Ruffer Multi-Strategies Fund holds 2.5% of its treasury in Bitcoin

Another multi-billion dollar firm is betting on bitcoin by holding a portion of its treasury in the leading digital asset. The investment firm Ruffer announced that one of its funds, Multi-Strategies Fund has bought bitcoin worth 2.5% of its portfolio.

The firm which has more than £20 billion in assets under management (AUM), mainly counts charities, pension funds, and individuals and families as its clients.

Ruffer Multi Strategy Fund enters the bitcoin market

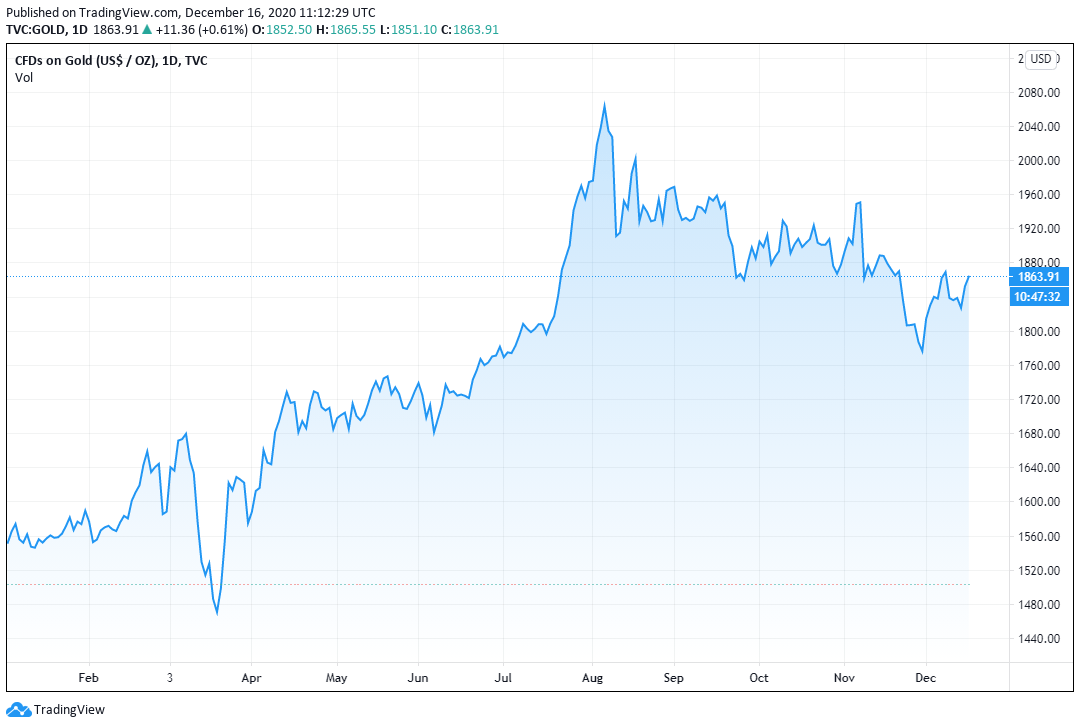

The fund added bitcoin to its portfolio as recently as November. Per the notice, “it is a primary defensive move” made after “reducing the company’s exposure to gold.”Gold was trading above $1,500 per ounce at the start of the year. The price fell to $1,470 in April before reaching its yearly high of more than $2,000 in September. It is currently selling for $1,864, marking modest year-to-date (YTD) gains of more than 20%.

[caption id="attachment_20091" align="aligncenter" width="1080"] Gold YTD performance | Credit / TradingView[/caption]

Gold YTD performance | Credit / TradingView[/caption]

With one of the portfolios of the Multi Strategies Fund managing assets worth roughly $620 million, it means that the funds bought bitcoins worth $15.5 million.

The fund sees the purchase of the digital asset “as a small but potent insurance policy against the continuing devaluation of the world’s major currencies.” The company has its investments tied to gold and inflation-linked bonds.

Bitcoin is being used as a hedge against some of the market and monetary risks seen by the fund, the company said.

Bitcoin, known for its volatility and wild price swings, has performed well in 2020. Bitcoin is widely seen as a safe-haven asset and a possible hedge against global events that rattle traditional markets.

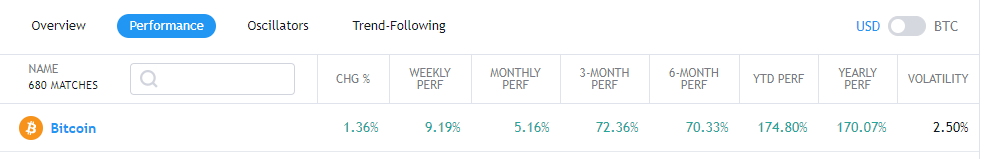

Despite the ongoing pandemic that caused panic and massive sell-off when countries began to implement lockdowns, bitcoin has seen overall YTD gains of 170% at the time of writing, according to TradingView data.

[caption id="attachment_20092" align="aligncenter" width="984"] Bitcoin’s year-to-date performance | Credit / TradingView[/caption]

Bitcoin’s year-to-date performance | Credit / TradingView[/caption]

Bitcoin opened the year trading in the $7,000 region but tumbled below $4,000 on some exchanges when selling pressure took over the market in March. However, buoyed by the halving event, increased institutional interest, the PayPal effect, positive sentiments, and long view by hedge fund managers, bitcoin reached a new all-time high of $19,864 on November 30.

[caption id="attachment_20090" align="aligncenter" width="1264"] Bitcoin reaches a new all-time high on November 30, 2020 | Credit / CoinMarketCap[/caption]

Bitcoin reaches a new all-time high on November 30, 2020 | Credit / CoinMarketCap[/caption]

Institutional money is flowing into bitcoin

Institutional capital is slowly making its way into the nascent cryptocurrency market as Wall Street and hedge funds see bitcoin as a safe haven asset just like gold.169-year-old life insurance firm MassMutual recently announced that it had purchased bitcoins worth $100 million.

American financial services firm Square Inc, founded by Twitter CEO Jack Dorsey, owns bitcoins worth $50 million.

Business intelligence firm MicroStrategy Incorporated has invested more than $500 million in bitcoins.

Bitcoin bull Mike Novogratz has previously said that the leading digital asset’s bull run is a ‘digital gold story,’ with more institutional pathways flowing into the emerging market.

"You're seeing more and more institutional pathways," says @Novogratz on #bitcoin's bull run. "It is a digital gold story." pic.twitter.com/PdXFW6NF0v

— Squawk Box (@SquawkCNBC) December 1, 2020

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms