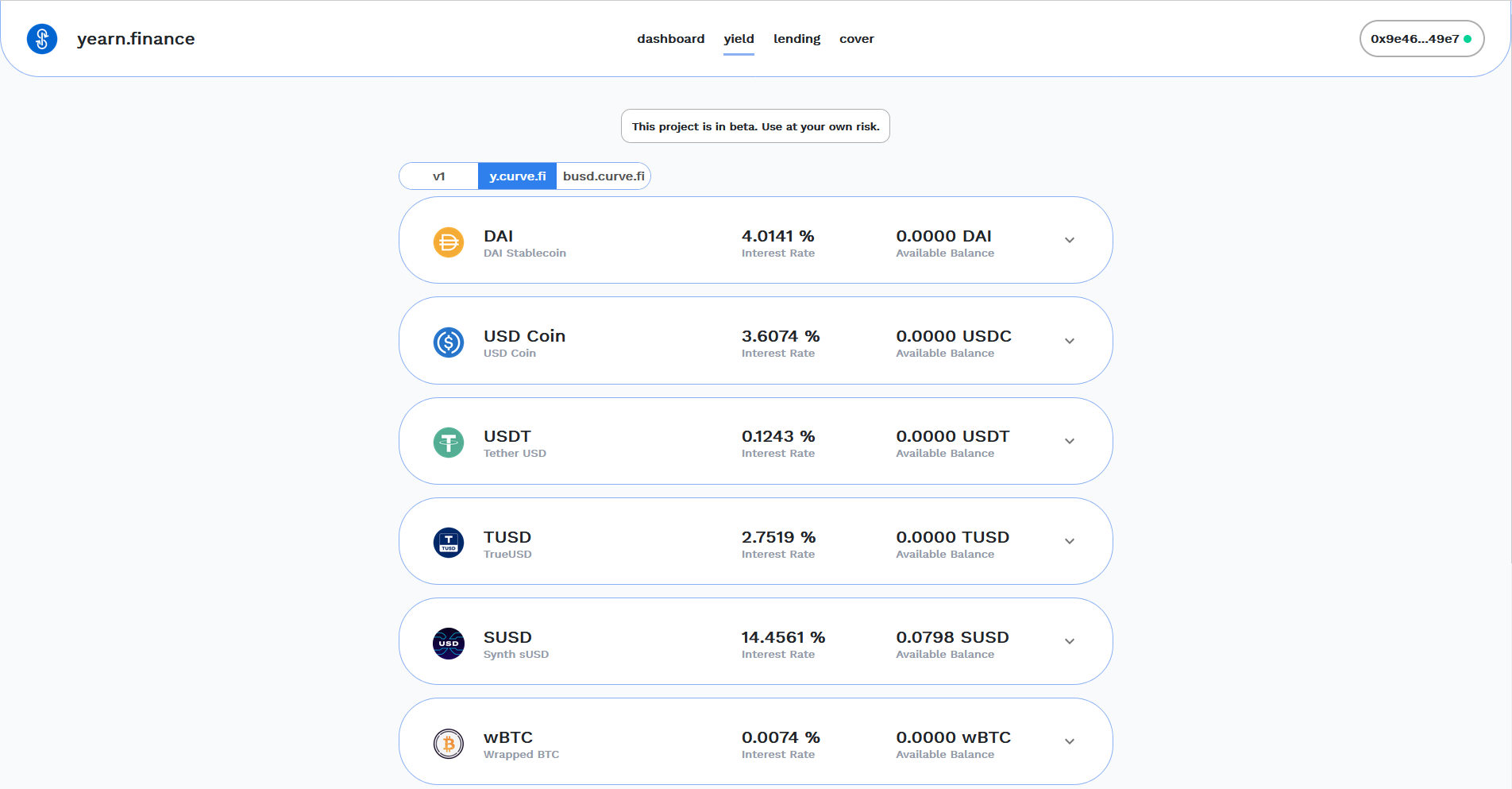

- Earn – users can deposit funds into the yEarn lending aggregator that ensures the user gets the best rates for lending their assets.

Yearn Earn (yEarn)

yEarn was the first product available on Yearn.Finance. Users deposit funds and the yEarn smart contract moves their funds around lending protocols (Aave, Compound and dYdX) with the goal of finding the best rates in order to optimise returns. It is a pretty simple concept; however, if the user was to carry out this sort of activity themselves they would be paying a substantial amount in transaction fees to get in and out of these protocols. For participants with smaller accounts this is simply not a feasible strategy – yEarn opens the door for everyone to benefit from this farming strategy, irrespective of account size.

Yearn Vaults (yVaults)

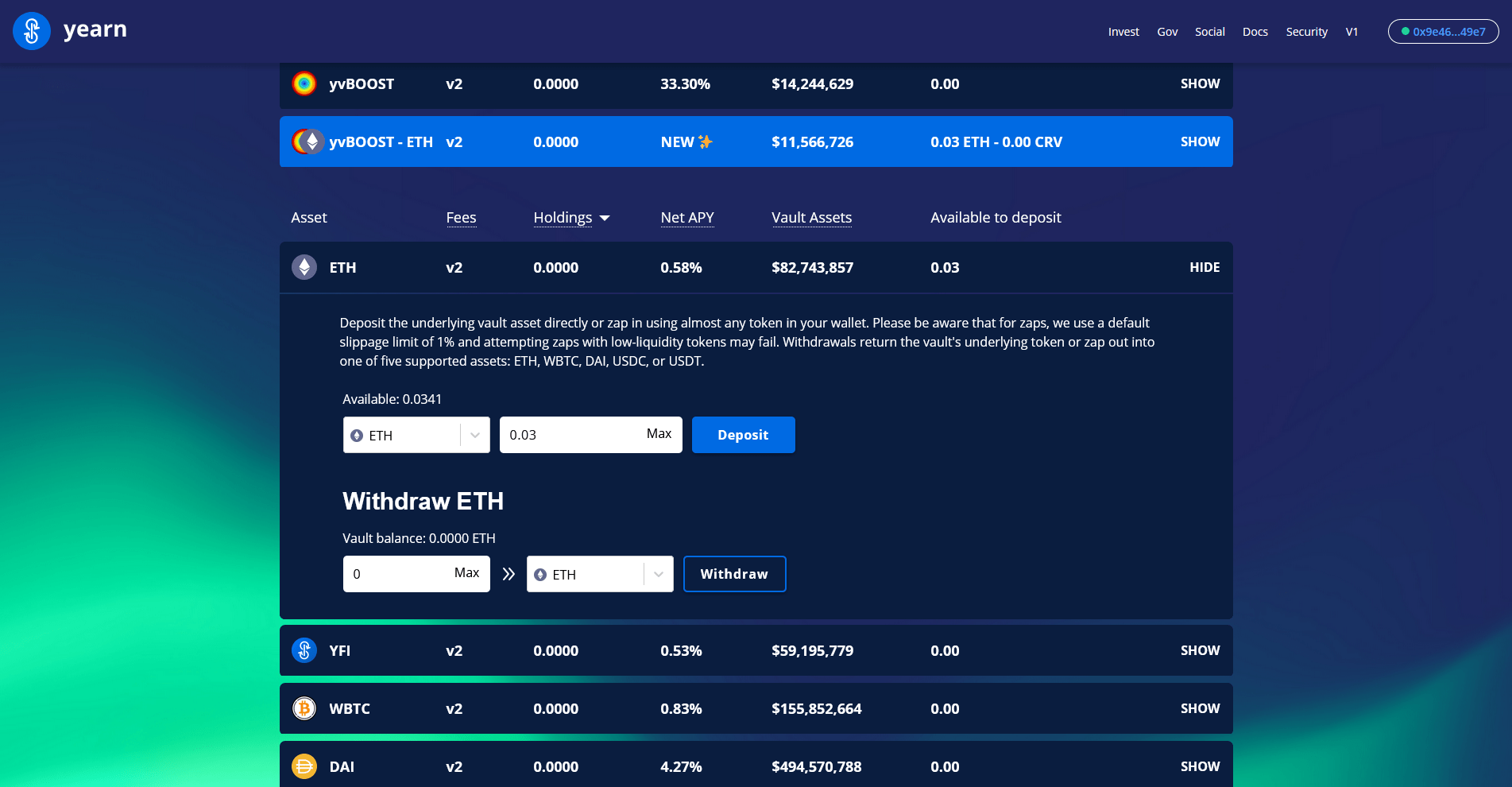

Yearn Vaults are presented as a savings account for your crypto. Once a user deposits assets to a yVault their funds are combined with other investor’s assets and routed through various DeFi protocols and lending platforms in order to find the best possible returns.

The user is provided with a yVault token relating to their position in one of the Vaults. For instance if a user deposited funds into the DAI vault they would be issued with a yvDAI token. These tokens are burned when the user withdraws their liquidity from a vault, acting as a sort of deposit receipt.

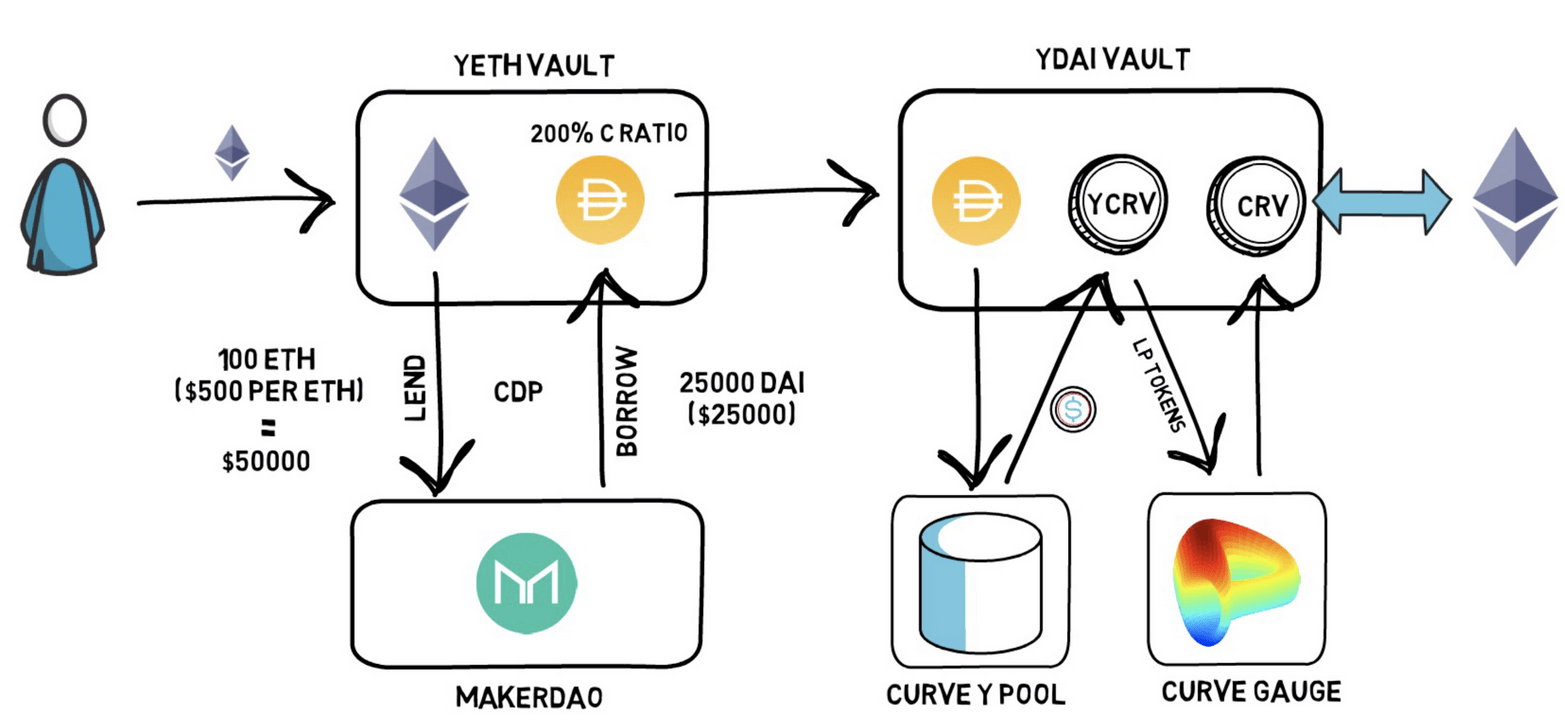

The various vaults all use different strategies that are sometimes interlinked. To provide an example of the kind of farming strategies that the vaults use let’s have a look at the ETH vault strategy historically used by Yearn:

- ETH is deposited to the Yearn yETH vault.

- The ETH is then sent to a MakerDAO lending platform and deposited as collateral in order to borrow DAI (a stablecoin).

- The borrowed DAI is then sent to another Yearn vault, the yDAI vault.

- DAI from this vault is routed to Curve Finance Y Pool, which generates returns from trading fees on Curve. Rewards from the Y Pool are also supplemented by yield from lending on DyDx and Aave.

- Depositing DAI into a Curve pool generates LP tokens, which are then locked in the Curve Gauge in order to generate Curve Token (CRV) rewards.

- Trading fees generated from the Curve LP are reinvested to generate even more yield.

- Periodically, CRV rewards are swapped back to ETH, which constitutes the final yield for the yETH Vault.

Another benefit of using Yearn is that through combining user funds a huge amount is saved on transaction fees since fewer transactions are necessary. This also has the domino effect of reducing the load on the Ethereum network.

YFI Token

YFI is the governance token for the Yearn Multi-DAO. Holders of YFI are granted voting rights providing them with a voice in the development and management of the protocol. YFI is different to other tokens we have covered in the past in that it has no emission schedule which means it has a set supply limit. However, this supply limit is decided by the DAO - new tokens can only be minted through a Yearn Improvement Proposal (YIP) vote, as was the case when 6,666 new tokens were minted after the YIP-57 vote.YFI currently has a circulating supply of 35,638, with a max supply of 36,666. It is due to the extremely small supply that the price of YFI is so high – at the time of writing YFI was trading at around $34,300.

Governance

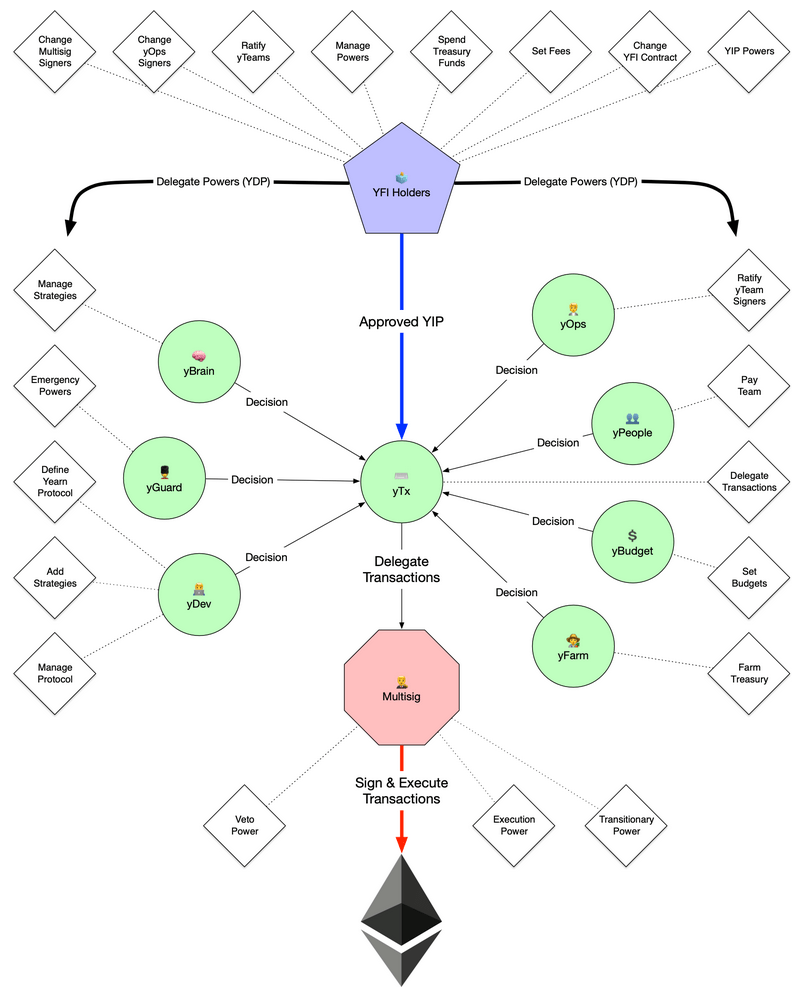

Yearn has a complex decentralised governance system whereby YFI token holders are at the core of any decisions made. yTeams are sort of like departments in a traditional corporation, and they handle various aspects of the day to day management of the protocol; for example Budgeting, Human Resources, Operations etc. Anything from changing vault farming strategies, to management of the Yearn treasury, are all delegated to yTeams through DAO voting.

Proposals are structured as follows:

- Yearn Improvement Proposal (YIP) – a vote to change anything with respect to the core protocol.

- Yearn Delegation Proposal (YDP) – a vote to decide on the creation/removal of a yTeam, or to define the powers delegated to a yTeam.

- Yearn Signalling Proposal (YSP) – a non-binding vote to gauge community opinion on any matter relevant to Yearn; for example to signify interest in a new yVault.

Yearn.Finance Exploit

On the 4th of February 2021 Yearn suffered an exploit of its yDAI vault whereby $11 million worth of funds were lost through a flash loan attack.- The perpetrators were able to utilise flash loans borrowed from dYdX and Aave.

- These loans were then used to take out another collateralised loan on Compound which was then deposited into Yearn’s yDAI vault, artificially inflating the price of the DAI in the vault.

- Curve tokens earned from the inflated DAI were then sold.